Peer to Peer (P2P) lending is a relatively new type of investment, launching in New Zealand in 2014. It involves investors lending money to borrowers (who are everyday people and businesses) through a P2P lending platform. In return, borrowers pay back the loan along with interest, over a period of time.

The key concept of P2P platforms is disintermediation – cutting out banks as the middleman in the lending world. Traditionally people deposit money into banks. The bank then lends the money out to borrowers, and in return, the bank pays the depositor interest. P2P lending platforms connect depositors (who in this case are lenders) directly to borrowers, which results in a number of implications that we’ll be looking at.

In New Zealand, there are seven P2P lending platforms, the most popular being Harmoney, Lending Crowd, and Squirrel Money (and I have personally invested with these three since their early days). Here are five things you should know about P2P lending before you invest.

Peer to Peer Lending platform reviews:

– Harmoney Review (closed to new investors)

– Lending Crowd Review

– Squirrel Review

This article covers:

1. P2P Lending is riskier than bank deposits

2. You can achieve much higher returns than bank deposits

3. Don’t forget about the fees

4. Prepare to have some of your money locked up for 3-5 years

5. P2P lending is more hands-on than other investments

1. P2P Lending is riskier than bank deposits

The biggest risk one faces when lending money is that the borrower doesn’t pay you back (“defaulting” on the loan). They may lose their job, face some other kind of financial hardship, or simply do a runner. When you deposit your money into the bank, the bank takes on the default risk, and therefore they lose money if a borrower defaults on their loan. Banks do not directly pass on losses from loan defaults to depositors.

With P2P lending, lenders directly expose their money to the risk of loan defaults. Your money is lent directly to borrowers (as opposed to via a bank), so if they default, you lose your money. Additionally, P2P lending platforms in New Zealand have yet to go through a financial crisis, so it is not yet known how P2P investments will perform when times get though.

There are a couple of strategies employed by P2P lending platforms to mitigate the risk to an investor’s money:

Fractionalisation & risk grades

With fractionalisation, each loan is split into $25 or $50 lots, called “notes”. Investors only need to invest in one “note”, as opposed to funding an entire loan. Because of this, you can spread your money across lots of different loans. So if one of your loans defaults, you won’t lose all of your money – your losses are limited to the amount you invested into the notes of that loan. This strategy is used by Lending Crowd.

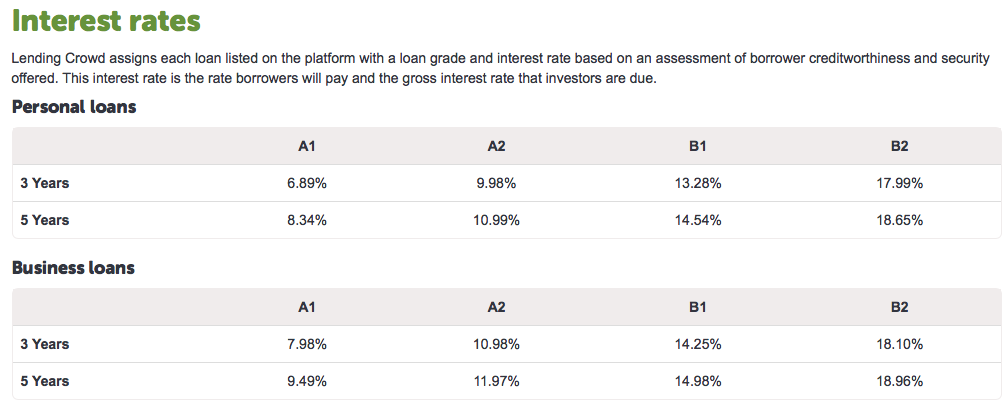

These P2P lending platforms also assign a risk grade to each loan. This is based on the borrower’s creditworthiness and how likely they are to default on their loan. Riskier grades pay a higher interest rate, but have a higher likelihood of default. Risk grades allows lenders to pick what loans they want to invest in based on their risk appetite.

In addition, some of Lending Crowd’s loans are secured against a motor vehicle and/or property, which provides a little more protection if a loan defaults.

Reserve funds

This is a pool of money, which is used in the case when a loan defaults. When an investor has a loan that defaults, the money in the reserve fund is used to fully compensate them for the loss (as long as there’s enough money available in the fund). Borrowers contribute to these funds, with a portion of their interest payments being paid into the fund. Although this strategy provides more protection to investors than fractionalisation, the risk here is that the reserve fund may run out of money (e.g. if there’s a financial crisis which results in many loans defaulting). This strategy is used by Squirrel Money.

2. You can achieve much higher returns than bank deposits

You’re the one lending the money, and taking the risk, so you’re the one who should get the returns.

Harmoney

With higher risk comes the potential for higher returns. Because there is no middleman (i.e. a bank) between lenders and borrowers to take a huge cut of the interest payments, lenders can earn a much higher interest rate than with traditional bank deposits. At current rates, your P2P lending returns could potentially be 2-3x higher than a term deposit with a major bank.

- Lending Crowd – the average return is 11.95%, as at June 2018. I haven’t been able to find more recent data.

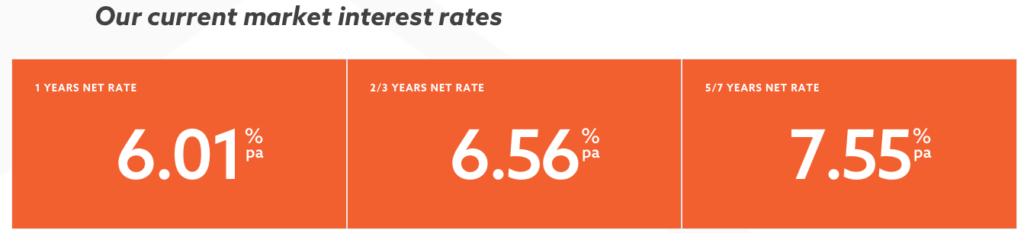

- Squirrel Money – The interest rates that investors can earn ranges from 5.5% to 7.5%, depending on the duration of the loan and demand.

3. Don’t forget about the fees

P2P platforms make money in two main ways. One is charging various fees to borrowers, such as loan establishment fees. The other is charging fees to investors by taking a cut of the interest you earn:

- Lending Crowd – Lending Crowd takes a 10% cut of the interest you earn for “standard loans”, and 25% for “referred loans” (loans that came to Lending Crowd through partner and referral channels).

- Squirrel Money – Squirrel Money does not charge any additional fee over the advertised interest rate that you earn. The advertised interest rate already factors in any fees, which get paid to Squirrel Money directly by the borrower when they make their loan repayments.

Investors should factor in these fees when deciding whether P2P investing is worth it for them. For me, I stopped investing with Harmoney in June 2016 when they raised their fees to the current level of 20%. I felt that giving Harmoney a 20% share of my returns was way too much, given that my capital was at risk.

4. Prepare to have some of your money locked up for 3-5 years

The loans offered on P2P lending platforms are usually for terms of 3 or 5 years. This means any money you invest into these loans can be locked up for this time period. While Squirrel Money has a secondary market, where you can sell your loan investment to another person, investors in Lending Crowd have no way of withdrawing their money early. They must wait for their loans to be repaid by the borrowers.

Fortunately, this feature of P2P lending isn’t as bad as it sounds. Firstly, the loans are repaid on a principal + interest basis, meaning every month the borrower pays interest on the money they borrowed, as well as some of the loan principal (the money they borrowed in the first place). Secondly, borrowers can (and do tend to) repay their loans early, or make additional repayments at any time.

These two factors mean that not all of your money will be locked up for 3-5 years, as you will receive a stream of repayments each month – which can then be reinvested in more loans or used elsewhere. Just don’t rely on having your money freely available to withdraw – over 3 years after I ceased to invest in Harmoney, I still have money locked into loan investments on the platform.

5. P2P lending is more hands-on than other investments

With bank deposits, you simply put your money into a bank account and it will automatically start earning interest. P2P lending isn’t as simple – after depositing cash into a P2P platform, you still need to invest your money into actual loans (or loan notes). In other words, you need to match your money with someone who wants to borrow it. Squirrel helps out with this by offering auto-invest functionality, which can automatically allocate investor funds into loans.

There is another issue that P2P lending investors may face – that is a shortage of loans to invest in. With lower and lower interest rates offered by bank deposits, and P2P lending becoming more mainstream, there often isn’t enough people borrowing money from these platforms to satisfy the increasing demand from investors. Many investors have expressed frustration at the lack of loans to invest in, however our P2P platforms have promised to address this by trying to attract more borrowers.

Getting a loan to invest in is almost as hard as winning a small prize in lotto. Really a waste of time.

Post on Sharetrader.co.nz about P2P lending

Unfortunately, your money in P2P platforms does not earn any interest while it is waiting to be invested into a loan. Therefore, investors need to keep an eye on their investment to ensure their non-interest earning balances don’t build up too significantly, particularly with a constant stream of loan repayments entering your account every month.

Is Peer to Peer Lending right for you?

If you have:

- A higher appetite for risk

- A desire for higher returns than bank deposits

- Money you don’t need for a few years

- A willingness to be a little more hands-on with your investment,

then P2P lending could be a useful way to diversify your portfolio beyond traditional bank deposits. I personally use P2P lending as a simple way to achieve high but relatively stable returns, and you can check my Peer to Peer Lending platform reviews below:

Peer to Peer Lending platform reviews:

– Harmoney Review (closed to new investors)

– Lending Crowd Review

– Squirrel Review

But maybe you’re more interested in hands-off investments? If so, investing in funds on InvestNow or Sharesies may be more suitable for you. Or after a safer, shorter-term investment? It may be more appropriate to stick with bank deposits.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.