Bonus Bonds is a savings scheme that was set up by the government in 1970 to encourage people to save more. Basically investors put money in, and in return they get the chance to win up to $1 million in a monthly prize draw. Bonus Bonds was the second type of investment I ever made – previously I had only invested in bank deposits and was excited to have something new to diversify my portfolio. Even more exciting was the prospect of becoming a millionaire each and every month!

Does the thrill of the prize draw and the opportunity to win $1 million every month make Bonus Bonds a worthwhile investment? Or is it just gambling?

The Bonus Bonds scheme is no longer open for new investment.

Update (1 October 2019) – Updated returns, fees, and odds based on the latest data

How Bonus Bonds work

These days the Bonus Bonds scheme is run by ANZ, and you can join by visiting an ANZ branch. Bonus Bonds have a minimum investment amount of $20, and you can withdraw your money at anytime. There is currently over $3 billion invested in Bonus Bonds.

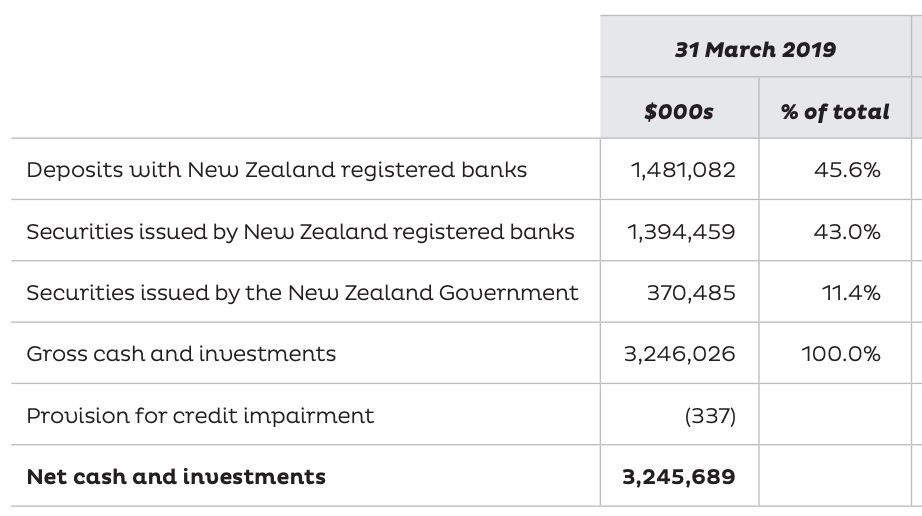

The Bonus Bond scheme is an investment fund in disguise. The fund invests your money in conservative assets such as government bonds and bank deposits in order to generate investment returns.

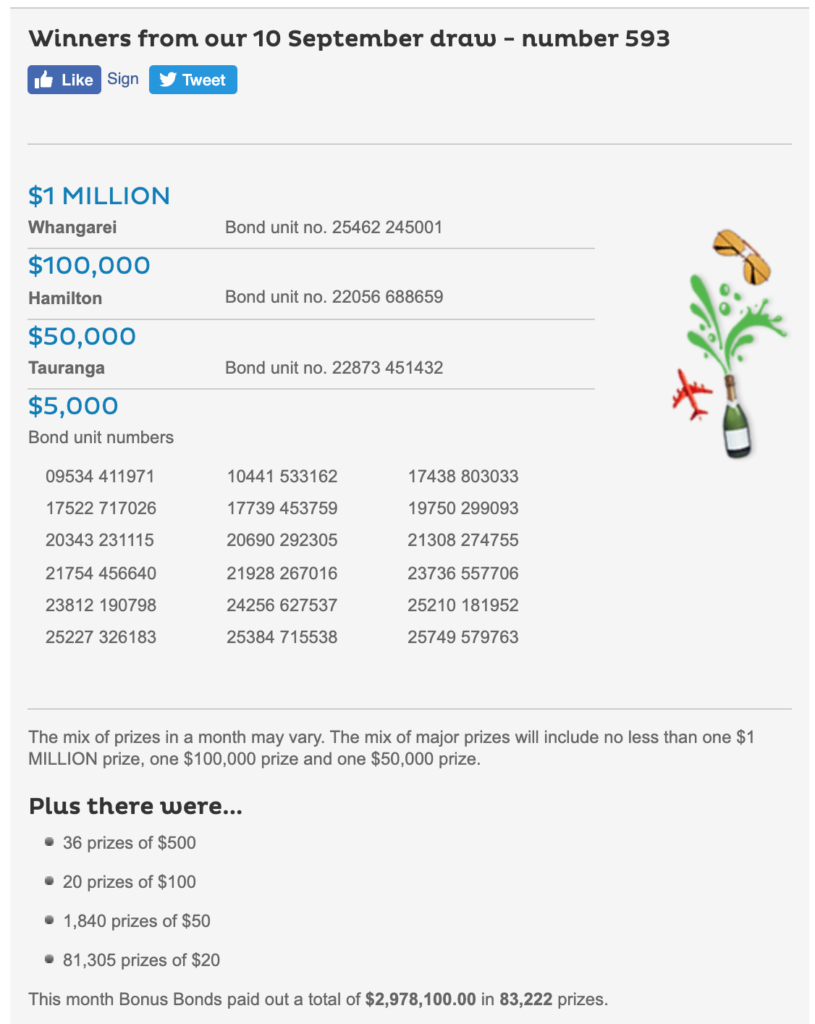

While normal investment funds distribute any returns to investors proportionally to how much they have invested, Bonus Bonds distributes its returns to investors randomly as prizes. To facilitate this, a monthly draw is held where each dollar you have invested, gives you one chance to win a prize. Prizes on offer each month are the big $1 million, $100,000, and $50,000 prizes, and various smaller prizes between $20 and $5,000.

This meant that every month you could win some life changing amounts of money. And if you didn’t win, your money still stays invested in the scheme for future prize draws, so it was safer than buying Lotto tickets. ANZ markets this as “The much more fun investment”. This got me hooked, and as a teenager, any birthday or Christmas money I received was invested into my Bonus Bonds account.

The numbers

We can see that the Bonus Bonds scheme is part investment fund, and part lottery. So let’s look at some numbers to see how they stack up:

- Overall returns of the scheme to see how they compare to similar investments

- The scheme’s management fees

- The odds of winning a prize in Bonus Bonds, compared with Lotto

A. Overall returns of the scheme

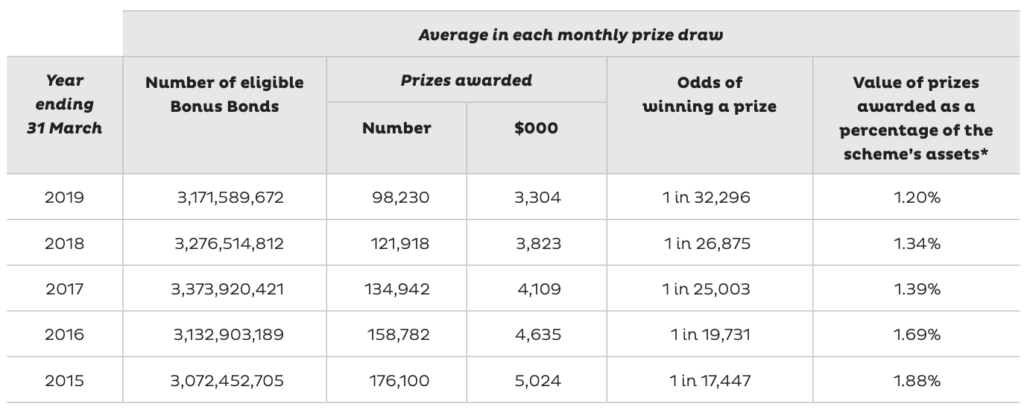

First, I’ll look at how the performance of the Bonus Bond scheme is overall. Looking at the Bonus Bonds Product Disclosure Statement (PDS), the scheme returned 1.20% (after fees and tax) to investors in the year ending 31 March 2019 (down from 1.34% in 2018). This return rates poorly compared to similar investments like the AMP NZ Cash Fund returning 1.56%, and the AMP NZ Fixed Interest Fund returning 4.67% in the same time period. Even term deposits do better, as you can currently earn over 2.5%.

And because the returns of Bonus Bonds are distributed randomly, the majority of investors would have received returns below 1.20%, as the returns are skewed in favour of those who win big prizes.

In addition, the scheme’s performance is getting worse over the years as interest rates fall. Even more concerning is that the rate of return is now lower than the rate of inflation (roughly 1.5% in NZ), so keeping your money is Bonus Bonds is resulting in your money eroding away.

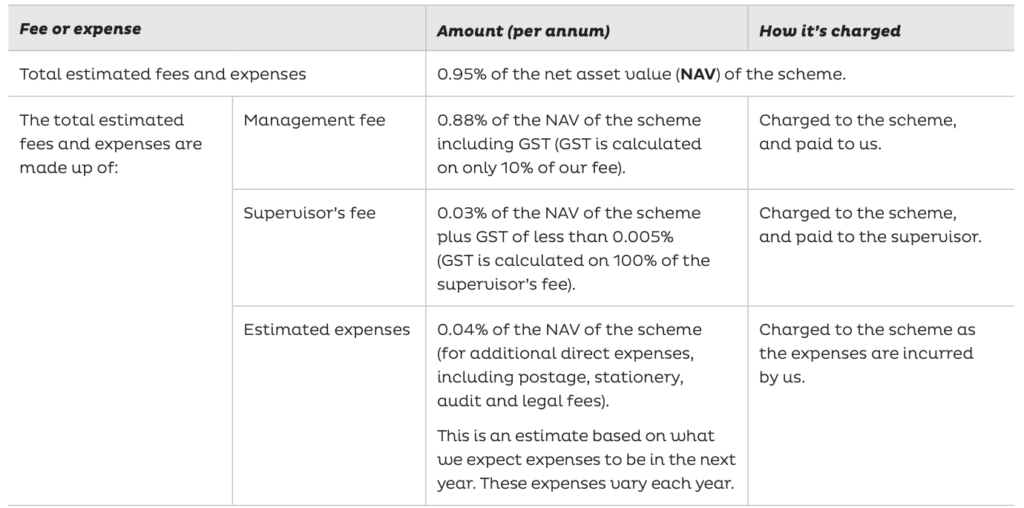

B. Fees

Now let’s look at the management fees and expenses of the scheme. Looking at the PDS, we can see it’s 0.95%. This was recently reduced from 1.23%, but I’d still consider this a rip-off, given funds investing in conservative assets like cash and bonds usually charge much less e.g. The AMP NZ Cash Fund charges 0.27%, AMP NZ Fixed Interest Fund charges 0.57%, and term deposits have no management fee at all.

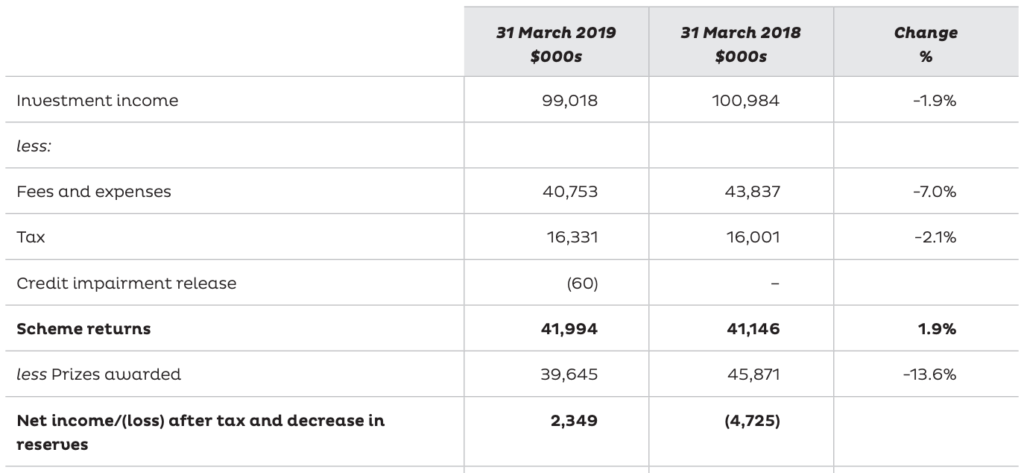

That helps explain why the returns to investors are so low, as close to half of the scheme’s investment income is eaten by fees. In the year ending 31 March 2019, the scheme made $99 million in investment income – 41% of that went to fees, and only 40% went to prizes.

C. Chances of winning

We’ve established that Bonus Bonds is a poor performing investment compared to some of the alternatives. But does the prize draw and the chance to win $1 million make up for it? Let’s examine the chances of winning a prize in each monthly prize draw.

In the year ending 31 March 2019, the odds of winning a prize for every dollar invested was 1 in 32,296, down from 26,875 in 2018. However, Bonus Bonds expect the odds to be even lower going forward, at 1 in 35,000 in the best case, and 1 in 78,000 in the worst case (this was previously between 1 in 25,000 and 1 in 50,000!)

For most prize draws over the next year, we expect that the chance of any Bonus Bond winning a prize will range between 1 in 35,000 and 1 in 78,000

Bonus Bonds

Odds of winning any prize

In the table below we have the odds of winning for four different amounts invested, under the best and worst cases:

| Amount invested | Best Case (1 in 35,000) | Worst case (1 in 78,000) |

| $20 | 1 in 1,750 | 1 in 3,900 |

| $1,000 | 1 in 35 | 1 in 78 |

| $10,000 | 1 in 3.5 | 1 in 7.8 |

| $50,000 | Expect at least 1 prize | 1 in 1.56 |

These odds suggest you can expect to win a prize every few months if you have a decent amount invested.

Odds of winning a prize larger than $20

Almost all Bonus Bond prizes are amounts of $20 (97.7% in the September 2019 prize draw). So in the table below we have the odds of winning a prize larger than $20:

| Amount invested | Best Case (1 in 35,000) | Worst case (1 in 78,000) |

| $20 | 1 in 76,087 | 1 in 169,565 |

| $1,000 | 1 in 1,522 | 1 in 3,391 |

| $10,000 | 1 in 152 | 1 in 339 |

| $50,000 | 1 in 30.4 | 1 in 67.8 |

No wonder I never won anything more than $20! Even with $50k invested, your chances of winning a prize greater than $20 is really slim.

Odds of winning the $1 million prize

Next we have the odds of winning the big $1 million prize (assuming $3.1b units in distribution):

| Amount invested | Probability of winning |

| $20 | 1 in 155 million |

| $1,000 | 1 in 3.1 million |

| $10,000 | 1 in 310,000 |

| $50,000 | 1 in 62,000 |

Not likely at all, even with $50k invested! Imagine getting picked as the single winner out of two Westpac Stadiums full of spectators.

Chances of winning Lotto?

Lastly, for comparison let’s take a look at the odds of winning 1st Division in Lotto (where the prize is typically $1 million):

| Amount spent on tickets | Probability of winning |

| $20 | 1 in 137,085 |

| $1,000 | 1 in 2,687 |

| $10,000 | 1 in 269 |

| $50,000 | 1 in 53.7 |

We can see than even winning Lotto is easier to come by than winning the big one in Bonus Bonds! (although with Bonus Bonds investors get their invested money back, while Lotto players don’t).

Are Bonus Bonds a worthwhile investment?

Based on the numbers, I don’t think so. The returns (and the resulting prize pool) are too low, and the fees are way too high compared to other types of investments. Having 41% of your investment returns eaten up by fees is not a good deal at all! The odds of winning aren’t great either, with the chances of winning a decent prize being pretty much zero (and even lower than winning Lotto!).

October 2019 update – The recent lowering of fees from 1.23% to 0.95% has not changed my opinion on Bonus Bonds being a rip-off, especially given the plummeting odds – from 1 in 26,875 in 2018 to 1 in 32,296 in 2019 (and expected to be even lower in 2020)!

But surely there must be a reason why there’s an enormous $3.1 billion “invested” in the scheme. Like what about the chance to become a millionaire each and every month?

Well, over the years I’ve learnt that investing is about putting your money into sensible assets and watching it grow over the long-term. Investing is not about getting rich quickly. Getting rich quickly is what gambling is for, but that is much more likely to lose you money. And that’s what I was doing with Bonus Bonds – I was holding onto hope that I could perhaps win the $1 million, and as a result I was letting my money erode away to inflation, and paying the opportunity cost of not investing in more profitable assets like shares.

Therefore, I sold half my Bonus Bonds 2 years ago, and just sold the other half earlier this year. I admit it was a hard decision for me to sell the last of my Bonus Bonds because I had FOMO – the Fear Of Missing Out on that potential $1 million prize, even when the chances of winning were so minuscule. Although Bonus Bonds may have helped me develop good savings habits as a teenager, I can now say that my money is invested somewhere that is slowly and steadily contributing to making me rich in the long-term.

Casino photo credit – Lidia

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.