The options for New Zealanders to invest their money for the long-term has grown substantially in recent years. More choice is great, but potentially adds to the confusion around what to invest in and how to build a well-rounded and well-diversified long-term investment portfolio. The intention of these portfolios is to buy and hold and/or make regular contributions to each payday, to steadily build your wealth over a minimum of 10 years (rather than a get rich quick scheme) – so having a strategy for your portfolio is important.

In this article I’ll be sharing six approaches you could use to build such an investment portfolio in New Zealand. None of these strategies are better than one another, but as you’ll see, the options can range from being simpler than you think, to being as complex as you want it to be!

The strategies and examples used in this article do not constitute financial advice and should only be used as a starting point for your own research. Always consider your personal financial circumstances or consult with a financial adviser before making any investment decisions.

13-19 September 2021 is Te Wiki o te Reo Māori, Māori Language Week. This article contains te Reo translations for some investment terms.

1. Single Fund Portfolio

You can create a long-term investment portfolio (huinga haumitanga) with just one fund (tahua)! This approach doesn’t have to compromise on diversification (whakakanorautanga) either – just like how your KiwiSaver (Poua he Oranga) is probably invested in just one fund. The funds I’m talking about here are multi-asset class, diversified funds which invest in a mix of domestic shares, international shares, and bonds. These funds can contain hundreds or even thousands of companies and bond issues – which sounds pretty diversified to me.

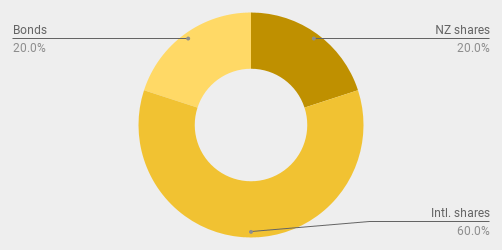

These funds typically come in Conservative (tūpato), Balanced (whārite), and Growth (manawanui) variations. Long-term investors will probably be more interested in Growth funds, given their higher weighting towards growth assets (rawa tipuranga) like shares (tūtanga pakihi), and a smaller weighting towards income assets (rawa whaipūtea) like bonds (haumitanga taurewa) and cash (pūtea). A typical Growth Fund might invest in:

- 20% NZ/Australasian shares

- 60% International shares

- 20% Bonds

These all play an important role in the fund:

- NZ/Australasian shares to provide a bias towards our more accessible and tax friendly home market.

- International shares to diversify the portfolio globally.

- Bonds to act as a shock absorber for the portfolio and reduce volatility.

Pros of this approach

Putting your whole portfolio into a single Growth fund is an extraordinarily easy way to invest for the long-term. It’s incredibly simple, yet well-diversified. There’s no need to worry about what specific companies or asset classes to invest in, whether you’re diversified enough or too much, or whether you’ve got your asset allocation (tiritiringa rawa) right.

Ongoing maintenance of your portfolio will be extremely easy too. Most providers of diversified funds allow you to set up automatic investing so you can effortlessly add to your portfolio over time. You’ll also be all sorted when it comes to tax (as long as you’re investing in a New Zealand domiciled fund), and your fund manager (taurima tahua) will also take care of rebalancing your fund so that the right mix of shares and bonds is maintained.

Cons of this approach

Diversified Growth funds won’t perfectly match everyone’s investment needs and preferences. For example, there could be a specific region you like (such as Emerging Markets) that your fund doesn’t invest in, or specific companies you’re wanting to avoid. The Single Fund Portfolio does not give you the flexility to add or remove specific assets you like or don’t like – you are stuck with what your fund manager has chosen to invest in.

While most Growth funds have a ~20% allocation to bonds, a lot of people don’t like to have bonds in their portfolio in favour of being 100% invested in shares – as they are willing to accept more volatility for potentially higher returns. However, some providers do offer aggressive (mātātoa) funds which have a greater weighting towards shares.

Investment platforms for this approach

- Simplicity – A popular low-cost KiwiSaver provider also offering non-KiwiSaver equivalents of their Conservative, Balanced, and Growth funds.

- InvestNow – Offers a number of diversified funds, both passively (hāngū) and actively (hohe) managed. Examples are the InvestNow Foundation Series Growth Fund (mostly passive) and the Pathfinder Ethical Growth Fund (active).

- SuperLife – Offers a few diversified funds mostly made up of Smartshares ETFs, including a High Growth Fund which invests almost entirely in shares. SuperLife also offer an Age Steps option which automatically allocates you to a diversified fund depending on your age – with younger investors having a higher allocation towards shares.

- Milford – An active fund manager who has a popular Growth fund as well as an Agressive option.

- Your bank – The major banks (ANZ, ASB, BNZ, Kiwibank, Westpac) all offer diversified multi-asset class funds.

Example Single Fund Portfolio

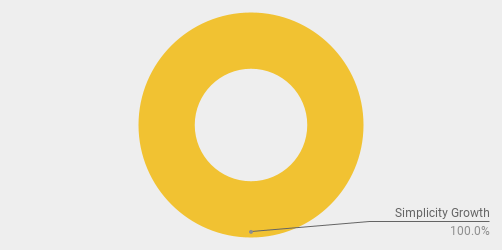

It’s as simple as this:

- 100% Simplicity Growth Fund (direct via Simplicity)

Further Reading:

– 4 steps to create an incredibly simple long-term investment portfolio

– InvestNow Foundation Series vs Simplicity funds – Tax leakage an issue?

2. Three Fund Portfolio

The Three Fund Portfolio aims to replicate a diversified Growth portfolio by investing in three funds (typically low cost index funds) each representing a different asset class (momo rawa):

- 20% in a New Zealand shares fund

- 60% in an international shares fund

- 20% in a bond fund

Pros of this approach

So why would you replicate a Single Fund Portfolio with three funds? The answer is that you get more flexibility:

- You have control to pick the specific funds that make up your portfolio. For example, if you’re looking to invest in a NZX 50 fund to make up the NZ shares portion of your portfolio, there are 5 different fund options to choose from! For your international shares exposure you could choose between funds that include or exclude emerging markets like China, India, and Brazil.

- You can tweak the weightings of each fund however you like. For example, if you wanted more exposure to overseas investments you could reduce your allocation to your NZ shares fund, and increase your weighting towards your international shares fund.

- You don’t have to strictly follow the three fund model, but rather use it as a starting point. You could remove bonds altogether to form an aggressive two-fund model, or replace bonds with another type of fund.

This flexibility doesn’t add too much complexity to your investments either, with Three Fund Portfolios remaining pretty simple.

Cons of this approach

Getting the right mix of funds can be confusing. For example, which of the five NZX 50 funds do you choose? Should you go hedged or unhedged for international shares? Analysis paralysis could discourage you from getting started, or encourage taking a punt on a poorly thought out choice.

There are also relatively few bond funds in New Zealand (particularly the low cost type). Internationally domiciled bond funds aren’t ideal for Kiwi investors as they aren’t hedged to the NZ Dollar, so may introduce undesirable volatility through foreign exchange fluctuations.

You may also have to manually rebalance (whakatika) your portfolio. Over time your funds will grow at different rates, so you will need to sell off units or buy more units of a particular fund to get your portfolio back in line with its target asset allocation (whāinga tiritiringa). This rebalancing may incur brokerage fees.

Investment platforms for this approach

- InvestNow – Offers an excellent selection of funds suitable for making up a Three Fund Portfolio. They are cost effective as they do not charge any brokerage or ongoing account fees.

- SuperLife – Offers a good range of single-asset class funds to choose from. A great feature with SuperLife is that they can automatically rebalance your portfolio.

- Kernel – They don’t have any bond funds, but their offering might be suitable for making up an aggressive variant of the Three Fund Portfolio.

- Sharesies – Less suitable for the Three Fund Portfolio as they charge brokerage fees for most of their funds (unlike InvestNow). And if you choose to use internationally domiciled funds for your portfolio, this may introduce more complexity to your investments in the form of foreign exchange fees and FIF tax.

Example Three Fund Portfolio

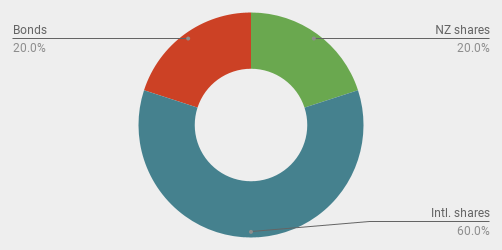

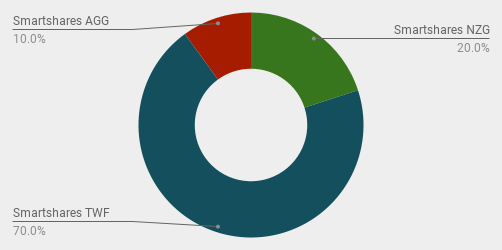

I have made this Three Fund Portfolio a little more aggressive by having a smaller 10% allocation to bonds, and increasing my exposure to international shares to 70%. This shows the added flexibility I have over a Single Fund Portfolio.

- 20% Smartshares S&P/NZX 50 ETF (via InvestNow)

- 70% Smartshares Total World ETF (via InvestNow)

- 10% Smartshares Global Aggregate Bond ETF (via InvestNow)

Further Reading:

– What’s the best NZ shares index fund in 2022?

– What’s the best global shares index fund in 2022?

– Smartshares vs SuperLife vs Macquarie vs Simplicity – Bond index fund shootout

3. Core-Satellite Portfolio

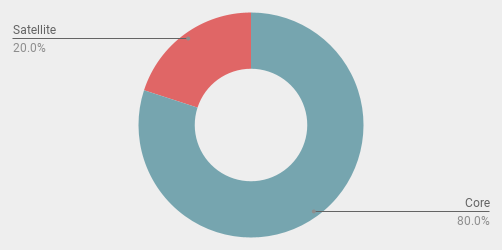

Core-Satellite portfolios are made up of two components:

- The Core made up of broad market funds (typically low-cost index funds) like an NZX 50 or global shares fund. You could use the above Single Fund Portfolio or Three Fund Portfolio to make up your core.

- The Satellite made up of whatever investments you want. These are typically investments with a narrower focus like thematic or sector funds, individual companies, or even alternative assets like Bitcoin.

The exact proportion of your portfolio you allocate to Core vs Satellite investments is up to you, but I personally like to use an 80-20 split as a starting point.

Pros of this approach

Single Fund and Three Fund portfolios aren’t particularly exciting, so introducing Satellite investments allow you to spice up your portfolio with more interesting assets without adding too much risk (tūraru) – given most of your money is still concentrated towards the Core. For example, you could actively pick a few individual companies you’re interested in to supplement your boring Core investments.

Because the Core portion of a Core-Satellite portfolio is typically made up of index funds, the Core’s performance will reflect the return of the market index. Having Satellite investments gives you the chance to outperform (māpua) the market. For example, you could use sector or thematic funds to tilt your portfolio’s exposure towards industries or themes you think will beat the market.

Cons of this approach

Your Satellite investments could add fees and complexity to your portfolio. Adding individual companies to your portfolio could result in paying brokerage fees. In addition, thematic funds tend to have higher management fees than broad market funds. However, your overall portfolio fees should remain low if you stick with low-cost passive investments for your Core.

Lastly, there is no guarantee that your Satellite investments will outperform the market. They could end up being a drag on your portfolio if they underperform (hōtoa) your Core.

Investment platforms for this approach

- Kernel – Proponents of the Core-Satellite approach, Kernel offer a good range of broad market index funds for your Core, as well as thematic index funds for your Satellite.

- InvestNow – Their wide selection of core investments could be complemented with Smartshares’ thematic funds or something like the Vault International Bitcoin Fund to make up your Satellite.

- Simplicity, SuperLife – Their funds could be suitable for making up the Core portion of your portfolio.

- Sharesies, Hatch – Could be used purely to make up the Satellite portion of your portfolio by using these brokers to invest in individual companies, or thematic ETFs. Or they could be used for both your Core (by investing in broad market ETFs) and your Satellite.

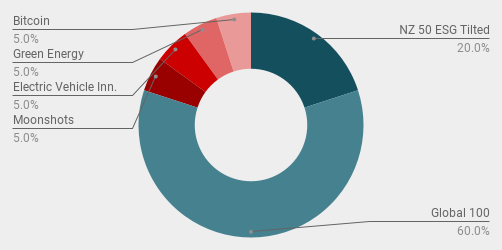

Example Core-Satellite Portfolio

I’ve chosen Kernel to make up my example Core-Satellite Portfolio, using a mix of their broad market and thematic funds, as well as a bit of Bitcoin to round off my Satellite:

Core (80% of the portfolio)

- 20% Kernel NZ 50 ESG Tilted Fund

- 60% Kernel S&P Global 100 Fund

Satellite (20% of the portfolio)

- 5% Kernel Kensho Moonshots Innovation Fund (direct via Kernel)

- 5% Kernel Kensho Electric Vehicle Innovation Fund (direct via Kernel)

- 5% Kernel Global Clean Energy Fund (direct via Kernel)

- 5% Bitcoin

Further Reading:

– Smartshares & Kernel – Thematic Index Fund shootout

4. Investment Bundles

Update (6 Apr 2022) – Kernel no longer offers investment bundles

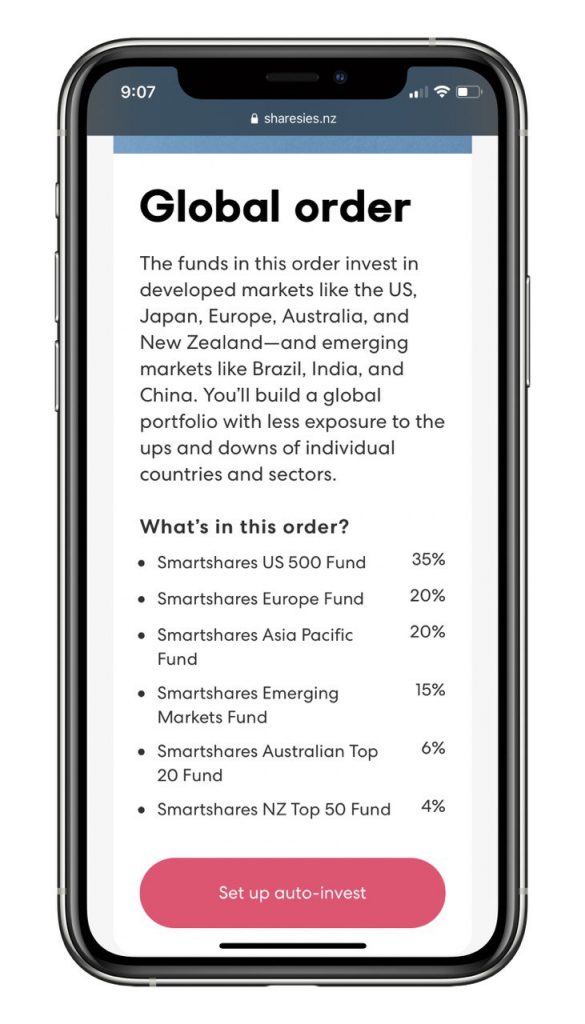

Sharesies offers Investment Bundles which are a pre-made, diversified selection of funds. You can set up auto-invest to contribute to these bundles on a regular basis.

Sharesies offers two Investment Bundles:

- Global order – Contains six Smartshares ETFs, each covering a different country/region from around the world.

- Responsible (haumi aronui) order – Contains three Pathfinder managed funds covering global shares, global property, and the water sector, as well as an AMP managed ethical NZ shares fund.

Pros of this approach

Investment Bundles provide a good starting point for new investors who are not sure what funds to pick for their portfolio. They are all well-diversified and could be used as the Core portion of a Core-Satellite Portfolio.

You can set and forget when it comes to these bundles, with Sharesies providing the ability to automatically contribute to the bundle on a regular basis.

Cons of this approach

These bundles can be unnecessarily complex, without providing any additional benefit over a Single Fund or Three Fund Portfolio. For example, Sharesies’ Global order contains six different funds (with a weighted average fee of 0.48%), all of which could be replicated by a single AND lower fee Smartshares Total World ETF (with a fee of 0.40%)!

These bundles might not contain funds that are best suited to your needs and preferences. For example, Sharesies’ Responsible order is made up with relatively expensive actively managed funds. Investors preferring lower cost, passively managed funds could be better off considering Smartshares’ ESG ETFs or internationally domiciled options.

Investment platforms for this approach

Only Sharesies offers Investment Bundles.

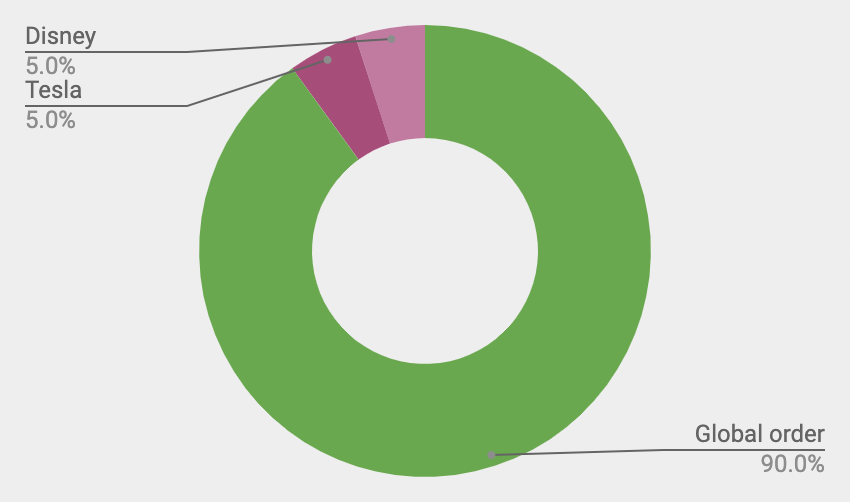

Example Investment Bundle Portfolio

Here I have followed the Core-Satellite strategy – utilising Sharesies’ Global Order as my Core, and investing in a couple of individual companies as my Satellite:

Core (90%)

- Sharesies Global Order

Satellite (10%)

- Tesla (TSLA) shares

- Disney (DIS) shares

5. Full DIY Portfolio

This approach involves building a portfolio however you like with no rules or limits. Everyone’s DIY Portfolio will be different! This would usually involve at least some degree of picking individual companies, but you can still utilise funds in your portfolio – without the rigid structure of a Single Fund or Three Fund Portfolio.

Pros of this approach

You have full control over your portfolio and are not bound by a fund manager’s rules and investment decisions. You can include whatever investments you like at any weighting you desire, and exclude any companies you don’t like so your portfolio can be fully aligned to your ethics. It can also be much more rewarding being your own fund manager, as you’ll certainly learn a lot this way, and it can be exciting to see the growth of your individual portfolio companies.

Cons of this approach

A DIY portfolio is hard to get right, especially as a beginner. You will need to have a good grasp on investing concepts and how to do due diligence (haurapatanga) on companies – which involves much more than posting on an investing Facebook Group asking for thoughts on a particular company. The importance of this is two-fold – not only do you need to research what companies or funds to buy, but you also need to know when to sell off a company or fund. You don’t have a fund manager making these decisions for you.

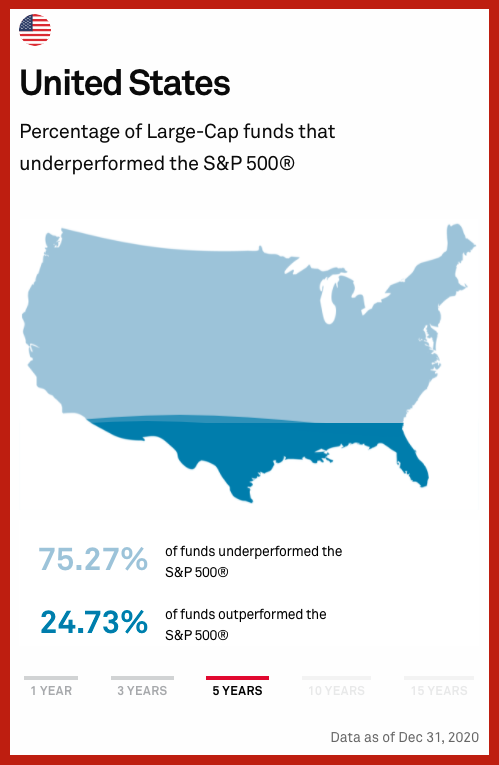

As a full DIY investor, you’re unlikely to outperform the market. You might be skilled enough to do so in the first and perhaps even the second and third year of your portfolio’s lifetime. But it is incredibly hard to keep up this outperformance over the long-term. Even the professional fund managers tend to fail in beating the market over the long-term!

This approach also requires more admin work. You’ll have more orders to place given auto-invest options for individual shares is uncommon. There are also dividends to manage, corporate actions to respond to, and taxes to calculate and pay.

Investment platforms for this approach

Any investment platform is suitable for a DIY approach. The ones you should use will depend on what assets you wish to include in your portfolio.

- Sharesies, Hatch – Great for investing in individual companies.

- InvestNow, Kernel – Don’t offer individual companies, but are excellent choices for funds.

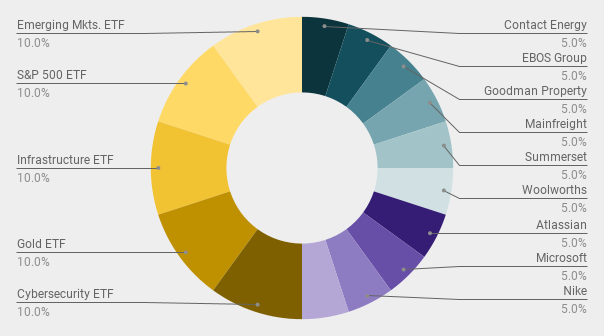

Example Full DIY Portfolio

In this DIY portfolio I have picked a mixture of local companies, an Australian company, a few US companies, and 5 ETFs to complete the portfolio. To keep things simple, I could use Sharesies which contains all these investments under one platform:

Australasian shares (30%)

- 5% Contact Energy (CEN) shares

- 5% EBOS Group (EBO) shares

- 5% Goodman Property (GMT) shares

- 5% Mainfreight (MFT) shares

- 5% Summerset (SUM) shares

- 5% Woolworths (WOW) shares

International shares (20%)

- 5% Atlassian (TEAM) shares

- 5% Microsoft (MSFT) shares

- 5% Nike (NKE) shares

- 5% Nvidia (NVDA) shares

Exchange Traded Funds (50%)

- 10% Global X Cybersecurity ETF (BUG)

- 10% SPDR Gold Shares (GLD)

- 10% iShares Global Infrastructure ETF (IGF)

- 10% Vanguard S&P 500 ETF (VOO)

- 10% Vanguard FTSE Emerging Markets ETF (VWO)

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

6. Ask an Adviser

The last approach involves asking a financial adviser (kaitūtohu ahumoni) for professional advice (tūtohunga) on setting up your investment portfolio. Advisers will work with you to understand your circumstances and recommend you an investment strategy (rautaki haumitanga). However you will typically still retain control of your money and make the final decisions on executing that strategy (i.e. your adviser won’t buy shares or funds for you without your permission). Some advisers can offer to fully implement and manage your portfolio without your input – great if you want a completely hands-off approach.

Pros of this approach

You will get the right portfolio construction (waihanga huinga haumitanga) for your financial objectives (whāinga haumi) and risk profile (āhuatanga tūraru) upfront. There is no need to spend time doing your own research on products, and figuring out the best approach for you by trial and error! I made lots of costly mistakes as a beginner investor, that I could have avoided by seeking professional advice.

An adviser can also be a useful investment sidekick. Long-term (pae tawhiti) investing can be challenging, having to navigate through market dips and changes in your personal circumstances. Your adviser can help you overcome these challenges (perhaps by encouraging you not to sell during the dips) and adjust your portfolio if necessary.

Cons of this approach

Using an adviser will usually be more expensive than a DIY approach – professional advice isn’t free! This extra expense might come in the form of upfront costs, or ongoing management fees. In addition, some advisers will require you to have a lot of money to invest (perhaps 6-figures or more) before they even consider to work with you (though Craigs Investment Partners has a mySTART service that requires a minimum of just $100).

Using an adviser could also be less convenient. Having to make an appointment and jump in a meeting or phone call with your adviser is definitely more of a hassle than staying at home in your pyjamas and DIY investing online. You might also have to go through the same inconveniences when wanting to make any tweaks to your portfolio – a real pain for those who prefer a digital approach.

Investment platforms for this approach

There are lots of different types of advisers that can help you with your investment portfolio such as:

- Fund manager adviser – Employed by a fund manager like Milford or Fisher Funds, so can only offer you an investment strategy based on that fund manager’s products. You may not have to pay any fees for this advice – instead they make money from the ongoing fund management fees you pay when investing in their funds.

- Broking firm adviser – Employed by a broker like Jarden or Craigs Investment Partners. They can offer you a much greater variety of investments, including shares from around the world, bonds, as well as funds. They make money from you by charging brokerage fees on any transactions you make, as well as ongoing portfolio management fees.

- Independent commission based adviser – These advisers are not employed by any investment provider. They make money by receiving a commission from any providers you choose to invest through as a result of their advice. This could result in you not getting the best product for your needs, but rather a product that pays commission. For example, that’s why so many advisers recommend the likes of Booster and Generate for your KiwiSaver, given these two fund managers are commission paying. They may also charge consultation fees in addition to receiving commissions.

- Independent fee only adviser – Not employed by any investment provider. They make money by charging consultation fees, so may be a good choice for getting advice on a wider selection of products.

Ensure you check a prospective adviser’s disclosure statement so you know how they’re making money from you, and select a type of adviser aligned with your preferences. For example, fund manager advisers would be good if you’re keen on a particular fund manager, and broking firm advisers would suit those looking to implement a portfolio of individual companies and funds.

Example Full DIY Portfolio

N/A. Your adviser should work with you to build a bespoke portfolio aligned to your personal goals and circumstances.

Further Reading:

– What I learnt – The Great FMA Debate: DIY Investing

Conclusion

These six ways to build an investment portfolio are just a few ways you can approach long-term investing. There are many more variations and combinations you can use in putting together a portfolio – and that’s the great thing about investing. There is no wrong approach, nor any superior or inferior strategy as long as it aligns with your investment objectives.

But one thing I hope this article has shown is that investing doesn’t have to be complicated. Investing in one fund is all it takes to achieve a well-diversified portfolio. Or you can make it as complex as you like by hand picking a diversified range of individual companies. So there is little excuse to get started in investing and building your wealth over the long-term.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

This was awesome, thanks. I learnt so much. Didn’t realise I was already using a form of core-satellite approach with the only difference being that my allocation is the complete opposite – more money invested in individual stocks and less in ETFs. This article is the nudge I needed to reconsider that allocation

Thank you

Please comment on the management fees for Single Fund Portfolio – from my reading of information relating to various products eg Foundation and Simplicity – it is not clear if the management fee is in addition or includes the management fees of the component funds that make up the portfolio.

Hi Rick, The fees for those funds are inclusive of any underlying fund management fees