Sharesies is an incredibly popular Wellington based investment platform, and is independently owned and operated, unassociated with any banks or traditional investment providers. They opened in 2017, competing against much bigger players in the industry by offering a small selection of funds. Since then they’ve added the option to invest in NZX shares (in 2019), followed by expanding into offering US markets (in 2020), and Australia (in 2021).

Sharesies have been a huge success story so far, introducing heaps of new people to the world of investing with their friendly and slick platform, and amassing over 500,000 customers to date. But since their launch the number of alternatives to Sharesies have grown substantially, with Kiwis having more choices than ever to invest their money. So how do they stack up as an investment platform in 2023?

This article covers:

1. What’s on offer?

2. Fees

3. Custody of your investments

4. Other considerations

5. Sharesies vs competing services

Update (21 Feb 2023) – Updated article to reflect new fee structure

Update (20 Apr 2023) – Updated to reflect Sharesies’ new Save offering

1. What’s on offer

Sharesies can be described as a broker. They don’t offer their own funds or manage your money for you, but rather they’re a service enabling you to buy and sell shares and ETFs listed in the following markets:

New Zealand (NZX)

Sharesies is an NZX participant, allowing them to trade on the NZX on behalf of their customers. Through this arrangement they offer about 170 NZX listed shares (e.g. Contact Energy, Spark, and Mainfreight) and ETFs (including the popular Smartshares range).

Australia (ASX)

Sharesies partners with CMC Markets as their Aussie broker, who execute ASX orders on behalf of Sharesies. Through this partnership they offer about 2,000 ASX listed shares (e.g. Xero, Woolworths, and Qantas) and ETFs.

United States (NYSE, Nasdaq, CBOE)

Sharesies partners with DriveWealth as their US broker. Through this partnership they offer over 3,000 US shares (e.g. Apple, Disney, and Nike) and ETFs (including the popular VOO – Vanguard S&P 500 ETF).

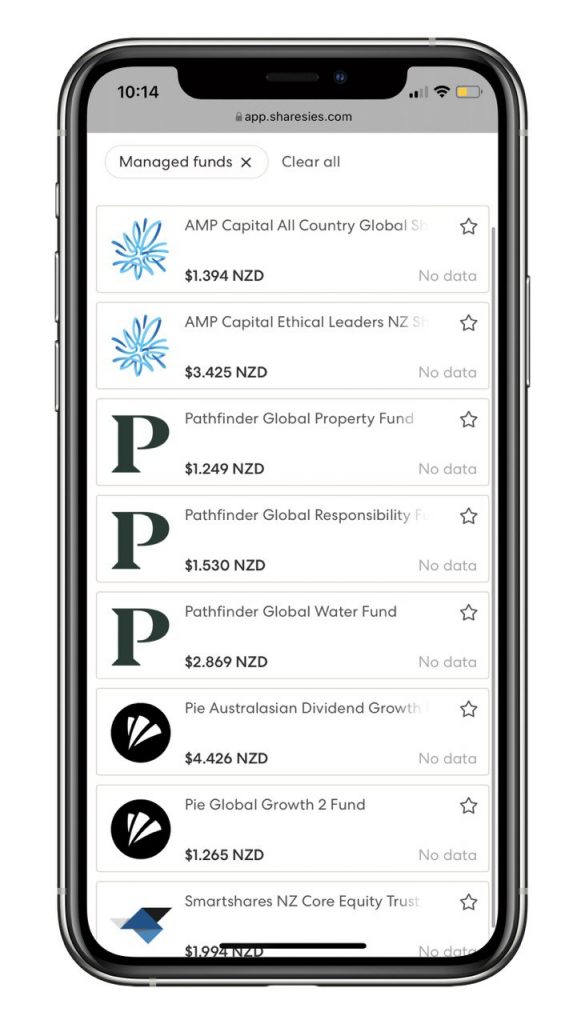

Managed Funds

Sharesies also offers a very small range of 9 unlisted funds offered by NZ fund managers such as Macquarie, Pathfinder, and Pie Funds.

Further Reading:

– Shares 101 – How to buy shares, which companies to pick, and more

– Funds 101 – What’s the difference between an Index Fund, ETF, and more?

Save

Sharesies Save is an on-call savings product which allows you to earn interest on any money kept in this account. Sharesies doesn’t any money kept in a Save account themselves. Instead the money will be held at a major NZ registered bank – While Sharesies haven’t disclosed the exact bank this is, they’ve stated that it has a credit rating of AA-, so it’s likely to be either ASB, ANZ, BNZ, or Westpac. Save is expected to launch in May 2023 with an interest rate of 4.35% (which is subject to change).

Minimum investment

There’s no minimum investment required on Sharesies, so you can invest with as little as 1 cent. They enable this by offering fractional shares. For example, 1 share of Amazon currently costs around $3,400 USD, but you don’t have to invest this much to become a shareholder of Amazon – it’s possible to invest $100 USD which would get you 0.029 Amazon shares, or even just $10 USD which would get you 0.0029 Amazon shares.

Selecting what to invest in

Sharesies’ investment offering is very comprehensive, with NZ, Aussie, and US options all under one roof. However, they provide an execution only service meaning they don’t offer advice on what you should invest in. You’re on your own when it comes to selecting what assets to buy, and this can make Sharesies confusing for beginners. Luckily there’s no minimum investment, so you could chuck a few dollars in just to play and learn the ropes of investing.

But Sharesies does offer pre-made investment bundles which aim to make putting together a well-rounded investment portfolio easy:

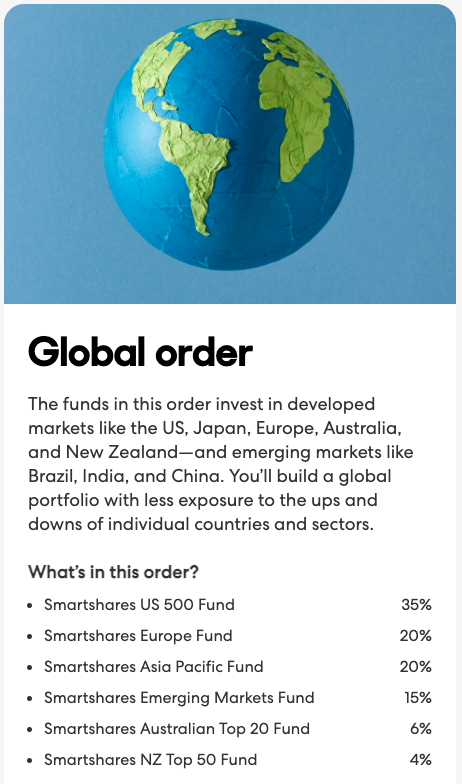

- Global Order – A bundle containing a range of Smartshares ETFs investing in different markets around the world.

- Sustainable Order – A bundle made up of Pathfinder and AMP managed funds that focus on investments that have a positive impact on the environment and society.

- Kids Order – A bundle for kids accounts made up of managed funds, with a slight focus on sustainable investments.

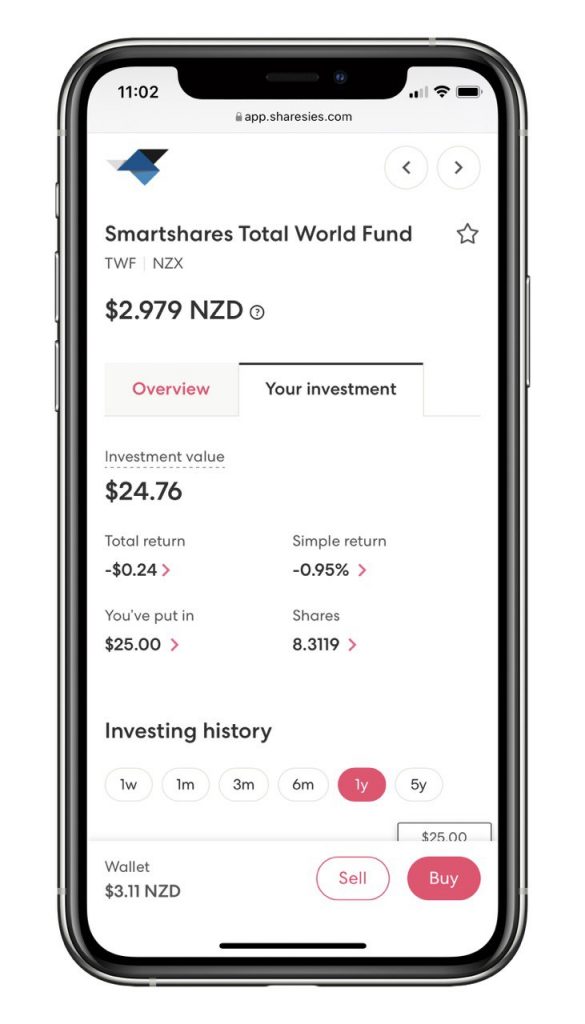

However, Money King NZ is not a fan of Sharesies’ pre-made orders. While buying these bundles are a convenient way to invest, they’re unnecessarily complex and usually result in higher fees than if you were to build your own portfolio of low cost index funds. For example, the Global order contains six different funds (with a weighted average management fee of 0.48%), all of which could be replicated by the single AND lower fee Smartshares Total World ETF (with a fee of 0.40%).

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

2. Fees

Transaction fees

Sharesies makes money by charging you transaction fees each time you buy or sell an investment. The ordinary transaction fee is 1.9%, and is capped at the following amounts:

- NZX – $25 NZD

- ASX – $15 AUD

- US – $5 USD

Sharesies doesn’t charge brokerage fees on their managed fund offerings (though fund managers may charge a spread when you buy or sell their funds). Instead Sharesies makes money from these funds by receiving a commission from the fund manager whenever someone invests in these funds.

Monthly plans

Sharesies’ 1.9% transaction fee is on the expensive side. It requires your investments to go up by ~3.8% just to break even and cover this fee. However, those investing larger amounts ($158 or more per month) may be better off subscribing to a monthly plan, which covers your transaction fees for up to a certain amount:

| Plan | What you’ll get each month |

| $3 plan | Transaction fees covered on up to $500 NZD of individual trades, plus Transaction fees covered on up to $1,000 NZD of auto-invest orders |

| $7 plan | Transaction fees covered on up to $1,000 NZD of individual trades, plus Transaction fees covered on up to $3,000 NZD of auto-invest orders |

| $15 plan | Transaction fees covered on up to $5,000 NZD of individual trades, plus Transaction fees covered on up to $10,000 NZD of auto-invest orders, plus NZX market depth subscription (usually $10 per month) |

| $1 kids plan | Transaction fees covered on up to $500 NZD of individual trades, plus Transaction fees covered on up to $1,000 NZD of auto-invest orders |

Depending on how much you invest, these plans could lower your effective transaction fees to as low as 0.10%. The problem is that these plans are only useful if you’re investing large enough amounts, so smaller investors are stuck paying the high 1.9% fee.

Further Reading:

– Sharesies’ January 2023 fee changes – Are they good or bad?

Foreign Exchange

To invest in the Aussie or US markets, you’ll need to change your New Zealand Dollars to the relevant foreign currency (AUD or USD). Sharesies charges a foreign exchange fee of 0.50% for swapping between currencies.

You can swap between currencies at any time. Otherwise Sharesies will automatically convert your money to the relevant currency whenever you buy shares. For example, if you have NZD on hand and buy ASX shares, your money will be automatically be converted from NZD to AUD when the purchase takes place.

Other fees

- Card top-up fee – Sharesies allows you to deposit money into your account using a credit/debit card. They aren’t transparent about how the fees for this is calculated, but it costs $2.91 for a deposit of $100 (though your very first card top-up of up to $100 is free). This is really expensive, so it’s best to deposit money into your account via bank transfer (which isn’t instant like card top-ups, but is free).

- Gifts – Sharesies has a really cool feature where you can gift a Sharesies top-up of between $5 and $2,000 to someone else. This attracts the same fee as card top-ups so you’ll get more bang for your buck by simply gifting someone cash.

- Fund management fees – Funds and ETFs charge all charge a percentage based management fee. These aren’t charged by Sharesies, but by the manager of the fund/ETF.

- ADR fees – If you invest in an American Depositary Receipt (ADR), there is a small management fee payable. These aren’t charged by Sharesies, but by the depositary bank offering the ADR.

- Account closure fee – There is normally no fee to close your Sharesies account. However, there’s a new $15 fee if Sharesies closes your account due to being non-compliant (e.g. for inappropriate activity or not meeting AML/CFT obligations).

- Sharesies Save – There are no fees associated with Sharesies Save

3. Custody of your investments

Ownership of shares

The investments you buy through Sharesies are held by a custodian:

- NZX shares – Held by Sharesies Nominee Limited under Sharesies Nominee’s CSN (Common Shareholder Number).

- ASX shares – Held by Sharesies Nominee Limited under Sharesies Nominee’s HIN (Holder Identification Number).

- US shares – Held by DriveWealth’s custodian under DriveWealth’s name.

All of this means your assets aren’t directly registered in your name, though you are still the beneficial owner of those assets. This arrangement is safe – if Sharesies were to go bust, your investments are held separately to the platform, so they can’t use them to cover their expenses or pay back their debts.

Having your shares held under custody still means you get access to any dividends your investments pay, and get to participate in any capital raises (i.e. Share Purchase Plans or Rights Issues). You also get voting rights on any NZX listed companies. However, Sharesies’ custody arrangements come with the following key issues:

- You can’t participate in Dividend Reinvestment Plans (DRPs). Some companies offer DRPs, allowing shareholders to automatically reinvest their dividends into buying more shares of the company, often at a discounted price. Instead all dividends are paid out to your Sharesies account, and you have to manually reinvest your dividends, incurring brokerage fees in the process.

- A few companies occasionally give special rewards to their shareholders (for example, Restaurant Brands give their shareholders a KFC voucher every year). These rewards aren’t available through Sharesies.

- Voting rights aren’t available for ASX or US companies. This occurs when companies allow their shareholders to vote on issues such as the election of directors, and on major company transactions.

Further Reading:

– What happens to your money if InvestNow or Sharesies go bust?

Transfers

Another key issue is whether it’s possible to transfer your Sharesies investments out to your own name or to another broker.

For NZX listed investments, you can transfer these out to your own CSN for a $15 fee. Having your shares under your CSN (i.e. your own name) would allow you to participate in voting and DRPs. In addition, investments held under your CSN can be transferred in to Sharesies for free.

For ASX and US investments, there is no way to transfer your investments in or out to/from another provider. You can’t transfer out to a HIN or SRN for your Aussie investments, nor can you transfer to another broker (like Hatch) or DRS (direct holding under your name) for your US investments. The process for transferring your investments to another broker would be:

- Sell off your shares (incurring brokerage fees),

- Exchange the proceeds back to NZD (incurring FX fees),

- Withdraw the NZD to your bank account,

- Deposit the NZD to your new broker,

- Exchange the NZD back to AUD/USD (incurring more FX fees),

- Repurchase your shares (incurring more brokerage fees).

This allows Sharesies to clip the ticket on each transaction you make, results in less control over your shares, and ultimately a poorer outcome for customers. We hope Sharesies introduces transfer functionality for ASX and US shares soon.

4. Other considerations

Account types

- Kids accounts – Sharesies allows kids accounts for under 18s. These accounts must be linked to and managed by an adult Sharesies account. You can choose an age (between 18 and 25) at which the account’s control is handed over to the kid.

- Joint accounts – Sharesies does not offer joint accounts.

- Trusts & Companies – Sharesies does not offer trust or company accounts.

User Interface

Sharesies’ UI is friendly and welcoming, and they have carefully considered ease of use in building the platform. They also have a native mobile app for Android and iOS, but this provides no extra features over their web app.

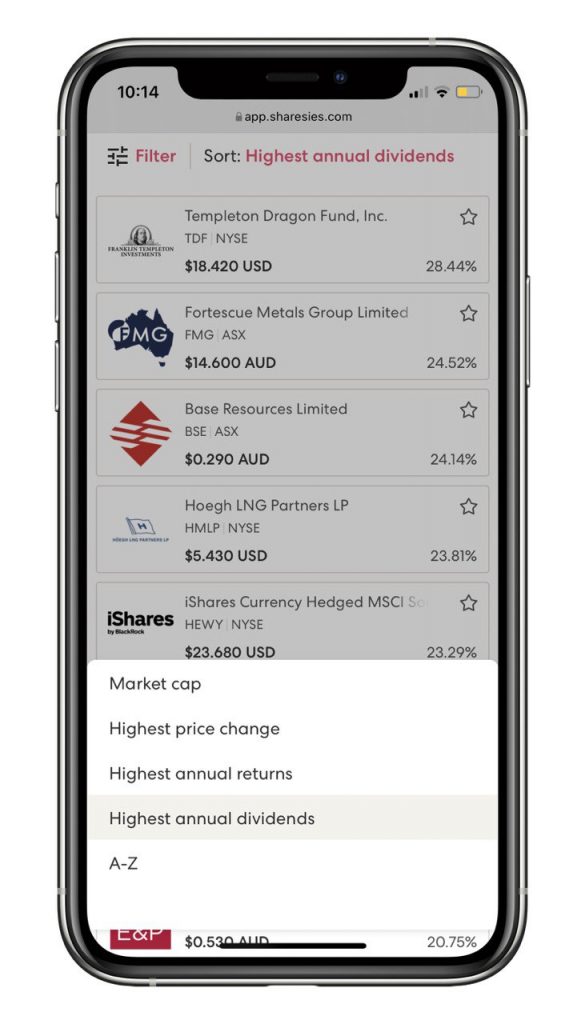

One thing about Sharesies’ UI that we aren’t a fan of is their ability to sort companies by “Highest annual returns” and “Highest annual dividends”. This could encourage beginner investors to make investment decisions based purely on these factors – and chasing past winners and dividend yield is a surefire way to get burnt in investing.

Placing orders

Sharesies allows you to place three types of orders:

- Market – Your order will be executed at whatever the market price is at the time you place your order (if there’s enough shares in the market to buy/sell).

- Limit – Allows you to specify a maximum price you’re willing to buy your shares at, or a minimum price you’re willing to sell your shares at. For example, if you place an order to buy Air New Zealand with a limit price of $1.60, your order will only execute at a price of $1.60 or less. Your order will not complete if the share price doesn’t drop to $1.60 or below. Limit orders aren’t available for fractional US shares (only for whole shares).

- Stop loss (available on US shares only) – Triggers a sell order for your shares if they fall below a certain price.

Market data

Sharesies does not provide the following market data elements:

- Live pricing – All share price data displayed on Sharesies is delayed by 20 minutes (although any orders you place still trade in real-time). This can be problematic as the price your order is executed at will often differ from the price quoted to you.

- Market Depth – This shows a list of all buy and sell orders in the market, and may be useful in informing what price to set your limit orders at. Sharesies does provide depth for the NZX, but only if you pay $10 per month. It’s an unnecessary subscription for most investors.

- Announcements – Market announcements are the main channel for companies to release important information such as financial results, and corporate action details (such as dividend payments and capital raises) out to investors. Announcements aren’t displayed on Sharesies, so you’ll need to refer to other sources like the NZX website to see these.

Auto-invest

Sharesies’ auto-invest functionality is available for all their investments including NZX shares, ASX shares, US shares, and managed funds. This allows you to automatically make investments into your desired selection of assets either weekly, fortnightly, every four weeks, or monthly.

Tax

Tax treatment of your investments is the same regardless of what investment platform you use. However, Sharesies automatically takes care of the following taxes for you:

- Dividends on most listed investments (including ASX and US shares) are automatically taxed at a rate of 33%.

- Listed PIEs are taxed at a rate of 28%.

- Unlisted managed funds are taxed at your Prescribed Investor Rate (PIR).

Sharesies doesn’t manage the following scenarios:

- If you need to have your dividends taxed at a different rate other than 33% (or 28% for listed PIEs). Though any under or overpayment of tax on dividends should be corrected when the IRD issues tax refunds or bills after the end of the tax year.

- If you have invested over $50,000 in Foreign Investment Funds (all US and some ASX investments). In this case you’ll need to calculate your taxable income under the FIF tax rules. Sharesies doesn’t handle this for you.

- If you are considered a “trader”, your capital gains may be liable for tax. Sharesies does not calculate or pay tax on capital gains on your behalf.

In addition, the way Sharesies treats tax on foreign investments (FIFs) may be financially disadvantageous:

- They deduct tax from you upfront when you receive a dividend, resulting in less cash to reinvest. On other platforms FIF tax is paid after the end of the tax year, so can be reinvested to earn a return in the meantime.

- They deduct tax from you even if your overseas dividends are below the $200 threshold. Normally you wouldn’t have to declare them to the IRD if the dividends (plus other untaxed income) are less than $200 for the year.

Further Reading:

– What taxes do you need to pay on your investments in New Zealand?

– Tax on foreign investments – How do FIF and Estate Taxes work?

Investor education

Providing investor education is in Sharesies’ interest as it empowers their customers to make informed decisions about their investments, and can encourage more people to start investing. Sharesies does this by putting out blog posts, hosting regular “Lunch Money” seminars, and producing a daily podcast covering the day’s financial news.

Sharesies also have an investors’ Facebook Group with almost 60,000 members (though Facebook communities aren’t the best place to obtain investment advice). However, some members report that Sharesies censors the group’s content, deleting any posts that criticise the platform. It feels like Sharesies want their own investor community to look at them through rose-tinted glasses.

Lower risk investments

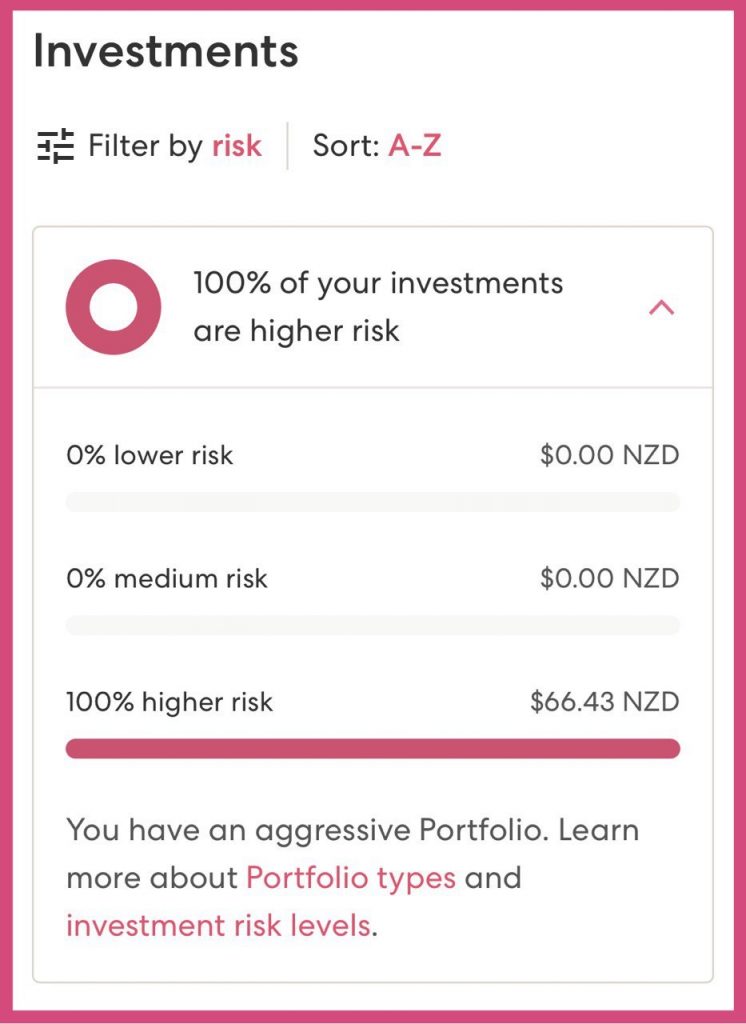

Sharesies categorises their investments into three buckets based on the riskiness of the investment:

- Higher Risk – These include shares, and ETFs that invest in shares. The majority of investments on Sharesies are classified as “higher risk”, and these are most suitable for long-term investing.

- Medium Risk – Includes ETFs that invest in bonds (e.g. Smartshares Global Aggregate Bond ETF), and some ETFs that invest in REITs (e.g. Smartshares NZ Property ETF). Best for medium-term investing.

- Lower Risk – Includes ETFs that invest in cash (e.g. Smartshares NZ Cash ETF), and some ETFs that invest in government bonds (e.g. iShares 1-3 Year Treasury Bond ETF). Best for short-term investing.

We’d suggest that “lower risk” investments aren’t worth it on Sharesies, given the fees will likely outweigh the potential returns of those funds. 0.5% brokerage fees to buy + 0.5% brokerage fees to sell an investment that will probably only deliver 1% p.a. in returns (like the Smartshares NZ Cash ETF) isn’t a good deal. International “lower risk” investments are an even worse deal, as you also have to pay foreign exchange fees, plus exchange rate fluctuations can add a layer of volatility onto a supposedly low risk asset. It’s probably better to stick to bank deposits or cheaper platforms like InvestNow for short-term investing.

Further Reading:

– What’s the best short-term investment?

5. Sharesies vs competing services

Here’s a brief overview of how Sharesies compares to competing platforms with links to more in depth comparisons:

Other brokers

NZX

For buying shares on the NZX, ASB Securities and Jarden Direct are the closest competitors. They’re almost always more expensive, especially for smaller investments given their fees start from $15 per transaction. However, their benefits are that they register your shares directly in your name under your CSN, and display live pricing and market depth for free.

Further Reading:

– Buying shares on the NZX – Sharesies vs ASB Securities and Jarden Direct

ASX

ASB Securities and Jarden Direct are also alternatives for investing in ASX shares. They’re more expensive but can register your shares directly under your HIN. Interactive Brokers and Tiger Brokers are other alternatives for the ASX that are cheaper for larger transactions (~ over $1,000 in size). However, like Sharesies they also hold your shares under custody.

US

For US shares Hatch, Stake, Interactive Brokers, and Tiger Brokers are the closest competitors. Fee-wise Sharesies are the best for smaller transactions. For example, with Hatch it’s not cost effective to invest $10 at a time, as their flat $3 brokerage fee would mean your investment would have to grow by 30% just for you to break even. Though for larger transactions, Hatch and Interactive Brokers are best – with Interactive Brokers being cheaper than Sharesies for transactions larger than ~$480 NZD, and Hatch becoming cheaper than Sharesies for transactions larger than ~$1,100 NZD.

Sharesies also has fewer features compared to these US brokers, such as the ability to transfer your shares in or out and voting. Interactive Brokers and Tiger Brokers also offer investment into other markets (such as Hong Kong, Canada, and the UK), and advanced products such as margin lending, options, and futures. Though none of Sharesies’ US competitors offer NZX shares.

Further Reading:

– Buying shares in the USA – Sharesies vs Hatch vs Stake

– Hatch review – Hard to recommend

– Stake review – Is there a catch to their $0 brokerage fee?

– Interactive Brokers & Tiger Brokers review – Better than Sharesies & Hatch?

Funds

InvestNow

InvestNow is a fund platform which is probably superior to Sharesies for investing in Smartshares’ ETFs – the main advantage being the fact that InvestNow do not charge any brokerage fees (compared to Sharesies’ 1.9% fees). InvestNow also offer a wider range of unlisted funds from several fund managers like Macquarie, Milford, and Fisher Funds, and the ability to automatically reinvest dividends.

The main downsides of InvestNow compared to Sharesies are their higher minimum investment of $50, and a less user friendly platform. In addition, InvestNow don’t offer individual companies listed on the NZX, nor do they have ASX and US listed investments.

Further Reading:

– InvestNow vs Sharesies – Ultimate Fund Platform showdown and review

Kernel & Simplicity

The likes of Kernel and Simplicity are less direct competitors to Sharesies. They are fund managers that offer a small selection of passively managed funds, as opposed to Sharesies which is a broker. These represent different ways to invest, so it’s like comparing apples to oranges, and the one most appropriate for you will come down to your personal preferences – though Kernel and Simplicity arguably represent an easier way to invest given they promote passive investing over actively researching and selecting individual shares. The below article provides further insight into the different approaches:

Further Reading:

– 6 ways to build a long-term investment portfolio in New Zealand

Sharesies Save vs other Savings accounts

On-call savings

Here’s how Sharesies Save stacks up against other on-call savings accounts (as at 20 April 2023):

- ANZ Online Savings – 2.25%

- ASB Savings On Call – 2.25%

- Westpac Simple Saver – 2.50%

- Kiwibank On-line Call – 3.85%

- Rabobank RaboSaver – 3.90%

- BNZ Rapid Save – 3.95%

- Sharesies Save – 4.35%

- Heartland Direct Call – 4.60%

- Squirrel On Call (funds stored with BNZ) – 5.00%

Sharesies’ offering is certainly competitive, but it’s not the best. Heartland and Squirrel both offer higher rates (and Heartland’s account is also available in PIE form, giving it an even better effective interest rate of 5.04% for 33% taxpayers). However, if you’re already a Sharesies customer, their Save account could still be a convenient place to park your money when it isn’t invested in the markets.

Sharesies Save vs Kernel Save

A few investors may be wondering how Sharesies Save compares to other products like Kernel Save (5.25% interest) and Rabobank’s PremiumSaver account (up to 4.65% interest). But isn’t an apples-to-apples comparison between these products:

- Sharesies Save is an on-call savings account, providing instant access to your money without any penalties.

- Rabobank PremiumSaver is a bonus saver account, also providing instant access to your money, but penalises you by paying you a lower interest rate of 2.25% if you don’t increase your account balance by at least $50 each month.

- Kernel Save is a notice saver account. It requires you to give 34 days’ notice to withdraw your money, so it’s a lot less accessible than the above two products.

Overall an on-call product like Sharesies Save would better suit someone who needs the flexibility to get their money out at anytime, while Kernel’s or Rabobank’s products would suit those who are willing to give up this flexibility in return for higher interest rates.

Conclusion

Overall Sharesies is a good, but not great investment platform in 2023. We believe the types of investor that Sharesies is best for has become smaller over time:

- For beginner investors, their interface is easy to use and welcoming. But arguably there are even friendlier ways to invest your money. The likes of Simplicity, InvestNow, or Kernel allow you to invest without the complexity of picking from thousands of companies and ETFs, and are potentially cheaper as they don’t charge brokerage fees.

- Many experienced investors or those investing larger amounts may find that they’ve outgrown the platform. There’s fewer features compared with competing brokers, and Sharesies’ fees are higher for larger transactions.

- They’re also unsuitable for short-term investors, given the fees will likely outweigh the potential returns on cash investments.

However, Sharesies is probably still the best choice for those wanting to invest very small amounts into individual companies on the NZX, ASX, and US markets. They don’t require any minimum investment, and the percentage based fees that don’t penalise small transactions. Just keep in mind that 1.9% is a very high percentage to pay for the privilege.

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.