Let me take you back to 2017, when Bitcoin was the hot investment of the year. Everyone wanted a piece of it, as its price went from $1,000 USD to almost $20,000 USD in just a few months. Then the carnage began, with Bitcoin’s price plummeting back to $3,000 in 2018. Bitcoin has created many millionaires, but at the same time caused agonising financial pain during its turbulent history. Faithful backers of the cryptocurrency remain hopeful that Bitcoin will make a surging comeback.

I first became a Bitcoin and crypto investor back in July 2017, after my colleague invited me to a blockchain meetup event, and since then I continue to be fascinated by this mash up between technology and finance. This article will cover the things I’ve learnt about Bitcoin after 2.5 years of being an investor – How does it work, and is it a worthwhile investment, or are you better off throwing your money in the trash?

This article covers:

1. What is Bitcoin?

2. How can you buy and sell Bitcoin?

3. What else do you need to know about how Bitcoin works?

4. What are the limitations of Bitcoin?

5. What’s the difference between Bitcoin, blockchain, Bitcoin Cash, Litecoin, and Ethereum?

1. What is Bitcoin?

Bitcoin (also abbreviated to BTC or XBT) is a cryptocurrency. Essentially it is a fully digital currency run by some clever software and a network of computers around the world. Like any other currency, Bitcoin can be used as a method of payment, but is also considered to be a store of value, hence it’s often called “digital gold”. Some consider Bitcoin the future of money – so what are its advantages over normal currencies like the New Zealand Dollar (fiat currencies), and gold?

Decentralised

Bitcoin is not owned or controlled by a single government, bank, or organisation. Bitcoin is decentralised, run by “the network”, a collection of computers all around the world, also known as miners. As members of the network, miners are responsible for processing and recording Bitcoin transactions and balances. Anyone can become a miner and join the Bitcoin network.

The network gives Bitcoin legitimacy. The more participants in the network, the harder it is to shut down, and the more secure Bitcoin becomes – to take over or hack the network requires you take control of at least 51% of the network. A very difficult feat considering how large and widespread the network is.

Ubiquitous

While we’re lucky to have widespread access to banking in New Zealand, research suggests that 2 billion people worldwide do not. With Bitcoin all you need is an app on your smartphone to be able to accept and send payments – so it has the potential to improve the world’s access to financial services, enable people to build savings securely, and increase participation in the world economy.

Hedge against inflation

Governments can ruthlessly print money, causing inflation and reducing the value of your currency. Inflation can be a serious problem, with Venezuela and Zimbabwe examples of countries suffering from hyper-inflation in recent times. And NZ is not immune to inflation, with a dollar losing half its purchasing power in the 20 years from 1989 to 2019.

With Bitcoin, the number of coins that can ever exist is limited to 21 million. Like gold, it is a finite resource where its value cannot be eroded by creating new coins out of thin air – hence it being considered a store of value. Some people even see Bitcoin as a form of protection against an economic apocalypse – an alternative monetary system in case our world’s debt-fuelled economy falls over.

Transactions are fast and cheap

I have invested in Bitcoin because I believe in its potential, the capacity it has to transform global payments is very exciting

Richard Branson

It takes seconds to make a transaction using Bitcoin, and only 10 minutes to finalise (or “confirm”) the transaction. Transaction fees are cheap, usually costing well under 50 cents. This is the case whether I’m sending Bitcoin to a local shopkeeper, or to someone on the other side of the world – try achieving the same with a bar of gold! While services like TransferWise have made global payments easier, Bitcoin is still superior to fiat currencies and gold, being a faster, cheaper, and truly borderless currency.

2. How can you buy and sell Bitcoin?

While traditional financial markets are only open during business hours, the Bitcoin market never sleeps. You can trade Bitcoin 24 hours a day, 7 days a week, and even on public holidays like Christmas Day. Here’s what you need to buy and sell Bitcoin:

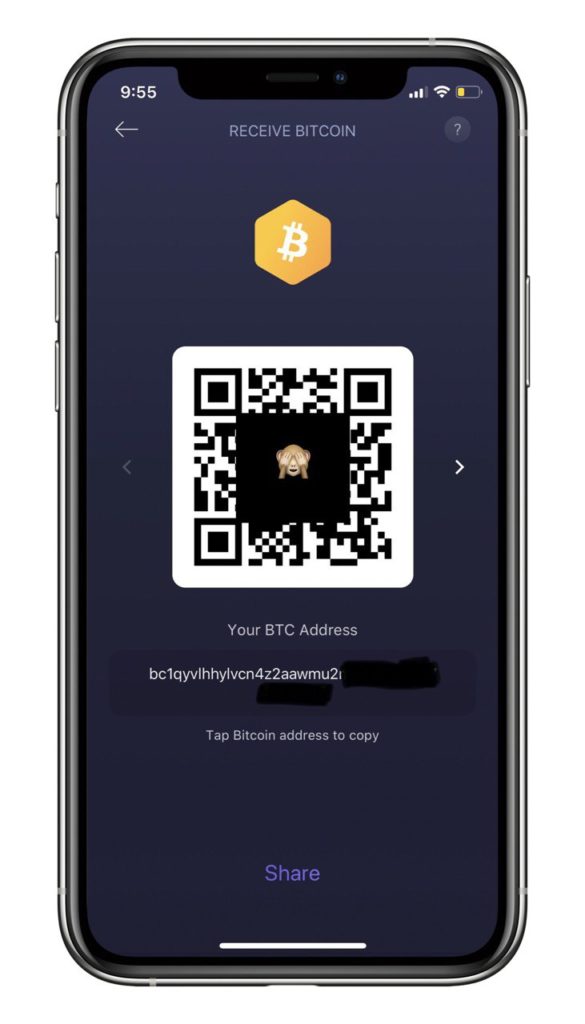

Wallet

A Bitcoin wallet is the first thing you need. Wallets come in many forms – from an app on your phone, a physical USB stick like device, or even a QR code printed on a piece of paper! Examples are the Exodus wallet app which you can download for free, or Ledger which is a physical device. A wallet gives you a Bitcoin address, and the keys to it, allowing you to receive, hold, and send Bitcoin.

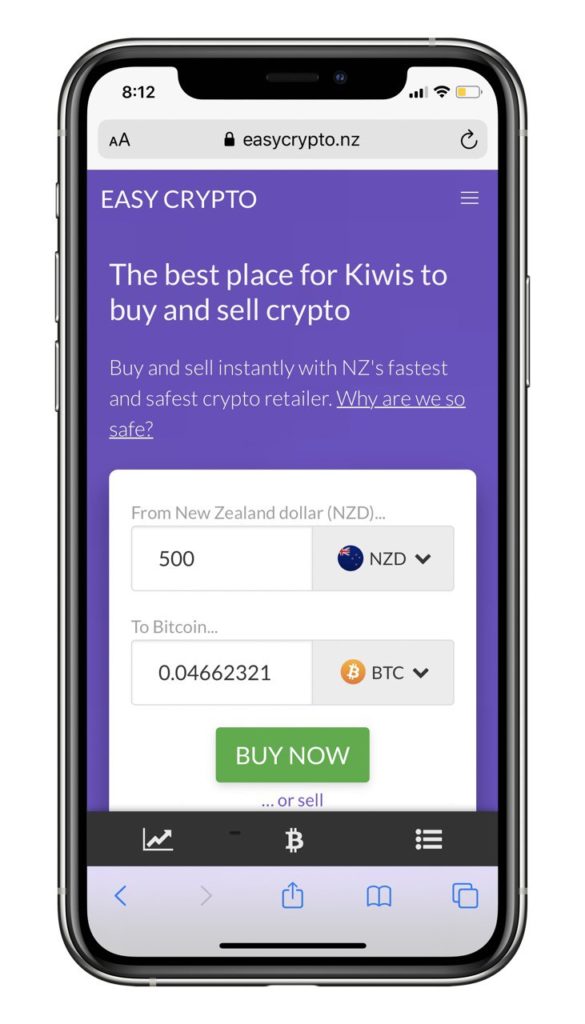

Exchange/Broker

The next thing you need is to sign up to a cryptocurrency exchange or broker. There are thousands around the world, but an example of a popular New Zealand based broker is Easy Crypto. They allow you to use your NZ Dollars to buy Bitcoin (and to sell Bitcoin back to NZ Dollars).

Safety

Lastly, you are responsible for keeping your Bitcoin safe. When you buy Bitcoin from an exchange, make sure your Bitcoins are sent to your own wallet that you have the keys to (as exchanges are often the targets of hackers). You must also back up your wallet (typically using a 12 word passphrase), in case you lose your wallet or the device that your wallet is sitting on.

I won’t go into any further detail about wallets, exchanges, and safety, as you can read my step-by-step guide on how to buy Bitcoin (link below) for more info.

Further Reading:

– How to buy Bitcoin in New Zealand (a step-by-step guide)

– How to sell Bitcoin in New Zealand

3. What else do you need to know about how Bitcoin works?

As a digital currency, some concepts behind Bitcoin are quite technical. I’ve done my best to explain them, starting with the less technical things you need to know.

Less technical concepts

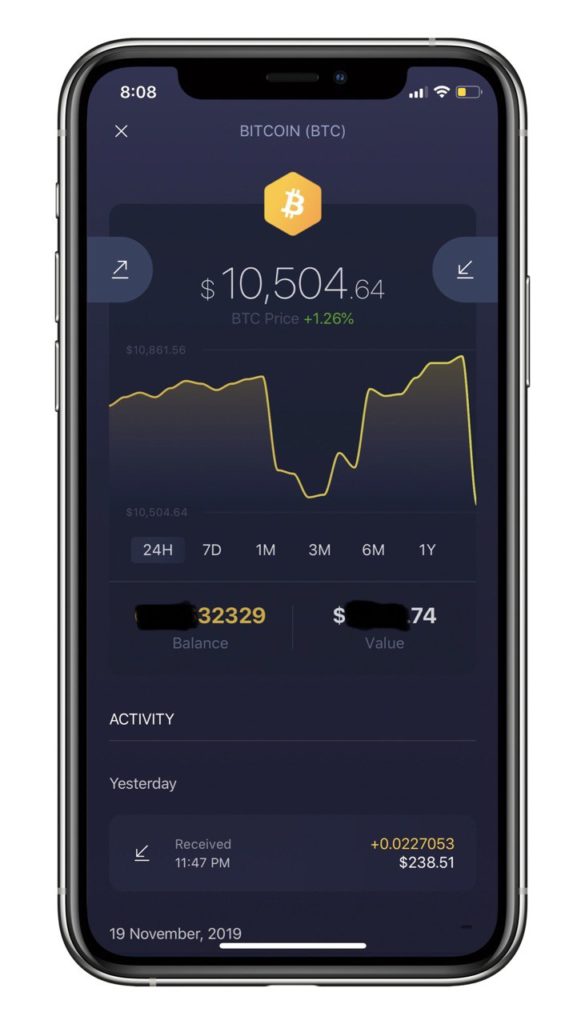

Fractionalisation

You don’t need to buy or sell a whole bitcoin at once, which is a good thing considering one whole Bitcoin is worth around $7,000 USD right now! Just like dollars can be split into cents, Bitcoin can be split into satoshi (named after Bitcoin’s creator, Satoshi Nakamoto). One satoshi is 100 millionth, or 0.00000001 of a Bitcoin.

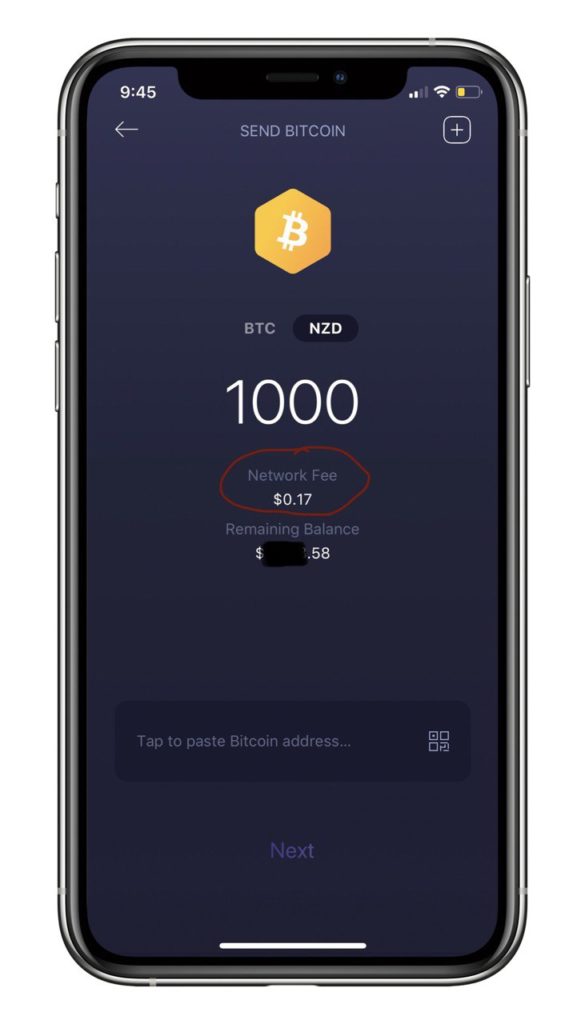

Transaction fees

When you make a transaction with Bitcoin you need to pay a transaction fee. This fee is typically well under 50 cents, but at times when the Bitcoin network is congested, you may need to pay a higher fee in order for it to be processed without delays – the network processes transactions that paid a higher fee sooner than transactions that paid a lower fee. It’s a bit like surge pricing with Uber.

Anonymity

Bitcoin is anonymous (kind of). Unlike bank accounts, a Bitcoin addresses do not have a person or identity associated with it, nor do its transactions pass through a bank. Bitcoin has been commonly associated with criminal activity for its anonymous, peer-to-peer nature. However, Bitcoin is not fully anonymous – the full history of all bitcoin transactions, as well as wallet balances is publicly viewable. However, it’s hard to associate these transactions and balances with a particular person.

More technical concepts

As mentioned in section 1, “the network” which is a bunch of computers (miners), is responsible for running Bitcoin and processing its transactions. Here’s some more detail on how it works:

Blocks

Bitcoin transactions are processed in blocks. The Bitcoin network processes a block every 10 minutes on average. Blocks are limited in the number of transactions they can handle (the current Bitcoin block size is 1 megabyte) – if a block is full, a transaction must wait to be processed in a later block. The queue of transactions waiting to be processed is known as the mempool.

Mining

The processing of blocks is known as mining, and is conducted by computers (miners) on the Bitcoin network. Miners get compensated for processing blocks by receiving the transaction fees that users pay, as well as block rewards, which are newly issued Bitcoins.

The block reward is currently 12.5 Bitcoin per block processed. The block reward is halved every 210,000 blocks processed, as a mechanism to control inflation and keep the supply of Bitcoin relatively scarce. Block rewards will continue to be issued and halved until the maximum supply of 21 million Bitcoins is reached. This is projected to happen in the year 2140.

Miners perform complex computing work in order to process blocks. Bitcoin uses a concept called Difficulty, which adjusts the complexity of the computing work in order to keep blocks being processed steadily every 10 minutes – no matter how many, or how few miners there are on the network. Given the large amount of computing power Bitcoin uses, energy consumption is a big concern, with the network using more power than Switzerland!

The blockchain

The Bitcoin blockchain is a complete record of all blocks processed by the Bitcoin network, to the beginning of time (or more precisely, to 2009 when the Bitcoin network started). As every new block is processed, it’s added to the chain, making the chain larger everyday. Computers all throughout the Bitcoin network keep a copy of the same blockchain, making it incredibly difficult to hack or alter the blockchain, for example, to spend counterfeit coins.

4. What are the limitations of Bitcoin?

Bitcoin is amazing as a currency and piece of technology, but are a few reasons not to invest. Here are its key negative points:

Adoption

For Bitcoin to be valuable as a currency, it needs wide use and acceptance. For example, social networks like Facebook and Instagram would not be useful if none of our friends used them. The problem for Bitcoin is how it will gain acceptance and use over our existing monetary system – while there is a stronger case to use Bitcoin in countries with instability like Venezuela, Bitcoin is less likely to find reasons to be more useful than the likes of US Dollars, Japanese Yen, or NZ Dollars.

Scalability

Given blocks are limited in the number of transactions they can handle, and are processed only every 10 minutes, Bitcoin is currently limited to handling a maximum of 7 transactions per second. Meanwhile, Visa (the card payments network) processes an average of 1,700 transactions per second!

In its current state, there is no way that Bitcoin can reach the scale required to be a widespread and global payments solution. However, it is hoped that the development of technical solutions such as the Lightning Network will resolve this scalability issue.

Hard to understand

Bitcoin is a lot more technical than traditional financial products. Sure, most people can learn, but you shouldn’t have to understand so many concepts to simply use it as a currency to buy a coffee. Of particular concern is how users need to understand how to keep their Bitcoin safe – it is estimated that 20% of all Bitcoin has been lost forever, due to users losing their wallets or keys, with even more Bitcoin being lost to hacks and scams. The user friendliness of Bitcoin certainly needs to improve for more everyday people to get onboard.

Extreme Volatility

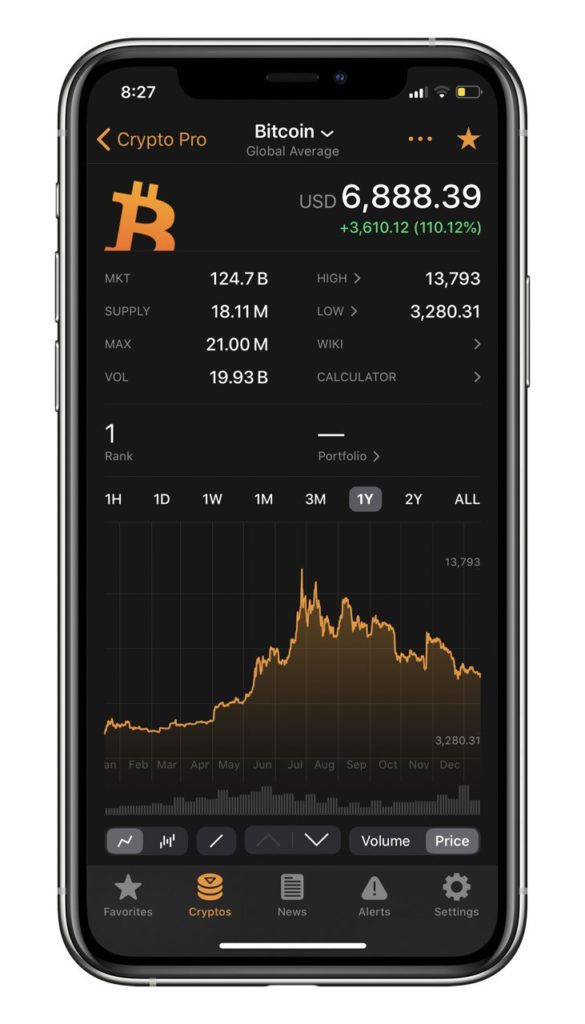

Bitcoin has performed well in the past year, having more than doubled in value. But this hasn’t been without a roller-coaster ride along the way, with the price rising from a low of $3,280 to a high of $13,793, before falling back to around $7,000 at the time I write this.

This extreme volatility makes Bitcoin hard to use as a currency – Imagine a cup of coffee wildly changing in price every hour! The volatility may also make it less attractive to investors – those who own Bitcoin face the realistic prospect that they could wake up the next morning with their investment halved in value.

Bitcoin vs traditional assets

Take traditional investments like shares in a company as an example – Think of companies as money-making machines with employees, products, services, and assets, all working to grow and generate a profit for its shareholders. It is relatively easy to put a value on a company’s shares based on its current and potential earnings.

On the other hand Bitcoin produces nothing. You can only make money from it if you can sell it for a higher price than you bought it at. And it’s hard to put a price on it – Bitcoin’s utility and value as a currency is hard to quantify.

It doesn’t do anything. It just sits there. It’s like a seashell or something, and that is not an investment to me

Warren Buffet

5. What’s the difference between Bitcoin, blockchain, Bitcoin Cash, Litecoin, and Ethereum?

Blockchain

Blockchain and Bitcoin are not the same thing. Blockchain is simply the technology that Bitcoin uses, and is essentially a special type of database recording and storing all transaction information, in a decentralised manner (stored on many different computers). Bitcoin is just one implementation of blockchain technology, but there are many other uses of blockchain such as in other cryptocurrencies, and non-cryptocurrency commercial applications.

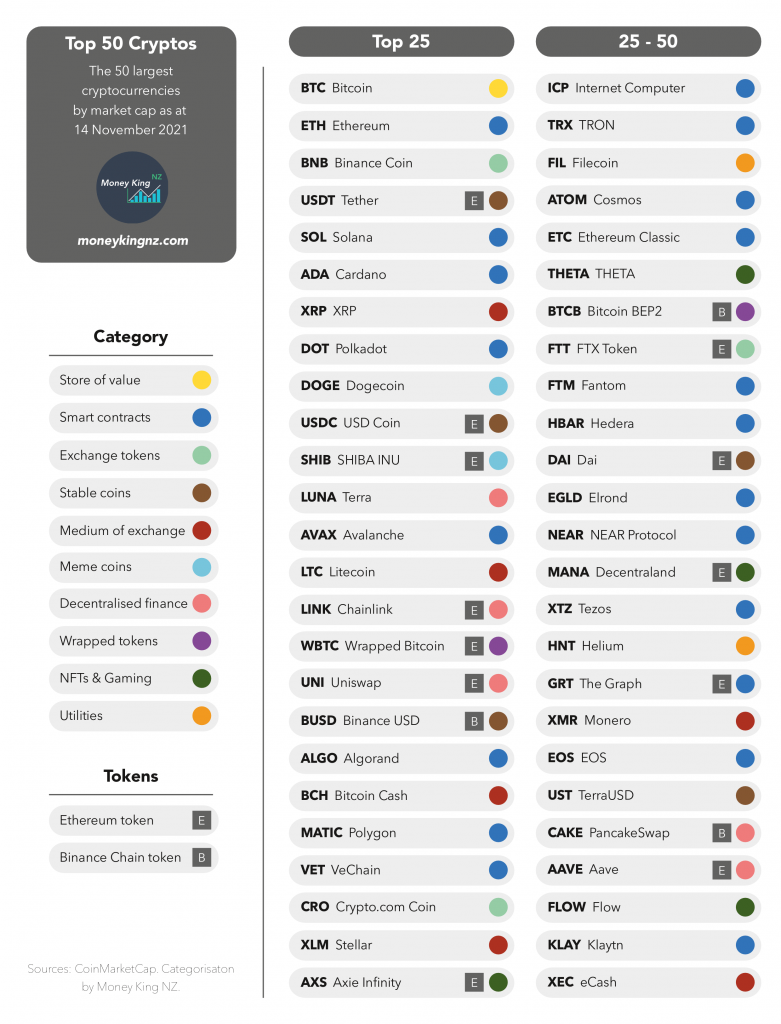

Altcoins

Apart from Bitcoin, there are thousands of other cryptocurrencies, collectively known as Altcoins. Many of them also use blockchain technology, while some use other technologies. Some Altcoins are used purely as a currency, but some perform other utilities.

Bitcoin Cash

In 2017 there was intense debate in the Bitcoin community around how to scale up its capacity. There were two schools of thought:

- Bigger Blocks – Increase the capacity of Bitcoin’s blocks (from 1MB to 8MB), so that each block can fit more transactions

- SegWit – Keep blocks the same size, but implement upgrades (one of which was called SegWit), which would enable technologies such as the Lightning Network to be developed.

This gave rise to the Bitcoin civil war – no consensus could be reached on how to proceed with scaling up Bitcoin, which ultimately led to Bitcoin being split into two coins – Bitcoin Cash, which implemented the “bigger blocks” option, and the original Bitcoin, which implemented the “SegWit” option. There are some people who still claim that Bitcion Cash is the real and original Bitcoin, creating further confusion for people who are new to cryptocurrency.

Litecoin

It is often said that Litecoin is Silver to Bitcoin’s Gold. Litecoin is designed to be a faster, lightweight version of Bitcoin, also using blockchain technology, but processing blocks four times more frequently at a rate of one every 2.5 minutes.

Ethereum

Ethereum is a platform on which developers can create apps, or even other cryptocurrencies. Users use the cryptocurrency Ether to access the Ethereum platform/network. Below is an example of a cryptocurrency powered by the Ethereum platform.

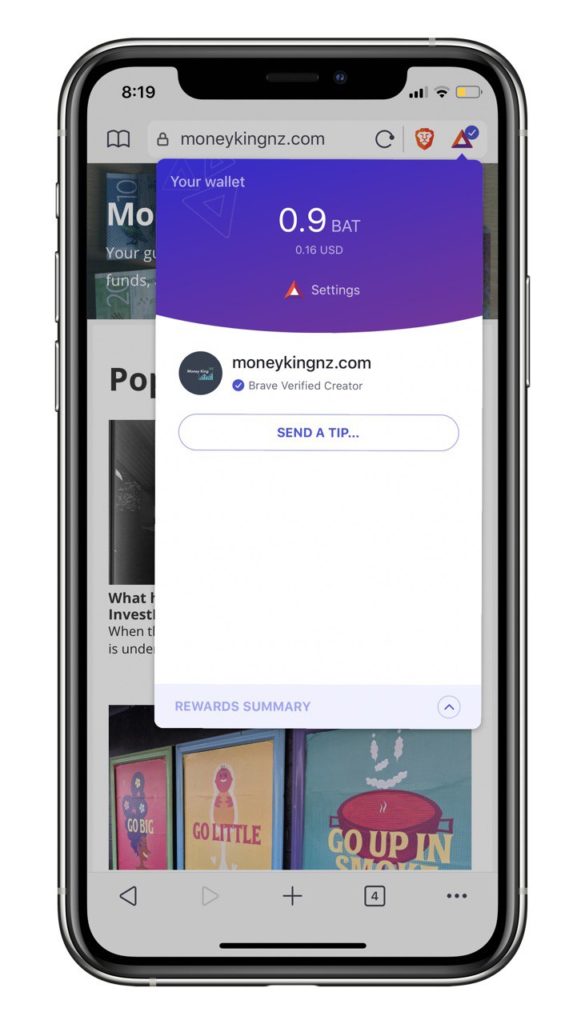

BAT

Basic Attention Token (BAT) is a cryptocurrency that doesn’t use its own blockchain, but instead runs on Ethereum’s blockchain. BAT works alongside the Brave Web Browser, which blocks traditional ads and replaces them with new ads. Users of the browser get rewarded with BAT if they opt-in to see those ads, which they can then use to tip their favourite websites, or withdraw to their own wallet. It’s certainly an interesting use of cryptocurrency that aims to transform web browsing and the digital advertising industry.

Is Bitcoin a good investment?

Bitcoin has a lot of potential. It is a completely borderless, peer-to-peer currency that you can use without a bank account, and cannot be controlled or interfered with by any government or organisation. With its scarcity and potential use as a store of value, Bitcoin is considered digital gold, with the advantage of being able to cheaply and quickly transact to anywhere in the world.

However, Bitcoin is a speculative “investment”. I think adoption of Bitcoin and other cryptocurrencies will be the primary driver of its value – and I don’t see Bitcoin taking off in a big way in New Zealand, or any other developed countries any time soon. Blockchain technology has great potential, but that doesn’t mean Bitcoin will be the beneficiary of its use.

As for me, I agree with Warren Buffet, and think it’s better to put your money into shares of proven companies that will generate profits for you, year after year. However, as a bit of a tech geek, I can’t resist having a tiny bit of my money invested in Bitcoin. Perhaps it will take off one day – but if it doesn’t, I don’t have enough money invested in it to be hurt. Whatever you think, you probably shouldn’t invest any money that you can’t afford to lose into Bitcoin.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.