For many of us, saving money is our first taste of the world of growing our wealth. I remember starting out as a kid by putting my pocket money into a piggy bank. I then moved on to a savings account at Westpac bank, discovering that I could earn more money (interest) just by putting my money in the bank! This blew my mind as a kid! Later, as my savings grew, I graduated to term deposits where my money earned even more interest.

Although the returns you get these days won’t make you rich, I think saving has a part to play in everyone’s lives, whether it be for an emergency fund, saving for a home, or teaching your children how to save. Fortunately our banks have a plethora of savings products to help us. In this article I’ll outline the different savings products that our major New Zealand banks offer. Everyday Savings vs Bonus Savers vs Notice Savers vs Term Deposits – what is each product is suitable for?

This article covers:

1. Everyday Savings accounts

2. Bonus Saver accounts

3. Notice Saver accounts

4. Term Deposits

Update (2 September 2021) – Updated for 2021. Heartland Bank now offers a Notice Saver account.

1. Everyday Savings accounts

Everyday Savings accounts allow you to make as many withdrawals and deposits as you like, and still earn interest on every dollar in your account. Here’s the everyday savings accounts offered by our big 5 banks:

| Bank | Account |

| ANZ | Online account |

| ASB | On Call account |

| BNZ | Rapid Save |

| Kiwibank | Back-Up Saver |

| Westpac | Simple Saver |

Most suitable for

I reckon it’s a bit of a stretch for the above banks to be calling these “savings” accounts. They all offer a measly 0.05%-0.10% interest rate so they aren’t the best accounts for saving money. However, because you can freely make withdrawals from these accounts, they’re useful for holding money you intend to spend in the next week or two.

Tip – Some of our smaller banks offer everyday savings accounts with higher interest rates, for example, Co-operative Bank, and Heartland Bank’s Direct Call Account.

2. Bonus Saver accounts

Bonus Saver accounts offer you the potential to earn more than Everyday Savings accounts by paying you “base interest”, as well as “bonus interest”. To earn the “bonus interest”, you must meet some requirements which are usually something like:

- You must increase your account balance by $20 each month. Any interest you earn doesn’t count towards this amount.

- You must not make any withdrawals from the account.

For example, ANZ’s Serious Saver account pays you a base interest rate of 0.10%, and bonus interest of 1.65% if you meet the above requirements. However, the requirements for earning bonus interest vary a bit between banks so check the below links to get all the details. Here are the bonus saver accounts at the big 5 banks:

| Bank | Account |

| ANZ | Serious Saver |

| ASB | Savings Plus |

| Kiwibank | Online Call, Fast Forward Saver |

| Westpac | Bonus Saver |

Most suitable for

These accounts used to be great for emergency funds because you can earn a decent interest rate, while giving you the ability to take money out immediately in the case that you need it. They were also good for kids as they encouraged regular saving. However, the measly interest rates on offer these days don’t really provide enough incentive to meet the monthly deposit requirements needed to get the bonus interest.

Tip – Set up a monthly automatic payment or reminder to deposit money into your bonus saver account, in order to qualify for the bonus interest. One time I forgot to add money to my account, and this cost me $90 in bonus interest 🙁

3. Notice Saver accounts

Notice Saver accounts offer relatively high interest rates. You can make as many deposits as you like, however to withdraw your money you have to wait for a notice period (usually between 32 and 90 days) before you receive your withdrawn money. These accounts are offered by:

| Bank | Account |

| Heartland | Notice Saver (32 days or 90 days notice periods available) |

| Kiwibank | Notice Saver (32 days or 90 days notice periods available) |

| Rabobank | NoticeSaver (60 days notice period) |

| Westpac | Notice Saver (32 days notice period) |

Despite their attractive rates relative to Everyday Savings and Bonus Saver accounts, the banks can reduce the interest rate of your Notice Saver account at any time.

Most suitable for

Anyone who finds it hard to save, and resist spending money might find these accounts useful. Given your money is locked away for a notice period of 32 to 90 days, this waiting period should be enough to remove the temptation of impulse spending (after 32 days you might not want that shiny new gadget anymore 🙂 ). They may also be suitable for savings that you’re not quite sure when you’ll need, as they offer good interest rates, while being somewhat flexible.

Tip – During the notice period, if you find that you no longer need the money you’re withdrawing, you can cancel the withdrawal.

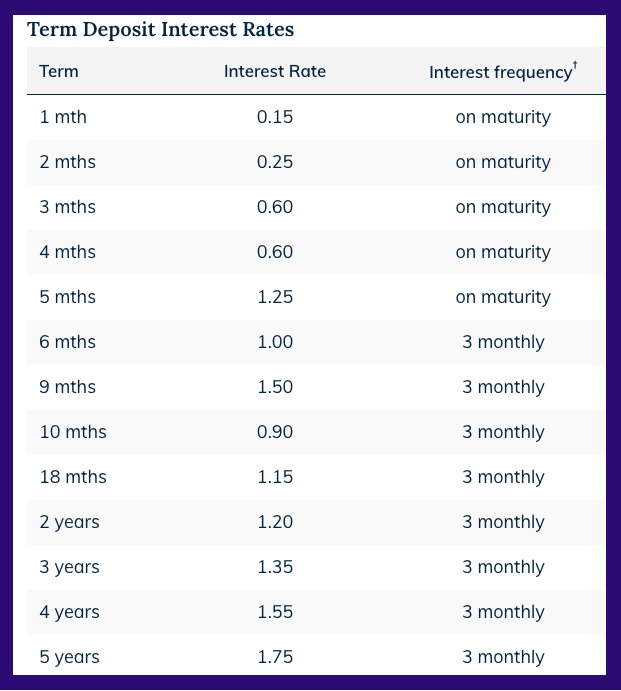

4. Term Deposits

Term Deposits allow you to deposit your money with the bank for a fixed period of time (between 1 month and 5 years), during which you’ll earn a fixed rate of interest. Term Deposits have an added advantage of being able to lock in a rate for the duration of the term (unlike the above savings products where banks can change the interest rate at any time).

You can’t make any withdrawals from Term Deposits until the fixed term is up, except in exceptional circumstances like financial hardship. Nor can you deposit additional funds into a Term Deposit, unless you open a new Term Deposit.

All good banks offer Term Deposits, but you will typically need at least $5,000 to open a Term Deposit at one of the major banks. The website interest.co.nz has some handy pages comparing term deposit interest rates for various terms across different banks. To see interest rates for terms up to 1 year click here, and for rates over 1 year, click here.

Most suitable for

Term Deposits offer the highest interest rates out of a bank’s savings products, but provide the least flexibility as you can’t make any withdrawals. They’re best for savings you know you won’t need for at least 6 months. For money you need in less than 6 months time, I would consider Notice Saver accounts because Term Deposit interest rates for terms under 6 months tend to be relatively low.

Term Deposits are also popular with retirees, as their fixed interest rates provide a stable and predictable stream of interest income. However, low interest rates have made achieving a reasonable level of income more difficult.

Tip – Check out my article “Term Deposit rates suck!” for five tips to get the most out of Term Deposits.

Conclusion

Almost everyone will need a savings account at some point in their lives, and the one that’s right for you comes down to how flexible you want your account to be. Everyday Savings accounts and Bonus Saver accounts allow you to freely withdraw your money, but pay a low rate of interest. Notice Saver accounts and Term Deposits pay higher rates of interest, but lock your money in.

In either case, given the low interest rate environment we’re in right now, no savings product is going to make you much money at all. Just keep in mind that savings accounts are typically for short-term investing or keeping money you want easy access to – they are for preservation of your money, rather than long-term wealth creation. For longer-term investing you may want to consider share and bond funds on platforms like InvestNow and Sharesies.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.