Hatch is a Wellington-based investment platform who launched in 2018, being the first Kiwi service to offer easy access to buy and sell US shares. They grown to become a trusted brand with a sizeable number of loyal customers, who have collectively invested over $1 billion. But since their launch the competition has heated up with the likes of Sharesies and Stake also opening up the US sharemarket to Kiwi investors. So how does Hatch stack up as an investment platform in 2022?

This article covers:

1. What’s on offer?

2. Fees

3. Other considerations

4. Hatch vs competing services

Update (15 March 2022) – Added detail around tax treatment of USD cash balances held with Hatch

1. What’s on offer

US shares

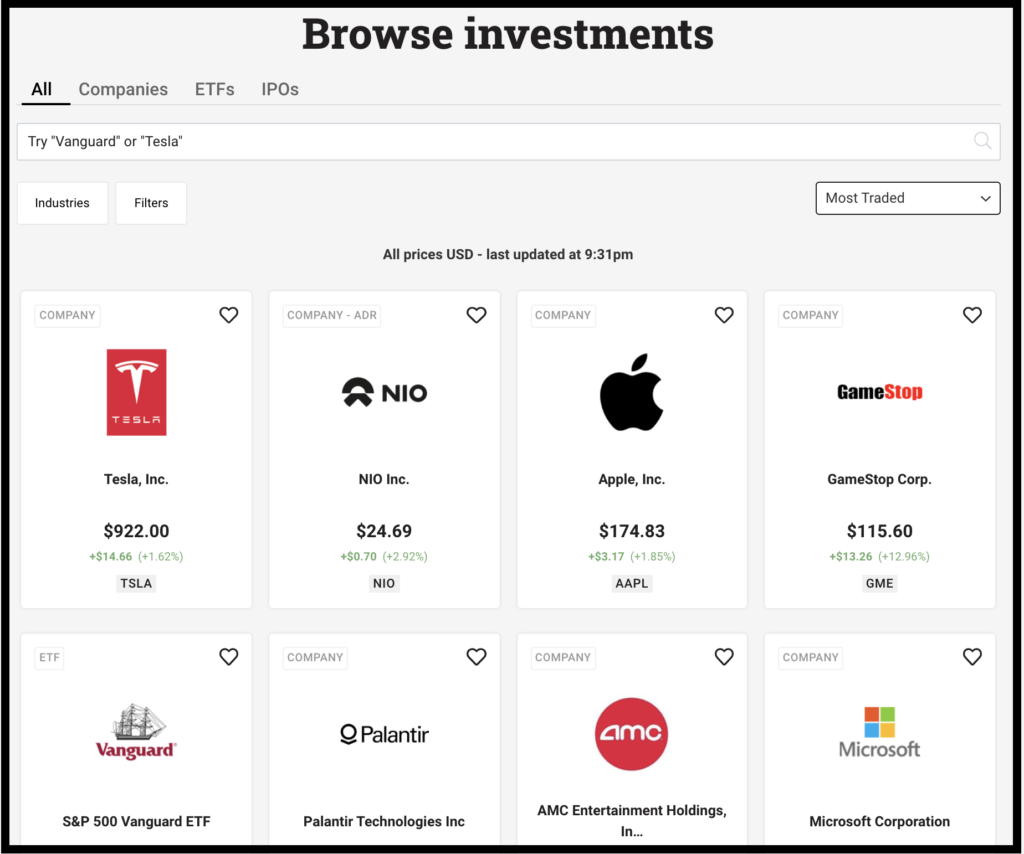

Hatch‘s main offering is investment into the US sharemarkets. This includes:

- Shares in individual companies – E.g. Apple, Disney, and Nike.

- Exchange Traded Funds (ETFs) – These are funds that contain a wide range of assets e.g. the Vanguard S&P 500 ETF (VOO) which invests the 500 largest companies listed in the US.

- American Depositary Receipts (ADRs) – Some foreign companies listed outside of the US (e.g. Alibaba and Nio) are available though Hatch as ADRs. These are receipts/certificates that represent the shares of those companies.

There’s no minimum investment required. Hatch offers fractional shares so you can buy partial shares in a company or ETF. For example, if you wanted to invest in Amazon, you don’t have to invest $3,200 USD to buy a full Amazon share – it’s possible to invest a smaller amount, say $1,000 to buy a fraction of an Amazon share.

Hatch partners with DriveWealth as their US broker who execute orders to buy and sell shares on behalf of Hatch’s customers.

US Initial Public Offerings (IPOs)

Hatch also provides access to IPOs, which is when a company is listing their shares onto the sharemarket for the first time. Through Hatch, you’re able to invest in the shares of selected companies going through the IPO process before they start trading on the sharemarket – it’s like getting early access to those shares before the wider public can buy them.

Hatch has offered access to one IPO so far, when Allbirds listed on the Nasdaq exchange in November 2021. It was a great offering, with investors participating in the Allbirds deal being able to buy shares at the IPO price of $15, then see the price quickly rise to around $30 USD when they started trading on the market. However, making money from an IPO is far from guaranteed. It’s possible that the shares could fall in value as soon as they start trading on the sharemarket. In fact, Allbirds shares have since fallen below their IPO price, trading at around $11 USD at the time of writing.

Other markets

Hatch currently doesn’t offer investment into the NZ sharemarket or any other sharemarket.

While Hatch’s offering is limited to the markets of one country, they’ll likely be offering access to additional investments in the future. Hatch’s previous owner Kiwi Wealth sold the platform to FNZ in October 2021. FNZ is a large provider of technology and backend infrastructure for the financial services industry, and have signalled an intention to invest in building up the Hatch platform.

FNZ intend to invest heavily in Hatch to broaden the range of asset classes, investment styles and expand the offering in other markets.

With the backing of a big player in the finance industry, we’re excited to see what Hatch will come up with next. Likely offerings are NZX and ASX shares, and unlisted funds. We’ll be sure to update this review once any new investments launch.

Who are these investments best suited for?

Hatch’s offering (which is largely made up of shares) would make them best suited to long-term investors. However, Hatch is limited to US shares so investors seeking access to other markets like NZ will have to use other platforms.

Shorter-term investors will find investments like bonds and cash more suitable, as they’re less volatile than shares. While these assets are available on Hatch (through bonds and cash ETFs), they’re not hedged to the New Zealand Dollar, meaning their value will move up and down along with the fluctuations of the NZD-USD exchange rate. This adds a layer of volatility to these investments, defeating the purpose of the stability these assets are supposed to provide. Therefore we don’t consider Hatch to be a suitable platform for short-term investors.

Further Reading:

– What’s the best short-term investment?

2. Fees

Foreign Exchange fees

When depositing money into Hatch your New Zealand Dollars are converted to US Dollars. There is an 0.5% foreign exchange fee for this. This fee also applies when you withdraw money from Hatch, at which time your USD is converted back to NZD.

Brokerage fees

Hatch charges a fee of $3 USD for every transaction you make to buy or sell shares. If you buy/sell more than 300 shares in one transaction, you’ll be charged $0.01 for every additional share over the 300, though most trades shouldn’t exceed this amount unless you’re trading very low priced shares and/or making very large transactions.

This flat fee structure works out better for those investing large amounts, but isn’t cost effective if you’re investing small amounts (despite Hatch not having a minimum investment). For example, if you invested just $10 NZD, the fee of $3 USD would represent a massive 45.45% of your investment value! This could also make dividends very expensive to reinvest.

| Transaction size | Brokerage fee | Fee as a % |

| $10 NZD | $3 USD | 45.45% |

| $100 NZD | $3 USD | 4.55% |

| $500 NZD | $3 USD | 0.91% |

| $1,000 NZD | $3 USD | 0.45% |

| $5,000 NZD | $3 USD | 0.09% |

Another way to think about it is to imagine your local supermarket started charging customers a $3 fee to enter the store. This fee might be fine if you’re buying an entire week’s worth of groceries, but those wanting to grab just a bottle of milk will be better off shopping elsewhere.

Hatch argues that paying their flat $3 USD fee is still worth it for small investments, because when it comes to selling your shares you’ll still pay the same $3 USD fee even if your investment has increased in value (while percentage based fees would increase in line with the value of your investment). However, this benefit will often not be enough to offset the high fees for buying into your investment in the first place (especially if contributing small amounts regularly). Therefore with Hatch we’d consider investing a minimum of several hundred dollars to make the fee worthwhile.

Other fees

- Tax form – Non-US residents need to complete and submit a W-8BEN tax form prior to investing in US shares. Hatch charges a one-off fee of $1.50 USD to complete and submit this form on your behalf, which is deducted when you make your first deposit into the platform.

- Tax Filing – This is an annual fee of $0.50 USD for submitting your US tax filing.

3. Other considerations

Account types

Hatch allows Individual and Trust accounts, but no Joint account option. They also offer kids accounts for under 18s. Kids accounts get a special brokerage rate of $0.50 USD per transaction of up to 50 shares (plus 1c for every additional share over 50 shares) – a significant discount from the adult fee of $3 USD.

Funding your account

You can add money to your Hatch account via bank deposit from a NZ bank account. Any money you add this way is immediately converted to USD – there’s no flexibility to leave the money as NZD and convert it at a later time, however you’ll earn a small amount of interest on any USD sitting in your Hatch account. In most cases if you make a deposit from your bank before 1pm on a business day, the USD will be available for you to invest later in the night when US markets open.

Hatch also allows you to directly deposit USD into your account, which saves you from paying the 0.5% foreign exchange fee for converting NZD to USD. There’s a few special requirements to do this, and when withdrawing money from the platform you still need to convert it back to NZD and withdraw to a NZ bank account.

Auto-invest

Hatch allows you to auto-invest into any of their investments on a weekly, fortnightly, 4 weekly, monthly, or quarterly basis.

Order types

Hatch offers the usual Market and Limit order types. In addition, they offer:

- Stop-loss orders – These orders trigger automatically to sell your shares if they drop to or below a certain price

- Stop-buy orders – These orders trigger automatically to buy shares if they increase to or above a certain price.

Trading restrictions

When you sell shares, the transaction doesn’t settle until two trading days after the trade takes place – during this time your funds are “unsettled”. Hatch allows you to immediately reinvest your unsettled funds into buying new shares, but if you sell those shares you bought using unsettled funds within two trading days, you’ll trigger a Good Faith Violation. If you make three Good Faith Violations in 12 months, you won’t be able to trade on unsettled funds for 90 days.

Custody of investments

Any investments purchased through Hatch aren’t held under your own name, but rather are held under DriveWealth’s name with Citi, a custodian. However, you’re still the beneficial owner of those shares and get any dividends and voting rights associated with them.

If either DriveWealth or Citi go bust, you’re protected by the Securities Investor Protection Corporation who insure up to $500,000 USD per customer in the case your funds go missing.

Transfers

Hatch allows transferring shares in or out of DriveWealth’s custody. Transfers between Hatch and Stake are free (given they use the same executing broker), while transfers to/from other brokers or to DRS (holding the shares under your own name) will incur a fee (we’ve seen reports of this being between $100-$130 USD).

Tax

The investments you buy through Hatch are considered to be Foreign Investment Funds (FIF) and are taxable under the FIF tax regime. Hatch doesn’t handle these tax obligations for you, but they provide some reporting to help you calculate your tax obligations at the end of the tax year.

A feature of Hatch results in a quirk in how you may be taxed under the FIF regime. Any money you deposit into Hatch is held in DARXX – a cash fund in which you can earn interest from your USD cash. DARXX is considered to be a FIF, which can result in unfavourable tax treatment. Take the following scenarios as examples:

- You deposit $60,000 NZD into Hatch but only invest $40,000 NZD of it into shares.

- You buy $40,000 NZD of Tesla shares. Later on you sell them for $80,000 NZD.

Both scenarios would normally make you exempt from FIF tax (given the cost of your FIFs are less than $50,000 NZD). However because Hatch stores your USD cash in a FIF, both of the above scenarios would result in over $50,000 NZD being invested in FIFs, requiring you to apply the full FIF rules to calculate your taxes (which is usually unfavourable compared with the exemption).

Further Reading:

– Tax on foreign investments – How do FIF and Estate Taxes work?

Investor education

Hatch takes investor education seriously, offering a free 10 day Getting Started Course. They also host regular webinars and have an investors’ Facebook Group where their customers can ask questions and learn from each other.

4. Hatch vs competing services

Here’s a brief overview of how Hatch stacks up to competing services:

Sharesies, Stake, Interactive Brokers

These three platforms also offer easy investment into US shares, providing close competition to Hatch.

Sharesies

Sharesies also offers US shares through broking partner DriveWealth, as well as investment into the NZ and Aussie markets.

Sharesies’ fee structure makes them much more suitable for those investing smaller amounts. They charge a percentage based fee of 0.5% for transactions up to $3,000, and 0.1% for amounts over $3,000. In terms of foreign exchange fees, Sharesies is slightly cheaper at 0.4% vs 0.5% with Hatch. Overall Sharesies is cheaper than Hatch for investments of up to ~$1,100 NZD in size. For example, a trade of $100 NZD would set you back ~$3.34 USD on Hatch while costing just ~$0.60 USD on Sharesies. The equation is slightly different for kids accounts, with Sharesies cheaper than Hatch for investments of up to ~$190 in size.

Sharesies has fewer features when compared to Hatch – for example, there’s no auto-invest for US shares, no ability to transfer your US shares to/from other brokers, and no stop-loss orders. Though the lack of these features won’t be a dealbreaker for many investors.

Further Reading:

– Sharesies review – Still a good investment platform in late 2021?

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

Stake

Stake is another platform offering investment into US shares via DriveWealth. Stake charges no brokerage fees, however their foreign exchange fees are relatively expensive at 1% (with a minimum charge of $2 USD). This makes Stake best suited for those frequently trading in and out of shares, but less suitable if you’re regularly contributing money to build up your portfolio.

Further Reading:

– Stake review – Is there a catch to their $0 brokerage fee?

– Buying shares in the USA – Sharesies vs Hatch vs Stake

Interactive Brokers

Interactive Brokers (IBKR) is a large American brokerage firm. Not only do they offer investment into the US markets, they have dozens of other markets including Australia, Japan, the UK, and Canada (but not the NZ market). They also offer other financial instruments like options.

IBKR’s fees are very reasonable, being ~$3 USD (inclusive of brokerage and FX) for most US share transactions. This implications of this are:

- Sharesies is still the cheapest platform for smaller transactions up until ~$480 NZD in size.

- Above $480 NZD IBKR is the cheapest platform, also beating out Hatch for all transaction sizes. For example on a $1,000 NZD trade, Hatch charges $6.30 USD, compared to just $3 USD for IBKR.

- For kids accounts, Hatch is cheapest for transactions between ~$190 NZD and ~$760 NZD in size, with Sharesies being cheapest for smaller trades, and IBKR being cheapest for larger trades.

Interactive Brokers is a powerful platform in terms of features, but they come with a few drawbacks. The platform is less user friendly, they lack a local Kiwi support team, and they don’t produce NZ specific tax reports so you’re on your own when it comes to calculating your FIF tax liabilities.

Further Reading:

– Interactive Brokers & Tiger Brokers review – Better than Sharesies & Hatch?

Want to do your own fee comparisons? Check out our US Brokerage calculator here.

Other platforms

Buying US shares isn’t the only way to invest your money. InvestNow, Kernel, and Simplicity are all good services offering funds that invest into NZ and international sharemarkets and more.

While their fund offerings don’t give you the flexibility to pick individual companies, their funds are still a preferred way of investing for many investors. They require less research to choose what to invest in, and are simpler investments, taking care of any foreign currency and tax obligations for you. InvestNow, Kernel, and Simplicity are suited to a wide range of investors thanks to their low fees and hands-off nature.

Further Reading:

– InvestNow review – The most efficient way to invest?

– Kernel review – High quality index funds

Conclusion

Hatch is a quality platform, packed full of great features. But in 2022 their offering isn’t as competitive as others:

- Investing small amounts – Hatch’s fee structure makes them very expensive for those wanting to invest small amounts of money at a time, and potentially to those wanting to reinvest their dividends. Sharesies is pretty much the only viable option for small investments (of a few hundred dollars or less) into US shares.

- Investing large amounts – Hatch’s fees are competitive for investing large amounts (~$1,100 NZD or more) at a time, but are still expensive compared to Interactive Brokers.

- Short-term investors – Hatch’s investments aren’t suitable for short-term investors in New Zealand. Their bond and cash ETFs aren’t hedged to the New Zealand Dollar so will be impacted by exchange rate volatility. These investors would likely be better off investing in funds through the likes of InvestNow or Simplicity.

Their high fees and narrow range of investment options leaves few investors that we believe Hatch would be best suited for. However, we think that Hatch would still be a good option for:

- Those wanting to invest larger amounts into US shares, but are wanting to support a local platform, or are uncomfortable with using foreign platforms like Interactive Brokers.

- Those wanting to invest in US shares for their kids. Hatch’s fees for kids accounts are reasonable and work out cheaper than Sharesies for transactions over ~$190 NZD in size, and are also cheaper than IBKR’s fees for transactions up to ~$760.

In addition there’s a lot to look forward to in the future – we’re sure that in the coming months Hatch will launch compelling options to invest in other markets like NZ and Australia.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.