When thinking about investing your hard earned money, it is understandable (and a good thing!) to question whether the investment provider you want to use such as InvestNow and Sharesies is safe. Common concerns include:

- What happens if the service I use goes out of business?

- Is this service safe and trustworthy?

- Could this service run away with my money?

Thankfully local investment providers have measures that help keep your money safe, many of which are required by strict New Zealand regulations. This article will provide an overview of how New Zealand investment providers look after your money, looking at a few scenarios including what happens if a Fund Platform or Fund Manager goes bust, and how you would get access to your money if the worst was to occur.

This article covers:

1. What happens if a Fund Platform goes out of business?

2. What happens if a fund manager goes out of business?

3. What happens if the Custodian goes out of business?

4. What happens if a company I’m invested in goes out of business?

5. What happened to Halifax?

6. Tips for finding a safe investment provider

1. What happens if a Fund Platform goes out of business?

Fund platforms like InvestNow and Sharesies provide a service through which you can buy a large selection of funds (and in Sharesies’ case shares in individual companies). Let’s take a look at who owns the investments that you buy through these platforms, and what happens if the platform goes out of business.

Who owns your investments?

The investments you buy through these platforms are not held in your name, nor are they owned by the platform. Instead they are held in the name of a Custodian, but on your behalf, with you as the beneficial owner of the investment. So what are the custodial arrangements that InvestNow and Sharesies use?

InvestNow

The InvestNow platform’s legal entity is InvestNow Saving And Investment Service Limited. InvestNow’s custodian is Adminis Custodial Nominees Limited, run by a specialist Wellington based investment administration company, Adminis Limited

Sharesies

The Sharesies platform’s legal entity is Sharesies Limited. Cash deposits, and investments in non-listed funds are held by custodian Sharesies Nominees Limited, while investments in listed funds and shares are held by NZX owned New Zealand Depository Nominee Limited. You can read more about Sharesies’ custodial arrangements here.

Example

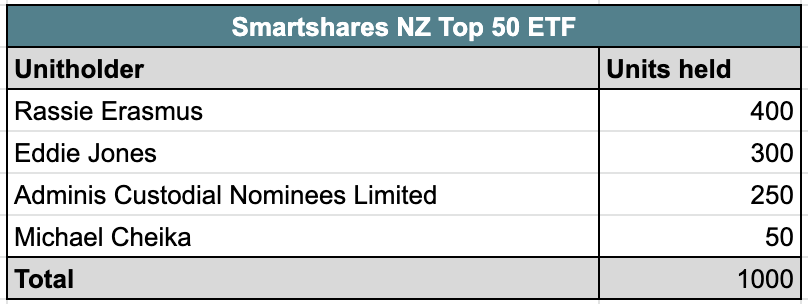

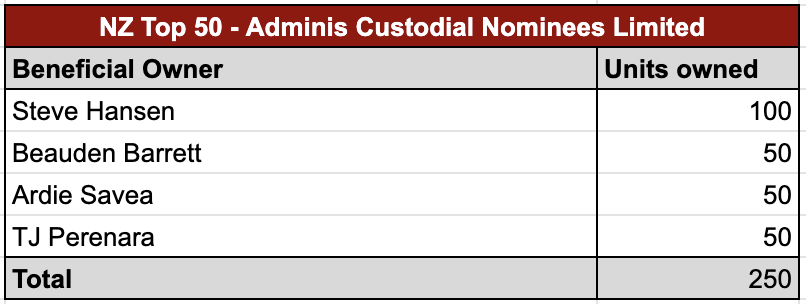

Steve Hansen bought 100 units in the Smartshares NZ Top 50 ETF through InvestNow. The share registry (record of who holds the shares, and how much they hold), would show the Custodian (Adminis) as the owner of the shares:

The Custodian keeps a record of who the beneficial owner of their holdings are. In this case Adminis’ holding is split between four investors:

How does a Custodian protect your money?

Your money doesn’t touch the platform

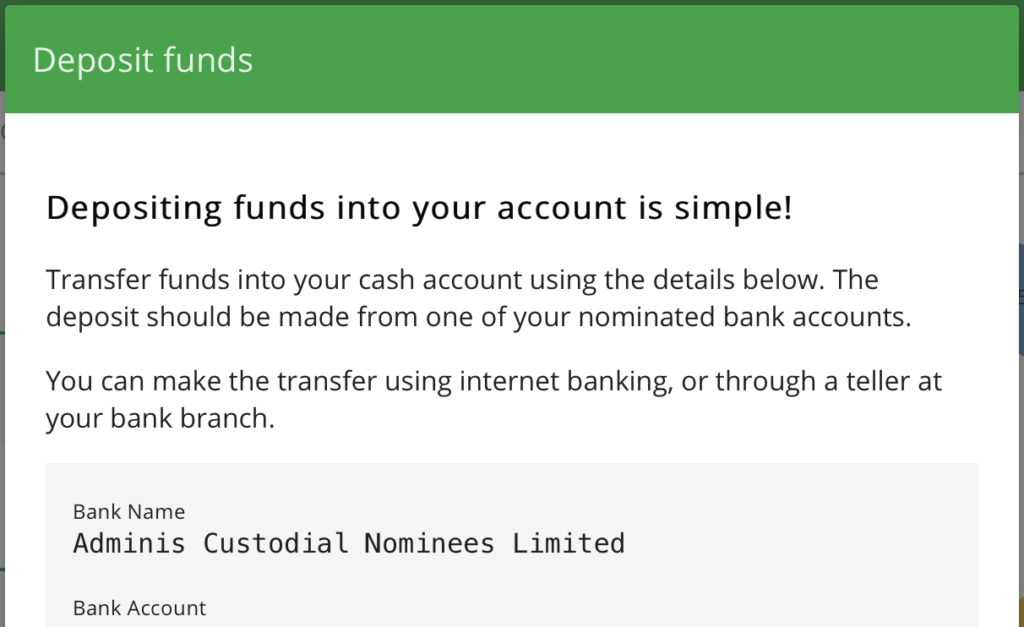

When you deposit money with the Fund Platform, the money goes straight from you to the Custodian. For example, when making a deposit with InvestNow, the money goes to the Custodian’s (Adminis’) bank account:

Subsequently, when you invest into a fund, your money goes straight from the Custodian to the Fund Manager. Investors’ money is never touched by the Fund Platform.

Segregation from the platform

Investors’ money is held in a seperate legal entity from the Fund Platform, with investors being the beneficial owners of that money. Therefore this money can’t be used by the platform to run their business. For example, Sharesies Limited cannot use investors’ money held in Sharesies Nominee Limited to pay their employees’ salaries.

In addition, money held by the Custodian can’t be touched by creditors. For example, if InvestNow went out of business while owing tax to the IRD, the IRD can’t touch the funds held by Adminis Custodial Nominees Limited to claim back InvestNow’s unpaid tax.

Also in InvestNow’s case, the Custodian (Adminis) is totally independent and unrelated to the Fund Platform. Sharesies’ custodial arrangements are less robust in this aspect, as their custodian Sharesies Nominees Limited is related to the platform, being fully owned and sharing the same directors as Sharesies Limited.

Auditing and reconciliation

Custodians are required to be independently audited annually, and must send the auditor’s report to the Financial Markets Authority (FMA). The audit includes assessing whether the custodians have the right procedures and controls in place to accurately process transactions, keep records, and safeguard investors’ money. Adminis uses PwC, and Sharesies uses KPMG to perform their audits. Custodians are also required to reconcile records of investors’ money daily.

Off-market transfer

InvestNow’s Custodian allows you to transfer ownership of an investment into your own name (this is subject to the Fund Manager accepting you onto their share registry). Sharesies allows the transfer of NZX listed shares and ETFs out of their custody into your own Common Shareholder Number (CSN) for a $5 fee per transfer.

[this] demonstrates that you can ultimately get ownership and take control of your own assets and investments. If the custodian cannot transfer your assets to you, then this should be an alarm bell.

Anthony Edmonds, Director, InvestNow

So what is the role of the fund platform?

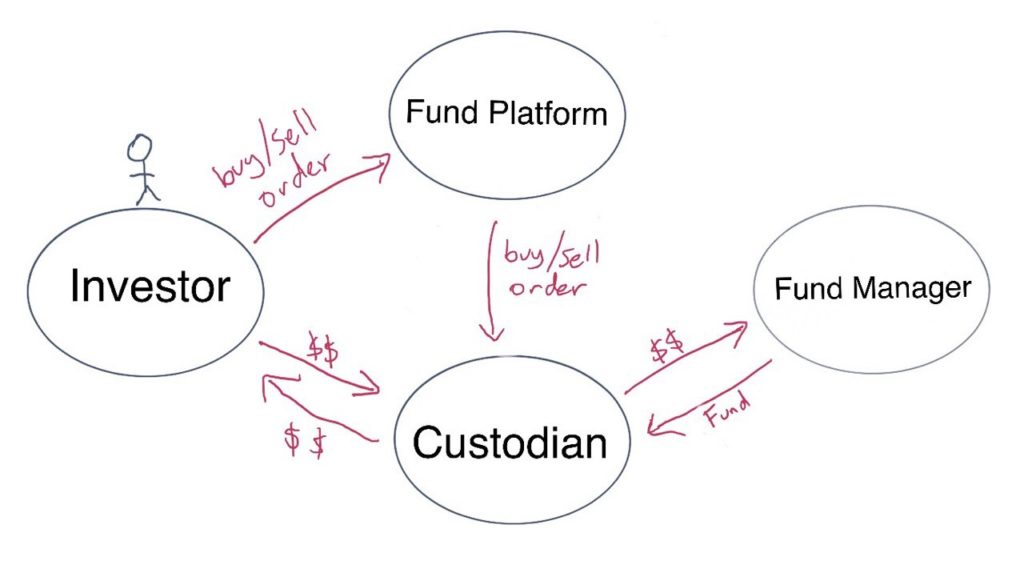

With the custodian handling all the money, what does the fund platform actually do? They act as an investor-facing facilitator, collecting buy/sell orders from investors, then passing these onto the custodian to execute. In addition, they carry out activities such as marketing the platform, onboarding new customers, supporting customers, and maintaining the platform.

What happens if a fund platform shuts down?

Your money is safe, as it is held separately by the Custodian. The platform cannot run away with your money or use it to pay their creditors, nor is the value of your funds or shares affected – after all, it is not the Fund Platform that determines the value of your funds and shares.

The problem now is how you are going to get access to your investments if the Fund Platform isn’t around. An administrator (for example, custodian Adminis, or the liquidator of Sharesies) would likely work to achieve the best outcome for investors. Here are the likely outcomes:

A. The investments are transferred into your name

An off-market transfer could be performed to transfer your investments out of the Custodian’s name and into your own name (and into your CSN in the case of shares). This relies on the manager of your fund willing to accept you onto their share registry – For example, the Vanguard funds on InvestNow require a minimum investment of $500,000 AUD, so Vanguard are unlikely to accept smaller investors.

B. Your investments are liquidated

Your investments could be sold, and the proceeds returned to you as cash. This would be the probable scenario if you hold the Vanguard funds on InvestNow, given most investors won’t meet the $500,000 AUD requirement to hold this fund in their own name.

C. New platform takes over

Another business could take over the InvestNow or Sharesies platform and the relationships with their customers. This would result in the platform continuing in operation as usual, apart from the platform having new owners.

2. What happens if a fund manager goes out of business?

Fund Managers/ETF issuers are the organisations responsible for managing the funds and ETFs you invest in. Examples are Smartshares, AMP Capital, Simplicity, and JUNO.

How does a fund manager protect your money?

Custodian

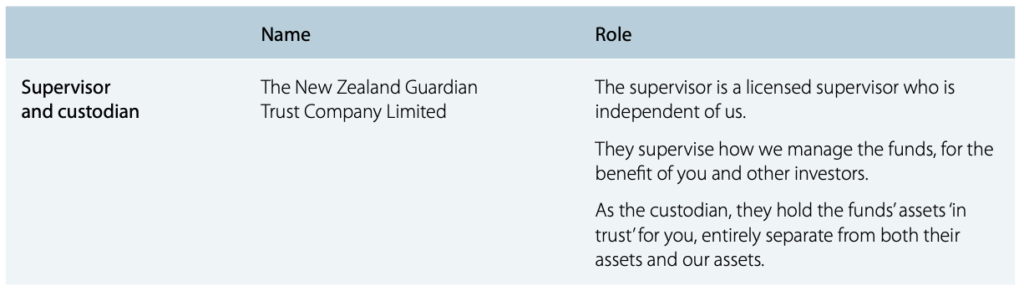

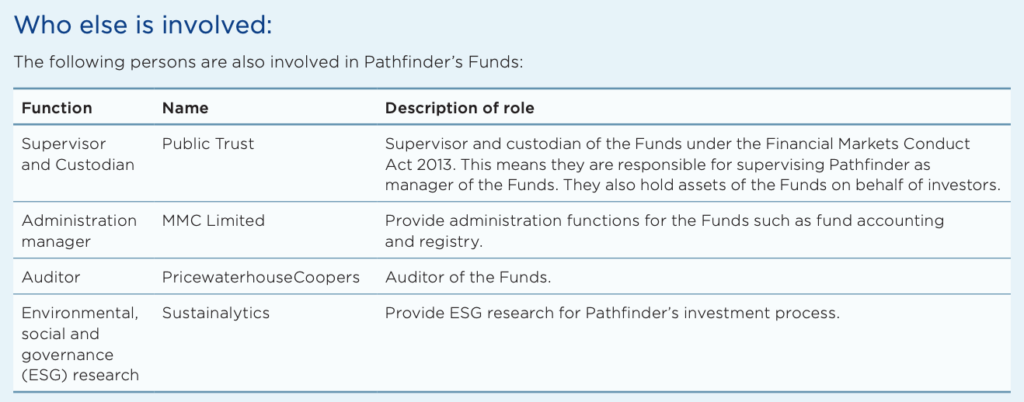

Reputable fund managers use a custodian to hold investors’ money independently from the fund manager’s business. Here are the custodians for a few different New Zealand fund managers:

- Smartshares – BNP Paribas Fund Services Australasia Pty Ltd, JBWere (NZ) Nominees Limited

- Pathfinder – Public Trust

- SuperLife – BNP Paribas Fund Services Australasia Pty Ltd and Public Trust

- Simplicity – Public Trust

- JUNO KiwiSaver – MMC Ltd

- Kernel – Adminis

- Kiwi Wealth – Public Trust

Like with Fund Platforms, the custodial arrangements mean that the Fund Manager doesn’t handle your money, nor do they own the underlying assets (e.g. shares and bonds) of their funds. When you invest in a fund, your money goes straight to the Fund Manager’s Custodian. The Fund Manager then tells the Custodian what to do with the money, for example, which shares and bonds to buy or sell in order to make up the assets of the fund.

Other roles

Licensed New Zealand Fund Managers all have an independent Supervisor. Their role is essentially to ensure that the Fund Manager is acting in the interests of investors, is in good financial shape, and acts in accordance with regulations.

Funds are also independently audited. Many Fund Managers also outsource administrative functions such as fund accounting, pricing, and the fund’s registry to other providers.

What happens if a Fund Manager shuts down?

Your money is also safe in this scenario, given the separation between the Fund Manager and investor’s money. The underlying assets (e.g. shares and bonds) of a fund are also unaffected as they are held by the Custodian.

To get access to your money in the case that the Fund Manager shuts down, the fund’s Supervisor would most likely facilitate either:

- The liquidation of the fund’s assets, with the proceeds returned to investors as cash, or

- The transfer of your fund’s management to another Fund Manager.

In the case of a KiwiSaver fund shutting down, your money would be transferred to another KiwiSaver provider.

3. What happens if the Custodian goes out of business?

We have established that Custodians hold your money in the case of both Fund Platforms and Fund Managers. What if the Custodian itself were to go out of business?

How does a Custodian hold your funds?

Custodians hold investors’ money in a dedicated entity that’s seperate from the actual business of the Custodian. For example, InvestNow’s Custodian Adminis Limited holds investors’ money in Adminis Custodial Nominees Limited.

What happens if a Custodian shuts down?

Again your funds are safe in this scenario because of the separation between the Custodian’s business and investors’ money. To get access to your money, your Fund Platform or Fund Manager would switch their custodial services to a new Custodian, after which business would carry on as usual.

If the custodian went out of business (which in our case is Adminis) it would not impact on our clients’ assets. This reflects that the custodial account they hold assets through (Adminis Custodial Nominees Limited) is a completely separate entity to their actual business. Accordingly we would transfer the custodial services to a new custodian. From a transactional perspective this would be no different than if we simply decided to change the custodian at some point in the future.

Anthony Edmonds, Director, InvestNow

4. What happens if a company I’m invested in goes out of business?

In the scenario that you’ve invested in the shares of an individual company, and that company goes bust, you will unfortunately lose money – It’s the company itself that gives that company’s shares value. As a shareholder of a failed company, chances are you will be left with nothing but valueless shares, after the leftover money and assets of the company are used up to pay outstanding wages, taxes and other creditors. Recent examples of listed companies going bust in NZ are Pumpkin Patch, Wynyard Group, and CBL Insurance.

Custodians won’t protect you from losses arising from poor investment choices or your company going bust, nor will holding the shares in your own name make a difference. Therefore it’s important to diversify your investment portfolio, so your whole portfolio isn’t wiped out if your company goes down the toilet.

If you’re investing in individual companies, that means you should buy multiple companies from different industries and different countries. Or you could just invest in a fund to achieve instant diversification (as funds can potentially contain hundreds or thousands of companies) – InvestNow and Sharesies have plenty of them!

5. What happened to Halifax?

Halifax Investment Services was an investment provider that allowed people to trade shares on a variety of platforms. Halifax got into financial trouble, and collapsed in late 2018 having lost almost $20 million in investors’ money. Right now investors’ funds are locked up as liquidation procedures are carried out, with investors facing a 7-15% loss in their investment. How was Halifax unsafe?

While there were a number of questionable things that Halifax did, one major issue was that they directly handled clients’ money, rather than having it go to an independent custodian. It appears that leading up to the collapse, Halifax were struggling to pay their bills, and were able to access clients’ money, subsequently using the funds to cover their own operating expenses.

Essentially it is a case of a platform going bust, and pulling their customers down with them. While custodians are not a bulletproof solution, It demonstrates the importance of choosing a platform that does not handle your money and uses an independent custodian.

6. Tips for finding a safe investment provider

Here’s some things you can do to see whether an investment provider is legitimate:

- In the case of Fund Platforms, read their terms and conditions, and relevant help articles to determine what their custodial arrangements are (Sharesies help article, InvestNow help article).

- For Fund Managers, read their funds’ Product Disclosure Statement (PDS). Section 7 of each PDS should show who the fund’s custodian, supervisor, and auditor are.

- Learn from other people. Read reviews of the service in the news, on blogs, or on social media

- Check the provider’s social media accounts. Are they posting actively, and do the likes and comments on their page appear to be genuine? Do the provider’s management have experience in the financial services industry (check their LinkedIn profiles)?

- If the provider is offering something too good to be true, it probably is. Ask friends, colleagues, or an independent financial adviser for a second opinion.

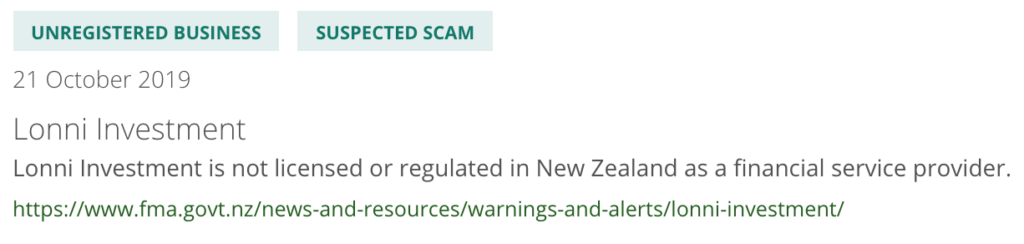

- Check if the provider is a registered Financial Services Provider

- Search for the provider on FMA’s website. They may be on FMA’s suspected scam list.

Conclusion

Reputable platforms and fund managers have robust controls and measures in place to keep your money safe. This includes using custodial arrangements to keep investors’ money segregated from their own business, and having auditors and supervisors assure they are acting in the interests of their investors.

Such measures are not a 100% guarantee that your money is protected against fraudulent activity. No matter where you put your money, whether it be at the bank, in shares, under your mattress, or in the casino, there is always going to be at least a little bit of risk – and no way to fully eliminate the risk. So don’t let this risk put you off from investing with a reputable provider.

Finally, I have just scratched the surface of what the players in our financial markets have to do to comply with regulations, and keep your money safe. I also haven’t covered how international investment providers like Vanguard or Hatch handle investors’ money. But these are topics I hope to write more about in a future article.

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Hi there,

Could you please explain in words all parts of the drawing you did with the 4 circles? 🙂

Thanks!

Sure. Firstly when investors deposit money into a Fund Platform like InvestNow, the money goes to the Custodian rather than the Fund Platform itself. Next when the investor places a buy order for a fund, the Fund Platform passes that buy order to the Custodian, who then places that order with the Fund Manager. Next, the units in the fund that are purchased as a result of that buy order are held by the custodian. So even though it’s the Fund Platform thats maintains the relationship with their investors, they don’t actually touch any client assets. Instead it’s the custodian that handles all the money and investments, in order to maintain separation from the platform.