January is the time of the year where lots of people are setting goals or reviewing their finances for the year ahead – And for some this might involve getting started with investing. So in our first article of 2023 we’ll be getting back to the basics of investing including what it is, types of investments, how to choose what to invest in, and services you can use to invest. Perhaps this article could be the starting point for your investing journey that you’ve been looking for!

This article covers:

1. What is investing and why should you do it?

2. What assets can you invest in?

3. How do I choose what to invest in?

4. What services can you use to invest?

5. Other important concepts

1. What is investing and why should you do it?

Firstly, let’s start with some fundamental concepts around investing.

This section covers:

A. What is saving versus investing?

B. Why would you invest?

C. Who can invest?

D. What investing isn’t

E. Is investing risky?

A. What is saving versus investing?

Saving and investing are related but different concepts. Simply put:

- Saving simply involves spending less money than you earn, and storing that money away for future use (usually in a bank account or perhaps under the mattress). For example, if you get paid $1,000, put aside $200 for the future, then spend the rest, you have saved $200.

- Investing is like an extension of saving. It involves putting your savings to work, by using it to buy into an asset (like shares, bonds, or a fund) so that it can grow into even more money in the future.

B. Why would you invest?

There are a number of reasons why investing is important over saving alone, such as:

- To grow wealth – Investing involves putting money you don’t need now to work, so that it can grow into more money in the future. It could result in having the means to support your child’s future education needs, the purchase of your first home, or being more wealthy in general.

- To keep up against inflation – Money you save will gradually lose its purchasing power thanks to inflation. Investing is needed so that your money has the opportunity to outpace inflation, especially if you don’t intend to use that money over the long-term.

- To replace your main source of income – Most people don’t intend to work until they die. An investment portfolio could gradually supplement and replace the income from your job, eventually supporting your retirement at age 65+, or even allowing you to retire early or pursue more flexible forms of work.

- To diversify your wealth away from your home – Many people have a big chunk of their wealth associated with their own home. This can be quite problematic. Firstly, you can’t sell off parts of your house to pay your bills. Secondly, a house can result in a big chunk of your net worth being tied up into a single asset in a single location. An investment portfolio can help diversify your wealth away into different assets, which can be easily sold off easily at any time if you needed the money.

C. Who can invest?

Almost anyone can invest! You don’t need to sign up for any expensive courses, understand how to read financial statements, or be rich to get started (many investing services allow you to get started with as little as $1). It’s never too late to get started either – chances are investing can make a positive difference to your finances regardless of your age or personal circumstances. However, it’s generally worth having the following sorted out before you start investing:

- High interest debt paid off – Any high interest debt you have like personal loans, credit cards, and car loans should be paid off before you invest. That’s because interest rates on these loans are likely higher than what you could potentially earn from investing.

- Emergency fund sorted – You should have some money put aside as an emergency fund. This saves you from having to take on debt or disturb your investments if any unexpected expenses arise.

D. What investing isn’t

Investing is a worthwhile thing to do for most people, but it’s important to be aware of the limitations. Here’s what investing isn’t:

- A get rich quick scheme – Investing won’t make you rich or solve all your financial issues overnight. It requires a lot of time (often several years or even decades) and patience to grow meaningful wealth.

- Trading – New investors sometimes fall into the habit of buying assets only to sell them shortly after for a profit. This is trading rather than investing. The latter is typically longer-term in nature, holding an asset for years or decades to take advantage of its long-term growth.

- Gambling – Unlike gambling, investing isn’t a game of chance. It involves putting money towards assets that you genuinely expect to appreciate over the long-term.

E. Is investing risky?

It is possible to lose money when investing. But one of the most important concepts to understand in investing is that low risk investments generally have low potential returns (perhaps even too low to outpace inflation). While higher risk investments generally have higher potential returns.

So you generally have to take on risk in order to make more money. However, risk often refers to volatile an investment is, rather than the risk of losing all of your money. For example, a highly volatile investment doesn’t go up in value in a straight line, but rather they’ll perform really well in some years, and perform really badly in other years. In other words, you’ll regularly face downturns in the value of your investments. More on this later.

But don’t let this scare you off! It’s often suggested that saving is even risker than investing as it will result in your wealth being eroded away by inflation, and you’ll risk not having enough money for a comfortable retirement. And fortunately there’s ways to reduce the risks of investing (like time and diversification, which we’ll also cover later on in this article).

2. What assets can you invest in?

There’s lots of different types of assets or ways you can invest (commonly referred to as an asset class). Here’s a brief overview of them:

This section covers:

A. Traditional assets

B. Funds

C. Alternative assets

A. Traditional assets

Bank deposits/Cash

This involves depositing your money in a bank savings account or term deposit.

- How you can make money – You’ll earn interest on the money you’ve deposited, according to the interest rate of the account/product you’ve selected. Ordinary savings accounts typically pay the lowest interest, but are most flexible (given they can be withdrawn from at any time). Term deposits typically pay the highest interest, but are least flexible (given your money is locked in for the duration of the deposit).

- How you can lose money – If the bank you deposited money with gets into financial trouble, you could lose some or all of your deposited money.

Bank deposits are very low risk investments. Although they currently aren’t government guaranteed in NZ, it’s highly unlikely for the major banks to go bust. However, the potential returns from bank deposits also tend to be low, and are unlikely to keep up with inflation over the long-term.

Further Reading:

– The ultimate guide to bank and savings accounts in New Zealand

Bonds

Bonds represent a loan to a government or corporation. When you buy bonds, you are essentially lending money to a bond issuer. For example, if you buy bonds issued by Fletcher Building, you’re essentially lending money to the company.

- How you can make money – Bond issuers pay their bondholders interest on a regular basis. Bonds can also become more valuable. If you sell your bonds at a higher price than what you originally bought them for, you’ll make a profit or capital gain.

- How you can lose money – If the bond issuer goes bust, you could lose some or all of your money. Bonds can also become less valuable. If you sell your bonds at a lower price than what you originally bought them for, you’ll make a loss.

The amount of interest you can potentially earn from bonds tends to be higher than that of bank deposits. But bonds come with higher risk, given their value can fluctuate up and down.

Further Reading:

– Bonds 101 – 5 things to know about investing in bonds

Shares

Shares represent a portion of ownership in a business. When you buy shares, you become a part owner of a business. For example, if you bought shares in Air New Zealand, you’d own a tiny part of the airline.

- How you can make money – If business becomes more valuable, the share price of that business may increase. If you sell your shares at a higher price than what you originally bought them for, you’ll make a profit or capital gain. Companies may also pay dividends, where a company pays out a portion of its profits out to their shareholders.

- How you can lose money – If business becomes less valuable, the share price of that business may decrease. If you sell your shares at a lower price than what you originally bought them for, you’ll make a loss.

The potential returns from shares tend to be high, but they come with even higher risk than bonds – Share prices can be very volatile, as factors like company performance, and economic conditions have a large influence on them.

Further Reading:

– Shares 101 – How to buy shares, which companies to pick, and more

– The ultimate guide to index funds in New Zealand

B. Funds

Managed funds

Funds are a type of investment which invests your money into lots of different assets at once. A single fund could contain hundreds or even thousands of shares in different companies, hundreds or different bond issues, or even a mix of both. Funds are great for both beginner and expert investors as they save you from having to pick individual assets yourself. Instead each fund has a fund manager who are responsible for investing your money on your behalf. Funds typically operate in one of the following ways:

- Actively managed funds – This involves a fund manager researching and investing in assets that they think will perform the best, in an attempt to beat the average return of the market. Actively managed funds tend to have higher fees, because they have to employ research and fund management staff.

- Passively managed funds – This involves investing in a market index, or in other words an entire slice of a market. These types of funds are also known as index funds and they try to match the average return of the market. They’re growing in popularity as they have cheaper fees and because actively managed funds tend to underperform the market over the long-term.

A common analogy to explain active vs passive funds – Actively managed funds try to find the needle in the haystack, while passively managed funds just buy the entire haystack.

- How you can make money – If the assets inside a fund go up in value, then the fund will also go up in value. You can then sell the fund for a capital gain. Some funds also pay distributions – this is when a fund earns dividends or interest from the assets inside the fund, then pays those dividends/interest out to investors in the fund.

- How you can lose money – If the assets inside a fund go down in value, then the fund will also go down in value. If you then sell the fund, this may result in a capital loss

Further Reading:

– Funds 101 – What’s the difference between an Index Fund, ETF, and more?

KiwiSaver

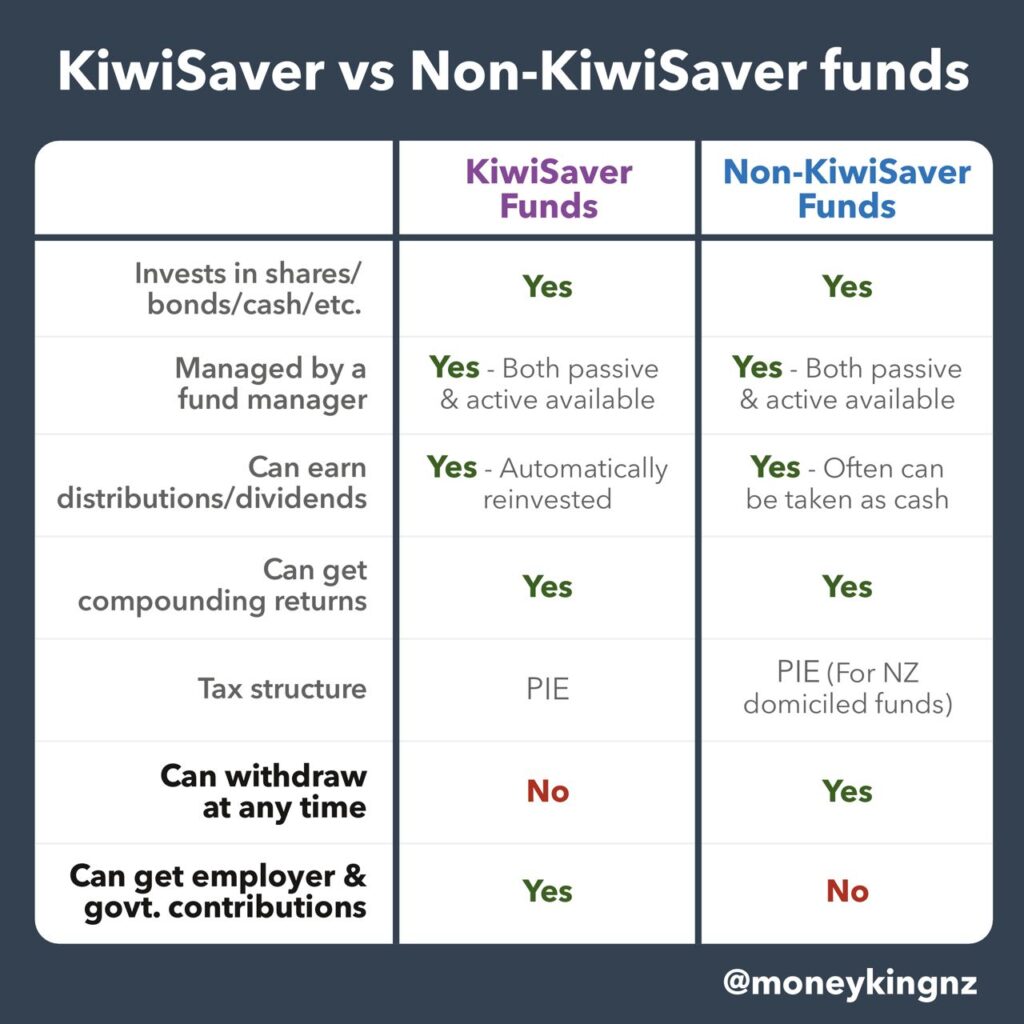

KiwiSaver funds are a special type of fund, which can only withdrawn in certain circumstances like for buying your first home or when you’re 65. This makes KiwiSaver one of the least flexible investment options, but in return for contributing to a KiwiSaver fund you get some financial benefits such as employer and government contributions.

Further Reading:

– KiwiSaver 101 – How does KiwiSaver fit into your investment portfolio?

C. Alternative assets

There’s lots of other ways you can invest. You can definitely live without them (especially as a beginner), but for awareness we’ll very quickly cover some of them:

- Property – This involves buying a property (like a house or commercial building) to earn rental income and capital gains. Whether your own home is a genuine investment is debatable – it can be argued that it’s just a lifestyle asset as its primary purpose is to provide you with shelter rather than to make you money.

- Cryptocurrency – Involves buying digital currencies like Bitcoin. The potential returns from cryptocurrency tends to be very high, but they come with very high risk. The value of crypto is unclear, and putting your money into it is arguably gambling, rather than investing into a genuine asset class.

- P2P lending – Involves lending your money out to other individuals or businesses.

- Equity Crowdfunding – An investment similar to shares, but involves investing in higher risk, earlier stage companies.

- Precious metals – This involves buying metals like gold or silver.

Further Reading:

– Property vs Shares – The pros and cons of buying residential property

– Cryptocurrency 101 – Is it investing or gambling?

– 5 things to know about investing in Peer to Peer Lending

– 4 things to know about investing in Equity Crowdfunding

– Gold and Silver – Is it investing or gambling?

3. How do I choose what to invest in?

Given there’s so many types of investments, the next question we need to address is how to choose which ones to invest in?

This section covers:

A. What type of assets should I invest in?

B. Strategies for picking assets

A. What type of assets should I invest in?

Unfortunately there’s no one-size-fits-all answer as to what you should be investing in. Everyone’s personal and financial circumstances are different, therefore different people will have different requirements when it comes to investments. But here are a couple of key things to consider when figure out what assets you should pick:

Your goals

Firstly you should have some clear goals in mind. In other words, what’s your reason for investing in the first place? Some common goals for investing are:

- Build a $1.5 million investment portfolio for my retirement in 30 years’ time.

- Build a $150,000 deposit to buy my first home in 5 years’ time.

- Invest $50 per week for my child’s university education in 15 years’ time.

- Put away 10% of my income just to beat inflation over 10-20 years.

Time horizon

This is perhaps the most important factor determining what you should invest in. Your time horizon refers to how much time you have to invest before you need the money for your above goal. In general:

- Those with longer time horizons should consider investing in the like of shares (or funds that invest into shares). Shares have high potential returns, allowing you to outpace inflation over the long-term. And even though shares are relatively risky assets, time is the one of the most powerful tools to reduce the risk of investing. A long time horizon will allow you to ride out any crashes in the sharemarket, and provide sufficient opportunity for your shares to recover in value.

- Those with shorter time horizons should consider sticking to more conservative assets like bonds and bank deposits, given short-term investors don’t have sufficient time for risker assets to recover in value if they suffered from a downturn. Investing isn’t always about trying to make the most money, but sometimes it’s about protecting your money.

Risk capacity

Your risk capacity refers to how well you can tolerate losses to the value of your investments. Would you be stressed out or remain calm if your investment fell by 20%, 30%, or more? Is your investment critical to meeting your goal, or is it money you could afford to lose?

- Those with a low risk tolerance may want to reduce their allocation towards riskier assets. These assets face downturns on a regular basis so you’d want to avoid overcommitting yourself to them if this will cause sleepless nights. Having some conservative assets to balance out your portfolio can reduce your portfolio’s volatility, acting as a “shock absorber” in market downturns.

- Those with a high risk tolerance may be willing to increase their allocation towards riskier assets like shares to increase their portfolio’s potential returns (at the expense of greater volatility).

Factors like your age, income, amount you’re investing might also have a small influence on what you should invest in. So figuring out to invest in can often be the trickiest part of investing – There really isn’t such thing as a “best” investment. But the most important thing is to consider your own circumstances when choosing what to invest in, rather than investing based on what others are doing.

We cover the above concepts around picking investments in more detail in the article below, otherwise the Investor Profile tool from Sorted is also helpful for figuring out what to invest in:

Further Reading:

– How to invest $1k/$10k/$100k in New Zealand

– Investor Profiler (Sorted.org.nz)

B. Strategies for picking assets

Regardless of what assets you choose to invest in, here’s some strategies you can follow:

Diversification

Diversification is another powerful tool to reduce the risk of investing. It involves spreading your investments across a number of different assets, which could involve:

- Company diversification – Spreading your investments across different companies (e.g. buying shares in Spark as well as a2 Milk).

- Sector diversification – Spreading your investments across companies operating in different industries (e.g. healthcare + information technology + utilities).

- Geographical diversification – Spreading your investments across assets from different countries and regions (e.g. NZ + US + Europe + Asia).

Diversification means you’re not putting all of your eggs into one basket – So if one company/industry/country were to perform badly or even go bust, having a diversified investment portfolio means you won’t lose all your money, or that a strong performing asset could offset the poor performing ones.

Make use of funds

While there’s nothing wrong with picking individual shares and bonds, it can be hard to achieve a well diversified portfolio that way. For example, building a share portfolio requires you to research, understand, and pick companies from several different countries and industries – not an easy job for most beginners. Investing in funds is a great solution to this, as it leaves that job to a professional fund manager.

Keep it simple

There are tens of thousands of assets you could possibly invest in, but you don’t need to go all out and invest in lots of them. In fact, it’s possible to build a well diversified investment portfolio by just investing into a single fund, because funds are already diversified by nature. As an example, you can check out our article below to see how we can build an incredible simple long-term investment portfolio just by investing in either the Kernel High Growth Fund or Foundation Series Growth Fund. A good investment portfolio really doesn’t have to be complicated!

Further Reading:

– 4 steps to create an incredibly simple long-term investment portfolio

4. What services can you use to invest?

Once you’ve chosen which types of assets to invest in, the next question to consider is how do you actually buy these assets? This is where services like Sharesies, Hatch, Kernel, and InvestNow come in. These are all examples of investment platforms which you can buy and sell investments through.

While it may seem like there’s an overwhelming number of platforms to choose from, fortunately when you break down the options, choosing the right one becomes relatively easy. That’s because most of the services are quite unique and offer different types of assets. For example, Hatch is a service which offers investment into the US sharemarket, while Kernel is a service which offers investment into funds – comparing them is a bit like comparing apples with oranges (though there’s often still a little bit of crossover between some platforms). So it’s a matter of working backwards, by choosing your investments first, then picking a suitable platform which offers those investments.

This section covers:

A. Banks

B. Fund managers

C. Fund platforms

D. Brokers

E. Alternative investment platforms

F. Financial advisers

A. Banks

If you want to put your money into a bank deposit, then a bank is the obvious place to go. Here’s some of the major banks in NZ:

The website interest.co.nz provides some handy pages allowing you to compare interest rates between the banks. Just be wary of the companies that offer substantially higher rates like Liberty and Xceda. The catch with their higher rates is that these companies are at higher risk of going bust, so tend to defeat the purpose of investing in bank deposits the the first place (which is to keep your money safe).

Further Reading:

– The ultimate guide to bank and savings accounts in New Zealand

B. Fund managers

For those looking to invest in funds (which all beginners should consider), fund managers are a good place to start. Fund managers are companies who manage and offer funds. They make money by charging fund management fees, which is a percentage of the amount you’re investing in each fund.

These are some popular fund managers who mostly offer passively managed (index) funds:

- Kernel – Offers 17 funds which mostly invest into shares.

- Smartshares – Offers 35 funds, mainly investing into shares with a small handful of bond and cash funds.

- Simplicity – Offers 6 funds, most of which invest across a diverse range of assets including NZ and international bonds plus NZ and international shares.

And here are some popular active fund managers:

- Milford

- Fisher Funds

- ANZ, ASB, BNZ, Westpac – In addition to bank deposits, these banks also offer investment funds.

Most of the above providers also offer KiwiSaver funds.

Further Reading:

– Kernel review – High quality index funds

– Smartshares & SuperLife review – The smart way to invest in shares?

– Simplicity review – Could there be better fund options out there?

– Milford review – Better than index funds?

– ASB, BNZ YouWealth, Kiwi Wealth review – Are managed funds with your bank worth it?

C. Fund platforms

Fund platforms (often known as “fund supermarkets”) are also good services to consider if you’re looking to invest in funds. They allow you to buy and sell funds from lots of different fund managers. For example:

- InvestNow – Offers over 150 funds from 26 different fund managers.

- Flint – Offers over 100 funds from 12 different fund managers.

Fund platforms have low minimum investments (starting from $50) and no transaction fees. They’re also useful if you’re after funds from lots of different fund managers, as they save you from having to sign up with multiple managers. However, the vast number of funds they offer could be overwhelming for beginners.

Further Reading:

– InvestNow review – The most efficient way to invest?

– Flint Wealth review – A superior InvestNow clone?

D. Brokers

If you’re looking to invest in individual shares or bonds, then brokers are for you. They give you access to buy and sell these assets on various markets – For example, Hatch and Stake offer investment into the US market, while Sharesies provides access to the NZ, Australian, and US sharemarkets. Brokers also allow you to buy and sell ETFs (these are a specific type of fund listed on the sharemarket, like those offered by Smartshares and Vanguard).

| NZX | ASX | US | Bonds | |

| Sharesies | Yes | Yes | Yes | |

| Hatch | Yes | |||

| Stake | Yes | |||

| Interactive Brokers | Yes | Yes | Yes | |

| ASB Securities | Yes | Yes | Yes | Yes |

| Jarden Direct | Yes | Yes | Yes | Yes |

| Tiger Brokers | Yes | Yes |

Brokers charge brokerage fees every time you buy or sell an investment, as well as foreign exchange fees if you need to change your money from one currency to another (e.g. if you swap NZ dollars to US dollars in order to buy US shares). Due to their fee structures, a lot of brokers aren’t cost effective for investing small amounts of money. For example:

- Hatch charges a flat $3 USD fee each time you buy or sell shares. On a $100 USD investment, that’s a big 3% cut of the money you’re investing.

- Sharesies is planning to charge a 1.9% fee for buying and selling most of the assets on their platform. This is incredibly high and means your investment needs to make a profit of ~3.8% just to breakeven.

So unless you’re investing at least a few hundred dollars every month, it might be worth considering sticking with investing through fund managers and platforms, given they don’t tend to charge such hefty transaction fees.

Further Reading:

– Sharesies review – Still a good investment platform in late 2021?

– Hatch review – Hard to recommend

– Stake review – Is there a catch to their $0 brokerage fee?

– Interactive Brokers & Tiger Brokers review – Better than Sharesies & Hatch?

E. Alternative investments

Alternative investments tend to have their own platforms, for example:

- Easy Crypto – Allows you to exchange NZD for cryptocurrency, and cryptocurrency back to NZD.

- Squirrel – A peer to peer lending platform.

- Snowball Effect – An equity crowdfunding platform.

Further Reading:

– Easy Crypto review – The best on-ramp to the world of cryptocurrency?

– Peer to Peer Lending review – Squirrel

F. Financial advisers

The above services are mostly DIY investment platforms, which require you to pick what to invest in yourself. And as we mentioned earlier in the article, this can be one of the hardest parts of investing. But it is possible to get professional help in deciding what to invest in. Financial advisers can help you understand your financial goals, recommend investments that align with your needs, and coach you through the process.

There’s lots of different types of financial advisers out there, but a good starting point is to look for an independent fee only investment adviser (like those on this MoneyHub list). These advisers are independent of any investment provider and make money by charging their clients consultation fees, so can recommend a broader set of investments to you (as opposed to commission based advisers who may only recommend you assets that pay them the most commission).

Getting professional investment advice costs money and some advisers only work with high net worth clients. But they can be well worth considering as they can save you from saving you from all the learning and guesswork related to getting started in investing.

5. Other important concepts

A mistake many investors make is thinking that investing is just about picking the right assets to invest in, and choosing the best platform to invest through. However, the behavioural and psychological aspects of investing are arguably just as critical. So lastly in this article we cover a few other key points you need to know about investing.

This section covers:

A. The best time to start investing

B. Greed

C. Fear

D. Ongoing management of your investments

A. The best time to start investing

Many people like to try and find the perfect time to start investing. For example, when the markets are doing well, some might be tempted to wait until they drop before they start to invest. And when the markets are doing poorly, others may be tempted to wait until the markets stabilise before starting. But this is a bad habit to get into as perfectly time the market is impossible thanks to how unpredictable they are. Trying to time the market puts you at risk of missing out on substantial gains if you were to get your timing wrong.

Instead anytime is a good time to invest because time in market beats timing the market. And you can always mitigate the risk of entering the market at a bad time by drip feeding your money in. For example, if you had $1,000 to invest, you could split that up and invest $100 per week over 10 weeks regardless of whether the market was going up, down, or sideways. Or you could simply align your investment contributions with every payday. This strategy is often referred as dollar cost averaging, and is a strong alternative to market timing or committing a lump sum into an investment all at once.

Further Reading:

– Does timing the market = better returns?

B. Greed

In the investing world you’ll sometimes see asset prices shoot up quickly, or perhaps big dividend payments on offer. This leads to people being greedy, investing in what’s hot in an attempt to outsmart the market or become rich quickly. Here’s some important points you should know in relation to greed:

- Past performance doesn’t equal future performance – Some people make the mistake of getting greedy, and invest purely on high performance figures. But just because an investment delivered an x% return in the past, doesn’t mean it’ll keep on delivering that same return into the future.

- Chasing dividends can be dangerous – For those investing in shares, some people get caught in the trap of chasing companies that pay the highest dividends. Chasing high dividend yields can be dangerous as they can come at the expense of low capital gains or could be a sign that the company is a dividend trap.

- Don’t follow the herd – Don’t invest in something just because everyone else is doing it. Everyone’s circumstances is different, and an investment that’s right for someone else, might not be right for you.

- Always do your due diligence – The vast majority of people conduct due diligence before buying a car or house, and the same idea should apply for investments. Always do your research and understand what you’re investing in before committing any money.

Further Reading:

– Dealing with Dividends – 5 things to know about them

– Due diligence – Do you really know what you’re investing in?

C. Fear

Volatile assets like shares regularly go through downturns, where you can see the value of your assets drop 10%, 20%, or even more. Fear is an emotion that commonly affects investors during these times. Here’s what you should know in relation to it:

- Don’t panic – In a market downturn it may be tempting to sell your investments (perhaps at a loss) to protect yourself from further losses. This will cause you to lock in or realise your losses. The trick is to hold on tight to your investments and give it time to eventually recover in value – there has never been a downturn the sharemarket hasn’t recovered from despite going through multiple wars, recessions, and other crises.

- It’s the long-term result that matters – Many investors get caught up with the short-term performance of their investments. But if you’re investing for the long-term, what your investments are worth today is irrelevant. Remember that not all investments perform well every single year, and that poor short-term performance doesn’t make an investment a bad one. It’s what your assets are worth in several years/decades that’s important.

- Ignore the noise – It’s common to see news headlines and social media commentators predicting some sort of impending crash in the financial markets, especially during times of market uncertainty. Seeing such predictions can be enough to scare you out of the market. But remember most of the predictions won’t come true, and they only exist because negative headlines get more clicks than positive ones. So shut out the noise and don’t let it influence your investing strategy.

- Downturns can be a good thing – When the markets are down, it’s like they’re on sale so you can buy up assets at cheaper prices – Something which should already be happening if you’re regularly investing or dollar cost averaging.

Further Reading:

– 2020 Recession? How to prepare your investment portfolio

D. Ongoing management of your investments

Good investing should be boring. That means there shouldn’t be much need for ongoing work in maintaining your portfolio. Investing is often about letting time do the work!

- There’s no need to check your portfolio often – Checking your portfolio more often won’t make your investments perform any better. In fact it can cause worse results as checking your investments more gives you more exposure to the volatility of the markets. As mentioned above, it’s the long-term result that matters, so occasionally checking up on your investments is enough.

- There’s no need to constantly tweak things either – Unless your investment goals have changed, there shouldn’t be any need to tweak your investment strategy or trade in and out of your investments. Unlike practising a sport or art, more action doesn’t necessary translate to better results when it comes to investing.

- Tax – You will have to pay tax on your investments, but in many cases this is calculated and paid for you automatically. Though tax is beyond the scope of this Investing 101 article, so you may wish to refer to the article below.

Further Reading:

– Portfolio WOF and service – How to maintain your investments

– What taxes do you need to pay on your investments in New Zealand?

Conclusion

There was lots to cover in this article, so let’s finish with a summary of the key points:

- What is investing and why should you do it? – It involves buying assets with the expectation they’ll increase in value or produce more money. All investing involves some degree of risk, but it’s an important tool to grow your wealth and outpace inflation.

- What assets can you invest in? – There’s a number of different asset classes you can invest in including shares, bonds, and bank deposits. There’s also funds which contain a diversified mix of assets. Generally asset classes with the highest potential returns come with the highest risk/volatility, while those with the lowest potential returns come with the lowest risk/volatility.

- How do I choose what to invest in? – There’s no one-size-fits-all answer as to what asset classes you should be investing in. Though the investments you choose should always align to your goals and personal circumstances. Very generally, those investing for long-term goals should consider higher growth investments like shares, while those investing for short-term goals should stick with bonds and bank deposits. Regardless of what you invest in, diversification can be a way to reduce risk – and that’s one reason why investing in funds is a great place to start.

- What services can you use to invest? – The investing platform you choose should be driven by what types of assets you want to invest in. Looking to invest in funds? Start by looking into fund managers like Kernel and Smartshares, or fund platforms like InvestNow and Flint. Wanting to invest in individual shares or bonds? Start by looking into brokers like Sharesies, Hatch, or Jarden Direct.

- Other important concepts – There’s more to investing than picking the right assets and platforms. Remember that time in the market beats timing the market, avoid investing in what’s hot, and stay calm if your investments go down.

Being an 101 level article, we certainly didn’t cover all the intricacies of investing here, but check out the rest of our site as we have plenty of other articles that dive deeper into various topics. Or feel free to share this article with others who may be looking to get started on their investing journey.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.