With an offering of over 150 funds, choosing which funds to invest in with InvestNow can be a daunting task – especially because InvestNow is aimed at self-directed investors and does not offer investment advice to prospective investors.

Sharesies has fewer funds to choose from (approximately 40 NZ domiciled funds), but that’s still a lot of choice. Sharesies also offers the ability to invest in individual companies, but that’s a topic for another article.

So here’s a beginner’s guide to choosing which fund to invest in on these platforms with three simple steps.

This article covers:

1. Determine your investment objectives and timeframe

2. Determine your asset allocation

3. Choose your fund(s)

Update (5 Aug 2019) – Updated the article to include information on Sharesies

Update (28 Jun 2021) – Updated for 2021

Update (4 Apr 2022) – AMP’s funds have been renamed to Macquarie

1. Determine your investment objectives and timeframe

Think about why you want to invest, and more importantly, how long you are willing to invest for. Use the below table as a starting point to determine whether you’re a short, medium, or long term investor:

| Investment timeframe | Years to invest |

| Short-term | 0-5 years |

| Medium-term | 5-10 years |

| Long-term | 10+ years |

Different people have different reasons for investing. Here are some examples:

- A short-term investor could be someone saving for a house that they expect to buy in a couple years time

- A medium-term investor could be someone who’s a few years away from retirement, or saving for something further into the future

- A long-term investor could be a younger person saving for retirement, someone putting money aside for their baby’s future, or someone generally wanting to grow their wealth over the long-term

2. Determine your asset allocation

Your investment timeframe from above will be used to inform your asset allocation – whether you should be putting your money in cash, bonds or shares. The table below provides a potential asset allocation for each timeframe:

| Investment timeframe | Suggested asset allocation |

| Short-term | Invest mostly in cash |

| Medium-term | A mix of bonds and shares |

| Long-term | Invest mostly in shares |

Why the above asset allocations?

Short-term – The objective here is to preserve your money for short-term goals, rather than grow it (which would put your money at higher risk). You’ll get low returns with cash, but its value is very stable

Medium-term – You can expect bonds to make more money than cash over the medium-term, while being more stable than investing all your money in shares

Long-term – Shares tend to go up and down like a roller-coaster, but over the long-term have the potential to grow much more than cash and bonds

These are guidelines rather than rules

The above are not set rules, but are guidelines only. For example, there’s nothing stopping you from investing in shares if you’re a short-term investor. You’d just be exposing yourself to more risk – there’s not much worse than seeing a big chunk of your house deposit wiped out with a share market crash, just as you’re about to buy a house 🙁

Conversely, there’s nothing stopping you from investing more in cash or bonds if you’re a long-term investor, especially if you’re risk adverse and don’t want to see your investment value fluctuate too much. You’d just miss out on potentially higher investment returns when you go for a safer asset allocation.

Lastly, the above guidelines don’t take into account everyone’s unique financial and personal situation, so you may want to consult with a professional financial adviser to help determine the most suitable asset allocation for you.

3. Choose your fund(s)

Now you can choose which fund(s) to invest in based on your desired asset allocation. I’ve provided examples of some funds on InvestNow and Sharesies for each asset class (cash, bonds, shares) below. I’ll also cover diversified funds which invest in multiple asset classes.

First, a brief note on actively managed vs passively managed funds. Actively managed funds have a fund manager who decides what the fund should invest in. Passively managed funds simply invest in a market index (e.g. top 50 NZ shares, or top 500 US shares). I’m mostly providing examples of passively managed funds in this article – Firstly, the fund management fees for passively managed funds are lower because there is no fund manager actively involved in deciding what the fund should invest in. Secondly, actively managed funds don’t tend to perform any better than passively managed funds over the long-term, despite their higher fees.

A. Cash funds

There is not much choice when it comes to cash funds. The fund management fees are in brackets.

- Smartshares NZ Cash ETF (0.20%)

- Macquarie NZ Cash Fund (0.27%) (InvestNow only)

These funds invest largely in bank deposits – So an alternative is to just deposit money with your bank directly (in term deposits or notice savers) instead of investing in these funds – you’ll save on fees that way.

Further Reading:

– Bonus Saver vs Notice Saver vs Term Deposit – Which savings product is right for you?

B. Bond funds

There are a couple of low cost bond funds available:

- Smartshares Global Aggregate Bond ETF (0.30%) – invests in almost 4,000 bond issues from around the world

- Smartshares S&P/NZX NZ Government Bond ETF (0.20%) – Invests in New Zealand government bonds

Further Reading:

– Bonus Saver vs Notice Saver vs Term Deposit – Which savings product is right for you?

C. Share funds

You’re spoilt for choice when it comes to passively managed share funds. I have split them into four categories:

Global funds

Invests in shares from a very wide range of countries. They are excellent funds to start your portfolio with because they provide a huge amount of diversification, and are suitable for making up a core part of your investment portfolio.

- Macquarie All Country Global Shares Index Fund (0.42%) – Invests in over 2,800 of the world’s largest companies in both developed countries and emerging markets (China, India, Brazil etc.)

- Smartshares Global Equities ESG (0.54%) – Invests in over 1,500 of the largest companies in developed countries, excluding those involved in thermal coal, controversial weapons, tobacco, and other controversial industries.

Further Reading:

– Smartshares vs Vanguard vs AMP vs Kernel – International Share Index Fund shootout

Country/Region specific funds

Invests in shares from a specific country or region(s). They aren’t essential in your portfolio if you’re buying global funds, but you can use them to get extra exposure to a particular region. For example, The S&P/NZX 50 ETF is good for getting more exposure to our home market, given global funds have very little invested in NZ.

- Smartshares S&P/NZX 50 ETF (0.20%) – Invests in the 50 largest companies in the NZ market

- Smartshares S&P/ASX 200 ETF (0.30%) – Invests in the 200 largest companies in the Australian market

- Smartshares US 500 ETF (0.34%) – Invests in the 500 largest companies in the US market

Further Reading:

– Smartshares vs AMP vs Kernel vs Harbour – NZ Share Index Fund shootout

Characteristic specific funds

Only invests in companies with certain characteristics e.g. based on company size or high dividend yield. Again, they aren’t essential in your portfolio, but you can use them if you want to achieve a specific investment objective such as obtaining dividend income.

- Smartshares NZ Dividend ETF (0.54%) – Invests in the 25 highest dividend yielding companies out of the NZ Top 50

- Smartshares US Large Growth ETF (0.51%) – Invests in large US companies that are expected to grow faster than average, but typically pay small dividends

Sector/Thematic funds

Only invests in shares from a specific industry. They offer lower diversification, sometimes have higher fees, and chances are the companies found in these funds are also part of a global or region specific fund (for example, NZ Property already makes up around 13% of the NZ Top 50 ETF). So use these funds to complement your portfolio, rather than make up a core part of it.

- Macquarie Australasian Property Index Fund (0.82%) (InvestNow only) – Invests in Real Estate Investment Trusts (REITs) listed in the NZ and Aussie markets. An alternative fund available on Sharesies is the NZ Property Fund (0.54%). Find out more about REITs in this article.

- Smartshares Healthcare Innovation ETF (0.75%) – Invests in companies innovating in medical treatment and technology.

- Smartshares Automation and Robotics ETF (0.75%) – Invests in companies associated with the development of automatic and robotic technology.

Further Reading:

– Smartshares & Kernel – Thematic Index Fund shootout

D. Diversified funds

InvestNow offers a couple of passively managed diversified funds. These funds contain a mixture of asset classes (cash, bonds, and shares), so they are a convenient alternative to picking multiple funds to make up your portfolio.

- InvestNow Foundation Series Balanced Fund (0.37%) – Invests 60% in shares and 40% in cash and bonds, making this fund most suitable for medium-term investors

- InvestNow Foundation Series Growth Fund (0.37%) – Invests 80% in shares and 20% in cash and bonds, making this fund most suitable for longer-term investors

Further Reading:

– InvestNow Foundation Series vs Simplicity funds – Tax leakage an issue?

Note the above isn’t a complete list of all passively managed funds available on InvestNow and Sharesies. For example, InvestNow also offers the popular Vanguard International Shares Select Exclusions Index Funds (0.20%-0.26%), but you should be aware of the tax implications of these funds as they are ‘Australian Unit Trusts’.

Resources

Want to dive deeper and learn more about what some of the above funds are invested in? These spreadsheets might help!

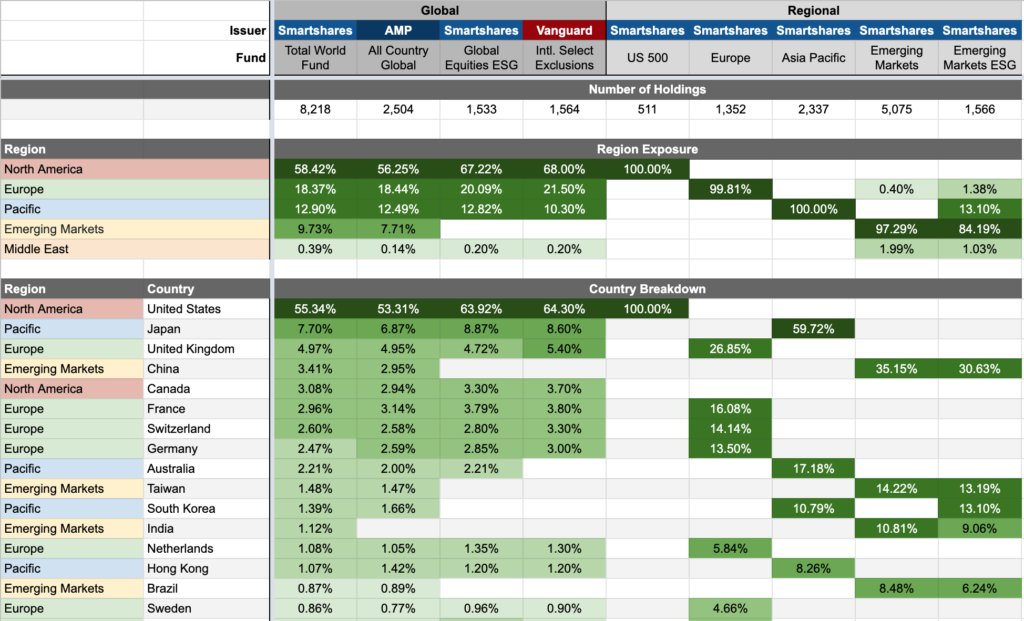

This first spreadsheet shows the countries and regions that various Global share funds are invested in.

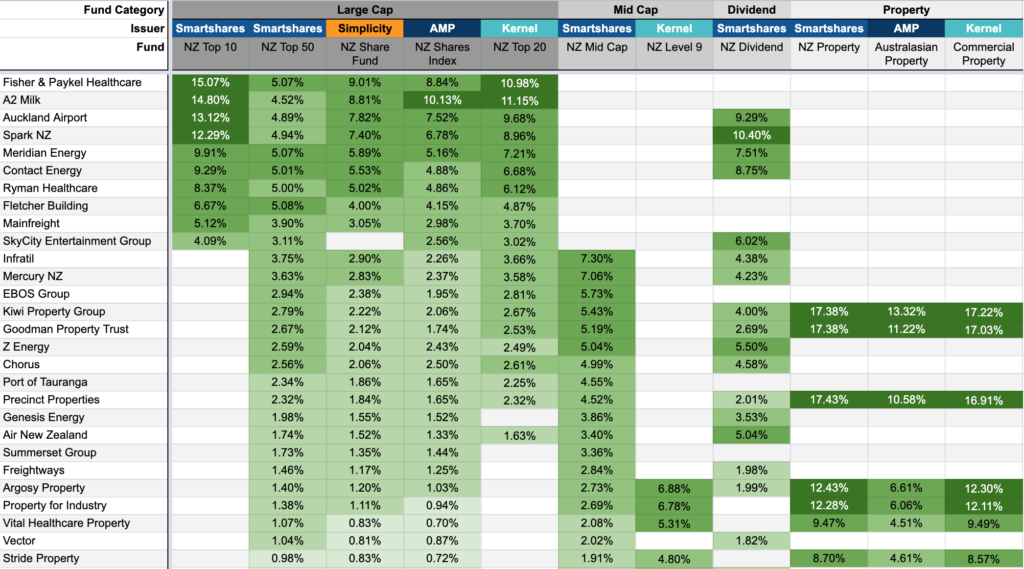

This second spreadsheet shows the exact companies that various NZ share funds are invested in.

You may use these spreadsheets to inform you which funds you should and shouldn’t invest in. For example:

- If you have invested in the Smartshares Total World ETF, you probably don’t need to invest in the Smartshares US 500, since the Total World Fund is already 58% invested in the US.

- If you have invested in the Smartshares NZ Top 50 ETF, you probably don’t need to invest in the Smartshares NZ Mid Cap ETF, since the Top 50 already contains all the companies that the Mid Cap Fund has.

Further Reading:

– More funds = less diversification? Are you investing in too many funds?

Note – not all funds contained in the above spreadsheets are available on InvestNow and Sharesies.

Conclusion

It can be pretty hard to choose which funds to invest in, given the large range available. But the most important thing is to consider your investment objectives, and pick funds that align with them. And remember, there is really no right or wrong when it comes to picking funds, as everyone’s personal circumstances are totally unique. If in doubt, keep it simple!

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

Once you’ve selected your fund(s), it’s time to get investing. If you’re not sure how much money you need to start investing, check out my post here.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.