KiwiSaver has been around since 2007, but Simplicity shook things up in 2016, when they launched new KiwiSaver funds with dramatically lower fees than most other funds out there. They had good reason to shake things up, with the average Growth fund charging fees of around 1.4% – and over a lifetime of investing in KiwiSaver, these high fees can impact your retirement savings by hundreds of thousands of dollars.

Since 2016 we’ve had the arrival of more low cost KiwiSaver providers – JUNO who launched in August 2018, and BNZ who revamped their KiwiSaver scheme to become a low fee one in May 2019. In this article I’ll be comparing the Simplicity, JUNO, and BNZ schemes. What are the pros and cons of each scheme? Are they really as cheap as they advertise, and if so, are they really worth it?

This article covers:

1. What’s on offer?

2. Fees

3. What the funds are invested in

4. Performance

5. Additional features

Update (5 June 2021) – Updated for 2021.

Update (19 September 2021) – BNZ are lowering their fees from 0.58% to 0.45% from 28 September 2021. Updated data on performance.

Update (1 December 2021) – Simplicity no longer charges a $20 annual membership fee.

1. What’s on offer?

All three low cost KiwSaver providers offer Conservative, Balanced, and Growth funds, which we’ll be comparing throughout this article.

Simplicity

Simplicity started up in 2016 and call themselves a low-cost, ethical KiwiSaver provider. They use a passive investing strategy and are a not-for-profit provider, with an aim to leave their members with more profit and money for retirement.

| Members | $ Under Management | |

| Conservative | 3,035 | $133,753,493 |

| Balanced | 8,001 | $318,518,218 |

| Growth | 33,856 | $1,219,817,915 |

JUNO

JUNO is a relatively new KiwSaver scheme, launching in August 2018. The scheme is managed by Pie Funds, a boutique investment manager who’ve been around since 2007. Unlike Simplicity, they use an active investing strategy, where a fund manager actively makes decisions about where to invest the scheme’s money, with the aim to outperform the market.

| Members | $ Under Management | |

| Conservative | 707 | $15,545,831 |

| Balanced | 1,510 | $48,859,071 |

| Growth | 10,577 | $347,287,501 |

BNZ

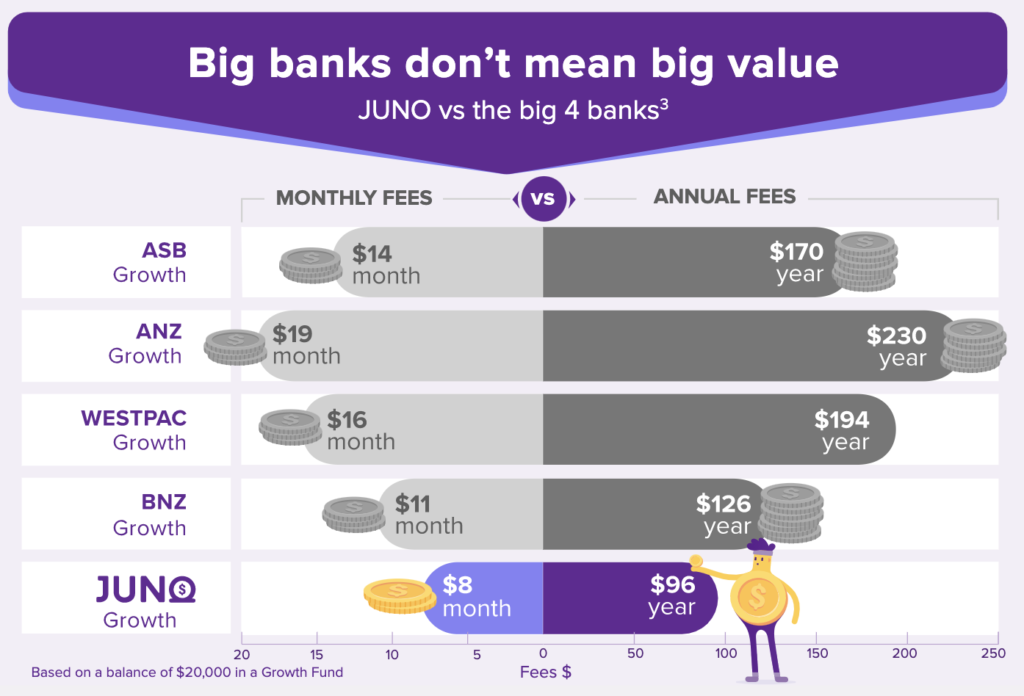

It’s not often you associate big banks with low fees. BNZ used to offer a typical high-fee (and problematic) KiwiSaver scheme. However, BNZ completely revamped their scheme in May 2019, adopting a passive investing strategy and dropping their fees to be among the lowest in New Zealand.

| Members | $ Under Management | |

| Conservative | 68,608 | $914,453,470 |

| Balanced | 28,952 | $622,362,638 |

| Growth | 49,462 | $982,846,513 |

BNZ also offer Cash, Moderate, and First Home Buyer funds.

2. Fees

All KiwiSaver providers charge fees, which are typically made up of:

- a Variable Management Fee (which may include performance fees), charged as a percentage of your balance

- a Fixed Membership Fee, charged monthly or annually as a fixed dollar amount

Having low fees are the main selling point of our low-cost providers, aiming to significantly undercut traditional providers, potentially saving an investor hundreds of thousand of dollars over a lifetime of investing.

The below table shows the fees charged by Simplicity, JUNO, and BNZ:

| Variable fee | Fixed fee | |

| Simplicity | 0.31% | n/a ($0) |

| JUNO | n/a (0%) | Tiered monthly fee based on balance: Under $5,000: $2.50 $5,000-$14,999: $5 $15,000-$24,999: $8 $25,000-$49,999: $20 $50,000-$74,999: $40 $75,000-$99,999: $60 $100,000-$199,999: $90 Then an extra $30 per month for every additional $100k invested |

| BNZ | 0.45% | n/a ($0) |

We can convert this into the below table which shows the annual percentage fee, for different amounts invested in each provider’s Growth fund:

| $2,500 | $5,000 | $10,000 | $20,000 | $50,000 | $100,000 | |

| Simplicity | 0.31% | 0.31% | 0.31% | 0.31% | 0.31% | 0.31% |

| JUNO | 1.20% | 1.20% | 0.60% | 0.48% | 0.96% | 1.08% |

| BNZ | 0.45% | 0.45% | 0.45% | 0.45% | 0.45% | 0.45% |

- Simplicity are widely regarded as the cheapest provider, which is true now that they’ve removed their $20 annual fee.

- JUNO disappointingly increased their fees in December 2020, making them more expensive, especially if your balance is at the smaller end of a tier (e.g. someone with a larger $74k balance pays the same fee as someone with a smaller $50k balance). But they are still cheaper compared to most active KiwiSaver providers.

- BNZ‘s fee stays at a consistently low 0.45% for all balances.

3. What the funds are invested in

Our low-cost providers operate a “three sizes fits all” approach, offering a selection from “Conservative”, “Balanced”, and “Growth” funds. For each type of fund, we would expect to see them invested in the following assets (their investment mix):

- Conservative: Mostly bonds and cash to reduce volatility and preserve capital, making these funds best for shorter-term investment.

- Balanced: Roughly evenly split between bonds and shares, making these funds best for medium-term investment.

- Growth: Mostly shares to achieve high growth (although with higher volatility), making these funds best for long-term investment.

Each fund has an actual investment mix (what asset classes they’re actually invested in) and a target investment mix (what the fund manager intends the funds to be invested in). Below are each fund’s actual investment mix as at 31 March 2021, with their target investment mix in brackets:

Conservative Funds

| Cash | Bonds | Shares | |

| Simplicity | 2.87% (2%) | 75.06% (76%) | 22.07% (22%) |

| JUNO | 34.11% (25%) | 48.09% (50%) | 17.80% (25%) |

| BNZ | 28.36% (25%) | 53.17% (55%) | 18.47% (20%) |

Balanced Funds

| Cash | Bonds | Shares | |

| Simplicity | 3.74% (2%) | 41.19% (42%) | 55.06% (56%) |

| JUNO | 31.61% (10%) | 22.76% (30%) | 45.63% (60%) |

| BNZ | 8.59% (5%) | 32.98% (35%) | 58.43% (60%) |

Growth Funds

| Cash | Bonds | Shares | |

| Simplicity | 3.50% (2%) | 19.67% (20%) | 76.83% (78%) |

| JUNO | 16.64% (5%) | 0.00% (15%) | 83.36% (80%) |

| BNZ | 5.82% (1%) | 16.79% (19%) | 77.39% (80%) |

Simplicity

They are spot on with their actual asset allocations being very close to their targets. It’s what you get from passive investing – they have a plan, and they stick to it (as opposed to trying to time the market), removing the need for an expensive team of fund managers making decisions on where and when to invest.

Simplicity also invests in a couple of interesting assets:

- They invest up to 5% of their Growth fund into Icehouse Ventures, who invest in emerging, high-growth, non-listed NZ companies.

- They plan to lend some of the fund’s money out to first home buyers, as home loans. This should earn their investors a tiny bit more than having their money in bank deposits (similar to P2P lending), but the exact percentage of funds they will allocate to home loans is not yet known, and this is likely to increase risk.

JUNO

You’ll notice a common theme among JUNO funds – they’re holding more cash than their target allocation. This demonstrates their active investing strategy, with their ability to hold more cash when there are limited investment opportunities, or to protect their funds against volatility. However, this doesn’t guarantee better performance, and adds risk – their funds will benefit if sharemarkets plummet sometime soon, but they’ll suffer from an underexposure to shares if the markets continue to rise.

BNZ

Like Simplicity, BNZ’s actual asset allocations are quite close to their targets, although they are carrying slightly more cash at the expense of their exposure to bonds and shares.

BNZ also offers the following funds:

- Cash Fund: BNZ’s most conservative fund holding 100% cash

- First Home Buyer Fund: A very conservative fund targeting 60% in cash, 25% in bonds, and 15% in shares

- Moderate Fund: Slots in between the Conservative and Balanced funds, targeting 15% cash, 45% bonds, and 40% shares

The Cash and First Home Buyer funds could be useful for those who may need a fund with an even greater level of safety versus conservative funds. Conservative funds still hold reasonable amounts of shares and bonds, so people wanting to withdraw their KiwiSaver in the imminent future may find them too risky for their needs.

Responsible Investing

KiwiSaver providers have come under fire in recent years for investing in controversial industries such as those dealing with firearms, tobacco, fossil fuels, and nuclear weapons. As a result, many providers now have Responsible Investment Policies, excluding certain types of companies from their portfolios.

Simplicity, JUNO, and BNZ all have Responsible Investment Policies which exclude companies dealing with controversial weapons, tobacco, and cannabis. Simplicity and JUNO take their exclusions further, banning gambling and adult entertainment companies from their portfolios.

But Simplicity has the most exclusions of them all, banning companies involved with alcohol and fossil fuels in addition to the above. Alcohol sure does have the potential to cause harm in our society, but my personal opinion is that excluding alcohol companies is taking it a step too far. What’s next? Banning fast food operators and soda manufacturers for causing obesity? Where do you draw the line between ethical and non-ethical companies?

Further Reading:

– Clean and Green? 5 things to know about Ethical investing

4. Performance

Performance, how much a fund returned, is not the best criteria to look at when comparing funds – past performance doesn’t guarantee future results. It’s still a handy metric to look at (particularly at long-term returns), as we can spot any consistent under-performers, or any consistent outperformers.

Unfortunately, we don’t have enough long-term data to make any meaningful performance comparisons reflecting how new some of these funds are. Below is the limited performance data we do have (do note that the returns shown below are much higher than average as they reflect the big rebound in asset prices following the COVID-19 crash).

Returns are after fees and before tax and are as at 31 August 2021. For comparison I’ve chucked in the performance for Milford, a top high-fee provider, and what I’ll call the “Money King NZ market benchmark”. This benchmark represents the weighted average market return from four asset classes (NZ Government Bonds, Global Bonds, NZ Shares, International Shares), with a heavier weighting towards bonds for the Conservative benchmark, and a heavier weighting towards shares for the Growth benchmark. If you’re interested, the spreadsheet I used to calculate these benchmarks can be found here.

Conservative Funds

| 1year (p.a.) | 3 years (p.a.) | 5 years (p.a.) | |

| Simplicity | 2.55% | 5.91% | n/a |

| JUNO | 6.84% | 5.29% | n/a |

| BNZ | 2.91% | 4.14% | 4.44% |

| Milford | 5.40% | 5.74% | 5.76% |

| MKNZ benchmark | 1.25% | 5.39% | 5.02% |

Balanced Funds

| 1year (p.a.) | 3 years (p.a.) | 5 years (p.a.) | |

| Simplicity | 11.02% | 9.55% | n/a |

| JUNO | 15.39% | 11.15% | n/a |

| BNZ | 11.00% | 8.51% | 8.68% |

| Milford | 17.30% | 10.56% | 10.32% |

| MKNZ benchmark | 11.06% | 9.02% | 9.94% |

Growth Funds

| 1year (p.a.) | 3 years (p.a.) | 5 years (p.a.) | |

| Simplicity | 16.52% | 11.68% | n/a |

| JUNO | 24.87% | 18.43% | n/a |

| BNZ | 15.38% | 10.54% | 11.02% |

| Milford | 23.46% | 12.77% | 12.58% |

| MKNZ benchmark | 15.64% | 10.82% | 12.32% |

For Growth and Balanced funds, JUNO‘s funds (particularly the Growth Fund) have had the best performance over the past 3 years. But this is quite a short timeframe to make any meaningful conclusions. An interesting fact is that JUNO’s manager, Pie Funds, has achieved returns of 16.79% per year since December 2007 with their flagship Growth Fund. It would be impressive if they could achieve similar, consistent results with JUNO’s KiwiSaver funds.

Simplicity follows in second place out of the low-cost funds, though they fall behind Milford. Going forward, Simplicity will deliver a market average performance each year, since they use a passive strategy – the idea behind this being that it’s very hard for an active fund manager to beat this average year after year.

BNZ is in last place, underperforming in all funds. This is disappointing given they follow a passive strategy like Simplicity, yet lag behind them in their returns.

5. Additional features

Here are additional features of each provider that you may want to consider when deciding on one, although none of them appear to be anything major.

Simplicity

- Members who have been part of Simplicity for over a year, can enter the ballot for a Simplicity first home loan. These home loans come at a fantastic floating interest rate (currently 2.95%), but there are a few conditions, such as requiring a 20% deposit, and the repayments must not exceed 30% of after-tax household income. I would be very cautious about switching to Simplicity solely based on this factor, given this feature appears to be more of a marketing gimmick.

- 15% of Simplicity’s fund management fees go to charity

JUNO

- All fees are waived for under 13s, and for members aged 13-17 the fee is a flat $2.50 per month

BNZ

- If you’re a Flybuys member, you can covert your points into KiwiSaver contributions towards your BNZ KiwiSaver fund at a rate of 108 points for a $20 contribution

- BNZ has a physical presence through their store/branch network

Limitations

There are a couple of limitations to picking Simplicity, JUNO, and BNZ KiwiSaver funds based purely on their low fees:

Low fees don’t guarantee outperformance

Having low fees don’t guarantee outperformance. The most important measure is a fund’s returns after fees – it’s better to have a fund that charges 1% and consistently returns 10% per year, than a fund that charges 0.5% but only returns 8% per year. Although, it’s rare (but still possible) to find such a fund that can consistently outperform the market.

Low cost providers don’t offer aggressive funds (yet)

The Growth funds offered by these low cost providers may not be aggressive enough for many investors. For example, Simplicity allocates 22% of the fund to cash and bonds. Those with a higher risk tolerance and a long investment timeframe may prefer their KiwiSaver fund to be 90-100% invested in shares to maximise their long-term potential returns. None of our low cost providers offer an “Aggressive” fund yet.

The best alternative providers would have to be InvestNow or SuperLife, which allow you to choose precisely what asset classes to invest in, from at least 30 different options. You could allocate your KiwiSaver to 100% global shares, or 100% Emerging Markets shares, or any combination you like.

Conclusion

Looking at Simplicity, I can see why they’re so popular. With their passive investing strategy, they stick to their target asset allocations, so you know exactly what you’re investing in, and there’s no messing around with trying to time the market. Simplicity’s fees are cheap, but I am not a fan of the marketing gimmicks they like to get involved in.

JUNO is a fantastic option to start your KiwiSaver off with. Although their fees aren’t as low as they used to be, they have been good value over that past year by delivering superior returns. However we’re yet to see whether these great returns will continue long-term, so I wouldn’t make a decision to switch to JUNO based solely on performance.

BNZ‘s KiwiSaver scheme has struggled in the past, but they are heading in the right direction with their low cost model. They are even cheaper than Simplicity at low balances. Apart from that, I don’t see anything major that differentiates BNZ from the other providers (except for having ultra-conservative funds), and their returns have continued to be disappointing.

As for me, I started my KiwiSaver journey in Westpac’s scheme, later happily switched to Milford’s Growth fund, and am now with JUNO. I really do like Simplicity’s funds and low fees, but I disagree with too many aspects of their scheme like their home loan offering. And while relatively expensive, JUNO’s performance so far have made the fees worthwhile.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.