Simplicity and Kernel can appear to be somewhat similar fund managers. They both offer (mostly) passively managed KiwiSaver and non-KiwiSaver funds with low fees, making them increasingly popular choices among New Zealand investors. But with their similarities, it can be confusing when deciding which fund to invest in – For example, should you invest in Simplicity’s High Growth Fund or Kernel’s High Growth Fund? In this article we break down the differences between the two fund managers to help you decide which one to invest with.

This article covers:

1. What’s on offer

2. In depth fund comparison

3. Other considerations

1. What’s on offer

Simplicity and Kernel offer single sector as well as diversified funds.

Single sector funds

Single sector funds invest in a single asset class. Each fund manager has a comprehensive selection of these funds:

Simplicity

- NZ Share – Invests in the largest companies listed on the NZ sharemarket.

- NZ Bond – Invests mainly in NZ government bonds.

- Unhedged Global Share – Invests into over 1,000 companies across 20+ developed markets.

- Hedged Global Share – Same as above, but hedged to the NZ dollar.

- Global Bond – Invests into global bonds, hedged to the NZ dollar.

- Homes and Income – Invests primarily in New Zealand housing related assets including build-to-rent housing and mortgage lending. We cover this fund in more detail here.

Kernel

- NZ 20 – Invests in the 20 largest companies listed on the NZX.

- NZ Small & Mid Cap Opportunities – Invests in smaller and mid-size NZX listed companies outside the S&P/NZX 20 Index.

- NZ 50 ESG Tilted – Invests in the 50 largest companies listed on the NZX, with exclusions and adjustments for ethical/sustainable reasons.

- NZ Commercial Property – Invests in the eight major Real Estate Investment Trusts (REITs) listed on the NZX.

- Global 100 – Invests in 100 of the largest global companies across the world’s sharemarkets.

- Global 100 (NZD Hedged) – Same as above, but hedged to the NZ dollar.

- Global ESG – Invests in over 700 companies across 24 developed markets, with exclusions and adjustments for ethical/sustainable reasons.

- Global ESG (NZD Hedged) – Same as above, but hedged to the NZ dollar.

- S&P 500 – Invests in the 500 largest companies listed in the United States, hedged to the NZ dollar.

- Global Dividend Aristocrats – Invests in close to 100 companies from around the world that have a strong, stable or growing dividend yield.

- Global Infrastructure – Invests in around 100 companies that derive at least 70% of their revenues from infrastructure type businesses such as transportation, water, or communications.

- Global Infrastructure (NZD Hedged) – Same as above, but hedged to the NZ dollar.

- Global Green Property – Invests in over 200 REITs from around the world, hedged to the NZ dollar.

- Electric Vehicle Innovation – Invests in 40+ companies involved in the electric vehicle ecosystem including manufacturers, and providers of charging infrastructure.

- Moonshots Innovation – Invests in 50 companies involved in emerging and disruptive sectors such as cyber security, genetic engineering, and space.

- Global Clean Energy – Invests in 60+ companies involved in producing clean energy or providing clean energy technology and equipment.

Simplicity’s single sector funds are only available as non-KiwiSaver funds. Kernel’s single sector funds are available as both KiwiSaver and non-KiwiSaver funds.

What’s the difference between hedged and unhedged funds?

See our article below:

– Hedged vs Unhedged funds – What’s better?

There are just a few types of funds that overlap between the two providers. Both offer NZ share funds, and global share funds (in both currency hedged and unhedged versions).

A few fund types are unique to Simplicity. These are the NZ Bond, International Bond, and Homes and Income funds. Kernel does have some bond funds in the works, but they have not yet announced when/if they’ll become available to retail investors.

And a few fund types are unique to Kernel, who overall offer a much greater selection of single sector funds (despite their current lack of bond funds). This includes the infrastructure, listed property, and thematic funds, as well the popular S&P 500 product.

Further Reading:

– S&P 500 vs Global index funds – What’s better?

Diversified funds

Diversified funds invest in multiple asset classes, mixing growth assets (e.g. NZ shares, overseas shares, property) with income assets (e.g. NZ bonds, overseas bonds, cash). These funds provide a convenient one-stop shop for investors to build an investment portfolio, removing a lot of the guesswork around which individual funds to invest in. Generally long-term investors would want to invest in a fund with more growth assets, and short-term investors would want to invest in a fund with more income assets.

Each of Simplicity’s and Kernel’s diversified funds is largely a combination of their respective single sector funds. For example, Kernel’s High Growth Fund contains a combination of their NZ 20, Global ESG, Global Infrastructure, as well as a couple of their other funds.

Simplicity

Simplicity offers five diversified funds. The High Growth fund has the highest allocation to growth assets, with an increasing allocation to income assets as you move down the list.

| Fund | Allocation to Growth assets | Allocation to Income assets | Minimum suggested investment timeframe |

| High Growth | 98% | 2% | 10 years |

| Growth | 80% | 20% | 9 years |

| Balanced | 59% | 41% | 6 years |

| Conservative | 23% | 77% | 3 years |

| Defensive | 5% | 95% | 2 years |

Kernel

Kernel has three diversified funds. The High Growth Fund invests almost entirely in growth assets, the Cash Plus Fund is fully invested in income assets, while the Balanced Fund sits in the middle.

| Fund | Allocation to Growth assets | Allocation to Income assets | Minimum suggested investment timeframe |

| High Growth | 98% | 2% | 5-10 years |

| Balanced | 60% | 40% | 3-7 years |

| Cash Plus | 0% | 100% | No minimum |

All of Simplicity’s and Kernel’s diversified funds are available as both KiwiSaver and non-KiwiSaver funds.

Just two fund types overlap between Simplicity and Kernel. Both providers offer High Growth funds (suitable for long-term investors willing to take on more risk) as well as Balanced funds (suitable for medium-term or risk adverse investors).

Three fund types are unique to Simplicity. Only Simplicity offers Growth, Conservative, and Defensive funds (although these funds essentially just invest in the same assets, but with differing proportions of growth vs income assets between them). This wider range of diversified funds does make it easier to invest in an asset allocation that meets your specific investing needs – For example, you might feel that High Growth is too risky for you, and that a Growth fund might be better as it has a small allocation to bonds to reduce the fund’s volatility. With Kernel you could combine their High Growth and Balanced funds to give you an asset allocation similar to that of a Growth fund, but this isn’t really a convenient solution compared with Simplicity’s pre-built options.

One fund type is unique to Kernel, which is their Cash Plus Fund. Catering to those investing for the very short-term (e.g. someone wanting to use the money for a house deposit very soon, or as an emergency fund), this fund is major advantage of Kernel, whereas Simplicity doesn’t have any suitable funds for those needing to withdraw their money within 1-2 years.

2. In depth fund comparison

Simplicity and Kernel have some key differences in how they build their funds. As for which is better, we don’t have a crystal ball to tell which fund manager is going to perform the best. However, we hope to highlight some points that may help you form your own opinion on which one you prefer.

Simplicity’s unlisted investments

Perhaps the most significant difference between Simplicity’s and Kernel’s diversified funds is that Simplicity’s diversified funds do not invest entirely into traditional assets. Instead a portion of each fund can be invested into the following (unlisted) initiatives:

- Mortgages – Involves lending out money as home loans to Simplicity’s KiwiSaver members who are buying their first home.

- Build-to-Rent (BTR) housing – Involves investing into Simplicity Living, a company associated with Simplicity that develops residential housing, and subsequently rents out the completed properties. All current developments are on the Auckland isthmus, with aspirations to expand further across the nation.

- Private equity – Involves investing in unlisted NZ companies, either directly or via Icehouse Ventures‘ private equity funds. These tend to be earlier stage, higher risk companies compared with those that are listed on the sharemarket.

Here is each fund’s target allocation to these unlisted assets:

| Fund | Allocation to Mortgages | Allocation to BTR | Allocation to Private Equity | Total allocation to unlisted assets |

| High Growth | 0% | 10% | 7.5% | 17.5% |

| Growth | 3% | 4.5% | 2.5% | 10% |

| Balanced | 6.5% | 3.5% | 0% | 10% |

| Conservative | 7.5% | 2.5% | 0% | 10% |

| Defensive | 15% | 5% | 0% | 20% |

The views on these investments are very mixed. Some people like that they’re investing in initiatives that improve the housing supply in New Zealand. But others are concerned that Simplicity is straying too far into becoming an active fund manager, investing in their own projects (in the form of mortgage lending and Simplicity Living), rather than being a purely passive, index tracking fund manager.

On the other hand, Kernel’s funds stick to investing in traditional listed assets like shares, bonds, and cash.

Diversified fund asset allocations

Simplicity and Kernel are similar in that they both offer High Growth and Balanced funds. Let’s look at each funds’ asset allocations.

High Growth funds

Both High Growth funds are similar in that they have a 98% allocation to growth assets. But there’s a couple of noticeable differences in the specific asset classes each fund contains:

- Kernel has significantly more exposure to listed NZ shares (29.4% vs Simplicity’s 7.5%). But when you add up all off Simplicity’s NZ growth assets (NZ shares + NZ unlisted shares + unlisted property) you’ll find that their fund has a target 25% exposure to NZ growth assets – Not too far off Kernel’s 29.4%.

- Kernel has less exposure to international shares (58.6% vs Simplicity’s 73%). But when you add in Kernel’s exposure to listed property and infrastructure, we end up with a total 68.6% allocation to international growth assets. Property and infrastructure companies are relatively defensive, so should reduce the overall volatility of the Kernel High Growth Fund.

| Simplicity | Kernel | |

| NZ shares | 7.5% | 29.4% |

| NZ unlisted shares | 7.5% | – |

| International shares | 73% | 58.6% |

| Listed property | – | 5.0% |

| Unlisted property | 10.0% | – |

| Infrastructure | – | 5.0% |

| NZ bonds | – | – |

| International bonds | – | – |

| Cash | 2.0% | 2.0% |

Balanced funds

Each Balanced fund has similar target asset allocations to their respective High Growth equivalents, but with less exposure to growth assets to make room to invest in bonds. Despite Simplicity and Kernel being mostly passive fund managers, their NZ bond investments do not track an index. Kernel actively manages their NZ bonds, and Simplicity’s NZ bond exposure is at least partially actively managed as it includes investments in home loans and other bond issues they may actively choose to invest in. However, both fund mangers passively manage (use index funds) their international bond exposures.

| Simplicity | Kernel | |

| NZ shares | 12.0% | 18.0% |

| NZ unlisted shares | – | – |

| International shares | 43.5% | 36.0% |

| Listed property | – | 3.0% |

| Unlisted property | 3.5% | – |

| Infrastructure | – | 3.0% |

| NZ bonds | 16.5% | 17.0% |

| International bonds | 22.5% | 18.0% |

| Cash | 2.0% | 5.0% |

Index differences

Despite each fund manager using elements of active management, their offering is still largely made up of index funds. However, Simplicity’s and Kernel’s funds track different indexes, resulting in slight differences in what each fund holds. For example:

NZ shares

- Simplicity’s NZ Share Fund is based on the Morningstar New Zealand Index which contains 32 companies, though Simplicity excludes a few of them for ethical reasons.

- Kernel’s NZ 50 ESG Tilted Fund tracks the S&P NZX 50 Portfolio ESG Tilted Index which contains 44 companies (the 50 largest companies listed in NZ, minus 6 for ethical reasons).

- Kernel’s NZ 20 Fund tracks the S&P/NZX 20 Index which has 20 of the largest companies listed on the NZ sharemarket without any ethical exclusions.

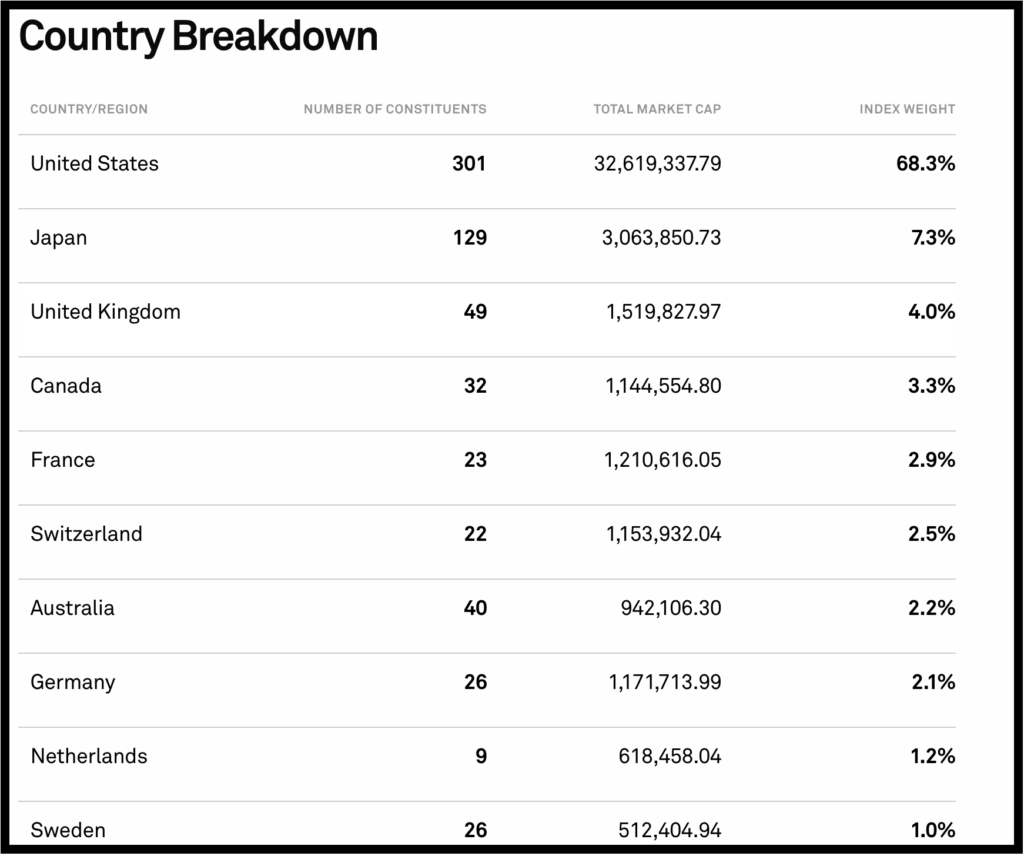

Global shares

- For their Global Share funds, Simplicity tracks the Bloomberg DM Ex NZ ESG Screened Index, which contains over 1,000 companies across 20+ developed markets.

- Kernel’s Global ESG Fund tracks the S&P Developed Ex-Korea Large Mid Cap Net Zero 2050 Paris-Aligned ESG Ex-Non-Pharma Animal Testing Index, which contains over 700 companies from 24 developed markets.

- Kernel’s Global 100 Fund tracks the S&P Global 100 Ex-Controversial Weapons Index, which contains 100 companies from across 11 countries.

Again we don’t have a crystal ball to tell which index is going to perform the best. But one interesting difference we do find is the transparency of the indexes. Kernel uses S&P’s indexes for their funds who has a website showing plenty of statistics for each index (such as the number of constituents, geographical breakdown, industry breakdown, and past performance).

On the other hand, the Bloomberg index Simplicity tracks for their global funds has no such data publicly available. The Morningstar index used for their NZ share fund does have publicly available data, however is not a 100% accurate reflection of what the Simplicity fund invests in (given the fund doesn’t actually “track” the index, but rather customises the index to exclude companies for ethical reasons).

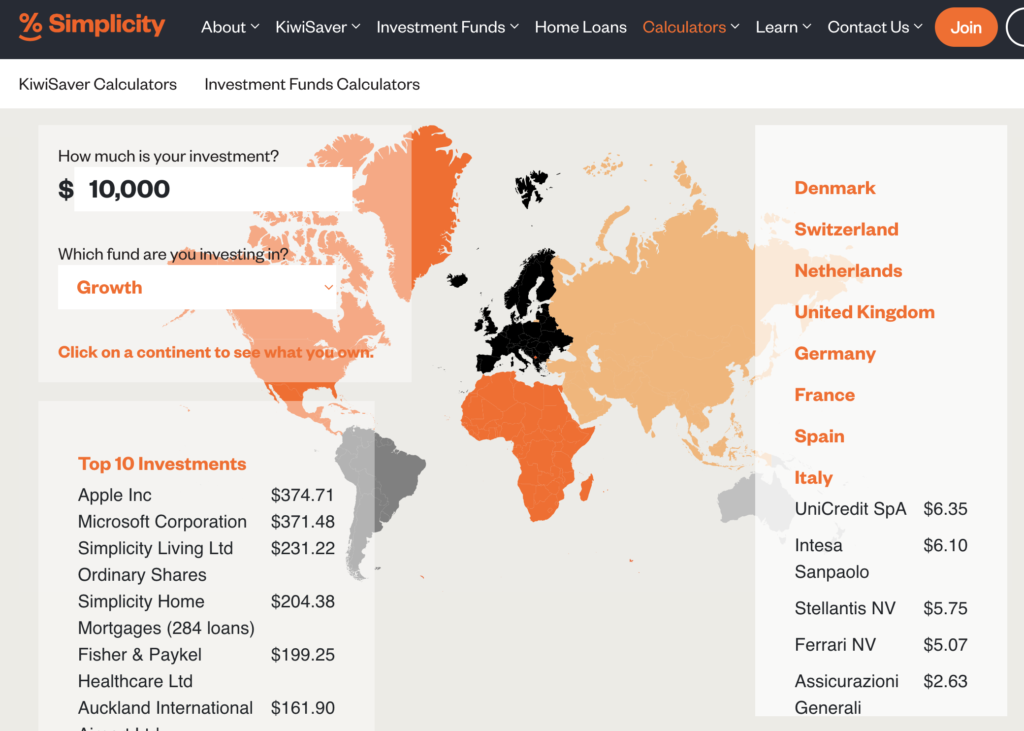

Fortunately both providers make lists of their funds’ full holdings easily accessible. Kernel displays a full list of holdings on each of their funds’ website page. Simplicity’s has a “where in the world is my money calculator” to show where each fund invests its money. However, Simplicity’s calculator is a bit clunky as you have to go through the list country by country to see every asset held in your fund. Simplicity also doesn’t disclose the exact companies they invest in for the private equity portion of the Growth and High Growth funds. Overall we find Kernel’s funds more transparent compared with Simplicity’s.

Ethical investing

There’s a few differences in how each fund manager approaches ethical investing.

Simplicity

All of Simplicity’s funds have ethical exclusions. They use “negative screening”, which basically means they exclude any companies operating in undesirable industries (such as alcohol, tobacco, adult entertainment, fossil fuels, gambling, and weapons) from their funds. An example of this is the exclusion of SkyCity, Amazon, and Meta from their funds (despite being a large companies in their respective markets).

Note that everyone’s preferences towards ethical investing is different, and may feel that these exclusions go too far, or perhaps not far enough. For example, Nestlé is a company that some people like to avoid for ethical reasons, but Simplicity still invests in despite their ethical exclusions.

Kernel

Many of their Kernel’s funds don’t have ethical exclusions. For example, their NZ 20 Fund invests in SkyCity, whereas Simplicity’s NZ Share Fund doesn’t. However, some of Kernel’s funds (like the NZ 50 ESG Tilted, Global ESG, and Global Green Property funds) go further than Simplicity in how they invest ethically. For these funds, Kernel doesn’t only use negative screening (to exclude companies in undesirable industries), but also re-weights companies based on ethical factors. Essentially these funds invest more into companies with a high ethical score, while investing less into companies with a low ethical score. Interestingly (unlike Simplicity), their Global ESG Fund avoids investing in Nestlé altogether, but still invests in Amazon and Meta.

Overall we think Kernel is more flexible in the ethical investing space as you can choose between investing in an “ethical” or “non-ethical” fund. Though one thing to be aware of is that Kernel’s diversified funds are not considered to be “ethical” (despite having an allocation towards their Global ESG Fund). So if you want a fully ethical/ESG (or fully non-ethical) offering with Kernel, you might want to build your own portfolio with their single sector funds, rather than use their diversified funds.

3. Other considerations

Fee comparison

Management fees

For the Single sector funds Simplicity charges lower management fees:

- Simplicity – 0.10% p.a. for the NZ Share and Bond funds, 0.15% p.a. for the Global Share and Bond funds, 0.29% p.a. (reducing to 0.25% p.a. from 1 February 2024) for the Homes and Income Fund.

- Kernel – 0.25% p.a., except for thematic funds (Global Clean Energy, Moonshots Innovation, and EV Innovation) which have a management fee of 0.45% p.a.

For the Diversified funds, both fund managers’ fees are the same when you take into account Simplicity’s upcoming fee reduction:

- Simplicity – 0.29% p.a., reducing to 0.25% p.a. from 1 February 2024.

- Kernel – 0.25% p.a.

Member fees

In most cases neither fund manager charges a member/platform/account fee. The exception is Kernel who charge a platform fee of $5 per month, if you invest $25,000 or more in their non-KiwiSaver funds. This charge doesn’t apply to their KiwiSaver funds

This fee is our least favourite aspect of Kernel. A $5 per month charge on a $25,000 portfolio equates to 0.24% per year, so when combined with their fund management fee of 0.25% for most of their funds, the total fees you pay with Kernel could be up to 0.49% p.a. On a $100,000 portfolio, the platform fee would equate to 0.06% p.a., or 0.31% when combined with the fund management fee. That’s still cheap, but not as cheap as Simplicity’s fees. Overall Kernel’s fees are more expensive than Simplicity’s fees if you’re investing $25,000 or more outside of KiwiSaver.

Transaction fees

Neither fund manager charges transaction fees or applies spreads when you buy or sell units in their funds. However, Kernel may charge “swing pricing” on large withdrawals, if the withdrawal is considered to have a material cost on the fund.

Further Reading:

– A beginner’s guide to investment fees – Management fees, transaction fees, and more

Tax

Both Simplicity’s and Kernel’s funds are taxed the same. All of their funds are Multi-Rate PIEs taxed at your PIR (which is either 10.5%, 17.5%, or 28%). Both fund managers also set up their funds in a tax efficient manner. Simplicity previously had tax leakage issues, but these have been resolved since April 2023.

Further Reading:

– What taxes do you need to pay on your investments in New Zealand?

Minimum investment

There is no minimum investment for KiwiSaver, but the following minimums apply for non-KiwiSaver funds:

- Simplicity – The minimum initial investment is $1,000 per fund for individual and joint investors. This increases to $50,000 for trusts and companies.

- Kernel – The minimum investment is just $1 per fund, making Kernel’s non-KiwiSaver funds a lot more accessible than Simplicity’s.

Distributing income

The underlying assets of a fund pay out dividends and interest. The two fund managers differ in how they pass this income on to investors:

- Simplicity automatically reinvests any income the fund receives into more assets. Therefore dividends and interest the fund earns is ultimately reflected in an increase in the fund’s unit price.

- Kernel pays any dividends and interest their funds earn as distributions roughly every 3 months (apart from their Electric Vehicle and Moonshots funds which do not pay distributions). Investors have the option to automatically reinvest their distributions to buy more units in their fund or to receive the distributions as cash.

The way each provider pays out income shouldn’t make a noticeable different in the returns you get. However, Kernel is more flexible given the option to receive distributions as cash. With Simplicity you’d have to manually sell some of your units if you wanted to create a stream of income from their funds.

Splitting funds

Both providers allow you to split your money across multiple funds. For example, with Simplicity’s non-KiwiSaver funds, you could put some money in the Global Share Fund, and some in the NZ Share Fund. Or with Kernel’s KiwiSaver scheme you could allocate 80% of your portfolio to the Global ESG Funds and 20% to the NZ 50 ESG Tilted Fund. This can be useful if you don’t like the asset allocations of their diversified funds as you could instead construct your own DIY portfolio using each provider’s single sector funds.

However, there are some limitations with splitting funds:

- Single sector funds aren’t available with Simplicity KiwiSaver. You can only invest in their diversified funds in KiwiSaver.

- In Simplicity’s KiwiSaver scheme you can only invest in one fund at a time. But we don’t think this limitation is a big deal – For example, there’s not much point to mix Simplicity’s High Growth Fund with their Balanced Fund, as you might as well invest in their Growth Fund to achieve a similar asset allocation.

- Kernel currently doesn’t offer single sector bond funds, so bonds are a bit harder to incorporate into a Kernel DIY portfolio.

Past performance

It is currently impossible to do a fair comparison of past performance between the two providers. Firstly, many funds (like Simplicity High Growth, and Simplicity Global Share) have only existed for a few months. That’s far too short to give us a meaningful comparison between the funds. Secondly, it’s inappropriate to compare some funds with each other (e.g. Simplicity’s Growth fund to Kernel’s High Growth Fund) as they’re two different fund types.

But here’s some of the limited performance data we do have. These figures are as at 30 November 2023 and are after fees are deducted, but before tax. Firstly, a comparison between the High Growth funds (which we only have 3 months of performance data for):

| Simplicity High Growth | Kernel High Growth | |

| 3 months | -0.11% | 0.07% |

The balanced funds, which we also have 1 year performance figures for:

| Simplicity Balanced | Kernel Balanced | |

| 3 months | 0.37% | 0.64% |

| 1 year | 6.81% | 7.30% |

The NZ share funds:

| Simplicity NZ share | Kernel NZ 50 ESG Tilted | |

| 3 months | -1.23% | -1.37% |

| 1 year | -0.69% | 1.86% |

And lastly, the global share funds:

| Simplicity Global Share | Kernel Global ESG | |

| 3 months (unhedged) | -1.65% | -1.32% |

| 3 months (hedged) | 1.55% | 1.96% |

With only 3 months to 1 year of performance data, it’s way too short of a timeframe to draw any meaningful conclusions of which funds perform better. In addition, these figures reflect past performance of each fund, not future performance – So even though Kernel’s funds have generally done better, this outperformance isn’t guaranteed to continue into the future.

Extra features

Both fund managers offer extra features to help their customers manage their wealth:

- Simplicity – They offer floating rate home loans to their KiwiSaver members, at rates lower than the banks. For example, Simplicity’s current floating rate is 6.40%, while the lowest interest rates at the major banks are currently just over 7%. However, the loans come with some major limitations. You have to be really well off in terms of your deposit and income to qualify for their loans in the first place, and the loans have fewer features (for example, you can’t fix your rates).

- Kernel – They offer Kernel Save, a notice saver account which allows you to earn a variable interest rate (currently at 5.25%), but requires 34 days notice to withdraw any money from. That 34 day lock in period for your money might be useful to prevent any impulse spending, but those wanting more flexibility with their savings might be better off with a product like Squirrel’s On-call account which has the same interest rate, but doesn’t have any restrictions on withdrawals.

Conclusion

Simplicity and Kernel have lots of similarities. For example, they offer quality High Growth funds and a range of NZ and global single sector funds that are mostly passively managed. And perhaps most importantly, they have low fees. However, the two managers have lots of differences. Kernel has a larger selection of unique funds (like Cash, S&P 500, and thematic funds) while Simplicity has a more complete range of diversified funds (like Growth, Conservative, and Defensive options).

But overall we don’t think there’s a definitive best between the two. Both have continued to improve their offerings over the years, and sit among the best investment options in New Zealand. The one you choose really comes down to personal preference – Do you mind investing in Simplicity’s special initiatives? What does ethical investing mean to you? Are you after a specific fund type that’s unique to only Simplicity or Kernel? Do you want the flexibility that Kernel offers in letting you pick single sector funds for your KiwiSaver?

And if you’re struggling to decide, don’t let analysis paralysis get in the way and just pick one (or invest with both)! Both are quality, competitive providers, and there’s no “wrong” decision. Choosing one over the other really isn’t going to make or break your portfolio.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

The difference in the NZ Share funds 1 year returns between Simplicity (-0.69%) & Kernel (+1.86%) seems too large. How would you explain this?

Per post:

“Simplicity’s NZ Share Fund is based on the Morningstar New Zealand Index which contains 32 companies, though Simplicity excludes a few of them for ethical reasons.

Kernel’s NZ 50 ESG Tilted Fund tracks the S&P NZX 50 Portfolio ESG Tilted Index which contains 44 companies (the 50 largest companies listed in NZ, minus 6 for ethical reasons).”

Given they don’t hold the same stocks nor the same weights its expected they would perform differently over time.

The Kernel NZ 20 seems to be the sweet spot for a NZ index. TNZ or NZ Top 10 too consolidated, NZX 50 has some poor performers, mainly the bottom 30.

It would be helpful for retired investors if the funds offered a regular withdrawal facility.

Another very helpful and well-written post, as usual. I was tossing up between Simplicity and Kernel for a while before going with Simplicity, but I appreciate both are attractive options and perhaps not even that different over the long term.

Despite a general overall preference for ESG, my main concern with Simplicity is the exclusion of massive companies like Amazon and Meta. I also feel its hypocritical of me to approve of these exclusions given that I use their products as well. Assuming that a global index fund such as Simplicity’s Global Share maintains the exclusion of 2 or so top performing companies in the world (whether the above two or others), is it possible to have a rough idea of how this might affect the fund in the long run?

It’s really impossible to say, as we don’t know how well the companies they exclude will perform over the long run. If they continue to perform well, that’ll hurt the performance of Simplicity’s fund (relative to other global funds), if not, that’s a good thing for Simplicity’s fund, as they aren’t holding those companies.