There’s been a lot happening in the financial markets and New Zealand investment scene this month, so here’s an article covering our views on what’s been going on including the current market volatility, Sharesies’ mobile app, and new investment platforms that have recently launched.

This article covers:

1. Market volatility

2. Sharesies’ mobile app

3. New investment platforms

4. Opoly property crowdfunding

1. Market volatility

Financial markets have had a rough start to the year

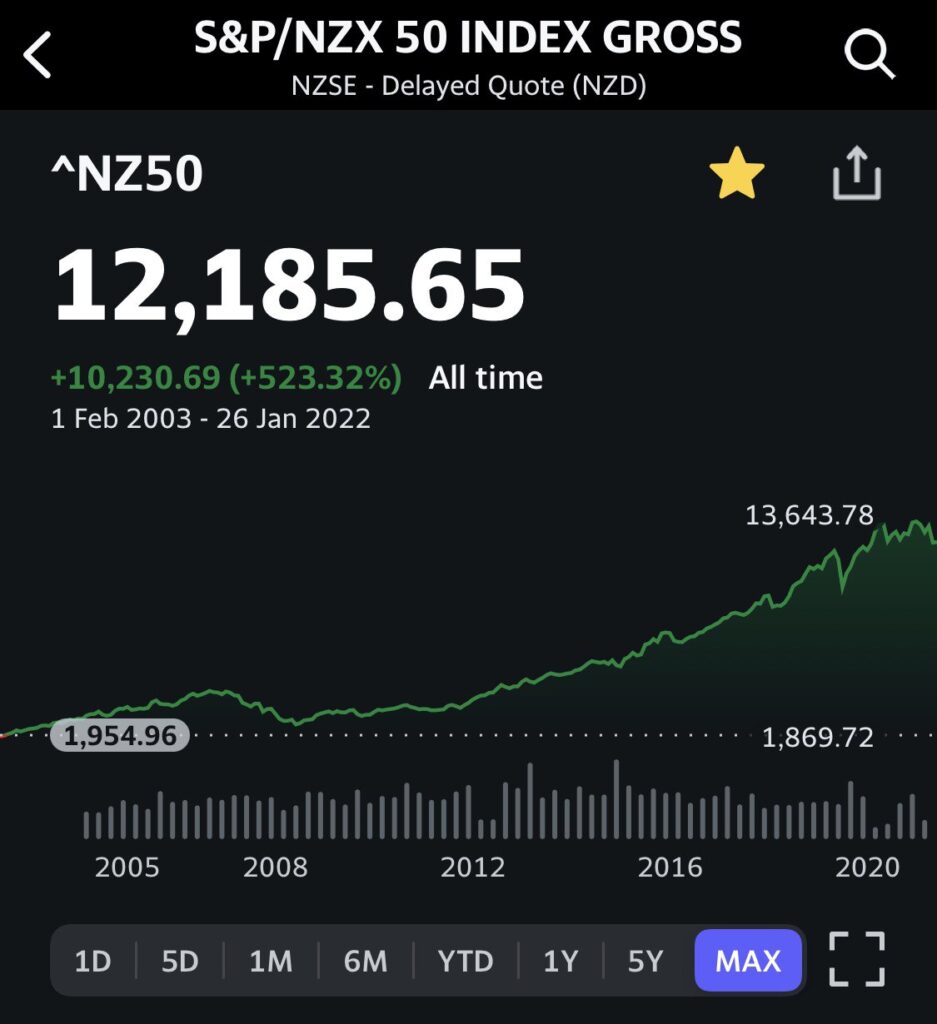

Our home market has fallen 6.51% year to date as represented by the S&P/NZX 50 index:

The US market has taken a greater fall, down 8.60% YTD as represented by the S&P 500:

Things aren’t so bad everywhere across the globe. UK shares are down just 0.18% YTD as represented by the FTSE 100:

But in the cryptocurrency world, things are looking worse with Bitcoin down more than 26% over the last month:

Seeing the markets drop over the past couple of weeks has left many investors spooked, especially considering we haven’t had this much market volatility in several months. It’s not always easy to pinpoint a particular reason for market dips, but in this case it appears that high inflation (leading to higher than expected interest rates and reduced economic stimulus from central banks) is the main cause, together with political instability in areas like Ukraine, and the Omicron variant of COVID-19.

It’s a long-term game

Most of you in the Money King NZ community know that investing in shares is a long-term venture to grow your wealth, that it’s normal to see the market dip on a regular basis, and that the best response is to hold onto your shares and ride out the bumpiness in the markets. A quick poll in our social media channels suggested that most of you are still feeling positive about your investments during this time which is great to see!

For others, it’s understandably unsettling to see your investments getting hammered every day. If you’re a bit worried, it’s time to keep calm and focus on the long-term where the market will eventually recover like it always has in the past.

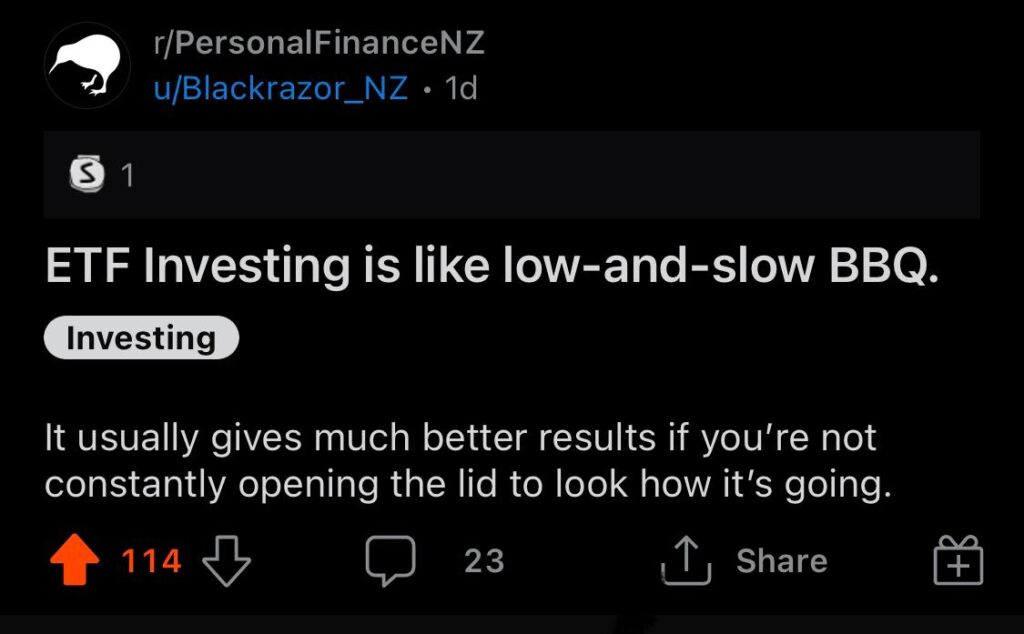

Less information is better

Thanks to slick digital investment platforms, it’s pretty easy to engage with your portfolio and check your balance everyday. But we’d argue that the day-to-day movements in your portfolio is just noise, distracting you from achieving your financial goals. Here’s a hypothetical example demonstrating why:

- In December 2021, Daniel invests $10,000 in the hypothetical Money King NZ Growth Fund.

- On 20 Jan, the value of Daniel’s investment was $9,300

- On 21 Jan, the value of Daniel’s investment was $9,000

- In December 2041, Daniel sold his units in the Money King NZ Growth fund for $40,000.

Points 2 and 3 showing Daniel’s daily portfolio value is excess information. Having this information doesn’t make Daniel a better investor, nor does it result in a better investment outcome. In fact, seeing that information could have made Daniel a worse investor by stressing him out and spurring him into selling at a loss in response to his investment value dropping.

So this may be a good time to filter out some of the noise that we get bombarded with everyday. More information and more action doesn’t tend to equate to better results in investing. So consider keeping your eyes off the headlines, and checking your portfolio less frequently – we trust it’ll be good for your mental health.

What’s next?

We have no idea what’s going to happen to the markets in the immediate future – it could go back up, go down even further, or go sideways. It’s impossible to reliably time the market or predict when it’ll reach the bottom. So we’re continuing to take the approach of averaging into the market, drip feeding a little bit of money into our investments every week regardless of which direction the market is heading. In fact we (like many other investors) are enjoying this dip, embracing the opportunity to buy into our investments at sale prices!

Further Reading:

– 2020 Recession? How to prepare your investment portfolio

2. Sharesies’ mobile app

No new functionality

Earlier this month Sharesies released native iOS and Android mobile apps for their platform to much fanfare. But if you weren’t already aware, Sharesies already had an app – a web app that’s accessed via your web browser, as opposed to a native mobile app which is downloaded as a piece of software onto your phone. The native app is just a wrapper for the web app i.e. all it does is direct you to the web app, essentially acting as a bookmark for the platform. The app adds no new functionality for Sharesies’ customers.

We did an experiment where we compared the new mobile app to a Home Screen bookmark (saving the Sharesies web app to our home screen). They both looked, felt, and behaved exactly the same, and we couldn’t tell the difference between them apart from the colour of the pineapple!

Just a marketing tool?

While the current version of the mobile app is identical to the web app, Sharesies promises they’ll build out the mobile app over time to offer more functionality. Some of them will be useful like biometric (fingerprint/face) login and certain types of push notifications. But we think some features (if implemented) could do more harm than good:

- Portfolio/price notifications (e.g. notifications when the price of a share or the value of your portfolio reaches a certain level) – This could create more noise for long-term investors who arguably have no need to constantly see the movements of their portfolio. Monitoring your portfolio too closely could lead to you freaking out when the markets go down.

- Product update notifications (e.g. notifications when Sharesies releases a new feature on their platform) – This provides no real functional benefit to investors, but rather mainly benefits Sharesies as they’re able to use your phone’s push notifications as another channel to promote their product.

- Widgets (e.g. a widget on your home screen which can display your portfolio’s balance) – This would be another dangerous feature, as having your portfolio balance too visible could also lead to freaking out when the markets drop.

Overall, we see the mobile app as more of a marketing tool (to increase engagement with the platform, and give it visibility in the mobile app stores), than something that provides genuine enhancements to the platform’s functionality. The app’s upcoming features could tempt investors to over-engage with their portfolios, when we’d argue that checking your portfolio less is better.

In addition, developing and maintaining the app requires Sharesies to employ expensive team members. We’re not against developing native mobile apps, and Sharesies have every right to do so. But the app could divert resources and attention away from potentially more important initiatives like lowering fees, and adding functionality to automatically reinvest dividends.

Focus on the important things

Despite its limited value, the app is still a step forward for Sharesies investors – it’s just not as revolutionary or exciting as the fanfare suggests. So don’t let the availability of a mobile app cloud your judgement of which investment platform to choose. Instead, select your platform based on things like fees, tax efficiency, and the quality of investments on offer, rather than the ability to access the platform via a mobile app over a web browser.

3. New investment platforms

A few new investment platforms have popped up recently, aiming to grab the attention of everyday Kiwi investors. It’s no surprise that more and more companies are developing these platforms, wanting a slice of the action after seeing the success of Sharesies, Hatch, and InvestNow. All these new platforms are still in beta/early access mode, so we’ll reserve our full reviews for later on – but here’s an initial look at each of them:

Flint Wealth

Flint Wealth is a fund platform like InvestNow, offering 40 funds from 7 different fund managers:

- Pathfinder

- Harbour

- Castle Point

- Devon

- Fisher Funds

- Nikko AM

- Mint

The minimum investment is $250. Given there are no low-cost passively managed fund options, and that almost all of their funds are already available on InvestNow, we don’t yet see any compelling benefits in Flint Wealth’s offering.

BlackBull Markets

BlackBull Markets is an Auckland-based derivatives and FX trading platform, who have just launched a share broking platform allowing investors to buy and sell shares from 80 different countries. They’ve partnered with Interactive Brokers who execute all their orders for them. With fees for US trades starting from ~$11.50 USD, and Aussie trades starting from $19.30 AUD, it appears that signing up directly for an Interactive Brokers account will be more cost efficient (IBKR’s fees start from $3 USD and $8.74 AUD). However, BlackBull Markets argue that they provide the benefit of a locally based platform and support team.

Also unlike Interactive Brokers, BlackBull Markets offers NZX listed shares. Their digital platform doesn’t support NZX trading yet, so any orders have to be placed manually via email or phone (but they’re hoping to build a digital platform for NZX trades in the future). For the NZX they have a minimum brokerage fee of $9 per trade, making them cheaper than ASB Securities and Jarden Direct, but more expensive than Sharesies for trades smaller than $1,800.

Sugar Wallet

Sugar Wallet is a platform who offers investment into Simplicity’s Growth, Balanced, and Conservative funds with a minimum investment of just $1. They charge an account fee of $3 per month if you have an investment balance of over $250 – therefore we struggle to see much benefit of investing through Sugar Wallet over investing in Simplicity’s funds directly (given the direct route doesn’t charge any account fees).

More to come?

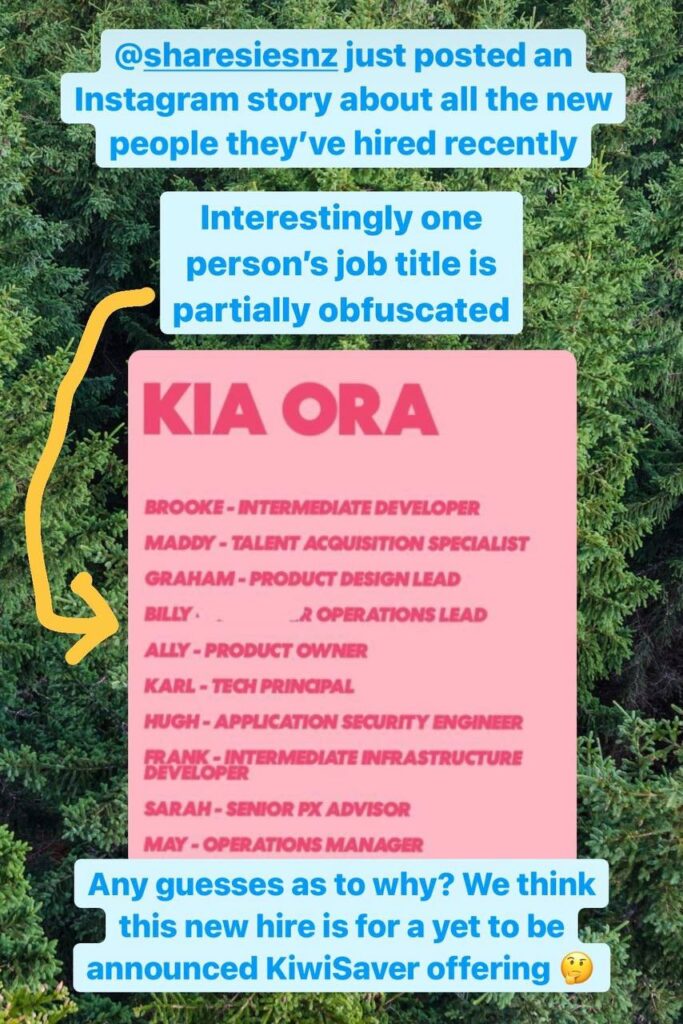

None of these new platforms are particularly exciting or game changing, but we’re looking forward to see how they develop. And apart from the above, we’re confident even more products will pop up in 2022. We won’t be surprised if the usual innovators (like Kernel, InvestNow, and Hatch) launch something new, but most notably we’ve heard suggestions that Sharesies is developing their own KiwiSaver scheme.

4. Opoly property crowdfunding

Another property crowdfunding platform goes silent

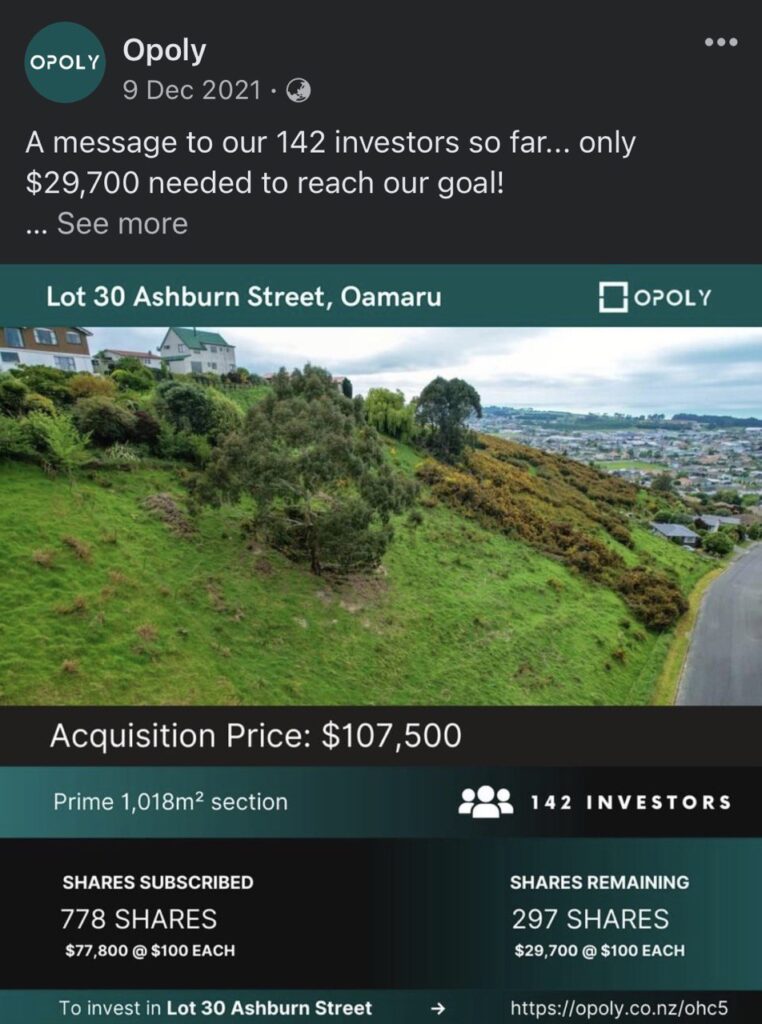

Opoly was a platform offering Kiwis the chance to invest in property with as little as $100 through crowdfunding (e.g. essentially combining the funds of lots of investors together to buy a house). They offered a total of 5 properties out to investors, though most offers were unsuccessful in raising enough funds to acquire the property:

- An apartment in Ponsonby, Auckland. Offer failed with $42,100 out of $1,100,000 raised.

- A commercial property in Orewa, Auckland. Offer failed with $53,500 out of $947,200 raised.

- A piece of bare land in Oamaru, Otago. Offer successful with $105,000 raised.

- A piece of bare land in Te Anau, Southland, Offer failed with $200,000 out of $250,000 raised.

- A piece of bare land in Oamaru, Otago. Offer failed with $83,700 out of $107,500 raised.

After their 5th crowdfunding offer failed to raise the required funds, they’ve gone totally silent with no posts on social media to acknowledge their unsuccessful offer, or to update investors on future plans for the platform.

We can only assume the founders are now focussing on their new venture in manufacturing and selling woollen jeans who recently successfully raised capital though a PledgeMe crowdfunding offer.

What went wrong?

Opoly was the 3rd unsuccessful attempt at offering Crowdfunding in NZ after The Ownery and The Property Crowd (who have both also disappeared from the face of the earth). It’s disappointing to see their platform didn’t work out, but we’re not surprised they followed the fate of their predecessors. We first wrote about Opoly in this article, where we suggested they didn’t learn from the shortcomings of The Ownery and The Property Crowd – the fees were extremely high, they didn’t utilise leverage in their offerings, and their bare land properties didn’t come with the potential of earning rental income. Combined with an environment where investors are becoming smarter and more aware of options to build wealth outside property investment, Opoly had limited chance to succeed.

Conclusion

We hope you enjoyed this article despite it being a bit more negative than we’d hoped things to be. 2022 could be a tough year for investors – but things like market volatility isn’t something we can control, so buckle up and try to enjoy the ride as much as you can. Things will get better eventually, but before they do don’t be afraid to take a break from checking your portfolio, and focus on the things that matter.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.