What I’ve been investing in is a monthly series covering what investments I’ve made during the month, and any investing related news that I’ve found interesting. In October 2019, Extinction Rebellion protestors blocked the streets of Wellington’s CBD, fire ripped through the SkyCity Convention Centre, and Diwali was celebrated on the 27th. In terms of investments, this month seems to have a bit of a KiwiSaver theme!

The below is not financial advice, nor a recommendation to invest in the following. Please do your own research before making any investment decisions.

What I’ve been investing in

Goodbye Milford, Hello JUNO!

After writing my comparison article between NZ’s low cost KiwiSaver funds, I decided that I should put my money where my mouth is, and personally make the switch to a low cost KiwiSaver provider. It had come down to a choice between Simplicity and JUNO – but although I really liked Simplicity’s funds, I found myself disagreeing with too many aspects of their scheme, such as their gimmicky home loan offering (more on that in the news section below).

So I finally decided to make the jump to JUNO KiwiSaver Scheme (into their Growth fund). They are backed by reputable fund manager Pie Funds, and I am going halve my fees compared to my old provider, Milford. I also came across a JUNO promo code which got me a bonus $100!

In case you’re wondering how switching KiwiSaver provider works, Rohan from Passive Income NZ has a good article on the switching process here. It is really easy to do so, and here’s my own experience:

Step 1 – Sign up with JUNO. On 7 October, I signed up with JUNO which took me two minutes. JUNO then handled everything else in the background, coordinating with the IRD and Milford to have everything transferred over seamlessly. On 9 October, JUNO emailed me with my login details to their online portal.

Step 2 – Goodbye Milford. After a bit of waiting, on 23 October I received an email from Milford saying that my request to switch KiwiSaver provider has been actioned. Goodbye Milford, and thanks for the great investment returns!

Step 3 – Hello JUNO! On 30 October I got an email from JUNO saying that they have received my funds from Milford, and I could finally see my funds in JUNO’s online portal. Done!

Argosy ‘Green’ Bonds

I invested in another set of bonds this month with money from a maturing term deposit. This time the bond issuer was Argosy Property, owner of a diversified portfolio of commercial property across NZ. This month they raised $100 million from issuing ‘green’ bonds with an interest rate of 2.90% for a term of 7 years. They are labelled ‘green’ bonds because the money raised from these bonds can only be used on their buildings that have a least a 4 star ‘Green Star‘ rating

This is another defensive move for my portfolio, similar to last month’s purchase of Metlifecare bonds. I really shouldn’t be so conservative with my portfolio, so hopefully I’ll come across some attractive opportunities to buy shares in the next few months.

Goodman Property Trust

Goodman Property Trust owns a portfolio of industrial property in Auckland. I first bought shares in Goodman in 2017, and this month they raised $25m in capital from their existing retail shareholders. They offered us the chance to apply to buy new shares at a price of $2.10 per share.

I decided to put in an application for 1,000 shares. Demand for the offer well outstripped supply, with a whopping $60 million in applications received. Therefore applications were scaled down, and I ended up only being able to purchase 318 out of the 1,000 shares I applied for.

InvestNow

I try and add a little bit into my InvestNow portfolio every month, and the funds I invested in this month were:

- AMP Capital All Country Global Shares Index Fund

- Smartshares Global Aggregate Bond ETF

- Smartshares Emerging Markets Equities ESG ETF

Smaller investments

- Added to my Squirrel Peer to Peer Lending portfolio

- Added to my Ratesetter Australia Peer to Peer Lending portfolio

- Had my Genesis Energy dividend reinvested as part of their dividend reinvestment plan

- For my speculative investment of the month, bought a tiny bit of Bitcoin when the price fell to under $7,500 USD

Investing news

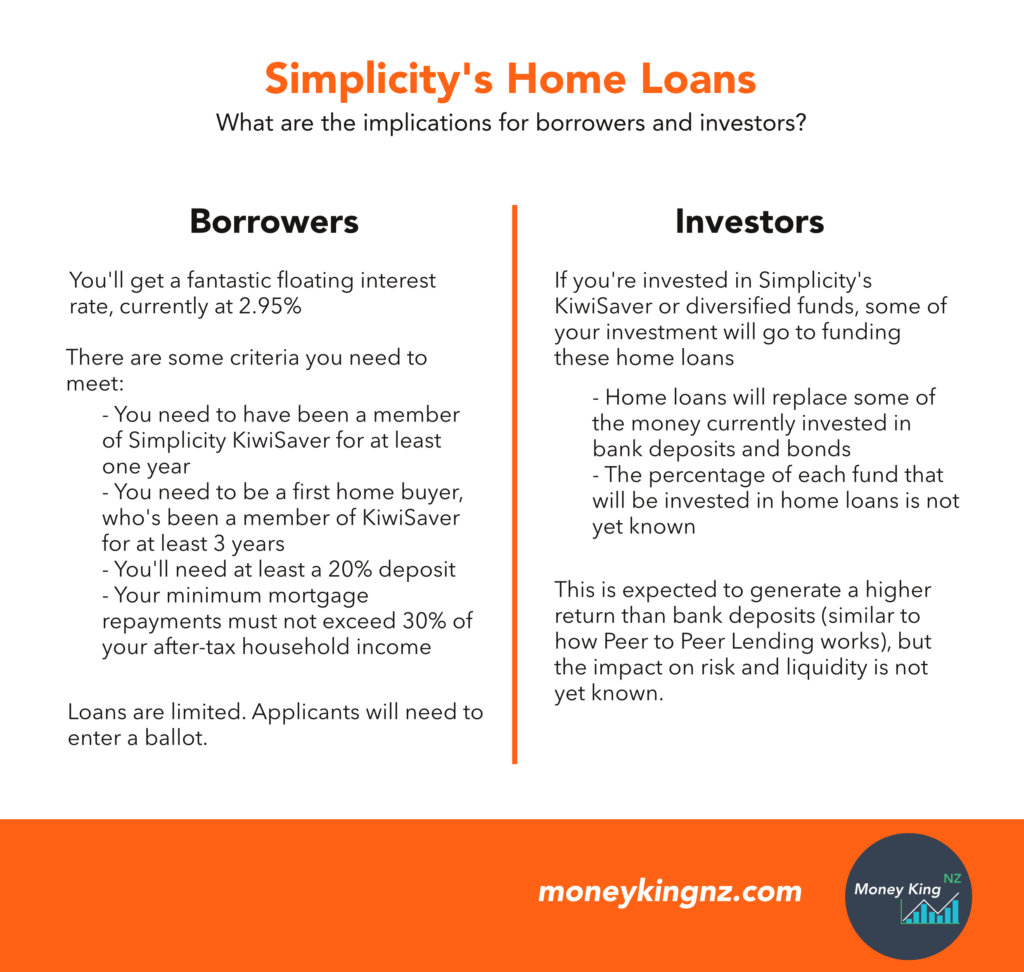

Simplicity announces home loan offering

This month KiwiSaver and managed fund provider Simplicity announced that they were entering the home loan market with an eye-catching interest rate of 2.95%! Here’s a rundown on what this new offering means for borrowers and investors:

The offering certainly grabbed everyone’s attention. But my opinion is that this offering is just a marketing gimmick:

- For borrowers: Availability of loans is low (you have to get lucky and win a ballot), and the criteria for qualifying for the loans is very strict – only those who are more well-off will be eligible.

- For investors: Having Simplicity’s investors fund the loans increases the risk of their investment, with very little additional return. It also deviates away from Simplicity’s passive, low cost investment strategy.

Nick from Your Money Blueprint wrote an excellent article, digging deeper into Simplicity’s home loan offering and reinforcing my above views. Highly recommended reading.

KiwiSaver fees propoganda?

Another attention grabbing piece of news this month was in relation to KiwiSaver fees, which allegedly increased by a shocking 13.5% over the last year. This news came in response to the FMA’s annual KiwiSaver report which revealed that KiwiSaver fund managers earned $60 million more in fees this year.

Here’s the real facts: KiwiSaver providers have NOT increased their fees! Fees are typically charged as a percentage of a member’s balance, and balances have increased by 17% over the last year. But providers have only collected 13.5% more in fees (suggesting the fees they charge have actually gone down). In other words, the $60 million extra in fees that providers collected is purely a result of increasing KiwiSaver balances.

An unfortunate consequence of these misleading headlines and commentary from Sam Stubbs, is that they can discourage people from investing, and ultimately miss out on the government contributions and long-term investment returns you can get from KiwiSaver:

However, I absolutely don’t dispute the opinion that more KiwiSaver providers should reduce their fees as they scale up and their Funds Under Management increase. So what can you do if you’re a disgruntled member? Don’t let this news put you off KiwiSaver. Vote with your money and consider switching to a low cost provider. You can read my comparison between the lowest fee KiwiSaver providers here.

Kōura KiwiSaver launches

Kōura, a new KiwiSaver provider launched this month. Their research found that more than half of Kiwis are in the wrong type of KiwiSaver fund, and this is partly due to lack of advice – financial advisers are seen as too expensive, and most people simply prefer to so their own financial research online. I can totally relate to this as I completely avoided KiwiSaver when I first started working, just because I didn’t understand it and didn’t have anyone to talk to about it.

To address this, Kōura has built a ‘Digital Advice Platform’ (which is really a robo-adviser) alongside their new KiwiSaver scheme. The advice platform can suggest which out of Kōura’s six passively managed funds you should invest in based on your circumstances, but you can ignore the robo-adviser and create a ‘DIY’ KiwiSaver portfolio.

Fees are relatively low at $30 + 0.63% per year, but not as low as Simplicity, JUNO, or BNZ‘s offering. Although I have no interest in switching to Kōura myself, I still admire their mission of getting New Zealanders into the KiwiSaver fund best suited for their investment objectives.

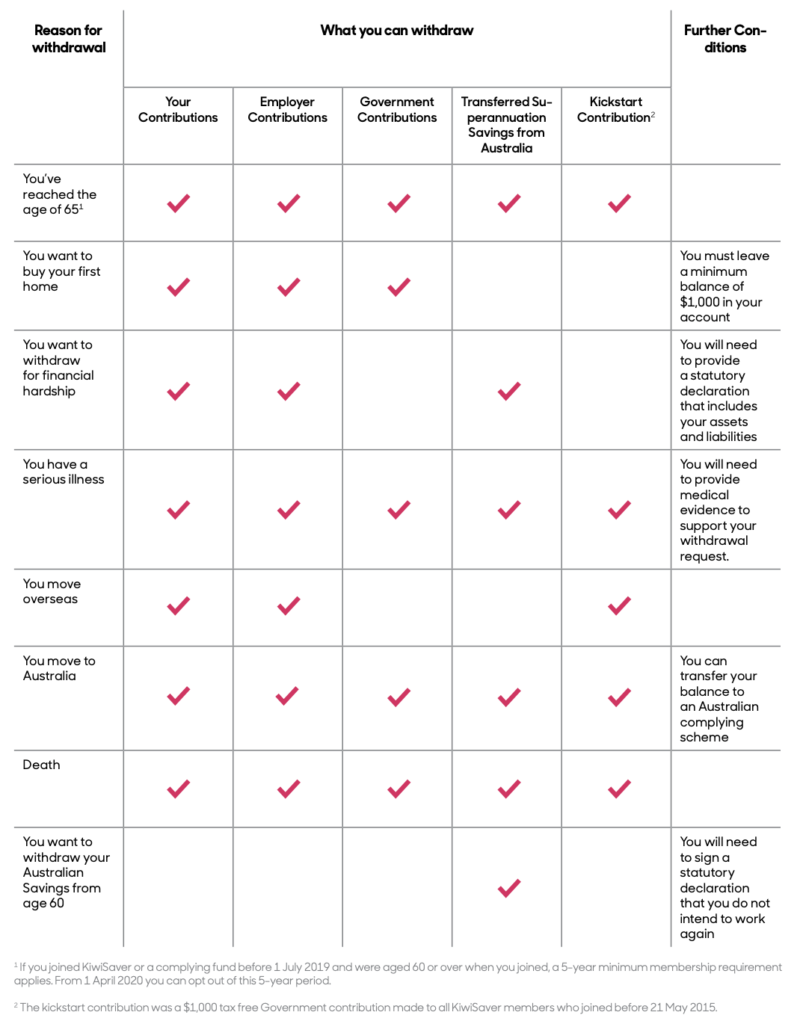

As a side note, I liked this table in Kōura’s Product Disclosure Statement which shows when (and what) you can withdraw from your KiwiSaver fund:

InvestNow has been busy this month

In addition to improving their online portal with an ‘advanced fund selector‘, InvestNow have added eight new funds to their platform, bringing their total number of funds to 118:

- APN Property Group – AREIT PIE Fund, Asian REIT Fund

- QuayStreet – NZ Equity Fund, Income Fund

- Milford – Australian Active Growth Fund, Balanced Fund, Conservative Fund

- Salt Funds Management – Long Short Fund

While none of the funds tempt me, I am impressed by how they are making their offering even more comprehensive. Keeping in line with this month’s KiwiSaver theme, I have also heard that InvestNow are working on a KiwiSaver offering!

Money King NZ news

This month has been an expensive one for me – I’ve finally replaced my dinosaur of a laptop, which I bought back in 2010! The credit card bill will hit me hard next month, but at least the new laptop will make it easier for me to produce content such as this article.

One thing I haven’t given any attention to in the past is the Podcast app on my phone. But this month I discovered a few NZ investment related podcasts, which I’ve begun listening to. Make sure you check out my fresh Blogs, Podcasts, YouTube page to see what other investment related content I’m subscribed to.

Lastly, I’ve been taking advantage of the longer daylight hours to do some running in the evenings after work. I registered for the Powerade Challenge where you run a 7.5-9km course in Auckland, Wellington, or Christchurch, and get a free Powerade afterwards. Can you beat my time of 39:23 on the Wellington course?

Most popular article this month: InvestNow vs Sharesies – Ultimate Fund Platform showdown and review

Previous month’s article:

– What I’ve been investing in – September 2019

Thanks for all your support!

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.