What I’ve been investing in is a monthly series covering what investments I’ve made during the month, and any investing related news that I’ve found interesting. In August 2019 New Zealand secured the Bledisloe Cup for the 17th year straight, massive protests continued in Hong Kong, and trade wars and OCR cuts have dominated the economic news. It has been a relatively quiet one for me in terms of my own investment portfolio, but I have a lot of news below that’s well worth reading about!

The below is not financial advice, nor a recommendation to invest in the following. Please do your own research before making any investment decisions.

What I’ve been investing in

Heartland Bank

I first bought shares in Heartland Bank late last year. They’ve been growing steadily (particularly in the reverse mortgages space) and have even just announced an increased dividend, so I decided to buy more shares in the bank. Probably not the worst idea considering declining interest rates – as some have said, it’s better to own the bank, than to lend money to the bank.

Squirrel Money

I’m continuing to increase my Peer to Peer Lending portfolio with Squirrel. I don’t think I will be adding much more money from now on, as loan demand has dried up a little, while investor supply has increased following the OCR cut.

InvestNow

Global sharemarkets have been volatile this month largely thanks to trade wars, Trump Tweets, and recession fears. I saw this as an opportunity to invest more while index funds are “on sale”, and have done so by contributing to my core holding on InvestNow, the AMP All Country Global Shares Index Fund.

Punakaiki Fund

Punakaiki Fund is a company I bought in an Equity Crowdfunding campaign on Snowball Effect back in late 2016. Punakaiki invests in a portfolio of relatively young, high-growth companies, mainly in the software space – I like this as there are not many opportunities to invest in tech in NZ!

Punakaiki holds share trading windows every 3 months, in which existing shareholders can trade Punakaiki shares with each other. The shares usually trade at a discount during these trading windows, so I bought a small amount at a discounted price of $19 per share (compared to their valuation of around $22.42).

Angel Food

I invested a small amount of money in another Equity Crowdfunding campaign this month, Angel Food. They are a fast growing producer of vegan cheese, and supply well known outlets like Hell Pizza and Z (for their vegan pepper mushroom pie). Given veganism and demand for meat and dairy alternatives is rapidly on the rise, I’m confident that Angel Food will continue to grow. Fortunately I don’t have to give up meat to become an investor in this rising trend!

Investing news

Reserve Bank slashes the OCR

On Wednesday 7 August, The Reserve Bank of NZ slashed the Official Cash Rate (OCR) from 1.5% down to a record low of 1%. It was widely expected to be reduced by 0.25% to 1.25%, but no one saw such a big cut coming.

This was immediately followed by a spike in NZ share prices, and a sharp fall in the NZD.

Bank deposit rates have dropped as a consequence of the rate cut. Here’s a selection of bank savings products and their rate changes from 6 to 12 August:

| 6 Aug | 12 Aug | Change | |

| Heartland Direct Call account | 2.15% | 1.90% | -0.25% |

| Westpac 32 day Notice Saver | 2.40% | 2.00% | -0.40% |

| Kiwibank 90 day Notice Saver | 3.10% | 2.70% | -0.40% |

| ANZ 1 year Term deposit | 3.00% | 2.85% | -0.15% |

Check out my most recent article for my insights on what you can do about declining term deposit interest rates.

Kernel

Kernel is a new fund manager that launched this month, with an initial offering of three low cost index funds investing in the NZ sharemarket:

- NZ 20 – Invests in the 20 largest companies on the NZX

- NZ Level 9 – Invests in 37 mid-small size companies listed on the NZX

- NZ Commercial Property – Invests in the 8 Real Estate Investment Trusts (REITs) listed on the NZX

Kernel’s fund management fees are 0.39% + a $3 per month account fee (but you can get a 0.10% fee rebate when investing over $25,000). My first impressions are that there are cheaper options available (like Simplicity and InvestNow), but the Level 9 fund is interesting, investing in 16 companies outside the Top 50. I will be keeping an eye on this new fund manager, and you can expect to see a review/comparison article soon!

Napier Port IPO

Napier Port is the latest company to be listed on the NZ sharemarket! They raised $234m in an IPO by issuing new shares at a price of $2.60 a piece. Being a key piece of infrastructure for Hawkes Bay, they plan to use the money to repay debt, and to be able to fund the construction of a new wharf. The shares have been in high demand, immediately shooting up 12% to $2.91 on the commencement of trading, and have since risen further to over $3.10.

Money King NZ news

I’ve added a couple of very interesting initiatives to the site this month:

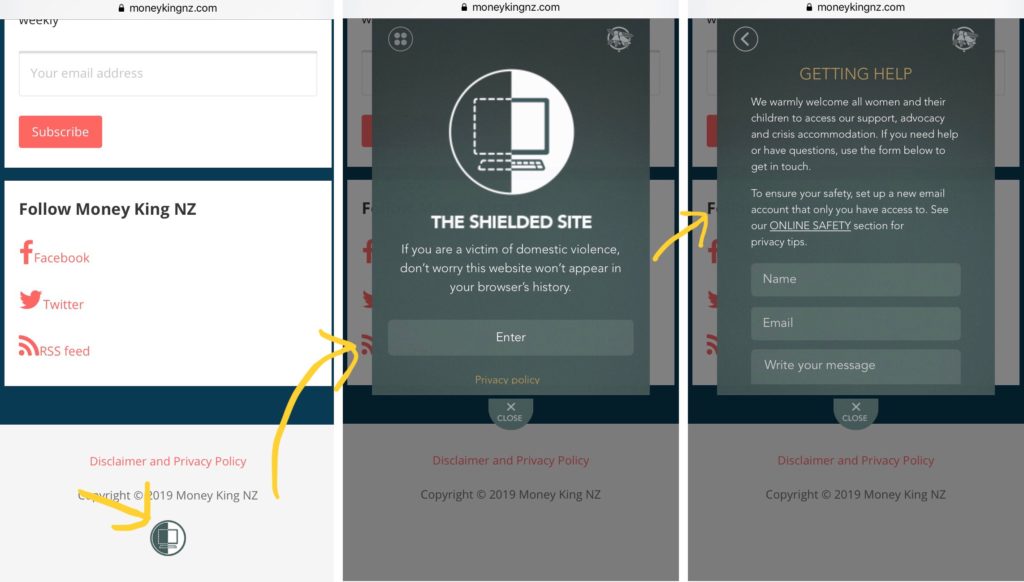

Shielded Site

Shielded Site is an initiative from Women’s Refuge NZ that allows victims of abuse to seek help, without it appearing in their browsing history. I’ve added the Shielded button to the bottom of all pages on Money King NZ. Anyone can add the Shielded button to their site, and several major New Zealand websites like Trade Me, The Warehouse, and Countdown have already done so – find out more at shielded.co.nz

Brave Verified Creator

Brave is an increasingly popular web browser that automatically blocks ads and trackers. But if you want, you can opt-in to see ads and be rewarded with cryptocurrency tokens, which you can then use to tip your favourite websites or withdraw. This month I’ve become a Brave Verified Creator, which allows users of Brave to reward this site with tips.

Download Brave through this link and you’ll also be supporting Money King NZ. Give it a go – I think you’ll be surprised at the insane amount of ads and trackers that are out there on the web. I’ve blocked over 112,000 ads during just a few months of use.

Most popular article this month: Simplicity vs JUNO vs BNZ – Battle of the low cost KiwiSaver funds

Previous month’s article:

– What I’ve been investing in – July 2019

Thanks for all your support!

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.