Dividends – everyone loves them, and they are a crucial aspect of investing as they are one of the two ways you can make money from shares (the other being capital gains). They give investors a regular return on their investment, and have recently become even more important as an alternative income source to declining term deposit returns.

However, dividends are often misunderstood and misused, particularly by beginner investors. In this article, I’ll be covering the specifics of dividends, such as when they’re paid, how much money you could make from them, and lastly, I’ll be looking at New Zealand’s biggest dividend trap, Sky TV.

This article covers:

1. What are dividends?

2. When do I get paid dividends?

3. How much money will I earn from dividends?

4. What is a Dividend Reinvestment Plan?

5. What is a dividend trap?

1. What are dividends?

Dividends are a way for companies to regularly pay a share of their profits out to shareholders. Paying dividends can make companies more attractive to investors, as it allows shareholders to receive a regular passive income stream (who doesn’t like receiving a payment into their bank or Sharesies account!?), and can also demonstrate that a company is profitable and financially strong.

A higher dividend doesn’t necessarily make a company better – when a company pays out dividends, this results in less money left in the company to invest in further growth. A company with relatively low growth opportunities (like Contact Energy) might pay most of their profits out to shareholders in dividends, as they have less need to retain that money in the business. While a company with more growth opportunities might pay a small dividend, and retain most of their profits in the company in order to fund that growth.

No dividends?

Many companies (e.g. A2 Milk, Amazon, Facebook) don’t pay a dividend at all – These are often high-growth companies, where you’ll hopefully benefit from higher share price appreciation to make money from investing in these companies. Although, such companies may also become dividend paying companies in the future.

Another reason a company might not be paying dividends is not a good one. A company’s profits might be declining to the point that they no longer have the capacity to continue paying dividends.

Special dividends

From time to time companies can pay a special dividend. These are often used to distribute excess capital to shareholders (e.g. surplus cash that isn’t needed by the company to fund further growth). Special dividends are usually one-off in nature, and shouldn’t be factored in when assessing a company’s level of dividend payments.

2. When do I get paid dividends?

Most dividend paying companies in NZ pay a dividend twice a year, in the form of an “interim” and a “final” dividend. They are not always paid in equal instalments – for example, the final dividend is often bigger than the interim dividend. A small number of companies pay them quarterly. Quarterly dividends won’t necessarily give you more money than six-monthly dividends, because quarterly dividend payment amounts are smaller – it’s like slicing a sandwich into four pieces instead of two.

Below are the critical dates that shareholders need to know for each dividend payment:

- Cum-Dividend (CD) – A company will declare they are making a dividend payment (and the amount of the dividend), typically as part of the announcement of their financial results. When a dividend is declared, the share becomes Cum-Dividend (has a dividend attached to it). Investors holding or buying the shares when it’s CD will receive the upcoming dividend payment, as long as they hold them until the Ex-Dividend date.

- Ex-Dividend (XD) date – This acts as a cut-off date where the shares no longer have any dividends attached to it. Investors buying shares on or after this date won’t receive the upcoming dividend payment, as they won’t make it onto the company’s share register on time for the Record Date (as it takes 2 days for trades to settle). Investors who sell their shares on this date will still receive the upcoming dividend, as they’ll still be on the share register on the Record Date. On the XD date, the share price of the company immediately goes down by the dividend amount to reflect the fact that the shares are no longer entitled to the upcoming dividend payment.

- Record Date – Immediately following the Ex-Dividend date is the Record Date. The upcoming dividend will be paid to all the shareholders that are on a company’s share register on the Record Date.

- Payment Date – This is the day dividends are paid out to those who held the shares on the Record Date. Woo!

Hope that makes sense. If it’s a bit confusing, the basic rules you need to know are:

- If you bought shares before its Ex-Dividend date: You’ll receive the upcoming dividend on the Payment Date

- If you bought shares on or after its Ex-Dividend date: No dividend. You’ll have to wait for the next dividend payment

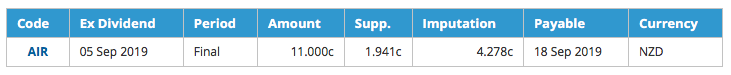

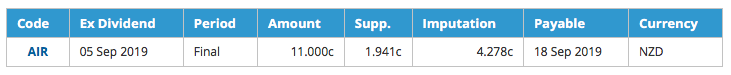

You can find key dividend dates for each company on the NZX website. As an example, this is Air New Zelaland’s upcoming September dividend payment:

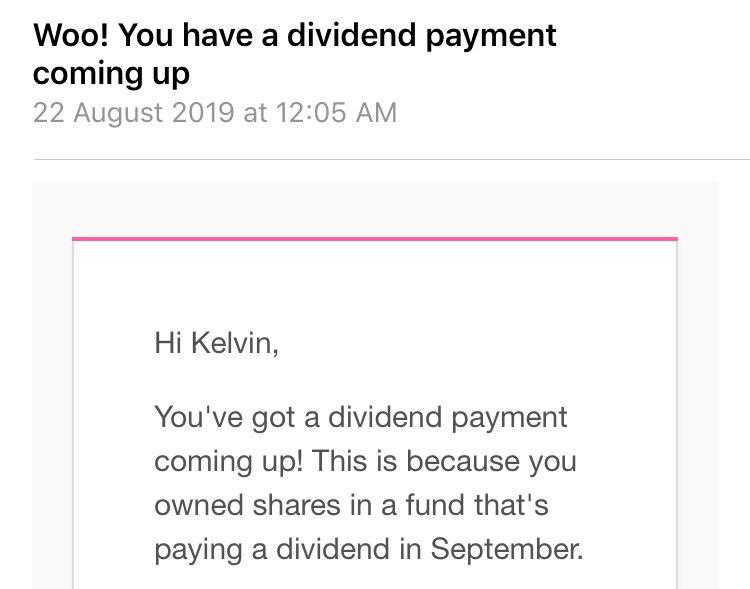

If you bought your shares through Sharesies, you’ll get an email notification on a share’s Ex-Dividend date, as well as on the dividend Payment Date.

3. How much money will I earn from dividends?

Dividend Yield

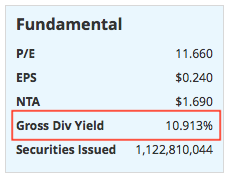

A company’s dividend yield is an estimate of the amount of dividends you might earn from owning shares in that company – For example, a share that’s at a price of $10, with a dividend yield of 5%, means you might get a dividend of 50 cents per share each year. A company’s dividend yield can be found on the NZX’s website.

Dividend yields provide a quick way to assess a company’s dividend payments, but are often very misleading:

- They are “backwards looking” (calculated based on dividends that the company paid in the past year). There is no guarantee that a company will continue to pay the same level of dividends into the future. Companies can just as easily reduce or cancel their dividend, as they can increase it.

- Dividend yields on the NZX website (and most other sources) also factor in special dividends (which are usually just paid as a one-off).

- Dividend yields ignore tax treatment of the dividends. Things like tax rate, residency, and “imputation credits” attached to the dividend have a big effect on the final amount of dividend you’ll get.

Calculating a dividend payment on your own

Because dividend yields can often be unreliable, you can do your own calculations to estimate the amount of dividends you could potentially get.

You’ll need a few numbers:

- Number of shares you own

- Dividend Amount – the number of cents being paid per share

- Imputation – this is a tax credit that many companies attach used to their dividends to reduce the tax you have to pay on them (to mitigate double taxation). The level of imputation can vary greatly from one dividend payment to another.

Dividend Amount and Imputation for each NZX company is available at the following URL. Replace <ticker code> with the company’s ticker code e.g. AIR for Air New Zealand. Or search the NZX website to find the company you’re looking for.

https://www.nzx.com/instruments/<ticker code>/dividends

Let’s perform some calculations using Air New Zealand’s (AIR) September 2019 final dividend payment as an example (pictured below). Let’s assume we have 1000 shares in AIR.

- Calculate the Gross Dividend: Multiply the Number of shares with Amount. Example: 1000 x $0.11 = $110

- Calculate Imputation Credit: Number of shares x Imputation. Example: 1000 x $0.04278 = $42.78

- Calculate Tax (Dividends always have tax deducted at 33%): (Gross Dividend + Imputation Credit) x 33%. Example: ($110 + $42.78) x 33% = $50.42

- Calculate Net dividend (the amount you’ll be paid): Gross Dividend + Imputation Credit – Tax. Example: $152.78 – $50.42 = $102.36

With our 1,000 Air New Zealand shares, we will receive $102.36 in the September 2019 final dividend payment. Given their March 2019 interim dividend was the same amount, the annual dividend we get from AIR is $204.72. If we had bought the 1,000 AIR shares at $2.85, that would give us a net dividend yield of 7.18% (assuming Air NZ maintained the same level of dividends into the future).

Your individual tax circumstances such as tax rate and tax residency may alter the amount of dividends you’ll be paid, and the amount of tax you are liable for. Check with a tax professional for guidance on your specific circumstances.

Fortunately you don’t have to perform all these calculations yourself – you can use our NZ dividend calculator which will do all the math for you. Alternatively you can use an investment tracking tool like Sharesight, which automatically tracks dividends for you.

Listed PIEs

Some companies in New Zealand are structured as PIEs. Some examples of PIEs are many of the Real Estate Investment Trusts (REITs) such as Kiwi Property Group, and Precinct Properties, as well as the Smartshares ETFs.

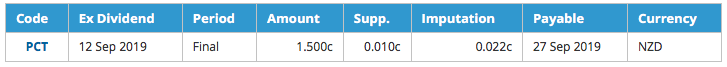

Dividends from PIEs are taxed at a rate of 28%. Usually the tax is covered by imputation credits so all you need to do is multiply the number of shares you own by the dividend amount. Below is the upcoming dividend payment for Precinct Properties (PCT):

Assuming we had 1,000 shares in PCT, we’d get $15 (1,000 x $0.015) in the upcoming dividend payment.

Your individual tax circumstances such as tax rate and tax residency may alter the amount of dividends you’ll be paid, and the amount of tax you are liable for. Check with a tax professional for guidance on your specific circumstances.

4. What is a Dividend Reinvestment Plan?

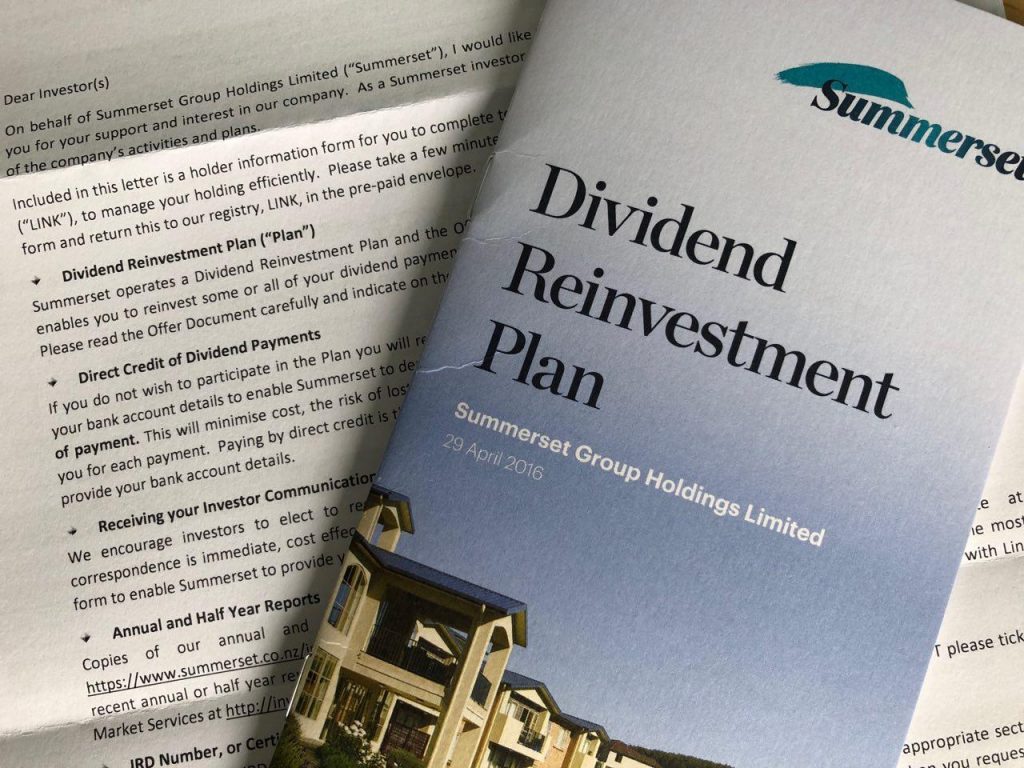

Dividend Reinvestment Plans (commonly known as DRPs or DRIPs) are where a company offers shareholders the opportunity to reinvest their dividend payments into buying more shares in the company, as opposed to receiving a cash payment. Only some companies offer DRPs – current examples being Heartland Bank, Summerset, and Vital Healthcare Property.

Companies that offer DRPs aim to create a win-win situation for the shareholder and company:

- Shareholders get the chance to accumulate more shares in the company without paying brokerage costs. This allows investors to take advantage of compounding returns. In addition, shares bought through a DRP are often discounted (for example, a 2% discount for the most recent Heartland Bank dividend).

- Companies get to keep capital inside the business, while at the same time keeping shareholders who want cash dividend payments happy.

How to join a DRP

DRPs are not yet available for investors buying shares through Sharesies.

Shareholders who want to participate in the DRP must opt-in via the company’s share registry. In New Zealand, this will either be Computershare or Link Market Services – they’ll send new shareholders a letter with instructions on how to do so.

There are two levels of participation in DRPs. You can opt for Full Participation where all of your dividends are reinvested, or Partial Participation where only a certain percentage of your dividends (specified by you) are reinvested, with the balance being paid in cash.

5. What is a dividend trap?

Dividend traps are companies that lure in investors by having a very high dividend yield, but the dividend payments are unsustainable. These companies typically have declining profitability, resulting in the person who invested for the high yield facing declining share prices and a reduction or cancellation of their dividend payments.

New Zealand’s biggest dividend trap

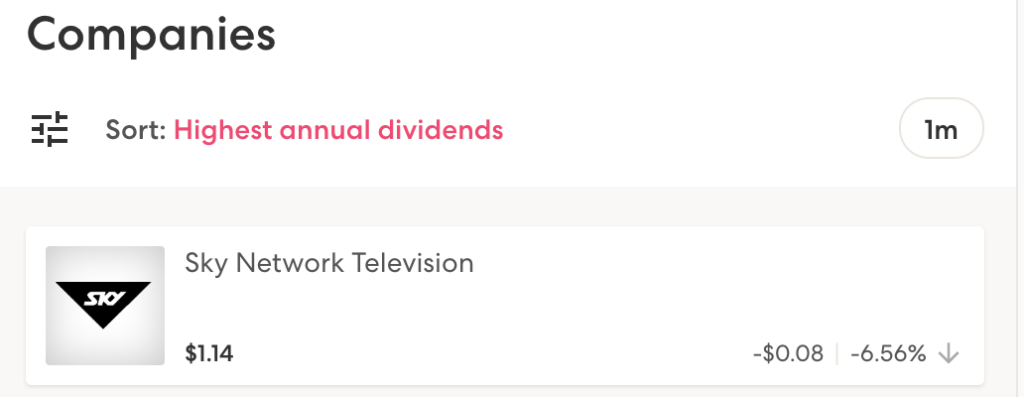

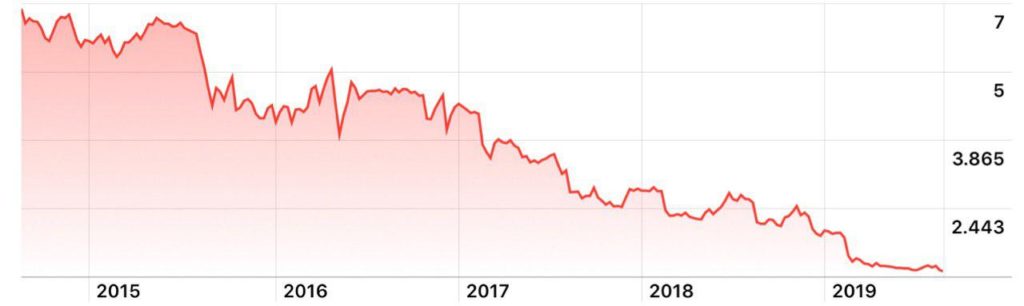

A local example of a big dividend trap right now is Sky TV. At the time of writing, the NZX website is showing Sky as having a HUGE 18% dividend yield. And if you’re a Sharesies user, when you sort companies by “Highest Annual Dividends” you’ll get Sky sitting at the top of the list – dangerously tempting for novice investors. However, this 18% yield is totally misleading – Sky have suspended their most recent dividend payment! So in reality, the company is currently yielding is 0% – they aren’t paying any dividends at all right now!

How can this happen? Sky TV has been constantly losing subscribers over the last few years for many reasons, including the emergence of streaming services like Netflix. Remember, dividend yields are backwards looking, so they are calculated on past dividends when the company was more profitable and had a higher share price. Given Sky’s falling subscriber numbers and profitability, their past dividends cannot be sustained – anyone who bought Sky shares based on dividend yield alone have been trapped with further share price declines and dividend cuts.

What to look for in addition to dividend yields

As we have seen with Sky, looking at the dividend yield alone when choosing a company to invest in is not a great idea. Instead, these are a few factors that can help you assess whether a company’s dividend might be sustainable into the future:

- Price History – Have the company’s profits and share price taken a sharp dive recently? This could be a strong indicator of a dividend trap.

- Dividend History – Does the company have a solid track record of steadily increasing dividend payments over the years?

- Dividend Payout Ratio – What percentage of the company’s profits are being paid out as dividends? A lower payout ratio gives the company capacity to increase dividends, while a high payout ratio might not be sustainable.

- Future prospects – Is there anything happening to the company in the future which could suggest an increase to dividends? e.g. increasing profitability and lower need for capital expenditure. Or is there anything that could happen to force it to cut their dividend?

- Other factors – Look at a company’s debt levels and dividend yield compared to other companies in the same industry.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.