Investment Services

These are some services you can use to invest your money in New Zealand.

Last updated: 20 May 2022

Fund Managers

KiwiSaver & Non-KiwiSaver Fund Managers

These providers offer both KiwiSaver and non-KiwiSaver funds.

Kernel

Kernel is an index fund manager with a small range of 11 NZ and international funds. Kernel also has the only index fund that invests outside the NZ Top 50. They’ll be launching a KiwiSaver scheme soon.

Further Reading:

– Kernel review – High quality index funds

Simplicity

Simplicity is a not-for-profit passive fund manager, with low fees of 0.31% + $20 per year. An increasingly popular choice among Kiwis.

Further Reading:

– Simplicity review – Could there be better fund options out there?

SuperLife

SuperLife offers 35 funds, mostly made up of Smartshares’ ETFs. They offer handy features like auto-rebalancing of your portfolio, and their fees are reasonable.

Further Reading:

– Build your own KiwiSaver – InvestNow vs SuperLife vs Craigs

Milford

Milford is a popular active fund manager with a decent track record, offering KiwiSaver and non-KiwiSaver funds.

Further Reading:

– Milford review – Better than index funds?

KiwiSaver Fund Managers

These providers offer KiwiSaver funds only.

Kōura

Kōura uses digital advice to cleverly recommend investors a suitable KiwiSaver portfolio built from a mix of 9 funds. They’re also the first KiwiSaver provider to allow you to invest up to 10% of your portfolio into cryptocurrency.

Further Reading:

– Kōura review – Crypto meets KiwiSaver

JUNO

JUNO is another relatively low cost KiwiSaver fund provider. They actively manage their funds, and already have a good track record despite being quite new.

Further Reading:

– Simplicity vs JUNO vs BNZ – Battle of the low cost KiwiSaver funds

Non-KiwiSaver Fund Managers

These providers offer non-KiwiSaver funds only.

Smartshares

Smartshares offers over 35 Exchange Traded Funds (ETFs). You can buy them from Smartshares directly, or through platforms like InvestNow or Sharesies.

Further Reading:

– Smartshares & SuperLife review – The smart way to invest in shares?

Fund Platforms

InvestNow

InvestNow is popular Fund Platform offering over 150 funds to choose from, from providers such as Smartshares, Vanguard, and AMP. There are no fees to pay to use the platform, and you can invest from as little as $50. InvestNow also offers a KiwiSaver scheme which allows you to invest your KiwiSaver money across 30 different funds.

Further Reading:

– InvestNow review – The most efficient way to invest?

Flint Wealth

Flint offers almost 100 funds from 12 different fund managers including SuperLife, Milford, and Fisher Funds. There are no account or transaction fees and their minimum investment is a low $250.

Further Reading:

– Flint Wealth review – A superior InvestNow clone?

Brokers

These platforms are DIY brokers allowing you to buy and sell individual shares and ETFs listed on various markets.

| Platform | Offers NZ shares? | Offers Australian shares? | Offers US shares? | Offers other markets? |

|---|---|---|---|---|

ASB Securities | Yes | Yes | Yes | Yes |

BlackBull Invest | Yes | Yes | Yes | No |

Hatch | No | No | Yes | No |

Interactive Brokers | No | Yes | Yes | Yes |

Jarden Direct | Yes | Yes | Yes | Yes |

Sharesies | Yes | Yes | Yes | No |

Stake | No | No | Yes | No |

Superhero | No | Yes | Yes | No |

Tiger Brokers | No | Yes | Yes | Yes |

Alternative Investments

Cryptocurrency

Easy Crypto

Easy Crypto is one of the easiest ways for Kiwis to buy Bitcoin and other cryptocurrencies. Purchases of crypto are usually completed and sent to your wallet within a few minutes.

Further Reading:

– Easy Crypto review – The best on-ramp to the world of cryptocurrency?

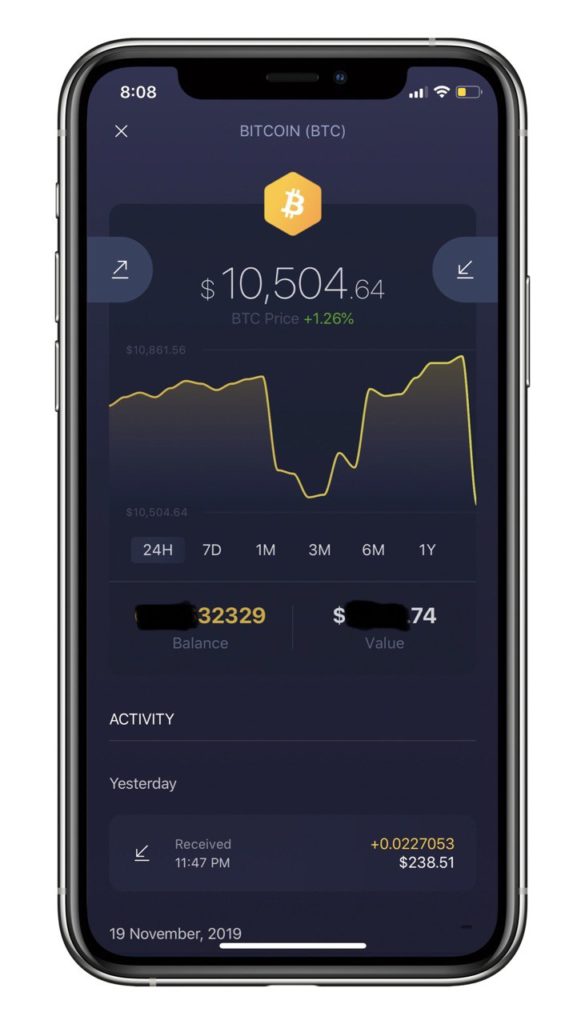

Exodus Wallet

If you don’t have a lot of cryptocurrency or are just staring out, a basic wallet on your mobile phone is usually adequate to store it. For this you can use Exodus which is a multi-currency wallet that can hold Bitcoin and most major altcoins, and is available on iOS, Android, and desktop.

Ledger Wallet

Ledger manufactures hardware wallets, which are a better option if you’re storing a large amount of cryptocurrency, given these wallets keep the keys to your coins offline and separate from your other devices like your phone or PC.

Wirex

When it comes to spending your cryptocurrency, Wirex offers a solution in the form of a debit card. You can transfer crypto to your Wirex card, convert it to NZD, then spend it at pretty much any retailer that accepts Visa cards.

Further Reading:

– How to buy Bitcoin in New Zealand (step-by-step guide)

– What’s the difference between Easy Crypto, Binance, Exodus, and more?

Peer to Peer Lending

Squirrel

Squirrel Money is the easiest Peer to Peer Lending platform to use. It’s the only one in NZ where you can sell your investment early. However, the potential returns are lower than Lending Crowd, and it requires a minimum of $500 to invest in each loan.

Further Reading:

– Peer to Peer Lending review – Squirrel

Lending Crowd

Lending Crowd has fewer features than Squirrel (e.g. no auto-invest), but makes up for it by offering loans to only high-quality borrowers.

Further Reading:

– Peer to Peer Lending review – Lending Crowd

Equity Crowdfunding

Snowball Effect

I’ve used Snowball Effect to invest in a few Equity Crowdfunding campaigns like Squirrel, Punakaiki Fund, and Zeffer Cider.

Further Reading:

– 4 things to know about investing in Equity Crowdfunding

Other Services

ANZ

There is not much difference between the major banks, but I am with ANZ as their Freedom account is fee free (including a free debit card) as long as I deposit at least $2,500 every month. Other banks may charge fees for things like having a debit card.

Heartland Bank

Heartland Bank’s Direct Call account is a solid option to keep your cash and emergency funds. It offers a high interest rate, with the ability to withdraw your funds at any time. Heartland also offers good term deposit rates, but the bank does have a lower credit rating than the main banks.

Further Reading:

– The best bank accounts and credit cards for managing your everyday finances

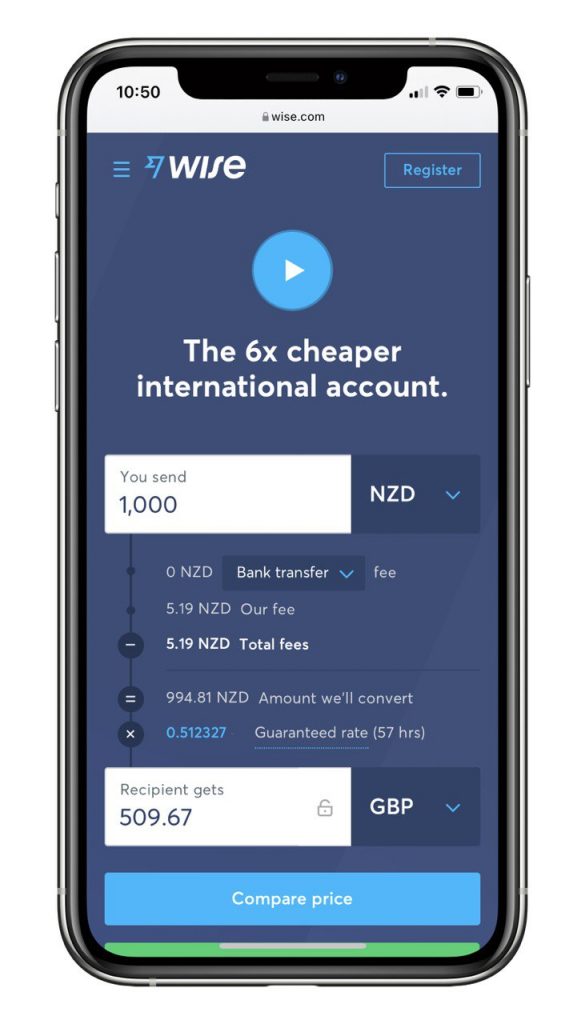

Wise

Wise is among the cheapest and fastest currency transfer services out there. They also offer a multi-currency Debit Mastercard (with very low fees!) which is handy for overseas travel.

Flick

Flick is one of the cheapest electricity providers in New Zealand.

Special Offer: Sign up to Flick using this link and we will both receive $50 credit towards our electricity bills.