Stockfox is a service aiming to provide professional sharemarket advice to everyday Kiwi investors, recommending what shares to buy and when to sell. Perhaps a fantastic idea given platforms like Sharesies and Hatch offer investment into thousands of companies, but don’t provide guidance on which ones to invest in. So is there a catch to getting stock tips from the service, and can it really help you to outsmart the market? And are any other paid services like Simply Wall Street and Kalkine worth it?

This article covers:

1. What’s on offer

2. Stockfox vs the alternatives

3. Are any other paid resources worth it?

1. What’s on offer

How does it work?

Stockfox operates by giving their subscribers recommendations on what shares to buy, and when to sell them. They do this by sending “tips” out by email and/or text almost everyday, which work as follows:

- Firstly, Stockfox issues a tip to buy a company’s shares. They outline the reasons why they’re recommending that company, provide the company’s target price, and risk level of that tip. Whether or not you act on that tip is totally up to you.

- Later on (typically 4-12 weeks later), Stockfox will issue a subsequent tip to sell the above company’s shares to take profits or cut your losses on that trade.

Stockfox can also issue tips to short a company’s shares (to profit from a company’s share price going down), which is higher risk and can be harder to access through investing platforms (Stockfox isn’t an investment platform, so you’ll still need a broker like Sharesies, ASB Securities, or Interactive Brokers to act on their tips).

Stockfox claim that each trade they’ve recommended has an average duration of 10 weeks (the time between issuing a buy and sell tip for a company), and that the average return of their tips is 8.77%:

Limitations

Sounds like an easy way to invest, having a resource which guides you on what stocks to buy and sell, especially when it’s profitable! But Stockfox has plenty of limitations – these don’t necessarily make Stockfox a bad service, but are things to be aware of when deciding whether the service is right for you.

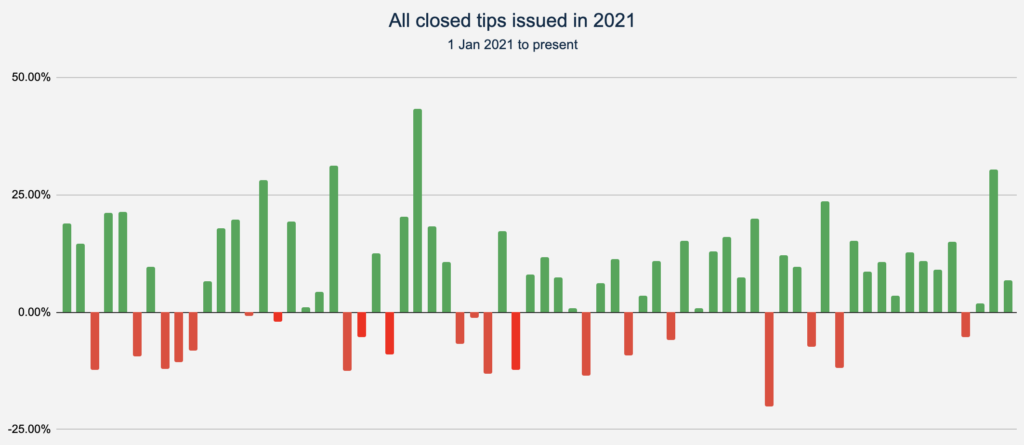

- Firstly, their tips and target prices are just forecasts on where they think a company’s shares are headed. Following them comes with risk, and you aren’t guaranteed to make a profit on them. In 2021, about 30% of their tips resulted in a loss:

- Secondly, we wouldn’t exactly call this an investing app, but rather a trading app. Their tips aren’t long-term buy-and-hold recommendations, but rather for short-term trades where your shares are typically sold within 4-12 weeks. Their tips are also time-sensitive, often requiring you to act on them fast before the company they’re recommending moves in price – a tip they issued a week ago may no longer be relevant today. You certainly need to be hands-on in using the service.

- Thirdly, as a side effect of it being a short-term trading tool, any trades taken as a result of following Stockfox’s recommendations will likely be classed as that of a trader. Therefore you’ll likely be liable to pay tax on the capital gains you make on the trades (long-term buy-and-hold investors would likely be exempt from this tax).

- Fourthly, the tips they issue don’t constitute personalised financial advice. They’re general in nature and don’t take into account whether the trades or companies they’re recommending are appropriate for your financial goals and risk tolerance.

Stockfox’s fees

Lastly, we have the fees. Subscribing to the service costs $24.95 per month. Equating to $299.40 per year, it’s likely you’ll need a decent amount of capital invested to make the fee worthwhile – it’s definitely not for those just dabbling in the markets.

2. Stockfox vs the alternatives

Let’s say you’re a investor who can’t decide what shares to invest in. Apart from using Stockfox, what are the alternative options?

- Index funds – Index funds invest in an entire slice of the sharemarket, saving you from the need to pick which companies to invest in. An example is the Smartshares Total World ETF which invests in over 9,000 companies from across the globe.

- Actively managed funds – Actively managed funds have professional investment managers who research and pick companies to invest in on your behalf. Examples of active fund managers are Milford, and Fisher Funds.

- Use a financial adviser – An adviser can work with you to recommend investments and create a portfolio that’s tailored for your personal circumstances and financial goals.

So in this section of this article, let’s compare Stockfox’s paid investing tips with the following:

- Index fund portfolio – Invested in a portfolio split 20% into the Smartshares NZ Top 50 ETF (investing in the 50 largest companies listed on the NZX), and 80% into the Smartshares Total World ETF. There are arguably better index funds (like the Smartshares S&P/NZX 50 ETF or Kernel NZ 20 Fund), but these launched fairly recently so have limited performance data.

- Actively managed fund – Invested 100% into the Milford Active Growth Fund, a popular fund investing into a mix of local and international shares and bonds. We would’ve liked to use the Milford Aggressive fund for this comparison (given its higher allocation to shares), but being a relatively new fund there’s limited performance data.

- Advised product – Using the Craigs mySTART product which allows you to invest into a selection of shares and funds with as little as $100, and includes the services of an investment adviser.

Fee comparison

First, let’s look at the yearly fees you’ll pay for each product:

A. For a portfolio of $10,000

For a $10,000 portfolio, our index funds have the cheapest fees at 0.42% of the portfolio value – this represents the weighted average fee of our two Smartshares ETFs, and assumes we use the InvestNow platform to avoid brokerage fees. Stockfox comes in as by far the most expensive option, as their fee takes up a relatively large proportion of the portfolio.

| Dollars | Percentage | |

| Stockfox | $299.40^ | 2.99% |

| Index fund portfolio | $42 | 0.42% |

| Actively managed fund | $125* | 1.25% |

| Advised product | $100^ | 1.00% |

^These figures exclude any brokerage or foreign exchange fees you’ll incur on the purchase or sale of any shares. This could add significant costs, especially for Stockfox which requires you to make several trades per year.

*Fees for the actively managed portfolio assume a base fee of 1.05% for the Milford Growth Fund + 0.20% for performance fees.

B. For a portfolio of $50,000

At $50,000 our index funds still have the lowest fees, however Stockfox becomes significantly cheaper as a percentage of the portfolio.

| Dollars | Percentage | |

| Stockfox | $299.40^ | 0.60% |

| Index fund portfolio | $210 | 0.42% |

| Actively managed fund | $625* | 1.25% |

| Advised product | $500^ | 1.00% |

C. For a portfolio of $100,000

Now at $100,000 Stockfox becomes the cheapest option given their fee takes up a much smaller proportion of the portfolio. However our index fund fees are still relatively low, especially compared with the actively managed and advised products.

| Dollars | Percentage | |

| Stockfox | $299.40^ | 0.29% |

| Index fund portfolio | $420 | 0.42% |

| Actively managed fund | $1,250* | 1.25% |

| Advised product | $937.50^ | 0.94% |

Performance comparison

Here we attempt to do a performance comparison between our index fund portfolio, actively managed fund, and a hypothetical Stockfox portfolio for a period between 8 June 2019 (when Stockfox issued their first tip) and 8 Dec 2021. The results for each product were:

- Index fund portfolio – 41.02% total return, based on a 28.2% return from the NZ Top 50 ETF and a 44.23% return from the Total World ETF.

- Actively managed fund – Approximately 30% total return, based on a 33.57% capital gain from the Milford Active Growth Fund minus tax.

- Advised product – Not possible to determine the performance of this, as an advised portfolio will vary greatly from investor to investor.

Bad data

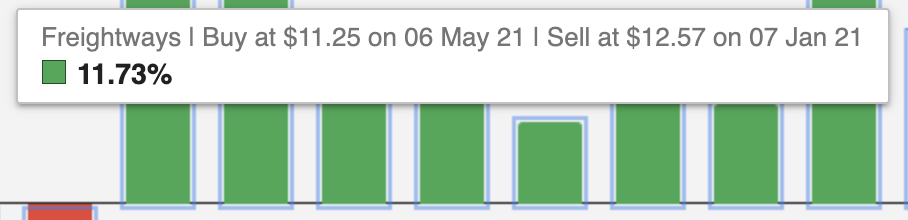

Unfortunately we came across a major stumbling block when trying to crunch the numbers on Stockfox’s performance. The performance data on their website wasn’t reliable enough – for example, they’ve claimed to have issued a tip to buy Freightways in May 2021, then sell in January of the same year!

And here they’ve claimed to have issued at tip to buy Restaurant Brands at $13.20 on 2 May 2021, and sell at $14.89 on 7 May 2021 for a 12.80% profit. However, the actual price of Restaurant Brands was only $13.89 on 7 May 2021 – just a 5.23% gain.

A rough calculation

With their performance data littered with errors, we had to turn to their Average Result metrics to perform a VERY rough estimate on how a hypothetical Stockfox portfolio would perform.

- Average performance – Stockfox claims their tips yield an average profit of 8.77% and has an average duration of 10 weeks. Therefore we’ll assume our capital can be put towards 5 tips per year. This gives us a return of 25.90% p.a. assuming we make 8.77% per tip (less brokerage and FX fees), and reinvest profits into the next tip (minus 33% for tax). Across a 2.5 year timeframe between 8 June 2019 – 8 Dec 2021, our total return would be 79.03%!

- Utilisation of capital – One major flaw in our above calculations is that we assume that as one tip closes, another one immediately opens, allowing us to keep our capital fully invested 100% of the time. In reality, our money won’t always be fully utilised given Stockfox’s tips often overlap with each other – at times our cash will be sitting on the sidelines waiting for the next tip to come up, and at other times we’ll have to reject tips because all our capital is already deployed towards other tips. If we assume our capital is utilised just 75% of the time, this brings our total return down to just 48.24%.

- Accounting for the subscription fee – Lastly we have to account for the cost of subscribing to Stockfox in calculating our total return, given paying the fee results in less money going towards buying shares. On a $10k portfolio, the fee drops the total return to 39.70%, while on a $100k portfolio the impact of the fee is a lot smaller, dropping our total return to 47.38%.

Overall results

We must admit it’s a very rough comparison, and definitely not an apples-to-apples one (especially with Milford’s fund investing 20% into bonds). But it appears that our index funds have performed best for our $10,000 portfolio, while Stockfox performed best for our larger portfolios even after taking fees and taxes into account.

| Product | Total return $10k portfolio | Total return $50k portfolio | Total return $100k portfolio |

| Stockfox | 39.70% $3,970 | 46.53% $23,264 | 47.38% $47,382 |

| Index fund portfolio | 41.02% $4,102 | 41.02% $20,510 | 41.02% $41,020 |

| Actively managed fund | ~30.00% ~$3,000 | ~30.00% ~$15,000 | ~30.00% ~$30,000 |

Is it worth it?

If by following Stockfox’s tips you can outperform the market (after accounting for all the associated fees and taxes) then perhaps the service is worth it. And with our rough calculations, we’ve demonstrated that they’ve done quite well over the last couple of years as long as you have a decent amount of capital.

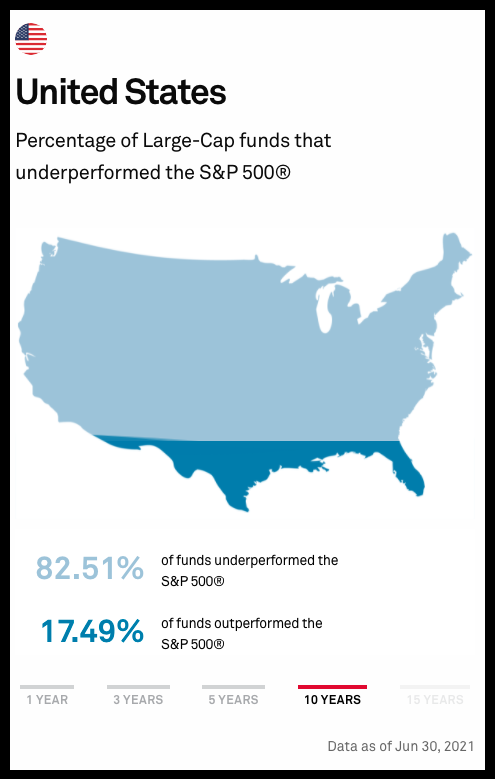

But could using Stockfox be a viable investment strategy over the long-term? We’re not convinced, and question whether trading in and out of positions every few weeks is sustainable over 10+ years. Firstly you’d need to form a habit of reading their tips and acting on them on an almost daily basis, something we can see investors lose interest in longer-term, especially during periods of poor performance, or when life gets busy. Secondly, we already know that most professional active fund managers can’t consistently beat the market over long periods of time. Even though Stockfox isn’t a fund manager, there’s nothing to suggest that their chances of outsmarting the market over the long-term are any higher.

A passive approach to investing by buying and holding low-cost index funds is hard to beat – so instead of spending $299.40 per year on a Stockfox subscription, our preference would be to use that money to buy more units in our index funds.

3. Are any other paid resources worth it?

There are lots of other paid resources out there aiming to provide sharemarket analysis and guidance such as:

- Simply Wall Street – Provides analysis on Global shares, as well as tools to analyse your own portfolio. Subscriptions range from free to $20 USD per month.

- Investify – Provides analysis and comparisons on NZ and Australian listed companies, as well as filters to help you discover companies that meet your criteria. Subscriptions range from $0.99 to $20 per month.

- Kalkine – A research firm who produce detailed reports primarily on NZ and Australian listed companies. Geared towards professional or wholesale investors, with most of their subscriptions costing in excess of $1,000.

They’re a bit different to Stockfox in that they don’t push out time sensitive buy and sell recommendations for companies, but instead provide analysis to help you perform your own research. They’re more geared towards long-term investing, helping investors make informed decisions on companies they want to buy and hold. So are these resources worth paying for? Probably not:

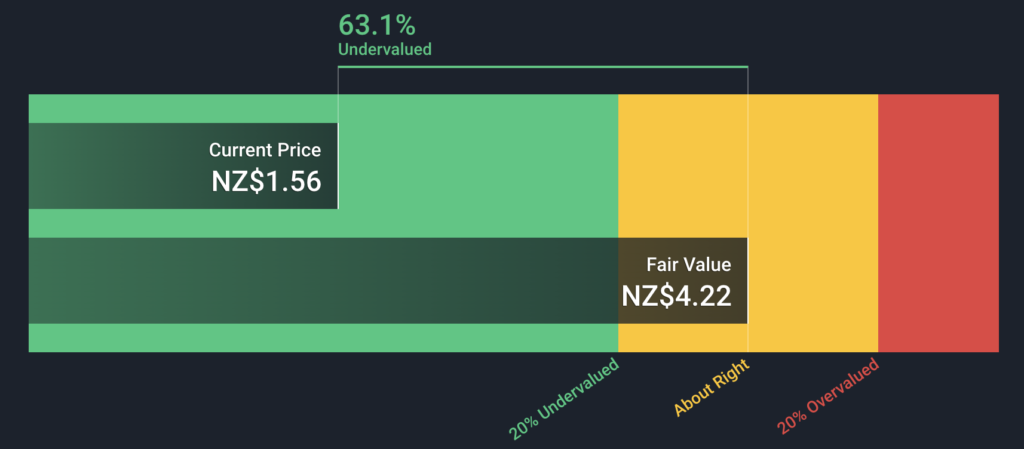

- Any recommendations and company valuations have to be taken with a grain of salt. They’re just forecasts, rather than guarantees, and in some cases are simply based off a computer crunching the numbers on a company’s annual report.

- They still require you to take plenty time and effort to assess each company’s merits before you invest in them. These services are even more hands-on than Stockfox.

- Lots of people think they can outsmart the market by picking stocks, but it’s unlikely these tools will give you a leg-up in doing so. Even professionals whose full-time job it is to manage investment funds tend to struggle to consistently beat the market over the long-term, when they have access to even more powerful tools and analysis.

- They don’t take into account your goals, risk tolerance, and personal circumstances. There’s a chance that the investments you make as a result of using the app might not be suitable for you.

Our view on these paid services is similar to that of Stockfox – if you need to rely on paid services to help you pick stocks, then perhaps you shouldn’t be picking stocks in the first place. Your money may be better off going towards buying more units in funds where an investment manager (whether they be active or passive) invests your money on your behalf, or alternatively to a financial adviser who can give you personalised financial advice on where to invest.

But if you insist on picking stocks and individual companies, we still don’t believe these paid services are worth it. They’re no substitute for doing your own research and forming your own views on a company.

Further reading:

– Due diligence on shares – How I evaluate companies before investing

Conclusion

Paid resources such as Stockfox are backed by very clever analysts, and help remove some of the guesswork in choosing what shares to buy and sell. However, we believe there’s better solutions out there for investors needing help on what to invest in:

- Index funds like those offered by Smartshares and Kernel

- Actively managed funds like those offered by Milford

- Talking to a financial adviser or using an advised service like Craigs mySTART

These options also take the guesswork away from choosing what to invest in, and come with the following advantages:

- Hands-off – There’s no need to do due diligence and place orders every time a new tip comes out, given fund managers and financial advisers can take care of the research and order execution for you.

- Sustainable – Index funds are a proven option for delivering some of the best results over the long-term, and the likes of Milford are also solid performers. These options are set-and-forget, so you don’t have to sustain a habit of checking and acting on tips over several years.

- Tax efficiency – Long-term investors who are infrequently trading in and out of positions, are unlikely to be liable for tax on their capital gains.

- Cost effective – You’ll save $299.40 per year on Stockfox’s subscription fee, plus in many cases you won’t have to pay any brokerage or foreign exchange fees. This is money that could go towards buying more units in your funds.

We think Stockfox would be more suitable as a tool for short-term, hands-on traders who have enough capital to make their fees worthwhile. But as investors seeking to build meaningful wealth over the long-term, we aren’t tempted by the lure of their quick results.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.