InvestNow is a Wellington based investment platform, and have been operating since 2017 with an aim to provide investors with easy online access to a large range of managed funds. While they’re a reasonably well known service with an attractive product offering, they haven’t seen the same level of popularity as other platforms like Sharesies. So does InvestNow deserve more love as one of New Zealand’s best ways to invest?

InvestNow is also a KiwiSaver provider. See our article Build your own KiwiSaver – InvestNow vs SuperLife vs Craigs for more details – this article will focus on InvestNow’s non-KiwiSaver investments.

This article covers:

1. What’s on offer?

2. Fees

3. Other considerations

4. InvestNow vs competing services

Update (4 Apr 2022) – AMP’s funds have been renamed to Macquarie

1. What’s on offer

Managed Funds

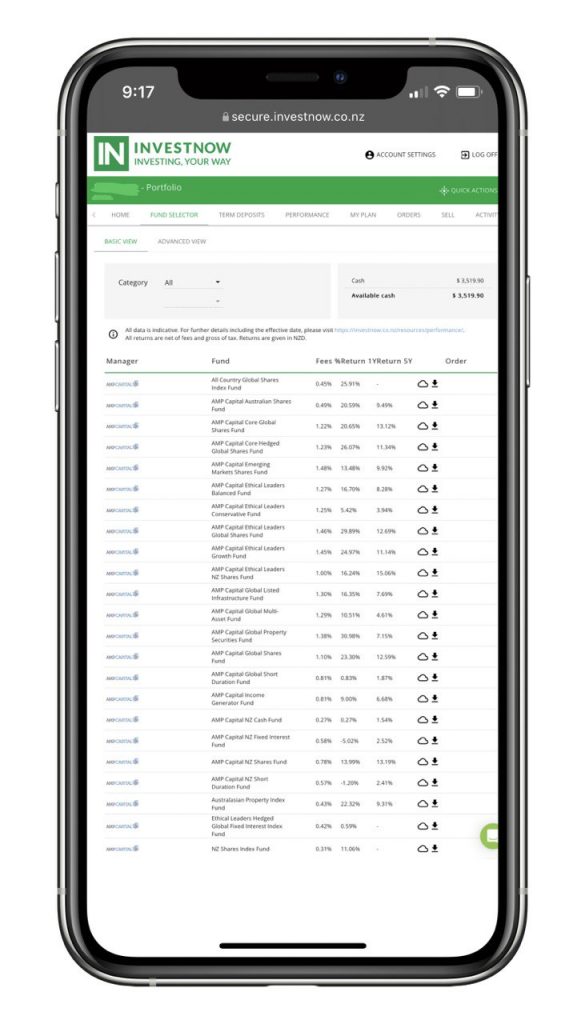

InvestNow is primarily a fund platform, where you can buy and sell a huge range of 153 managed funds from 27 different fund managers.

Asset classes

Each of InvestNow’s funds invest in one of the following eight asset classes:

- Cash & Cash Equivalents – Funds that invest in bank deposits and short-term loans to corporations. For example, the Macquarie NZ Cash Fund.

- New Zealand Fixed Interest – Funds that invest in NZ bonds. For example, the Harbour NZ Corporate Bond Fund.

- International Fixed Interest – Funds that invest in international bonds. For example, the Russell Investments Global Fixed Interest Fund.

- Australasian Equities – Funds that invest in NZ and/or Australian shares. For example, the Macquarie NZ Shares Index Fund (NZ), Smartshares S&P/ASX 200 ETF (Australia), and Milford Trans-Tasman Equity Fund (both).

- International Equities – Funds that invest in international shares. Examples are broad market funds like the Macquarie All Country Global Shares Index Fund, ethical funds like the Pathfinder Global Responsibility Fund, and thematic funds like the Smartshares Automation and Robotics ETF.

- Listed Property – Funds that invest in Real Estate Investment Trusts (REITs). For example, the Macquarie Australasian Property Index Fund.

- Diversified – Funds that invest across multiple asset classes. For example, the InvestNow Foundation Series Growth Fund which invests in a mix of NZ shares, international shares, and bonds.

- Other – InvestNow has recently started offering the Vault International Bitcoin Fund which tracks the price of Bitcoin.

Management styles

InvestNow’s fund offering includes both passive and actively managed funds:

- Passive – Funds that track a market index, aiming to match the return of the market (with the view that it’s very hard to outperform the market over the long-term). This includes Macquarie’s index funds, two Vanguard funds, and the entire range of Smartshares ETFs (except for the Total World NZD Hedged ETF and the NZ Government Bond ETF).

- Active – Funds that actively research and pick which assets to invest in, aiming to beat the market. This includes funds managed by Milford, Fisher Funds, Pathfinder, and many more.

Overview

InvestNow’s fund offering covers a wide range of asset classes (even cryptocurrency!), providing a good amount of flexibility in building a diversified investment portfolio. This is regardless of whether you’re a shorter-term investor (where cash and bond funds will suit you better), a longer-term investor (where equity funds will suit you better), or whether you prefer passively or actively managed funds.

Our customers broadly fit into one of three equally-sized categories – one third only invest in passive funds, one third only hold actively-managed funds and the final third hold a mixture of both.

Mike Heath, General Manager, InvestNow

This table summarises the number of funds on offer across the different asset classes and management styles:

| Passive | Active | Total | |

| Cash | 0 | 4 | 4 |

| NZ Fixed Interest | 0 | 10 | 10 |

| International Fixed Interest | 2 | 8 | 10 |

| Australasian Equities | 13 | 32 | 45 |

| International Equities | 19 | 30 | 49 |

| Listed Property | 3 | 9 | 12 |

| Diversified | 2 | 20 | 22 |

| Other | 0 | 1 | 1 |

| Total | 39 | 114 | 153 |

This summary doesn’t do justice to how comprehensive their range is, given it doesn’t capture all the subcategories of funds on offer like dividend, ethical, and thematic funds. You can check out a list of all of InvestNow’s funds here.

Term Deposits

InvestNow also offers term deposits from six different banks (ANZ, Bank of China, BNZ, China Construction Bank, Heartland Bank, and SBS Bank). These work the same as investing in an ordinary term deposit – your money gets locked in for a fixed term of between 1 month and 5 years, and you earn a fixed rate of interest (which will vary depending on the term and bank you select).

The benefit of InvestNow’s offering (over getting a term deposit directly from the bank) is that you can select from term deposits from multiple banks, without having to sign up for an account at each of those banks. Additionally, InvestNow often offers higher rates of interest – for example, ANZ and BNZ are currently offering a rate of 1.75% for a 12 month term, but on InvestNow these rates are 1.80% and 1.91% for the respective banks.

The disadvantage of InvestNow’s term deposits is that they’re less flexible. All their term deposits pay out interest at maturity (unless the term is 2 years or longer, in which case interest is paid out annually or semi-annually), while banks often allow you to have your interest paid out or compounded more regularly (e.g. monthly or quarterly). InvestNow’s term deposits don’t come in PIE form either, so you’ll pay tax on them at your marginal tax rate as opposed to the maximum 28% tax rate on PIE term deposits.

To help you decide between InvestNow vs a bank’s offering, you can use our simple calculator to compare the rates between two term deposits.

Minimum investment

For Managed Funds, the minimum lump sum investment is $250 per fund. For example, if you wanted to invest in two funds your minimum investment would be $500. But if you set up a Regular Investment Plan the minimum investment drops to $50 per fund. More on Regular Investment Plans later in the article.

This often compares favourably to investing directly through a fund manager where the minimums can be higher. For example, if you were to invest in Milford’s funds directly via Milford, the minimum investment would be $1,000.

For Term Deposits the minimum investment varies by bank:

- ANZ and China Construction Bank – $10,000

- Bank of China – $100,000

- All other banks – $2,000

Selecting what to invest in

InvestNow is a DIY investment platform – you’re on your own when it comes to picking what to invest in, and 153 funds is a lot of choice. They don’t provide too much in terms of resources and investor education to help you out either, so you’ll have to do a lot of your own research.

Just one thing to remember is that the investments on InvestNow are funds – assets that contain potentially hundreds or thousands of shares and bonds, so are already diversified by nature. With this in mind there’s no need to invest in lots of funds to achieve a well-diversified portfolio. A simple approach will suffice, and you can check out the below articles for ideas on how you might go about it.

Further Reading:

– 6 ways to build a long-term investment portfolio in New Zealand

– How to choose which fund to invest in on InvestNow and Sharesies

– All articles on Funds

2. Fees

Fees for using the platform

InvestNow doesn’t charge investors any fees for using the platform – there’s no brokerage, transaction, membership, or foreign exchange fees. There’s no catch to this – instead InvestNow makes money by earning commission from the fund managers who list their funds on the InvestNow platform.

It’s a win-win arrangement, with fund managers being able to reach a larger audience of investors through the platform, and investors having fewer fees to pay. In addition, InvestNow’s owner is Implemented Investment Solutions (IIS) who are themselves involved in issuing funds, so the platform provides a way for their own parent company to distribute their funds out to investors.

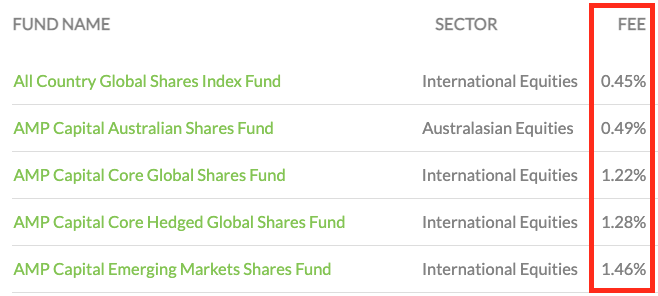

Fund management fees

While the platform doesn’t charge any fees, you’ll still need to pay the fees charged by the manager of the funds you invest in:

- Fund management fees – All funds charge a percentage based management fee. These range from 0.20% to 3.26% p.a. though most funds charge under 1.50% p.a., and passively managed funds charge less with most fees being under 0.60%. These fees are reflected as a tiny deduction in the value of your fund everyday. For example, if your fund’s management fee is 1%, the value of your fund would drop by 0.00274% (1% divided by 365) on a daily basis to reflect this fee.

- Performance fees – A few actively managed funds charge performance fees if they perform better than a certain benchmark set by the fund. A fund’s estimated performance fee is included within the above fund management fee.

- Spreads – Many funds apply spreads whenever you buy or sell units in the fund. These range from 0.05% to 0.5% and are reflected in the price you buy or sell your fund at. For example, if a fund’s buy spread is 0.10%, you’ll buy units in the fund at a 0.10% premium to the current unit price. If a fund’s sell spread is 0.10%, you’ll sell units in the fund at a 0.10% discount to the current unit price. Spreads apply to cover the transaction costs of entering or exiting a fund, so that investors already invested in the fund don’t bear the costs of that trading activity. You can find the spreads for InvestNow’s funds on this page, or in each fund’s Product Disclosure Statement.

Without buy-sell spreads, investors who remain in the funds end up subsidising the trading costs of those coming in or leaving through receiving lower returns.

Mike Heath, General Manager, InvestNow

Term deposit fees

There are no fees for investing in term deposits.

3. Other considerations

Custody of investments

The funds you buy through InvestNow are held by their independent custodian, Adminis. Your assets are held separately to the InvestNow platform, so if InvestNow were to go bust they can’t use them to cover their expenses or pay back their debts. Your assets aren’t directly registered in your name, but you’re still the beneficial owner of them, and you still get the full benefit of any gains and distributions they make.

Further Reading:

– What happens to your money if InvestNow or Sharesies go bust?

Transfers

InvestNow provides the ability to transfer your funds in to their platform and Adminis’ custody (as long as InvestNow offers that same fund). For example, if you held units in the Smartshares S&P/NZX 50 ETF under your CSN, you can request an off-market transfer to have these units transferred into the platform. This could be a handy option for Smartshares investors given InvestNow doesn’t charge brokerage to sell these ETFs.

Subsequently you can transfer your funds out to a fund manager or to your own CSN. For example, if you held units in the Milford Active Growth Fund through InvestNow, you can have these units transferred out to be held directly with Milford (as long as you have an account with Milford). You’ll need to contact InvestNow support to initiate this process, and transfers out might not be available in some circumstances (for example, where you don’t meet the minimum holding requirements of that fund manager).

Account types

InvestNow offers individual, kids, joint, trust, and company accounts.

Regular Investment Plan

InvestNow provides the ability to set up a Regular Investment Plan. This allows you to automatically buy a selection of any of their funds on a weekly, fortnightly, monthly, quarterly, or six-monthly basis. This is a handy feature for setting and forgetting your investment contributions, and also lowers the minimum investment to $50 per fund, but there’s a couple of limitations:

- The $50 minimum may not work for some investors. For example, if you wanted to create a portfolio with an allocation of 80% towards Fund A and 20% towards Fund B, and a weekly contribution of $100, this would not be possible as the allocation towards Fund B is only $20. You would either have to increase your weekly contributions, make less frequent and larger contributions, or increase your allocation towards Fund B.

- You can only set up one Regular Investment Plan at a time. For example, there’s no way to set up a plan to buy some funds on a fortnightly basis, and other funds on a monthly basis.

User Interface

InvestNow’s user interface is lacking when it comes to being friendly and welcoming. Their desktop site is fine from a functional perspective, but has a dated and clunky appearance. Their mobile site is non-existent, leaving smartphone users having to navigate through the desktop site.

However, you could argue that the user interface isn’t hugely important for the platform. InvestNow is designed for long-term set and forget investing, rather than catering to those who actively trade or frequently log in to check their portfolio – therefore there’s no great need for a slick and colourful interface. But we think that revamping the UI would still go a long way in attracting and retaining customers.

Order execution

Any orders you place on InvestNow are executed once every business day. There’s a 12pm cut-off time for your orders to execute on the same day, and at the current day’s price (with a few minor exceptions). If you place an order after 12pm, your order will execute the next business day at that day’s price.

After your order is executed, for most funds it takes 2 business days for the transaction to settle. For example, when you sell units in a fund it will take 2 business days for the cash proceeds of the sale to arrive in your InvestNow account. Some funds have different settlement timeframes – details can be found on this page.

Fractional units

Most funds on InvestNow offer fractional units. Let’s say you have an order to buy $50 of a fund whose unit price is $15. This would result in $45 buying you 3 whole units, and the remaining $5 buying you 0.3333 units – overall your $50 order has bought you 3.3333 units.

However, InvestNow doesn’t offer fractional units on Smartshares ETFs, which results in a couple of quirks relating to buying Smartshares’ funds:

- Firstly, they deduct the value of two units from your order. Let’s say you have an order to buy $50 of a Smartshares ETF whose unit price is $12. Your order will be deducted by $24 ($12 x 2), resulting in an order value of $26. This deduction occurs to prevent you from spending more than the $50 you originally ordered, in the case the unit price of the ETF increases between the time you placed the order and the time the order is executed.

- Secondly, following on from the above example, your $26 order is only enough to buy 2 whole units of the above Smartshares ETF – $24 going towards the two units at $12 each, and $2 as “change”. Overall your $50 order has resulted in just $24 being invested, and $26 left as cash in your account!

The above quirks mean you’ll almost always be left with uninvested cash after investing in Smartshares ETFs. While the above example is on the extreme end (most Smartshares ETFs have lower unit prices), and you could workaround this by placing orders for a higher dollar amount (e.g. for $75 worth of units), it’s still a slight annoyance.

Distributions/Dividends

For funds that pay distributions, you can have them:

- Automatically reinvested into more units of the fund (the default setting), or:

- Paid out in cash to your InvestNow account.

This is an all-or-nothing setting – you can’t have some of your funds automatically reinvest, and others pay out distributions in cash.

Tax

Most funds are Multi-Rate PIEs which are taxed at your Prescribed Investor Rate (PIR). Taxes on these funds are calculated and charged:

- Annually after 31 March, in which case your tax payable is deducted from your InvestNow cash balance. Or,

- Whenever you sell units in these funds, in which case any tax payable is automatically deducted from your sale proceeds.

The exceptions to this are:

- Smartshares’ ETFs are listed PIEs, taxed at a flat rate of 28%.

- A few funds are Australian domiciled and fall under the FIF tax regime. These include Vanguard, a few Russell funds, India Avenue, Morphic, a couple of APN funds, and Platinum. For these funds you have to do your own taxes according to the FIF tax rules.

For term deposits, the interest you earn is taxed at your marginal tax rate.

Further Reading:

– What taxes do you need to pay on your investments in New Zealand?

– InvestNow Tax Guide

4. InvestNow vs competing services

Here’s a brief overview of how InvestNow compares to competing services with some links to in depth comparisons:

Flint

Flint is another fund platform which is very similar to InvestNow. They have a smaller (but still comprehensive) offering on 98 funds from 12 different fund managers, and don’t charge any account or transaction fees. Their minimum investment is $250.

They offer SuperLife’s funds instead of Smartshares, which don’t face the cash drag issue (as they allow the purchase of partial units), nor a flat 28% rate (as they’re taxed at your PIR). Flint also has a better, mobile-friendly UI. However, being a new platform, Flint is missing a few features such as auto-invest, distribution reinvestment, and joint accounts.

Further Reading:

– Flint Wealth review – A superior InvestNow clone?

Sharesies

Sharesies is another platform that offers the Smartshares range of ETFs. The advantage of Sharesies is that they offer fractional units, enabling lower minimum investments – you could invest as little as 1 cent to buy a fraction of a unit of an ETF! But their big downside is that you have to pay transaction fees of up to 0.5% for buying and selling the funds, compared to no fees under InvestNow.

Outside of Smartshares, Sharesies also offers NZX listed shares, ASX and US listed shares and ETFs (none of which InvestNow offers), as well as a small selection of 9 managed funds.

Further Reading:

– InvestNow vs Sharesies – Ultimate Fund Platform showdown and review

Smartshares

It’s possible to invest in Smartshares’ ETFs directly through Smartshares, but we’d say this is an inferior approach compared with InvestNow:

- They have a $30 set-up fee for new customers, compared to $0 for InvestNow.

- Their minimum lump sum investment is $500, compared to InvestNow’s $250.

- Their orders are processed only once per month, compared to every business day with InvestNow.

- You can’t sell your units through Smartshares (you have to sell them through a NZX broker like ASB Securities or Jarden Direct), while InvestNow allows you to sell your units with no fees .

The only benefit Smartshares has over InvestNow is that your units are registered under your own CSN rather than held in custody, though it’s a very minor benefit given InvestNow’s custody arrangements are sound.

Simplicity

Simplicity offers three diversified funds (Conservative, Balanced, and Growth) plus two single sector funds (NZ shares and NZ bonds). Their diversified funds are particularly attractive, allowing you to diversify your investments easily given they contain a broad mix of local and international shares and bonds. However, InvestNow’s offering provides more flexibility – for example, you could forgo investing in bonds for a more aggressive portfolio, or allocate some of your money towards emerging markets. While with Simplicity, you’re stuck with their set asset allocations.

Simplicity’s fees are very competitive, charging a low 0.31% management fee for their diversified funds. However, InvestNow offers the comparable Foundation Series funds with an also competitive 0.37% management fee, though arguably Simplicity’s funds are inferior due to tax leakage.

Further Reading:

– Building an investment portfolio – Simplicity vs InvestNow

– InvestNow Foundation Series vs Simplicity funds – Tax leakage an issue?

Kernel

Kernel offers 13 index funds, some of which could be considered strong alternatives to InvestNow’s passively managed funds:

- The NZ 50 ESG Tilted or NZ 20 funds as alternatives to the AMP NZ Shares Index Fund, Smartshares S&P/NZX 50 ETF, or Smartshares NZ Top 50 ETF.

- The Global 100 fund as an alternative to the Smartshares Total World ETF, or Vanguard’s funds.

- The NZ Commercial Property fund as an alternative to the Smartshares NZ Property ETF.

Though not all their funds overlap, and Kernel offers a few unique funds like the Electric Vehicle Innovation and Global Clean Energy funds. However, Kernel won’t suit shorter-term investors given they don’t have any bond or cash funds.

In terms of fees, Kernel’s fund management fees are slightly cheaper than the Smartshares and AMP range of index funds, with their core funds charging 0.25%. However, they also charge a $60 per year fee if you’re invest more than $25,000 – this can add a bit of weight to their fees as it equates to an additional 0.24% fee for a balance of $25,000.

Hatch, Stake

Hatch and Stake are not direct competitors to InvestNow, given their focus as brokers for US listed investments. However, the US listed ETFs they offer provides even more variety, and some are compelling alternatives to InvestNow’s funds. For example, the Vanguard S&P 500 ETF has the exact same underlying investments as the Smartshares US 500 ETF with a lower management fee (0.03% vs 0.34%).

However, you also have to pay foreign exchange and brokerage fees on Hatch and Stake, compared to none on InvestNow. In addition, Hatch and Stake requires more work when it comes to taxes given the FIF status of US ETFs. There is no definitively better option, and the below article provides a more detailed comparison.

Further Reading:

– Smartshares US 500 (USF) vs Vanguard S&P 500 (VOO) – Which ETF is better?

Conclusion

On the surface InvestNow may seem complicated with its dated interface, the many quirks, and sometimes overwhelming fund offering. But deep down they provide an incredibly simple and efficient way to invest:

- They don’t charge any fees – there’s no transaction, foreign exchange, or account fees. The only fees you pay are charged by the fund managers of the funds you invest in.

- Their large suite of funds will suit a wide range of investment goals and preferences. There’s funds for both short-term and long-term investors, for both active and passive management preferences, and even a way to get exposure to Bitcoin.

- In addition, their investment offering gives you a good level of flexibility in building a portfolio (over the likes of Simplicity), without getting into the complexity of having to pick individual shares.

- Their Regular Investment Plan enables you to invest on auto-pilot, and reduces the minimum investment to a low $50.

- Most funds are structured as PIEs, so tax is taken care of for you – there’s generally no need to learn the FIF tax rules, hire an accountant, or do anything extra for your tax return.

The platform is excellent for a lazy, set and forget approach to investing, and would suit those who want to spend less time managing their portfolio, and more time doing other things. But while it’s quite hard to find any major cons of InvestNow, the platform won’t suit every investor:

- You can’t use InvestNow to invest in individual companies. You’ll need a broker like Sharesies to do so.

- Their term deposit offering is nothing special, and you might get a better deal by going directly to a bank (given the more flexible interest payment terms, and PIE options).

- Those willing to put in a bit more work to invest in US ETFs through Hatch, Stake, or Sharesies may find that there’s more choice and potentially cheaper fees when going for these offshore options.

- We don’t think their inferior user interface is a dealbreaker, given a slick UI isn’t necessary for the purposes of long-term investing. But a refresh and a mobile friendly site would still go a long way towards winning more investors.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Thank you for this very informative article as always. If one was to purchase Smartshares USF ETF through Investnow , do you buy your units immediately or is it a once a month affair like through the Smartshares site? Thanks

Hi James, InvestNow processes orders daily. Any Smartshares orders that are placed before their 12pm cut-off time are executed shortly after at around 1pm.

Thanks for the article – very informative!

Just a quick question here. I’m wondering how much effect the cash drag issue with the Smartshares ETFs has in the long term? (Any analysis/spreadsheets previously done regarding this?) My hunch is that it “may” be more than an annoyance. Say, Person A receives a small amount of cash left over each time their weekly/monthly/etc. auto-invest is processed. That cash is sitting there unused until it becomes big enough for a lump sum investment (currently at $250 minimum). This may take quite a long time depending on how big/often their regular contribution is. (Yes, they can top up their wallet any time to reduce the idle time but it kind of defeats the purpose of auto-invest IMHO.)

I appreciate that InvestNow provides a better overall experience than investing directly via Smartshares (trading every business day versus monthly), can sell without having to deal with a broker directly, etc.), but I still find it not ideal for some investors.

Hey there, we haven’t done any calculations on the exact impact of the cash drag issue, but would guess that the impact wouldn’t be massive (say a few hundred dollars over the long-term). As opposed to things like transaction fees which can make a big difference (like if you were to buy the ETFs through Sharesies). The reason being the uninvested cash will get invested eventually, whereas transaction fees are gone forever.

BTW, the direct via Smartshares route has a cash drag issue too due to not supporting fractional units. Though it’s probably not as severe as InvestNow’s cash drag issue.