What I’ve been investing in is a monthly series covering what investments I’ve made during the month, and any investing related news that I’ve found interesting. Things are quietening down in the month of November as we rapidly approach the Christmas and New Year holidays – where has the time gone this year!?

The below is not financial advice, nor a recommendation to invest in the following. Please do your own research before making any investment decisions.

What I’ve been investing in

Punakaiki Fund

Punakaiki Fund invests in a portfolio of relatively young, high-growth companies in the technology space. I first bought shares in Punakaiki in December 2016 through an Equity Crowdfunding campaign on Snowball Effect. About once a year Punakaiki opens the fund to investment from retail investors, and in 2019 they provided two options for investors:

- Public retail offer: An opportunity for new or existing investors to buy 100 or more shares at a price of $23 per share.

- Discounted rights issue for existing shareholders: An opportunity for existing investors to acquire 1 new share for every 7 shares they already owned, at a discounted price of $16 per share.

As an existing shareholder I had the opportunity to buy 22 discounted shares through the rights issue, which I took up as I do like a good discount. I also applied to buy an additional 20 shares from other investors who didn’t take up their rights issue shares. Altogether I purchased 42 new shares for a total of $672.

InvestNow

I’m still growing my InvestNow portfolio, and the funds I invested in this month were:

- AMP Capital All Country Global Shares Index Fund

- Smartshares Global Aggregate Bond ETF

- AMP Capital Australasian Property Fund

There were also a couple of skeletons in my InvestNow cupboard that I have cleaned up. I’ve been holding on to two actively managed funds on InvestNow for a couple of years now, and although they’ve made satisfactory returns, I am shifting my whole portfolio to low fee funds. The two funds I sold were:

- Devon Dividend Yield Fund

- Pathfinder Global Property Fund

I put some of the proceeds from these funds into the AMP All Country Global Shares Index Fund, and parked the rest in the Smartshares NZ Dividend ETF for now.

Australian portfolio

My Aussie portfolio got a little boost:

- Added to my Ratesetter Peer to Peer Lending account

- My dividend from Arena REIT was reinvested as part of their Dividend Reinvestment Plan

Cryptocurrency portfolio

Following on from my InvestNow portfolio clean up, I also did some spring cleaning for my cryptocurrency portfolio. I had been holding two alt-coins which have been terrible “investments”, together losing 50% in value since I bought them. It goes to show how dangerous buying cryptocurrency can be, and that it is just a fun and speculative investment for me. I decided to consolidate my portfolio, exchanging these alt-coins for other cryptocurrencies. These were:

- XRP (Ripple), exchanged for Bitcoin

- Dash, exchanged for Ethereum

In other cryptocurrency news, I added Basic Attention Token (BAT) in my crypto portfolio, thanks to my earnings from the Brave web browser. I use Brave as my main browser as it blocks traditional ads and trackers while you browse the web, but also allows you to opt-in to see alternative ads, which pay you with BAT if you do so. You can download Brave using this link, and will be supporting Money King NZ if you do so.

Investing news

Official Cash Rate on hold

The Reserve Bank of New Zealand surprised us back in August with a big 0.5% cut to the Official Cash Rate (OCR). While many were expecting a further OCR cut in November, the RBNZ surprised us again with no cut this month. It seems that this news has contributed to the cooling down in the share prices of high yielding companies – both NZ High Dividend and NZ Property indexes fell around 1% over the month, while the NZX 50 index has gone up 3.89%.

KiwiSaver market share stats

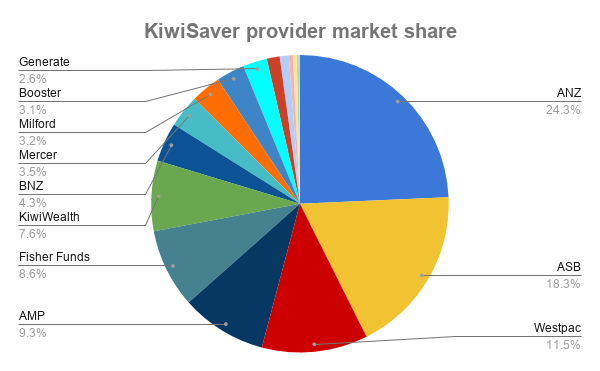

Investment analysis firm Morningstar releases a KiwiSaver report every quarter. This month their report for the quarter ending 31 September 2019 came out, and I found their market share data for KiwiSaver providers particularly interesting:

It appears that the KiwiSaver market is really concentrated, with the three largest providers (ANZ, ASB, and Westpac) making up over 50% of the KiwiSaver market, and the 6 largest providers having a market share of almost 80%! Despite the rising popularity in low cost providers like Simplicity and JUNO, there are still mountains of money sitting in traditional providers! Speaking of low cost providers, I’ve updated my comparison between Simplicity, JUNO, and BNZ with the latest fund and performance data here.

Sharesies introduces limit orders and new funds

Sharesies started offering investing in individual companies back in July, however they were missing the ability to place limit orders. Limit orders allow you to specify a maximum price you’re willing to pay for your shares (or minimum price you’re willing to sell your shares at), providing you with more control and certainty.

Sharesies finally introduced limit orders to their platform on the 19th of November. This is a great development for their platform, and hopefully they have many more improvements (like the ability to participate in Dividend Reinvestment Plans) in the pipeline! Check out my updated comparison between Sharesies and ASB Securities/Direct Broking here.

Sharesies ended the month with the introduction of two funds from boutique fund manager Pie Funds onto their platform – The Australasian Dividend Fund, and the Global Climate Friendly Fund.

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

Levridge – a new home ownership model

Levridge is an interesting new home ownership model that has just launched. Their service aims to help both first home buyers and investors:

- Home buyers – Levridge allows home buyers to buy a house without a deposit! However they will still be responsible for the mortgage repayments, insurance, rates, and maintenance.

- Investors – The investor will provide the 20% deposit for the house. In return, the investor will be entitled to 50% of the capital gains upon the sale of the property.

I will reserve my opinion for a future article on the topic of alternative home ownership models.

Mercer Periodic Table of Investment Returns

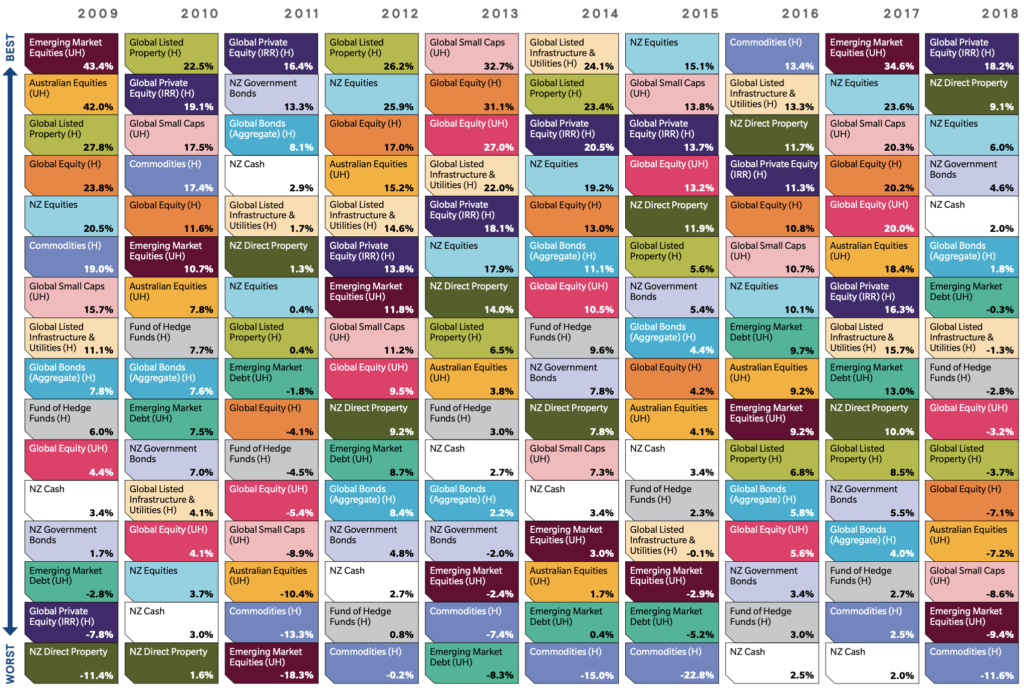

Lastly, I came across this awesome chart from Mercer showing the returns of different asset classes over 10 years – you will have to zoom in on mobile! The full report can be found here.

This shows that:

- There is no asset class that consistently performs the best. So diversify into different assets across different geographies.

- One year’s winners can easily be next year’s losers. So don’t chase the winners, and instead pick an appropriate investment strategy and stick to it.

Money King NZ news

This month I put together a couple of spreadsheets that take a look at what various index funds are invested in, and they have been really well received:

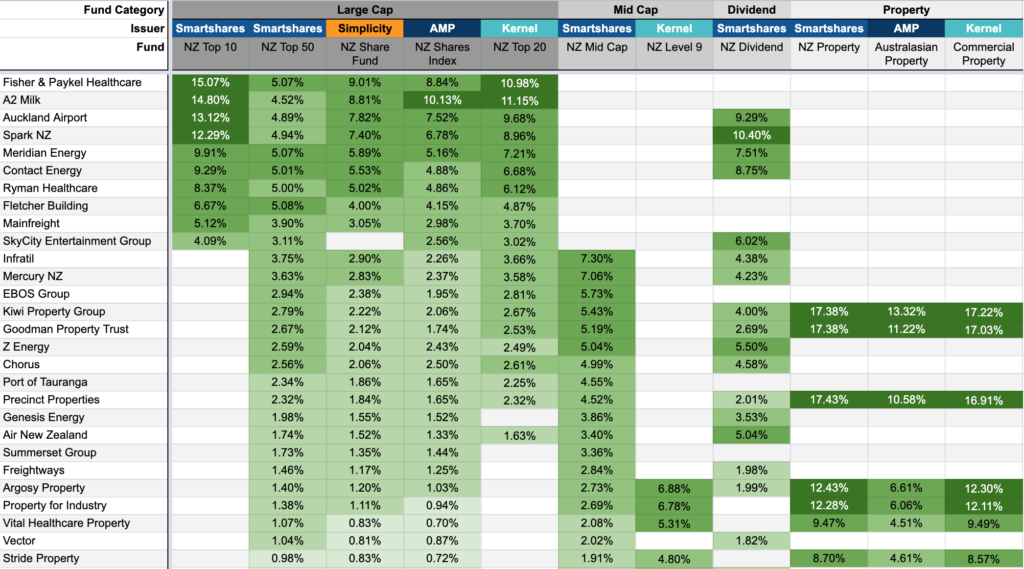

Ever wondered what exact companies are inside the Smartshares NZ Top 50 ETF, and other NZ share index funds? Check out the NZ Share Index Fund holdings spreadsheet.

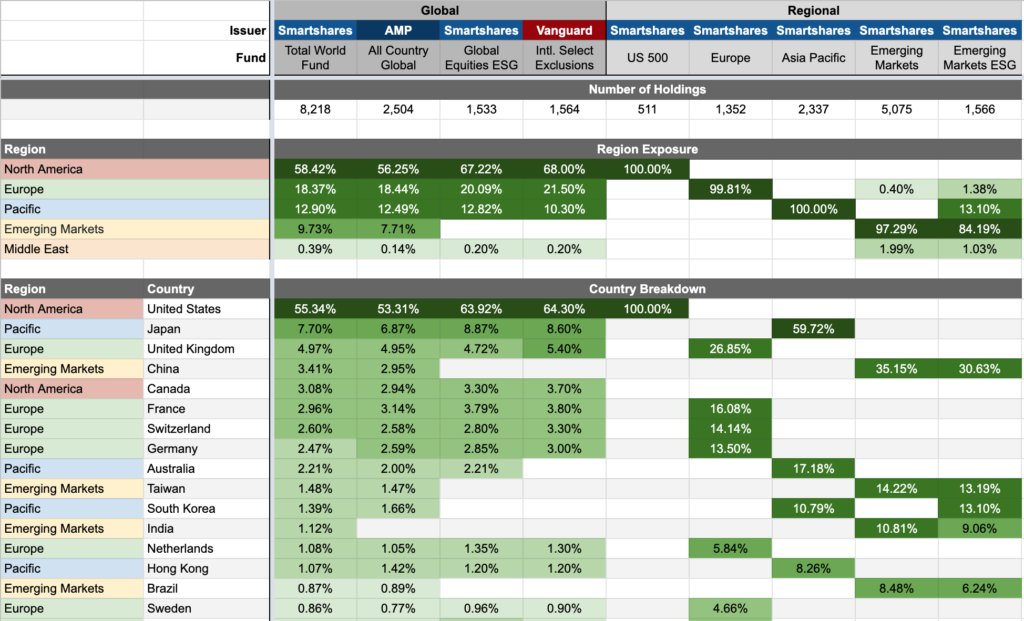

Ever wondered which countries the Vanguard International Select Exclusions Shares Index Fund, and other international share index funds are invested in? Check out the International Share Index Fund country exposures spreadsheet.

You can check out the full list of spreadsheets on my spreadsheets page.

Most popular article this month: What happens to your money if InvestNow or Sharesies go bust?

Previous month’s article:

– What I’ve been investing in – October 2019

Thanks for all your support!

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.