You probably already know about Crowdfunding (and Equity Crowdfunding) where many people put their money together to fund a common cause. Property Crowdfunding applies this concept to property, allowing many investors to pool their money together in order to invest in real estate. This enables people to get on the property ladder for just a few hundred dollars, as opposed to the tens of thousands you might need for a house deposit.

Internationally there are many Property Crowdfunding platforms operating successfully. With ongoing housing affordability problems in New Zealand, you might expect that such a concept would be successful here, with those locked out of the housing market searching for alternative ways to get a slice of the action. However, this has not been the case so far, with two Kiwi platforms failing to gain traction. So let’s take a look at how Property Crowdfunding works, and why it has yet to take off in New Zealand.

This article covers:

1. How does Property Crowdfunding work?

2. Property Crowdfunding in New Zealand

3. What went wrong with Property Crowdfunding in NZ?

4. What’s next for Property Crowdfunding in NZ?

Update (28 April 2021) – Update to cover Opoly, the third company looking to offer Property Crowdfunding in New Zealand

Update (20 September 2021) – Update on Opoly’s situation

1. How does Property Crowdfunding work?

This is how a typical Property Crowdfunding platform would work:

- The Property Crowdfunding platform acquires a property (usually a residential house). They create a holding company to hold the property.

- The Property Crowdfunding platform offers shares in the property’s holding company (investors will own the property indirectly via the holding company).

- Investors keen on the offer buy the shares. The money from investors is pooled together and used to fund/settle the property.

- The property is rented out to tenants and managed by a property management firm.

- Rental income from the property (minus expenses like management fees and insurance) is paid out to the investors as dividends on a regular basis.

- The value of the shares goes up and down, depending on the value of the property. This means investors can make money on any capital appreciation of the property (or lose money if the house’s value goes down).

- Investors may be able to sell their shares, either to another investor or back to the Property Crowdfunding platform.

This sounds great on the surface. We can already become a part-owner of a company by buying shares in that company, and now we can become a part-owner and landlord of a house – collecting rental income and benefiting from capital gains, without needing to scrape together years of savings for a house deposit.

2. Property Crowdfunding in New Zealand

In New Zealand, at least two companies have attempted to offer Property Crowdfunding to local investors. Unfortunately both companies, The Ownery, and The Property Crowd, have seen little success so far. What happened?

Company 1: The Ownery

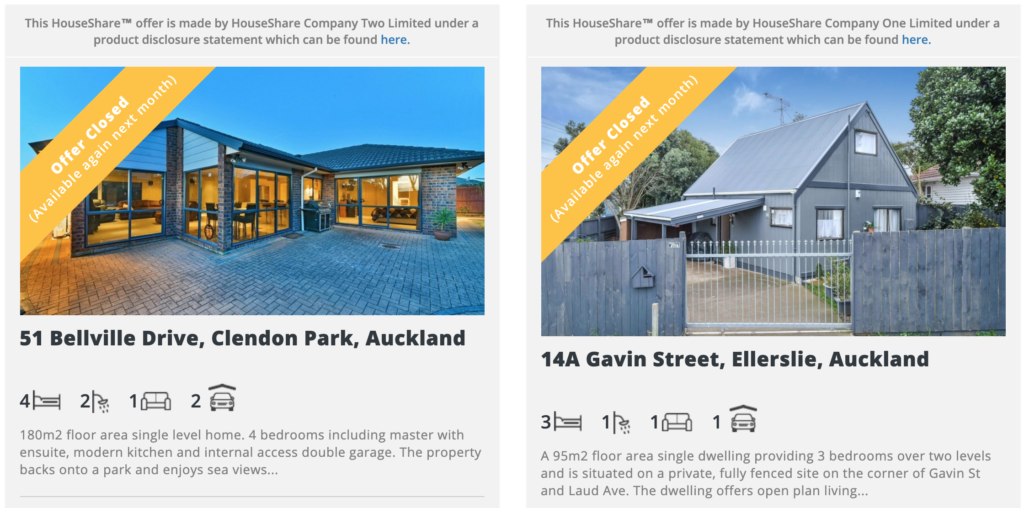

The Ownery launched in 2016, offering shares in a house in Ellerslie, Auckland. The Ownery aimed to lower the barrier of entry onto the property ladder (and the “Kiwi dream” of home ownership) with a minimum investment amount of $500.

They reportedly had underwhelming investor interest in the Ellerslie property, with not even a quarter of the shares taken up by investors. In 2017 The Ownery went on to register another holding company to offer a house in Clendon Park, Auckland to investors, but I’m unsure how well this offer went as I can’t find any mention of it in the news or social media.

Since the end of 2016, The Ownery’s social media accounts have been inactive (with their Facebook page deactivated), and there is nothing on their website to suggest any activity beyond their first two property offers.

I emailed The Ownery to ask if they are still actively operating, and if not, what happened to them. I did not receive a response from them.

Company 2: The Property Crowd

The Property Crowd launched in April 2019, offering shares in a house in Browns Bay on Auckland’s North Shore. The Property Crowd aimed to make it possible for anyone to get on the property ladder, with the minimum investment being just $100. They also wanted investing in their properties to be a socially responsible investment, by providing a long-term, high quality, and well maintained rental home for tenants.

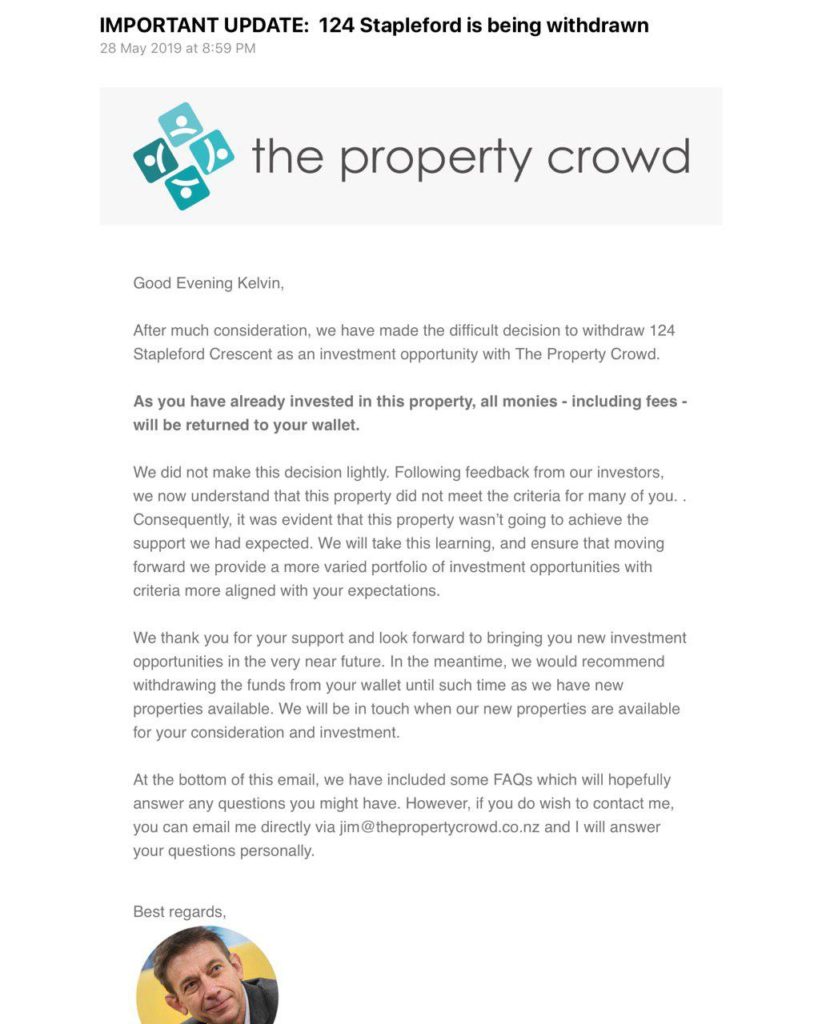

On 28 May 2019, The Property Crowd suddenly withdrew the Browns Bay property from the platform – they closed the platform to further investment, and those who had already invested got their money back. They cited a lack of investor demand for the Browns Bay property, meaning they wouldn’t have enough funds to pay for its purchase.

I emailed The Property Crowd to get more insight on the reasons behind withdrawing the Browns Bay property. CEO Jim Janse responded:

We decided to withdraw the house before we got to settlement when it became obvious that we didn’t have the support for the house we’d expected. We had hoped to get halfway but that looked increasingly unlikely so the decision was made to withdraw this one and start again.

Jim Janse, CEO of The Property Crowd

We carried out a number of surveys and ran two open homes where we also managed to talk to investors. That proved really helpful in giving us insights on what we could have done differently. Investors wanted clarity around exit (secondary market) and also different properties (and more properties) were high on the investors’ wish list. Investors also all had their own criteria around yield, location, and type of property they were looking for.

As soon as we have more information to share I’ll update everyone. I’m hoping it’s not that far off. There’s a lot of interest in the shared ownership model and what it could do for everyone. I was surprised at the ongoing support (despite our first house being withdrawn) and it’s critical we get things right before we place our next property(s) up for funding.

The Property Crowd has gone fairly quiet since then with limited posts on their Facebook page, and no firm timeframes for when any new properties might be available.

3. What went wrong with Property Crowdfunding in NZ?

Two companies had a crack at bringing Property Crowdfunding to New Zealand, and both have failed to gain any traction. My take on the reasons they didn’t succeeded are:

- High fees – These platforms charged a one-off transaction fee when you invested in a property. These fees were quite high, at 5.175% with The Ownery, and 4% at The Property Crowd. It would probably take at least 1.5-2 years of dividend income from your property, just to break-even from this fee.

- Market size – The population in New Zealand is too small to get enough people to invest enough money to fund an entire house. With these platforms offering such a small minimum investment amount, they’d need to convince several hundred (or even thousands of) people to invest in each property to raise enough funds (The Property Crowd’s Browns Bay property only got around 200 investors before it was withdrawn). Perhaps they need some funding from institutional investors to make it work?

- Competing investments – They have to compete for a potential investor’s attention and money against platforms like InvestNow and Sharesies, who offer more traditional investments like shares. More importantly, these platforms offered investments in trustworthy brands and companies, while the Property Crowdfunding platforms have no track record.

- Lack of diversity – These platforms offered only 1-2 properties for investment, without any guarantee that there would be more properties available for investment in the future. It is not possible for investors to achieve a diversified property portfolio with such few properties available to invest in.

- No leverage – Leverage (making investment gains off borrowed money) is one of the big factors that have made property such a successful investment for many people. These platforms did not take advantage of leverage in any of their offerings, and without this, property is a much less compelling asset class.

Lastly, profit isn’t always the primary goal of investing in property. Property is often bought as a stable place to live in, to gain freedom from renting, and to have a place to call their own home. Investing in Property Crowdfunding doesn’t help people achieve these goals.

4. What’s next for Property Crowdfunding in NZ?

While The Ownery and The Property Crowd have gone silent, a new Property Crowdfunding company has emerged in the name of Opoly, who in April 2021 attempted to raise funds to buy a 2-bedroom apartment in Ponsonby, Auckland. Unfortunately they were unsuccessful, raising only $41,200 out of the $1.1 million required.

Opoly did not give up, with a second crowdfunding offer for a commercial property in Orewa, Auckland. This one was also unsuccessful, raising only $50,000 out of the $947,200 required.

Despite their early challenges Opoly are still active, so there is still hope for Property Crowdfunding to be successful in New Zealand. In September 2021 their third crowdfunding campaign was successful, raising $105,000 to buy a piece of bare land in Oamaru, and they launched a fourth offer for a piece of land in Te Anau.

However, I feel that Opoly isn’t approaching the concept any differently than The Ownery and The Property Crowd, with the main issues being:

- The fees are still very high. For their Oamaru and Te Anau offers, for every $100 invested, over $10 of that is going towards fees. This makes me question whether they are just trying to capitalise on people’s FOMO towards the housing market, rather than genuinely helping people own a slice of property.

- They still have to compete with alternative investment options. New Zealanders are increasingly starting to realise they no longer have to invest in property to build wealth. Share investment platforms like Sharesies, Hatch, and InvestNow have only grown stronger since the demise of The Ownery and The Property Crowd.

- I’m not sure I’m a fan of their pivot into land banking. The piece of bare land they’re offering investment into doesn’t produce anything – there is no opportunity to earn rental income. Instead investors are totally dependent on the land increasing in value to make a return on their investment.

So while I don’t like seeing investment companies fail, I’m not yet convinced that Opoly has the potential to become a well-established investment platform in New Zealand.

Further Reading:

– Property vs Shares – The pros and cons of buying residential property

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.