Have you signed up to Sharesies or Hatch but are not sure what you’re doing? Or maybe all your friends and family are into investing in shares and you don’t know what the fuss about? Or perhaps you simply want to get started in investing in shares and not sure how? If so, that’s all good – we’re all beginners at some point in our lives. And hopefully this articles serves to help you out.

This beginner’s guide to shares comprehensively covers all the basics you need to know including what shares are, how you buy them, the fees you need to look out for, how to pick which companies to invest in, and the risks of investing. So grab a nice beverage, find a comfortable spot, and prepare to absorb some really good info!

101 articles:

– Shares 101 – How to buy shares, which companies to pick, and more (this article)

– Bonds 101 – 5 things to know about investing in bonds

– Funds 101 – What’s the difference between an Index Fund, ETF, and more?

– KiwiSaver 101 – How does KiwiSaver fit into your investment portfolio?

– Cryptocurrency 101 – Is it investing or gambling?

This article covers:

1. What are shares and why would you invest in them?

2. What is the sharemarket?

3. How do you buy shares and what are the fees?

4. Which company’s shares should I buy?

5. What are the risks of investing in shares?

1. What are shares and why would you invest in them?

Shares, also commonly known as stocks or equities, represent a unit of ownership in a company. When you buy shares in a company, you become a part owner of that company! Owning a slice of a company can give you benefits such as:

- Capital gains – If the company you own does well, their shares could go up in price. If you sell your shares for a higher price than what you bought them at, you’ll make a profit (known as a capital gain).

- Dividends – Companies may distribute out a portion of their profits to shareholders, usually 2 or 4 times a year. This distribution is known as a dividend. Not all companies pay dividends – these companies may instead reinvest their profits to further grow the business, or perhaps they’re not profitable enough to pay a dividend.

- You can brag to your friends that you’re the owner of some awesome companies.

Shares are a great way to participate in the fruits of owning a business, without actually having to run a business. The companies you own shares in aren’t going to ask you to do work for them like cleaning their toilets. And unlike owning a rental property, you don’t have to advertise for tenants or chip in for maintenance. Shares are a way to passively grow your wealth and generate income – utilising a company’s management, employees, and assets to work and earn money for YOU, the shareholder.

You don’t have to be rich to invest in shares. A number of investing services in New Zealand allow you to get started with less than $100. While investing just $100 probably won’t grow into a life changing amount of money, it’s a starting point to learn about shares, and could also be the start of a habit of investing small amounts regularly – which can grow to a large amount over time.

2. What is the sharemarket?

A sharemarket is a place for the public to buy and sell shares of companies listed on the market. When you buy shares on the sharemarket, you are buying them from another shareholder who is selling those shares, rather than from the company itself. When you sell shares, you’re selling them to another shareholder.

So why do companies list their shares on the sharemarket for the public to buy and sell? Here are a few reasons:

- For liquidity – If a company isn’t listed on a sharemarket, it can be hard for that company’s shareholders to sell the shares of that company – imagine trying to sell off some old furniture without having services like Trade Me or Facebook! Listing the company makes it much easier for shareholders to sell their investment, as it opens up trading of those shares to the public. In addition, having this greater level of liquidity (ability to buy and sell an investment) can attract more people to invest in the company.

- To get a higher profile – Listing a company can result in more visibility, media attention, and credibility for that company.

- To raise capital – If a company needs more capital (e.g. money to expand their business or pay back debt), they can raise funds more easily if they’re listed on the sharemarket, given the larger audience of investors they can reach.

There are lots of sharemarkets around the world such as the:

- NZX – Based in New Zealand, our domestic sharemarket.

- ASX – Australia’s sharemarket.

- NYSE, Nasdaq – Two of the largest markets based in the United States.

Most listed companies will list their shares for trading on their home sharemarket. Some companies list on multiple sharemarkets – for example, New Zealand has several “dual-listed” companies who list on both the NZX and ASX (like a2 Milk, Spark, and Air New Zealand). Some companies list exclusively on foreign markets, for example Xero, a NZ based company who are listed on the ASX.

Does the sharemarket have every company?

Not all companies are listed on a sharemarket – in fact most companies aren’t. These companies either have other ownership structures (e.g. family or privately owned), or are too small or have no desire to meet the costs of listing on a sharemarket. So if you’re looking to buy shares in Foodstuffs (think Pak’nSave and New World supermarkets) to cash in on their booming toilet paper sales, you’re out of luck. Fortunately there are plenty of other great listed companies to choose from.

3. How do you buy shares and what are the fees?

To buy and sell the shares of a company listed on a sharemarket, you will need the services of a broker. Brokers buy and sell shares on the sharemarket on behalf of all their customers, and handle a lot of the admin work involved with trading on the sharemarket like settling your transactions.

Different brokers allow you to buy and sell shares on different sharemarkets. Here are some popular brokers that New Zealanders use:

- Sharesies – Allows you to buy and sell shares on the NZX, ASX, and US markets.

- Hatch – US markets only.

- Stake – US markets only.

- ASB Securities – Offers NZX, ASX, US, UK, and Canadian markets.

- Jarden Direct – Offers NZX, ASX, US, and UK markets.

These are all online brokers which you can use from the comfort of your own home, and even while sitting on the toilet if you wish. There’s no need to fill in and post any paper forms, or make phone calls to a financial adviser to sign up and make an investment. All it takes to get started is to visit the broker’s website and sign up for an account.

It doesn’t require much money to get started with these brokers either. Sharesies is particularly beginner friendly with no minimum investment amount, allowing you to invest with just a cent! Lastly, none of these brokers require an ongoing commitment to invest further amounts, and you can withdraw your money at any time if you decide that your broker isn’t right for you.

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

Other investment services you may have heard of like InvestNow, and Kernel aren’t brokers, as they don’t allow you to buy or sell shares through the sharemarket. They offer a different service which I’ll mention below.

What are the fees?

There are a couple of important fees you need to be aware of when buying or selling shares:

Brokerage

Brokerage fees are charged for every transaction you make to buy or sell shares. Here’s a brief overview of the fees for popular NZ brokers (I don’t cover the entire brokerage fee structure for each broker, but you can click on the links below to get more info):

- Sharesies – 0.50% of the transaction value, for transactions up to $3,000 in size

- Hatch – $3 USD per transaction

- Stake – No brokerage fees

- ASB Securities – Starting from $15 for transactions up to $1,000

- Jarden Direct – Starting from $29.90 for transactions up to $15,000

Foreign exchange

To buy shares on international sharemarkets, you’ll need to change your money from New Zealand Dollars to the currency of the market you want to invest in e.g. Australian or US Dollars. The same applies after you sell those shares – you’ll have to convert your money back to NZD. To change your currency, brokers will charge a foreign exchange fee. The foreign exchange fees for each broker are:

- Sharesies – 0.40%

- Hatch – 0.50%

- Stake – 1%

- ASB Securities – ~1% margin on the exchange rate

- Jarden Direct – ~1% margin on the exchange rate

These fees will not apply if you have NZD and are investing domestically on the NZX.

Further Reading:

– Buying shares on the NZX – Sharesies vs ASB Securities and Jarden Direct

– Buying shares in the USA – Sharesies vs Hatch vs Stake

4. Which company’s shares should I buy?

This might be the hardest part of getting started with shares. With tens of thousands of companies listed on the world’s sharemarkets how do you pick what to invest in?

Finding the best companies to invest in is often compared to looking for a needle in a haystack. Fortunately there is an easier way:

The easier way

The easier way to invest in shares is to buy a fund. These are investment products that can contain the shares of many different companies. Examples are:

- Smartshares S&P/NZX 50 ETF – This fund contains the shares of the 50 largest companies listed on the NZX. You can buy this fund through Sharesies, ASB Securities, Jarden Direct, or InvestNow (a platform which offers over 100 funds to invest in).

- Smartshares Total World ETF – Contains the shares of over 8,000 companies from all over the world including the US, South America, Europe, and Asia. You can buy this fund through Sharesies, ASB Securities, Jarden Direct, or InvestNow.

- Vanguard S&P 500 ETF – Contains the shares of ~500 of the largest companies listed in the US. You can buy this fund through Sharesies, Hatch, Stake, ASB Securities, or Jarden Direct.

- Kernel Kensho Electric Vehicle Innovation Fund – Contains the shares of 44 companies related to the electric vehicle industry. You can buy this fund through Kernel (a fund manager who offer a small range of 11 funds).

Funds do the work of picking companies for you. There is no need for you to research companies, guess which industries will perform the best, or worry about getting your selections wrong.

Further Reading:

– Investing in individual companies vs funds – What’s better?

– How to choose which fund to invest in on InvestNow and Sharesies

– Funds 101 – What’s the difference between an Index Fund, ETF, and more?

The harder way

And then there is the hard way – if you choose not to invest in funds, you will need to pick companies yourself. There’s nothing wrong with this approach, and it’s certainly doable. In fact you could find it enjoyable, but it is definitely more challenging. So here’s how I would approach the challenge:

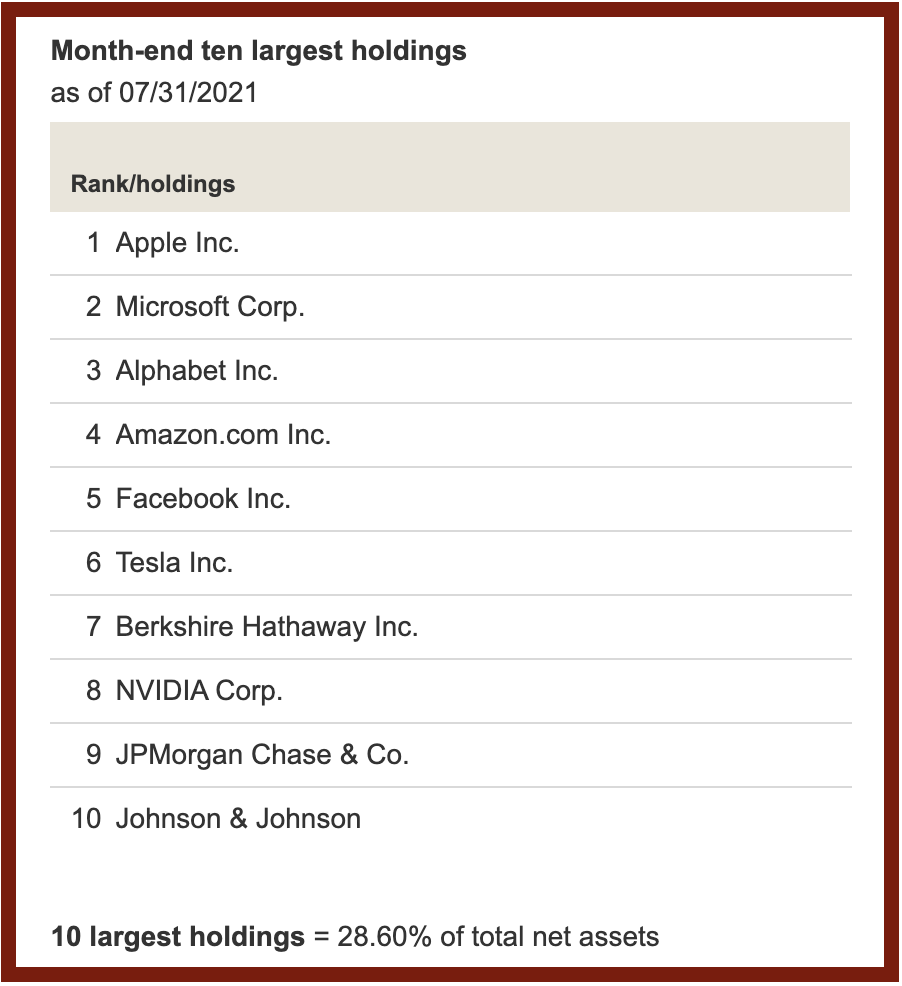

- You can get ideas of what companies to invest in through reading the business news, seeing what companies funds are invested in, or thinking about what types of businesses will do well in the future (e.g. Will retirement companies do well with an ageing population? Will electric vehicle companies do well with the move away from petrol powered cars?). Some brokers may produce company research or blogs which can also be a source of ideas.

- Next further research a company by understanding how it works, how they make money, and what their plans are for the future. You could start by reading a company’s annual reports. Keep it simple and stick to what you know – if you don’t understand a company, there’s many more you can move on to.

- Do your own analysis on the company – What are the company’s strengths and weaknesses? What opportunities does the company have to grow, and what risks do they face? Do you believe in the company’s future?

- Look at the company’s financial metrics. How does their financial position compare with other companies in the same sector? E.g. What are their debt levels and dividend payout levels compared to similar companies?

After all the above, you should have a good idea of whether that particular company is a business you’d like to own. Overall it should be a company that you understand, a company that you think will perform well long-term, and a company in a solid financial position.

Further Reading:

– Due diligence on shares – How I evaluate companies before investing

Examples of not so good strategies to choose companies

These strategies should be avoided when picking companies to invest in:

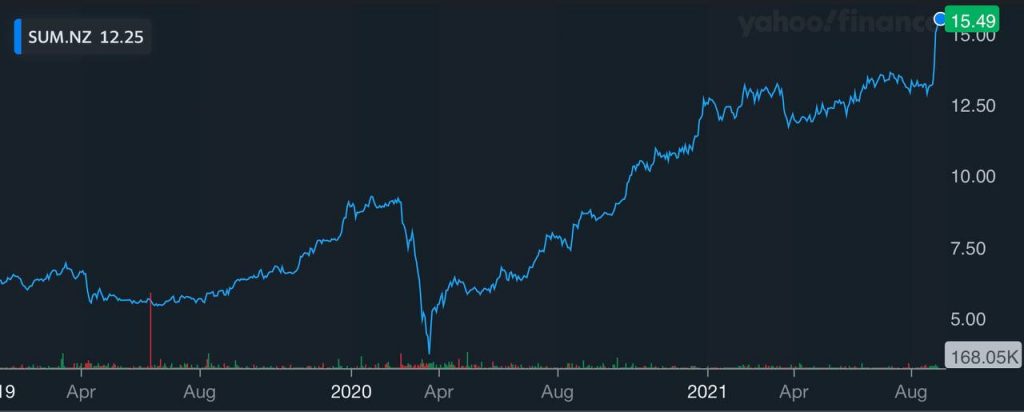

- Buying shares in a company just because the share price has performed well recently. The past performance of a share is no guarantee it will perform the same way in the future.

- Buying shares just because people on social media (e.g. Facebook Groups or Reddit) are investing in that particular company. Social media is a great place to obtain ideas, but the discussions are not always rational or well thought out.

- Buying shares purely based on the fact they pay a high dividend (I got burnt badly by doing this before). These dividends might not be sustainable and companies can reduce or cancel them at any time.

- Buying shares just because the price went down recently, so it’s a chance to get them at a discounted price. Yes, it’s a great idea to buy shares while they’re on sale, but cheap doesn’t necessarily mean good. The shares may have gone down in price for a good reason, such as the company losing customers.

- Buying shares just because your broker advertises a new investment opportunity to you. These aren’t necessarily bad investments – but you don’t have to say yes to all the opportunities that come your way.

5. What are the risks of investing in shares?

Investing in shares involves risk. Here are the key risks and some strategies to mitigate them.

Your company performs poorly

A company you invest in could perform badly. Take Sky TV for example, a company that has struggled to keep up with streaming services like Netflix, and as a result has lost subscribers and profitability.

A company you invest in could also face some sort of external change such as environmental or political changes. For example, customer numbers for airlines and tourism companies have been slashed by the COVID-19 pandemic, rather than poor performance by the companies themselves.

The above factors could result in the share price of your company going down, as companies are generally worth less if their ability to grow and make a profit falls. If you sell your shares at a lower price than what you bought them at, you’ll make a capital loss.

Companies have the right to cut or cancel their dividend payments at any time, usually as a result of poor performance or business uncertainty. For example, Kiwi Property Group (who own properties like Sylvia Park) cancelled one of their dividend payments in 2020, as they were worried about the impact COVID-19 would have on their business. This would result in you making less than expected income from your shares.

While businesses listed on the sharemarket are mostly resilient and adaptable, in the worst case the company you invest in could go bust. This would likely result in you losing all the money you invested into those shares as those shares become worthless.

Volatility

A company’s share price can change everyday. Sometimes there is a clear reason for share prices to move – a company could announce strong financial results resulting in the share price going up, or pessimism over the economy (e.g. due to a pandemic) could result in share prices falling.

Sometimes there’s no apparent reason for a company’s share price to change – that’s just how the markets work. Share price volatility can be very uncomfortable for investors, especially when prices fall. Falling share prices can incite fear and tempt investors to sell their shares at a loss with the intention of trying to avoid further losses. Volatility is unavoidable – not even good companies are immune from the ups and downs of the sharemarket.

Strategies for mitigating risk

Fortunately, there are a few strategies than you can use to reduce the risks of investing in shares:

Have a long-term investment timeframe

While share prices are volatile in the short-term, they have always trended upwards in the long-term. So avoid thinking of shares as get rich quick scheme, or as a tool for short-term investing – you’re just as likely to lose money in the short-term as you are to make money, so keep your short-term money in less volatile investments like bank deposits.

Buying and holding your shares for the long-term maximises the your ability to ride out any volatility (giving time for share prices to bounce back if they do go down), and simply view the volatility as a distraction. In fact, good investors see price drops as an opportunity, as they give you the chance to buy more shares at a lower price.

And remember if the price of your shares go down, you don’t lose any money unless you sell those shares at the lower price. For example, if you bought some shares at a price of $2, then they drop to a price of $1.80, followed by a rise back up to $2, you wouldn’t have lost any money unless you sold those shares when they were at a price of $1.80.

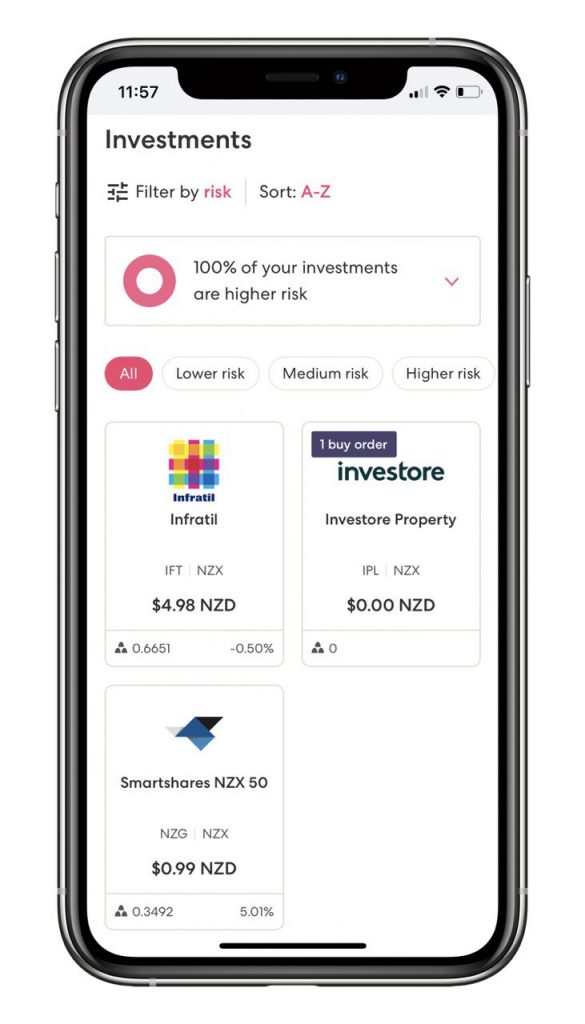

Diversifying your share investments

Diversification involves investing in the shares of several different companies, so that if one company performs poorly or goes bust, you won’t lose all your money. Investing in companies in different industries or different countries is a good way to start diversifying – that way if one industry or one country’s economy doesn’t do too well, chances are the other companies you’ve invested in won’t be so worse off.

Investing in funds is also a great way to achieve diversification (particularly broad market funds like NZX 50, S&P 500, or Total World funds), as they can contain the shares of many (potentially a few thousand!) companies across different industries.

Diversifying doesn’t require you to get your hands on every single company out there. A well thought-out portfolio of several high quality companies should be sufficient, and will probably work better than taking a punt on lots and lots of less thought-out company selections.

Dollar cost averaging

The prospect of your shares falling in value puts a lot of people off investing – what if you buy some shares and the price falls shortly after? Dollar cost averaging is a strategy where you spread your investments out by investing a regular amount of money at regular intervals (as opposed to a lump sum investment where you make a one-off investment into some shares). An example could be splitting a $1,000 investment by investing $100 every month over 10 months.

By spreading your investments out over a period of time, you reduce the risk of ending up investing your money all at once when the share price is high. For example, if you first buy into a company at a price of $2 per share, and next month the price drops to $1.80, your subsequent investment into the company will be at a lower price – therefore lowering the average price you’ve paid for that company’s shares. This strategy removes the need to “time the market” and trying to predict the perfect time to buy your shares.

Conclusion

Shares are an amazing way to grow your wealth as they allow you to passively participate in the successes of a company. The sharemarkets are super accessible too, as everything is doable online, and only requires a few bucks, a little bit of time, and willingness to learn to get started. Anyone can do it!

There can be a lot of information to take in when starting to invest in shares, but hopefully this article has helped you in your journey. And once you’re comfortable with the basics and ready to learn more, Money King NZ is here to help with articles on other topics surrounding share investing:

- Tax – What taxes do you need to pay on your investments in New Zealand?

- Dividends – Dealing with Dividends – 5 things to know about them

- Share prices – Prices don’t matter! 4 things to know about share prices (part 1)

- Corporate actions – Rights issues, share buybacks, and acquisitions – 5 things to know about Corporate Actions

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.