Pak’nSave vs Countdown. Cadbury vs Whittakers. Air New Zealand vs Jetstar. There are heaps of great rivalries around NZ and the world, and InvestNow vs Sharesies is one of them when it comes to the NZ investing scene.

Both platforms continue to cause confusion as many investors struggle to decide which to use – the choice as not as easy as deciding between Cadbury and Whittakers! They are both fund platforms providing investors easy and cheap access to a large range of funds, but digging deeper uncovers many differences. So here’s a comprehensive look at both platforms to help you decide which is best for you.

Sharesies also offers you the ability to invest in individual companies listed on the NZX, ASX, and US markets, but this won’t be a focus of this article. Use this article as a comparison between InvestNow and Sharesies purely for the purpose of investing in funds and NZX listed ETFs.

This article covers:

1. What’s on offer?

2. Getting started

3. Regular Investing

4. Fees

5. User Interface

6. Ownership of investments

7. Other Considerations

Update (4 January 2020) – Added details about dividend reinvestment options

Update (17 April 2021) – Updates to reflect Sharesies’ new fee structure effective from 29 April 2021

1. What’s on offer?

Both InvestNow and Sharesies are fund platforms. They allow you to invest in large range of funds in once place, and manage your investments through their online portals at anytime of the day or night.

InvestNow

Owned by Wellington based Implemented Investment Solutions, InvestNow launched in 2017 and now has over 13,000 users, with over $300 million invested through the platform. InvestNow allows you to invest in over 110 funds including:

- The very popular and cheap Vanguard International Shares Index funds

- The also popular and cheap Macquarie Index funds

- A selection of Smartshares ETFs

- A large variety of actively managed funds from over 20 fund managers

Offering over 100 funds gives investors a huge amount of choice – and they continue to add more! But this is not always a good thing! This can be overwhelming for new investors, and make choosing a fund a lot harder – however, I’ve boiled down the choices in my article How to choose which fund to invest in on InvestNow and Sharesies.

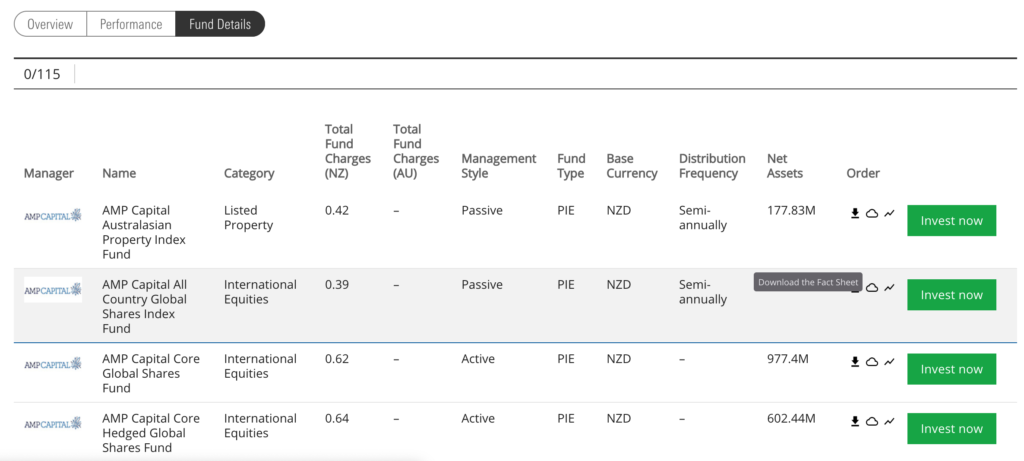

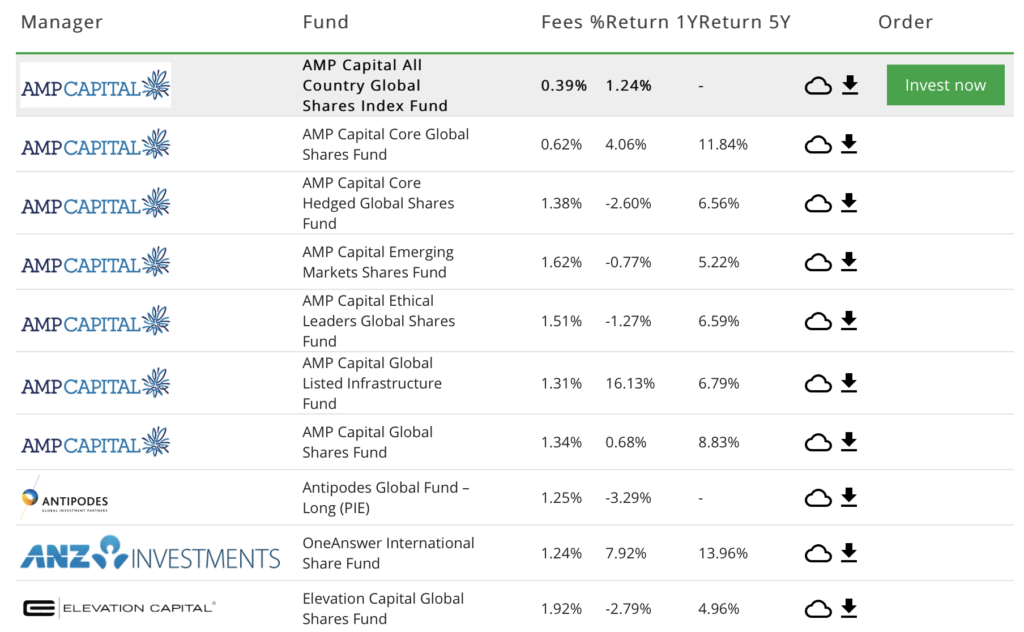

To help you research and choose a fund, InvestNow has an ‘Advanced Fund Selector’. It allows you to search and filter funds, and contains handy information such as a fund’s management style, distribution payment frequency, price history chart, and links to a fund’s fact sheet and product disclosure statement.

InvestNow also offers term deposits from four different banks, but this won’t be a focus of this article.

Sharesies

Launched in 2017, Sharesies has around 60,000 users and over $60 million invested. They’re also based in Wellington, and are owned by a variety of shareholders – the largest being Trade Me who own 15.64% of the platform. Sharesies allows you to invest in 40 funds:

- 35 Smartshares ETFs

- Two funds from Macquarie

- Three funds from Pathfinder Asset Management

- Two funds from Pie Funds

- The Salt Carbon Fund, which invests in carbon credits

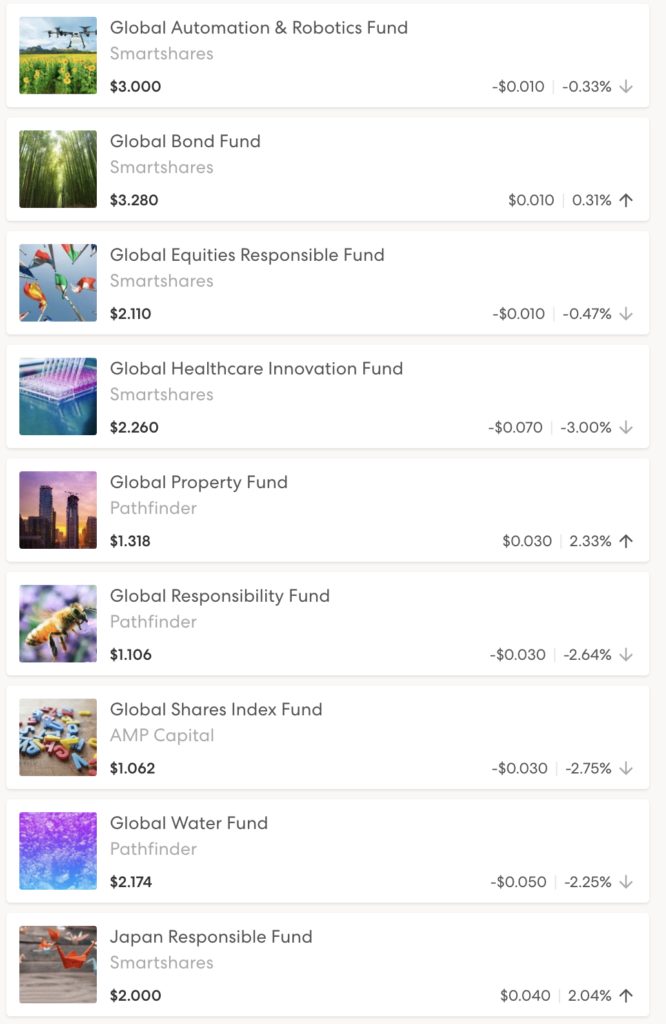

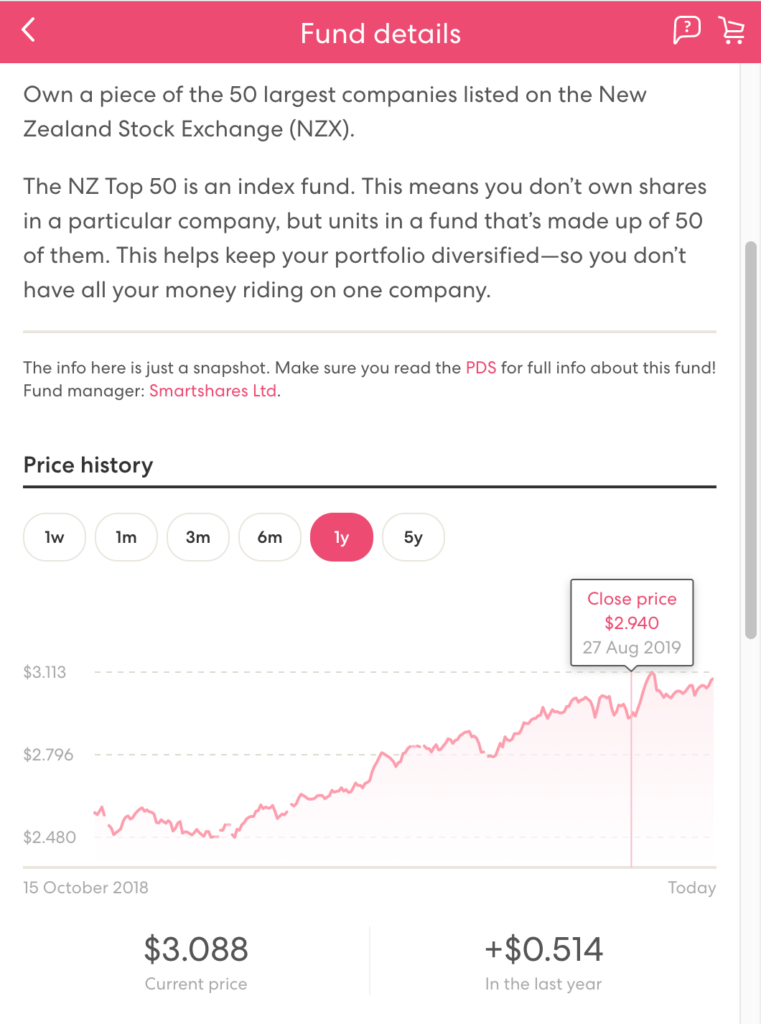

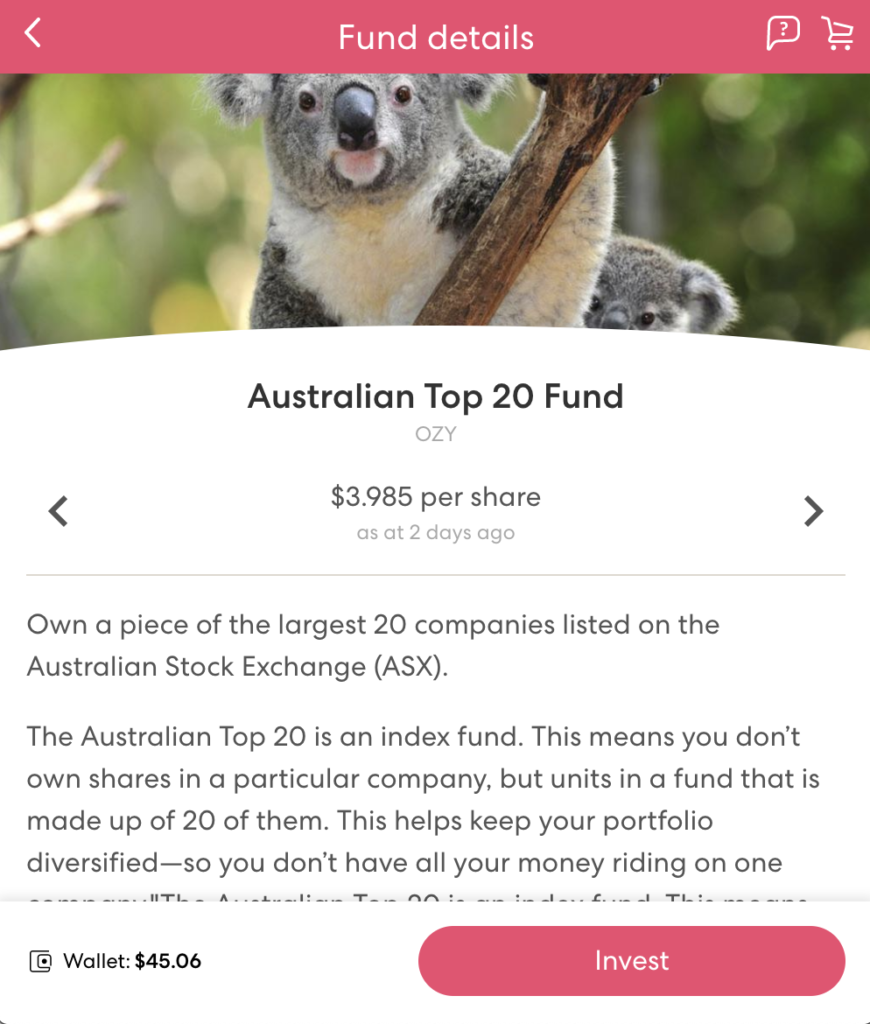

To help you decide which fund to invest in, Sharesies provides a brief overview of each fund, its risk indicator, dividend details, and price history chart.

Sharesies also offers you the ability to invest in individual companies listed on the NZX, ASX, and US markets, but this won’t be a focus of this article. See my article Sharesies vs ASB Securities and Direct Broking for more information on investing in individual companies.

There is quite a bit of overlap between the funds you can find on InvestNow and Sharesies. The only Sharesies funds you can’t get on InvestNow are:

- Smartshares Total World (NZD Hedged) ETF (TWH)

- Smartshares S&P/NZX NZ Government Bond ETF (NGB)

- Macquarie NZ Responsible Fund

- Pie Funds Global Climate Friendly Fund

- Salt Carbon Fund

But I don’t think any of these 5 funds are compelling enough to make you choose Sharesies purely based on wanting to invest in these funds.

Winner: InvestNow

2. Getting started

What does it take to get started on each platform?

InvestNow

InvestNow requires a minimum investment of $250 for a one-off investment into a single fund. This amount can be reduced to $50 per fund if you set up a regular investment plan (see section 3 below). This is low considering investing in funds directly through a fund manager can often require anything from $500 to $2,000, or even $500,000 AUD in the case of the Vanguard Funds.

Depositing money into your InvestNow account is done via a bank deposit, and deposits are usually processed overnight.

Sharesies

Sharesies requires a minimum investment of just one cent! Although investNow already makes starting to invest accessible with a low $50 minimum, Sharesies makes it just a little bit easier to dip your toe in the water.

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

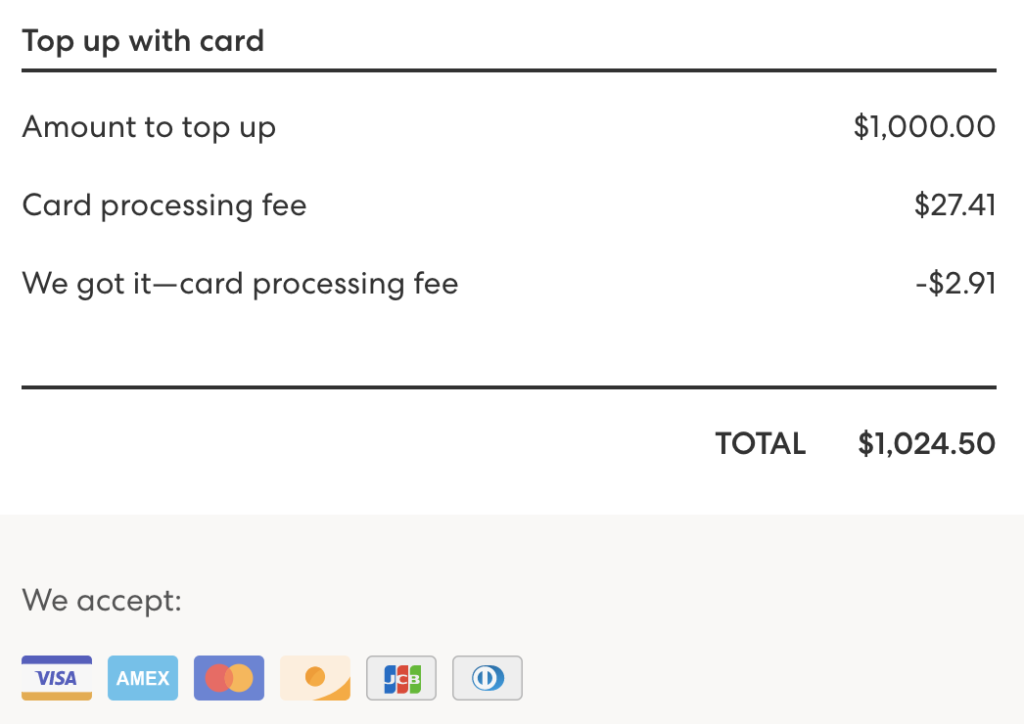

You can top-up your Sharesies account through bank deposit or by credit card. The credit card method is instant as you don’t have to wait for bank processing to occur – but topping up by credit card incurs fees of $0.18 + 2.65% (unless it’s your first ever top-up of up to $100), so you really don’t want to rely on this method. 2.65% is really high and could be high enough to eat up all your dividends for the year!

Sharesies also allows you to give and redeem gifts of between $5 and $2,000. I really like this idea, as it’s an elegant way of helping a friend or family member build their investment portfolio. However, gifts also incur the same fees as topping up by credit card, so be careful about relying on this method too much. You’d be better off gifting someone cash to top up their Sharesies account by bank deposit!

Winner: Sharesies

3. Regular Investing

Regular investment is a great way to gradually build up an investment portfolio over time. Both platforms allow you to automatically invest into the funds of your choice on a regular basis.

InvestNow

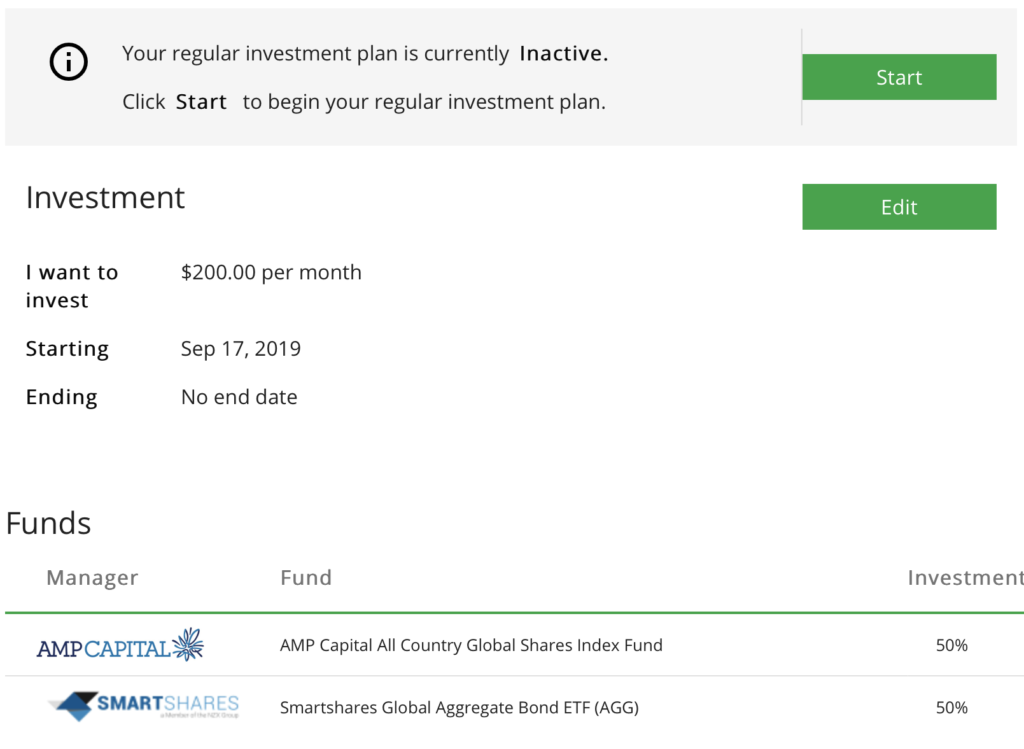

InvestNow’s regular investment plans allow you to invest a minimum of $50 per fund weekly, fortnightly, monthly, quarterly, or six-monthly. If you change your mind about the plan, you can edit or cancel it at any time.

The $50 per fund minimum is low, but could still be restrictive for some people. For example, let’s say you want to make weekly investment of $100 into a portfolio consisting of 90% into a share fund and 10% into a bond fund. Well, you can’t invest in the bond fund because 10% of $100 is below the $50 minimum. Your options to workaround this might be to:

- Change your portfolio to 50% shares and 50% bonds

- Increase your weekly investment to $500

- Reduce your investment frequency to something like $500 per month

Sharesies

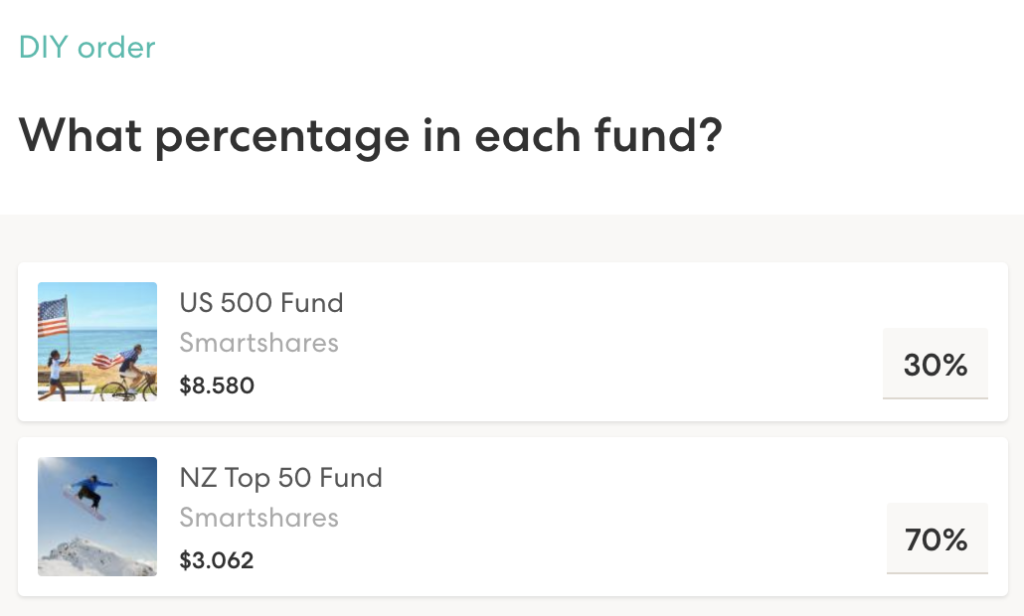

Sharesies’ auto-invest allows you to invest $5 or more into a selection of funds either weekly, fortnightly, every four weeks, or monthly. You can choose to invest in a pre-made order, which contain a bunch of pre-selected funds and weightings, or you can create a DIY order, where you choose your funds and weightings on your own.

Having the minimum auto-invest order at a very low $5 makes Sharesies significantly more flexible than InvestNow for regular investing.

Winner: Sharesies

4. Fees

You can’t avoid fees when investing! So what will you pay under each platform?

InvestNow

Account fees

InvestNow does not charge an account fee. InvestNow makes money by charging fund managers to have their funds listed on the platform (I suspect this is through a commission). In return, fund managers increase the exposure and accessibility of their funds, hopefully resulting in more customers.

InvestNow also offers funds that are distributed and owned by Implemented Investment Solutions (InvestNow’s parent business), such as the Russell, Legg Mason, and Hunter funds – therefore providing the aforementioned exposure and accessibility benefits to their parent.

Fund Management Fees

Even with zero account fees, you will still have to pay fund management fees – this is a fee paid to the manager of the fund you invest in, and is calculated as a percentage of the value of your investment. On InvestNow, this fee ranges from 0.20% per year for the Vanguard International Shares Select Exclusions Index Fund or the Smartshares S&P/NZX 50 ETF, up to 2.75% per year for the Fisher Funds Property & Infrastructure Fund.

Sharesies

Transaction fees

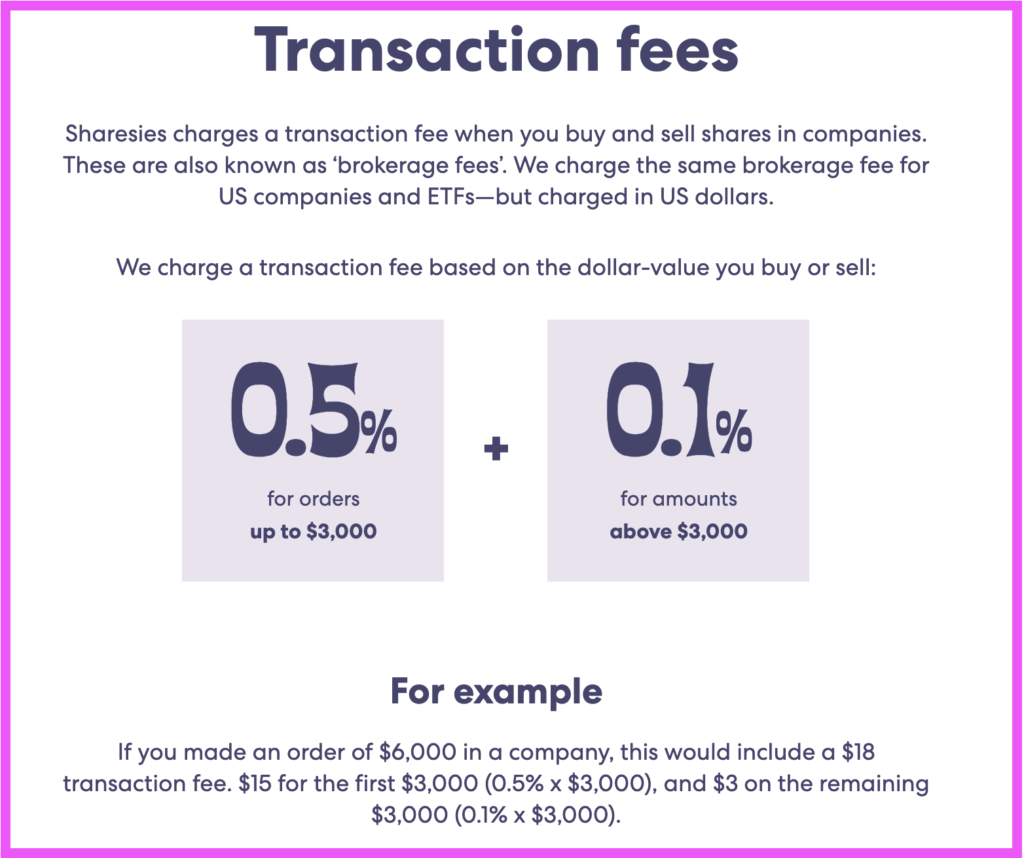

Sharesies charges a transaction fee every time you buy or sell an ETF. These fees are:

- 0.5% of your transaction value on orders up to $3,000

- 0.1% on any transaction amounts above $3,000

This immediately puts Sharesies investors at a disadvantage to InvestNow users, as the fee means you’re down over 0.5% just by making an investment.

Buying and selling the managed funds from AMP, Pathfinder, and Pie don’t incur this fee.

Fund Management Fees

Like InvestNow, you will pay fund management fees which ranges from 0.20% per year for the Smartshares S&P/NZX 50 ETF, to 1.30% per year for the Pathfinder Global Water Fund.

Fund management fees are not deducted from your InvestNow or Sharesies account’s cash balance. Instead fund management fees are calculated daily and are deducted/reflected in the unit price of your fund.

Winner: InvestNow

5. User Interface

With InvestNow and Sharesies being fully online platforms, user interface is an important consideration. This consideration is quite subjective though, so the best judge of user friendliness is you!

InvestNow

Opinion on InvestNow’s user interface is somewhat mixed, with this type of comment being somewhat common on social media sites:

I went to InvestNow but their website was confusing to navigate.

Facebook comment

On the other hand there are many comments, including their Facebook reviews, that are positive about the interface:

Easy to use interface, minimal fees, wide selection of funds. What’s not to like?

Facebook review

I agree that the portal has room for improvement, but personally I think it’s perfectly adequate once you familiarise yourself with it. It does what you’d expect it to do well – in fact it takes only seven mouse clicks to go from logging in to placing an investment in a fund – the same number of clicks as Sharesies!

I think the interface’s biggest weaknesses are the lack of a mobile friendly interface, and how it makes you download a fund’s Product Disclosure Statement every single time you place an investment order – very annoying!

Sharesies

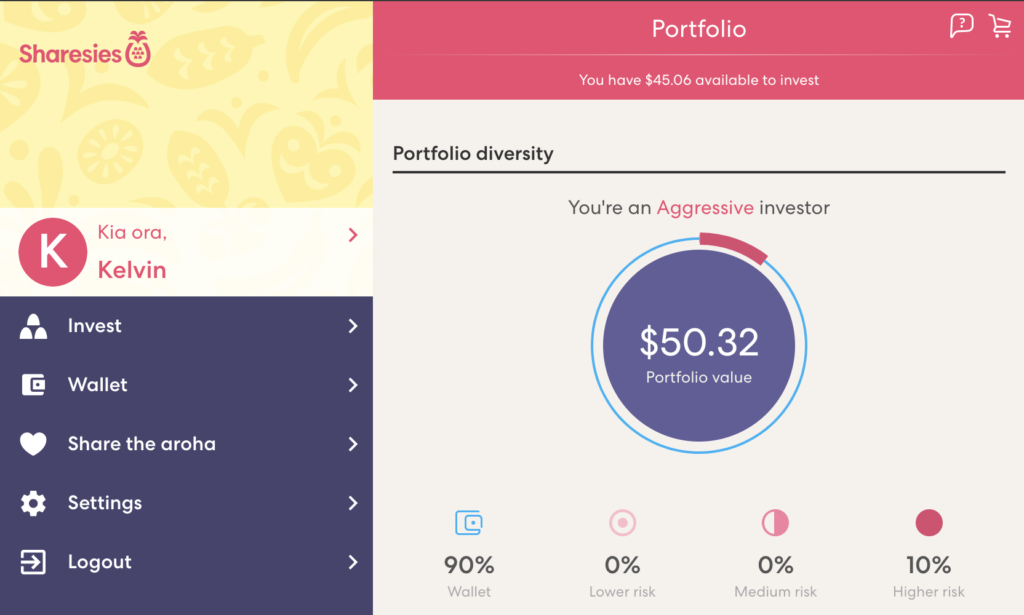

Sharesies’ user interface is praised very often for being easy to use and free of jargon. If you dig around on social media sites, you’ll find heaps of positive comments from their happy users.

I’m really enjoying Sharesies. Easy, quick to use. Instead of buying alcohol, gambling, or buying junk food, I invest. Win win. And fun.

Twitter Tweet

I like Sharesies. The psychological reinforcement that the app provides will benefit me more than the $30 per year.

Reddit comment

The platform is certainly much more colourful and inviting compared with InvestNow. It’s also mobile friendly – in fact they use the same responsive interface for both mobile, tablet, and desktop.

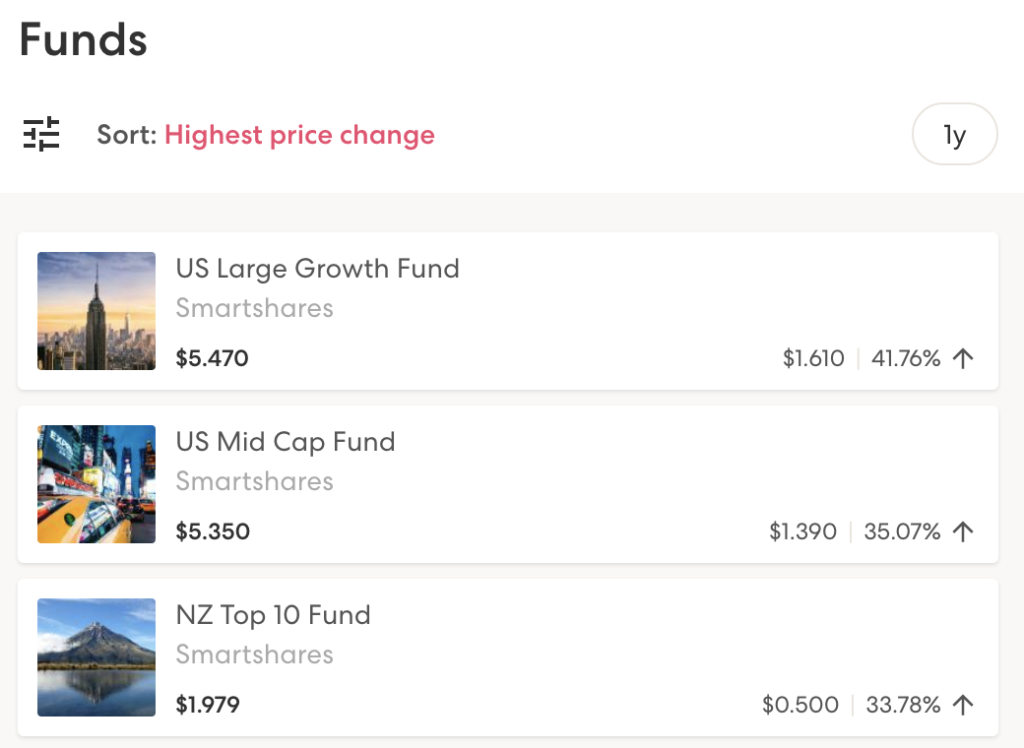

There are still bad points about the interface. For example, I’ve never been a fan of them allowing you to sort funds and companies by ‘highest dividends’ and ‘highest returns’. Given Sharesies targets beginner investors, this feature could encourage investing based simply on past returns and biggest dividends. This is absolutely not a good investment strategy as past performance is not an indicator of future performance.

Some people also think the interface is too simple:

Surprised how big Sharesies has become, seems so very basic and dumbed down.

Reddit comment

Winner: Sharesies

6. Ownership of investments

A very common concern when investing through these types of platforms is who actually owns the investment, and what happens if the platform goes out of business?

Neither InvestNow or Sharesies allow you to hold your investment under your name. Instead they are held on your behalf by a custodian, which is not as ideal as owning the investment yourself, but there a couple of features that come with custodians to protect you:

- Segregation – your money and investments are held by a legally seperate entity to the InvestNow and Sharesies platform. This means your money can’t be mixed with the platform’s money, and won’t be affected in the case that the platform goes out of business.

- Auditing – custodians are legally required to be independently audited every year. The custodians here use reputable auditors such as PwC and KPMG.

InvestNow

The InvestNow platform’s legal entity is InvestNow Saving And Investment Service Limited. InvestNow’s custodian is Adminis Custodial Nominees Limited, run by a specialist Wellington based investment administration company, Adminis, so are completely independent from InvestNow.

In addition, with InvestNow it’s usually possible to perform an off-market transfer to transfer ownership of an investment into your own name. The exception to this would be the Vanguard funds for example, where you need at least $500,000 AUD invested to own the funds under your own name – in this situation, an off-market transfer is probably not doable unless you have the required amount.

Sharesies

The Sharesies platform’s legal entity is Sharesies Limited. Cash deposits, and investments in non-listed funds are held by custodian Sharesies Nominees Limited, while investments in listed funds and shares are held by NZX owned New Zealand Depository Nominee Limited. You can read more about Sharesies’ custodial arrangements here.

Sharesies’ custodial arrangements are not as robust as InvestNow:

- The custodian Sharesies Nominee Limited is not fully independent from the Sharesies platform, as it is 100% owned by Sharesies Limited, and both entities share the same directors

- Sharesies do not allow you to make off-market transfers from their custodians into your own name. This is probably partly due to their fractionalisation feature.

Further Reading:

– What happens to your money if InvestNow or Sharesies go bust?

Winner: InvestNow

7. Other Considerations

Dividend reinvestment

By default InvestNow automatically reinvests any dividends/distributions into the fund the distribution came from. However, you can contact InvestNow to change this and have all your distributions paid as cash. With Sharesies, all dividends/distributions are paid into your wallet. These must be reinvested manually, therefore incurring the transaction fee in doing so.

Account ownership and access

Sharesies only offers individual accounts, while InvestNow also allows you to create joint, trust, and company accounts.

InvestNow also allows you to give other people access to your account. You can give someone (e.g. your partner) control of your account, or allow someone to view your account (e.g. your accountant or adviser).

Tracking & reporting

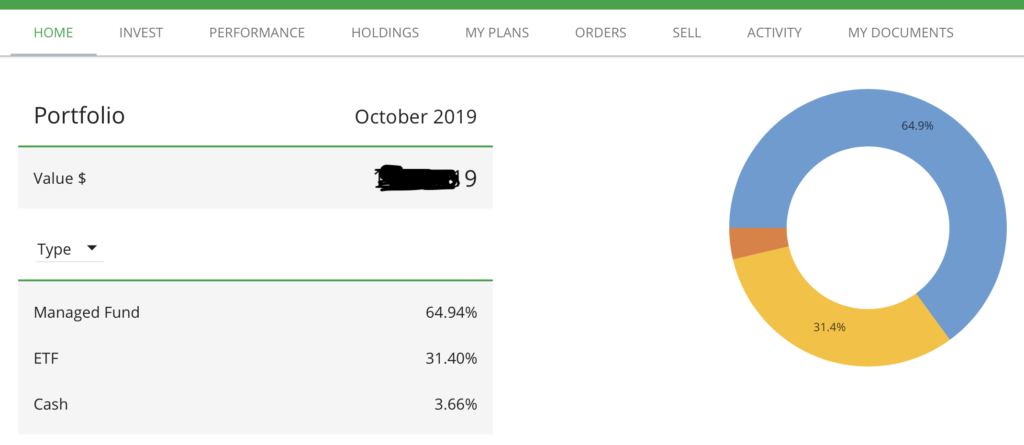

Both platforms do a good job of telling you how your investments are performing, at both the portfolio and individual fund level. Here is a very cool Sharesies feature which shows how much my portfolio value has changed over time:

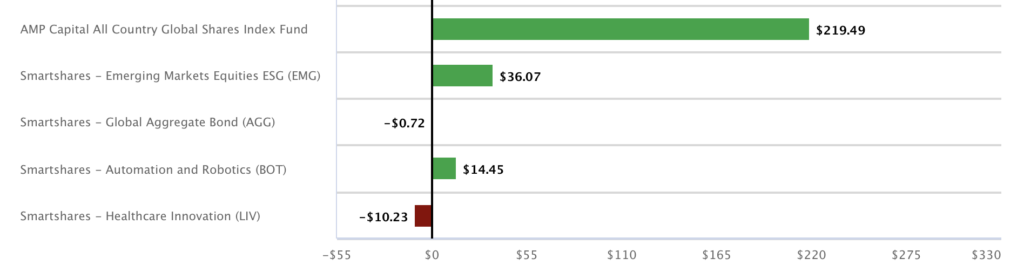

Here’s InvestNow which provides an awesome graph showing your profit or loss for each fund. With Sharesies you have to dig through a few screens to see the same information. Unfortunately InvestNow only updates the data on their Performance tab monthly.

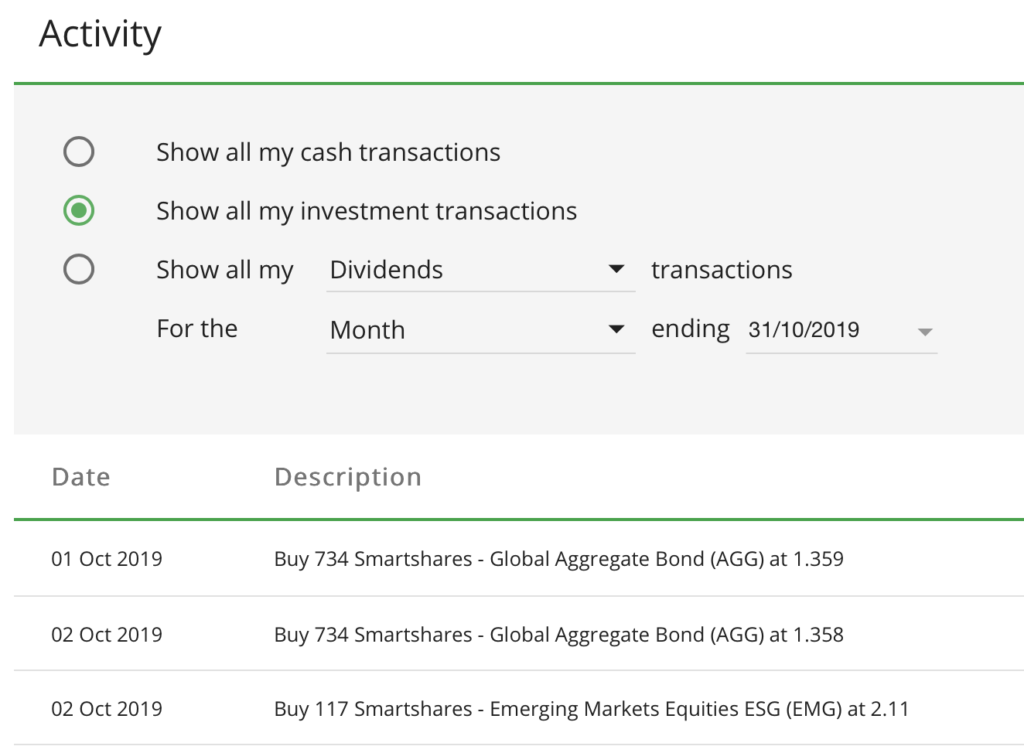

But overall I think InvestNow provides better reporting as their functionality for filtering transactions is a lot more complete (on the Activity tab).

With both platforms you can also generate a detailed PDF report containing all of your holdings and transactions at any time. However, InvestNow’s report is a little more comprehensive with seperate sections for holdings, dividends, tax, deposits, and fund transactions.

2-Factor Authentication

InvestNow requires 2-factor authentication (2FA) when you log in to the platform – in addition to entering your email and password, you also need to enter a six-digit code sent to you as an email or SMS. While this adds more security to your account, I wish there were more granular options to control when 2FA is required. For example, it would be awesome if I didn’t need 2FA to log in, and only needed 2FA to buy/sell funds and make withdrawals.

Order processing times

If you invest in a Smartshares ETF on Sharesies, and the sharemarket is open (normally 10am-4:45pm on business days), your investment order is usually processed and settled almost immediately. With InvestNow, all investment orders are only processed once per business day, and you need to place an order before the 12pm cut-off time if you want your order to begin processing on the same day. Once orders begin processing with InvestNow, they then take at least couple of business days to settle (i.e. for your money to change hands with the fund manager).

So Sharesies can be a lot faster than InvestNow for buying and selling Smartshares ETFs, but this is a very minor point as it hardly makes a difference when you’re investing in these funds for the long term.

Kids accounts

Both platforms allow you to create kids accounts. Sharesies offers half price account fees for under 18s, but InvestNow still wins with their zero account fees. Just one thing to be cautious about is that most funds on Sharesies are not tax friendly for kids, as the Smartshares ETFs are all taxed at 28%. InvestNow has more options for tax friendly funds for kids. See my article How to invest for kids in New Zealand for more info.

Tax

Your tax obligations should not differ between investing in InvestNow and Sharesies. The exception is if you’re investing in any of the Australian Unit Trusts on InvestNow – you may have to complete a tax return for these as they are overseas investments. See section 2C of my article about tax for more information.

Withdrawing money

Withdrawing your cash is painless with both platforms, and in my experience both had the money in my bank account within a business day.

Conclusion

Most of the time you are going to be better off going with InvestNow (myself included). I would say that based on fees alone – why pay for something when you can get a free alternative that’s just as good? Their UI is not as daunting as it first appears to be, and their minimum investment amount is still fairly easy to work with. You also get a wider offering of funds, including the low fee Vanguard and AMP index funds.

However, there are a few reasons you might want to consider Sharesies:

- Lower minimum investment – Sharesies allows you to invest amounts smaller than InvestNow’s $50 minimum. However, alternatively you could save up in a bank account until you reach the $50 needed for InvestNow.

- User friendliness – Sharesies has a better interface and is easier to use, but ask yourself whether this is worth paying the transaction fees for. InvestNow’s interface is pretty good once you familiarise yourself with it.

- You want to invest in individual companies via Sharesies, and want to keep all your investments in one place. Should you be investing in individual companies? Check out my article Investing in individual companies vs funds – what’s better?

- Learning – Given its beginner friendly interface, you could use Sharesies to learn and become comfortable with investing. Then you can switch over to InvestNow when you’re ready to invest larger amounts.

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

So that concludes my comparison between InvestNow and Sharesies. I didn’t expect to write almost 3,000 words on this topic, but it turned out there were more differences than I originally thought!

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Great comparison, what’s your view on the cash drag associated with Investnow vs the likes of Sharesies. If I brought $100 of an ETF on Sharesies it would buy fractional shares and leave no cash left ‘uninvested’ in my wallet, Invest now potentially leaves a lot of cash remaining indicitive of the current share price.

It’s annoying, but there’s ways to manage it. For example you could make an extra one-off order when the uninvested cash has built up, or put in slightly larger investment orders to counter the cash drag. The issue shouldn’t make a huge difference over the long-term, especially when you balance it with the fact that InvestNow doesn’t charge transaction fees while Sharesies does.