What I’ve been investing in is a monthly series covering what investments I’ve made during the month, and any investing related news that I’ve found interesting. In September 2019, Japan upset Ireland in the Rugby World Cup, climate strikes were held in NZ and around the world, and local government elections are now underway – so make sure you vote for the mayor of your city or district! As usual I’m continuing to develop my investment portfolio, and this month the low OCR continues to be a major theme.

The below is not financial advice, nor a recommendation to invest in the following. Please do your own research before making any investment decisions.

What I’ve been investing in

Metlifecare Bonds

Metlifecare, a retirement village operator, issued $100 million worth of bonds this month at a rate of 3%, for a term of seven years. I decided to buy $5,000 worth of bonds (the minimum amount), following the maturity of one of my term deposits.

The 3% rate isn’t great, but this is a defensive move for my portfolio. I’m not comfortable investing all my money into shares, and the OCR and term deposit rates are projected to go even lower, so these bonds allow me to lock in this rate for several years. Bonds also give me the flexibility to sell the investment at anytime, and given most NZ corporate bonds are trading at yields well under 3%, these Metlifecare bonds should be popular on the secondary market.

InvestNow

I try to add some money to my InvestNow portfolio every month, and the funds I chose to invest in this month were:

- AMP Capital Australasian Property Index Fund

- Smartshares Healthcare Innovation ETF

- Smartshares Global Aggregate Bond ETF

None of these are core holdings in my portfolio, but just supplement my main fund, the AMP Capital All Country Global Shares Index Fund.

In addition, late last month I sold my holding in the Smartshares NZ Top 50 ETF. I put $250 in this fund two years ago, and don’t need it in my portfolio since I already have enough NZ exposure through holdings in individual companies. It’s done well for me though, returning $16 in dividends and $56 in capital gains.

Squirrel Money

If you’re a regular reader of my What I’ve been investing in series, last month you might remember me talking about slowing down my investment into Squirrel. But a lot can change within a month, and my investment into the platform is still going strong! Steady demand for loans on the platform, and falling bank deposit rates have driven me to continue investing here.

Dividends reinvested

Heaps of NZ companies pay dividends in September, following the end of their financial year on 30 June. Most pay out dividends in cash (which I then spend or put towards other investments), but three of my companies have dividend reinvestment plans which allow me to automatically reinvest my dividends into more shares (at a discount and free of brokerage!). These are Heartland Bank, Vital Healthcare Property, and Summerset Holdings.

Investing news

Further OCR cuts?

Following on from August’s big 0.50% OCR cut, ANZ’s chief economist Sharon Zollner, has come out with a bold prediction that the OCR will be cut further to 0.25% by May 2020! The cuts will be driven by the deteriorating outlook for the local and global economy, and inflation remaining low. You can read the full report here.

Regarding shorter term predictions, economists are picking the Reserve Bank of New Zealand to cut the OCR to 0.75% in November. The commentary from bank economists (ANZ, ASB, Kiwibank) is well worth a look if you’re interested in reading more. It seems inevitable that our interest rates will be staying lower for longer.

Booster lists Private Land and Property Fund

The New Zealand sharemarket got a new listing this month in the form of a managed fund – the Private Land and Property Fund managed by Booster. The fund primarily invests in agricultural and horticultural land in NZ, targeting annual returns of 8% from rental income and capital gains.

The fund is not new, having been open for two years already, and the reasons for Booster to list the fund on the NZX are:

- Exposure – to make more people aware of the fund

- Liquidity – to allow investors to buy and sell units of the fund at anytime (previously withdrawals were only processed once per month, and any withdrawals over $50,000 incurred a fee)

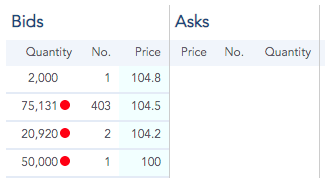

There appears to be a fair amount of interest in the fund so far, with plenty of buyers lined up, but no one wanting to sell!

Savings interest rate cuts

A few interest rates I mentioned in my article The best bank accounts and credit cards for managing your everyday finances have been further reduced this month. The changes are:

– Heartland YouChoose: 2.00% > 1.70%

– Heartland Direct Call: 1.90% > 1.60%

– Rabobank 60 day Notice Saver: 2.75% > 2.60%

Is Peer to Peer Lending viable in NZ?

Last week Gareth Vaughan from interest.co.nz reported that Harmoney’s founder Neil Roberts says ‘he can’t see a viable P2P lending model in New Zealand‘. This explains why Harmoney have been lending a lot of their own money to borrowers, as opposed making more loans available for retail investors to invest in. It certainly appears that Harmoney desires to transition away from Peer to Peer Lending in the medium-long term.

Vaughan released a follow-up article the next day, sharing competitors Squirrel and Lending Crowd’s stance on the issue. Squirrel CEO John Bolton tended to agree with Harmoney’s Roberts (with P2P being a low margin business), while Lending Crowd’s Managing Director, Wayne Croad thinks P2P Lending is alive and well.

I disagree with both Roberts and Bolton. I believe the main purpose of P2P Lending is to disrupt the banking industry – not by lending their own money, but by providing a high-tech platform to connect borrowers directly to lenders, to cut out the middleman. It is the same concept as Airbnb not owning any accommodation themselves, but instead providing a platform to connect travellers with property owners.

Māori Language Week

Both Māori Language Week and Money Week were celebrated between the 9th and 15th of this month. Here’s some te reo Māori investment related vocabulary that you can use:

Money King NZ news

Money King NZ has been live for over three months now, and here are some quick stats:

Most popular article this month: How to invest for kids in New Zealand

Previous month’s article:

– What I’ve been investing in – August 2019

Thanks for all your support!

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.