Do you want to start investing and want to know what the options are? Here’s a beginner’s guide to nine investing options available in New Zealand – from the four traditional asset classes of cash, bonds, shares, and property – to funds, KiwiSaver, and alternative investments like cryptocurrency.

This is not a complete list – there are certainly more investing options out there like commodities, foreign exchange, derivatives, or even artwork, but these are less accessible, less common, and sometimes require more input and skill from investors.

Traditional Investments

1. Bank Deposits (Cash)

Difficulty: Easy

Potential risk & return: Low

Bank deposits are as easy as it gets. Put your money in a bank account or term deposit and get paid interest according to the interest rate being offered. Bank deposits will give you low returns, but are low risk, making them ideal for saving money for the short-term or for storing your emergency fund.

Key risks: This is one of the safest places to put your money, but in the unlikely event that your bank gets into financial trouble, you could lose some or all of your money. And with low risk you’ll get low returns – which might not be enough to beat the rate of inflation.

$ needed to get started: $0.01 for most savings accounts, at least $1,000 or more for term deposits

How to invest: Open a savings account, Notice Saver account, or term deposit with your bank.

Further Reading:

– Bonus Saver vs Notice Saver vs Term Deposit – Which savings product is right for you?

– What’s the best short-term investment?

2. Bonds

Difficulty: Hard

Potential risk & return: Low-Medium depending on the credit rating of the bond

When you buy bonds (not the underwear brand!) you lend money to a government or company (corporations), usually for terms of five years or more. In return, you’ll get paid a fixed rate of interest. With corporate bonds the interest rates tend to be higher than a term deposit at a bank, while government bonds have lower rates but come with lower risk.

Unlike term deposits, bonds can be bought or sold at anytime on the NZX debt market. Also, unlike term deposits, the value of a bond can go up and down depending on market conditions (although their value is less volatile than shares). Almost all bonds issued in New Zealand have a minimum investment amount of $5,000 so are less accessible than other investments.

Key risks: The issuer of the bond could get into financial difficulty and not be able to pay you back. In addition, interest rates of other investments can go up, making the bonds you’re invested in less attractive, causing the value of your bonds to go down.

$ needed to get started: Typically $5,000

How to invest: You’ll need a broker to buy and sell bonds, like Direct Broking. ASB Securities also offer bond brokerage services, but orders must be placed over the phone.

Further Reading:

– Bonds 101 – 5 things to know about investing in bonds

3. Shares

Difficulty: Medium

Potential risk & return: High

When you buy shares, you buy a piece of ownership in a company. Also commonly known as stocks, investors in shares can profit from capital gains if the value of their shares go up. Many companies also pay dividends to their shareholders every 3-6 months, which is a portion of the company’s profits.

You can buy and sell shares at anytime on the sharemarket. With so many companies listed on sharemarkets around the world, you can invest in companies you see and use everyday like Spark, Google, and Uber. Shares in different companies have different characteristics, for example, Contact Energy pays high dividends but has low growth prospects, while Facebook has high growth prospects but pays no dividends.

Key risks: The company you buy shares in may perform poorly, in which case the value of your shares is likely to fall (and you could lose all your money in the worst case).

$ needed to get started: Under $100

How to invest: You’ll need a broker to buy and sell shares, like Sharesies or Hatch.

Further Reading:

– Shares 101 – How to buy shares, which companies to pick, and more

4. Property

Difficulty: Hard

Potential risk & return: High

Property investing is a New Zealand favourite and considered to be part of the “Kiwi dream”. Unlike the other investments here, property is more tangible, for example a house, office block, or industrial building that you can see and touch. Property investors can profit from capital gains (the value of the property increasing) and rental income.

Key risks: The value of your property could decrease, or you may struggle to find a buyer when you want to sell. Interest rates may rise, tenants might leave, or changes in your life circumstances could make your mortgage repayments less affordable. Also, your property could sustain damage (from bad tenants or natural disasters), and insurance may not cover all the costs.

$ needed to get started: At least tens of thousands of dollars

How to invest: There are many parts to investing in property. You’ll need financing (through a bank/mortgage broker), a lawyer, insurance, and a property to buy.

As an alternative you can also invest in property by buying shares in Real Estate Investment Trusts (REITs). REITs are companies that invest in a portfolio of (typically commercial) properties.

Further Reading:

– Property vs Shares – The pros and cons of buying residential property

– What’s inside your property fund? 5 things to know about REITs

Funds

5. Funds

Difficulty: Easy

Potential risk & return: Low-High depending on type of fund

Funds are not a standalone asset class, but rather a scheme where lots of investors put their money together, and then have the money invested into lots of different assets like shares, bonds, or cash – giving you lots of diversification at once. There are many types of funds, for example, active funds (where there is a professional fund manager who decides where and how to invest the money), and passive funds (where the money in the fund is invested in a market index e.g. Top 50 companies in the NZ market).

With so many funds to choose from, there is most likely to be one that matches every investor’s investment objectives. Investors can profit from capital gains, and some funds pay regular distributions (a share of the dividend or interest income that the fund earns). Funds are one of the most accessible investment options, as you can start with as little as $50.

Key risks: Funds invest in assets like shares and bonds, so if the value of those assets fall, the value of the fund will also fall.

$ needed to get started: Under $100

How to invest: You can buy funds through a platform like InvestNow or Sharesies, or direct from a fund manager like Kernel or Simplicity.

Further Reading:

– Funds 101 – What’s the difference between an Index Fund, ETF, and more?

– 6 ways to build a long-term investment portfolio in New Zealand

6. KiwiSaver

Difficulty: Easy

Potential risk & return: Low-High depending on type of fund

KiwiSaver is just a type of fund, but a very special one. It’s designed to be a retirement savings scheme where contributions are made from your wages/salary, your employer, and the government. These contributions are then invested into a KiwiSaver fund of your choice, which invest in a mix of shares, bonds, and cash. The employer and government contributions make KiwiSaver one of the best investments in New Zealand, however, your money is locked in until you’re 65, or when you’re buying your first home.

Key risks: Your money invested in KiwiSaver can’t be withdrawn at any time – it is essentially a fund with special restrictions. You might also choose the wrong fund for your investment objectives or risk tolerance, which could result in sub-optimal investment returns.

$ needed to get started: Under $100

How to invest: If you’re eligible, you’ll be enrolled in the scheme automatically when you start a new job. You can also enrol manually by registering with a KiwiSaver fund provider, or through your employer.

Further Reading:

– KiwiSaver 101 – How does KiwiSaver fit into your investment portfolio?

– Simplicity vs JUNO vs BNZ – Battle of the low cost KiwiSaver funds

Other Investments

7. Peer to Peer Lending

Difficulty: Easy-Medium

Potential risk & return: Medium-High

This is where you lend your money to other people or businesses through a Peer to Peer Lending platform, and they’ll pay you back along with interest over a period of 1-7 years. On offer is an interest rate 2-3x higher than what you can get with a bank term deposit.

Key risks: The person or business borrowing your money might not pay you back, in which case you could lose your money.

$ needed to get started: Under $100

How to invest: Join a peer to peer lending platform like Lending Crowd, or Squirrel.

Further Reading:

– 5 things to know about investing in Peer to Peer Lending

8. Equity Crowdfunding

Difficulty: Hard

Potential risk & return: Very high

This is similar to buying shares, where you buy a piece of ownership in a company. With equity crowdfunding, companies offer to sell shares in their company to the public (the “crowd”), in order to raise money to grow. The main differences between shares offered in equity crowdfunding, and traditional shares (section 3) are:

- These shares are not listed on the sharemarket so you can’t buy or sell them at anytime.

- Companies that use equity crowdfunding are usually smaller and less mature, so have more potential to grow, but comes with a higher risk.

- Equity Crowdfunding gives you the opportunity to invest in cool, start-up style companies you won’t find on the sharemarket. But that also means there’s less information available about those companies, making it harder to assess whether to invest or not.

Key risks: You may lose some or all of your money if a company you invest in performs badly or fails. You might not be able to sell your shares when you want to because they aren’t listed on the sharemarket.

$ needed to get started: At least a few hundred dollars

How to invest: Visit equity crowdfunding platforms like Snowball Effect and PledgeMe.

Further Reading:

– 4 things to know about investing in Equity Crowdfunding

9. Cryptocurrency

Difficulty: Medium

Potential risk & return: Very high

These are digital currencies like Bitcoin, Ethereum, and Litecoin. Cryptocurrencies use blockchain and other emerging technologies to facilitate transactions around the world, without the need for banks, and without control by governments. Cryptocurrency is famous for its meteoric price rises and crashes, for example, when Bitcoin went from $900 to almost $20,000 in 2017, then back down to $3,000 in 2018.

Key risks: Buying cryptocurrency is arguably gambling, rather than an investment. Cryptocurrency is a very new type of asset, therefore extremely volatile, and the true value of the asset is still unclear. In addition, cryptocurrency is largely unregulated, and because it’s completely digital, investors are more at risk to hackers and scammers.

$ needed to get started: $100

How to invest: Buy through an exchange like Easy Crypto

Further Reading:

– Cryptocurrency 101 – Is it investing or gambling?

Bonus option: Pay off interest bearing debt

Let’s say you have money owing on a credit card charging an interest rate of 20%. If you pay off that credit card, you’ll no longer have to pay interest on it – that’s an instant 20% return, tax free and risk free! That’s why it’s a good idea to pay off any high interest debt like credit cards, hire purchases, and personal loans before investing.

Which options are right for you?

The options you should invest in depends on a lot of things such as your investment objectives, risk tolerance, and how long you are investing for. For example, those putting money away to buy a house should stick to bank deposits to preserve their capital, while those investing for decades and have a higher risk tolerance might be better off investing in shares (or funds investing in shares) to grow their money over the long term.

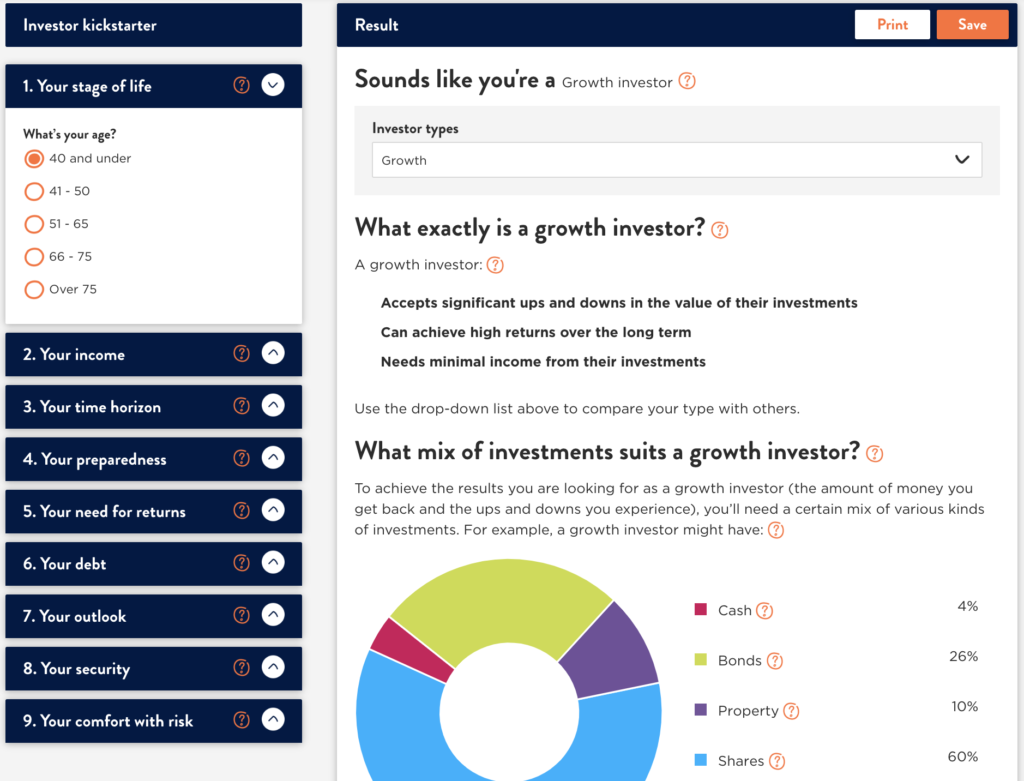

The Investor Kickstarter tool on Sorted.org.nz provides a good starting point to help you determine what kind of investments are right for you. You may want to speak with a financial adviser for investment advice better tailored to your personal circumstances.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.