What I’ve been investing in is a monthly series covering what investments I’ve made during the month, and any investing related news that I’ve found interesting. As we countdown to the new year (but not the new decade), this edition of What I’ve been investing in also includes a wrap up of 2019, and what to expect in 2020!

The below is not financial advice, nor a recommendation to invest in the following. Please do your own research before making any investment decisions.

What I’ve been investing in

Investore Property

Investore is a Real Estate Investment Trust (REIT) that invests in large format retail buildings, housing supermarkets and stores like Countdown and Bunnings. I’ve been a shareholder in Investore since July 2016, and late in November they announced their intention to acquire three new properties – Mt Roskill Bunnings, Mt Wellington Shopping Centre, and Bay Central Shopping Centre in Tauranga.

To fund these acquisitions, Investore offered existing retail shareholders the chance to buy up to $50,000 in new shares at $1.75 per share, as part of an $80 million capital raise. I applied for, and successfully purchased 850 shares.

InvestNow

I made my usual monthly contributions into InvestNow, but this month I also did a massive clean up of my portfolio. I sold the last of my expensive, actively managed funds (which I’ve had since 2017), as well as some unnecessary Smartshares funds:

- Nikko AM NZ Corporate Bond Fund

- Smartshares Automation and Robotics

- Smartshares Healthcare Innovation

- Smartshares Australia Top 20

The proceeds were then redeployed into my existing funds, primarily the AMP All Country Global Shares Index Fund. This consolidation has brought the number of funds I own through InvestNow down to 5, from around 12 at the start of this year! I’ll have an article out next year looking at whether investing in too many funds actually hurts your portfolio.

Smaller investments

- Reinvested dividends for Infratil and Vital Healthcare Property through their Dividend Reinvestment Plans (DRPs)

- Added to my Ratesetter Australia Peer to Peer Lending portfolio

- Bought some Bitcoin after the price fell to below $7,000 USD

Portfolio wrap up – 2019

2019 has been a year of consolidation, phasing out of expensive, unnecessary or redundant investments. My InvestNow portfolio has reduced from 12 funds to 5, I’m winding down my P2P Lending investments with Lending Crowd, and I’ve switched my KiwiSaver from Milford to JUNO. I’m already realising the benefits of this consolidation, spending less time and effort managing my investments, and paying lower fees.

My investments into individual companies this year have been a great success. Shares I bought in aged care operators Summerset and Arvida have shot up over 55% in the short time I’ve owned them (partly thanks to the Metlifecare takeover bid which I’ll discuss more next month). Capital raises from Infratil and Arvida, have helped me deploy some of my money into the markets at great prices, and have already delivered good returns.

OCR cuts this year have made things challenging for savers and investors. I’ve managed to offset lower bank deposit rates, and dividend yields by increasing my investments into Squirrel Money, a couple of bond issues, and REITs like Vital Healthcare Property, Investore, and Goodman.

What to expect – 2020

Despite the progress in 2019, my portfolio is still far from where I want it to be. I didn’t invest enough on InvestNow this year, which I primarily use to give my portfolio global exposure. This has left my portfolio overexposed to the NZ market. However, with my freshly consolidated and more focussed InvestNow portfolio, I am in a good position to substantially build up my investments in international share index funds next year to make up a core part of my overall portfolio. I wouldn’t mind a dip in the markets right now to make this a little cheaper 🙂

I will also continue to keep a healthy amount of cash aside to take advantage of any bargains in the sharemarket, or equity crowdfunding opportunities that come up. Other parts of my portfolio like KiwiSaver and Peer to Peer Lending will continue to tick along as usual.

Investing news

ShareMeUp

Sharesies has some new competition when it comes to micro-investing in shares on the NZ sharemarket. ShareMeUp is a new service from registry provider Link Market Services. Here’s a quick rundown on how it works:

- You can make investments into a selection of NZX companies with as little as $50

- Brokerage fees are 1.98% of your purchase, plus a $1 + 0.1% merchant fee for each transaction

- The shares you buy are owned under your name

- There are no account fees

And here are the key limitations:

- Your initial investment in a company must be at least $500 (after which you can make subsequent investments with $50 or more)

- You cannot sell your shares via ShareMeUp. You have to use a broker like ASB Securities to do this

- The companies you can invest in are currently limited at 14

It seems like a good way to gradually accumulate shares in a company, however it’s a bit limited right now with just 14 companies on offer. Some of you have already expressed interest in an article comparing ShareMeUp with Sharesies, which I hope to do in the coming months.

RBNZ Bank Capital Review

You’ve probably heard in the news that the Reserve Bank of New Zealand has been reviewing the amount of capital that banks operating in NZ must hold. The RBNZ announced the outcome of the review this month, and they were softer than originally proposed. This along with a more positive economic outlook led to ANZ revising their OCR forecasts to just one further cut in May 2020 to 0.75%:

The increased capital requirements aim to make the banking system safer and lessen a bank’s probability of failure, but this will likely negatively impact bank interest rates, and perhaps GDP. If you want to learn more, this is an easy to read PDF explaining what bank capital is, and what the intentions behind the Capital Review were.

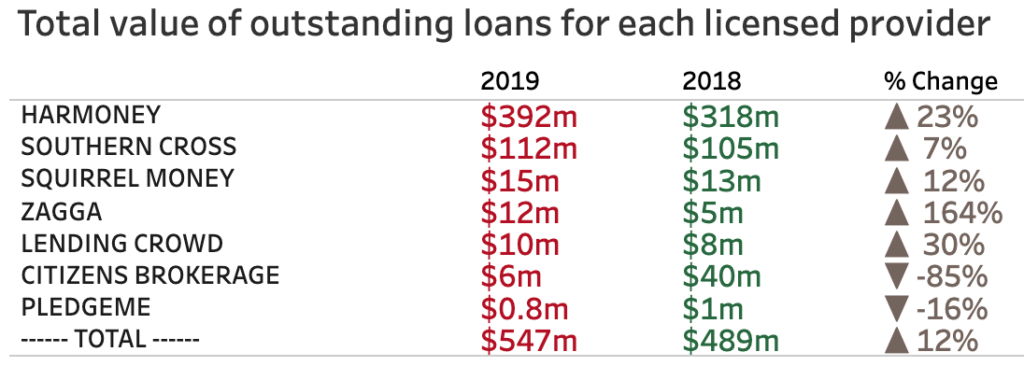

FMA P2P Lending & Equity Crowdfunding data

The Financial Markets Authority has published some data on New Zealand’s Peer to Peer Lending and Equity Crowdfunding industries. Take a look if you’re interested in stats like how much has been invested through the various platforms.

The FMA publishes a lot of useful data apart from this, such as (scroll down to the the Fund update files section):

- A spreadsheet of all data from the fund updates of all KiwiSaver funds

- A spreadsheet of all data from the fund updates of all non-KiwiSaver funds

Investing News wrap up – 2019

2019 has been a great year for Kiwi investors:

- We’ve seen new ways to invest open up, such as Sharesies (and now ShareMeUp) offering cheaper solutions to invest in individual companies on the NZX.

- Not all new services have been a success though – The Property Crowd attempted to offer residential property crowdfunding early this year but pulled out after disappointing investor interest.

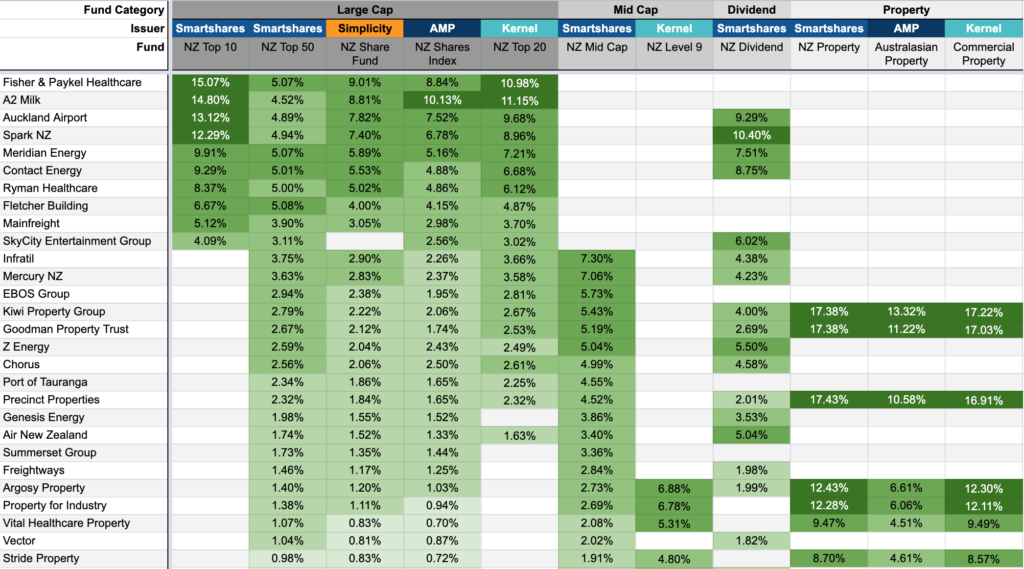

- We’ve seen the introduction of awesome new index funds, with Smartshares offering 8 new ETFs, and Kernel launching as a totally new index fund manager with an initial 3 funds.

- The KiwiSaver space has been interesting as usual. Kōura, a new low cost (but so far quiet) provider launched. Simplicity introduced a controversial home loan product, and their founder Sam Stubbs continued to moan about high fees.

And the performance of financial markets has been stunning this year:

- NZX50 (Capital) index up 27.69%

- S&P500 index up 28.61%

- ASX200 index up 20.33%.

Falling interest rates around the world was a key driver of the markets, including in New Zealand where the OCR was cut from 1.75% to a record low 1.00%. REITs and high dividend yielding companies performed well this year, as people looked for alternatives to low yielding term deposits. However, the threat of Tiwai Point Aluminium Smelter closing weighed down on electricity sector shares towards the last quarter of the year.

What to expect – 2020

I can’t say for sure what will happen in the future, but I feel we are in for a very exciting year ahead. For New Zealand investment services I predict:

- InvestNow and Sharesies will continue to be the most popular players, adding more funds and features. Calls for Sharesies to support Dividend Reinvestment Plans and trading on the Australian market will be unmet (for now).

- New players Kernel and ShareMeUp will continue to develop their funds and offerings. Stake will bring competition to Hatch in enabling Kiwis to invest in the US markets.

- KiwiSaver will continue to be an interesting space. We could see the launch of InvestNow’s KiwiSaver scheme. Politicians might propose new rules to make the scheme more attractive, such as boosting government contributions. Sam Stubbs will continue to find things to moan about.

- I wouldn’t be surprised if Harmoney exits the P2P Lending space, getting all their funding from institutional investors like banks.

- Alternative property investment models like The Property Crowd and Levridge will be out trying to capture the attention of investors. Will they be successful next year?

For financial markets, in 2020:

- Most economists appear to be mildly optimistic, predicting slower economic growth, but no recession.

- Politics will continue to cause volatility in the markets. Ongoing trade wars, Brexit, and elections in the US and NZ are key events to watch out for.

- A further OCR cut to 0.75% may be on the cards, a lot less severe than the cut to 0.25% predicted a few months ago. As a result, REITs and high dividend yielding companies should have a much quieter year compared to 2019.

For further reading, I thought this article from Mark Lister of Craigs Investment Partners was a good article about the major themes to keep an eye on in 2020.

Money King NZ news

Money King NZ wrap up – 2019

Money King NZ is now 6.5 months old, with around 100,000 words written across 45 articles! The response has been really pleasing so far, with over 580 subscribers across Facebook, Twitter, and email, and tens of thousands of visitors.

The 3 most viewed articles were:

- What’s the difference between InvestNow, Sharesies, Simplicity, Hatch, and more?

- How to choose which fund to invest in on InvestNow and Sharesies

- Buying shares on the NZX – Sharesies vs ASB Securities and Direct Broking

It seems people were really curious about popular investment platforms like Sharesies and InvestNow! Outside of the top 3, I’d have to say my favourite article was What happens to your money if InvestNow or Sharesies go bust? It was a tricky one to wrap my head around and write, but it answers an important question that most users of those platforms have wondered about.

A lot of you found some of my spreadsheets quite useful, particularly the one pictured below which shows exactly which companies each NZ Share Index Fund invests in. Due to its popularity, I’ll be sure to update it in about 5 months time when fresh data comes out.

Most importantly, in the process of preparing all this content I’ve learnt a lot about investing and have become a better investor – and as a reader, I hope you have learnt a lot too.

What to expect – 2020

The focus in 2020 will continue to be writing comprehensive and high-quality articles on topics relevant to Kiwi investors. I also want to write more articles geared towards beginner investors, and already have some awesome articles lined up for early next year. I’ll continue to write my monthly What I’m investing in series.

Another thing I want to do is to get a little more input from others (like investing bloggers, investment service providers, and maybe even readers) into my articles. I’ve already reached out to some people who have put their hand up to help me, so you expect some future articles to contain snippets of information from other perspectives.

Please feel free to let me know if there’s a specific topic you want me to cover or see more of.

Thank you

Lastly, thank you to everyone reading, supporting, and those who had input into my articles. Have a fantastic new year, and I hope 2020 is a happy year for your investment portfolio, and that it takes you closer to your financial goals.

Countdown Greenlane photo credit – Lidia

Previous month’s article:

– What I’ve been investing in – November 2019

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.