2021 has certainly been eventful! While we’ve been really lucky to enjoy several months of freedom under COVID-19 Level 1 restrictions, the incursion of the Delta variant has put the country under a series of fresh restrictions. On top of that we have the Evergrande situation, and rising interest rates posing as further threats to the global sharemarkets. There’s definitely a lot of uncertainty in the air, and you may be feeling anxious about your investments. So are the markets about to come tumbling down? Is it time to sell off your shares? This short article explores what you should do in response to the current situation.

This article covers:

1. Background

2. Reasons to sell your shares

3. Reasons to hold your shares

1. Background

There’s currently at least three major themes influencing the sentiment in the financial markets:

A – Evergrande

Evergrande are a large Chinese housing developer who appear to be moving in the direction of going bust, struggling to pay back their debts. It seems inconceivable that the demise of a single company in China could impact the global financial markets – but Evergrande’s debt is huge (hundreds of billions of dollars worth) and the company’s collapse could trigger a domino effect, bringing down other companies in their supply chain, resulting in a huge loss of jobs, causing investors and consumers to sell off other assets to cover their losses, and causing a drop in business and consumer confidence resulting in a slower economy.

There’s already plenty of commentary out there on Evergrande so we won’t go into further detail. If you want to learn more this article from Milford is pretty comprehensive.

B – COVID-19 Delta variant

Over 1.5 years after the initial outbreak, the COVID-19 pandemic is still dragging on. The current situation is pretty tiring, having been in some form of lockdown for two months, yet we’re seeing dozens of new infections everyday as the Delta variant appears impossible to stamp out. There’s a glimpse of light at the end of the tunnel with vaccinations getting up to a good rate, but there’s still plenty of uncertainty and time to pass before the pandemic plays out. Plenty of individuals and businesses are hurt and struggling from the ongoing situation.

C – Rising interest rates

There is no doubt record low interest rates and central bank monetary policies have contributed to the recent gains in the financial markets, driving people out of savings accounts and into the likes of shares and index funds. We’re now seeing a reversal in these low rates in response to inflation kicking in, with this month seeing a rise in New Zealand’s OCR from 0.25% to 0.50% (with further increases pencilled in).

Higher interest rates have a wide range of impacts, creating an environment less supportive of high share prices. Higher rates means consumers spend more money on servicing debt and less money in the wider economy, results in bank deposits becoming slightly more attractive relative to shares, and makes it more expensive for businesses to borrow money and grow.

What’s the impact of these events?

Unfortunately no one knows how these events will play out and the exact impact they’ll have on the movements of the financial markets. It’s only possible to make predictions or speculate, similar to forecasting the weather or picking next week’s rugby scores. The only certainty we have is uncertainty, and that over the next few months the sharemarkets are going to move either move up, down, or sideways!

With this in mind, below are two reasons to sell your shares, and two reasons to hold on to your shares.

2. Reasons to sell your shares

You can’t bear the thought of losing money

It’s very normal to feel anxious about your investments going down. But if you absolutely can’t bear the thought of your portfolio dropping, perhaps you don’t have the right risk tolerance to be investing in shares.

People should be jumping into shares with the expectation their investment can and will fall in value at some point. If you don’t like this fact, then you might need to switch into more conservative investments (like bank deposits and bonds). These investments are much less volatile and have a significantly lower likelihood of seeing steep dips in value.

The downside of these conservative investments is that they have lower potential returns over the long-term compared to shares. So if you’re a long-term investor, also consider taking some time to better understand share investing, particularly familiarising yourself with the following concepts:

- Shares don’t deliver a constant rate of return like term deposits. You won’t make a profit from them every month.

- Shares can sometimes fall in value by a lot, very quickly. This is a very normal part of their behaviour.

- When your shares fall in value, you haven’t lost money unless you sell them.

- Sharemarkets have always bounced back from dips, crashes, and corrections over the long-term.

Further Reading:

– 2020 Recession? How to prepare your investment portfolio

You’re investing in the wrong asset class

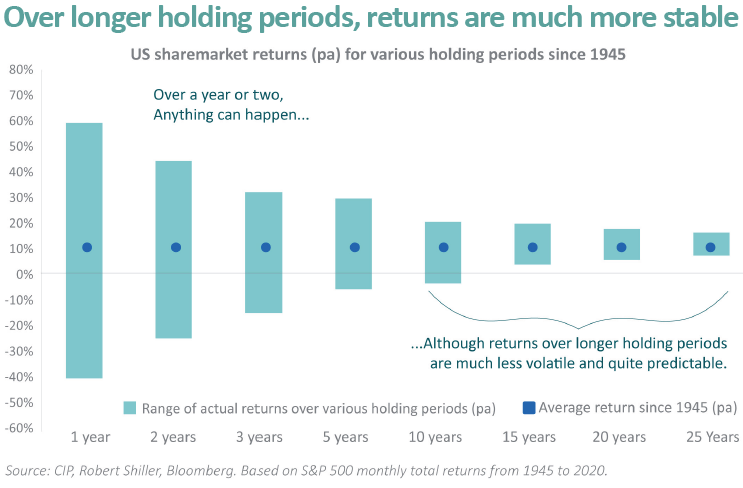

Shares are a powerful asset class but they don’t suit all investors. Your investment timeframe (how long you intend to invest your money) is key, with shares less suitable for those investing short-term. This is because shares are volatile and short investing timeframes might not give you enough time for your investments to recover if a market crash or correction were to occur. The below chart shows that it’s quite possible you’ll make a loss if you invest in shares for the short-term, with negative returns becoming less likely the longer you invest:

So if you’re a short-term investor (say you want to buy a house in 1-2 years time), you may want to consider selling your shares in favour of conservative investments. These investments serve to protect your capital over the short-term, so you’re less likely to take a loss when it comes to withdrawing your money for your house deposit.

Further Reading:

– What’s the best short-term investment?

3. Reasons to hold your shares

You’ll probably mistime the market

You may be wondering: isn’t it better to sell off your shares now while there’s so much uncertainty in the market, and buy back your shares after they’ve dropped? Unfortunately this requires you to time the market – and you’ll probably get the timing wrong:

- First you have to time your exit – the point at which you sell off your shares. It’s pretty hard to tell when the market is at its peak – what if your shares continue to go up and pay out dividends after you’ve sold them off?

- Secondly you have to time your re-entry – the point at which you buy back into your shares. Timing this is just as problematic. What if the market continues to drop after you buy back in? Alternatively, what if you’re waiting for the market to drop further, only to see it rise back up? Or what if the market doesn’t go down as far as you expect, and as a result your market timing exercise isn’t worth the brokerage fees and effort?

So it’s better to take a simple and lazy approach and just hold your shares. You’ll save on brokerage fees, and save your own valuable time by not having to keep a close eye on the markets.

There’s always bad news around the corner

This one might seem counterintuitive – isn’t this a reason to sell off your shares? The point we are trying to make here is that there’s always uncertainty, and there’s always an excuse to stay out of the market. Recent examples are:

- Brexit

- The election of Donald Trump

- The election of the Labour Government

- The COVID-19 pandemic

- The sharemarkets being at all time highs

But despite these events, shares have continued to advance upwards. Below is the chart of the S&P/NZX 50 index over a period of almost 20 years, where each market dip has become largely irrelevant compared to the market’s overall rise. Those waiting on the sidelines for the perfect time to enter the market will probably never find it, and risk missing out on significant gains.

The Evergrande situation and rising interest rates are just more of the same – news headlines that unfortunately shake investors out of their assets. And chances are these headlines won’t amount to much. The Chinese Government could swoop in to bail out Evergrande or throw economic support at those impacted by the fallout. All the pent-up demand from COVID-19 lockdowns (like not being able to go on holiday) could produce a surge in spending once the world opens up. Interest rates probably won’t rise as steeply as you imagined. And if any of these events do have a material impact on the markets, the dip will be temporary just like all the previous ones, and your investment portfolio will long outlive these events.

Conclusion

Evergrande, COVID-19, and rising interest rates provide plenty of uncertainty for our investment portfolios. But we firmly believe that your investment decisions should never be driven by news headlines. So use this as an opportunity to do a check up on your portfolio – does it align with your investment timeframe and risk tolerance? If not, perhaps you shouldn’t have been invested in shares in the first place – consider seeking the safety of more conservative assets like bank deposits and bonds.

If shares do suit your personal circumstances, then it’s probably a good time to do nothing and continue to hold your investments. Use any dips as an opportunity to buy up assets at a lower price, and remember to take a break from looking at your investments once in a while. In 10-20 years time there’s a very good chance your portfolio would have survived any carnage, reaching fresh all time highs. And all these events will be nothing but a distant memory.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.