Smartshares and related company SuperLife are well-established New Zealand based fund managers owned by the NZX. Their funds are widely known and available, and chances are you already have at least one of their products in your portfolio. Smartshares and SuperLife primarily take a passive approach in their offerings, providing investors with a smart, low-fee way to build a diversified investment portfolio without the hassle of picking individual assets. However, could their broad suite of funds be confusing for investors? This article takes a look at what’s on offer through each provider, the fees, and how they compare with competing funds.

This article covers:

1. What’s on offer – Smartshares

2. What’s on offer – SuperLife

3. Where you can invest and the associated fees

4. Other considerations

5. Smartshares & SuperLife vs competing services

1. What’s on offer – Smartshares

Smartshares is a fund manager owned by the NZX.

Exchange Traded Funds (ETFs)

Smartshares offers 35 ETFs – this simply means their funds listed and traded on the NZX (as opposed to unlisted funds which aren’t listed and traded on a sharemarket). Currently Smartshares is the only issuer of ETFs in the NZ market. Most of the 35 ETFs are passively managed and track a market index, but there are a few exceptions. Here’s a summary of all funds on offer:

New Zealand shares

There are 6 ETFs that invest in the shares of companies listed on the NZ sharemarket (the NZX):

- [NZG] S&P/NZX 50^ – Invests in the 50 largest companies listed on the NZX. Tracks the S&P/NZX 50 Index.

- [FNZ] NZ Top 50 – Invests in the 50 largest companies listed on the NZX, but with a maximum 5% weighting towards any single company. Tracks the S&P/NZX 50 Portfolio Index.

- [TNZ] NZ Top 10 – Invests in the 10 largest companies listed on the NZX. Tracks the S&P/NZX 10 Index.

- [MDZ] NZ Mid Cap – Invests in the 11th to 50th largest companies listed on the NZX, excluding ANZ and Westpac whose primary listings are on the ASX. Tracks the S&P/NZX Mid Cap Index.

- [DIV] NZ Dividend – Invests in the 25 highest dividend paying companies within the S&P/NZX 50 index. Tracks the S&P/NZX 50 High Dividend Index.

- [NPF] NZ Property – Invests in the 8 major NZX listed Real Estate Investment Trusts. Tracks the S&P/NZX Real Estate Select Index.

What are the specific companies that each fund invests in?

For more information on the specific holdings and their weightings of each NZ ETF, check out this spreadsheet (opens in Google Sheets).

Australian shares

There are 7 ETFs that invest in companies listed on the Aussie sharemarket (the ASX):

- [AUS] S&P/ASX 200^ – Invests in the 200 largest companies listed on the ASX (via the iShares Core S&P/ASX 200 ETF). Tracks the S&P/ASX 200 Index.

- [OZY] Aus Top 20 – Invests in the 20 largest companies listed on the ASX. Tracks the S&P/ASX 20 Index.

- [MZY] Aus Mid Cap – Invests in the 51st to 100th largest companies listed on the ASX. Tracks the S&P/ASX Mid Cap 50 Index.

- [ASD] Aus Dividend – Invests in 50 high dividend paying companies within the S&P/ASX 300 Index. Tracks the S&P/ASX Dividend Opportunities Index.

- [ASF] Aus Financials – Invests in ~27 companies in the financials industry (e.g. banks and insurance companies) within the S&P/ASX 200 Index. Tracks the S&P/ASX 200 Financials Ex-A-REIT Index.

- [ASR] Aus Resources – Invests in ~39 companies in the resources industry (e.g. mining and energy companies) within the S&P/ASX 200 Index. Tracks the S&P/ASX 200 Resources Index.

- [ASP] Aus Property – Invests in ASX listed Real Estate Investment Trusts. Tracks the S&P/ASX 200 A-REIT Equal Weight Index.

US shares

There are 6 ETFs that invest in companies listed on the US sharemarkets:

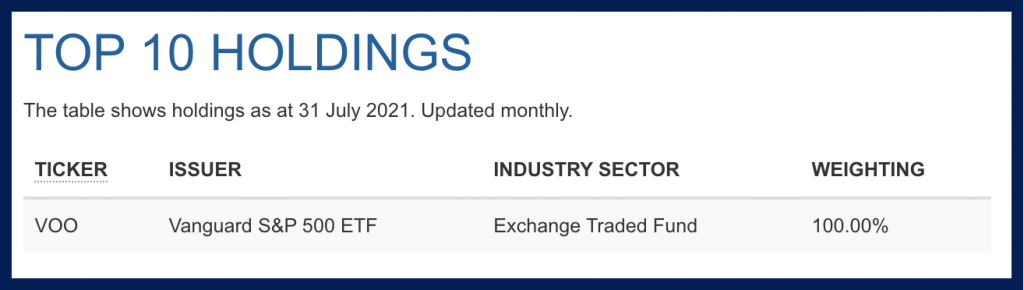

- [USF] US 500^ – Invests in the ~500 largest companies listed on the US sharemarkets (via the Vanguard S&P 500 ETF). Tracks the S&P 500 Index.

- [USA] US Equities ESG* – Invests in ~590 companies listed on the US sharemarkets (via the iShares MSCI USA ESG Screened UCITS ETF). Tracks the MSCI USA ESG Screened Index.

- [USG] US Large Growth – Invests in ~270 growth companies listed on the US sharemarkets (via the Vanguard Growth ETF). These are companies that are seen to have higher potential for growth. Tracks the CRSP US Large Cap Growth Index.

- [USV] US Large Value – Invests in ~350 value companies listed on the US sharemarkets (via the Vanguard Value ETF). These are companies that typically have lower growth prospects, but are seen to be trading at a lower price than what they’re actually worth. Tracks the CRSP US Large Cap Value Index.

- [USM] US Mid Cap – Invests in ~380 mid-sized companies listed on the US sharemarkets (via the Vanguard Mid Cap ETF). Tracks the CRSP US Mid Cap Index.

- [USS] US Small Cap – Invests in over 1,500 small-sized companies listed on the US sharemarkets (via the Vanguard Small Cap ETF). Tracks the CRSP US Small Cap Index.

Regional shares

There are 6 ETFs that invest in companies from a specific region:

- [EUF] Europe – Invests in over 1,300 companies from European countries (via the Vanguard FTSE Europe ETF). Tracks the FTSE Developed Europe All Cap Index.

- [EUG] Europe Equities ESG* – Invests in over 400 companies from European countries (via the iShares MSCI Europe ESG Screened UCITS ETF). Tracks the MSCI Europe ESG Screened Index.

- [APA] Asia Pacific – Invests in over 2,300 companies from countries in the Asia Pacific (via the Vanguard FTSE Pacific ETF). Tracks the FTSE Developed Asia Pacific All Cap Index.

- [JPN] Japan Equities ESG* – Invests in ~250 companies listed in Japan (via the iShares MSCI Japan ESG Screened UCITS ETF). Tracks the MSCI Japan ESG Screened Index.

- [EMF] Emerging Markets – Invests in ~5,000 companies from emerging markets like China, India, and Brazil (via the Vanguard FTSE Emerging Markets ETF). Tracks the FTSE Emerging Markets All Cap China A Inclusion Index.

- [EMG] Emerging Markets Equities ESG* – Invests in over 1,500 companies from emerging markets like China, India, and Brazil (via the iShares MSCI EM IMI ESG Screened UCITS ETF). Tracks the MSCI EM IMI ESG Screened Index.

Global shares

There are 3 globally diversified ETFs investing in companies from across the whole world:

- [TWF] Total World^ – Invests in over 8,000 companies from around the whole world, including developed and emerging markets (via the Vanguard Total World Stock ETF). Tracks the FTSE Global All Cap Index.

- [TWH] Total World (NZD Hedged)^ – Invests in the same as above (via the Vanguard Total World Stock ETF), but utilises currency hedging to greatly reduce the exchange rate volatility associated with investing in overseas shares.

- [ESG] Global Equities ESG* – Invests in over 1,500 companies from 23 developed countries across the whole world (via the iShares MSCI World ESG Screened UCITS ETF). Tracks the MSCI World Ex Australia Custom ESG Leaders Index.

Thematic shares

There are 2 thematic ETFs investing in companies relating to a specific theme:

- [BOT] Automation and Robotics – Invests in ~130 companies involved with developing automatic and robotic technology (via the iShares Automation & Robotics UCITS ETF). Tracks the iSTOXX FactSet Automation & Robotics Index.

- [LIV] Healthcare Innovation – Invests in ~190 companies involved with innovative developments in the healthcare sector (via the iShares Healthcare Innovation UCITS ETF). Tracks the iSTOXX FactSet Breakthrough Healthcare Index.

Bonds & Cash

There are 5 ETFs that invest in bond or cash assets:

- [NGB] S&P/NZX NZ Government Bond^ – Invests in bonds issued by the NZ Government. Tracks the S&P/NZX NZ Government Bond Index.

- [AGG] Global Aggregate Bond^ – Invests in over 8,000 government and corporate bond issues from around the world (via the iShares Core Global Aggregate Bond UCITS ETF). Tracks the Bloomberg Barclays Global Aggregate Index.

- [NZC] NZ Cash^ – Invests in cash and cash equivalents (e.g. bank deposits). An actively managed ETF, with the goal of outperforming the S&P/NZX Bank Bill 90-Day Index over rolling 1-year periods.

- [NZB] NZ Bond – Invests in NZ government and corporate bonds. An actively managed ETF, with the goal of outperforming the S&P/NZX A-Grade Corporate Bond Index over rolling 3-year periods.

- [GBF] Global Bond – Invests in government and corporate bonds from around the world. An actively managed ETF, with the goal of outperforming the Barclays Global Aggregate Index (hedged to NZD) by 1% per annum over rolling 3-year periods.

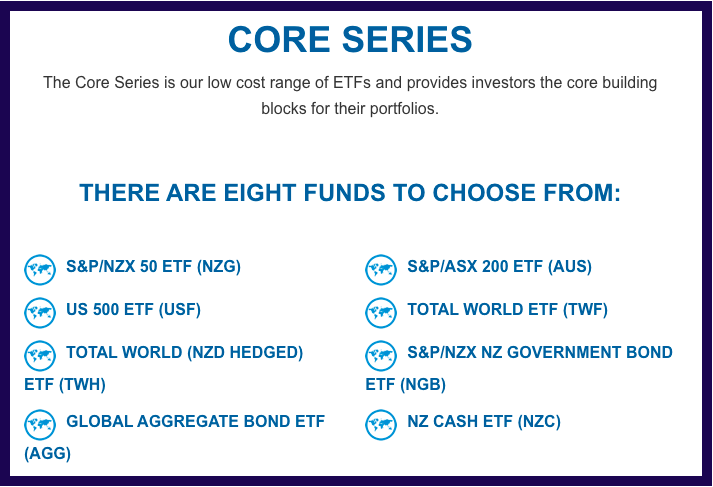

^Core Series ETF – These are broadly diversified funds that provide core building blocks for an investor’s portfolio.

*ESG funds – These funds exclude investment into companies engaging in contentious activities such as controversial weapons, civilian firearms, nuclear power, and tobacco.

Summary of offering

35 ETFs may seem like a reasonably large offering, and this is somewhat true. Their funds provide investors with access to investments domestically, in Australia, and across all corners of the world. In addition, cash and bond funds are available making their range also suitable for shorter-term or more risk adverse investors. Smartshares’ Core Series ETFs are particularly powerful given they’re broadly diversified, and give investors a handy starting point for building an investment portfolio.

Beyond the Core Series some Smartshares’ ETFs don’t provide much in terms of uniqueness. For example, the S&P/NZX 50 ETF, NZ Top 50 ETF, NZ Top 10 ETF, NZ Mid Cap ETF, NZ Dividend ETF, and NZ Property ETF all invest in different subsets of companies within the S&P/NZX 50 index – there’s probably little point to investing in more than one of the above funds. There’s plenty of other examples of overlaps in Smartshares’ offering, which can make it a little confusing for investors who don’t know the underlying investments of each ETF. This isn’t helped by the fact that Smartshares only lists the top 10 investments of each ETF on their website.

Further complicating things is the fact that for most international ETFs, Smartshares invests in Vanguard and iShares ETFs to track the index (rather than investing directly in the individual companies of the index). Take the Smartshares US 500 ETF for example, which tracks the S&P 500 Index – instead of investing directly into the ~500 companies of the index, the fund’s sole investment is the Vanguard S&P 500 ETF! This reduces transparency given the underlying companies of their international ETFs are hidden behind multiple layers.

Further Reading:

– More funds = less diversification? Are you investing in too many funds?

– Beyond the top 10 – How to see everything your fund is invested in

2. What’s on offer – SuperLife

SuperLife is also owned by the NZX, with most of their funds being based off Smartshares’ range of ETFs.

SuperLife also offers a KiwiSaver scheme. See our article Build your own KiwiSaver – InvestNow vs SuperLife vs Craigs for more details.

Unlisted funds

SuperLife offers 49 unlisted funds (not listed on a sharemarket like the NZX).

Smartshares duplicates

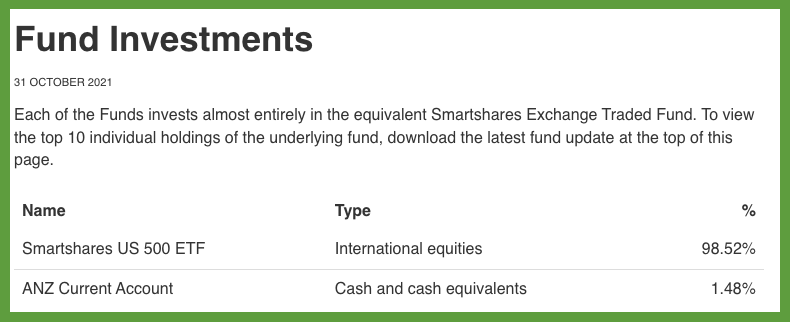

These 29 funds each invest entirely into a single Smartshares ETF (apart from a little bit of cash), essentially duplicating a large chunk of Smartshares’ offering. The only Smartshares ETFs not available in SuperLife form are the Smartshares Thematic and ESG ETFs.

- S&P/NZX 50 – Invests in the Smartshares S&P/NZX 50 ETF

- NZ Top 50 – Invests in the Smartshares NZ Top 50 ETF

- NZ Shares – Same as the above. We’re unsure why this fund exists.

- NZ Top 10 – Invests in the Smartshares NZ Top 10 ETF

- NZ Mid Cap – Invests in the Smartshares NZ Mid Cap ETF

- NZ Dividend – Invests in the Smartshares NZ Dividend ETF

- NZ Property – Invests in the Smartshares NZ Property ETF

- S&P/ASX 200 Fund – Invests in the Smartshares S&P/ASX 200 ETF

- Australian Top 20 – Invests in the Smartshares Aus Top 20 ETF

- Australian Mid Cap – Invests in the Smartshares Aus Mid Cap ETF

- Australian Dividend – Invests in the Smartshares Aus Dividend ETF

- Australian Financials – Invests in the Smartshares Aus Financials ETF

- Australian Resources – Invests in the Smartshares Aus Resources ETF

- Australian Property – Invests in the Smartshares Aus Property ETF

- US 500 – Invests in the Smartshares US 500 ETF

- US Large Growth – Invests in the Smartshares US Large Growth ETF

- US Large Value – Invests in the Smartshares US Large Value ETF

- US Mid Cap – Invests in the Smartshares US Mid Cap ETF

- US Small Cap – Invests in the Smartshares US Small Cap ETF

- Total World – Invests in the Smartshares Total World ETF

- Total World (NZD Hedged) – Invests in the Smartshares Total World (NZD Hedged) ETF

- Asia Pacific – Invests in the Smartshares Asia Pacific ETF

- Emerging Markets – Invests in the Smartshares Emerging Markets ETF

- Europe – Invests in the Smartshares Europe ETF

- S&P/NZX NZ Government Bond – Invests in the Smartshares S&P/NZX NZ Government Bond ETF

- Global Aggregate Bond – Invests in the Smartshares Global Aggregate Bond ETF

- NZ Bonds – Invests in the Smartshares NZ Bond ETF

- Overseas Bonds – Invests in the Smartshares Global Bond ETF

- NZ Cash – Invests in the Smartshares NZ Cash ETF

Smartshares bundles

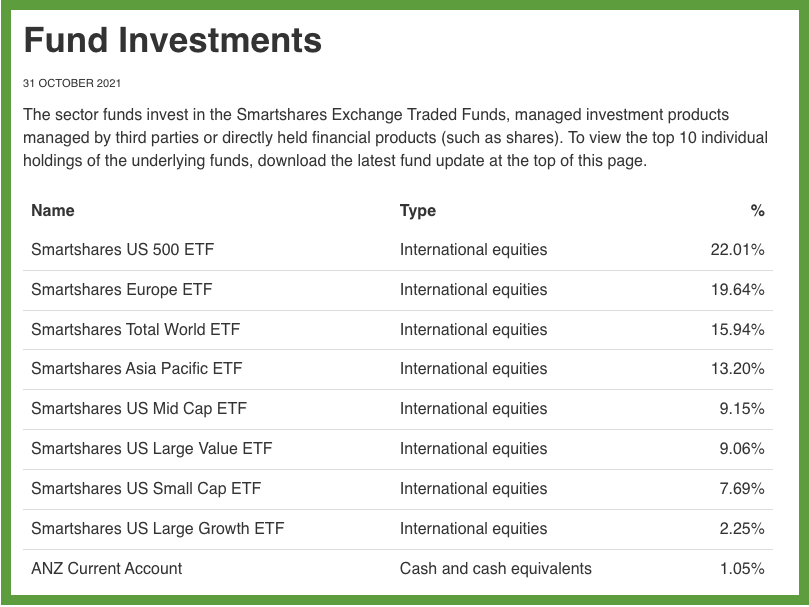

These 3 funds bundle up related Smartshares ETFs to form a single fund.

- Australian Shares – Bundles up the 7 Smartshares Australian ETFs including the S&P/ASX 200, Aus Mid Cap, and Top 20 ETFs.

- Overseas Shares – Bundles up 8 Smartshares US and international ETFs including the US 500, Europe, Asia Pacific, and Total World ETFs.

- Overseas Shares (Currency Hedged) – Same as the above, but utilises currency hedging to greatly reduce the impact of foreign exchange fluctuations on the fund.

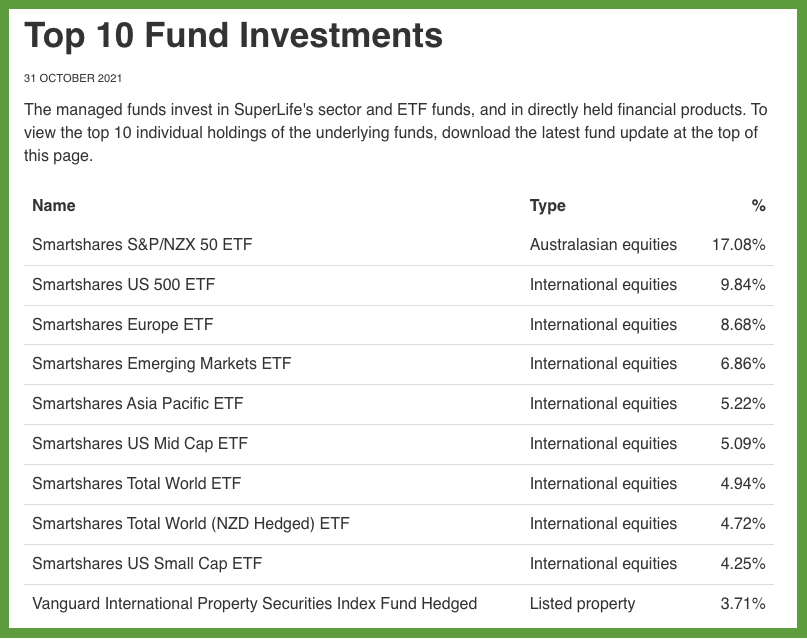

Diversified funds

These 5 funds primarily combine multiple Smartshares ETFs into a single product, providing a well-diversified fund with exposure to local and international shares and bonds. Each fund differs with their weighting towards share, cash, and bond ETFs.

- Income – Invests 100% into cash and bond ETFs

- Conservative – Invests 30% into share ETFs, and 70% into cash and bond ETFs

- Balanced – Invests 60% into share ETFs, and 40% into cash and bond ETFs

- Growth – Invests 79% into share ETFs, and 21% into cash and bond ETFs

- High Growth – Invests 99% into share ETFs, and 1% into cash and bond ETFs

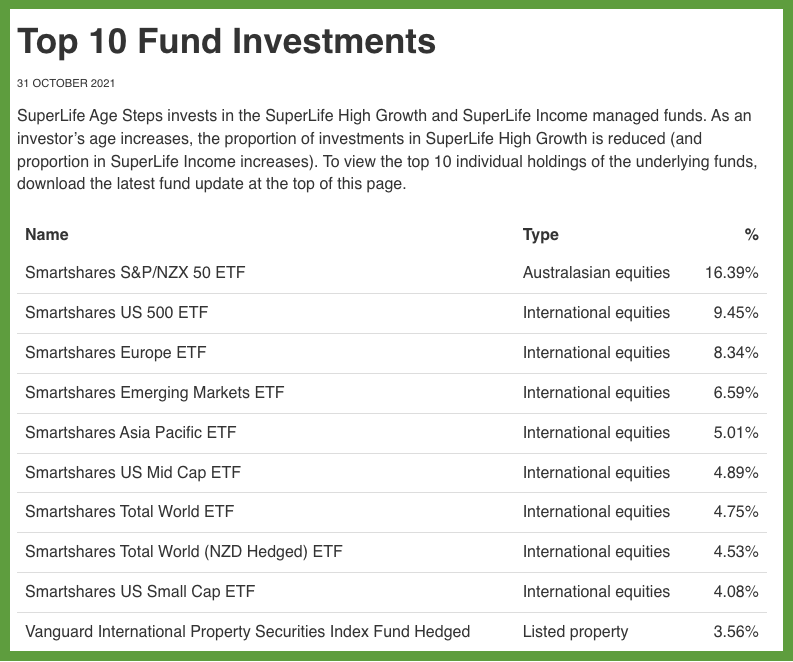

Age Steps

The Age Steps product automatically allocates you to a fund depending on your age – with younger investors having more exposure to shares, and increasing your allocation towards bonds and cash as you move through the age brackets.

- Age 20 – Invests 96% into share ETFs, and 4% into cash and bond ETFs

- Age 30 – Invests 80% into share ETFs, and 20% into cash and bond ETFs

- Age 40 – Invests 80% into share ETFs, and 20% into cash and bond ETFs

- Age 50 – Invests 75% into share ETFs, and 25% into cash and bond ETFs

- Age 60 – Invests 57.5% into share ETFs, and 42.5% into cash and bond ETFs

- Age 70 – Invests 40% into share ETFs, and 60% into cash and bond ETFs

- Age 80 – Invests 10% into share ETFs, and 90% into cash and bond ETFs

Other funds

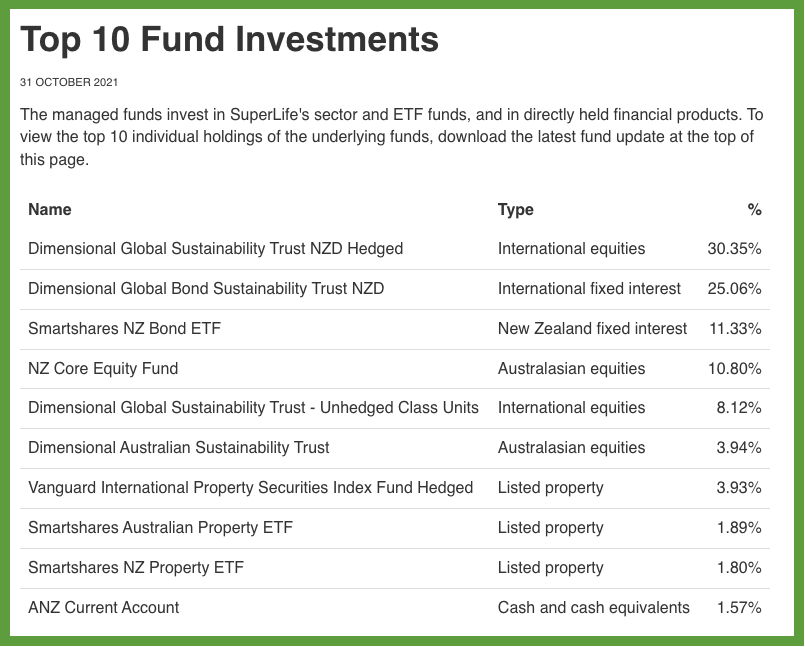

These 5 funds don’t relate to any particular Smartshares ETF.

- Ethica – Invests in a balanced portfolio of share and bond funds, which exclude companies that are involved in contentious activities such as gambling, alcohol, tobacco, and fossil fuels.

- Castle Point 5 Oceans – Invests in the Castle Point 5 Oceans Fund, an actively managed fund investing in a diversified portfolio of local and international shares and bonds.

- Global Property – Invests in a Vanguard global property fund, as well as the Smartshares NZ Property and Aus Property ETFs.

- Overseas Non-government Bonds – Invests in the Vanguard International Credit Securities Index Fund, providing exposure to international corporate bonds.

- UK Cash – Holds UK cash only.

Summary of offering

SuperLife’s fund offering isn’t particularly special. Most are duplicates of the Smartshares range, which is very wide but faces the same issue of overlaps between funds. To add to the confusion, their Smartshares bundle funds cause even more overlap in their offering. In our opinion they don’t add much value to SuperLife’s range:

- The Australian Shares Fund unnecessarily bundles up 7 Smartshares Australian ETFs, when the single S&P/ASX 200 Fund already provides enough diversification across the Aussie sharemarket.

- The Overseas Shares Funds bundles up 8 international ETFs, while the Total World Funds are already sufficient in providing broad diversification across the US, Europe, Asia Pacific, and Emerging Markets.

However, SuperLife’s Diversified and Age Steps funds are great options as they provide investors with pre-built portfolios diversified across local and international shares and bonds, taking the guesswork out of constructing an investment portfolio.

3. Where you can invest and the associated fees

Platform fees

The great thing about Smartshares ETFs is that you can invest in them through a wide range of platforms. Each of them comes with different fees and features:

Direct via Smartshares

The first way to get access to Smartshares’ ETF is to apply directly via the Smartshares website.

| Minimum investment | $500 lump sum, or $50 via a regular investment plan |

| Fees | $30 establishment fee when investing for the first time |

| Order execution | Monthly |

| Regular investment plan | Monthly |

| Custody of investment | Under your CSN |

Investing direct through Smartshares is quite a cost effective option, but comes with a couple of major limitations. Firstly, you can’t sell your ETFs through them – if you want to sell your units you’ll have to sell them through a broker like ASB Securities, or transfer them into Sharesies or InvestNow. Secondly, Smartshares only executes orders once a month, so if you miss the cut-off date (the 20th of each month) you’ll have to wait until next month before your order is processed! Going direct via Smartshares probably isn’t the best option, unless you want your units registered under your own CSN (which offers very little benefit) rather than held through a custodian.

InvestNow

InvestNow is a fund platform which offers all of Smartshares’ ETFs except for the Smartshares Total World (NZD Hedged) ETF and the Smartshares S&P/NZX Government Bond ETF.

| Minimum investment | $250 lump sum, or $50 via a regular investment plan |

| Fees | None |

| Order execution | Daily on business days |

| Regular investment plan | Weekly, fortnightly, monthly, quarterly, or six-monthly |

| Custody of investment | Under InvestNow’s custodian (Adminis) |

There are no fees associated with InvestNow, so it’s perhaps the best option for buying and selling Smartshares ETFs. The only issue InvestNow has is a quick relating to how they handle Smartshares orders which results in you buying a lower number of units than you ordered (described in section 4 of the InvestNow review article below).

Further Reading:

– InvestNow review – The most efficient way to invest?

Sharesies

Sharesies is a NZX broker which offers investment into Smartshares’ full range of ETFs.

| Minimum investment | $0.01 |

| Fees | Brokerage fee of 0.5% on orders up to $3,000 +0.1% on any amounts above $3,000 |

| Order execution | Instantly during NZX trading hours |

| Regular investment plan | Weekly, fortnightly, every four weeks, or monthly |

| Custody of investment | Under Sharesies’ custody |

Sharesies is likely an inferior option compared to InvestNow due to their brokerage fees for buying and selling ETFs. This may make investing in Smartshares’ cash and bond ETFs unviable through Sharesies, due to the returns being too low to cover the fees. Sharesies would only be suitable if you’re investing in share ETFs and intend to invest less than InvestNow’s minimum investment of $50.

Further Reading:

– Sharesies review – Still a good investment platform in late 2021?

ASB Securities & Jarden Direct

ASB Securities and Jarden Direct are both NZX brokers who offer investment into Smartshares’ full range of ETFs.

| Minimum investment | 100 units |

| Fees | Brokerage fee starting from $15 on ASB Securities and $29.90 on Jarden Direct |

| Order execution | Instantly during NZX trading hours |

| Regular investment plan | None available |

| Custody of investment | Under your CSN |

These options are less ideal given their hefty fees starting from $15 per transaction, though they have the benefit of directly registering your units under your CSN.

Direct via SuperLife

Going direct through SuperLife‘s own platform is the only way to invest in SuperLife’s funds.

| Minimum investment | $1 |

| Fees | $12 annual admin fee |

| Order execution | Daily on business days |

| Regular investment plan | Weekly, fortnightly, monthly |

| Custody of investment | Under your own name |

SuperLife’s platform fees are reasonable, except if you have a very small balance that would result in the $12 fee making up a large percentage of your portfolio.

Fund management fees

All Smartshares ETFs and SuperLife funds charge a management fee to cover the costs of running the funds. These fees apply the same regardless of what platform you use to buy the fund through:

- Smartshares’ fees range from 0.20% to 0.46% for their Core Series ETFs, and 0.34% to 0.75% for all other ETFs.

- SuperLife’s fees range from 0.42% to 0.63% for their Smartshares duplicates, 0.46% to 0.53% for their diversified/Age Steps funds, and 0.39% to 1.34% for their other funds.

Overall management fees for both Smartshares and SuperLife are quite competitive, and are lower than what you’d find on most actively managed funds. However, outside of the Core Series ETFs, the fees are on the mid-to-high end for passively managed funds. A couple of other interesting points to note are:

- For Smartshares’ Core Series ETFs, the SuperLife duplicates generally have a higher management fee. While for all other Smartshares ETFs, the SuperLife duplicates generally have lower management fees.

- SuperLife’s diversified and Age Steps funds have a higher management fee than if you were to invest into the underlying assets of those funds individually. Investors essentially pay a small premium for the convenience of having SuperLife bundle up multiple ETFs to make up these diversified funds.

Here’s a table showing the management fees for all Smartshares and SuperLife funds:

| Fund | Smartshares fee | SuperLife fee |

| S&P/NZX 50 | 0.20% | 0.49% |

| NZ Top 50 | 0.50% | 0.49% |

| NZ Top 10 | 0.60% | 0.49% |

| NZ Mid Cap | 0.60% | 0.49% |

| NZ Dividend | 0.54% | 0.49% |

| NZ Property | 0.54% | 0.49% |

| S&P/ASX 200 | 0.30% | 0.49% |

| Aus Top 20 | 0.60% | 0.49% |

| Aus Mid Cap | 0.75% | 0.49% |

| Aus Dividend | 0.54% | 0.49% |

| Aus Financials | 0.54% | 0.49% |

| Aus Resources | 0.54% | 0.49% |

| Aus Property | 0.54% | 0.49% |

| US 500 | 0.34% | 0.44% |

| US Equities ESG | 0.34% | n/a |

| US Large Value | 0.51% | 0.47% |

| US Large Growth | 0.51% | 0.47% |

| US Mid Cap | 0.51% | 0.47% |

| US Small Cap | 0.51% | 0.47% |

| Total World | 0.40% | 0.48% |

| Total World (NZD Hedged) | 0.46% | 0.48% |

| Global Equities ESG | 0.54% | n/a |

| Asia Pacific | 0.55% | 0.49% |

| Japan Equities ESG | 0.55% | n/a |

| Europe | 0.55% | 0.49% |

| Europe Equities ESG | 0.55% | n/a |

| Emerging Markets | 0.59% | 0.63% |

| Emerging Markets Equities ESG | 0.59% | n/a |

| Automation & Robotics | 0.75% | n/a |

| Innovation Healthcare | 0.75% | n/a |

| S&P/NZX NZ Government Bond | 0.20% | 0.44% |

| Global Aggregate Bond | 0.30% | 0.49% |

| NZ Bond | 0.54% | 0.44% |

| Global Bond | 0.54% | 0.49% |

| NZ Cash | 0.20% | 0.42% |

| Income | n/a | 0.46% |

| Conservative | n/a | 0.47% |

| Balanced | n/a | 0.50% |

| Growth | n/a | 0.51% |

| High Growth | n/a | 0.53% |

| NZ Shares | n/a | 0.49% |

| Australian Shares | n/a | 0.49% |

| Overseas Shares | n/a | 0.48% |

| Overseas Shares (NZD Hedged) | n/a | 0.48% |

| Ethica | n/a | 0.60% |

| Castle Point 5 Oceans | n/a | 1.34% |

| Global Property | n/a | 0.48% |

| Overseas Non-Government Bonds | n/a | 0.44% |

| UK Cash | n/a | 0.39% |

| Age Steps Age 20 | n/a | 0.53% |

| Age Steps Age 30 | n/a | 0.52% |

| Age Steps Age 40 | n/a | 0.52% |

| Age Steps Age 50 | n/a | 0.51% |

| Age Steps Age 60 | n/a | 0.50% |

| Age Steps Age 70 | n/a | 0.48% |

| Age Steps Age 80 | n/a | 0.46% |

4. Other considerations

Distributions

Most Smartshares ETFs pay dividends on a six-monthly basis in June and December. The exceptions are:

- No dividends – All Thematic and ESG ETFs do not pay dividends. Instead any income the funds earn are reflected as an increase in the fund’s value.

- Quarterly dividends – All Cash and Bond ETFs pay dividends in March, June, September, and December.

SuperLife’s funds do not pay out distributions/dividends, instead any income the fund earns is reflected as an increase in the fund’s unit price.

Tax

While all funds are PIE funds (taxed at your Prescribed Investor Rate or PIR), there is a slight difference in tax treatment between Smartshares and SuperLife funds.

- Smartshares – These are Listed PIEs which are taxed at a flat rate of 28%. If your PIR is lower than 28%, you can claim back the excess tax paid in your following year’s tax return in order to reduce your overall tax liability. Tax is reflected as a reduction to the dividends you receive or a reduction in the fund’s value.

- SuperLife – These are Multi-rate PIEs which are taxed according to your PIR. This may make SuperLife’s funds more efficient for those on a PIR lower than 28% given you’re taxed at the correct rate upfront (and don’t have to wait until the end of the tax year to claim back any overpayment). Tax is deducted at the end of the tax year (31 March) or whenever you sell units in a fund.

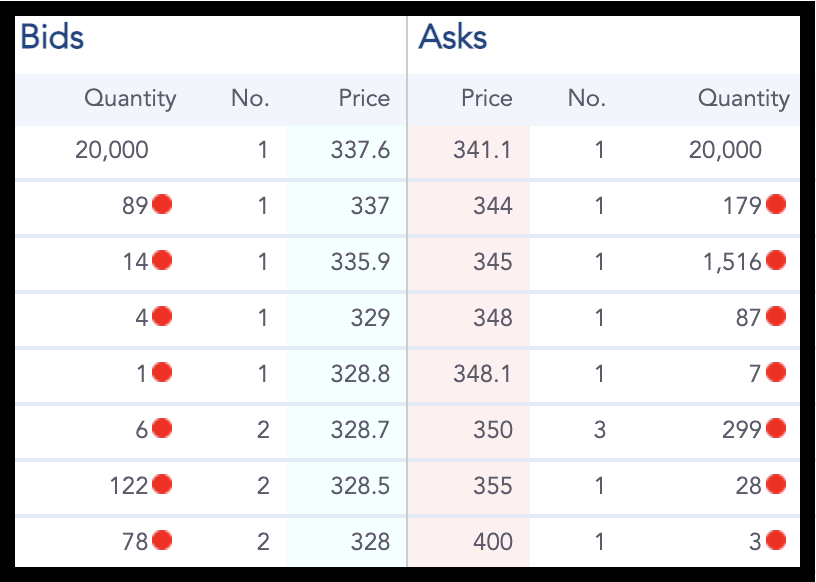

Spreads

Because Smartshares ETFs are bought and sold on the NZX, you may end up paying a spread on each transaction. This is essentially means you buy units at a small premium, and sell them at a small discount – effectively an additional fee.

Let’s take the Smartshares Total World (NZD Hedged) ETF (TWH) for example, and say it has Net Tangible Assets (NTA) per share of $3.40 (which essentially means the underlying assets of the fund are worth $3.40 per share). Below is the market depth for TWH:

If you placed an order to buy TWH at market price, your order will be executed at $3.411 representing a 1.1 cent premium to the NTA per share. If you placed an order to sell TWH at market price, your order will be executed at $3.376 representing a 2.4 cent discount to the NTA per share. This spread can be mitigated by placing limit orders (if buying and selling the ETFs through Sharesies, ASB Securities, or Jarden Direct), however, this might result in your order being slower to fill.

To help keep the spreads small and to ensure there’s always liquidity, Smartshares employs market makers who ensure there is always a buyer and seller in the market for each ETF.

Switching funds

With Smartshares, if you wish to switch which funds you’re invested in, you’ll need to sell your old funds and use the sale proceeds to buy your new funds.

With SuperLife, switching funds is more streamlined. You can complete an “Investment Switches” form (to switch your existing funds only) or a “Change Investment Strategy” form (to also switch your future investment contributions to your new funds), and SuperLife will take care of the switching for you.

Rebalancing

A special feature of SuperLife’s platform is that they can automatically rebalance your portfolio for you. This is done by selling off units in a share fund and using the money to buy units in a bond fund. For example, let’s say you have a target asset allocation of 80% towards shares and 20% towards bonds – if share prices rose faster than bonds, making your actual asset allocation become 85% shares and 15% bonds, some shares would be sold to buy bonds in order to bring the asset allocation back to the target.

This rebalancing happens on a monthly basis, and only works one-way between share funds and bond funds. Rebalancing doesn’t occur between SuperLife’s share funds, nor from a bond fund to a share fund (in the case you had excess bonds in your portfolio).

5. Smartshares & SuperLife vs competing services

Here’s a brief overview of how Smartshares and SuperLife compare to competing services with links to more in depth comparisons:

Vanguard, iShares

Given many of Smartshares’ international ETFs simply invest in Vanguard and iShares ETFs, many people wonder whether it’s better to cut out the middleman and invest directly into those funds – especially as their management fees tend to be lower. For example, the Smartshares US 500 ETF has a management fee of 0.34% vs 0.03% for the equivalent Vanguard S&P 500 ETF.

However, keep in mind you also have to pay foreign exchange and brokerage fees to access Vanguard and iShares ETF, compared with potentially no fees to invest in Smartshares. In addition, these ETFs require more work when it comes to taxes given the FIF status of these ETFs. There is no definitively better option, and the below article provides a more detailed comparison.

Further Reading:

– Smartshares US 500 (USF) vs Vanguard S&P 500 (VOO) – Which ETF is better?

Kernel

Kernel offers 13 index funds, some of which could be considered strong alternatives to Smartshares and SuperLife’s funds:

- The NZ 50 ESG Tilted or NZ 20 funds could be alternatives to the S&P/NZX 50 or NZ Top 50 funds.

- The Global 100 Fund could be an alternative to the Total World funds.

- The S&P 500 Fund is a currency hedged alternative to the US 500 fund.

- The NZ Commercial Property Fund is a like-for-like alternative to the NZ Property fund.

- The Global Green Property Fund could be an alternative to the SuperLife Global Property Fund.

Though not all their funds overlap, and Kernel offers a few unique funds like the Electric Vehicle Innovation and Global Clean Energy funds. However, Kernel won’t suit shorter-term investors given they don’t have any bond or cash funds.

In terms of fees, Kernel’s fund management fees are slightly cheaper than the Smartshares range of index funds, with their core funds charging 0.25%. However, they also charge a $60 per year fee if you’re invest more than $25,000 – this can add a bit of weight to their fees as it equates to an additional 0.24% fee for a balance of $25,000.

Further Reading:

– Kernel review – High quality index funds

– Smartshares & Kernel – Thematic Index Fund shootout

Macquarie

Update (4 Apr 2022) – AMP’s funds have been renamed to Macquarie

Macquarie offers a few good index funds which are available through the InvestNow platform. They’re all Multi-Rate PIEs which may make them more tax efficient compared to Smartshares’ ETFs.

- The All Country Global Shares Index Fund (0.42% fee) could be an alternative to the Total World funds.

- The NZ Shares Index Fund (0.36% fee) could be an alternative to the S&P/NZX 50 or NZ Top 50 funds.

- The Australasian Property Index Fund (0.82% fee) could be an alternative combining the NZ Property and Aus Property funds.

- The Ethical Leaders Hedged Global Fixed Interest Index Fund (0.42% fee) could be an alternative to the Global Aggregate Bond fund.

Further Reading:

– What’s the best global shares index fund in 2022?

– Smartshares vs SuperLife vs Macquarie vs Simplicity – Bond index fund shootout

– Smartshares vs Macquarie vs Milford vs Nikko AM – Cash fund shootout

Simplicity, Harbour

Simplicity and Harbour provide incredibly low cost NZ index funds:

- The Simplicity NZ Share (0.10% fee) could be an alternative to the S&P/NZX 50 fund.

- The Simplicity NZ Bond Fund (0.10% fee) could be an alternative to the S&P/NZX NZ Government Bond or NZ Bond funds.

- The Harbour NZ Index Shares Fund (0.20% fee) is available on InvestNow and tracks the S&P/NZX 50 Portfolio Index, making it a like-for-like alternative to the NZ Top 50 fund.

In addition, Simplicity’s diversified Growth/Balanced/Conservative funds provide a solid alternative to SuperLife’s diversified funds, though notably Simplicity doesn’t offer a high growth/aggressive fund option. There are a couple of other limitations of these providers. Firstly, they don’t offer any international index funds. Secondly, Simplicity has a minimum investment of $1,000 making them much less accessible than other fund managers.

Further Reading:

– What’s the best NZ shares index fund in 2022?

Conclusion

Smartshares and SuperLife offer a wide range of funds, which are easily accessible across multiple platforms. This makes their funds suitable for a large number of investors:

- For new investors, Smartshares’ Core Series ETFs are an easy way to get started in investing. They’re broadly diversified and save you from having to research and pick individual assets. SuperLife’s diversified or Age Steps funds also provide an incredibly simple way to put together an investment portfolio, removing the guesswork around which funds to select.

- For experienced investors, Smartshares’ and SuperLife’s funds provide cost effective building blocks for a portfolio, plus offer a high level of customisation given how wide their range is.

However, the range of funds can be a little confusing and investors will need to do some research to build out a well-rounded portfolio and avoid overlap between funds – adding extra funds may just end up increasing the concentration of your portfolio rather than diversifying it. SuperLife’s funds which largely duplicates the Smartshares range, adds to the confusion. Improving the transparency of their funds (such as showing a full breakdown of their holdings and geographic spread) would greatly help investors here.

There are also plenty of competing funds offered by the likes of Vanguard and Kernel which could (depending on your personal circumstances) work out better than Smartshares and SuperLife. While Smartshares and SuperLife’s funds have reasonable fees, outside of the Core Series ETFs the fees are at the higher end for passively managed funds. But regardless of whose funds you choose, Smartshares and SuperLife funds are always reliable options for your portfolio, and are probably smarter than picking your own shares.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.