The sharemarket can be incredibly volatile and this often leads to questions about what strategies one should use when investing – Should I start investing now, or wait for the market to bottom out? Should I sell my investments, and buy back into the market once it’s dropped? And if I have a lump sum, should I invest it all at once or dollar cost average into the market? This article crunches the numbers to determine which strategy delivers the best results!

This article was inspired by Jeremy Schneider’s article How to Perfectly Time The Market, an awesome comparison between three friends who used different strategies to invest in the US sharemarket.

This article covers:

1. Does timing the market work?

2. Investing a lump sum

1. Does timing the market work?

Let’s take a look into the lives of five (hypothetical) investors who start with nothing, and in January 2003 decide to get serious about saving and investing. They each save $1,000 per month and choose to invest into an index fund tracking the S&P/NZX 50 index. They all take different approaches to deploying their savings into the market:

A. Bad Luck Bianca

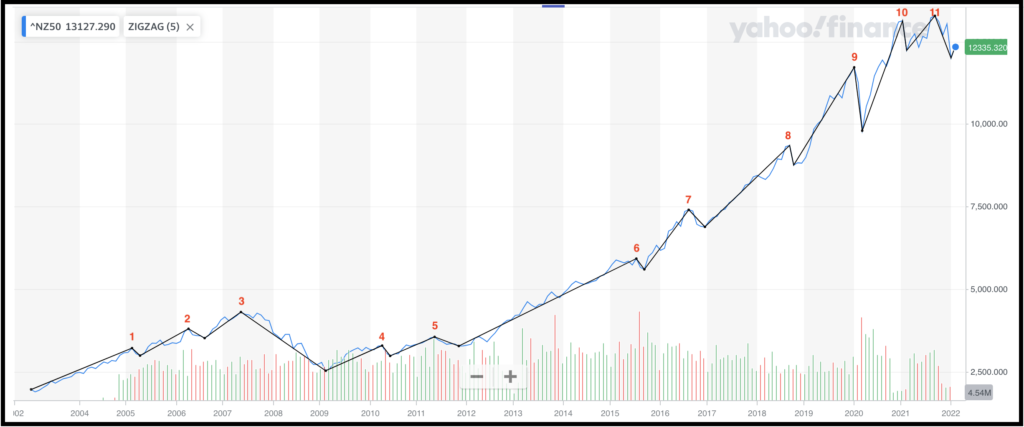

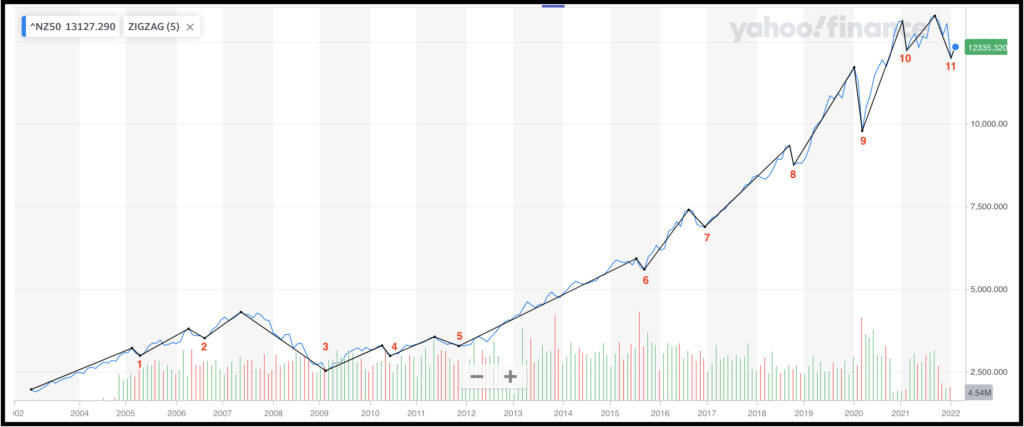

First we have Bad Luck Bianca who isn’t confident about the sharemarket and chooses to hold off investing her monthly savings. Instead she lets the cash accumulate in a bank account. Bianca happens to invest her accumulated savings only when the market peaks (just before a dip of 5% or more), as rising market gives her FOMO and causes her to invest at the worst possible times. She invests into a total of 11 market peaks up until February 2022.

On 4 February 2022, her buying the top “strategy” has resulted in an investment value of $561,718. Still a pretty good outcome despite her terrible market timing.

B. Master Timer Martin

Our second investor Master Timer Martin also chooses to hold off on investing his monthly savings. He leaves the money in a bank account, and only invests his accumulated cash at the very bottom of each dip (of 5% or more). He invests into a total of 11 market peaks up until February 2022 – impeccable market timing!

On 4 February 2022, his invest at the bottom strategy has resulted in an investment value of $656,433.

C. Buy The Dip Ben

Buy The Dip Ben splits his monthly savings of $1,000 into two. First he invests $500 into his index fund, regardless of what the market is doing. Then he keeps the remaining $500 saved up in his bank account as “dry powder” to take advantage of any downturns in the market. Like Martin, Ben perfectly times the market and invests his accumulated savings at the bottom of every dip.

On 4 February 2022, his buy the dip strategy has resulted in an investment value of $660,375.

D. Consistent Courtney

Consistent Courtney isn’t one to wait around. She invests her $1,000 each month regardless of what’s happening in the market. She doesn’t attempt to pick the bottom of the market, nor does she keep any spare cash on hand.

On 4 February 2022, her strategy known as dollar cost averaging has resulted in an investment value of $664,317.

E. Expert Trader Emma

Expert Trader Emma takes things to a whole new level. Like Consistent Courtney, she starts by investing her $1,000 every month. However, just as the market reaches its peak she sells off her entire investment. Emma then keeps the money in her bank account until the bottom of the dip, at which time she reinvests all of her cash back into the market. Up until February 2022, Emma sells out of the market at the top and buys back in at the bottom a total of 11 times.

On 4 February 2022, her “sell at the top and buy back at the bottom” strategy has resulted in an investment value of $1,752,764.

Results

In February 2022, all of our five investors have invested a total of $230,000. But with their different strategies for investing into the market, they’ve each ended up with different results:

| Investor | Investment value |

| Bad Luck Bianca | $561,718 |

| Master Timer Martin | $656,433 |

| Buy The Dip Ben | $660,375 |

| Consistent Courtney | $664,317 |

| Expert Trader Emma | $1,752,764 |

The clear winner is Expert Timer Emma, whose strategy of selling off her investment at the peaks of the market and buying back at the bottom has been far more profitable than any others. However, it’s a totally unrealistic result to achieve. Not only does Expert Trader Emma need to know exactly when the top AND the bottom of the market is, she has to pull off her perfect timing 11 times over the course of 19 years. She could’ve easily stuffed up her strategy – perhaps by selling off her investments, only for the market to continue rising. Or she could have bought back into her investments too early, only for the market to continue declining.

Therefore in the absence of a crystal ball telling you when the peaks and troughs of the market are, Consistent Courtney’s dollar cost averaging strategy is the next best option. Even though Courtney didn’t perform significantly better than Master Timer Martin or Buy The Dip Ben, her strategy removes the need for any guesswork, or the need for good luck in getting the timing right.

2. Investing a lump sum

Our above example looked at investors who started with nothing, and began to build up their investments over time. But what if we had a lump sum of cash to start with, say from previous savings, some windfall, or an inheritance? Should you invest the whole lot at once, or average in to the market (e.g. over a period of 12 months)?

Let’s take a look at two investors who have $120,000 to invest into an index fund tracking the S&P/NZX 50 index:

- Lump Sum Lydia – Invests her entire $120,000 at once.

- Dollar Cost Average Dan – Drip feeds into his investment, investing $10,000 per month for 12 months.

As for which investor comes out better off, the answer isn’t so clear. When investing a lump sum, the time at which you enter the market matters. To demonstrate how, here’s a couple of scenarios:

A. In a declining market

Lydia and Dan start their respective investment strategies in mid 2007, just as the market starts to decline due to the Global Financial Crisis.

In February 2022, their investments would be worth:

- Lump Sum Lydia – $344,053

- Dollar Cost Average Dan – $373,719

In this scenario Dollar Cost Average Dan is better off, as he’s able to enter into his investment at lower prices as the market goes down.

B. In a rising market

Lydia and Dan start their respective investment strategies in early 2009, just as the market starts to trend upwards, recovering from the depths of the Global Financial Crisis.

In February 2022, their investments would be worth:

- Lump Sum Lydia – $586,856

- Dollar Cost Average Dan – $505,006

In this scenario Lump Sum Lydia is better off, given Dan is averaging into what is an increasingly expensive market.

What’s better?

The decision to lump sum or dollar cost average would be very easy if we knew whether the markets were going to rise or decline in the coming months. The problem is that we don’t have a crystal ball and can only speculate as to where the market will move.

However, statistically the market goes up more often than it goes down. From January 2003 to February 2022 the S&P/NZX 50 index had 150 months with a positive return, and just 80 months with a negative return. This favours the lump sum strategy.

On the other hand, dollar cost averaging provides a form of insurance by spreading your entry into the market over a longer period of time. Given the market goes down roughly a third of the time, it could be a handy insurance policy to have – though you’ll pay for it if the market trends upwards.

So in deciding whether to invest as a lump sum or to dollar cost average you might want to consider:

- Your risk tolerance – Are you likely to freak out if you see the value of your investment plummet shortly after you’ve invested? If so, a dollar cost averaging approach will provide some psychological benefits over lump sum investing given you haven’t committed all of your money at once.

- The volatility of your investment – For assets more likely to jump around in price (like shares in individual companies or cryptocurrencies), it may be prudent to drip feed your money in.

Conclusion

Does timing the market result in better returns? Yes, particularly if you can sell your investments at the peak, and buy back in at the bottom. But is timing the market a realistic strategy to pull off? Absolutely not, without a crystal ball. No one knows when an investment has peaked, and when it’s hit the bottom – if someone claims to know, they’re likely just speculating. And if someone claims to have correctly predicted the market top/bottom in the past, it was probably just a fluke.

So trying to outsmart the market with any of these strategies is probably a bad idea:

- Waiting for the market to bottom out before you invest,

- Keeping spare cash on the sidelines to take advantage of market downturns, or

- Trying to sell off your investment before the market crashes, so you can buy back in at lower prices,

We prefer Consistent Courtney’s strategy of dollar cost averaging into the market – buying and holding your investments no matter what the market is doing. It’s boring but effective, and completely removes the uncertainty of whether you should start investing now or wait a few months in the hope that the market goes further down.

For those with a lump sum to invest, the merits of dollar cost averaging over investing the whole lot at once is less clear. Lump sum investing will statistically provide the better result, whereas averaging in provides some protection in case the market goes down. Overall, the strategy that’s right for you will come down to personal preferences.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.