Most people living in New Zealand are familiar with the risk of natural disasters, like a major earthquake. We prepare for this risk by making plans with family, stocking up on water, canned food, and first aid kits. A recession could be considered as similar to a natural disaster – but rather an economic one. So how can you prepare your investment portfolio for one? Is there an investing equivalent to stocking up on water and canned food? And with the chatter of a recession in 2020, should we keep our money on the sidelines until the threat subsides?

1. About recessions

What’s a recession?

A recession is defined as a fall in GDP in two successive quarters. In general a recession involves the slowdown of economic activity, which may result in some or all of the following:

- Businesses hire fewer people and cut down on employees

- People spend less money

- Businesses earn less money

- Share prices of businesses fall

What we don’t know is the exact impact a future recession will have. We don’t know the extent to which the economy will slow, we don’t know what percentage the financial markets will drop, and we don’t know how long a recession will last before the economy recovers.

When will a recession hit?

We do know that the economy goes up and down in cycles, therefore a recession is coming. The economy doesn’t go up constantly in a linear fashion, and you can expect it to stumble periodically. Some suggest that an economic cycle lasts roughly 10 years on average. You can see a brief history of NZ recessions on Passive Income NZ’s article here.

What we don’t know is when we’ll have the next recession. Despite the current economic cycle being mature and over 10 years old, this is no guarantee we’ll have a recession in 2020, or even in 2021, 2022 or beyond. In fact most economists seem to be optimistic for modest economic growth in 2020. However, we cannot be complacent – politics, international conflict, or a “Black Swan Event” could all shock the world and quickly turn optimism into pessimism.

2. Preparing for a recession

A recession is similar to an earthquake – we don’t know when one will hit, and when one does, we don’t know how what the severity and impact will be. But there are certain things we can do to prepare, such as stocking up on emergency supplies, and securing shelves and furniture.

However, all this preparation only helps us cope better when an earthquake hits, and it doesn’t make us totally earthquake proof. There is a limit to what we can do to prepare for an earthquake. For example, those living in earthquake prone areas cannot live their whole lives braced under a table just in case a big one hits – and even that would not be a 100% guarantee of your safety.

This is the same for your investment portfolio. There are strategies investors should have in place at all times (whether you’re expecting a recession or not), to help you cope better through a recession. I will cover these strategies below. But there is a limit to what you can do. There is nothing you can do to 100% eliminate risk and make your portfolio entirely recession proof.

Investing mindset

Firstly, make sure you’re here for the right reasons. Investing is not a get rich quick scheme. It is a marathon, not a sprint.

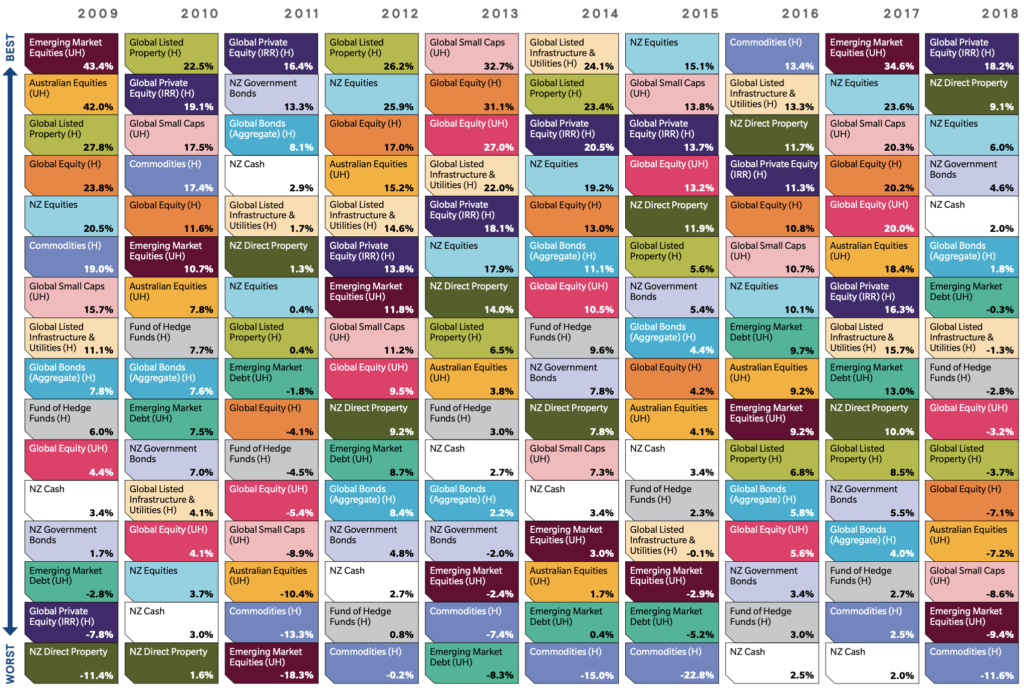

Secondly, don’t be greedy. Don’t chase last years’ winners, or invest in something just because it had great returns in the past. Just because a fund or company performed well last year, it doesn’t mean it will continue to do so in the future. The below chart shows that one year’s best performing asset class is never the best performer the following year:

Why is having the right mindset important? It is about setting expectations that there are no shortcuts to getting rich, and that investing is often a long and boring journey with lots of ups and downs. For excitement and the chance to get rich quick, consider a trip to the casino. Having the right investing mindset in the first place will help you get through once a recession hits.

Have an emergency fund

Putting aside an emergency fund in a place you can easily access (like in a bank savings account) is a must. The purpose of this fund is to have the means to cover a job loss or other unexpected emergency, without having to disturb your long-term investments or take on debt. How much money your emergency fund should contain depends on your personal circumstances – Nick from Your Money Blueprint has an article with some questions you can ask yourself to figure this out.

You might be understandably frustrated that interest rates on bank savings accounts are incredibly measly, and are wondering if you could stick your emergency fund somewhere else with higher returns. But remember the mindset to not be greedy! The role of an emergency fund is to protect you (like a form of insurance), not to make you wealthy, so stick with bank deposits.

Review your asset allocation

Right now investors might be excited to invest in shares, after seeing over ten years of strong returns. But shares come with a dark side. Craigs Investment Partners’ August 2019 magazine puts it nicely:

Shares and listed property have a dramatically different risk profile to term deposits, bonds or fixed income. Shares provide higher returns… but they are much more volatile and more sensitive to economic conditions.

Craigs Investment Partners, News & Views, August 2019

Shares are a volatile asset class, and can go up and down like a rollercoaster. They are not suitable for everyone, particularly those with shorter investment timeframes who don’t have the time to ride out any volatility. Other asset classes behave differently to shares, so are more suited to different circumstances. For example, bonds can act as a bit of a shock absorber for your portfolio, so are better suited for shorter-medium term investors:

The NZX All index fell 49.2% from its 2007 peak to its 2009 low… In contrast, the NZX Investment Grade Corporate Bond Index rallied 14.4% in 2008, while government bonds performed even better. That’s your true protection during a period of major market weakness.

Craigs Investment Partners, News & Views, August 2019

Here’s an example of why the volatility of shares makes them unsuitable for some people:

Harry has been diligently saving up for a deposit for his first home. He is close to achieving his dream, expecting to buy in just 6 months time. Seeing the poor returns on savings accounts, Harry decides to put his $100,000 deposit in the sharemarket which has seen great returns.

Unfortunately the sharemarket crashes and Harry’s investment drops to $80,000. With just months until his house purchase, he doesn’t have enough time for the markets to recover. Harry now faces the prospect of buying a lot less house or delaying his dream.

The implication of all this is that you must have an asset allocation appropriate for your investment objectives and timeframe. That means not being greedy like Harry, and holding an increasing amount of defensive assets like bonds and cash the closer you get to your investment goal. You should also properly diversify your portfolio (including in overseas markets), and have the right KiwiSaver fund for your circumstances.

Also consider other factors like your risk tolerance in your asset allocation. If you think a big drop in your investment portfolio’s value will make you lose sleep at night, you might consider investing in more defensive assets. Although risk tolerance can be hard to determine, as we don’t know how we’ll truly react when the markets plummet (particularly those who haven’t experienced a recession before.

Everyone has a different answer when it comes to an asset allocation that’s appropriate for you, so Sorted’s Investor Kickstarter tool or a financial adviser may be able to help you with this.

Buy quality

In good economic times, it’s relatively easy to make money on the sharemarket. For those of you who invest in individual companies, even taking a punt on random companies here and there could get you a good result. A rising tide takes all boats up with it – and a rising sharemarket has the same effect.

You won’t be so lucky in an economic downturn. Tough times are when the quality of the companies you invest in really get tested, and when the weakest companies fail. As the Warren Buffett quote goes:

You only find out who is swimming naked when the tide goes out

Warren Buffett

When buying shares, you are not just buying a financial instrument, but also ownership of a business. So instead of just speculating on what shares are going to go up in value, buy quality assets that you believe can weather economic storms and prosper for many years to come.

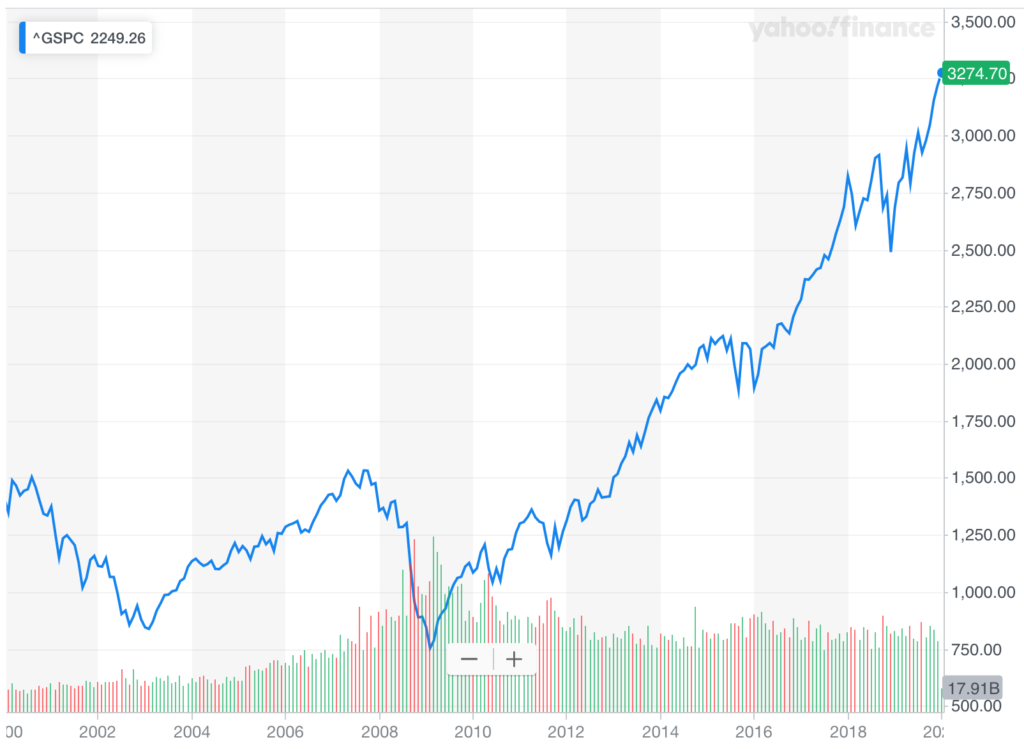

Don’t time the market

Every year, there are discouraging articles in the media (such as predictions of an upcoming recession) that prompts questions along the lines of “should I sell all my shares and invest in gold or bonds?” or “should I wait for prices to drop before investing in the sharemarket?”. The problem is that there is always some excuse to sell, or put off your investment in shares – whether it be some international conflict, or experts predicting imminent economic doom and gloom (examples in the Instagram post below). Despite all these excuses, the market has continued its advance.

I myself am a victim of all these recession predictions, having kept too much cash on the sidelines over the last few years. Having your portfolio in cash also has its risks – and for me this has resulted in missing out on years of great sharemarket returns. So ignore these negative headlines and stop trying to find the perfect time to enter the market – otherwise the excuses are endless, and you will never find that perfect time.

The stock market has predicted nine of the past five recessions

Paul Samuelson

Instead, the best time to start investing is now! There are plenty of articles that demonstrate that “time in the market beats timing the market”. I particularly like this article from Personal Finance Club, which is a simple story of three friends who saved $96,000 over 40 years, and invested the money using three different market timing strategies. In summary:

Tiffany Top is the world’s worst market timer and only invested into the sharemarket at its peaks. She ended up with $663,594 after 40 years.

Brittany Bottom is the world’s best market timer and only invested into the sharemarket at its troughs. She ended up with $956,838 after 40 years.

Sarah Steady did not time the market. She invested some money into the sharemarket every single month regardless of market conditions. Sarah ended up with $1,386,429 after 40 years.

3. During a recession

During a recession you log in to see your investment portfolio, and all you can see are negative signs and the value of your investments slashed. Stories of economic gloom and falling KiwiSaver balances dominate the news. It’s a horrible feeling! What should you do?

Investing mindset during a recession

During a recession, fear dominates the investor community. To overcome this fear, “Harden up!” – That’s what my best friend Igor says to me (especially when I’m struggling while on a run). This might include:

- Not paying so much attention to your portfolio or the news. This could result in more fear or negativity.

- Remembering your long term goals. Investing is a marathon, not a sprint. The average length of recession is about 13 months, so the pain is temporary.

- Getting support and encouragement from fellow investors, or your financial adviser.

- Enjoying other things life has to offer.

- Not panicking and being as calm as possible until the markets improve.

All of this is easier said than done. But if you planned correctly and have the right mindset, you will come out of it ok. As a runner, I pushed through a lot of pain while training and ultimately became a better runner. The same goes for investing – “Harden up!” and the downs of the market you go through will make you a smarter and more resilient investor.

Hold on tight

During market downturns, many investors consider selling their investments to protect themselves from further losses. Related to my above point about mindset, don’t panic, and don’t sell! You haven’t lost any money unless you sell, and you should be able to ride out the volatility if you have the right emergency fund and asset allocation.

To illustrate this, using Kernel’s investment calculator (found here), let’s say you invested $10,000 into the NZ Top 20 in January 2008. After one year at December 2008, the Global Financial Crisis has struck and your investment would have fallen to just $6,724! If you sold at that point, you would have made a loss of $3,276. Now let’s say you hold on to your investment for another 9 years. At December 2017, your investment would be worth $22,915 – a $12,915 gain.

The fact that your investment was only worth $6,724 at one point doesn’t matter. It’s the end goal that matters, and the volatility that happens in between is just a temporary distraction to your goal.

The decline is temporary, the advance is permanent

Buy on sale

Market downturns provide a golden opportunity. They are the investing world’s equivalent of Boxing Day sales. Recessions might not be as inviting as buying sneakers on sale though, as the markets are falling almost every day, and there is fear of it dropping even further. It may seem like the world is going to end! But remember not to time the market!

You can buy your favourite shares and funds at some fantastic discounts, with the average recession resulting in a ~32% drop from peak to trough. And best of all, you’ll make some awesome gains as the markets recover. Now is the time to be a little greedy and keep on investing.

Be fearful when others are greedy, and greedy when others are fearful

Warren Buffett

Conclusion

A recession is not dissimilar to a natural disaster like an earthquake. There are certain things you can do to prepare to help you cope better when one hits. In summary, all investors (whether you think a recession is imminent or not) should have the following:

- The right mindset and expectations as an investor

- An emergency fund

- An asset allocation appropriate for your personal goals and circumstances

- A portfolio of high quality, rather than speculative assets

- An approach to investing that involves starting now, rather than timing the market.

However, in the same way it’s impossible to make everything 100% earthquake proof, there is no way to make your portfolio entirely recession proof. There’s a limit to we can do, given we don’t know when one will hit, and what the exact impact will be. So just prepare what you can, and don’t be afraid to get on with everyday life.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.