Have you come across index funds that invest purely in robotics, or electric vehicle related companies? These are examples of thematic funds, a somewhat new offering in the New Zealand investment market offered by Smartshares and Kernel.

This article will take a look at the New Zealand domiciled thematic index fund options, the different channels you can buy these funds through, and their fees. Do you need these funds in your portfolio?

Index Fund shootout articles:

– Smartshares vs AMP vs Kernel vs Harbour – NZ Share Index Fund shootout

– Smartshares vs Vanguard vs AMP vs Kernel – International Share Index Fund shootout

– Smartshares & Kernel – Thematic Index Fund shootout (this article)

– Smartshares vs SuperLife vs AMP vs Simplicity – Bond index fund shootout

– Smartshares vs AMP vs Milford vs Nikko AM – Cash fund shootout

This article covers:

1. What’s on offer?

2. Through which channels can you invest in these funds?

3. What are the fees?

4. The role of thematic funds in your portfolio

Update (11 Apr 2022) – Kernel have updated their fees

1. What’s on offer?

What are thematic index funds?

The bulk of index funds invest in broad segments of the market. For example, S&P 500 index funds invest in the 500 largest companies listed in the US, regardless of the industries these companies operates in. This fund would give you good exposure to the US sharemarket as a whole.

Thematic funds invest in companies that centre around a particular theme or idea – typically this theme is a view as to how the world will look like or trend towards in the future. Examples of themes are:

- Cybersecurity or cloud computing – relating to the increased digitisation of our society.

- Ageing population – relating to the increasing elderly population.

- Climate change – relating to the increasing awareness of climate issues and the need to combat them.

Thematic funds are designed to give investors exposure to a particular theme, with the belief that the companies surrounding that theme will perform better than the broader market. For example, if there is increased action against climate change in the coming years, will companies with products that combat climate change do really well as a result?

Thematic funds can be wide reaching in the industries they invest in. For example, the BetaShares Climate Change Innovation ETF (an Australian listed thematic fund) has Tesla (electric vehicles), Zoom (digital communications), Beyond Meat (alternative/sustainable foods), and Mercury (clean energy) among its holdings. As opposed to sector funds which invest only in a single industry such as technology or utilities.

Smartshares and Kernel are the only two New Zealand based issuers of passively managed thematic funds, so let’s take a look at the options from each provider:

A. Smartshares

Smartshares, an ETF Issuer owned by NZX, offers a total of 35 funds – two of them being thematic:

- Automation and Robotics (BOT) – Invests in 134 companies “associated with the development of automatic and robotic technology”.

- Healthcare Innovation (LIV) – Invests in 203 companies “focused on innovation within global healthcare services, pushing the boundaries in medical treatment and technology”.

B. Kernel

Kernel Wealth is a relatively new player in the NZ investment scene, having just launched their thematic funds earlier this year. They offer three thematic funds:

- S&P Kensho Moonshots Innovation – Invests in 50 “innovative” US-listed companies “at the forefront of disruptive themes changing our tomorrow”.

- S&P Kensho Electric Vehicle Innovation – Invests in 44 companies “involved in the electric vehicles sector and the ecosystems supporting it – energy storage systems, clean fuel technology, charging infrastructure and more”.

- S&P Global Clean Energy – Invests in 76 companies “involved in the production or provision of Clean Energy”. Not advertised by Kernel as a thematic fund, but I consider clean energy to fit the definition of a theme.

More options:

There are currently very few NZ domiciled thematic funds. If you want more thematic funds, you can consider swapping your NZD for AUD or USD and go shopping on the Aussie or US sharemarkets for more options (using Sharesies, Stake, or Hatch). Remember to be aware of brokerage and FX fees, and your international tax obligations. Not all ASX and US listed thematic funds are passively managed like the above Smartshares and Kernel funds.

2. Through which channels can you invest in these funds?

There are multiple ways you can invest in these NZ domiciled thematic index funds. Let’s take a look at the options:

A. Smartshares

Smartshares’ thematic funds are the most widely available, being offered through three different channels:

Direct

You can buy Smartshares’ funds directly from Smartshares. They require a minimum initial investment of $500, and subsequent investments require $250 for one-off investments, or $50 for regular monthly investments.

A limitation of investing direct through Smartshares is that they don’t provide any facility to sell/withdraw your investment. You would need to use a broker like ASB Securities or Jarden Direct to sell your investment.

Another limitation is that investments made direct through Smartshares are only processed only once a month. When you make an investment order, your money is direct debited from your bank account on the 20th of the month, and the units of your investment are allocated to you on the 3rd of the following month. This process is a bit old school, especially as all other channels process your investment orders within a couple of days, rather than on a set day every month.

Fund Platforms

The InvestNow platform gives investors access to Smartshares funds, starting at $50 if you invest through a Regular Investment Plan, or $250 for one-off investments. Unlike investing directly through Smartshares, InvestNow allows you to sell your investment through their platform.

Sharesies also offers buying and selling of Smartshares’ index funds with a low minimum investment of just 1 cent!

Keen to start building your investment portfolio with Sharesies? Sign up with this link, and you’ll get a bonus $5 in your account to invest!

Brokers

Smartshares’ funds are Exchange Traded Funds (ETFs). This means the funds are listed and traded on the sharemarket, just like the shares of an ordinary company. You can use a broker like ASB Securities or Jarden Direct to buy and sell these ETFs through the NZ sharemarket. This requires you to buy a minimum of 100 units for an initial investment into a fund – currently about $360 for the Healthcare Innovation ETF, or $434 for the Automation and Robotics ETF.

B. Kernel

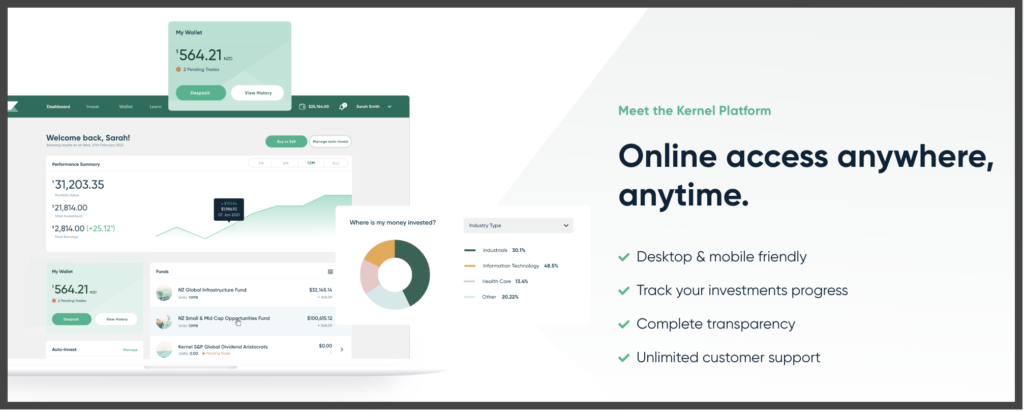

Direct

Kernel’s funds can only be bought direct from Kernel themselves, through their own online platform – their funds aren’t listed on platforms like InvestNow or Sharesies. The minimum investment is $1.

3. What are the fees?

There are two main types of fees you’ll pay when investing in NZ these thematic index funds:

- Fund Management Fee – A fee charged as a percentage of the amount you have invested in the fund

- Channel Fee – A fee depending on what channel you use to invest in these funds such as an account fee, or brokerage fee

A. Smartshares

Fund Management Fees

Smartshares’ Fund Management Fee for both thematic ETFs is 0.75%, the highest fee in the Smartshares range:

| Fund | Management Fee |

| Automation and Robotics | 0.75% |

| Healthcare Innovation | 0.75% |

Channel Fees

- Direct through Smartshares – A $30 Establishment fee applies if you’re investing directly through Smartshares for the first time.

- InvestNow – No other fees apply, apart from the above Fund Management Fees.

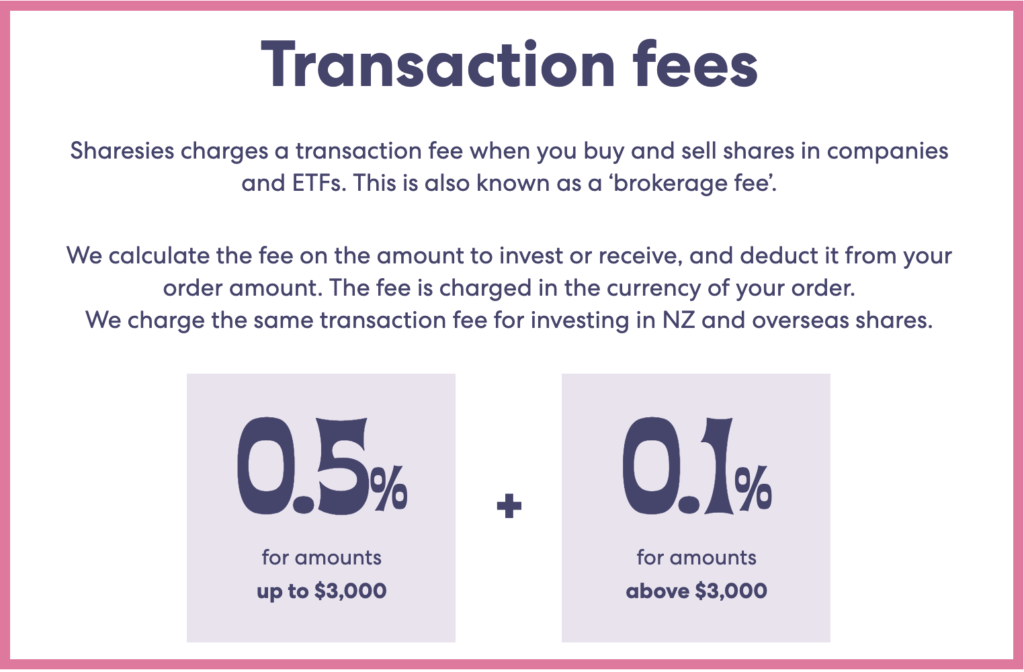

- Sharesies – A brokerage fee of 0.5% on orders up to $3,000, then 0.1% on any amounts above $3,000, applies to buying or selling any Smartshares ETFs.

- Brokers – Brokers charge brokerage fees every time you buy and sell shares. This fee can be quite expensive, starting at $15, so investing in Smartshares funds through brokers is probably not an ideal strategy for investing at a small scale.

Other fees

Spreads are charged whenever you buy or sell units in Smartshares’ funds. This is a small fee to cover the transaction costs of the fund, and is $0.005. This means when buying the units you pay a $0.005 per unit premium over the unit price, and when selling the units you sell them at a discount of $0.005 per unit.

B. Kernel

Fund Management Fees

The management fee for Kernel’s thematic funds is cheaper than Smartshares, coming in at 0.45% (although they are more expensive than Kernel’s core index funds which charge 0.25%).

| Fund | Fee |

| Moonshots Innovation | 0.45% |

| Electric Vehicle Innovation | 0.45% |

| Global Clean Energy | 0.45% |

Channel Fees

Kernel charges a membership fee of $5 per month ($60 per year), if you’ve invested more than $25,000 with them.

Other fees

Kernel does not charge any transaction fees.

4. The role of thematic funds in your portfolio

Thematic funds are most suitable for investors who are seeking long-term capital growth. With the exception of Kernel’s Global Clean Energy fund, none of the funds covered in this article pay distributions (dividends). Investors looking at thematic funds should pick a theme they really believe in, and be willing to hold the investment for several years to ride out any short-term volatility in the fund’s value.

Thematic funds are intended to complement your portfolio, rather than make up a large part of it. They play a useful part in a “core-satellite” investment strategy – a strategy where the “core” of your portfolio (typically low cost, broad market index funds), are accompanied by “satellite” investments (typically higher risk and potentially higher return, such as individual companies, or in this case, thematic funds).

Example core-satellite portfolio with Smartshares’ ETFs:

| Holding | Core/Satellite | Weighting |

| Smartshares S&P/NZX 50 ETF | Core | 20% |

| Smartshares S&P/ASX 200 ETF | Core | 10% |

| Smartshares Total World ETF | Core | 50% |

| Smartshares Automation and Robotics ETF | Satellite | 5% |

| Shares in individual companies | Satellite | 15% |

Example core-satellite portfolio with Kernel’s funds:

| Holding | Core/Satellite | Weighting |

| Kernel NZ 20 Fund | Core | 25% |

| Kernel S&P Global 100 Fund | Core | 65% |

| Kernel S&P Kensho Moonshots Innovation Fund | Satellite | 5% |

| Kernel S&P Global Clean Energy Fund | Satellite | 5% |

The benefits of having a small part of your investment portfolio in satellite investments are:

- Spicing up your portfolio – Investing purely in broad market index funds like the Smartshares S&P/NZX 50 ETF can be boring. While boring doesn’t mean bad in the world of investing, satellite investments allow you to satisfy your desire to have a more interesting or active portfolio without taking on too much extra risk (given the bulk of your portfolio is still in lower risk core investments).

- Tilting your portfolio – Satellite investments allow you to “tilt” your portfolio to get more exposure to a particular company, industry, geography, or theme. For example, you can tilt your portfolio towards the clean energy theme with Kernel’s Global Clean Energy Fund. You could enhance your portfolio’s returns if the companies surrounding that theme outperformed the broader market.

The downsides of the core-satellite strategy are:

- Higher fees – Satellite investments typically come with higher fees. For Smartshares and Kernel, their thematic funds have the highest management fees in each provider’s respective range of funds. For example, Smartshares’ thematic ETFs charge 0.75%, compared to their “core” range of ETFs which have management fees ranging from 0.20% to 0.46%.

- Higher risk – Satellite investments such as thematic funds do not guarantee to improve your portfolio’s overall returns. Thematic funds are somewhat speculative – a theme may fail or be slow to gain traction, and even if it does, it does not guarantee that the companies surrounding that theme will “go to the moon” or grow at a faster pace than the broader market. Some themes may also turn out to be short-term fads that investors have FOMO’d into, rather than genuine long-term trends.

Overall the reasons to hold satellite investments are compelling. However, it’s fine if you choose not to include satellites in your portfolio. A core portfolio of broad market index funds should still deliver solid growth over the long-term, and will always be diversified enough, even without thematics. Winning themes will eventually find their way into those broad market index funds (like how tech companies such as Apple, Amazon, and Facebook have gradually grown to become among the largest companies in the S&P 500 over the last couple of decades), so there is no need to worry about missing out.

Conclusion

It is fantastic to see two of NZ’s best index fund providers offer thematic funds. They provide interesting options to complement a low-cost, diversified investment portfolio without needing to:

- Research and take on the extra risk of investing in individual companies

- Take on the extra work and fees of foreign exchange and taxes (as these are NZ domiciled funds)

But although these funds aren’t necessary to have in everyone’s portfolio, and the range of NZ domiciled thematic funds is small, they are still useful and convenient options for many investors. It would be great to see the offering evolve and the fees reduce as more people get onboard.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.