February 2022 has been a bit of a crazy month, both inside and outside the financial markets. In this month’s news article we cover what’s happening with the ongoing market volatility, more new investment products launching in NZ, and share our thoughts on proposed changes to the KiwiSaver scheme.

This article covers:

1. The market volatility continues

2. More new investment products coming

3. Potential KiwiSaver changes

4. Our 100th article!

1. The volatility continues

Tough time in the markets

Continuing on from last month, February 2022 has been a bumpy ride in the financial markets.

Our home market has fallen 1.90% this month (and is down 8.52% year to date) as represented by the S&P/NZX 50 index.

The US market has increased by 0.65% despite some bumpiness along the way. But it’s still down 8.00% YTD as represented by the S&P 500.

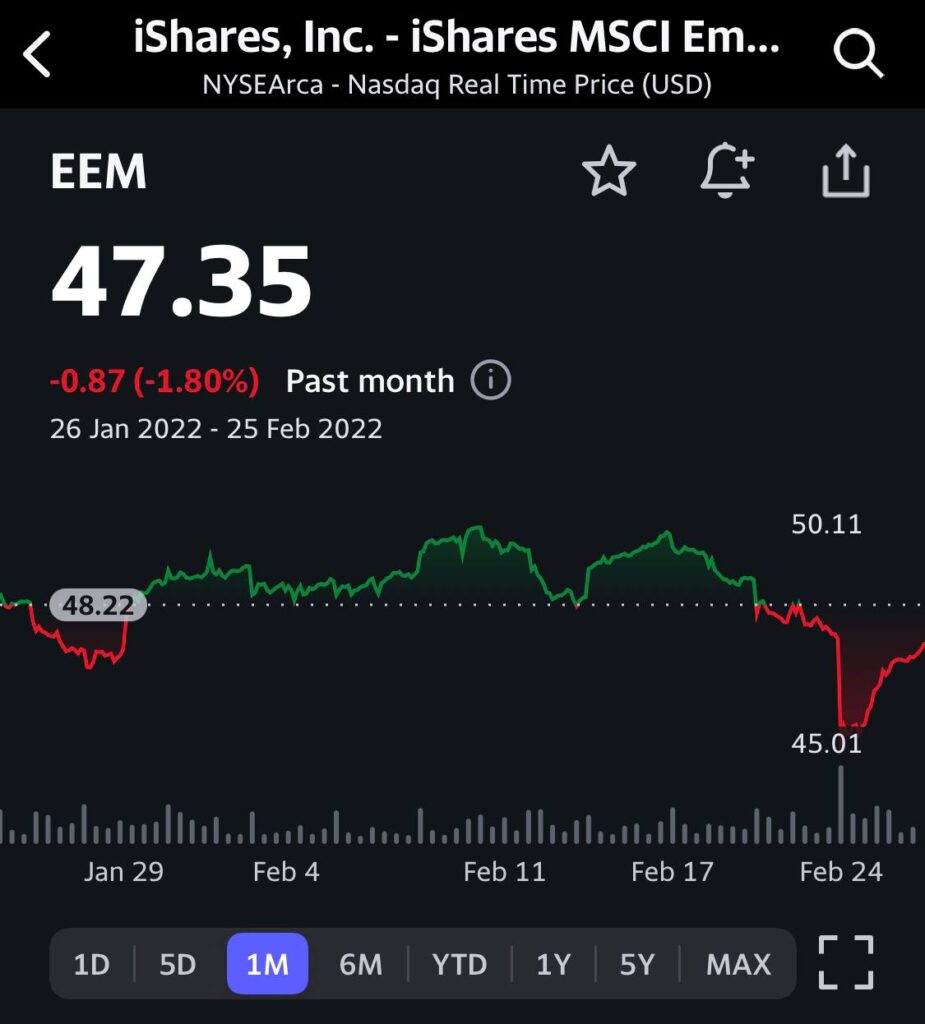

Emerging Markets (which includes countries like China, India, Taiwan, and Russia) fell ~1.80% this month (and is down just 3.07% YTD).

In the cryptocurrency world, Bitcoin increased ~6% over the last month (but is still down ~16% YTD).

This month’s roller coaster ride has largely been due to the escalating conflict between Russia and Ukraine. This has created fear in the market, thanks to the uncertainty around areas such as:

- Sanctions being imposed on Russia, and the economic impact they might have.

- Whether the conflict might escalate further and spill into other countries.

- The potential for oil and commodity prices to increase, therefore increasing costs for companies.

Putin ordered the invasion of Ukraine on the 24th of February, leading to a steep decline in the markets, including the NZX which was down 3.31% by the end of the trading day. But since then we’ve seen the market bounce back strongly, so why might that be? It’s hard to pinpoint a particular reason in such a complex situation, but some factors might include:

- The conflict already being “priced in” to the market, so the dip may have been an overreaction to the news.

- Sanctions being less severe than anticipated.

- Possibility for central banks to raise interest rates less aggressively as a result of the conflict.

- Shorters taking profits, and investors buying into the market weakness.

There’s still a lot of uncertainty surrounding the war, so don’t expect markets to be plain sailing over the coming weeks and months. What’s happening is truly horrific and despicable, and we feel for the innocent people of Ukraine whose lives have been affected. We hope that things can end as quickly and peacefully as possible 🇺🇦.

Navigating the volatility

The volatility in our portfolios is nothing in comparison to the awful situation Ukrainians are facing. While we don’t want to detract from the severity of the conflict, plenty of investors are still worried about their investments, especially when the markets are going up and down every week like a roller coaster ride. So here we’ll address a couple of common concerns from investors:

Firstly, when will the volatility end? Nobody knows how long it’ll take, but we do know that the market has always recovered from geopolitical events in the past – So all we can do is be patient and wait the turbulence out. It can be a negative experience seeing your portfolio in the red, but here’s how a few of our followers are dealing with their investments during this time:

Just don’t look at it 🙈. Ignorance at the moment is bliss.

Just don’t look at them. Drink more wine.

Dollar cost averaging and sticking to it trusting markets will recover in the long run.

Dollar Cost Average during a downward trend. It’s accumulation time. Buy the fear. Hodl hodl hodl.

My entire portfolio is red but not worried because my timeframe is 30+ years

Secondly, should you sell off your shares (or stop buying them) until the markets settle down? Probably not – Unless your investing goal or risk tolerance has changed, your investing strategy shouldn’t change either. Timing the market (trying to pick the perfect time to buy/sell investments) is incredibly difficult, and right now when prices are depressed is probably the worst time to pull out from the market:

Do you stop buying groceries or petrol when prices go on special?

Reddit thread

The below article is particularly relevant to how you might respond to bad news in the markets:

Further Reading:

– Evergrande, COVID-19, rising interest rates – Sell all shares now?

2. More new investment products coming

In January 2022’s news article we wrote about a few new investment platforms (Flint Wealth, BlackBull Markets, Sugar Wallet, and Sharesies KiwiSaver) that were launching in New Zealand. This month is no different, with even more new products in the pipeline:

BetaShares

BetaShares is a well established ETF issuer in Australia, managing over 60 funds. They intend to launch a selection of their funds in a NZ friendly format later this year. These will likely be unlisted PIE funds, simplifying tax obligations and removing the need to convert currency to AUD for Kiwis wanting to invest in those funds.

Their current Australian offering includes funds investing in:

- Australian shares – e.g. the classic ASX 200 fund.

- International shares – e.g. Nasdaq 100, S&P 500 Equal Weight, and FTSE 100.

- Thematic shares – e.g. funds investing in cybersecurity, video gaming, and crypto companies.

- Ethical shares – e.g. a “Global Sustainability Leaders” ETF.

- Commodities – e.g. gold, crude oil.

- Futures – e.g. funds to short the ASX 200 or S&P 500 (profit from the market going down).

There’s plenty of interesting funds throughout their range which you can check out on the BetaShares website. But we’ll have to wait and see to find out which funds will get the PIE treatment.

Superhero

Superhero is an Australian platform allowing investment into ASX and US listed shares and ETFs. They plan to open up to NZ customers in a few months time, adding NZX shares in the process. Such an investment offering would provide direct competition to Sharesies who currently offer access to the same markets.

Their fees for NZ investors haven’t been confirmed yet, but if their Aussie pricing is anything to go by then Superhero might be a very competitive option. In Australia their current fees are:

- $5 to buy or sell ASX shares

- $0 to buy ASX ETFs, $5 to sell them

- $0 to buy or sell US shares & ETFs + 0.70% foreign exchange fees

Hatch

Back in October 2021, Kiwi Wealth sold the Hatch platform to FNZ, at which time FNZ signalled an intention to invest heavily into the platform and offer investment into new markets. This month Hatch confirmed their plans to add NZX, ASX, and potentially other markets to the platform, building on their current US shares offering:

…we’ll gain access to a range of benefits FNZ has to offer. Meaning, we can turn on more markets (yep, that includes your local fave, the NZX, and managed funds but also internationals, like the ASX and beyond), plus currencies and new investment types at the click of a button.

Hatch blog

It’s exciting news, and the huge expansion of their investment offerings is sure to make Hatch a much more compelling service.

Further Reading:

– Hatch review – Hard to recommend

Smartshares

Smartshares is a well-established NZ ETF issuer, with a current offering of 35 funds. This month the NZX (owner of Smartshares) announced a desire to launch some new funds. Here’s what we know about the new funds:

- A “NZ Equities large, mid and small cap equity product” – This appears it’ll be Smartshares’ 7th fund to invest in NZ shares (potentially making their NZ shares offering even more confusing than it already is). “Small cap” suggests this fund might include companies outside of the NZX 50 like Kernel’s NZ Small & Mid Cap Opportunities Fund.

- “Sector products – agri, tech, renewables” – These appear to be sector/thematic funds investing in agriculture, technology, and renewable energy related companies.

Further Reading:

– Smartshares & SuperLife review – The smart way to invest in shares?

3. Potential KiwiSaver changes

The government has kicked off a review of KiwiSaver, where 5 changes to the scheme are being considered. Below is an overview of the potential changes and our thoughts on them. Keep in mind there’s no guarantee these changes will come to fruition.

New government contributions system

Current state: Any employee and voluntary contributions you make to KiwiSaver count towards getting the annual government contribution (in which the government contributes $0.50 for every $1 you contribute). The government contribution is capped at $521.43 per year.

Potential change: Employee contributions may no longer count (or may count to a lesser extent) towards getting the government contribution. Instead voluntary contributions may become the primary way of qualifying for government contributions, incentivising people (particularly self-employed) to invest more into the scheme.

This change could include increasing the maximum government contribution to $2,000 per year, offset by only paying it out for a limited number of years (currently the government contribution is paid out for 47 years between the ages of 18 and 65).

Our view: Not sure how we feel about this, especially if government contributions were cut after a certain number of years of contributing to the scheme. This proposal could also penalise lower income earners who can’t afford to make voluntary contributions. However, it could make the scheme much more compelling for the self-employed.

Wider eligibility for employer contributions

Current state: Employers aren’t required to make employer contributions for under 18s and over 65s (though they can still do so voluntarily).

Potential change: It may become mandatory for employers to make contributions for over 65s. Mandatory employer contributions for under 18s are also being considered.

Our view: Mandating employer contributions for over 65s is an excellent change. Not everyone stops working at age 65, so those who don’t shouldn’t lose employer contributions just because of their age.

Ability to use KiwiSaver as an emergency fund

Current state: Money in your KiwiSaver account can’t be withdrawn for emergencies.

Potential change: KiwiSaver members may be required to make additional employee contributions of 1% into a “sidecar account”, unless you opt-out of the sidecar scheme. This sidecar account will be able to hold up to $3,000, after which the additional 1% contribution is diverted into your main KiwiSaver account. Money in the sidecar account can be withdrawn for emergencies.

Our view: This is another handy change as it’ll make it easy for people to accumulate emergency savings. It’ll be interesting to see the detail behind this proposal like what constitutes an emergency, how withdrawal requests are managed (i.e. is there a painful approval process to get your money out?), and how the sidecar account will be invested (i.e. will you be able to choose a fund similar to your main KiwiSaver account, or will the sidecar account be kept as cash?).

Disallowing total remuneration packages

Current state: Employers can offer employees “total renumeration” packages which result in employer contributions getting taken out of the employee’s salary – effectively meaning the employee doesn’t get employer contributions.

Potential change: Total renumeration may be phased out, no longer being allowed in new employment contracts. It may still be allowed for senior management roles only.

Our view: This is a great change, removing a confusing aspect of the scheme. But employers may find ways to get around this rule, for example, by offering lower salaries to compensate.

Automatically increasing contributions

Current state: Employees can contribute to their KiwiSaver at a rate of 3%, 4%, 6%, 8%, or 10%. To change your contribution rate, you have to do so manually by notifying your employer.

Potential change: New KiwiSaver members (and those that choose to opt-in) will be put into a “small steps” programme where employee contributions start at a rate of 3%, then will automatically increase by 0.5% per year over 14 years to a rate of 10%.

Our view: This might be the least useful proposal out of the five. It’s a bit rigid as it assumes people will want to gradually increase their contributions in a straight line – in reality someone’s desired contribution rate is likely to fluctuate up and down over 14 years depending on income and personal circumstances. In addition there’s still little incentive to make employee contributions above the minimum rate. But the change could still be helpful to those who find it hard to save/invest outside of KiwiSaver.

Further Reading:

– KiwiSaver 101 – How does KiwiSaver fit into your investment portfolio?

4. Our 100th article!

Lastly, just a quick note to say this is our 100th article on the Money King NZ website! We’d like to thank you all for reading our various guides, reviews, and comparison articles, and hope you’ve found them valuable in your investment journey. We’ve got lots more great content coming over the next couple of months, but as always feel free to let us know if you want us to write about anything in particular.

Statistics:

– Page views: 430,945

– Visitors: 200,838

– Subscribers/followers: 4,559

Most viewed articles:

– How to buy Bitcoin in New Zealand (step-by-step guide)

– What taxes do you need to pay on your investments in New Zealand?

– 9 ways to invest in New Zealand

– InvestNow vs Sharesies – Ultimate Fund Platform showdown and review

– What happens to your money if InvestNow or Sharesies go bust?

Conclusion

Investing probably isn’t at the forefront of many people’s minds right now, especially with all the things happening locally and further afield. But it might be a good thing to take a break from your portfolio once in a while, especially if the volatility is getting you down. Regardless of what you get up to, have a safe March 2022 and we’ll hopefully catch you in next month’s news article.

In case you missed them – February 2022’s articles:

– Stockfox review – Are paid investing tips worth it?

– Does timing the market = better returns?

– Hatch review – Hard to recommend

– How to invest $1k/$10k/$100k in New Zealand

– Milford review – Better than index funds?

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.