Cryptocurrencies have had another hot year in 2021, with more investors than ever piling in to the relatively new and controversial asset class. This article explores the basics of what cryptocurrencies are, how you can buy and sell them, and whether crypto is a worthwhile investment or just gambling.

101 articles:

– Shares 101 – How to buy shares, which companies to pick, and more

– Bonds 101 – 5 things to know about investing in bonds

– Funds 101 – What’s the difference between an Index Fund, ETF, and more?

– KiwiSaver 101 – How does KiwiSaver fit into your investment portfolio?

– Cryptocurrency 101 – Is it investing or gambling? (this article)

This article covers:

1. What is cryptocurrency?

2. How do I buy and sell cryptocurrency?

3. How can I make money from cryptocurrency?

4. What other concepts should I know about cryptocurrency?

5. Is buying cryptocurrency investing or gambling?

1. What is cryptocurrency?

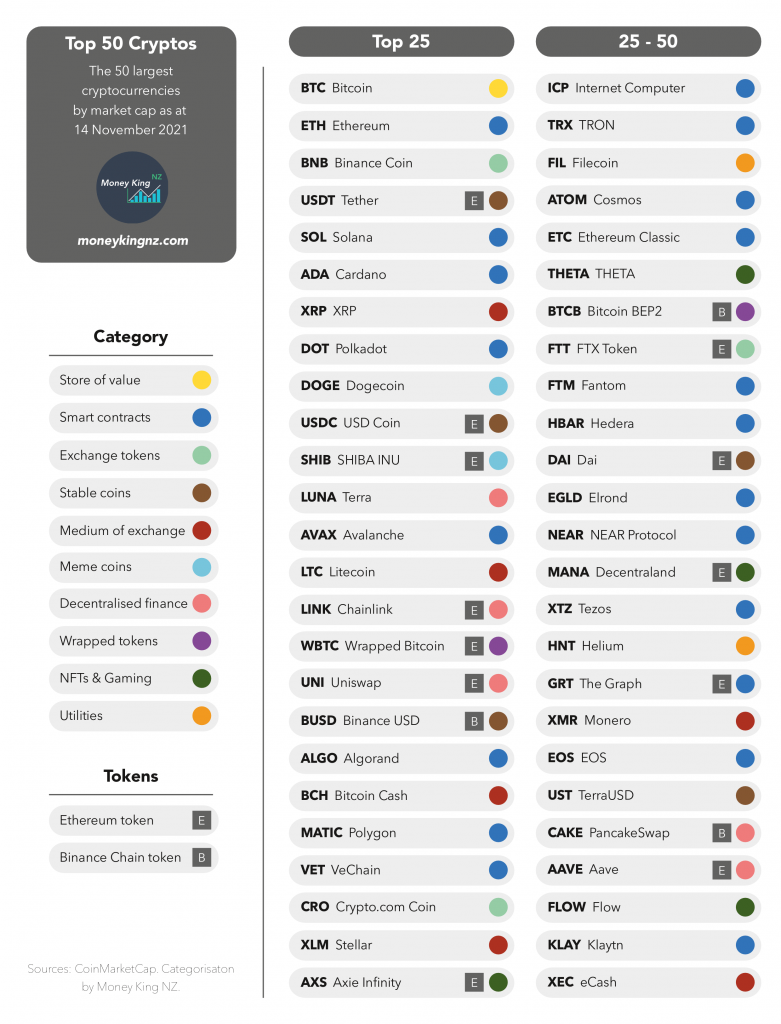

Cryptocurrency is a type of currency. Unlike fiat currencies like New Zealand Dollars or US Dollars, they’re not issued or controlled by governments or central banks. Instead cryptocurrencies are fully digital and utilise software, cryptography, and a network of computers to operate. Cryptocurrency and Bitcoin aren’t the same thing – Bitcoin is just one kind of cryptocurrency, with thousands more cryptocurrencies existing beyond that. Here is a list of some of the largest cryptocurrencies:

It’s not always easy to fit each cryptocurrency into a specific category, but the most common uses of crypto are:

- Store of value – An asset that retains its value over a long period of time. An example is Bitcoin which is commonly referred to digital gold and has a maximum supply of 21 million coins, designed to resist inflation.

- Smart contracts – These are platforms that can be used to build and run apps or store data. Each smart contract platform uses a cryptocurrency to transact and run apps on that platform. An example is the Ethereum network which can be used to run apps or transact tokens, and the public can use Ether to pay for using the network.

- Exchange tokens – Primarily used to pay for fees or access features on cryptocurrency platforms and exchanges. An example is the Crypto.com Coin which can be used to obtain a debit card and other benefits from the Crypto.com platform.

- Stablecoins – A cryptocurrency that’s designed to represent a fiat currency in order to facilitate easy trading between crypto and fiat. An example is USD Coin where 1 USD Coin equals 1 US Dollar, so doesn’t fluctuate in price like other cryptos.

- Medium of Exchange – Designed to facilitate the efficient exchange of money between two parties. An example is Ripple/XRP which is designed to facilitate the fast transaction of money across the world.

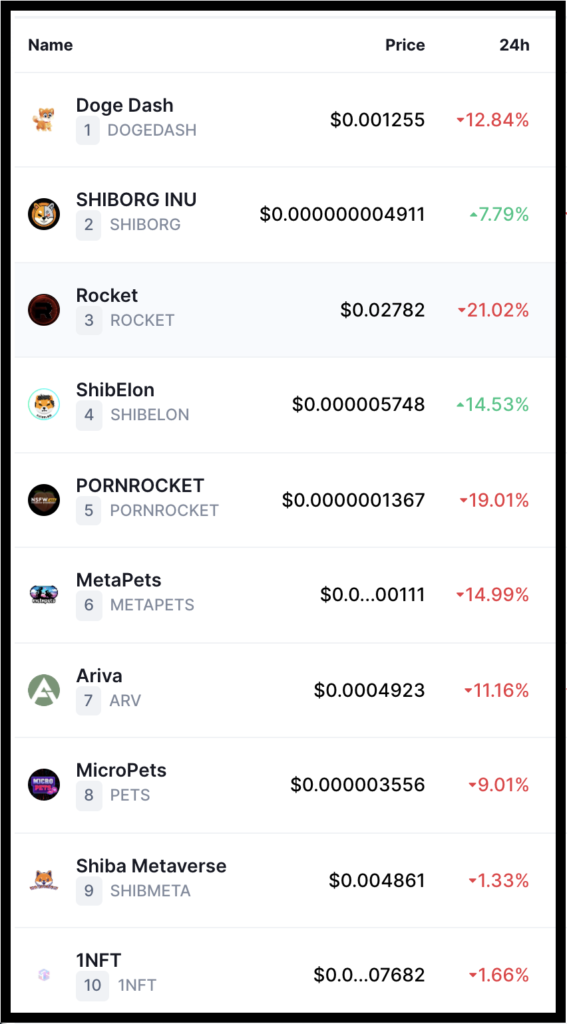

- Meme Coins – Cryptocurrencies that exist as a joke, and typically have little real-world value. An example is Dogecoin featuring a shiba inu dog as its logo.

- Decentralised Finance – Facilitates banking-like services like saving, borrowing, and exchanging cryptocurrency. An example is Aave which is a platform allowing lending and borrowing of crypto, with holders of the Aave token receiving discounts on the platform’s fees.

- Wrapped Tokens – A cryptocurrency that’s designed to represent another cryptocurrency. An example is Wrapped Bitcoin where 1 Wrapped Bitcoin token represents 1 actual Bitcoin. WBTC operates on Ethereum, enabling people to transact Bitcoin across the Ethereum network.

- NFTs and Gaming – Used for games and NFT trading. An example is Axie Infinity which is a game where users can collect Pokemon-like characters. Holders of the game’s token can vote on the future direction of the game (making it a “governance token”).

- Utilities – Used to pay for computing services. An example is Filecoin which can be used to pay to store data on the Filecoin network.

Cryptocurrencies aren’t always easy to explain in a clear and concise manner, but below are some links you can use as a starting point to learn more:

Further Reading:

– Digital Gold? 5 things to know about Bitcoin

– Top 50 Cryptocurrencies summarized in 1 sentence (Whiteboard Crypto YouTube channel)

– Cryptocurrency prices by market cap (CoinMarketCap website)

2. How do I buy and sell cryptocurrency?

There are three main ways you can use to invest in cryptocurrency. Here we’ll describe the process and the pros and cons of each method:

A – Self-custody

Self-custody involves buying and holding cryptocurrency yourself in your own wallet.

Buying

First you’ll need your own cryptocurrency wallet, which provides a place for you to receive and store your cryptocurrency. There’s plenty of options for this, with the below wallets supporting most major kinds of cryptocurrencies:

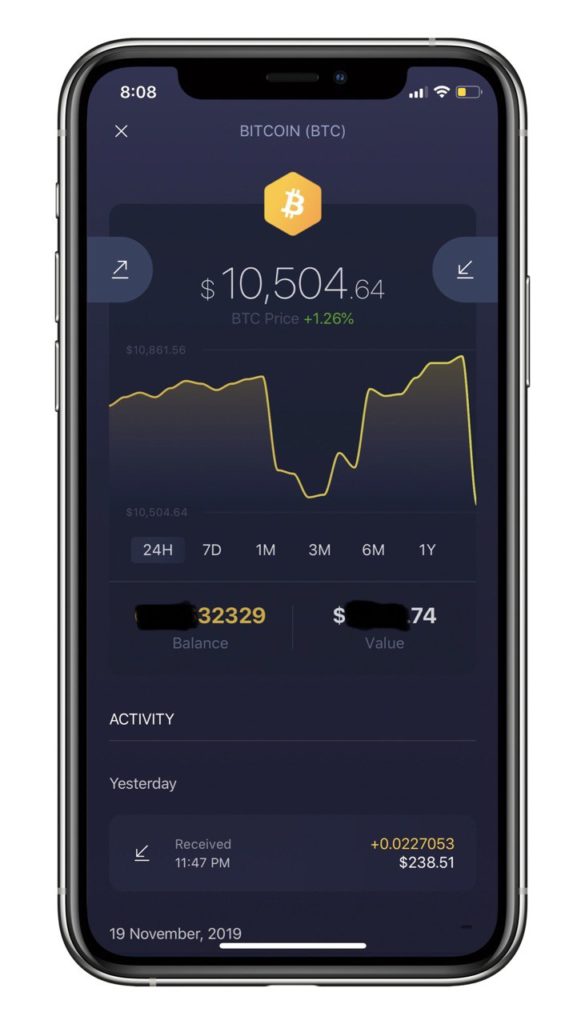

- Software wallets like Exodus and Trust Wallet are free and can be installed as an app on your smartphone.

- Hardware wallets like Ledger or Trezor are physical devices which offer greater security due to their separation from your internet connected smartphone or PC.

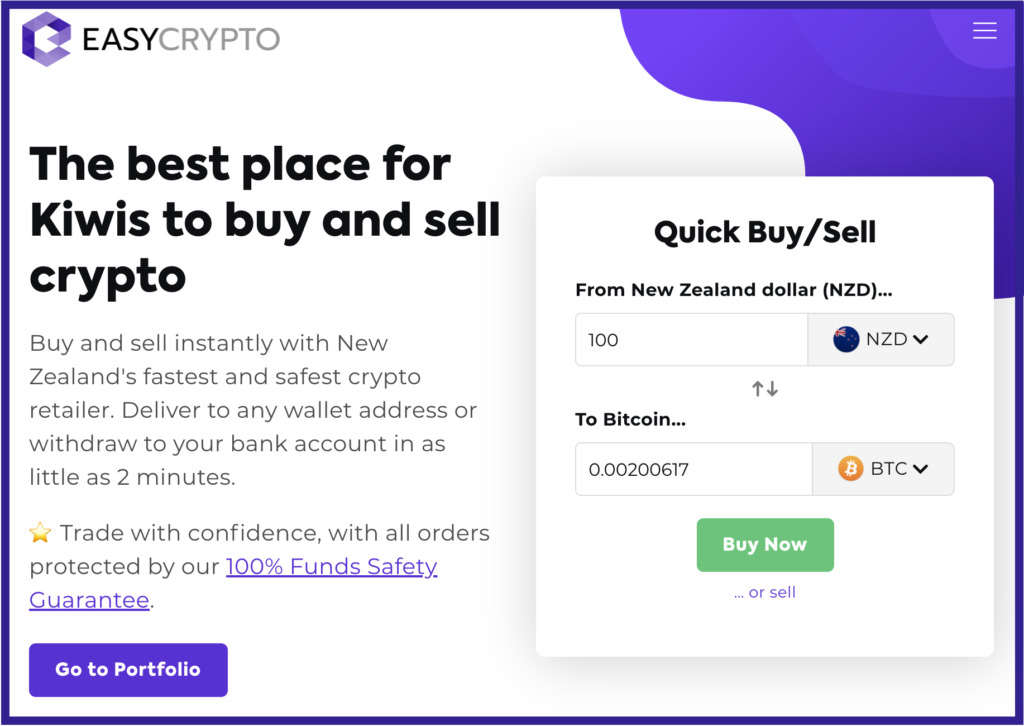

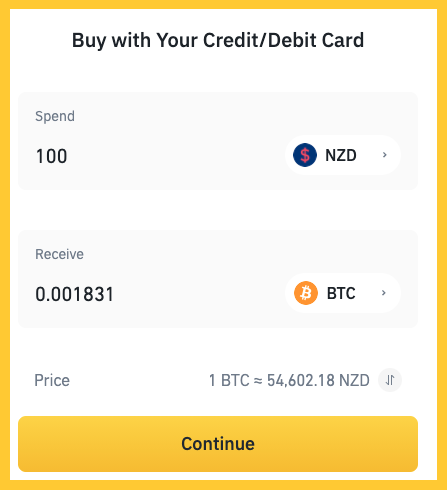

Secondly, you’ll need a way to exchange your New Zealand Dollars to cryptocurrency. A popular way to do this is to use a broker like Easy Crypto, who sell a large variety of cryptocurrencies and send your purchases directly to your wallet.

Further Reading:

– Easy Crypto review – The best on-ramp to the world of cryptocurrency?

Selling

To sell your cryptocurrency you’ll need a way to convert it back to NZD. A broker like Easy Crypto can be used to do this, who will exchange your crypto and deposit the proceeds straight to your bank account. Not all kinds of cryptocurrency can be sold through Easy Crypto – in this case you may need to exchange it for a major crypto like Litecoin, or Binance Coin before selling.

An alternative way is to get a crypto debit card offered by Wirex or Crypto.com. These allow you to load your account with cryptocurrency, convert it to NZD, then spend in-store or online.

Pros and cons

The main benefit of this method is that it provides the most control. With self-custody you hold the keys to your crypto and can choose to do whatever you want with them, whether that be holding, spending, or exchanging. Neither do you have to trust any other party (like an exchange or custodian) to hold your coins for you. This method would suit those holding their crypto for the long-term.

The downsides of this approach is that you’re on your own when it comes to looking after your crypto. If you somehow lose access to your wallet or have your funds stolen, there’s no way to get your crypto back. There’s no helpdesk or password reset option with self-custody, so it requires a deeper understanding of crypto to keep your holdings safe. In addition, fees for transferring some cryptocurrencies to your own wallet can be an issue – these network fees can be $30+ per transaction for coins like Ethereum.

Further Reading:

– How to buy Bitcoin in New Zealand (step-by-step guide)

– How to sell Bitcoin in New Zealand

B – Funds

This involves investing in cryptocurrency through a fund.

Buying

There aren’t many options to buy crypto through a fund in New Zealand, with only two locally domiciled funds on offer:

- The Vault International Bitcoin Fund (VIBF) gets exposure to Bitcoin by investing in overseas Bitcoin funds. This fund can be bought through InvestNow.

- Crossgate Capital is a diversified crypto fund investing in Bitcoin, Ethereum, and a few other major coins like Cardano and Polkadot. This fund can be bought by applying through the Crossgate Capital website.

Selling

With its listing on InvestNow, the VIBF can also be sold at anytime through the InvestNow platform. The Crossgate Capital fund is much more troublesome to sell. They’re listed on the Unlisted Securities Exchange (USX) which has little liquidity (i.e. not many buyers on the exchange), and there’s very few brokers who can access that exchange.

Pros and cons

This is probably the easiest option to invest in cryptocurrency. There’s no need to set up a wallet and learn how to securely hold your own crypto. And in the case of the VIBF, it’s as easy as buying and selling any other fund on the InvestNow platform. There may also be tax benefits associated with investing in crypto through a fund. This method would suit those holding their crypto for the long-term, and who want to avoid the complexity of self-custody.

However, you lose flexibility given your cryptocurrency is wrapped into a fund – for example, you can’t spend, exchange, or lend out your coins for interest. You also have to pay ongoing management fees – these are 2.50% p.a. for the VIBF, and 3.00% p.a. plus hefty performance fees for Crossgate Capital.

Further Reading:

– Vault International Bitcoin Fund review – The best way to own Bitcoin?

C – Exchanges

This involves buying and holding cryptocurrency through an exchange.

Buying

First you need to open an account with a cryptocurrency exchange like Binance or Crypto.com. You can then buy crypto off these platforms with your debit or credit card, and any purchases will be stored in the exchange’s custody (though you can withdraw it from the exchange for a fee). Alternatively, you can buy your crypto off a broker like Easy Crypto and have it sent to your exchange for storage.

Selling

Depending on the exchange, it can be a bit tricky to sell your crypto for NZD. While some exchanges like SwyftX support NZD bank withdrawals, popular services like Binance, Crypto.com, and Coinbase don’t (though Binance does have Peer-to-Peer selling option which doesn’t always offer attractive rates). In these cases you’ll need to send your crypto to a broker like Easy Crypto, who can then convert it to NZD and send to your bank account.

Pros and cons

Buying through an exchange is convenient, as there’s no need to set up and look after your own wallet. Storing your holdings on an exchange also means you have easy access to the variety of features they may offer such as the ability to trade your crypto for other cryptocurrencies, and the ability to earn interest. This method would suit those wanting to trade between different cryptocurrencies.

However, storing your cryptocurrency on an exchange may be less secure. The exchange has ultimate control of your crypto as they hold the keys to them, with “Not your keys, not your coins” being a common phrase used to warn people of the danger of holding on an exchange. Exchanges can lock your account, suspend the withdrawal of your coins for no apparent reason, or get hacked.

Fees can also be problematic. The debit/credit card fees they charge, and the network fees you incur when you withdraw your holdings from the exchange will often make them more expensive than self-custody. Some banks also consider crypto purchases using a credit card as cash advances, meaning you could incur interest by buying crypto this way.

Further Reading:

– What’s the difference between Easy Crypto, Binance, Exodus, and more?

3. How can I make or lose money from cryptocurrency?

How you can make money

Capital gains

The first way to make money from crypto involves selling your cryptocurrency at a higher price than what you bought it at. It’s possible (but not guaranteed) for crypto to increase in price very quickly compared with other asset classes. Here are the past returns of some of the major cryptos, though it’s important to note that past performance isn’t indicative of future returns.

| 1yr | 2yrs | 5yrs | |

| Bitcoin (BTC) | 204% | 691% | 7,459% |

| Ethereum (ETH) | 711% | 3,112% | 56,254% |

| Binance Coin (BNB) | 2,004% | 4,022% | 597,382% |

| Cardano (ADA) | 927% | 4,137% | 6,315% |

| Solana (SOL) | 10,967% | 32,518% | n/a |

Lending

Similar to a bank savings account or term deposit, this involves depositing your cryptocurrency into a platform like Crypto.com or Celsius and earning interest in return (with the interest ultimately coming from people who borrow money off those platforms). The rates can be high compared with traditional bank deposits, but is likely to be less stable and regulated than the banks.

Staking

This involves locking up your crypto in order to facilitate the operation of a cryptocurrency’s network (by verifying transactions). You’ll earn staking rewards in return, which will vary depending on the crypto you stake. Only cryptocurrencies that use the Proof of Stake mechanism to validate transactions (like Cardano, Solana, and Tezos) can be staked, and many wallets like Exodus are starting to allow people to stake their coins directly from their wallet.

Mining

This involves using computer equipment to support the operation of a coin’s network, and earn mining rewards in return. Cryptocurrencies that use the Proof of Work mechanism to validate transactions (like Bitcoin, Litecoin, and Dogecoin) can be mined. Mining involves having the right equipment and technical knowledge, so is not for everyone. In addition, the electricity consumption relating to mining can be controversial (with the popularity and scale of Bitcoin mining resulting in the network consuming 0.55% of the world’s electricity production!).

How you can lose money

Selling for a loss

The cryptocurrency market is incredibly fickle and 10+% price dips in the matter of hours is an incredibly common and normal occurrence.

The roller coaster ride of price changes can be sickening and may tempt holders to panic sell their crypto for a loss. Bear markets (where the price of cryptocurrencies goes down for a sustained period of time) are violent and it’s common for cryptos to lose 80% or more of their value.

Fortunately, quality coins like Bitcoin have recovered over the long-term. But there’s no guarantee long-term holding will see such a recovery, as cryptocurrencies can come and go. For example, Dash was once a popular coin, but has never come close to reaching its previous all-time high of about $1,250.

Theft or mishandling of keys

Your crypto doesn’t have to go down in price for you to lose money. There’s plenty of scams in the crypto world trying to separate you from your coins. These range from simple ones like scammers promising to instantly double your money if you send them some Ethereum or fake customer support representatives asking for your wallet’s seed phrase, to more complex scams like fake apps or pyramid schemes (for example, Lion’s Share).

In addition, your exchange or platform could get hacked. Mt. Gox was a major exchange which got hacked in 2014, and Cryptopia was a NZ based exchange which got hacked in 2018. Those who had funds stored on these platforms haven’t seen any of it recovered so far.

It’s not just bad actors that can result in a loss of crypto – you could be your own worst enemy. Losing the keys or passwords required to access your coins or wallet is a common issue.

4. What other concepts should I know about cryptocurrency?

Trading hours

There is no single centralised exchange that cryptocurrencies trade on like the NZX. Instead cryptocurrency markets never close and can be traded 24/7. The prices you see on sites like CoinMarketCap reflect the average price of a given cryptocurrency across exchanges from around the globe.

Fractionalisation

You don’t need to buy cryptocurrencies in whole units. For example, Bitcoin’s price of ~$50,000 USD may appear unaffordable, but it’s possible to buy fractions of the coin, with each Bitcoin being dividable into 100 million units (with 0.00000001 Bitcoins often referred to as 1 “Satoshi”).

Addresses and keys and wallets

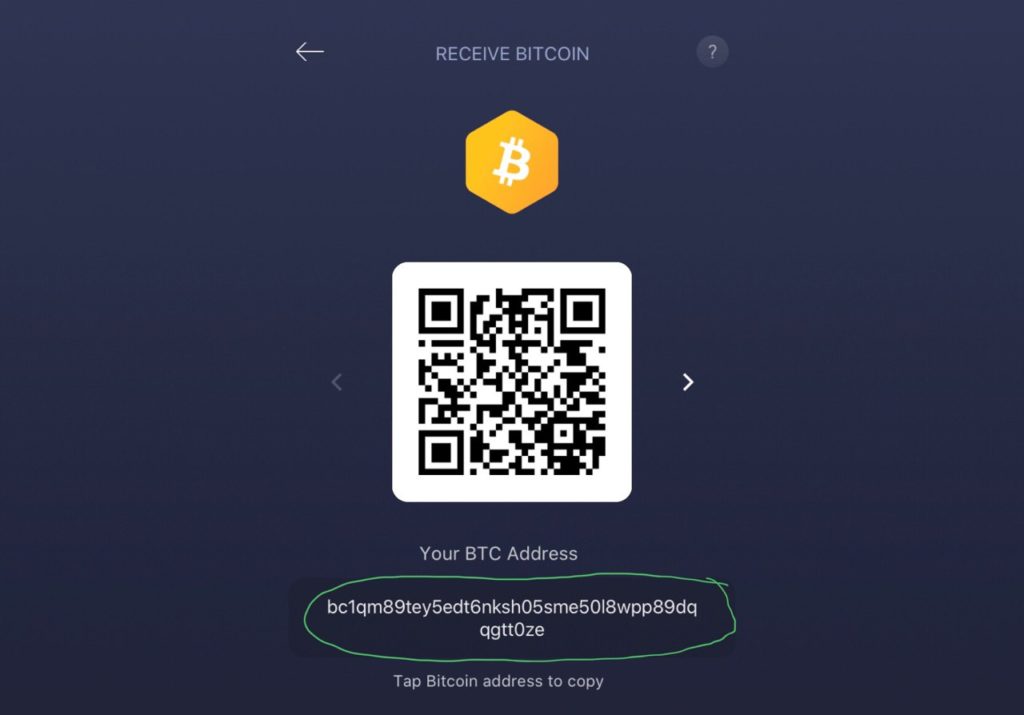

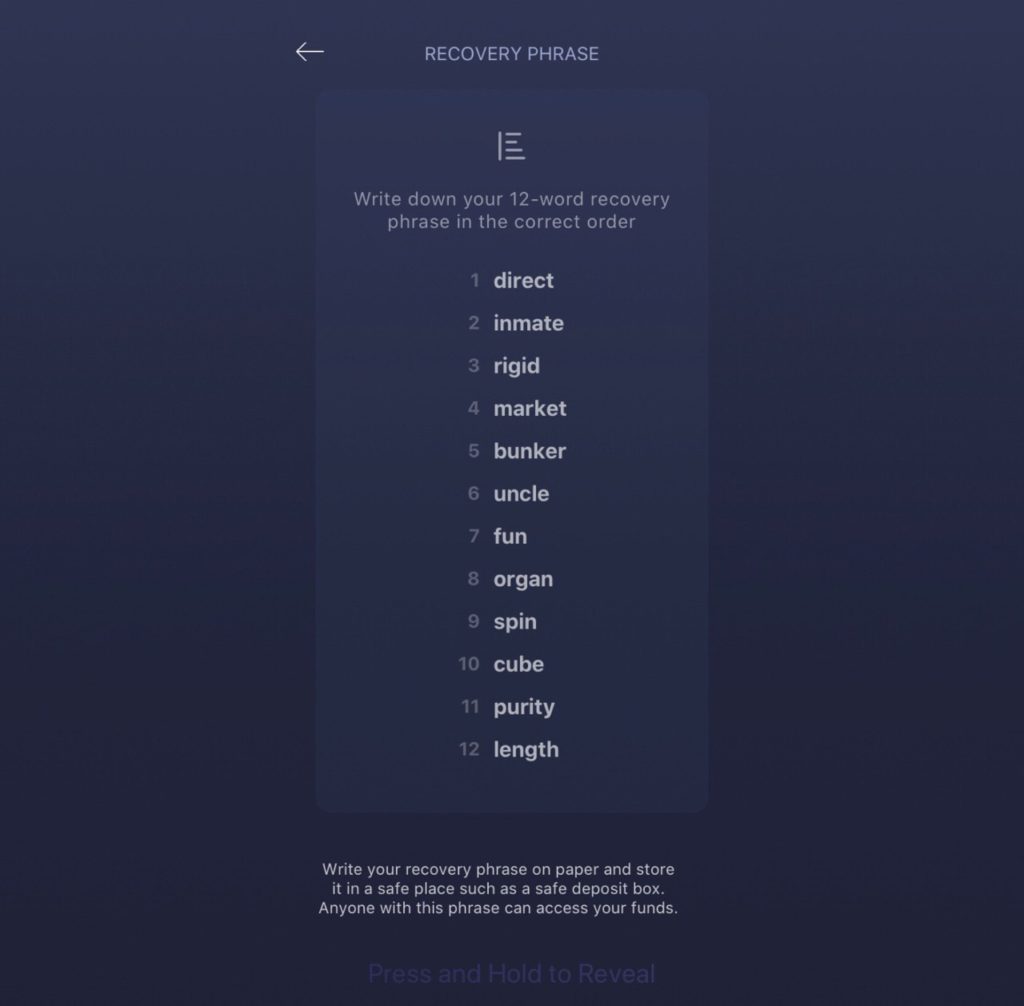

If you’re using the self-custody method to invest in crypto, here’s an overview of a few important technical concepts you need to know:

- Network – Different cryptocurrencies have different networks. For example, the Bitcoin network utilises miners and blockchain technology to process transactions and store a record of all the data relating to Bitcoin. Ethereum has its own separate network.

- Address – An address is a place on a crypto’s network where you can send and store your cryptocurrency. Addresses are typically anonymous, with no name associated with it – instead they’re usually made up of a long string of letters and numbers.

- Keys – Your keys act as a password to an address, giving you ultimate control over the cryptocurrency stored at that address (i.e. the ability to send or spend coins from that address).

- Wallet – Unlike the name suggests, a wallet is not where you store cryptocurrency. Instead wallets are an app or device that can generate an address and its keys, and allow you to interact with that address (like the ability to check the balance of that address or send coins out of it). If you lose your wallet, this doesn’t mean you’ve lost your crypto given they’re stored on an address on your cryptocurrency’s network.

- Seed phrase – This is typically a 12 or 24 word phrase that your wallet gives you the first time you set it up. Seed phrases can be input into a wallet to recover your cryptocurrency addresses and keys in case you lose your wallet, so are more important than a wallet itself.

Coin vs token vs NFT

You might hear the terms coin, token, and NFT to describe assets in the crypto world. Here’s the differences between them:

- Coin – Coins are cryptocurrencies that have their very own blockchain/network. For example, Bitcoin and Ethereum are coins as they have their own networks to process and keep track of all their transactions.

- Token – Tokens are cryptocurrencies that utilise another network (like Ethereum or Binance Smart Chain) to operate, saving that token from the burden of operating their own network. For example, Shiba Inu is a token based on the Ethereum network, so any Shiba Inu transactions take place and are recorded on the ETH network – as a result you must pay Ethereum network fees to transact this token.

- NFT – NFTs (Non-Fungible Tokens) are a type of token representing the ownership of a digital artwork or real-life item, rather than a currency. Each NFT is unique and recorded securely on a network (like Ethereum).

Decentralisation

Most cryptocurrencies are decentralised, which means there’s no single organisation that operates them. For example, Bitcoin is made up of a network of miners (rather than a single entity) whose computers run Bitcoin’s code and keep it secure. This makes cryptocurrency incredibly resilient and hard to shut down or censor, given there’s no single geographic location or organisation that operates it.

The downside of decentralisation is that sometimes things do go wrong. If you get your coins stolen, there’s no organisation to help you, nor is there any way to reverse transactions made on the network. Sometimes miners can disagree on upgrades made to a cryptocurrency’s code, and as a result may result in a cryptocurrency splitting into two different coins. For example, Bitcoin split into Bitcoin (BTC) and Bitcoin Cash (BCH) in 2017 after the community disagreed on the future direction of the cryptocurrency – Bitcoin is governed by the miners and the code it runs on and there is no Bitcoin CEO to make decisions on the coin.

5. Is buying cryptocurrency investing or gambling?

This can be a controversial topic, with strong arguments for both sides. We think the answer depends on why you bought the crypto in the first place. Unfortunately crypto is likely used as a gambling tool for most people. For these people crypto is bought purely for the hope their crypto will go up in price, rather than for the coin or technology itself (forgetting there are teams of developers behind each coin, constantly making improvements the coin’s software). Others buy due to FOMO or to chase quick gains, sucked in by exponential price rises or social media price predictions of Bitcoin going to $100,000 or Dogecoin going to $1.

In a bull market it can be incredibly easy to make money this way, regardless of what crypto you buy and strategy you use. Unfortunately good times won’t last forever, and a lot of people will get hurt when the market turns around. There are over 15,000 cryptocurrencies, most of them worthless “shitcoins” which won’t survive the next bear market.

A few cryptos arguably have genuine value and real world use cases. The technology behind some cryptocurrencies are incredibly powerful and they can be a genuine component in a long-term investment portfolio, perhaps by acting as a hedge against inflation and the current monetary system (Bitcoin), or by participating in a powerful computing network (Ethereum). Quality coins will stick around through the peaks and troughs of the market, and the extra risk you take on by adding them as a small part of your portfolio may be worth it for the potential gains.

Either way cryptocurrency is speculative, offering high potential reward with high risks. The success of it as a genuine investment asset class ultimately depends on its adoption – a currency is useless if it isn’t considered valuable, or widely accepted as a means of exchange. We just don’t know how the cryptocurrency ecosystem will play out over the long-term.

Safety tips

Regardless of whether you treat crypto as a gamble or as an investment, always:

- Start small – This will limit your losses if something goes wrong.

- Know how to get your money out before buying a cryptocurrency – Any profits you make are meaningless if you can’t get your money out.

- Be aware of common scams – Never give out your seed phrase if using your own wallet, and don’t let greed tempt you into falling for a scam.

- Remember past performance doesn’t guarantee future results – Big increases in price will often be followed by periods of poor performance.

- Take price predictions with a grain of salt – These are usually based on hope rather than made with any justification. It’s incredibly hard to predict the movements of the crypto market, and following predictions or trying to analyse charts will likely result in a bad time.

Conclusion

It’s still early days in the world of cryptocurrency, and it’s still a divisive topic. Some believe it’s a legitimate and revolutionary asset class, while others call it a scam and will bash this site for even writing about it. But even though it’s used as a gambling tool more widely than we’d like, we don’t think crypto is going away anytime soon. It’s survived multiple, severe bear markets, and has thriving development teams continually growing adoption and the ecosystem. It’s delivered excellent returns for early investors, is looking like an increasingly viable alternative to traditional financial products, and still has a lot of potential to grow.

This doesn’t mean you should go out and invest. While it’s easy to make money from crypto in a bull market, the next bear market is just a matter of when. It’s hard to see value in many cryptos, and many shitcoins will be wiped out when the good times end. Even the best coins will see massive amounts of volatility, with no guarantee of their prices recovering over the long-term. It’s not an asset class for everyone, and you have to go in with the expectation that your crypto could easily crash over 20% in the matter of hours. Traditional assets like shares already provide plenty of opportunity to grow your wealth, so adding crypto to your portfolio may just result in exposing yourself to unnecessary risk.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.