I bet most people reading this are indirectly invested in bonds (often referred to as “Fixed Interest” investments) – either through their KiwiSaver, or through a fund on InvestNow or Sharesies. However, I also bet that almost none of you have invested in bonds directly – i.e. have bought an individual bond issue.

Investing in bonds is an often overlooked part of investing, as self-directed investors typically gravitate towards shares, funds, and peer to peer lending. This isn’t surprising as investing in bonds is relatively complicated and less accessible, and this is exemplified in the scarce resources out there about bond investing. As a result I really struggled to grasp several concepts when starting to invest in individual bonds.

So here’s five things to know about investing in bonds. Even if you aren’t interested in investing directly in individual bonds, I think you’ll still find this information useful to better understand how the fixed interest portion of your KiwiSaver/fund works. Note the ideas discussed below are applicable to corporate (company issued) bonds, but may differ for government issued bonds.

101 articles:

– Shares 101 – How to buy shares, which companies to pick, and more

– Bonds 101 – 5 things to know about investing in bonds (this article)

– Funds 101 – What’s the difference between an Index Fund, ETF, and more?

– KiwiSaver 101 – How does KiwiSaver fit into your investment portfolio?

– Cryptocurrency 101 – Is it investing or gambling?

This article covers:

1. What are bonds?

2. What are the Terms (rules) of a bond issue?

3. How can I buy and sell bonds?

4. How does the price and yield of a bond change?

5. What are the risks of investing in bonds?

1. What are bonds?

Companies and governments often ask investors to lend money to them. In return, investors who lend money to them are issued bonds. A bond entitles the bondholder to regular interest payments at a fixed interest rate, and for their money to be paid back at some point in the future.

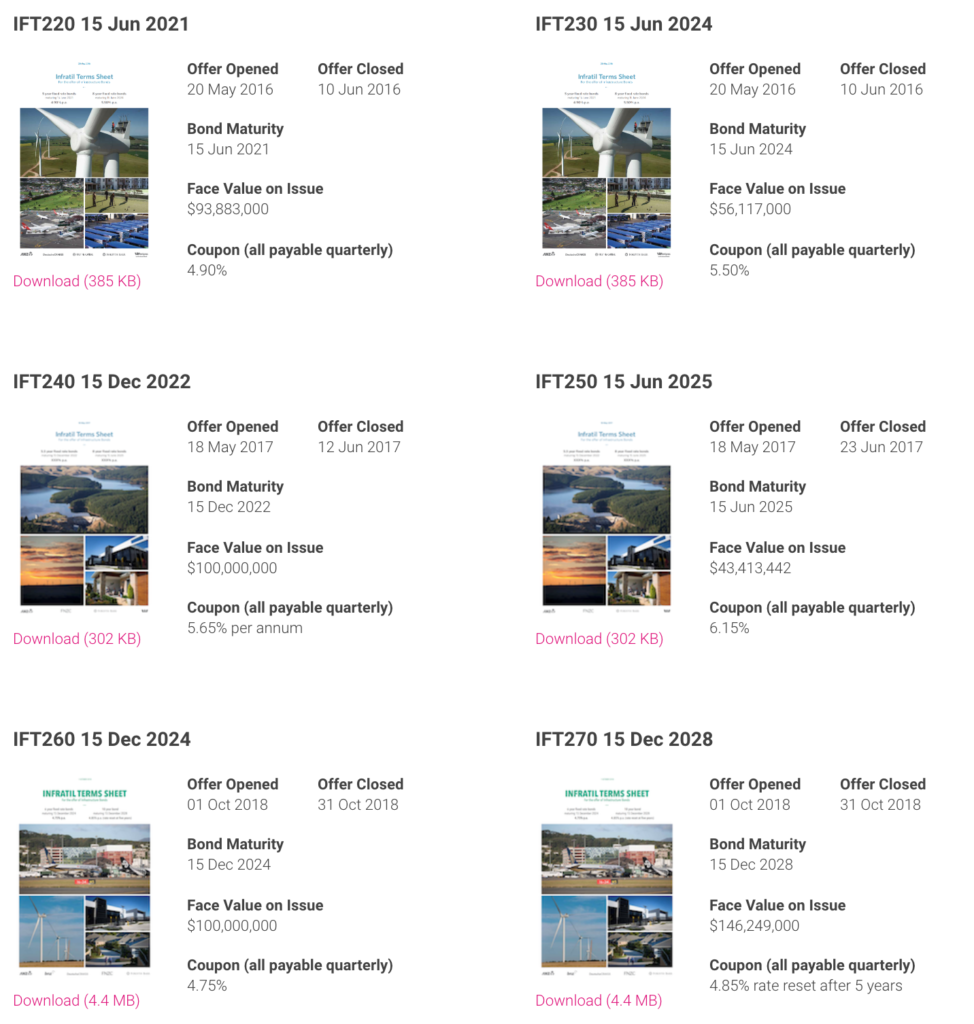

A company can issue multiple sets of bonds, each with different interest rates and terms. For example, Infratil currently have 11 different bond issues!

Role of bonds in an investment portfolio

Bonds are considered relatively low risk and conservative investments. Imagine a company whose profits fall during an economic downturn – that company’s share price will probably fall, and it may have to cut its dividends. Meanwhile, that company’s bonds will continue to pay a fixed amount of interest, regardless of the company’s profitability and economic conditions.

Bonds provide stability to one’s investment portfolio, and may even increase in value during economic downturns as investors seek safer investments when sharemarkets fall. Bonds also offer a higher returns than bank term deposits, but with the flexibility to sell the investment at any time. However, because of their stability, bonds do not have the potential to grow as much as shares. Overall they are best suited for those with a medium-term investment timeframe.

2. What are the Terms (rules) of a bond issue?

Different bond issues will have different terms, or rules, which determine exactly how the bond will work and behave. These are indicated by each bond issue’s terms sheet.

Some key components of a bond’s terms sheet are:

- Offer amount – How many dollars worth of bonds are being offered under this bond issue

- Face value/issue price – The value of each bond/unit being issued (should always be $1)

- Minimum investment – Almost always $5,000 for corporate bonds

- Term – How long the bond is being issued for before being repaid to investors.

- Maturity date – The end date of the bond issue, when the money will be repaid to investors. On rare occasions bond issues are perpetual (perpetual bonds), meaning they do not have a maturity date – instead they can be repaid anytime at the issuer’s discretion.

- Interest rate – The interest rate a bondholder will receive, also known as the bond’s coupon

- Interest payment dates and frequency – The dates on which interest will be paid to the bondholder. Usually once every quarter, but sometimes twice a year.

- Ranking – The priority of the debt. Bonds ranked as “Senior” have priority over bonds ranked as “Subordinated”. This means if the issuer went bankrupt, Senior bondholders would be repaid first before Subordinated bondholders get any repayment.

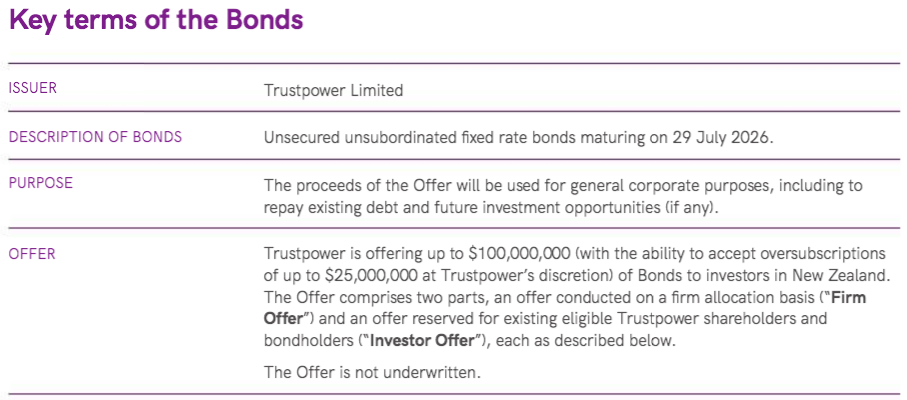

- Credit rating – A rating of the bond issue’s creditworthiness by an independent agency. Not all bond issues are rated.

A small number of bond issues can have extra rules and features. It’s advisable to read a bond issue’s Terms Sheet carefully to understand these features. Examples of these extra rules are:

- Reset date – Some bonds will have their interest rate “reset” to a new rate at some point during the term

- Early redemption – An option for the bond issuer to repay the bonds before the maturity date

- Conversion to shares – An option to have the bonds converted into shares in the company (convertible bonds)

3. How can I buy and sell bonds?

These are the ways you can obtain and dispose of individual bonds:

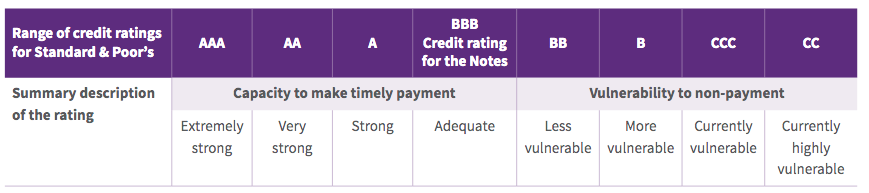

New issues

A company issuing new bonds will offer them through brokers. You will first need to become a client of a broker such as Direct Broking and ASB Securities. The broker will advertise any new bond issues, and those wanting to invest need to call the broker to request a firm allocation of the bonds. Once your allocation is confirmed, you’ll fill in an application form and pay for the bonds. No brokerage fees are charged to the investor.

Holding to maturity

You can hold a bond until its maturity date, when the money you invested will be returned to you (without any brokerage costs). Occasionally the company issuing the bond will offer you the opportunity to reinvest that money into a new bond issue.

Secondary market

Corporate bond issues in New Zealand are almost always listed on the NZDX (NZ Debt Exchange). This allows investors to buy and sell bonds from each other, including selling them at anytime before their maturity date. Similar to shares, you’ll need to go through a broker (E.g. Direct Broking) to buy and sell bonds on the NZDX.

The brokerage fee to buy or sell bonds starts from around $35. This is expensive so it’s probably best to stick to buying new issues, and holding the bonds to maturity where possible.

4. How does the price and yield of a bond change?

Bond prices can change on the secondary market

When bonds are first issued and listed on the secondary market (the NZDX), they have a value of $1 per unit. Similar to shares, their market price can go up or down depending on the demand for that bond. Let’s use a bond issued with an interest rate of 4% for example:

- A bond’s price can go up – If the bond becomes attractive compared to other investments. E.g. interest rates go down, resulting in rates for term deposits and new bond issues to go down, making our 4% bond more attractive and more in demand. This would allow you to sell the bond on the NZDX for a capital gain.

- A bond’s price can go down – If the bond becomes unattractive compared to other investments. E.g. interest rates go up, making term deposits and new bond issues more attractive than our 4% bond. If you sold the bond on the NZDX, you’d make a loss.

If you are holding a bond to maturity you don’t need to worry about its market price, because at maturity the bond will be repaid to you at face value ($1 per unit). So even if you buy a bond on the NZDX for $0.95 per bond, you’ll still be repaid $1 at maturity. Likewise, if you bought a bond for $1.05, you’ll only be repaid $1 at maturity.

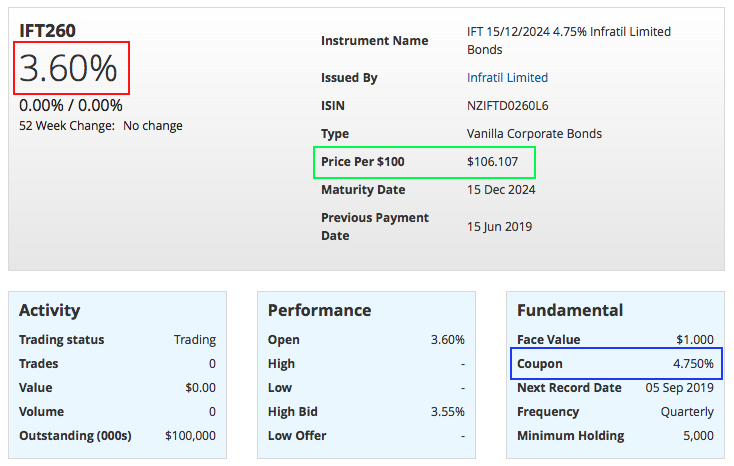

A bond’s yield changes when its price changes

A bond’s yield is the actual annual rate of return you’ll make when buying that bond from the secondary market. Let’s say a bond with an interest rate of 4% is bought for $1.05 per bond. Your yield will be less than that 4% (3.81% in this example) interest rate because you’ve paid a 5% premium in order to obtain these bonds. Likewise if you paid $0.95 per bond, your yield will be higher than 4% (4.21%) because you acquired the bonds at a discount. Therefore:

- if the price goes up, the yield goes down

- if the price goes down, its yield increases

To further complicate things we must consider the fact that when a bond is repaid at maturity, the bondholder is repaid $1 per bond even if they paid a premium or discount on the bond. If you intend to buy shares off the secondary market and hold it to maturity, then this premium or discount must be factored into your total return. This calculation is known as the Yield to Maturity. Let’s assume our example 4% bond matures in 5 years time:

- if we pay $1.05 per bond, our yield to maturity is 2.91% – lower than the yield of 3.81%, because we have to factor in the 5 cents per bond that we lose when the bond is repaid.

- if we pay $0.95 per bond, our yield to maturity is 5.16% – higher than the yield of 4.21%, because we gain 5 cents per bond when it’s repaid.

You can check each bond issue’s price and yield to maturity on the NZX website, or calculate yields yourself using this bond yield calculator. The screenshot below shows the details of the IFT260 bond issued by Infratil on the NZX website. The red box shows the Yield to Maturity (at 3.6%), the green box shows the market price you’ll pay per $100 of bonds ($106.107), and the blue box show’s the bond’s original interest rate (4.75%).

5. What are the risks of investing in bonds?

Even though bonds are considered conservative investments, there are risks associated with investing in bonds (as with any other investment). The key risks are:

Credit risk

The bond issuer might get into financial trouble and not be able to pay you back some or all of your money, or miss interest payments (known as defaulting). Bonds with lower credit ratings are more likely to default, but in return offer higher interest rates to investors.

Interest rate risk

Interest rates could go up, making other investments such as term deposits or newer bond issues more attractive (and making your bonds less attractive). This means you pay the opportunity cost of not having your money in the more attractive investment. This also means if you need to sell your bonds on the secondary market, you’ll have to sell it at below face value.

Liquidity risk

You may not be able to sell your bonds on the secondary market when you need to if there is a lack of people willing to buy the bond. Your might have to sell your bonds at a lower price than you want in order to attract buyers.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.