Lending Crowd lives in the shadow of bigger, more well known Peer to Peer Lending platforms like Harmoney, but do they deserve more attention? Lending Crowd is a simple platform that promises to connect investors to a crowd of high-quality, creditworthy borrowers, without involvement of the big banks. With that comes the opportunity for investors to earn returns far higher than what the banks are offering with savings accounts and term deposits.

Based in Newmarket, Lending Crowd launched in late 2015, and is owned by finance company Finance Direct. I’ve been an investor on the platform since May 2017, and in this article I’ll be reviewing the Lending Crowd platform and its returns, risks, fees, and features. Is it better than investing in Harmoney?

This is the second article in my Peer to Peer Lending review series:

Article 1 – Harmoney review

Article 2 – Lending Crowd review (this article)

Article 3 – Squirrel review

This article covers:

1. Getting Started

2. Potential Returns

3. Risk

4. Platform Fees

5. Platform Features

6. Other Talking Points

1. Getting Started

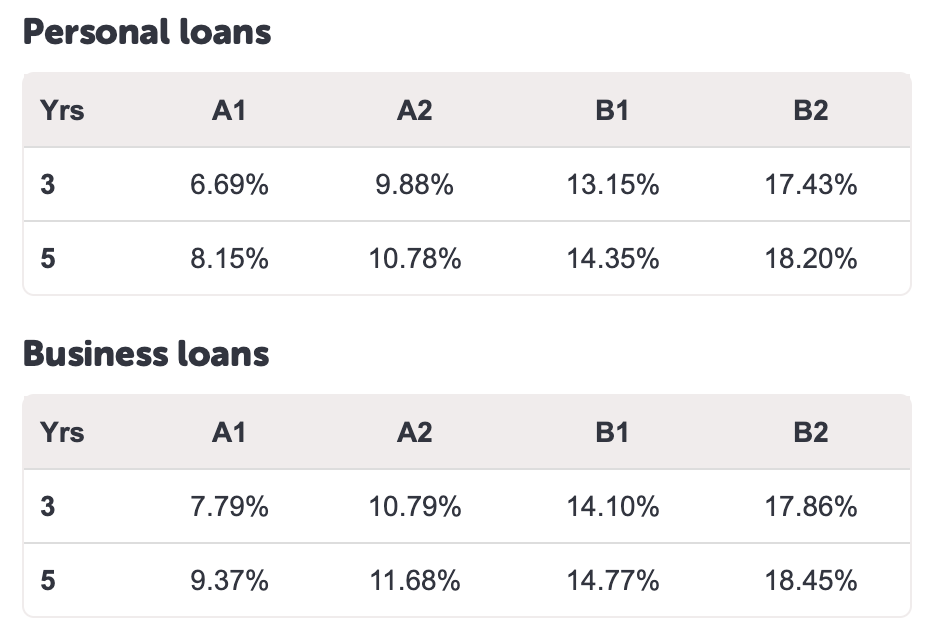

As an investor on the Lending Crowd platform, you can choose to lend your money in either 3 or 5 year loan terms across four different risk grades (A1, A2, B1, B2), and to both Personal and Business borrowers. This is very interesting because it’s uncommon for everyday people to be able to invest in business lending!

Lending Crowd’s minimum investment amount is $50, which happens to be the size of a single loan note on the platform (each loan is split up into $50 notes for investors to invest in). Lending Crowd allows borrowers to borrow between $2,000 and $200,000.

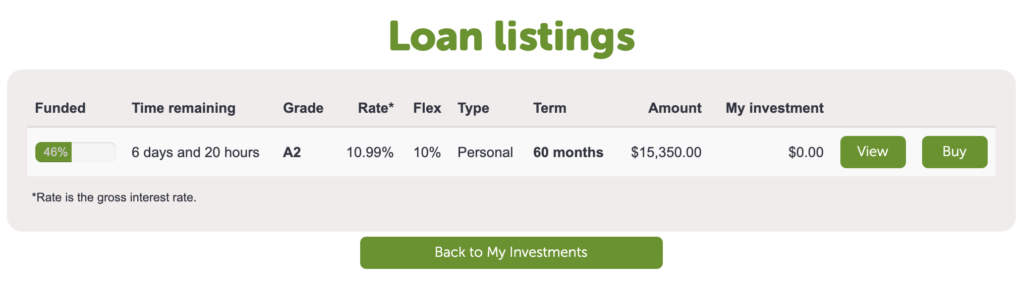

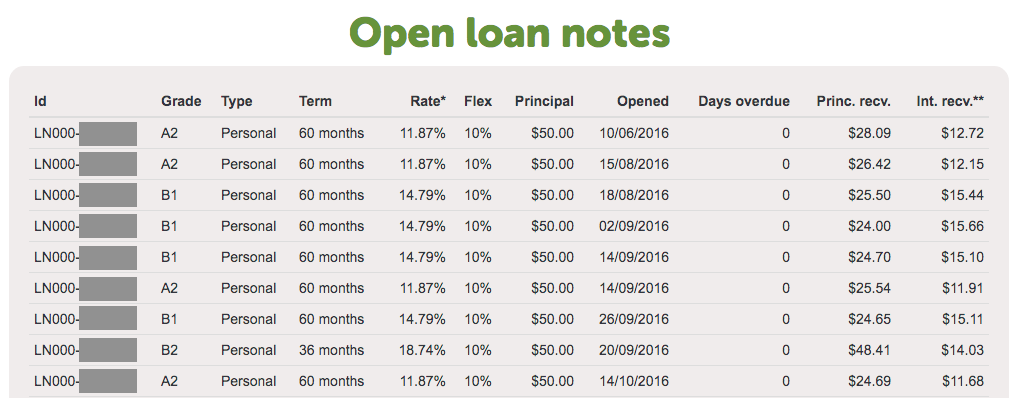

The process for investing in loans is similar to Harmoney’s. You start by logging in to the platform where you’ll be presented with a list of loans available to invest in, along with each loan’s term, interest rate, risk grade, fee, and whether it’s a business or personal loan.

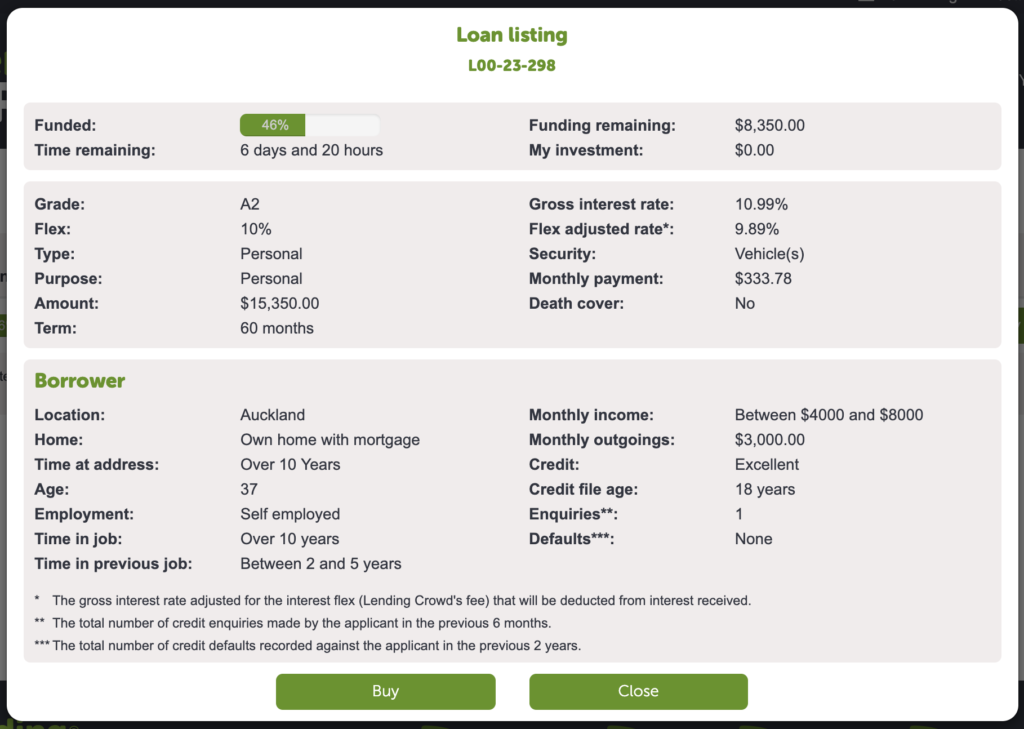

You can view the details of each loan to see details like a borrower’s income, age, employment, and residential status. If you want to invest in that loan, you then buy notes in that loan until all the notes are sold out. The minimum investment in a loan is one note ($50), but you can buy multiple notes in a loan if you wish.

My experience – What did I invest in?

My strategy was to invest in loans with risk grades between A2 – B2. I felt that A1 grade loans offered an interest rate that was too low (see below for the rates), as you can get a similar interest rate on the Squirrel P2P Lending platform at a lower risk.

I actively invested in Lending Crowd between June 2017 and May 2019. Currently I’m not actively investing on the platform for a variety of reasons, which I’ll cover below.

2. Potential Returns

Interest

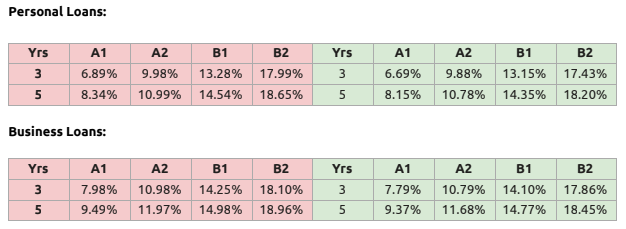

Lending Crowd gives investors the opportunity to earn interest at rates between 6.69% and 18.45%. This is lower than Harmoney (6.99% – 29.99%), but higher than Squirrel (6% – 8.5%). With Lending Crowd you’re rewarded with a higher interest rate for investing in the longer 5 year term, unlike Harmoney which pays the same rate for both 3 and 5 year terms.

The above are Lending Crowd’s new rates that just came into effect on 2 September – if you’re interested, I’ve put a comparison between the old and new rates at the bottom of this article. Lending Crowd are the first lenders to drop their personal loan interest rates following the big OCR cut in August 2019.

While the rate cut means lower returns for investors, it’s hoped that lower rates will make Lending Crowd more attractive to borrowers. It is certainly a challenge for P2P Lending platforms to balance out the interests of investors and borrowers, and I’d say Lending Crowd’s rates are still very attractive to investors.

Lending Crowd uses a statistic called Net Average Return (NAR) to measure an investor’s overall pre-tax returns on the platform, taking into account interest earned, fees, and any loan write-offs. The platform’s average NAR as at June 2018 was 11.95%, but they have not provided an average NAR since then.

My experience – What returns did I get?

My current NAR on Lending Crowd is 12.68% which I’m really happy with. It’s not as much as I could have earned with Harmoney, but I feel I am exposed to less risk with Lending Crowd – read on for more detail.

3. Risk

Overdue payments

The first risk you face when investing in P2P Lending is overdue payments, where borrowers don’t make their loan repayments on time. They are annoying because you get paid late, and overdue payments are at risk of turning into write offs. On Ledning Crowd a loan can be overdue for up to 90 days, before the loan gets placed “In Collection”:

In the unfortunate circumstance that a loan exceeds 90 days overdue the loan will be placed ‘in collection’ and the borrower will be informed that the full balance on the loan is due immediately. Security repossession and sale procedures will also commence.

Write offs

The main risk of Peer to Peer Lending is that the borrower doesn’t pay you back at all. On Lending Crowd, loans that have been “In Collection” for 180 days (or after collection procedures, such as repossession and sale of the loan’s security, are complete) get written off.

A loan can stay ‘in collection’ up to 180 days, and at some point during or at the end of that period, when collection procedures are deemed complete or exhausted, the loan will be ‘written off’.

When a loan is written of, you may lose the money you invested in that loan. Lending Crowd uses fractionalisation as the primary strategy to mitigate the impact of loan write offs, as each loan is split into $50 notes. This means that investors only need to expose $50 of their money to each loan, and can diversify their lending portfolio across a large number of loans.

Lending Crowd has a couple of other strategies to mitigate risk, that in my opinion makes them safer than Harmoney:

- High Quality borrowers – Lending Crowd only accepts high-quality A and B grade borrowers, and do not lend to the likes of Harmoney’s risky E and F grades. They only approve around 17% of borrower applications they receive.

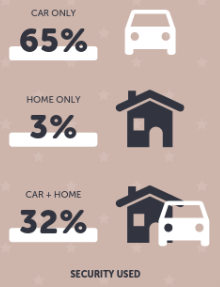

- Secured loans – All loans on the Lending Crowd platform are secured by the borrower’s vehicle, property or both. This gives more protection to the lender – for example, a car used as security on a loan can be repossessed and sold to recover money still owing on a written off loan.

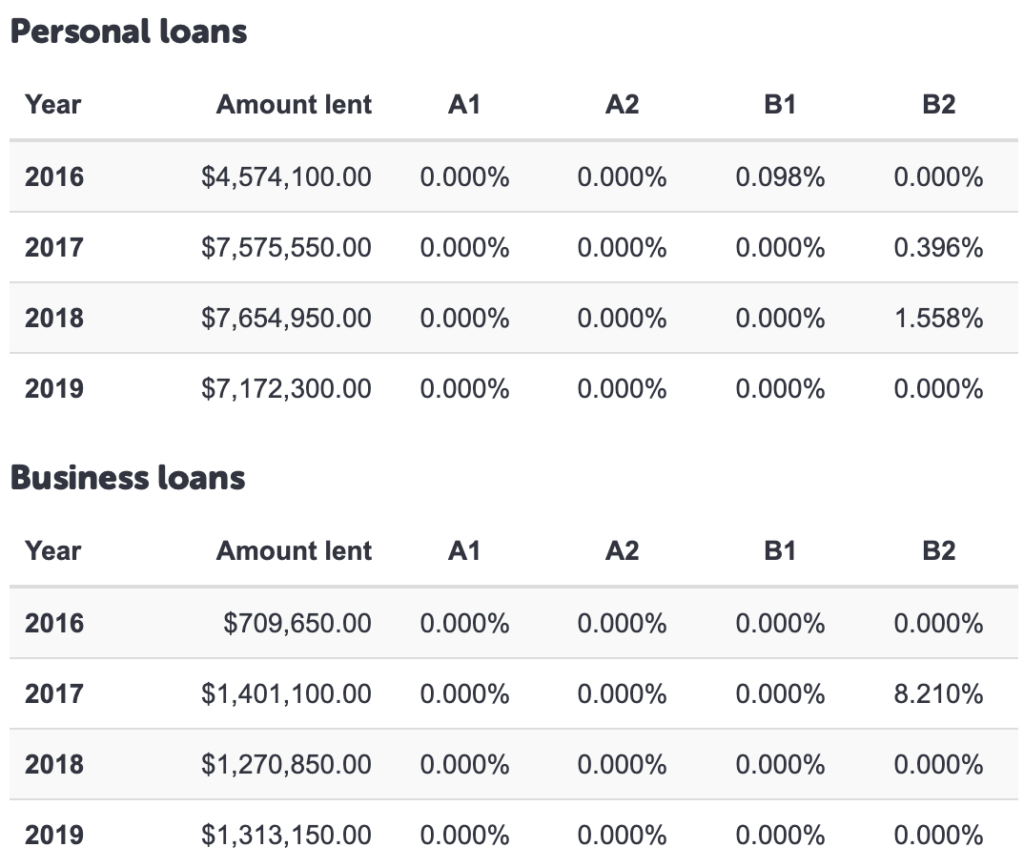

So how do these features translate into results? The real test will be how the loan book performs over the long-term and through a recession, but below are the platform’s write off rates so far – they are very low, with no write offs at all in the A1 and A2 grades!

Early Repayments

Early loan repayments can also be troublesome. Although investors are not penalised when a borrower pays back their loan early, it results in rework in having to reinvest your money into new loans.

My experience – Did the risk occur for me?

Overdue payments – Out of 274 loans I’m currently invested in, only four are overdue by 10 days or more. My overdue payments have always been low, and I’m not sure if that’s because the quality of borrowers is high, or because Lending Crowd are great at chasing up late payments. Either way, I am very very impressed.

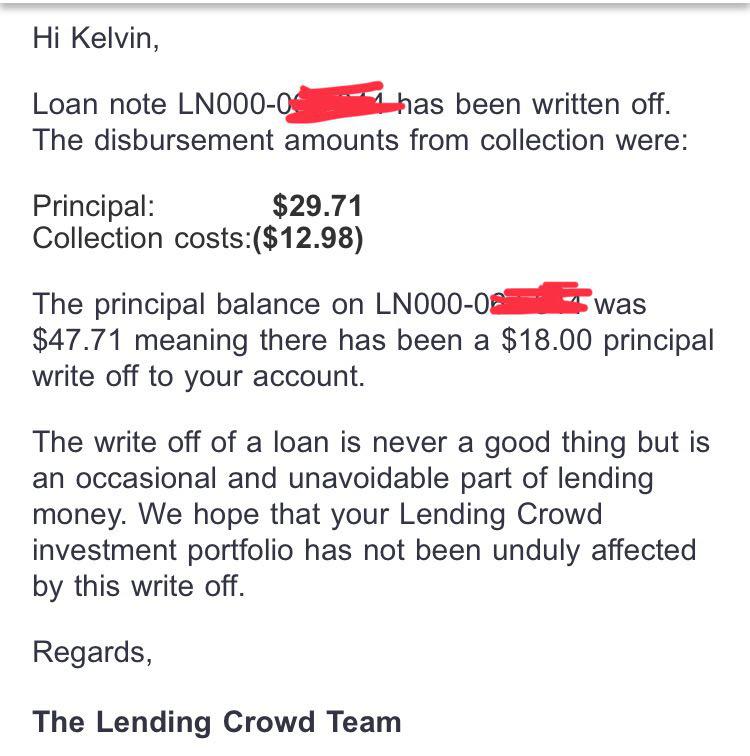

Write offs – Loan write offs have been uncommon for me. I’ve had 5 so far, with another two loans currently “In Collection”. Fortunately Lending Crowd has managed to recover some of the outstanding money from my written off loans, so the overall impact of write offs on my portfolio is very tolerable. If a write off occurs to your loan you get an email informing you of the details, such as how much was written off, and how much was recovered (minus any “collection costs” involved in recovering the money).

Early repayments – There is no easy way to measure early repayments, but I can say they are pretty high. I get a steady stream of borrowers paying back their loans early, which I have to reinvest or withdraw from the platform.

4. Platform Fees

Lending Crowd takes a cut of the interest you earn with a fee they call Interest Flex. The amount of Interest Flex you pay depends on the origin of the loan.

- 10% of interest earned for non-referred loans e.g. loans that people applied for directly through the Lending Crowd website.

- 25% of interest earned for referred loans e.g. loans that were referred to Lending Crowd through their partners such as a car dealer.

Referred loans were introduced late in 2018 as a way for Lending Crowd to acquire more borrowers. This has been successful so far, resulting in a 45% increase in loan listings. The fee for referred loans are higher as Lending Crowd pays commission to the referring partner.

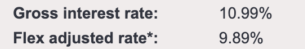

Each loan listing shows a “Flex adjusted rate” which shows the impact of the Interest Flex fee on the loan’s interest rate:

My experience – Fees

I thought Harmoney’s 20% fee was expensive enough! I think Lending Crowd’s 25% fee for referred loans is way too much – referred loans give no extra benefit or return to investors (apart from having more loans available to invest in) over non-referred loans that charge a lower 10% fee.

I think the 10% fee for non-referred loans is VERY good though. As a result I avoided referred loans and only invested in the non-referred ones. Given about half of Lending Crowd’s loans are referred, this really limited the number of loans I was willing to invest in.

5. Platform Features

Lending Crowd is the most basic out of the Peer to Peer Lending platforms I’ve used:

Auto-lend: Lending Crowd has no auto-lend functionality – all loan investments must be placed manually instead. Developing an auto-lend feature doesn’t seem to be a priority for them either:

We understand investors thinking: “Why doesn’t Lending Crowd develop software to offer automated investing or create rules around maximum investments?”. The reality is, investing lots of money by developing these services will not solve the real problem – that we simply need more quality, secured loans on the platform to meet the insatiable investor demand.

Lending Crowd Investor Update, November 2018

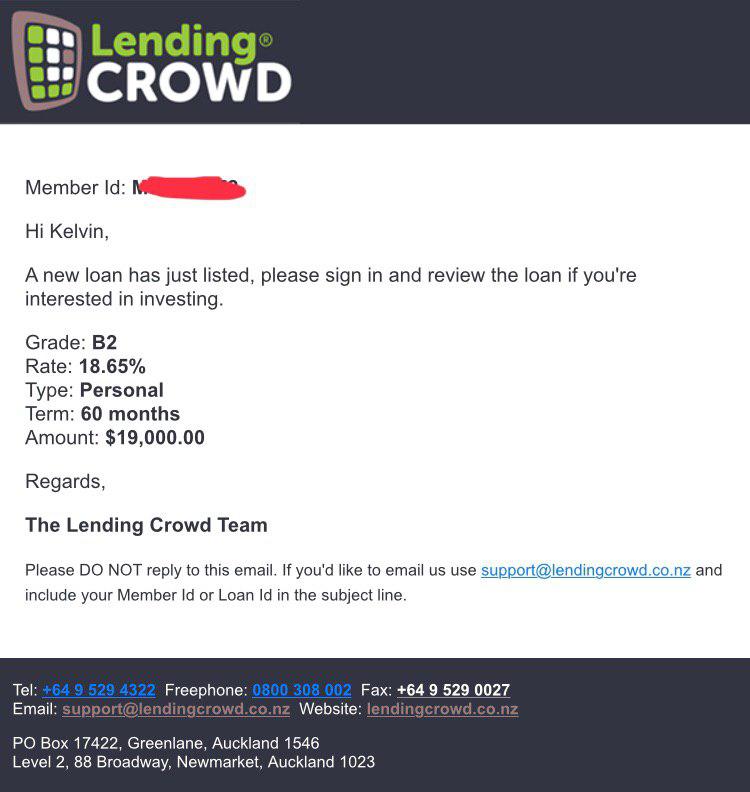

Loan Notifications – Lending Crowd’s workaround for the lack of auto-loan is to send out email notifications whenever a new loan becomes available for investment. Investors can then log in to buy notes in that loan if they wish. You have to be fast to get in before all the loan notes are sold out – first in, first served!

There are a couple of limitations to these notifications:

- No filters – You get email notifications for ALL loans listed on the platform. There is no way to filter out notifications for types of loans you’re not interested in, such as referred loans or particular risk grades.

- Email notifications are “shuffled” – The notifications are sent out to investors in random order. Sometimes you will get the notification immediately after a loan is listed, other times you will receive it 10 minutes or more after the listing. This is intended to make it more fair for investors (as not everyone can respond to the notifications immediately), but just means your ability to invest in a loan before it’s sold out comes down to luck.

Getting your money out early – Like Harmoney there is no secondary market where you can sell your loan investments to get your money out early. You have to wait for borrowers to make repayments over the term of their loan.

Reporting – The reporting provided on the platform is a basic list of the loans you’ve invested in.

My experience – Platform features

Lending Crowd may seem light on features, but I think this is actually a strength of the platform. What’s there works well – the site is simple, snappy, free of bloat, and is both mobile and desktop friendly.

In regards to the lack of auto-invest, in the past I didn’t mind it as I was able to quickly respond to email notifications most of the time. But right now I’d prefer a more passive investment and not to have notifications disrupting me throughout the day. This makes me hesitant in recommending Lending Crowd to others, as not everyone has the time or opportunity to quickly respond to new loan listings.

I did have major issues with the “shuffling” of loan notifications though. It was frustrating to receive a loan notification email and log in to the platform, only to see no loan to invest in, as the loan had already been sold out by the time I received the email! For me this is a poor user experience, and I also don’t like how this made your ability to invest in loans come down to luck.

6. Other Talking Points

Loan availability

Low loan availability is a common issue among New Zealand P2P Lending platforms and Lending Crowd is no exception. You can expect a steady trickle of loans to be listed, but will still take some time to build up a diversified lending portfolio. Together with the fact that I avoided referred loans meant that I had barely any choice of loans to invest in, and is the main reason I stopped investing in the platform.

Institutional Investors

Unlike Harmoney where ~80% of loans are funded by institutional investors, Lending Crowd’s loans are 92% funded by retail investors. This is great as it doesn’t mean the likes of banks and finance companies taking the already low amount of loans on offer. Lending Crowd seem to genuinely care about the interests of retail investors, and this is what P2P Lending should be about – providing a platform that benefits everyday people, instead of just banks and finance companies.

Platform reliability

I’ve found the Lending Crowd platform to be very reliable so far, and haven’t come across any glitches at all. The only issue is that they sometimes perform maintenance on the site during business hours. I think it’s quite unusual to perform maintenance during the day – time is money and I hope they don’t put off prospective customers by having the site down during business hours.

Future Expansion

At present Lending Crowd only offers secured lending, but has indicated that they’re looking to expand into the unsecured loans space, with the backing of a new institutional lender:

Moving forward, we feel the obvious next step is to explore expansion into the unsecured lending space. This may mean that we’re willing to start conversations with another cornerstone financial institution to participate in these loans.

Lending Crowd Press Release, September 2019

I’m not sure I’d like this, as one of Lending Crowd’s strongest selling points for investors is that all their loans are secured – which provides a lot more assurance (to me at least) compared to the unsecured loans of Harmoney. But I will reserve any further judgement until the final product is released.

Conclusion

I really like the Lending Crowd platform and think it does deserve a little more recognition. It’s simple, the borrowers are high-quality, overdue payments and write offs have been low so far. Is it better than Harmoney? It absolutely is in my opinion – and I would say that based purely on the fact that Lending Crowd has better quality borrowers, and only does secured loans. Most importantly this has resulted in my returns being great so far, with a 12.68% NAR.

There are a few things that hold the platform back. The low loan volume, the high 25% fee for referred loans, and annoying loan listing email notifications are all reasons that led me to stop investing. But it mainly comes down to time – there are other more passive, and less time-consuming investment opportunities for me to pursue right now. If circumstances change, I would definitely consider investing in Lending Crowd again (and that just might happen with the OCR heading down towards 0%).

So who do I think Lending Crowd is right for? If you want the potentially high returns from P2P Lending with more security than Harmoney, and are prepared to put in a bit of time and effort, then Lending Crowd is the way to go. If you want a more “set and forget” type of investment, then I would look at other options like Squirrel.

Pros

- All loans are secured and borrowers are high-quality. Feels a lot safer than Harmoney

- Very low fee (10%) for non-referred loans

- Outstanding management of loans resulting in low number of overdue payments and write-offs, and great overall returns

- Platform is reliable and free of bloat despite a lack of features

Cons

- Very high fee (25%) for referred loans

- Low loan availability

- No auto-lend functionality, requiring time, effort, and dealing with loan notification emails to get your money invested into loans

- No secondary market to get your money out early

Old vs new rates

For those interested, here are Lending Crowd’s old interest rates compared to their new rates that came into effect on 2 September 2019:

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

I’ve just started using this platform. I’m just having a play around with a few $$ at this stage. You are right some loans go very quickly!

At least that’s a sign of an investor community that’s alive and well!