There’s a new kid on the block. Previously ASB Securities (owned by ASB Bank) and Jarden Direct (formerly Direct Broking) were the cheapest brokers to buy and sell shares in individual companies listed on the New Zealand sharemarket (NZX). We now have Sharesies, a popular Fund Platform with over 60,000 users, offering this service. How does it stack up against the traditional share brokers?

This article provides a comparison between Sharesies, ASB Securities, and Jarden Direct across criteria such as fees, user experience, ownership of shares, and other features.

This article covers:

1. What’s on offer?

2. Minimum investment

3. Ownership of shares

4. Fees

5. User experience

6. Trading features

Update (20 November 2019) – Sharesies now allows you to make limit orders

Update (17 April 2021) – New Sharesies fee structure effective 29 April 2021. Direct Broking is now Jarden Direct.

1. What’s on offer?

There are around 140 individual companies listed on the NZX. Chances are you already interact with some of these companies on a regular basis – such as Meridian Energy, Spark, Air New Zealand, The Warehouse, Westpac Bank, and Burger Fuel. By buying shares in one of these companies, you become a shareholder, and own part of the company!

Sharesies, ASB Securities, and Jarden Direct allow you to buy and sell shares in any of these ~140 companies.

All three brokers also offer investment into companies listed on the ASX and US markets, although these won’t be covered in this article.

Further Reading:

– Buying shares in the USA – Sharesies vs Hatch vs Stake

Winner: Tie

2. Minimum investment

Sharesies

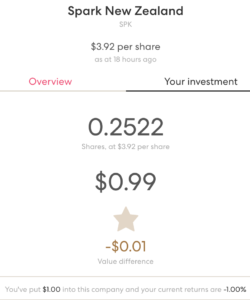

The minimum investment amount with Sharesies is a super low $0.01. Sharesies offers fractional share investing, so even if a share costs more than the amount of money you want to invest, you can still buy a fraction of that share. For example, if a share in Spark costs $4, I could still invest $1 to buy a quarter of a share.

ASB Securities and Jarden Direct

Investors using ASB Securities or Jarden Direct must buy enough shares to meet the minimum holding requirements determined by each company. Currently only one company, Chorus, has specifified a minimum holding amount of $1,000.

Issuers of securities on the NZX enforce their own minimum holding requirements. Where an issuer has not specified a Minimum Holding, then there is no required minimum

Share trading minimum holding requirements, ASB Securities

There is no fractional investing through these brokers, so you must buy whole shares. For example, if a Mainfreight share costs $40, you must invest in increments of $40. You cannot invest $20 to buy half a share.

Winner: Sharesies

3. Ownership of shares

Sharesies

When you buy shares through Sharesies, you do not get direct ownership of them. Instead they are owned by a “Sharesies Nominee” which is a custodian holding the shares on your behalf. This has a number of implications:

- You can’t participate in Dividend Reinvestment Plans (DRPs). DRPs are plans offered by some companies, allowing shareholders to automatically reinvest their dividends into buying more shares, with no brokerage costs, and usually at a discounted price. DRPs are a great way to grow and compound your investment. With Sharesies, your dividends are always paid as cash into your wallet.

- It is not totally clear how Sharesies will handle “corporate actions” on your shares. There is no guarantee you’ll get the full benefits of being a shareholder like being able to vote on important company issues, or participating in rights offers (where companies sell new shares to existing shareholders to raise more capital), though they have usually been reliable in passing on these rights in the past.

“You acknowledge that we don’t have to forward to you, or take any action on, reports, notices, proxy forms, or other communications we receive about Investments in your Portfolio.”

Sharesies Terms and Conditions

Further Reading:

– What happens to your money if InvestNow or Sharesies go bust?

However, Sharesies does allow you transfer your shares out to your own CSN (Common Shareholder Number), at a cost of $5 per transaction. This would give you direct ownership of those shares and allow you to participate in DRPs and corporate actions.

You can also transfer shares held in your CSN into Sharesies at no cost – though in this case you would lose access to DRPs and potentially corporate actions.

ASB Securities and Jarden Direct

Shares bought through ASB Securities and Jarden Direct are held under your CSN (Common Shareholder Number). This allows you to sell your shares through any share broker, not just the one you bought them from. This also means that your shares are held directly in your name on a company’s share registry.

Having direct ownership gives you the full benefits of being able to participate in DRPs, corporate actions, and Annual General Meetings for the shares that you own.

Winner: ASB Securities and Jarden Direct

4. Fees

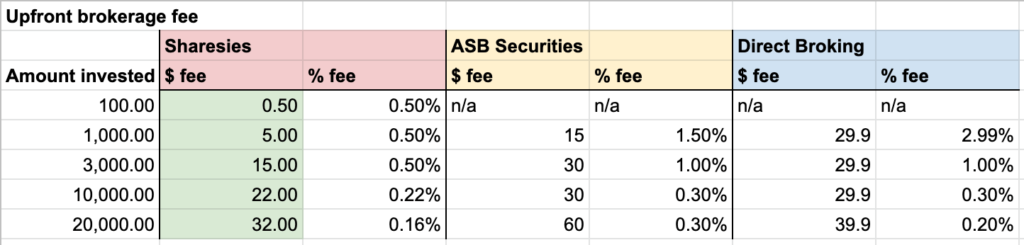

Brokers charge brokerage/transaction fees on every trade i.e. whenever you buy or sell shares. The brokerage fees for each service are:

| Sharesies | 0.5% for trades up to $3,000 Plus 0.1% for amounts above $3,000 |

| ASB Securities | $15 for trades up to $1,000 $30 for trades between $1,000 and $10,000 0.3% for trades over $10,000 |

| Jarden Direct | $29.90 for trades up to $15,000 Plus 0.2% for amounts above $15,000 |

The table below shows the brokerage fee that would apply to different dollar amounts invested (ASB Securities and Jarden Direct show n/a for $100 invested because this falls below the minimum investment amount).

Overall Sharesies is significantly cheaper especially for smaller investment amounts. The only thing to watch out for when brokerage is so cheap, is that it could facilitate “taking a punt” or “dabbling” in various companies, while high brokerage fees encourages investors to thoroughly evaluate a company before investing.

Winner: Sharesies

5. User experience

Sharesies

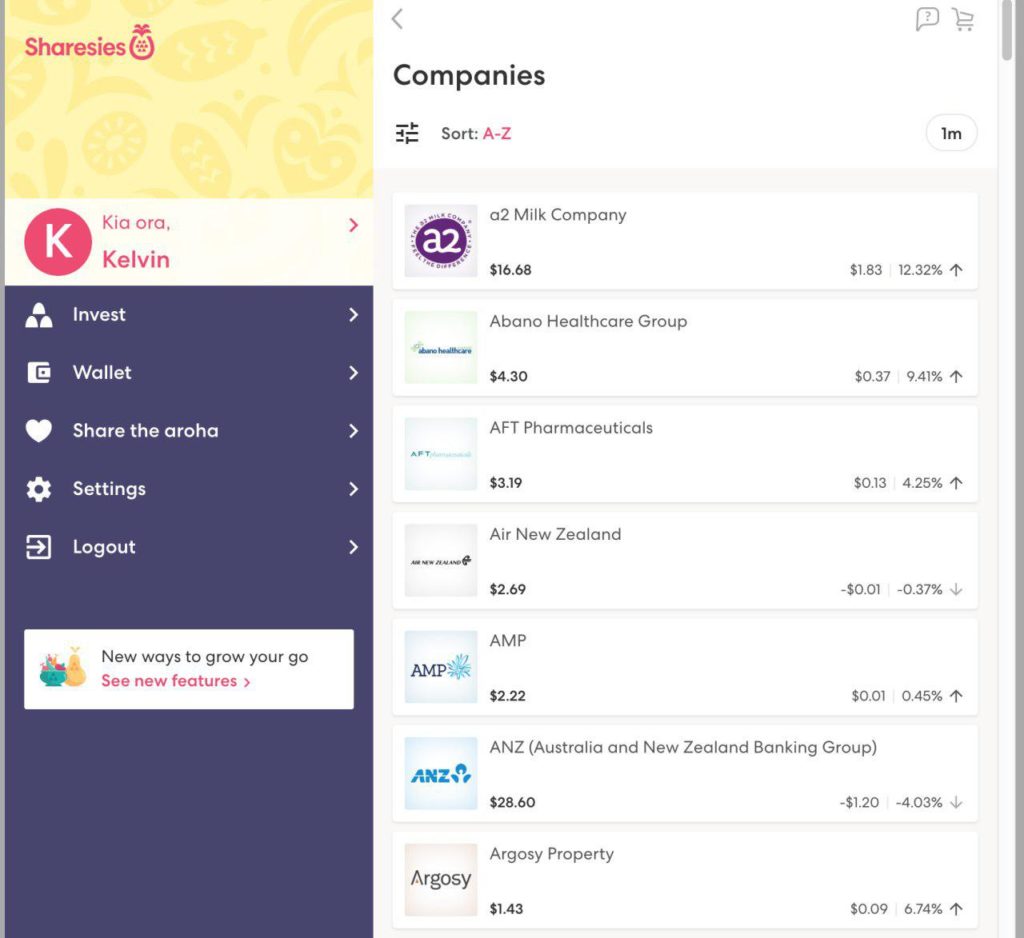

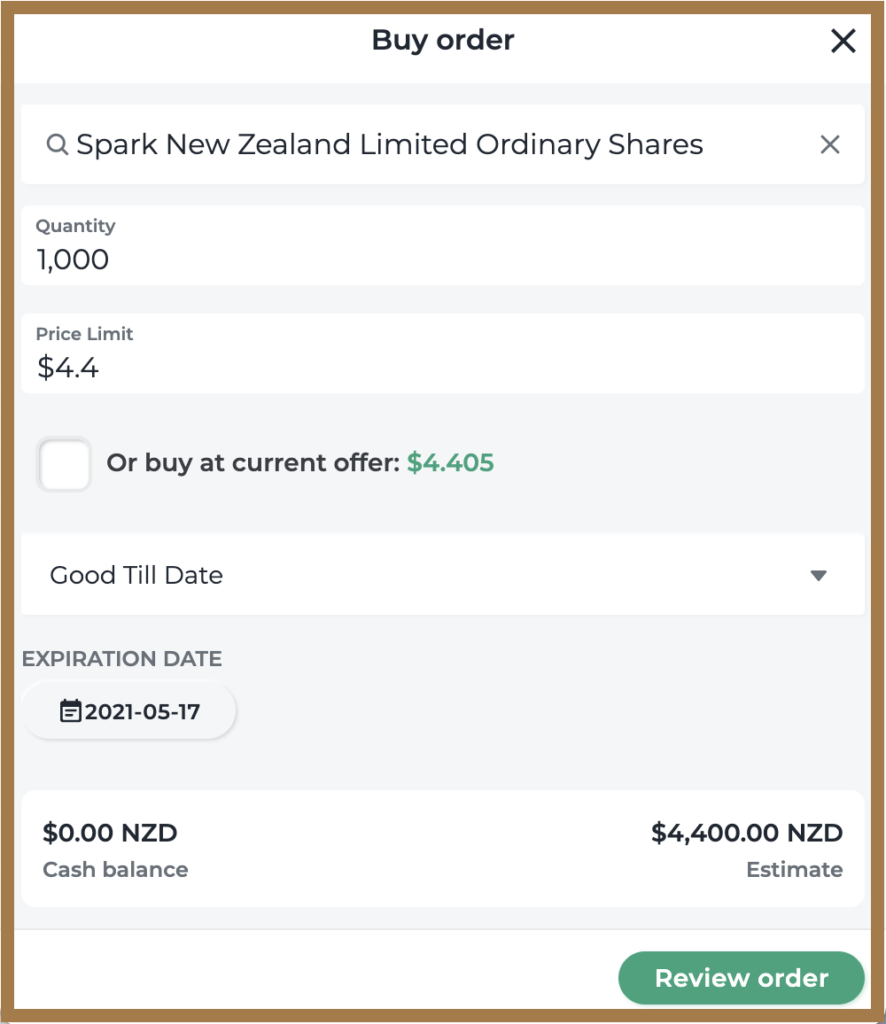

In typical Sharesies fashion, they have provided a fantastic user experience for buying shares. The user interface is uncluttered, easy to navigate, and works great on mobile.

There is still room for improvement though, and I would say the following are the current weak points of the interface:

- You can’t see any company announcements on the site. These can contain very important information about the companies you’ve invested in such as financial reports, trading updates, and major events such as capital raises or acquisitions. You would need to check the NZX website or the Tradalia app to see these announcements.

- You can’t see fundamental company statistics such as market capitalisation, P/E ratio, and Net Tangible Assets. However this data is publicly available on the NZX website or Yahoo Finance.

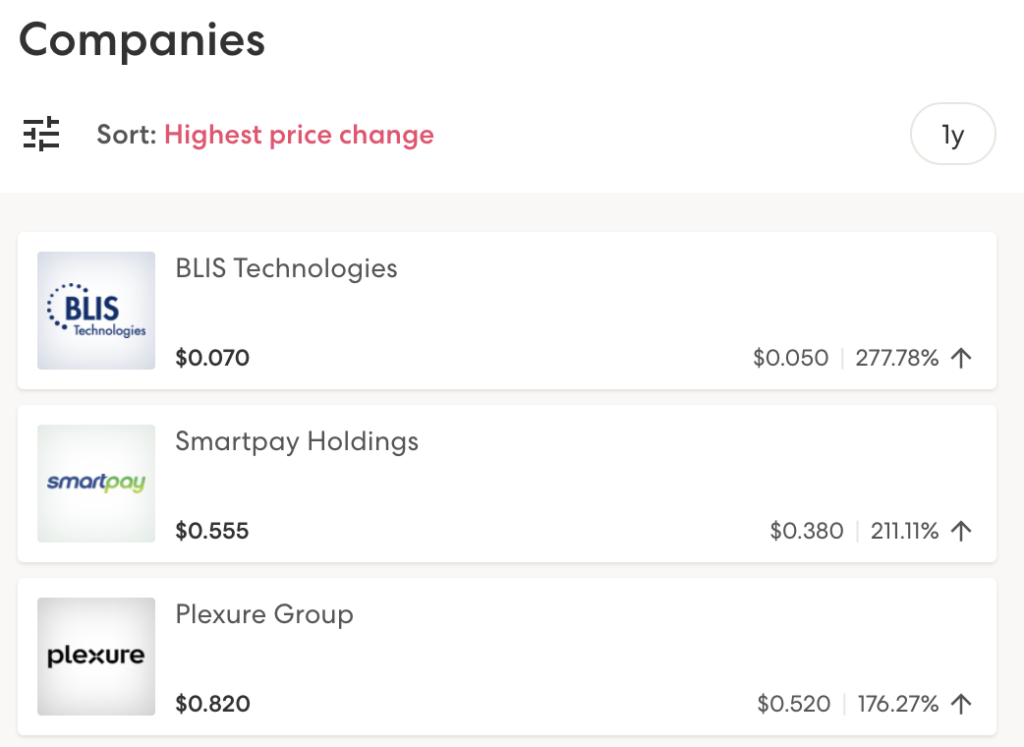

- You can sort the companies list by “Highest price change”, as well as “Highest annual dividends” or “Highest annual returns”. This is very concerning – given Sharesies’ targets beginner investors, this feature could encourage investing based simply on the biggest dividends and biggest returns. This is absolutely NOT a good investment strategy. Past performance is not an indicator of future performance, and the very highest paying dividend companies are almost always “Dividend Traps“.

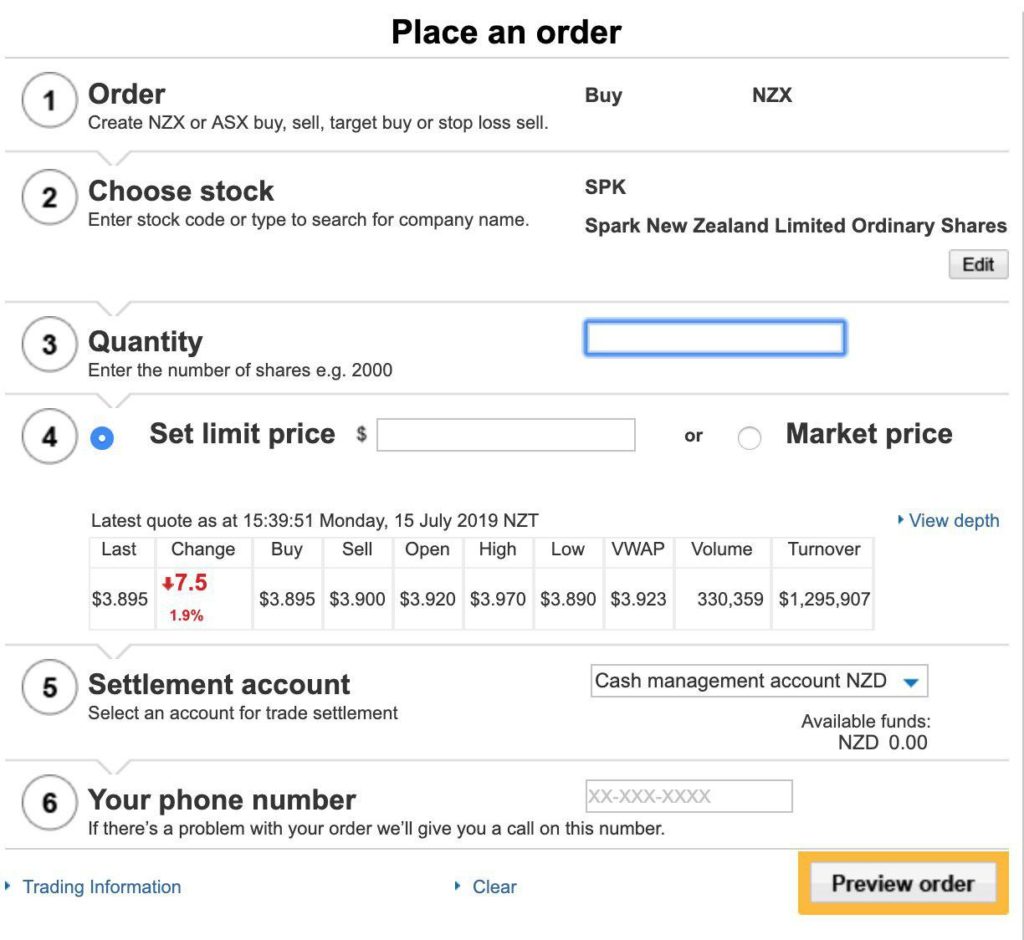

ASB Securities and Jarden Direct

These interfaces are cluttered, and unfriendly compared to Sharesies. Although Jarden Direct offers improvement over its predecessor Direct Broking with a mobile friendly view. I’ll let the screenshots do the talking.

Winner: Sharesies

6. Trading features

Live market prices and depth

ASB Securities and Jarden Direct show live prices (as long as you have traded with them in the last 90 days), as well as market depth which is a list of buy and sell orders for a particular share. This can be helpful in informing you about what price to buy or sell your shares at.

The share prices are shown on Sharesies are delayed by at least 20 minutes. Because share prices can be volatile, the delay can be problematic as the price of a share could surge, but not be reflected in the price you see on Sharesies. You can opt-in to see live market prices and depth on Sharesies, but this costs an extra $10 per month.

Limit orders

All three brokers allow you to place market orders or limit orders:

- Market order – The price you buy your shares at depends on the current selling price. Using the above Spark depth chart as an example, a market order will get you shares at a price of $3.95 per share. This is a slight premium over the current $3.925 share price.

- Limit order – This allows you to specify a maximum price you’re willing to pay for your shares (or minimum price you’re willing to sell your shares at), providing you with more control and certainty.

Although Sharesies introduced the limit order feature on 20 November 2019, it is still at a disadvantage to ASB Securities and Jarden Direct. Without live market prices and depth, you have less data to inform you what price to set your limit order at.

Advanced Features

Sharesies does not offer the following:

- Trigger orders – an instruction to place an order to buy or sell a share if it reaches a certain price

- Margin lending – the ability to borrow money to trade shares in order to leverage your investment (similar to a mortgage)

Winner: ASB Securities and Jarden Direct

Conclusion

Sharesies is a fantastic option for investing in NZX shares. They offer low-cost brokerage and ultra-low minimum investment amounts, meaning it’s perfect if you want to invest small amounts to learn, or slowly build up a share portfolio with small amounts over time – something that previously wasn’t possible with ASB Securities’ and Jarden Direct’s high upfront costs.

However, if you have a decent amount of money to invest, consider sticking with a traditional broker like ASB Securities or Jarden Direct. Although the upfront brokerage costs will be slightly more expensive, you will directly own the shares under your name, and can fully participate in any DRPs, rights issues, and voting. Given I don’t buy or sell shares frequently, this little extra cost is worth it for me.

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.