Property is a Kiwi obsession. Yet it is unaffordable for so many of us. Therefore it’s not uncommon for us to look at adding Property funds and REITs (Real Estate Investment Trusts) to our investment portfolios for exposure to the sector. But many people misunderstand what’s inside those property funds, and how REITs work. Do they go out and buy houses and rent them out to people?

This article will look at REITs, what they do, how you can invest in them, how they make money, and their pros and cons. Read on because chances are you are already invested in REITs!

This article covers:

1. What is a REIT?

2. How do I invest in REITs?

3. How can I make money from REITs?

4. What are some REIT concepts I need to know about?

5. What are the pros and cons of REITs?

1. What is a REIT?

A Real Estate Investment Trust (REIT) is a company that invests in a portfolio of properties. Some REITs are unlisted, while some are listed on the sharemarket just like an ordinary company. I will focus on Listed REITs in this article – which are commonly referred to as Listed Property. In New Zealand, REITs invest almost entirely in commercial property, typically in one of three sectors:

- Offices – E.g. buildings that house corporate and government offices

- Retail – E.g. shopping malls and large format retail stores

- Industrial – E.g. factories and warehouses

Some REITs only invest in one sector of commercial property (e.g. industrial property only), some are diversified (e.g. invest in all three sectors), and some only invest in a specialised type of property (e.g. only in hospitals, or large format retail stores).

Residential property?

If you are specifically looking to invest in residential property (like houses and apartments that people live in), then REITs are not for you – not in NZ anyway. Even though Kiwi Property Group has recently announced their interest in building apartments, NZ REITs provide no meaningful exposure to the residential property market. Retirement companies like Arvida and Summerset will give you better exposure to residential property than REITs do.

In Australia there are a couple of REITs investing in residential property, like Stockland and Mirvac, but Australian REITs are still largely focussed on commercial property.

2. How do I invest in REITs?

NZ Listed REITs

There are eight major REITs listed on the NZ sharemarket. These REITs might even own a property that you work in or visit on a regular basis!

| REIT | Type | Notable property |

| Kiwi Property Group (KPG) | Diversified | Sylvia Park |

| Goodman Property Trust (GMT) | Industrial | Highbrook Business Park |

| Precinct Properties (PCT) | Diversified | Bowen State Building |

| Argosy Property (ARG) | Diversified | 15-21 Stout Street (MBIE) |

| Property for Industry (PFI) | Industrial | Shed 22 |

| Vital Healthcare Property (VHP) | Medical | Wakefield Hospital |

| Stride Property Group (SPG) | Diversified | NorthWest Shopping Centre |

| Investore Property (IPL) | Retail | Countdown Greenlane |

Buying shares in these REITs is no different to buying shares in any other company listed on the NZX. To do so, use a broker like ASB Securities, Direct Broking, or Sharesies.

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

NZ Property Funds

New Zealand has a small selection of property index funds. These funds invest in Listed REITs, giving you a convenient way to invest in many REITs at once:

- Smartshares NZ Property ETF

- Kernel NZ Commercial Property Fund

- Macquarie Australasian Property Index Fund (also contains Australian REITs)

Both Smartshares and Kernel funds contain the eight individual NZ REITs mentioned above, while the AMP fund invests in both NZ and Australian REITs. To invest in these funds, use a fund platform like InvestNow and Sharesies, or invest directly through the fund manager (e.g. through Smartshare, and Kernel).

Further Reading:

– Smartshares vs Simplicity vs Macquarie vs Kernel – NZ Share Index Fund shootout (contains a comparison on the 3 property funds and where you can invest in them)

International REITs

Our closest neighbour Australia has no shortage of individual Listed REITs, which are known as A-REITs over there (Australian-REITs). Use a broker like ASB Securities and Direct Broking to invest in them:

- There are traditional REITs investing in offices, industrial, and retail (e.g. Vicinity, and Scentre – who also own Westfield malls in NZ).

- The Aussie market also has a few specialised REITs – For example, National Storage (investing in self-storage units), Arena (childcare centres), and BWP Trust (investing almost entirely in Bunnings Warehouse sites!)

A couple of NZ domiciled index funds invest in Australian REITs:

- Smartshares Australian Property ETF

- AMP Capital Australasian Property Index Fund (also contains NZ REITs)

To get exposure to REITs outside Australasia, there aren’t many funds available in NZ, apart from a few expensive actively managed ones. Examples found on InvestNow are (fees in brackets):

- AMP Capital Global Property Securities Fund (1.33%)

- APN Asian REIT Fund (0.98%)

- Pathfinder Global Property Fund (1.00%)

This is where a service like Hatch could come in handy, as Hatch gives you access to the US market where there are plenty of low-fee property index funds (e.g. iShares Global REIT ETF), or even individual REITs investing in interesting properties like cell towers, and data centres!

Chances are you’re already invested in REITs!

Even though you may not directly own any of the above REITs or property funds, there is a good chance you are still an indirect shareholder in one or more REITs! For example:

- If you own the Smartshares NZ Top 50 ETF, roughly 13% of your fund is invested in NZ REITs.

- Smartshares NZ Mid Cap ETF – approximately 25.5% invested in REITs

- Kernel Small & Mid Cap Opportunities fund – approximately 26% invested in REITs

- Smartshares NZ Dividend ETF – approximately 10.5% invested in REITs

- Vanguard International Shares Select Exclusions Index Fund – a more modest 3.4% exposure to REITs

The main point is that it’s unnecessary to go out of your way to buy individual REITs or property funds, as you already get exposure to them in ordinary index funds. However, there is nothing wrong with investing in REITs or property funds in addition to ordinary index funds, particularly if you want to increase your exposure to the sector.

3. How can I make money from REITs?

Dividends

REITs earn a steady income stream. Firstly, they lease their properties out to tenants, many of them being well known organisations like government departments and major retailers. Tenants then pay rent, with periodical rent reviews built into lease agreements, allowing for increasing rental income based on inflation or market conditions. This income stream translates to regular (and hopefully steadily increasing) dividend payments for investors.

Dividend yields from REITs are solid, often higher than the yields of an ordinary company (as well as the yields from residential property!). At the time of writing, the Smartshares NZ Property ETF has a dividend yield of 3.88% compared to a yield of 3.66% for the Smartshares NZ Top 50 ETF. Example yields of individual REITs are:

- Argosy Property (ARG) – 4.58%

- Precinct Properties (PCT) – 3.40%

- Investore Property (IPL) – 4.28%

All major NZ listed REITs pay dividends quarterly, except for Kiwi Property Group (every 6 months). The eight major NZ Listed REITs are also structured as Listed PIEs, so may be tax efficient for you.

Capital/Revaluation Gains

If you’re a homeowner in NZ, you’ve probably seen your home’s value creep up over the last few years. You may have also completed (or have in progress!) some form of renovation or improvement to increase your home’s value. These same concepts apply for commercial property:

- Firstly, REITs periodically revalue their properties which can result in an increase in their portfolio’s value, and they can also realise capital gains on the sale of a property.

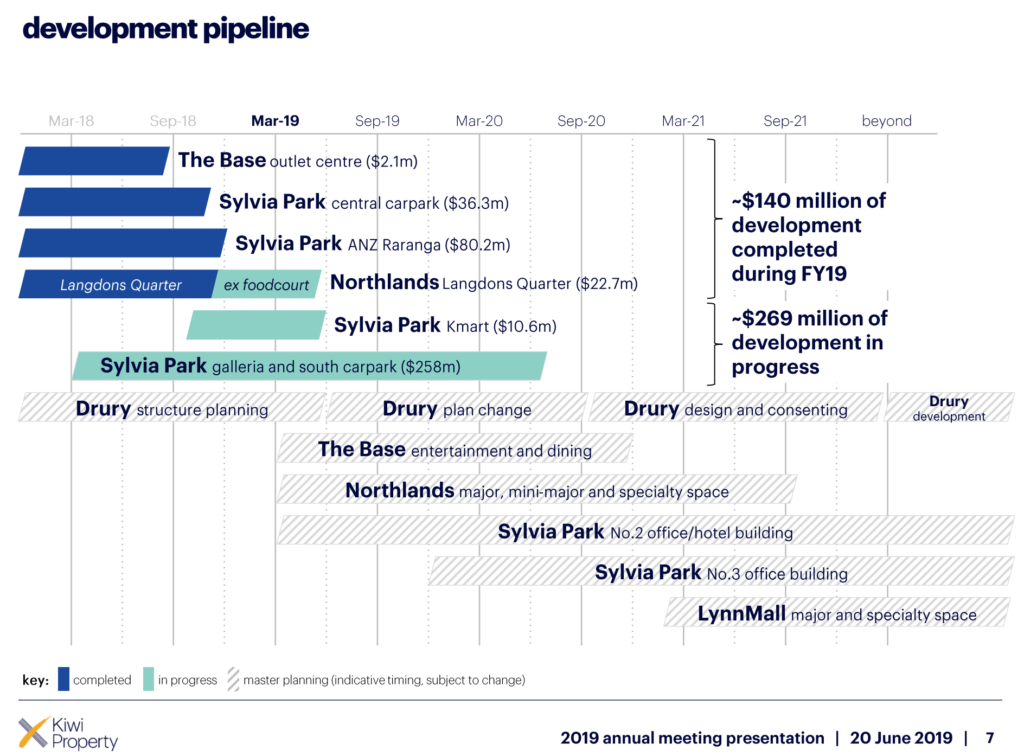

- Secondly, REITs actively develop and add value to their properties through refurbishments, extensions, or rebuilds. Examples are Scentre’s rebuild of Westfield Newmarket, and Argosy’s redevelopment of Stewart Dawson’s Corner (tipped to be the home of a new Central Wellington H&M store).

4. What are some REIT concepts I need to know about?

If you’re reading a REIT’s annual report, you’ll come across a few different terms and concepts. Here’s a basic rundown of what a few REIT related concepts are:

Net Tangible Assets (NTA)

This is the value of the property portfolio, minus debt, and is usually expressed as an amount per share (e.g. $1.73 per share). It is better to invest in a REIT when its share price is close to its NTA – just like you wouldn’t want to pay $600,000 for a $500,000 house. Unfortunately this is hard to do right now as so many REITs are trading at a premium to their NTA (thanks to high demand for REITs in recent times). Examples are (as at 21 Nov 2019):

| REIT | NTA | Share Price | Premium |

| Goodman | $1.73 | $2.085 | 18.6% |

| Precinct | $1.46 | $1.765 | 18.9% |

| Vital Healthcare | $2.32 | $2.66 | 13.7% |

Occupancy

You don’t earn rental income from empty properties. Higher occupancy rates are more desirable.

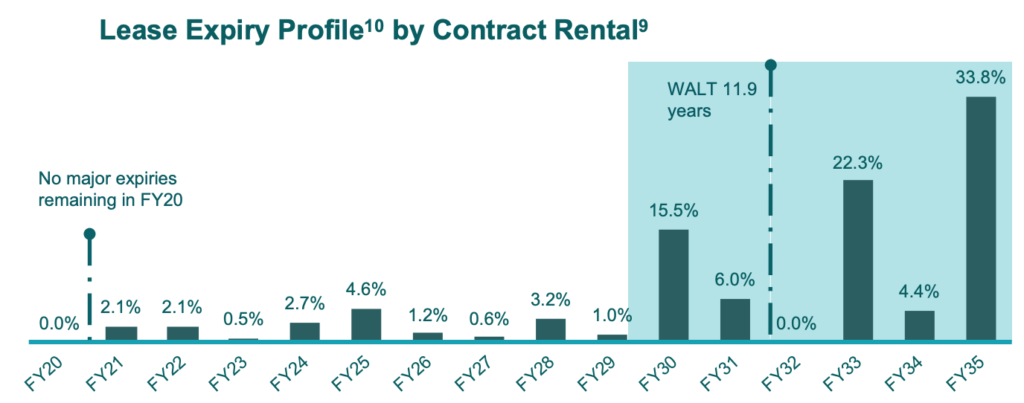

Weighted Average Lease Term (WALT)

Also know as WALE (Weighted Average Lease Expiry), WALT is the average number of years before the leases in a REIT’s portfolio expire. A Longer WALT is typically more desirable, indicating more stability and lower risk.

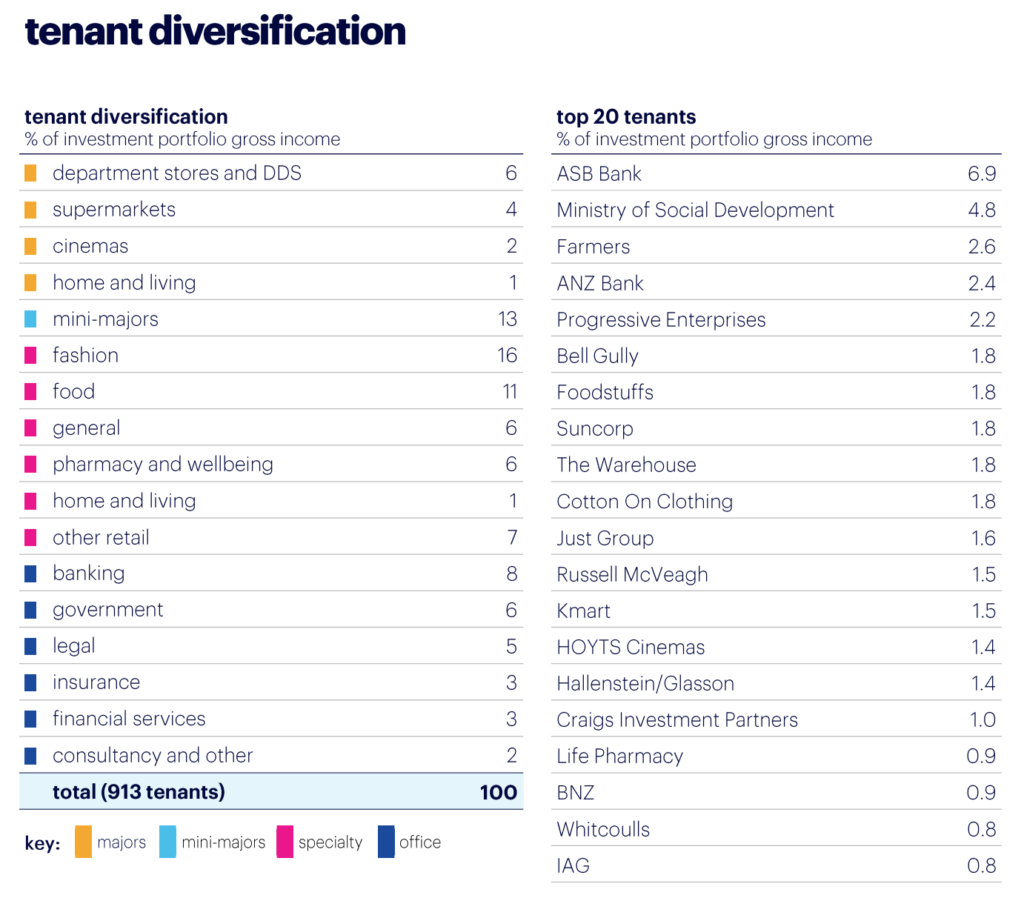

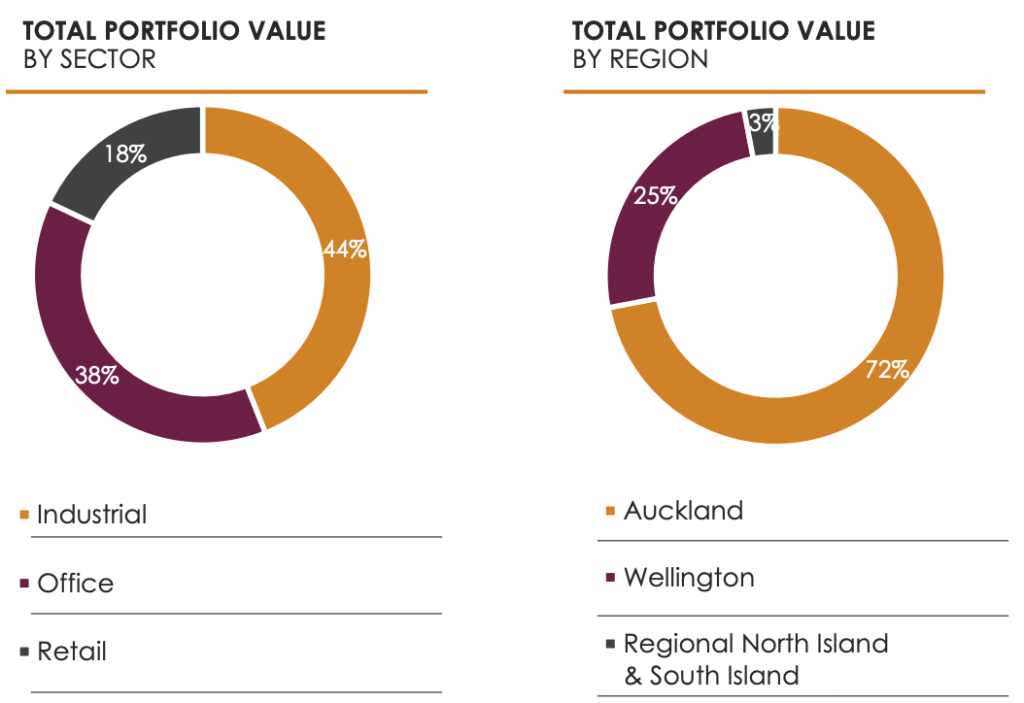

Portfolio diversification

Investing in a single REIT already gives you diversification because they own many properties within their portfolios. There are three main ways in which REITs can further diversify their portfolios:

- By Geography – Provides protection against localised economic downturns or natural disasters, particularly with the earthquake risk in Wellington.

- By Tenant – Having a diverse range of tenants protects against a particular tenant collapsing or downsizing. Government tenants are seen as more stable, but it’s still possible for a government department to be downsized or restructured.

- By Sector – Provides protection against a particular sector not performing well. In addition some sectors are more defensive than others, for example, shopping malls might be more sensitive to economic downturns, while hospitals might not be. Not all REITs have sector diversification.

Debt

If you have a mortgage, you’re probably already familiar with the concept of using debt or leverage to invest in property. REITs are no different, except they use debt more conservatively. While Loan-to-Value Ratios (LVR) for residential mortgages can be up to 80-90%, a typical LVR (or gearing) for REITs is between 20-40%. A higher LVR means more risk and more sensitivity to interest rates, but debt is not necessarily a bad thing as it gives REITs capacity to expand and develop their portfolio.

5. What are the pros and cons of REITs?

Here are some other pros and cons of REITs that I haven’t mentioned above.

Pros

- Affordable – Buying a commercial property is expensive. But if you invest in a REIT or property fund, you can get exposure to the sector for as little as $50 via InvestNow, or even $0.01 (via Sharesies).

- Liquidity – Property is typically illiquid – it takes significant time and effort to buy or sell one. However, Listed REITs and property funds are very liquid as you can buy and sell them quickly via the sharemarket or Fund Platform.

- Be a hands-off landlord – REITs allow you to be a landlord for many well known organisations, without dealing with the everyday management of the properties.

- Can be less volatile – REITs can reduce the volatility of your investment portfolio, as they are somewhat uncorrelated to the wider sharemarket (i.e. REITs don’t tend to rise and fall the same amount as the wider market). Part of this might come down to the separation of REITs from actual businesses. For example, BWP Trust only owns the buildings that Bunnings Warehouses operate in, rather than running the actual business of Bunnings. BWP would still continue collecting rent, even if Bunnings were to suffer from poor hardware sales.

Cons

- Property risks – All industries have their unique risks. With REITs the usual risks of owning investment property apply, such as properties becoming out of favour, oversupply, and vacancies. With commercial property, vacancies can be hard to fill, given the specialist nature of some properties. Natural disasters may also cause disruption, for example the Kaikoura Earthquake damaged Argosy’s 7 Waterloo Quay. While insurance will cover much of the damage and lost rental income, there is ongoing disruption, and dispute over the insurance claim.

- Not immune from economic downturns – In economic downturns, REITs might be more susceptible to issues such as vacancies, compared to residential property (as everyone still needs a place to live). Increased vacancies can lead to dividend cuts and falls in property values. Here’s an extract from a Craigs newsletter talking about the performance of Listed Property during the Global Financial Crisis:

The NZX All index fell 49.2% from its 2007 peak to its 2009 low.

Listed property wasn’t spared either. Property for Industry and Vital Healthcare held up best, falling 32.3% and 28.9%, while the three other largest listed property companies fell by an average of 48.9%.

Every listed property vehicle on the NZX cut its dividend, apart from Property for Industry.

Craigs Investment Partners News & Views, August 2019

- Lower growth potential – While certain types of businesses can more feasibly scale up (e.g. software/IT companies can more easily grow their revenue by 10x), it is impossible for a REIT to increase rents or the value of a building by the same scale, in the same amount of time.

- Sensitive to interest rates – The Smartshares NZ Property ETF has gone up around 22% since the start of 2019. This is largely driven by falling interest rates, resulting in high demand, and high share prices for REITs, as people seek alternatives to term deposits. When interest rates rise you can expect REIT prices to cool down. And given REITs can hold a lot of debt, their interest bills will increase, affecting their earnings.

Conclusion

REITs and property funds are often misunderstood. REITs are not a substitute for residential property, and you don’t necessarily need to buy a standalone property fund to invest in them. The truth is that REITs are just companies investing in commercial property, listed on the sharemarket like normal shares, and make up a substantial part of ordinary index funds. Chances are you already own some as part of your existing investments.

REITs and property funds can play a useful part in your investment portfolio. They lower the barriers to investing in commercial property, and allow you to be a landlord for some well known organisations without getting hands on. I personally have a lot invested in REITs, however I invested in them at much lower valuations. REITs are a little expensive now, trading well above their NTAs, but I intend to keep them in my portfolio for the steady income and capital growth I’ll get over the long term.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Really great information 🙂 thank you for writing this