Kernel is an Auckland-based fund manager who launched in 2019, initially with a modest offering of three index funds. They’ve since refined their product, expanded their range to eleven funds, and are looking to cement themselves as one of New Zealand’s top wealth-building platforms. So are they quickly becoming a worthy challenger among the numerous investment options Kiwis have?

This article covers:

1. What’s on offer?

2. Fees

3. Other considerations

4. Kernel vs competing services

Update (28 Oct 2022) – Kernel has added 3 new funds including the Balanced and Cash Plus funds.

Update (20 Apr 2023) – Kernel has added Global ESG funds.

1. What’s on offer

Background

Kernel is an index fund manager and investment platform offering the following products:

- Kernel Invest – A selection of 19 index funds.

- Kernel KiwiSaver – A KiwiSaver scheme in which you can select from Kernel’s range of 17 funds.

- Kernel Save – A short-term savings account.

Given their main offering is index funds, here’s a refresher on what index funds are:

Index funds are passively managed and track an index, investing in all of the constituent companies of that index (as opposed to actively managed funds which have fund managers researching and picking what shares to invest in).

An index is designed to measure the performance of a market, or a part of a market. It does this by calculating the collective price movements, and therefore performance, of the selected stocks that are within the index.

Dean Anderson, Founder & CEO, Kernel

For example, Kernel’s NZ 20 Fund tracks theS&P/NZX 20 Index, which measures and represents the performance of the 20 largest companies listed on the NZX. Therefore the fund invests in the 20 companies within that index like Fisher & Paykel Healthcare, Auckland Airport, and Spark.

The result is that an index fund will deliver the same return as that index (as opposed to actively managed funds which aim to outperform the market). Kernel utilises a passive, index tracking strategy for all their funds, with the belief that actively picking stocks in an attempt to beat the market is incredibly hard (and expensive) to do successfully and consistently over the long-term.

A. Kernel Invest

Kernel’s 19 index funds are (with the index they track in brackets):

New Zealand funds

- NZ 20 (S&P/NZX 20 Index) – Invests in the 20 largest companies listed on the NZX.

- NZ Small & Mid Cap Opportunities (S&P/NZX Emerging Opportunities Index) – Invests in 42 smaller NZX listed companies outside the S&P/NZX 20 Index. Example holdings are Air New Zealand, Vital Healthcare Property, and My Food Bag.

- NZ Commercial Property (S&P/NZX Real Estate Select Index) – Invests in the eight major Real Estate Investment Trusts (REITs) listed on the NZX. Example holdings are Goodman Property, Kiwi Property Group, and Investore.

Global funds

- Global 100 (S&P Global 100 Ex-Controversial Weapons Index) – Invests in ~100 of the largest global companies across the world’s sharemarkets. Examples holdings are Apple, Nestle, and Samsung Electronics.

- Hedged Global 100 – Invests in exactly the same companies as the above Global 100 Fund, but is currency hedged to the New Zealand Dollar.

- Global Infrastructure (Dow Jones Brookfield Global Infrastructure Index) – Invests in 105 companies that derive at least 70% of their revenues from infrastructure type businesses such as transportation, water, or communications. Examples are American Tower Corp, Sydney Airport, and Transurban Group.

- Hedged Global Infrastructure – Invests in exactly the same companies as the above Global Infrastructure Fund, but is currency hedged to the New Zealand Dollar.

- Global Dividend Aristocrats (S&P Developed Ex-Korea Dividend Aristocrats Quality Income Index) – Invests in 89 companies from around the world that have a strong, stable or growing dividend yield. Example holdings are Exxon Mobil, Pfizer, and Verizon.

- Kernel S&P 500 Fund (S&P 500 Dynamic Hedged Index) – Invests in the 500 largest companies listed in the United States, hedged to the New Zealand Dollar.

Thematic funds

- Electric Vehicle Innovation (S&P Kensho Electric Vehicles Index) – Invests in 44 companies involved in the electric vehicle ecosystem including manufacturers, and providers of charging infrastructure. Example holdings are Tesla, Blink Charging, and NIO.

- Moonshots Innovation (S&P Kensho Moonshots Index) – Invests in 49 companies involved in emerging and disruptive sectors such as cyber security, genetic engineering, and space. Example holdings are Virgin Galactic, Dropbox, and iRobot.

Sustainable funds

- NZ 50 ESG Tilted (S&P/NZX 50 Portfolio ESG Tilted Index) – Invests in the companies of the S&P/NZX 50 index, excluding SKYCITY (for gambling) and Z Energy (for fossil fuels). Each company is weighted up or down according to their ESG score – companies with positive environmental, social, and governance practices make up a larger proportion of the fund, compared to companies with less positive practices. The fund’s largest holdings are Auckland Airport, Meridian Energy, and Fisher & Paykel Healthcare.

- Global ESG (S&P Developed Ex-Korea LargeMidCap Net Zero 2050 Paris-Aligned ESG Ex-Non-Pharma Animal Testing Index) – Invests broadly into over 600 companies across 24 developed countries, and incorporates some special ESG features, excluding companies that are involved with certain activities including non-pharma animal testing, fossil fuels, controversial weapons, and tobacco, and adjusting the weightings of companies based on their exposure to the physical risks of climate change.

- Global ESG (NZD Hedged) – Same as above, but hedged to the NZ Dollar

- Global Green Property (Dow Jones Global Select Green Real Estate Securities Index) – Invests in 242 real estate companies from around the world with a heavier weighting towards those who demonstrate high ESG standards. Example holdings are Goodman Group, Scentre, and Simon Property Group.

- Global Clean Energy (S&P Global Clean Energy Index) – Invests in 71 companies involved in producing clean energy or providing clean energy technology and equipment. Example holdings are Plug Power, Contact Energy, and First Solar.

Diversified funds

Kernel High Growth Fund – A fund investing in a diversified portfolio of NZ and international shares by bundling together a 5 Kernel funds. A handy option if you’re not sure which funds to pick. The High Growth Fund invests in:

- NZ 20 Fund (23.5%)

- NZ Mid & Small Cap Opportunities Fund (5.9%)

- Global 100 Fund (58.6%)

- Global Infrastructure Fund (5%)

- Global Green Property Fund (5%)

- Cash (2%)

Kernel Balanced Fund – Invests in a diversified mix of shares, bonds, and cash. 60% of the fund invests in a portfolio of shares similar to that of the above High Growth Fund. The remaining 40% of the fund is split between:

- NZ bonds (17%)

- International bonds (18%)

- Cash & cash equivalents (5%)

Kernel Cash Plus Fund – Invests in cash and cash equivalents, aiming to protect the value of your investment, while earning returns higher than the average bank savings account.

B. Kernel KiwiSaver

Kernel KiwiSaver is a KiwiSaver scheme which allows you to invest your KiwiSaver money into their High Growth/Balanced/Cash Plus funds, or a custom-built mix of any of Kernel’s above funds. They’re a welcome addition to the market as currently there’s very few KiwiSaver funds (especially low cost index funds) that allow you to invest aggressively into a portfolio allocated 100% to shares.

C. Kernel Save

Kernel Save is a short-term savings account which requires 34 day’s notice to withdraw your money (essentially a “notice saver” account which you can get from Westpac, Kiwibank, Heartland, or Rabobank). The account currently pays an interest rate of 5.25% – lower than what you could get from a term-deposit, but slightly more flexible. Kernel plans to add an on-call savings option which would allow you to withdraw your money without the requirement for 34 day’s notice.

Quality of funds

19 funds isn’t a huge offering, but we wouldn’t consider this a weakness of Kernel as there’s much to like about their range. Most funds offer something unique and there isn’t much overlap between them. Some of their funds are broadly invested funds (like the NZ 20 and Global 100 funds), others are more specialised and exciting (like the Moonshots Innovation and Global Clean Energy Fund) – This makes their range suitable for a core-satellite approach to investing, where a core portfolio of broad market funds is supplemented by a satellite of specialised investments (to spice up what could be a somewhat boring portfolio).

Kernel also take a quality over quantity approach when it comes to their funds. Their focus on quality and efficiency is evident in some of their funds which may appear unusual at first glance. For example:

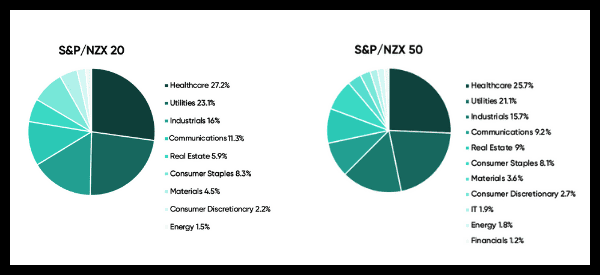

- NZ 20 – Most of Kernel’s competitors offer funds based on the broader and more popular NZX 50 index. Kernel chose to offer a NZX 20 fund given the index captures a similar sector composition to the NZX 50 (so are closely correlated in how they move) – but because the NZX 20 has fewer companies, poor performing ones drop out of the index (and therefore the fund) faster than the NZX 50. This is one of the reasons the NZX 20 has outperformed the NZX 50 by 1.58% p.a. over the last 11 years.

- Global 100 – Global index funds tend to contain thousands of companies, but Kernel’s core global offering contains just 100 companies! Their reasoning is that 100 companies already provides plenty of diversification (e.g. adding a 101st company to a portfolio of 100 will have barely any impact on diversification), is highly correlated to the broader indices that contain thousands of funds, and reduces costs (as there’s fewer companies to buy and sell).

A few of Kernel’s other funds stand out as unique. For example, the NZ Small & Mid Cap Opportunities Fund is the only index fund which invests in companies outside the NZX 50, and their Electric Vehicle Innovation Fund is one of the first EV funds in the world. They also write blog posts detailing the considerations they’ve made in crafting each fund, and the indexes behind them. They’re worth reading to get a good understanding of each fund and how they might fit into your portfolio. Examples are:

- Investing in Global Infrastructure – why, what & how

- Investing for Income – Global Dividend Aristocrats

- Everything you need to know about our Electric Vehicle Innovation Fund

Who are these investments best suited for?

Most of Kernel’s funds invest in shares, which are best suited for longer-term investors who have a high risk tolerance – in fact, Kernel’s minimum suggested investment timeframe on these funds is 5-10 years (and 7-10 years for their thematic and Global Clean Energy funds).

However, they now have a small number of relatively conservative options to dial down the risk. Medium-term investors may find the Balanced Fund a good option, as it has an allocation to bonds to reduce the fund’s volatility. Shorter-term savers may find the Cash Plus Fund or Kernel Save useful.

2. Fees

Fund management fee

Kernel charges a percentage based management fee on all their funds. These fees are the same for their KiwiSaver and non-KiwiSaver funds:

- Most funds – 0.25% p.a.

The exceptions are:

- Electric Vehicle Innovation, Moonshots Innovation, and Global Clean Energy – 0.45% p.a.

There’s no transaction fees like spreads, brokerage, or foreign exchange associated with their funds. Overall Kernel’s management fees are incredibly competitive – amongst the lowest for index funds in New Zealand.

Account fee

If you invest $25,000 or more through Kernel Invest, you’ll be charged an account fee of $5 per month ($60 per year). This can add a fair amount to the base 0.25% fee on most funds. For example, the below table shows the total annual fees (fund management fee + account fee) for investing various amounts of money into the NZ 20 Fund. For an investment of $25,000, the account fee almost doubles your effective fee. However, Kernel’s overall fees are still very reasonable.

| Amount invested | Total annual fee |

| $10,000 | $25 (0.25%) |

| $25,000 | $122.50 (0.49%) |

| $50,000 | $185 (0.37%) |

| $100,000 | $310 (0.31%) |

Kernel doesn’t charge account fees for their KiwiSaver product.

3. Other considerations

Minimum investment

The minimum investment on Kernel is $1 per fund.

Auto-invest

Kernel’s auto-invest functionality enables you to invest in their funds or bundles automatically on a weekly, fortnightly, or monthly basis.

Distributions

All of their funds (except for the thematic funds) pay distributions on a quarterly basis. You can choose to have these automatically reinvested, or paid out in cash.

Tax

All of Kernel’s funds are Multi-Rate PIEs so are taxed at your Prescribed Investor Rate. They calculate your tax obligations for you, which is payable after the end of every tax year (31 March) or whenever you sell units of a fund. Any tax liability will be deducted from your Kernel account’s cash balance.

Currency hedging

Most of Kernel’s international funds don’t use currency hedging, so their value will be impacted by exchange rate fluctuations. However, the following funds are hedged to the NZD, which removes most of the exchange rate volatility:

- S&P 500

- Global Green Property

- Global 100 (available in both hedged and unhedged versions)

- Global Infrastructure (available in both hedged and unhedged versions)

- Global ESG (available in both hedged and unhedged versions)

Further Reading:

– Hedged vs Unhedged funds – What’s better?

Account types

Kernel offers individual, joint, kids, company, and trust accounts.

User friendliness

Kernel provides a modern, mobile-friendly digital platform for investors to view and manage their investments. If you get stuck, support is available through phone or email.

Investor education

Kernel has a few initiatives to improve people’s investing and financial literacy, and are probably one of the better producers of educational content. They have a good blog, hold regular in-person events (pre-COVID-19 lockdowns), and host webinars. In addition, Cat and Christine from the Kernel team host the It’s No Secret podcast. The podcast isn’t directly Kernel related though – instead covering a broad range of personal finance topics.

4. Kernel vs competing services

It’s quite hard to compare Kernel with other platforms, given many of their funds are unique for the NZ market (and even globally!). But here’s a brief overview of how Kernel stacks up to competing services:

Smartshares

Smartshares is another index fund provider who offer 35 funds, some of which are somewhat close (but not necessarily like-for-like) alternatives to Kernel’s funds:

- The Smartshares S&P/NZX 50 ETF or NZ Top 50 ETF are alternatives to the NZ 20 or NZ 50 ETF Tilted funds.

- The Smartshares NZ Mid Cap ETF is an alternative to the Small & Mid Cap Opportunities Fund.

- The Smartshares Total World ETF is an alternative to the Global 100 or Global ESG Fund.

- The Smartshares US 500 ETF is an alternative to the S&P 500 Fund.

- The Smartshares NZ Property ETF is an alternative to the NZ Commercial Property Fund.

- The Smartshares NZ Cash ETF is an alternative to the Cash Plus Fund.

- The Smartshares NZ Government Bond and Global Aggregate Bond ETFs, could be used to make up the bond portion of a balanced portfolio.

Though not all of Smartshares and Kernel’s funds overlap. Smartshares has a more comprehensive offering including funds that cover more specific geographies and sectors such Europe, Emerging Markets, and Australian Resources. Smartshares also have a couple of thematic funds in the form of an Automation and Robotics ETF and Healthcare Innovation ETF, and more conservative bond and cash options. However, a few of Smartshares’ funds overlap with each other and can be confusing for investors. Many of Kernel’s funds like the Global Infrastructure and Global Dividend Aristocrats funds don’t have a Smartshares alternative.

Another key difference is that Kernel’s funds are unlisted, while Smartshares’ funds are ETFs (listed on the NZ sharemarket and available through brokers like Sharesies and platforms like InvestNow). Kernel argues unlisted funds provide a more efficient structure in terms of tax and trading costs. This may be true with Kernel’s fees lower than Smartshares’ fees on average. But those investing between $25,000 to around $50,000 may find Smartshares slightly cheaper due to Kernel’s account fee.

Further Reading:

– Smartshares vs Macquarie vs Kernel vs Harbour – NZ Share Index Fund shootout

– Smartshares vs Vanguard vs Macquarie vs Kernel – International Share Index Fund shootout

– Smartshares & Kernel – Thematic Index Fund shootout

InvestNow

InvestNow is a fund platform offering over 150 funds from 27 different fund managers. Most are actively managed, but they still have a decent passive range from Macquarie, Vanguard, Foundation Series, and the above Smartshares ETFs. Their lack of brokerage or account fees make for an attractive option.

The key downsides of InvestNow are their higher minimum investment of $50 per fund versus Kernel’s $1 per fund, inferior user interface, and cash drag from not being able to buy fractional units in Smartshares ETFs. In addition, InvestNow’s KiwiSaver scheme is limited in the index fund options that are available.

Further Reading:

– InvestNow review – The most efficient way to invest?

– Build your own KiwiSaver – InvestNow vs SuperLife vs Craigs

Simplicity

Simplicity‘s key offerings are their diversified funds which contain a mix of local and international shares and bonds. This makes it incredibly simple to put a well-rounded portfolio together without having to worry about what individual funds to pick. Simplicity’s fees are comparable, charging a 0.31% management fee.

However, you lose flexibility in being able to choose exactly what asset allocations to invest in. For example, in their Growth fund you’re stuck with their prescribed allocation of ~22% towards cash and bonds, which some people consider not aggressive enough. Meanwhile Kernel allows you to select exactly how you want to allocate your portfolio towards each sector out of their NZ, global, thematic, and sustainable funds, with the advantage of being able to invest more aggressively than Simplicity’s funds allow.

Further Reading:

– InvestNow Foundation Series vs Simplicity funds – Tax leakage an issue?

Sharesies, Hatch, Stake

Sharesies, Hatch, and Stake are not direct competitors to Kernel, given their focus as brokers for individual share and ETF investments. You’ll get much more choice in investment options with these platforms, while Kernel represents a much more simple way to invest.

Some of the US listed ETFs they offer may be compelling alternatives to Kernel’s funds. For example, the Vanguard Total World Stock ETF could be used as an alternative to the Kernel Global 100 Fund and has a lower management fee (0.08% vs 0.25%). But don’t forget you also have to pay foreign exchange and brokerage fees on Sharesies, Hatch, and Stake, compared with none on Kernel. In addition, these platforms may require more work when it comes to taxes given the FIF status of US ETFs. There is no definitively best option, and the one that works best for you will come down to your investing behaviours and preferences.

Conclusion

Kernel doesn’t offer many bells and whistles like the ability to pick from thousands of individual stocks and ETFs, participate in IPOs, or trade in and out of your funds daily – but Kernel isn’t built for that type of investor. They’re best suited to investors wanting to keep their portfolios simple and down-to-earth by investing long-term in a carefully considered range of index funds. And they still have plenty of features like auto-invest, and easy-to-digest blog posts to help you along on your investing journey.

In terms of KiwiSaver, Kernel offers an excellent product. It’s flexible (in that you can choose from a mix of 19 funds), and allows you to invest aggressively with a 100% allocation to shares. The fees are incredibly low and are even cheaper than Simplicity and InvestNow’s options.

Kernel’s fees are very competitive, though the $5 monthly account fee (for those investing over $25,000 into Kernel Invest) can add a bit of weight onto their headline management fees. Overall, while Kernel’s range of investment options is relatively small and provides less flexibility, their funds are high quality and quite unique. We consider Kernel to be a solid alternative to investing through the likes of Smartshares and InvestNow, and being a relatively new provider we can expect more refinements and improvements in the coming years.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

The sweet spot for Kernel seems to be $1-$24999 after that there is a massive fee increase. I have just reduced my funds to drop below this fee increase threshold. Interesting fee structure by Kernel. I wonder if other investors sitting around the 25k mark will do something similar.

Interesting you say that Brett – We’ve had similar conversations with other investors who also feel discouraged from investing $25k plus, so you’re probably not alone. We definitely prefer the old fee structure which provided an incentive (with the management fee rebate), rather than a penalty, to invest more.

I’ve also withdrawn funds to reduce my balance below the $25k mark. I have been with Kernel from when they only had 3 funds. I’m a little surprised by these changes. The incentive for saving hard and investing more has been removed. As a larger long term investor I’m disappointed with these fee ‘reductions’.

Wow, you’ve been with Kernel from the very start! We’re with you Nigel in feeling disappointed with the fee changes.

Very good, detailed and concise information. Love it!

Thanks Michelle!

I only have several thousand in Kernel so I’m stocked about the new fee reduction.

It’s a little confusing, so under $25,000 I’ll pay .25% then my fee doubles to .49% at 25,000?!? I’m not sure that makes sense. Larger customers are already paying more $$ in fees!

But….I’m happy for the larger investors to pay an administration fee so I don’t have too! ☺️

That’s right – larger customers are rewarded with a chunky fee increase. And yes, they’re essentially subsidising the smaller customers, so good on you for taking advantage of that. But the new fees have definitely left us scratching our heads.

I’m looking at starting off with Kernel, one thing I can’t find information about, is the withdrawal conditions/terms.

I want to be able to access funds if needed. Unlike KiwiSaver.

Thanks Christinebk

Hi Christine, Kernel’s funds come in two types:

– Invest funds – can be withdrawn at anytime without restrictions

– KiwiSaver funds – the usual KiwiSaver withdrawal restrictions apply

So their Invest funds would meet your requirements, but keep in mind they’re designed for long-term investment (5 years+)

Ive read their thesis on global 100 vs s&p 500 in terms of diversity, which states global 100 is more diversified. However I cant help notice that the global 100 has 40% of the index in the top few tech companies. Specifically Apple and Microsoft take up 25% of the index, which seems very high weighting to the top two. Im not sure how or when it gets rebalanced if these companies would result in lower weighting, but for now it seems the s&p 500 fund offers more diversity

The Global 100 is probably more diversified from a geographical perspective (containing non-US companies as well), but not from a company perspective (100 vs 500 companies). Apple and Microsoft wouldn’t get a lower weighting unless their market caps shrunk relative to the other companies in the index. But the Global 100 isn’t intended to be the only fund in your portfolio. Say you split your portfolio 50/50 between the Global 100 and other funds (NZ 20, Global Infrastructure etc.), that would reduce the overall weighting of AAPL and MSFT to a more reasonable level.

Not a Kernel user but certainly considering it.

Currently I own investments in individual companies and ETFs and Australian unit trusts.

I think you need to look at the platform and how easy it is to use it.

It surprises me how concerned people can get regarding the monthly account fee.

It is equal to one late a month. Less than most trading bank monthly account fees.

As someone who regularly pays out thousands of dollars to accountants, it is unbelievably cheap.

People need to cast the fee charge in “perspective”.

Hi Richard, yes the dollar amount of the monthly fee is very cheap. But the main issue arises when you calculate the fee as a percentage of your investments. On a $25,000 portfolio, the fee equates to 0.24% of your investments. That may not seem like much, but now your effective fees for using the platform are almost double the headline 0.25% funds management fee. Another concern investors may have is around why they’re effectively subsidising the fees of small investors and KiwiSaver members (who do not pay a monthly fee to use Kernel).