Most people will be familiar with the cash asset class, including the likes of term deposits, and savings accounts. These are simple investments where you leave your money with a bank or finance company, and earn some interest in return. However, most are less familiar with cash funds – cash investments you can buy through platforms such as InvestNow and Sharesies.

This article will take a look at some cash fund options in New Zealand, the different channels you can buy these funds through, and their fees. How might these funds fit into your portfolio, and how do they compare to term deposits and savings accounts?

Index Fund shootout articles:

– Smartshares vs Macquarie vs Kernel vs Harbour – NZ Share Index Fund shootout

– Smartshares vs Vanguard vs Macquarie vs Kernel – International Share Index Fund shootout

– Smartshares & Kernel – Thematic Index Fund shootout

– Smartshares vs SuperLife vs Macquarie vs Simplicity – Bond index fund shootout

– Smartshares vs Macquarie vs Milford vs Nikko AM – Cash fund shootout (this article)

This article covers:

1. What’s on offer?

2. How can you invest in these funds, and what are the fees?

3. The role of cash funds in your portfolio

4. Cash funds vs Term deposits

Update (4 Apr 2022) – AMP’s funds have been renamed to Macquarie

1. What’s on offer?

What are cash funds?

Like shares and bonds, cash investments are also available in the form of a fund. Cash funds package up multiple cash and cash equivalent assets up into one fund. This includes:

- Bank Deposits – These are everyday banking products that consumers can invest in such as savings accounts, and term deposits.

- Short-term debt securities/certificates of deposit – These are similar to bonds where you lend money to an organisation, but are much shorter in duration (i.e. for weeks or months, rather than years for a bond issue). Cash funds generally only lend money to high quality borrowers, and combined with having short-term maturities, the risk of the fund is kept low. These debt securities are generally only available to wholesale investors.

Smartshares, AMP, Milford, and Nikko AM are NZ fund managers offering cash funds with relatively low fees. None are index funds – instead all are actively managed attempting to outperform a certain benchmark:

A. Smartshares

- Smartshares NZ Cash ETF (NZC) – Aims to outperform the S&P/NZX Bank Bills 90-Day Index (a benchmark closely connected to the OCR). Launched in November 2015, the fund has $226,616,898 under management. Example holdings include an ANZ term deposit, short-term debt securities with the NZ Local Government Funding Agency, Auckland Airport, and Fonterra.

B. Macquarie

- Macquarie NZ Cash Fund – Aims to outperform the Bloomberg NZBond Bank Bill Index. Launched in June 1995, the fund has $2,183,476,670 under management. Example holdings include cash in a Rabobank Call Account, and short-term debt securities with Westpac and ASB.

C. Milford

- Milford Cash Fund – Aims to provide a return above the New Zealand Official Cash Rate (OCR). Launched in March 2019, the fund has $102,421,662 under management. Example holdings include cash in a Westpac 32 day Constant Maturity Deposit (a notice saver account), and short-term debt securities with Meridian Energy.

D. Nikko AM

- Nikko AM NZ Cash Fund – Aims to outperform the Bloomberg NZBond Bank Bill Index by 0.20% per annum. Launched in June 2014, the fund has $177,926,193 under management. Example holdings include short-term debt securities with NZ banks.

2. How can you invest in these funds, and what are the fees?

There are two main types of fees you’ll pay when investing in these cash funds:

Fund Management Fee

This is a fee charged as a percentage of the amount you have invested in the fund. Low management fees are important for cash funds, given their lower return compared to bonds and shares:

| Fund | Management Fee |

| Smartshares NZ Cash ETF | 0.20% |

| Macquarie NZ Cash Fund | 0.27% |

| Milford Cash Fund | 0.20% |

| Nikko AM NZ Cash Fund | 0.33% |

Channel Fee

There are multiple channels in which you can invest in these cash funds. Most charge a fee such as an account fee, or brokerage fee:

A. Smartshares

- Direct through Smartshares – You can buy Smartshares’ funds directly from Smartshares. They require a minimum initial investment of $500, and subsequent investments require $250 for one-off investments, or $50 for regular monthly investments. You cannot sell any investments through Smartshares – instead any sell transactions must be done through a broker.

- InvestNow – The InvestNow platform gives investors access to the Smartshares NZ Cash ETF. The minimum investment is $50 if you invest through a Regular Investment Plan, or $250 for one-off investments. Unlike investing directly through Smartshares, InvestNow allows you to sell your investment through their platform.

- Sharesies – Sharesies offers buying and selling of all Smartshares’ funds with a low minimum investment of just 1 cent.

- Brokers – Smartshares’ funds are Exchange Traded Funds (ETFs). This means the funds are listed and traded on the sharemarket, just like the shares of an ordinary company. You can use a broker like ASB Securities or Jarden Direct to buy and sell these ETFs through the NZ sharemarket. This requires you to buy a minimum of 100 units for an initial investment into a fund – currently about $295 for the cash ETF.

The fees for each channel are:

| Channel | Fee |

| Smartshares (direct) | A $30 Establishment fee applies if you’re investing directly through Smartshares for the first time. |

| InvestNow | No other fees apply, apart from the above Fund Management Fees. |

| Sharesies | A brokerage fee of 0.5% on orders up to $3,000, then 0.1% on any amounts above $3,000, applies to buying or selling Smartshares ETFs. This probably makes investing in the NZ Cash ETF through Sharesies not worthwhile as the brokerage fee could end up being more than the potential returns. |

| Brokers | Brokers charge brokerage fees every time you buy and sell shares. This fee can be quite expensive, starting at $15, so investing in Smartshares funds through brokers is probably not an ideal strategy for investing at a small scale. |

Other fees:

- Smartshares’ funds are Listed-PIEs, which means they are taxed at a flat 28% tax rate. This may not desirable for those on lower tax rates. All other funds in this article are Multi-Rate PIEs which allows investors at lower tax rates to be taxed at their appropriate rate (e.g. 10.5% or 17.5%).

B. Macquarie

Macquarie’s NZ Cash Fund is available through InvestNow. No other fees apply, apart from the fund management fee. The minimum investment is $50 if you invest through a Regular Investment Plan, or $250 for one-off investments.

C. Milford

Milford’s Cash Fund is available through InvestNow. No other fees apply, apart from the fund management fee. The minimum investment is $50 if you invest through a Regular Investment Plan, or $250 for one-off investments.

It’s also possible to invest in the Cash Fund directly through Milford. The minimum initial investment is $1,000, but there are no minimums for subsequent contributions into the fund.

D. Nikko AM

GoalsGetter is Nikko AM’s in-house platform for retail investors. The platform offers Nikko AM’s range of funds, including the NZ Cash Fund. Like InvestNow, no other fees apply, apart from the fund management fee. The minimum initial investment is $250, and the minimum required for subsequent investments is $20.

The Nikko AM NZ Cash Fund is not available on InvestNow.

3. The role of cash funds in your portfolio

You may be wondering why you should even bother with cash, given the minuscule interest rates offered by savings accounts and term deposits. Despite the low returns, cash plays an important role in providing short-term capital preservation i.e. keeping your money safe (as opposed to long-term capital growth). While shares and bonds provide better returns over the long-term, they also put your money at risk, exposing it to the ups and downs of the market. Here’s a performance comparison between the three asset classes between 24 February 2020 to 23 March 2020 to show how each behaved during a major market crash:

| Cash NZ Cash ETF | Bonds NZ Bond ETF | Shares NZ Top 50 ETF |

| -0.50%* | -2.15% | -35.86% |

*We did see the NZ Cash ETF go down in value, but this can partially be explained by the fund going ex-dividend during this time (going down in value to reflect that it paid out a dividend) .

Why might you need short-term capital preservation? There are many reasons you may need to keep your money safe for the short-term such as needing it to buy a house, or for an upcoming expense.

Example: Brian buys a house

In September 2019 Brian signs a contract to buy a new build house due for completion and settlement in March 2020. He has $100,000 cash which is required to settle the house. Sick of declining term deposit rates, he puts the money into the Smartshares NZ Top 50 ETF (a share fund), given the fund has returned about 12% a year over the last few years.

Now in March 2020, his new house is complete and it’s time to pay the $100,000 before he gets the keys. Unfortunately COVID-19 has begun to affect the world and sharemarkets are falling quickly. On the day he withdraws his Smartshares investment, his investment is down to about $70,000. He has lost $30,000 and is unable to settle the house purchase.

You may write this off as Brian having bad luck or timing, or this as a rare one-off crash. But markets will dip and crash again at some point in the future – we just don’t know when or by how much. So is it really worth gambling with something as important as your house deposit for the chance of getting a few extra percent in returns?

International cash funds

These funds are priced in foreign currencies, therefore the value of the fund will go up and down along with the exchange rate fluctuations between the NZ Dollar and that foreign currency. This exchange rate volatility makes the international cash funds you might find on Sharesies, Hatch, or Stake unsuitable for the purpose of capital preservation.

Cash funds are not suitable for long-term investment, as over time inflation will erode the value of cash (this is where shares come in). However, long-term investors may still need cash for an emergency fund – money you can use on a rainy day without having to sell off your shares or other assets.

Further Reading:

– What’s the best short-term investment?

4. Cash funds vs Term deposits

Cash funds are popular with wholesale investors, including InvestNow’s parent company (Implemented Investment Solutions):

InvestNow holds relatively high levels of cash on our parent company’s balance sheet, and use PIE cash funds to provide us with higher returns, without the hassle of managing term deposits. Also, we can readily access this money as needed on short notice.

InvestNow – How to cash in on cash

Retail investors tend to seek traditional savings accounts and term deposits for their cash holdings – so how do cash funds compare to these?

Liquidity

While term deposits offer the highest returns at a bank, they are the least liquid. You’re not allowed to withdraw money from a term deposit (or add more money to it) until the end of the term – and if you do break a term deposit, you’ll probably be penalised by losing any interest you’ve earned. Bank savings accounts offer a high level of liquidity (you can make deposits and withdrawals at anytime), but offer measly returns.

Cash funds provide the best of both worlds. They offer a return greater than a savings account, and can be withdrawn almost immediately – there is just a wait of up to 2 days for cash fund buy and sell transactions to settle.

Interest payments

With term deposits interest is often paid at maturity of the investment, but most banks will provide the option of paying out interest monthly or quarterly. Savings accounts typically pay interest every month.

With cash funds any accrued interest your fund earns is reflected as an increase in the fund’s unit price, meaning investors earn interest on their investment in real-time. Most cash funds will pay out this interest as dividends or distributions – Smartshares and Nikko AM pay distributions on a quarterly basis, and AMP does so semi-annually. Distribution payments are accompanied by a drop in the fund’s unit price equal to the amount of the distribution. Milford’s cash fund does not pay any distributions – instead investors must sell units in the fund to cash out the returns.

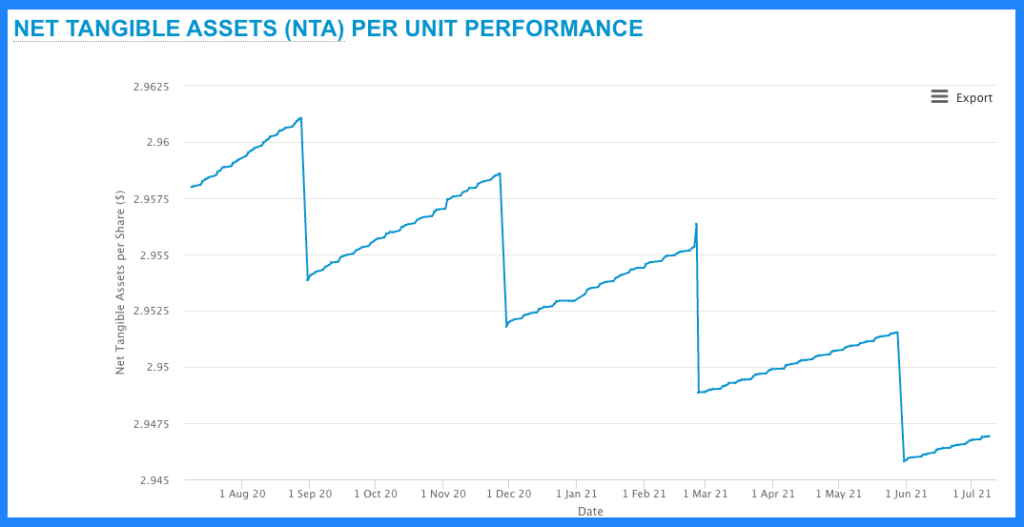

What’s up with NZC’s performance chart?

Below is the performance chart of the Smartshares NZ Cash ETF, which often leaves investors puzzled. Here’s what’s going on:

– We can see that the value of the fund plummets downwards at regular intervals. These represent money exiting the fund in response to the fund’s quarterly dividend payments.

– These falls are followed by gradual increases in the fund’s value. This represents the interest that the fund is earning. This is good as investors earn interest in real-time and aren’t unfairly penalised for withdrawing money from the fund before the dividend payments.

– Overall the fund’s value has been slowly trending down as the fund is paying out more in dividends than what they’ve earned in interest (due to the declining interest rates over the past year)

Performance

Here are the returns on some bank savings products over the past year, compared to the returns on our cash funds (returns are after fees, but before tax):

| Product | Past year’s return^ | Average Return over last 5 years |

| 12-month term deposit | 2.50%* | n/a |

| ANZ Serious Saver | 0.20% | n/a |

| Heartland Direct Call account | 0.50% | n/a |

| KiwiBank 90-day Notice Saver | 1.00% | n/a |

| Smartshares NZ Cash ETF | 1.09% | 2.25% |

| Macquarie NZ Cash Fund | 0.34% | 1.73% |

| Milford Cash Fund | 0.37% | n/a |

| Nikko AM NZ Cash Fund | 1.51% | 2.21% |

| S&P/NZX Bank Bills 90-Day Index | 0.33% | 1.63% |

| Bloomberg NZBond Bank Bill Index | 0.31% | 1.60% |

| Official Cash Rate | 0.25% | n/a |

^1 year return to 31 March 2021

*average rate as at 1 April 2020

Generally cash funds perform better than an ordinary savings account, but lag behind term deposit returns (assuming that the term deposit is not a short duration one e.g. 30 days).

However, this isn’t an entirely fair comparison as the above term deposit rate of 2.50% assumes you locked your money in a term deposit on 1 April 2020, before rates plummeted later in the year. Given cash funds invest in assets with very short-term maturities, they are constantly reinvesting into new assets with new interest rates. The impact of this is:

- Term deposits could be better when you expect interest rates to fall, as you can lock in a rate for a given term.

- Cash funds could be better when you expect interest rates to rise, as they don’t lock you into a rate, and are constantly reinvesting into new assets (with potentially increasing yields).

Fees

While term deposits usually do not have any fees, all cash funds charge a management fee. However, these fees are relatively low compared to funds investing in other asset classes.

Some other fees relating to cash funds could make them not worthwhile to invest in. For example, if you invested in the Smartshares NZ Cash ETF through Sharesies, you have to pay 0.5% brokerage to buy the fund, then another 0.5% in brokerage to sell the fund. That’s 1% of your investment gone, and the returns of the cash ETF probably won’t make up for that.

Transparency

Term deposits offer more transparency. You are locked in to a term, so you know the exact return you’re getting and exactly how long that investment will last.

With cash funds, you don’t know how much in returns the fund will deliver. We can only see the backwards yield (i.e the fund’s return in the past year) but this isn’t very helpful in determining future returns – the overall yield of the fund changes all the time as the assets in the fund mature and are reinvested in new assets.

Further Reading:

– Which NZ bank savings product is right for you?

Conclusion

Cash is an asset not often talked about, but remains an important tool in one’s investment toolbox. Even though the returns on cash are currently poor, its role is to protect your capital (rather than to grow your wealth), by keeping it away from the ups and downs of the bond and share markets. Whether you need money for something in the short-term, or just need money set aside for emergencies, cash is a necessary holding for most people.

Cash funds are a handy option for investors. They give better returns than ordinary savings accounts, and while they do not give the stability and potentially higher rates of term deposits, they do give you the freedom to withdraw the money at any time – so think about which option best suits your personal financial situation.

As for which cash fund is best, there is no clear winner from the funds mentioned in this article. All funds have relatively low fees, with the Smartshares and Milford funds being the cheapest at 0.20%. The Smartshares and Nikko AM funds standout in performance, but this is not a reliable indicator of which fund will perform better in the future. But if I had to pick an overall winner, it would be the Smartshares fund, given its track record and accessibility. Just make sure you invest in it through InvestNow, as the fees of other platforms could easily wipe out your returns from the fund.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Interesting they are offering these when there are better returns for a 1 year TD at 4%.

I have TDs and notice saver spread and achieve 2.5 to 4 % range for short term.

planning to buy an investment property.

I know you do excellent articles on these asset classes , could you do one on investment property.

Once you fact or Interest non deducibility and healthy homes cost, (I don’t like new builds as there is no value add and yields no good either) what yield do you think we should be aiming for ?

Right now anything less than 8% breaks even , so hard to find decent yield unless you go Air bnb or multi units.

Plan is to use my savings towards sharemarket ( 7-10 yr horizon) DCA’s. Thinking of Managed funds and ETF’s and some plays in Sharesies. which has come back from -20 to now almost positive. !

Borrow against my equity to leverage with property which then makes it worthwhile.

Thanks , keep up the good work

Yes, they are interesting products and you’re probably better off just selecting a TD most of the time. But they’re still competitive funds considering you can withdraw from them at any time.

We’d love to do more property articles, but sadly we aren’t experts in the intricacies of residential property investment, and don’t want to be publishing bad content! But there’s a number of other content creators who do have a focus on property e.g. the following podcasts: