“More than half of New Zealanders do not search for any information at all before buying financial products”. There could be two reasons behind this: One, we’re either super confident in our financial literacy and don’t need to do any research. Or two, we don’t know what information to look for, so we just take a punt and hope everything goes well. We suspect the latter reason is the more accurate explanation for this shocking statistic from Te Ara Ahunga Ora.

Doing no research might be fine if you’re gambling on an investment using money you can afford to lose. But genuine investors will probably want to stop and do some basic due diligence before investing to make sure their investment is fit for purpose. So whether you’re a beginner, or just need a friendly reminder on what to look for, let’s have a look at six simple questions you can ask yourself about an investment before jumping in, so you can do so with more confidence.

1. Who am I investing with?

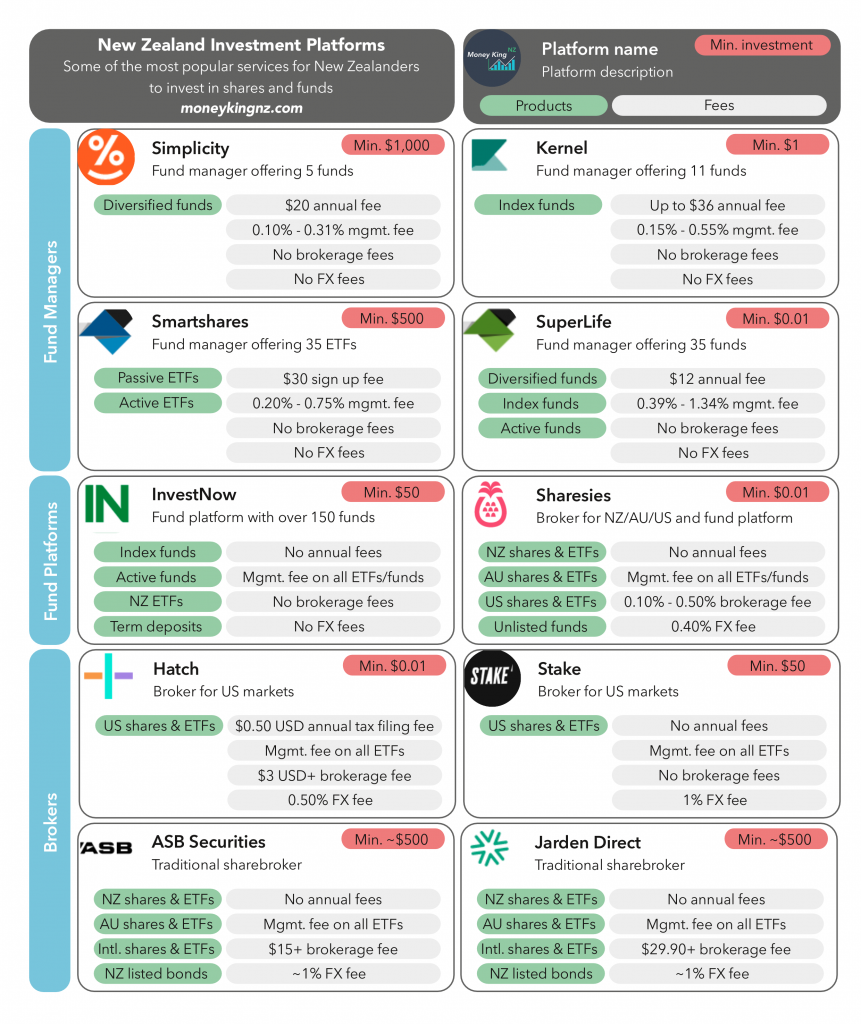

We have lots of reliable investment platforms to choose from these days:

But that doesn’t stop scams from being everywhere, attempting to suck in investors by offering high returns, or exclusive pre-IPO access to new companies. If you’re thinking of investing somewhere new, make sure that:

- They actually offer the investments you’re after – Not all platforms will offer the assets you want to invest in. For example, signing up for Stake won’t help if you’re looking to invest in NZX listed investments.

- The reviews are acceptable – They’ll always be grumpy customers, but if there’s a lack of information or overwhelmingly bad reviews, it’s probably a bad sign.

- They’re appropriately regulated – Are they licensed by the FMA?

- They hold your money safely – This typically involves holding your money under a custodian, separate from the investment provider – so if they go bust, your money is kept safe.

- They’re open about the risks of investing – All investing involves risk, so an investment provider promising a guaranteed return is likely to be a scam.

- They didn’t cold-call you – An investment provider probably isn’t genuine if they’re cold-calling prospective customers.

It’s illegal in New Zealand to sell financial products through cold-calling or other unsolicited communication.

FMA

If in doubt stick to a trusted, local brand, and don’t let greed over lower fees or higher returns tempt you into investing with an unknown service. If it sounds too good to be true, it probably is.

Further Reading:

– What happens to your money if InvestNow or Sharesies go bust?

2. Are the fees good value for money?

Fees are unavoidable when investing, but fortunately they’ve come down a lot over the last few years. But that doesn’t mean every investment provider out there is cheap, so it still pays to understand how they’re making money off you, and check whether the fees are good value for money:

Consider your own personal circumstances – An investment option that’s cost effective for another person, might not be for you. For example, if you’re looking a cheap KiwiSaver provider, Simplicity might be a good option if you have a large investment balance. But this isn’t the case if you have a smaller balance – for a balance of $1,000 Simplicity’s fees are a high 2.31%.

Consider the total cost of ownership (not just the headline management fee) – There’s often a lot of additional fees you’ll need to consider when comparing products. For example, the Smartshares US 500 ETF has a higher management fee (0.34%) compared to the Vanguard S&P 500 ETF (0.03%). But in comparing the two funds, you need to factor in the additional brokerage, foreign exchange fees, and tax implications associated with the Vanguard fund.

Consider the value of extra features or services – Cheaper isn’t always better. For example, when buying US shares Hatch is generally more expensive than Sharesies for transactions under ~$1,000 NZD in size. However, there’s a few reasons you might still choose Hatch over Sharesies, given Hatch has a few extra features like stop-loss orders and the ability to transfer your shares in and out to/from other brokers (though for very small transactions, we wouldn’t consider Hatch’s $3 fee good value for money).

Further Reading:

– InvestNow Foundation Series vs Simplicity funds – Tax leakage an issue?

– Smartshares US 500 (USF) vs Vanguard S&P 500 (VOO) – Which ETF is better?

– Buying shares in the USA – Sharesies vs Hatch vs Stake

3. What am I actually investing in?

The amount of choice we have for what we can invest in is incredible. Unfortunately with accessible fees and slick platforms, investing has started to become gamified. Some investors can start to lose sight of what they’re actually investing in, and as a result investing can often feel like we’re just betting on horses.

But in reality your investments are much more than just a financial instrument or stock ticker. So instead of just picking the flavour of the month, it’s best to stick to investments you can understand, so you can properly assess what makes the investment valuable and the potential risks. For example:

Shares – When you buy shares, you are buying partial ownership of a Company. Over the long-term the value of your shares will largely be driven by the company’s performance and prospects for the future. So before buying any shares, ask yourself whether you understand the company and if you’d genuinely like to own that business.

Buy into a company because you want to own it, not because you want the stock to go up.

Warren Buffet

Funds – These are a diversified basket of assets like shares or bonds. For example, the Kernel NZ 20 fund contains the shares of the 20 largest companies listed in NZ, including Spark, Mainfreight, and a2 Milk. Pick funds not just based on their name, but what assets are in the fund and how they fit into your portfolio.

Crypto – While the legitimacy of cryptocurrency as a genuine investment is debatable, some coins like Bitcoin and Binance Coin have practical use cases. But for many other coins like Safemoon and Squid Game Token, it’s a lot harder to see their value beyond being a Ponzi scheme. Before investing ask yourself whether you understand what the coin is trying to achieve, and what gives it value over other cryptocurrencies?

Further Reading:

– Shares 101 – How to buy shares, which companies to pick, and more

– Funds 101 – What’s the difference between an Index Fund, ETF, and more?

– Digital Gold? 5 things to know about Bitcoin

4. What are the risks, and do they align with my goals and risk tolerance?

If you started investing in the last year or so, you would’ve likely made some great returns. This has made it very rewarding and exciting over the short-term, but can lead to complacency and forgetting about the risks. So instead of investing purely for gains, invest in assets that align with your investment timeframe (whether you need the money in the short-term or long-term) and risk tolerance. For example:

Shares – Share prices are volatile – they jump up and down on a daily basis, sometimes by significant amounts. In the worst case companies go bust. Shares are best suited for long-term investors who don’t need to take their money out for several years (so that you have sufficient time to recover from any volatility), and who have a high appetite for risk (so that any volatility in your shares won’t keep you up at night).

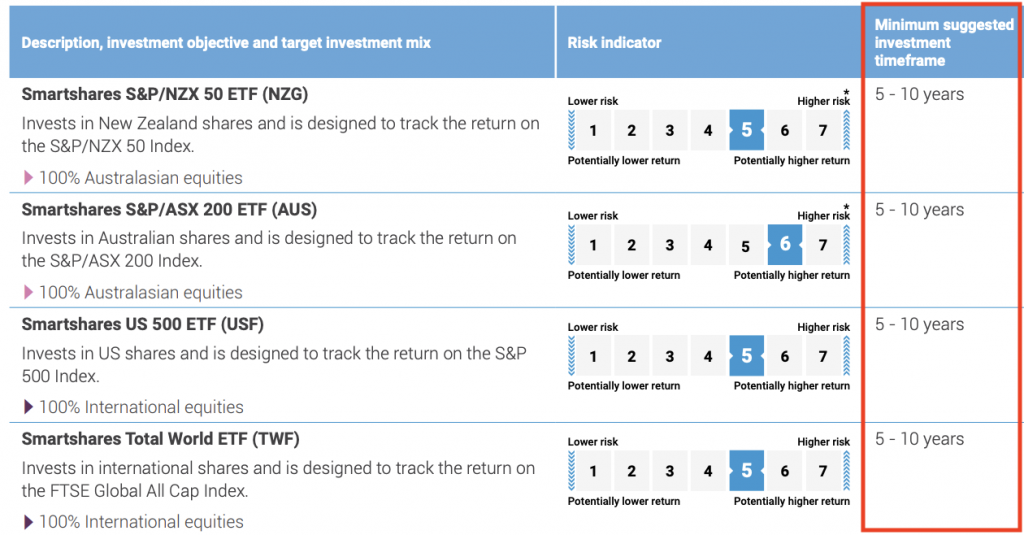

Funds – Funds are less risky than buying individual assets like shares since they spread your money across multiple assets. But funds aren’t a substitute for a savings account (apart from those that invest purely in cash). The assets in your fund can still go down in price, reducing the fund’s value. In NZ each fund’s Product Disclosure Statement will have a “minimum suggested investment timeframe” – the recommended amount of time you should be investing to minimise the risk of losing money.

Crypto – Holding crypto has been very rewarding recently. However, cryptocurrency crashes can be incredibly violent, and the next big crash is a matter of when, not if. You should have a very high risk tolerance when investing, and be prepared to lose all the money you put in.

Cash and Bonds – It’s often forgotten that investing isn’t always about chasing the largest gains possible, and many people automatically dismiss these asset classes due to their lower returns. Cash and bonds help shield your capital from the volatility of shares and crypto, so money you need in the short-term like a house deposit is protected from price crashes and corrections.

Further Reading:

– What’s the best short-term investment?

5. Is the price I’m paying (or returns I’m expecting) realistic?

Almost everyone takes price into consideration when buying things in everyday life. For example, you wouldn’t spend $10 on an ordinary cup of coffee, when you’d normally expect to pay $5. Unfortunately we sometimes forget to apply the same price consciousness when it comes to buying investments.

Unrealistic prices

Understandably it’s incredibly hard to put a dollar value on a company or cryptocurrency, and sometimes it’s tempting to just jump in due to FOMO. While most investments have realistic prices, it’s easy for hyped up investments to get pumped up into a bubble. So it’s worth doing a basic sanity check by looking at a company’s valuation or market cap to ensure you’re not paying too much for too little company. Here’s a couple of examples:

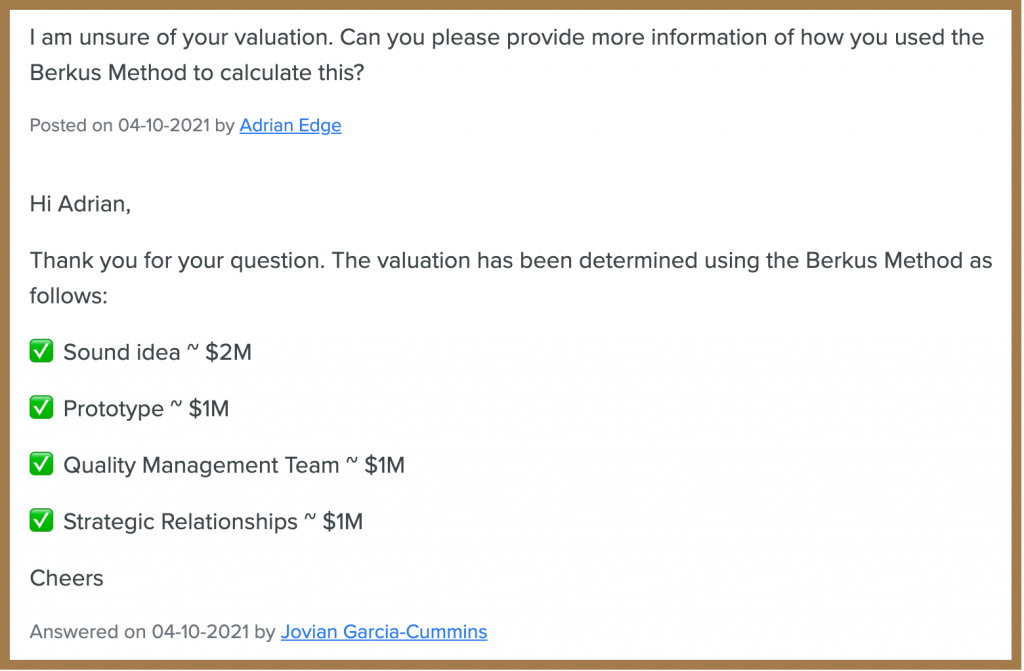

Woolies Jeans – This is a startup looking to manufacture the world’s most comfortable jeans, and are currently raising capital through an equity crowdfunding campaign. The problem is they’ve yet to manufacture or sell a single pair of jeans, yet they’ve valued the company at $5 million. This valuation is based purely on having a sound business idea, prototype, management team, and strategic relationships. Are these worth $5 million in a crowded apparel industry? Too much for too little in our opinion.

Nikola – A zero-emission vehicle manufacturer who at one point grew to having a market cap of over $30 billion – larger than Ford at the time! Like Woolies Jeans, they had no revenues and no in-production vehicles. Their meteoric price rise came largely from prototypes, partnerships, and hype. However, they allegedly made everything thing up, with their prototypes not being functional, and their technology not even existing. Their market cap has since fallen to just over $5 billion, and shows what can happen when investors pile in, paying unrealistically high prices for nothing of any real substance.

Unrealistic expectations of price appreciation

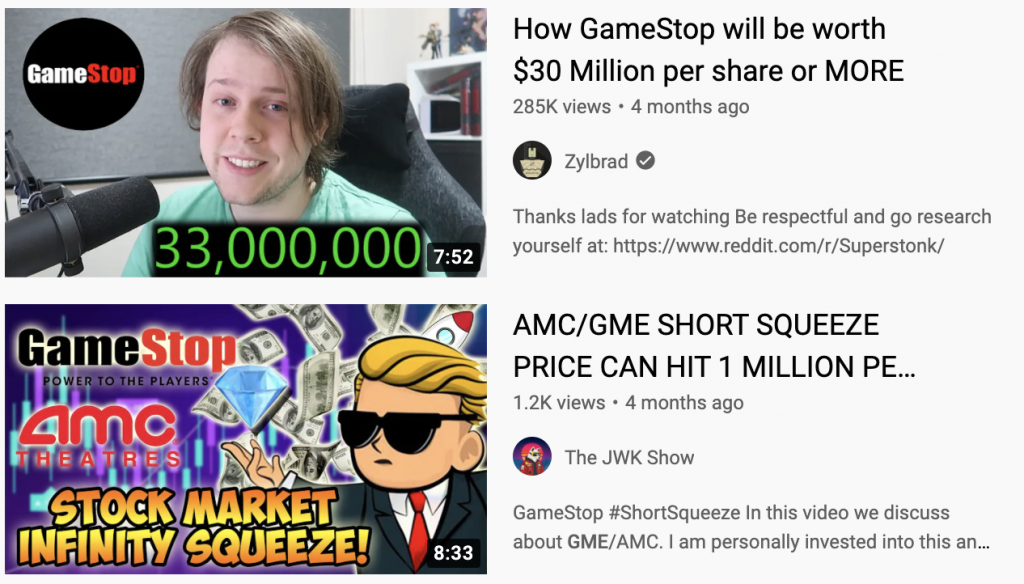

Some social media influencers will often give insane price predictions for a certain investment, prompting people to FOMO into that investment with the expectation of incredible returns. However, these price predictions are often unrealistic, and we can do another sanity check here to ensure we’re not being misled into investing for the wrong reasons. Examples are:

GameStop (GME) – Memes usually come and go pretty quickly, but GameStop shares have built up a substantial cult following this year. Some suggest that GME is going to a price of $1 million and beyond! With a current share price of $200 USD, it appears to be a cheap ticket to becoming a millionaire – but is this price prediction even realistic? We don’t think so. A price of $1 million would give GME a market cap of ~$70 trillion – almost double the market cap of the entire S&P 500! It’s unrealistic to expect a video game retailer to be worth that much, and to be investing with the expectation of such large gains.

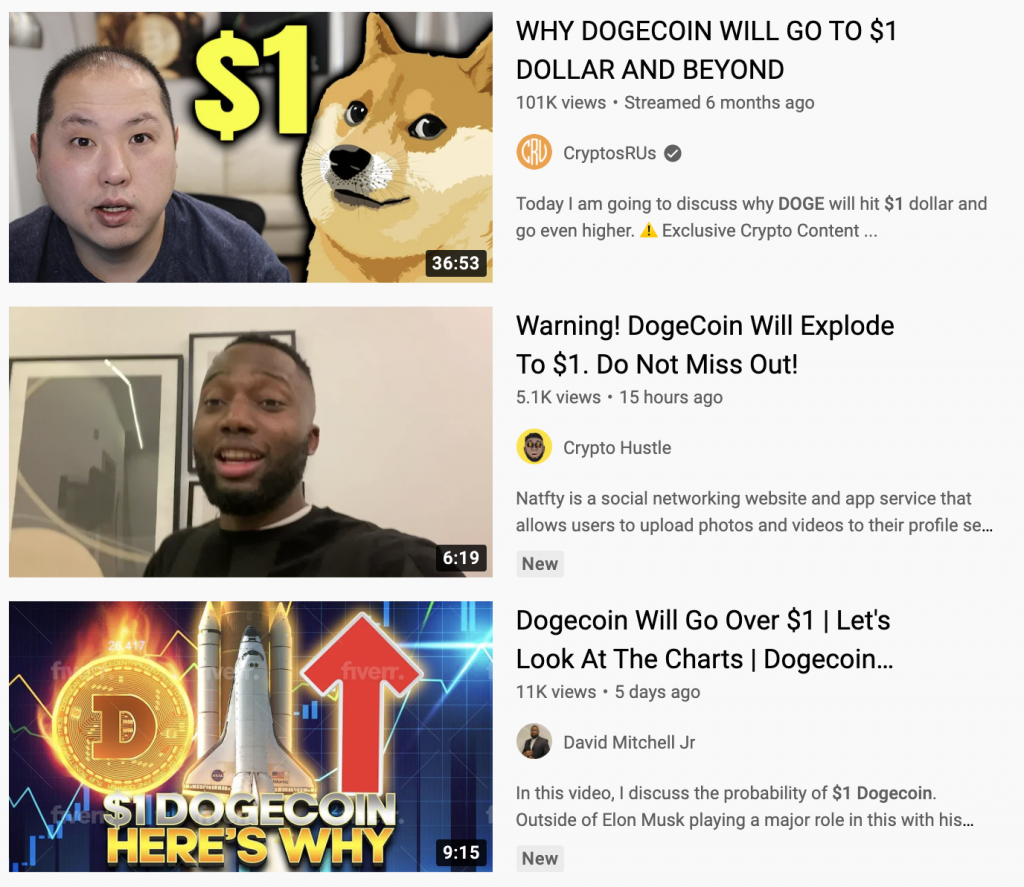

Meme coins – Dogecoin (DOGE) and Shiba Inu (SHIB) are both meme cryptocurrencies that have delivered astronomical returns of 10,000% and 72,000,000% over the past year! The influencers believe there’s more to come, with some predicting DOGE (currently $0.275 per coin) will rise to $1 and SHIBA (currently $0.00005354) will rise to $0.01. Is this even realistic?

DOGE at a price of $1 would give it a market cap of about $132 billion, making it the 3rd largest cryptocurrency after Bitcoin and Ethereum, and worth as much as companies like Boeing, Starbucks, and American Express! SHIB at a price of $0.01 would give it a market cap of about $5.5 trillion! That’s equal to the combined market cap of Apple and Microsoft with plenty of change leftover. It’s probably unrealistic for joke cryptocurrencies with no meaningful use cases to be worth that much, so best to keep your life savings elsewhere.

This goes to show the danger of getting investment tips and price predictions from YouTubers, social media influencers, and Facebook comments. It’s always best to do your own research, looking into both favourable AND unfavourable views on a prospective investment so that you can avoid confirmation bias.

6. How can I get my money out?

This one is important – It doesn’t matter how much your investment went up if you can’t even get your money out. But in the pursuit of your next exciting investment opportunity, it’s easy to jump into one without considering how you can sell it for NZD and withdraw the money into your bank account.

Getting your money out of shares and funds is typically easy. In most cases you can sell your shares and funds using the same platform you bought them from. Just be aware of the fees you’ll pay, and how long it’ll take to get the money out. Unfortunately withdrawing your money might not be so straightforward for some alternative investments, so it pays to do some research upfront to avoid having your money stuck further down the track.

Examples

Cryptocurrency platforms – International platforms like Coinbase and Crypto.com are increasingly popular channels for Kiwis to buy crypto. However, many investors are getting stuck as these platforms don’t offer a way to sell your crypto for NZD and withdraw the money into your bank account. You’d have to use a service like Easy Crypto to sell your coins, but this can still be problematic – Easy Crypto doesn’t support all cryptocurrencies, so you might have to convert your coins before you can sell them. In addition, Easy Crypto’s minimum transaction size is $100, so your coins could be stranded if you have less than that amount.

ERC-20 tokens – These are Ethereum based crypto tokens such as Chainlink and Loopring. While these are easy to buy and send to your own wallet, getting them out of your wallet is more problematic. These tokens require you to buy and send Ethereum into your wallet, in order to pay for the transaction fees to send these stranded coins out – a process which will most likely incur at least $50-$60 in fees. In doing your research beforehand you may realise that with all the hoops you need to jump through, your investment might not be worth the effort.

Equity Crowdfunding – This involves buying shares in a private, unlisted company. Unlike shares listed on a sharemarket like the NZX, you can’t sell these shares through a broker like Sharesies. So always check the exit strategy for each Equity Crowdfunding deal you want to invest in – is the company planning to list on the sharemarket or be acquired by another company? Or do they facilitate the trading of shares between shareholders. In many cases you’ll find that you can’t get your money out of these deals easily, so consider this fact before you invest in the first place.

Further Reading:

– How to sell Bitcoin in New Zealand

– 4 things to know about investing in Equity Crowdfunding

Conclusion

Hopefully this article has given you an idea of some simple things you can ask yourself before sinking your money into an investment, so that you don’t get caught out in the future. In summary:

- Who am I investing with? If in doubt, stick to the trusted platforms. The promise of better returns, lower fees, or a nicer interface isn’t usually worth the risk of going for an unknown investment provider.

- Are the fees good value for money? The investment providing best value for money will vary depending on how much you’re investing, and your personal investing behaviours and preferences.

- What am I really investing in? Only invest in what you understand, so you can assess what gives your investment value and the potential risks.

- What are the risks, and do they align with my goals and risk tolerance? Different investments suit different investment timeframes and appetites for risk. Invest in things that align with your personal circumstances.

- Is the price I’m paying (or the returns I’m expecting) realistic? Buying investments just because of hype or insane price predictions often leads to disappointment – their valuations or expected valuations are often unrealistic.

- How can I get my money out? You only make money on your investments when you take your money out, so make sure you know how to do so prior to putting your money in.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.