Milford is an Auckland based fund manager offering a selection of actively managed KiwiSaver and non-KiwiSaver funds. Despite the rise in low cost, passively managed index funds over recent years, Milford remains a popular choice among investors, being the 7th largest KiwiSaver provider in the world with close to $5 billion under management. This review takes a look into Milford’s funds, their fees, and performance. Could their funds be the superior option?

This article covers:

1. What’s on offer?

2. Fees

3. Past performance

4. Other considerations

5. Milford vs competing services

1. What’s on offer

Background

Milford is a fund manager offering 12 funds:

- 6 of these funds are available in non-KiwiSaver form only. Non-KiwiSaver funds can be withdrawn from at any time.

- 1 fund is available in KiwiSaver form only. You can only invest in this fund as part of Milford’s KiwiSaver scheme, and the usual KiwiSaver restrictions apply when withdrawing from the fund.

- 5 funds are available in both non-KiwiSaver and KiwiSaver form. You can choose whether to invest in these funds outside of KiwiSaver, or as part of Milford’s KiwiSaver scheme.

Further Reading:

– KiwiSaver 101 – How does KiwiSaver fit into your investment portfolio?

All of Milford’s funds are actively managed. This means each of their funds have a team of Portfolio Managers and Investment Analysts to research, select, and invest in assets they think will perform well. Here’s what Milford says about their own fund management approach:

As markets change, we constantly re-evaluate our investments to achieve the best outcomes.

We take advantage of investment opportunities as they arise and seek to minimise downside risk when markets are less favourable.

We interact with hundreds of companies each year to assess where your money should and shouldn’t be invested.

We research investments to identify potential opportunities others may not see.

Milford’s active management approach

With their active management approach, Milford’s funds seek to achieve one of the following two objectives:

- Most of Milford’s funds aim to outperform (beat) the market. For example, if global sharemarkets deliver a return of 12%, Milford’s Global Equity Fund will aim to beat that 12% return.

- Some of Milford’s funds target a certain percentage return. For example, Milford’s Active Growth Fund targets a return of 10% per year after fees.

An active management approach can be contrasted with passive management – the approach which index funds use. Passively managed funds invest into the market as a whole (rather than picking individual assets), trying to match the return of the market. For example, if global sharemarkets deliver a return of 12%, a passively managed global shares fund will aim to match that 12% return (with the belief that it’s very hard for active fund managers to consistently beat the market over the long-term).

Funds on offer

Multi Strategy funds

Milford’s Multi Strategy funds invest across multiple asset classes, ranging from the Conservative Fund which has a high allocation to bonds and small allocation to shares, to the Aggressive Fund which is almost entirely invested in shares.

- Conservative Fund – Invests in roughly 20-80 split between shares and bonds/cash. Has a minimum recommended investment timeframe of 3 years.

- Diversified Income Fund* – Invests in a mix of bonds and dividend paying shares with a view to generate income. Aims to deliver a return of 2.5% above the Official Cash Rate (OCR) and has a minimum recommended investment timeframe of 4 years.

- Moderate Fund^ – Invests in roughly 40-60 split between shares and bonds/cash. Has a minimum recommended investment timeframe of 4 years.

- Balanced Fund – Invests in roughly 60-40 split between shares and bonds/cash. Has a minimum recommended investment timeframe of 5 years.

- Active Growth Fund – Invests in a roughly 80-20 split between shares and bonds/cash, including an allocation to private equity. Aims to deliver an average return of 10% per year and has a minimum recommended investment timeframe of 7 years.

- Australian Absolute Growth Fund* – Invests primarily in NZ and Australian shares. Aims to deliver a return of 5% above the OCR and has a minimum recommended investment timeframe of 7 years.

- Aggressive Fund – Invests almost entirely in NZ, Australian, and international shares. Has a minimum recommended investment timeframe of 10 years.

*The Diversified Income and Australian Absolute Growth Funds are not available as part of Milford’s KiwiSaver scheme.

^The Moderate Fund is only available as part of Milford’s KiwiSaver scheme.

The below table shows the target asset allocation for each of their Multi Strategy funds:

| Fund | NZ/Aus shares | Intl. shares | NZ bonds | Intl. bonds | REITs | Cash |

| Conservative | 4% | 9% | 25% | 50% | 5% | 7% |

| Diversified Income | 16.5% | 5% | 10% | 45% | 18.5% | 5% |

| Moderate | 15% | 19% | 15% | 36% | 6% | 9% |

| Balanced | 25% | 29% | 6% | 25% | 7% | 8% |

| Active Growth | 28% | 40% | 2% | 14% | – | 6% |

| Aus. Absolute Growth | 80% | 2.5% | 10% | – | – | 7.5% |

| Aggressive | 25% | 70% | – | – | – | 5% |

Single Sector funds

Milford’s Single Sector funds invest into a single asset class.

- Cash Fund – Invests in NZ cash investments only. Aims to deliver a return above the OCR and has no minimum recommended investment timeframe.

- Trans-Tasman Bond Fund* – Invests in a 50-50 split between New Zealand and Australian bonds. Has a minimum recommended investment timeframe of 3 years.

- Global Corporate Bond Fund* – Invests in international corporate bonds only. Has a minimum recommended investment timeframe of 3 years.

- Global Equity Fund* – Invests in international shares only. Has a minimum recommended investment timeframe of 8 years.

- Trans-Tasman Equity Fund* – Invests in New Zealand and Australian shares only. Has a minimum recommended investment timeframe of 8 years.

*These funds are not available as part of Milford’s KiwiSaver scheme.

Milford also manages the Dynamic Fund which isn’t available to new investors, so won’t be covered further in this review.

Who are these funds best suited for?

Milford’s range of funds is simple, but suit a wide range of investors. Their Multi Strategy funds range from the Conservative fund which suits shorter-term investors, to Growth and Aggressive funds which suit longer-term investors. These funds have investments spread across multiple industries, asset classes, and throughout NZ, Australia, and abroad. This spread is enough to provide a diversified investment portfolio with just one fund! They’re great for hands-off investors – saving you from having to pick multiple funds or individual assets.

Milford’s range of Single Sector funds is more limited, but are still useful if you’re after a specific asset class like international shares, or international corporate bonds.

2. Fees

Fund management fees

Base management fee

The main way Milford makes money is by charging a percentage based management fee on all their funds. These range from 0.20% to 1.35% per annum. This fee is reflected as a tiny deduction in the value of your fund everyday. For example, the Active Growth Fund’s management fee is 1.05%, so the value of that fund would drop by 0.00288% (1.05% divided by 365) on a daily basis to reflect the fee.

Performance fees

In addition to the base management fee, performance fees are charged on 5 of Milford’s funds. These fees are applied on any excess return above each fund’s benchmark. For example, the Active Growth Fund has a benchmark of 10%. If the fund delivers a return higher than that, any profits over that 10% will incur a 15% performance fee (the full methodology they use to calculate performance fees can be found in Milford’s Product Disclosure Statement).

| Fund | Performance fee | When the fee applies |

| Diversified Income | 10% | On any excess return above the OCR + 2.5% |

| Active Growth | 15% | On any excess return above 10% p.a. |

| Australian Absolute Growth | 15% | On any excess return above the OCR + 5% |

| Global Equity | 15% | On any excess return above the market index |

| Trans-Tasman Equity | 15% | On any excess return above the market index |

In addition, the Balanced and Aggressive funds can indirectly incur performance fees, as they may invest in Milford funds that charge performance fees.

Overall fees

The below table shows the combined base management fees and estimated performance fees (with the historical average performance fee in brackets) for each fund:

| Fund | Base fee | Performance fee | Total fee |

| Conservative | 0.95% | n/a | 0.95% |

| Diversified Income | 0.65% | 0.25% (0.37%) | 0.90% (1.02%) |

| Moderate | 1.05% | 0.01% | 1.06% |

| Balanced | 1.05% | 0.02% (0.36%) | 1.07% (1.41%) |

| Active Growth | 1.05% | 0.20% (0.56%) | 1.25% (1.61%) |

| Aus. Absolute Growth | 1.05% | 0.25% (0.55%) | 1.30% (1.60%) |

| Aggressive | 1.15% | 0.00% (0.15%) | 1.15% (1.30%) |

| Cash | 0.20% | n/a | 0.20% |

| Trans-Tasman Bond | 0.65% | n/a | 0.65% |

| Global Corp. Bond | 0.85% | n/a | 0.85% |

| Global Equity | 1.35% | 0.00%/1.01% | 1.35% (2.36%) |

| Trans-Tasman Equity | 1.05% | 0.00%/0.40% | 1.05% (1.45%) |

While Milford’s fees are roughly in line with other active fund managers, they’re significantly higher than the fees of passively managed (index) funds (most NZ domiciled index funds charge management fees of between 0.20% and 0.60%, with no performance fees).

Swing pricing

When you buy or sell units in Milford’s funds, they may apply a swing pricing adjustment which could result in the unit price of your fund being marked up or down. This adjustment works similar to spreads on other investments, and is used to cover the cost of investors transacting in or out of the fund. It can work in or against your favour depending on how much money is flowing in or out of a fund on a given day. Here’s how it works:

- Example 1 – Mary invests into the Aggressive Fund when it’s at a price of $1 per unit. On the day she invests there’s more money flowing into the fund than out of it (due to lots of other investors buying into the fund on the same day). As a result the price of the fund “swings” up to $1.001, which is effectively a 0.10% premium for Mary to invest into the fund.

- Example 2 – John invests into the Aggressive Fund when it’s at a price of $1 per unit. On the day he invests there’s more money flowing out of the fund than into it. As a result the price of the fund “swings” down to $0.999, which is effectively a 0.10% discount for John to invest into the fund.

Essentially when lots of people are entering into a fund, the fund’s price gets marked up. And when lots of people exit a fund, the fund’s price gets marked down. Below are the swing pricing adjustments that can apply to each fund:

| Fund | Swing pricing adjustment |

| Conservative | 0.11% |

| Diversified Income | 0.13% |

| Moderate | 0.11% |

| Balanced | 0.12% |

| Active Growth | 0.13% |

| Aus. Absolute Growth | 0.16% |

| Aggressive | 0.10% |

| Cash | 0.00% |

| Trans-Tasman Bond | 0.11% |

| Global Corp. Bond | 0.11% |

| Global Equity | 0.07% |

| Trans-Tasman Equity | 0.18% |

3. Past performance

One way the success of Milford’s performance can be measured is by comparing the returns of their funds with that of the market. All of Milfords funds have a set of market indices that they benchmark their performance against. For example:

- The Global Equity Fund is benchmarked against the MSCI World Index

- The Trans-Tasman Equity Fund is benchmarked against the blended performance of the S&P/NZX 50 Gross Index and S&P/ASX 200 Total Return Index

A full list of Milford’s funds and their market index benchmarks can be found here.

The below table shows the 1 year and average 5 year performance for Milford’s funds (after fees, but before tax), compared to their respective benchmarks (as at 31 December 2021):

| Fund | 1yr return Fund | 1yr return Market | 5yr return Fund | 5yr return Market |

| Conservative | 1.56% | 2.22% | 5.66% | 5.47% |

| Diversified Income | 5.72% | 6.42% | 7.77% | 7.82% |

| Moderate | 6.47% | 6.30% | n/a | n/a |

| Balanced | 12.07% | 10.77% | 10.42% | 10.01% |

| Active Growth | 18.12% | 12.69% | 12.97% | 12.25% |

| Aus. Absolute Growth | 18.17% | 12.67% | n/a | n/a |

| Aggressive | 20.21% | 21.27% | n/a | n/a |

| Cash | 0.48% | 0.33% | n/a | n/a |

| Trans-Tasman Bond | -2.58% | -2.70% | 3.74% | 3.58% |

| Global Corp. Bond | -0.29% | 0.91% | n/a | n/a |

| Global Equity | 25.13% | 26.18% | 15.67% | 14.42% |

| Trans-Tasman Equity | 11.20% | 8.75% | 16.29% | 12.75% |

Milford’s 1 year results are mixed, with 5 out of 12 funds performing worse than the market. Although this time period is too short to draw any meaningful conclusions.

Their 5 year results are much better, with 6 out of 7 funds outperforming the market. While they haven’t beaten the market by significant margins in most cases, their returns still suggest that their high fees have been worth it over index funds in recent years. However, it’s not guaranteed that their great past performance will translate into future results.

4. Other considerations

Account types

Milford offers individual, joint, kids, company, trust, partnership, and estate accounts.

Minimum investment

The minimum initial investment with Milford is $1,000 per fund, with higher minimums for trusts, companies, and partnerships ($100,000), and estates ($10,000). For KiwiSaver funds, there’s no minimum investment required.

InvestNow

All of Milford’s non-KiwiSaver funds are also available on the InvestNow platform. The benefits of investing through InvestNow (as opposed to investing direct via Milford) are:

- Minimum investment – InvestNow’s minimum investment is $250 (or $50 for regular investments) per fund, significantly lower than Milford’s minimum of $1,000.

- Other funds – InvestNow offers over 150 funds from 27 different fund managers. This means you can invest in Milford’s funds together with other fund managers under one roof.

InvestNow also offers a KiwiSaver scheme which offers over 30 funds from 14 fund managers. Three of Milford’s funds (Conservative, Balanced, Active Growth) are available through InvestNow KiwiSaver, allowing you to build a bespoke KiwiSaver portfolio by mixing Milford’s funds with those offered by other fund managers.

Further Reading:

– InvestNow review – The most efficient way to invest?

– Build your own KiwiSaver – InvestNow vs SuperLife vs Craigs

Distributions

The following Milford non-KiwiSaver funds pay distributions (which can be withdrawn as cash or reinvested into the fund):

- Diversified Income (paid quarterly in Feb, May, Aug, Nov)

- Conservative (paid quarterly in Jan, Apr, Jul, Oct)

- Trans-Tasman Bond (paid quarterly in Mar, Jun, Sep, Dec)

- Global Corporate Bond (paid quarterly in Mar, Jun, Sep, Dec)

- Trans-Tasman Equity (paid semi-annually in Mar, Sep)

All other funds and Milford’s non-KiwiSaver funds do not pay distributions. Instead any interest or dividend income these funds receive are reflected as an increase in the value of the fund.

Tax

All of Milford’s funds are Multi-Rate PIEs so are taxed at your Prescribed Investor Rate. They calculate your tax obligations for you, which is payable after the end of every tax year (31 March) or whenever you sell units of a fund. Any tax liability will be settled automatically by selling off enough of your fund’s units to pay off your taxes.

Ethical investing

Milford’s funds aren’t marketed as ethical or sustainable. However, Milford does take sustainability factors into consideration when deciding what assets to invest in. For example, any companies involved in contentious activities such as nuclear weapons, whaling, tobacco, and recreational cannabis are put on their exclusions list, which disqualifies that company from consideration in Milford’s funds.

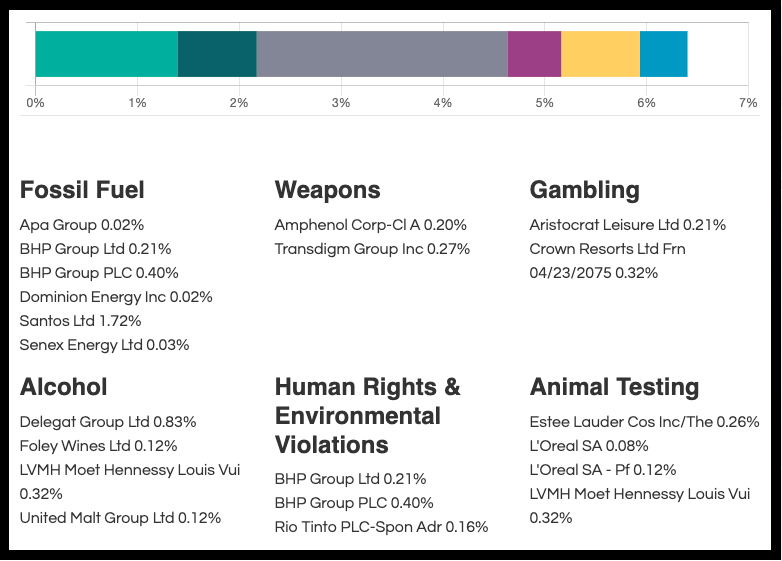

That doesn’t mean Milford’s funds will meet your standards of what is ethical. Every investor has a different view towards what’s ethical and what isn’t, and looking at the Mindful Money website there are a few companies that Milford’s funds invest in that you personally might consider unethical, including those involved with animal testing, fossil fuels, and gambling:

Financial advice

Milford offers financial advice to high-net-worth clients (investing $500,000 or more) through their Private Wealth service. However, their advisers can only give you guidance on Milford’s products – they can’t advice you on products from other providers even if those products were better suited to you.

5. Milford vs competing services

Here’s a brief overview of how Milford stacks up to competing services:

Other active fund managers

Banks

The big banks (ANZ, ASB, BNZ, Kiwibank, Westpac) are still the dominant players in the KiwiSaver and non-KiwiSaver fund space. They all have similar offerings – a range of Conservative, Balanced, and Growth type funds, with the convenience of being able to invest through your own bank. However their past performance has been lacklustre.

Further Reading:

– ASB, BNZ YouWealth, Kiwi Wealth review – Are managed funds with your bank worth it?

Fisher Funds

Fisher Funds is another popular active fund manager, taking out 4th place in KiwiSaver market share rankings. They have a few funds which are similar (but not identical) to Milford’s funds, which we can use to compare their performance over 5 years:

| Fund | Fisher Funds 5yr return | Milford 5yr return |

| Conservative | 5.50% | 5.66% |

| Balanced | 9.32% | 10.42% |

| Growth | 12.41% | 12.97% |

| International Growth/Global Equity | 19.50% | 15.67% |

Fisher Funds’ Conservative, Balanced, and Growth funds have underperformed compared to Milford, but their single sector International Growth fund has outperformed by quite some margin!

In terms of fees, Fisher Funds tends to be slightly more expensive. For example, their Conservative Fund charges a fee of 1.30% versus 0.95% for the equivalent Milford fund. Their KiwiSaver fees are more competitive, for example their Growth fund charges 1.03% versus Milford’s 1.05% (not inclusive of performance fees which both managers charge). However they also charge their KiwiSaver members an $18 annual account fee.

Top 8 KiwiSaver providers by market share:

1. ANZ

2. ASB

3. Westpac

4. Fisher Funds

5. Kiwi Wealth

6. AMP

7. Milford

8. BNZ

Source: Morningstar

Others

There’s heaps of other active fund managers competing for your money such as Booster, Pie Funds/Juno, Pathfinder, and Nikko AM. There’s too many to cover in this article, so if you’re interested at investing with any of them make sure to look at what their funds invest in, whether their fees are reasonable, and whether you like the fund manager and their approach to issues like ethical investing. You can also check their track record when it comes to performance, but keep in mind this provides no guarantee as to their future performance.

Passive fund managers

Also competing with Milford are passive fund managers, who are able to offer lower fees (and sometimes a larger variety of funds):

- Smartshares – Offers 35 funds covering NZ shares, international shares, bonds, and cash. Fees range from 0.20% to 0.75%, and their funds are available across multiple platforms like InvestNow and Sharesies.

- SuperLife – Offers 49 funds mostly mirroring Smartshares’ offering, as well as a few diversified funds investing in a mix of local and international shares and bonds. Fees range from 0.20% to 1.34%. SuperLife also offers a KiwiSaver scheme.

- Kernel – Offers 13 funds covering NZ shares, international shares, and a couple of thematic funds. Fees range from 0.25% to 0.45%, plus a $60 annual account fee if you’ve invested over $25,000. Kernel also offers a KiwiSaver scheme.

- InvestNow Foundation Series – Offers simple and tax-efficient Balanced and Growth funds, both investing across NZ and international shares and bonds (however the international bond portion of the fund is actively managed). Fees are 0.37% for both funds. The funds are also available as part of InvestNow’s KiwiSaver scheme.

- Simplicity – Offers 5 funds – multi-sector Conservative, Balanced, and Growth funds, as well as single-sector NZ shares and NZ Bond funds. However, their funds aren’t entirely passively managed as they include investment into private equity, build-to-rent housing, and mortgage lending. Fees are 0.31% for the multi-sector funds, and 0.10% for the single-sector funds. Simplicity also offers a KiwiSaver scheme.

So should you invest in these passively managed funds or in an actively managed fund like Milford’s? While research suggests that most active fund managers fail to perform consistently over the long-term (despite charging much higher fees), there is no definitive best option, and Milford has demonstrated an ability to continuously beat the market. It’s down to your personal preferences – We personally prefer the cheaper passively managed funds, but still believe that actively managed funds are a valid and excellent way to build your wealth.

Further Reading:

– Kernel review – High quality index funds

– Smartshares & SuperLife review – The smart way to invest in shares?

– InvestNow Foundation Series vs Simplicity funds – Tax leakage an issue?

Other platforms

Sharesies, Hatch, and Stake are popular investment platforms, but they aren’t direct competitors to Milford, being brokers that offer access to buy and sell individual shares and ETFs listed on the sharemarket. They’re better suited to those wanting to research and select companies or ETFs themselves (essentially allowing you to be your own fund manager), while Milford targets hands-off investors.

Further Reading:

– Sharesies review – Still a good investment platform in late 2021?

– Hatch review – Hard to recommend

Conclusion

Milford is a quality active fund manager, evidenced by the sizeable amount of money under their management. They’re a good option to leave your money with, both as a KiwiSaver manager or as a non-KiwiSaver investment manager. Their selection of funds in relatively simple but diverse, with options that suit both long and short-term investors, and whether you’re risk adverse or non-risk adverse. However, they wouldn’t suit:

- Those looking for more control over the specific asset classes and sectors they’re investing in – for example, if you wanted to tilt your portfolio towards a specific sector like commercial property, or to a specific region like Emerging Markets. In this case services like InvestNow, SuperLife, and Kernel may be more suitable as their broad range of funds provides more flexibility in building a portfolio.

- Those wanting to pick their own individual companies to invest in. In which case a service like Sharesies would be more suitable.

And as with all active fund managers, their downside is that you pay relatively hefty fees. But so far Milford has justified their fees by delivering solid results. So should you let Milford manage your money for you? Despite their great past performance, their future returns aren’t guaranteed, yet they’ll continue to charge high fees even if their performance were to drop. Therefore we personally prefer index funds which can deliver the return of the market every year (minus fees and taxes). While we won’t have the chance to outperform the market, our fees will always be minimal in comparison.

However that’s just our preference. Overall the choice comes down to your own personal views – there’s no “right” or “wrong” option when it comes to choosing between active and passive funds. In terms of active management, we’d definitely consider Milford as one of our favourites.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Thanks so much for your views. I have investments in both Milford and Fisher Funds for the last 10 years and happy with both Thanks Tom Hellyer

Thanks for reading Tom 🙂

The performance fee is a concern. I would be only with it if they outperformed in a difficult market year, but let’s be honest, a blind monkey could have done well over the past year. Also a greater discussion of self driven options would be useful, because you can invest in a passive market index through Sharsies or to a lesser extent Hatch, for a very low fee. Vanguards VOO, S&P index fee is virtually zero and will give you US market returns which trash international markets in recent times and particularly the very underperforming NZX. In factvif Mikford indexed their returns against the S&P 500, they wouldn’t be outperforming.