Investing is all about putting your money to work for you – so that it grows into even more money. But how much money do you need to start investing? Tens of thousands? Several hundred? Do I need to sacrifice my smashed avocado on toast to save enough money for investing!?

No! Investing is accessible to almost anyone! Whether you’re keen as a bean to start investing, or just want to dip your toes with a little bit of money, you need less than $100 NZD to get started.

Update (19 February 2022) – Updated for 2022.

How can I invest with only $100?

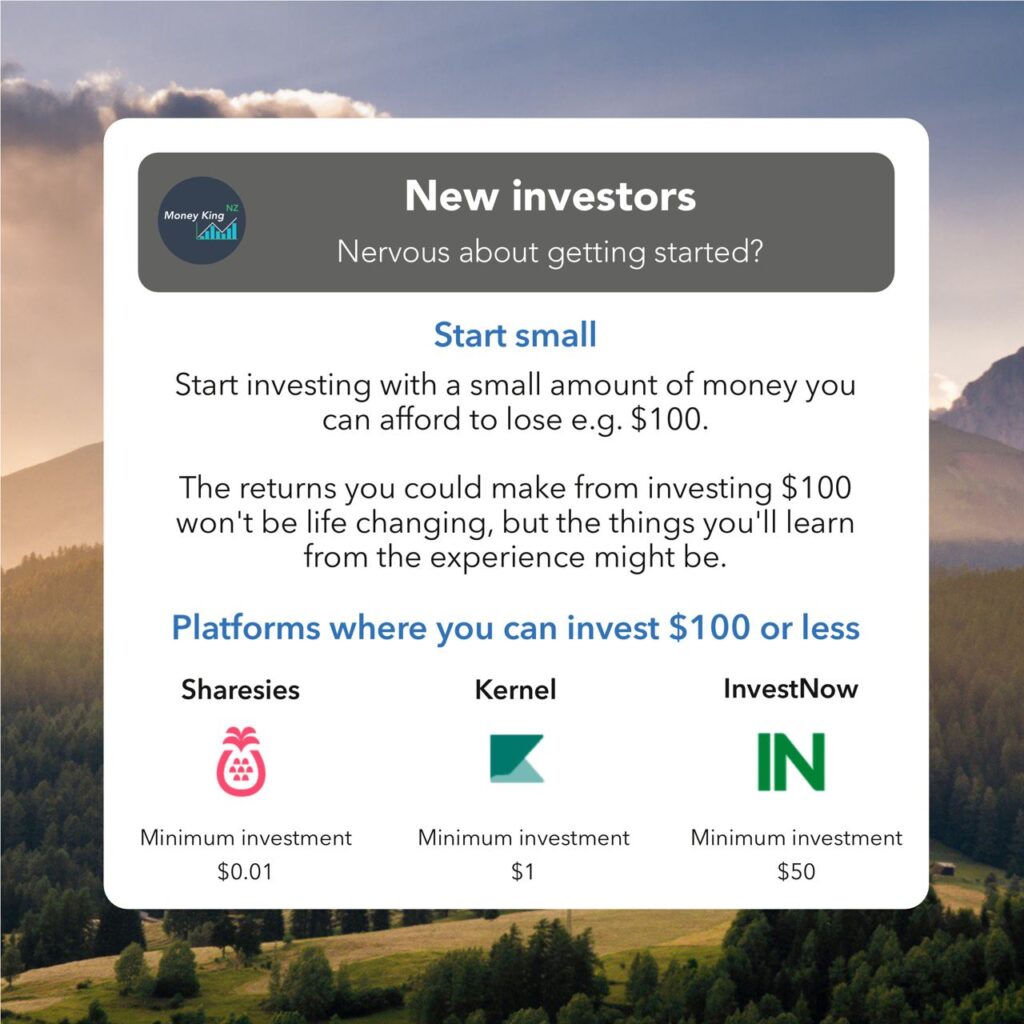

Here are some good investment platforms that allow you to get started with investing with $100 or less:

Sharesies

Minimum investment – $0.01

Sharesies is a platform that allows you to invest in the NZ, Australia, and US sharemarkets. Their site is incredibly user friendly, and their minimum investment is just 1 cent! Their downside is that they charge a fee for every transaction you make to buy or sell shares, and that the large range of investment options can be overwhelming for beginners.

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

Kernel

Minimum investment – $1

Kernel is a platform that allows you to invest in a small range of 11 funds. This includes funds investing in shares in New Zealand companies, overseas companies, as well as unique funds like one which invests in companies involved in the electric vehicle industry! Their small range isn’t necessary a bad thing, as their selection is well diversified, and makes selecting what to invest in easier.

InvestNow

Minimum investment – $50

InvestNow is a platform that allows you to invest in a range of over 150 funds. This includes funds investing in shares in New Zealand companies, overseas companies, commercial property, bonds, and even Bitcoin. Another great thing about InvestNow is that they don’t charge you any transaction or account fees.

Further Reading:

– Sharesies review – Still a good investment platform in late 2021?

– Kernel review – High quality index funds

– InvestNow review – The most efficient way to invest?

Is it worth investing with only $100?

Yes. In most cases, investing $100 won’t change your life, but we all have to start somewhere. Firstly, consider that $100 as education money. Even if you end up losing it all, the things you’ll learn from investing that money will be worth it – whether it be the start of a habit of investing regularly, learning from the mistakes you make, or simply figuring out how it all works.

You can also consider that $100 the foundation of your investment portfolio. Consider investing $100 every month for 10 years. Assuming you earn a 6% return every year, you’d end up with over $16,302 after the 10 years. That might not seem like much for 10 years of investing, but if you were investing for your child, $16,000 would probably mean a lot to them!

If you increased your investment to $100 a week for 10 years, you’d end up with over $69,990 after that time. Like a tree, an investment portfolio starts as a small seed and takes many years to grow big.

Someone’s sitting in the shade today because they planted a tree a long time ago.

Warren Buffet

What are the reasons to not start investing?

So you have $100 to spare, and are considering taking the next step to start investing. Are there any reasons you shouldn’t? A few reasons come to mind:

- You have high interest debt like credit card debt, personal loans, hire purchases. These debts should be paid off first, as their interest rates are usually higher than what you could reliably earn through investing.

- You don’t have any emergency savings. You should strongly consider putting together some emergency savings before investing. Having an emergency fund reduces the chance you’ll have to sell or withdraw your investments in the case an emergency strikes.

- Investing just isn’t a priority right now. Maybe you are focused on other ways to improve your financial position such as getting a better paying job, or finding ways to reduce your expenses. Or maybe you want to use all your money on things like travel and hobbies. If that’s the case, I hope you consider becoming an investor again soon!

What’s next?

So you’ve read this article and keen to start investing? Now the hard part is choosing what to invest in. We have plenty of other articles to help you get started such as:

Further Reading:

– How to invest $1k/$10k/$100k in New Zealand

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.