A common challenge for investors in both KiwiSaver and non-KiwiSaver funds is being able to find information on a fund’s full holdings. People want to see an entire list of the assets a fund holds, so that they know precisely what companies they are investing in. It is often easy to find out a fund’s top 10 holdings, but let’s do some digging to find out what lies beyond the top 10!

Notes:

– The steps described in this article are subject to change as investment providers modify their websites

– Most steps in this article are not mobile friendly, so are best carried out on a full-size screen

1. The top 10

Fund Update documents

All New Zealand Fund Managers release Fund Update documents a few weeks after every calendar quarter (31 March, 30 June, 30 September, 31 December). This document contains details of the top 10 holdings of a fund, and can typically be found on the Documents, Legal Documents, or Investor Documents page of each Fund Manager’s website. Here’s the links to the Documents page for a selection of Fund Managers, where you’ll subsequently fund a Fund Update document for each of their funds:

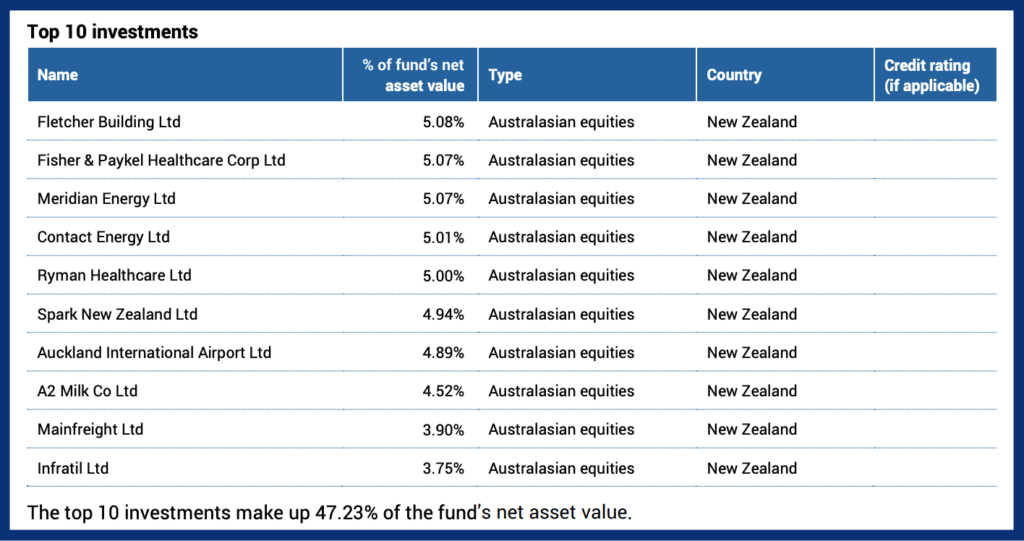

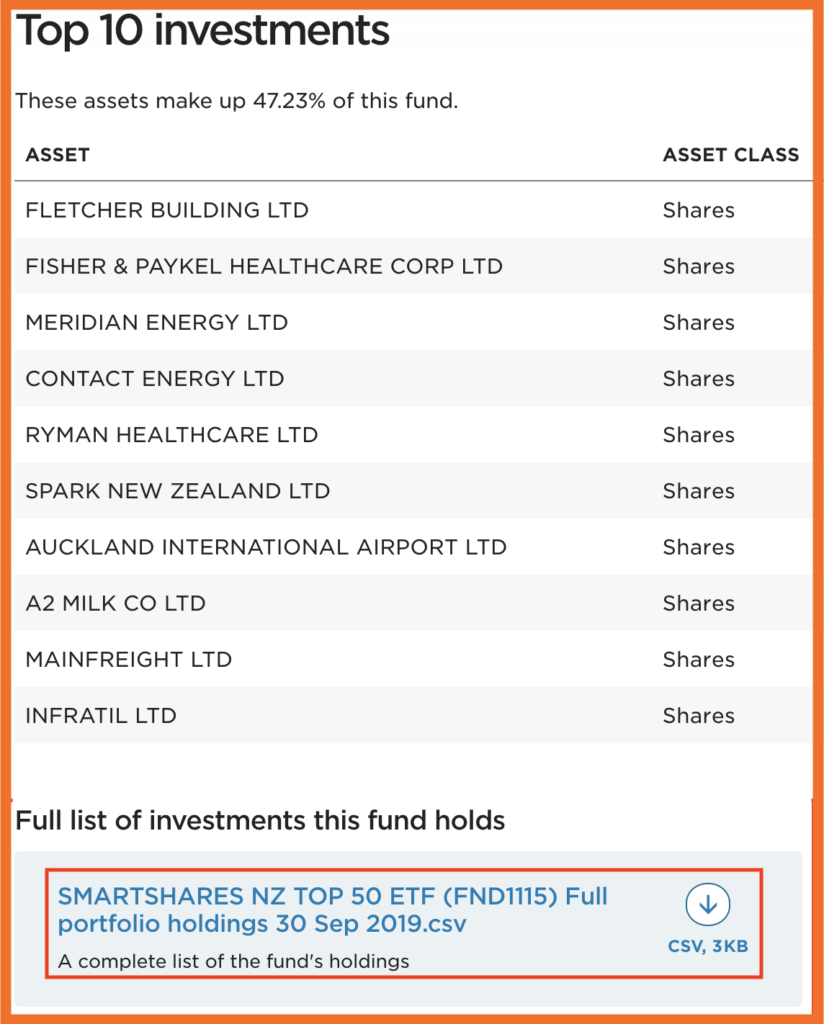

All Fund Update documents follow the same template. You’ll always find details of a fund’s top 10 holdings near the end of the document, which looks like the below table. Accompanying the table is a statement saying something along the lines of “The top 10 investments make up 47.23% of the fund.”

So what about the other half of this fund’s holdings? By seeing the top 10 we have only scratched the surface of what a fund invests in. To find out, let me show you how to dig deeper to reveal a fund’s entire holdings in the next section of this article.

2. Beyond the top 10

Fund Manager’s website

Sometimes you’ll get lucky and find a fund’s full holdings published in plain sight on a Fund Manager’s website. For example, Kernel publishes the full holdings for each of their funds on their website every month. But this is the exception, rather than the rule – Fund Managers rarely make such information this easy to find.

Simplicity has another take on showing their fund’s full holdings. Using their Where in the world calculator, you enter how much money you have invested in one of their funds, and it will show you which assets your money is invested in, and how much money you have invested in each asset. I think this is an awesome way to provide transparency to investors, although it doesn’t work on mobile devices.

Smart Investor

In the likely case that you fail to find the desired information on your Fund Manager’s website, we have another tool at our disposal – Sorted’s Smart Investor site. This is our killer tool in our hunt for a fund’s full holdings, and here’s a step-by-step guide:

1. Go to the Sorted Smart Investor website.

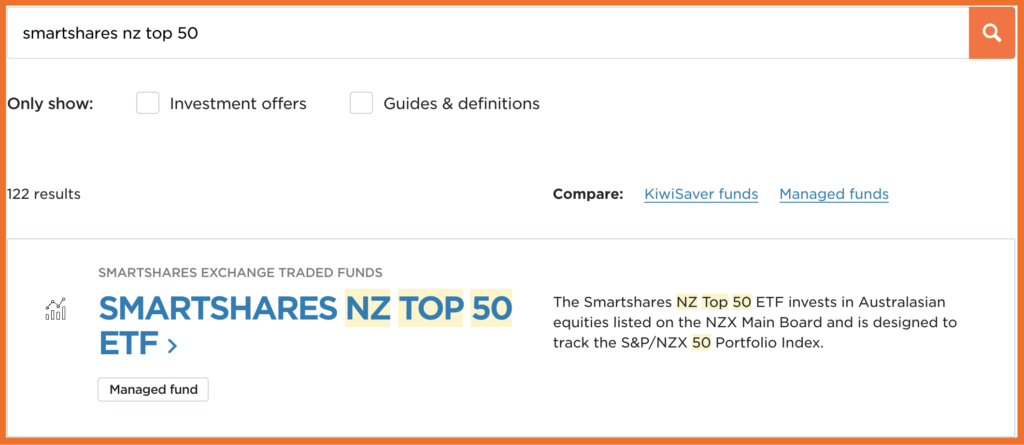

2. Search for the fund you want to see the full holdings for. In this example, I’m searching for the Smartshares NZ Top 50 ETF.

3. Select your fund from the search results.

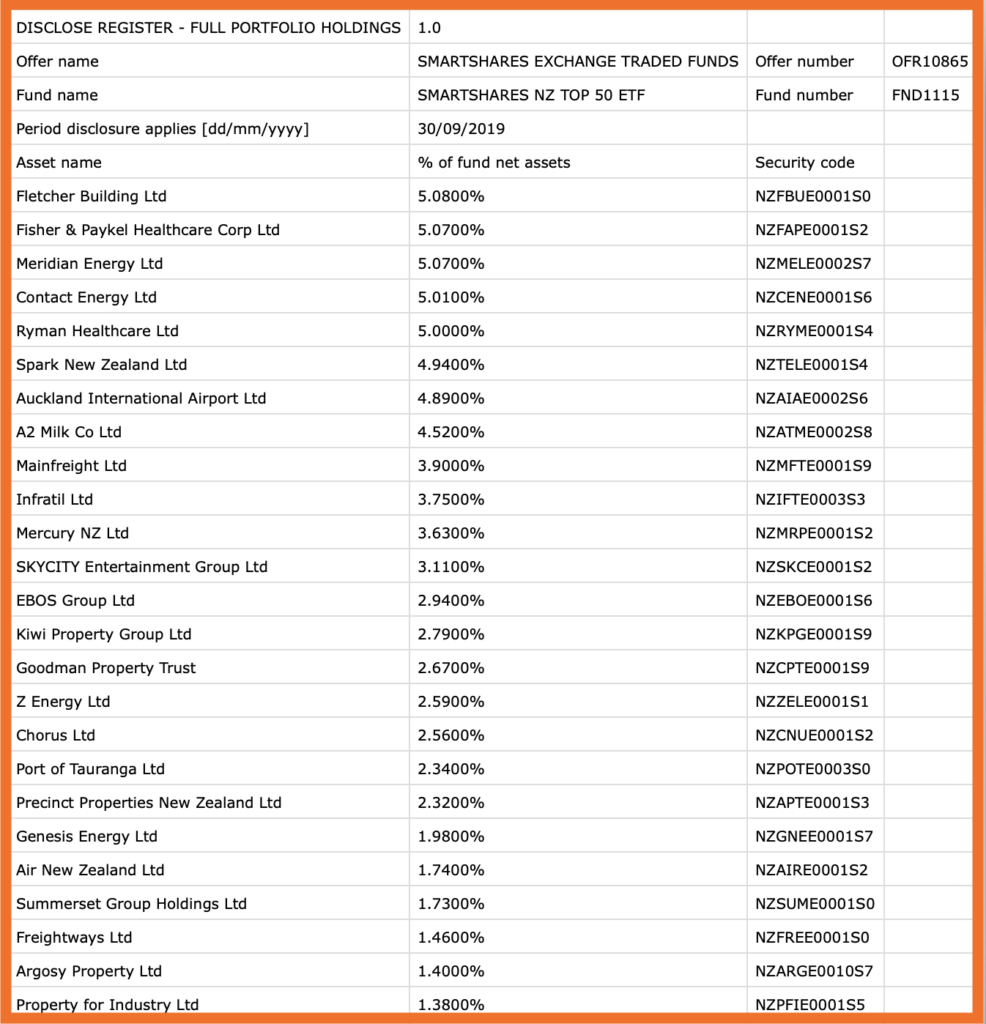

4. Scroll down to the Top 10 investments section. At the bottom of this section there is an area labelled Full list of investments this fund holds. This contains a Full Portfolio Holdings spreadsheet which you can download.

5. Open the spreadsheet to reveal the fund’s full holdings.

Sorted Smart Investor is certainly a user friendly way to get detailed information about funds, but is far from perfect. In particular, the search function is terrible. For example, when I search for “AMP”, “JUNO”, “Pie Funds”, or “Fisher Funds”, I frustratingly get the result Sorry, there are no results for your search, even when these are genuine Fund Managers. Fortunately, the following tool provides a solution.

Disclose Register

Disclose Register is the actual source of the information displayed by Smart Investor. The register is not always useful given its clunkiness, but there are a couple of reasons you might want to use it over Smart Investor:

- Smart Investor’s search function doesn’t work properly for your search query, and gives you the result “Sorry, there are no results for your search”.

- Fresh data has just been uploaded to the Disclose Register, and has not yet been propagated to Smart Investor.

So here’s the step-by-step guide to getting a fund’s full holdings off the Disclose Register:

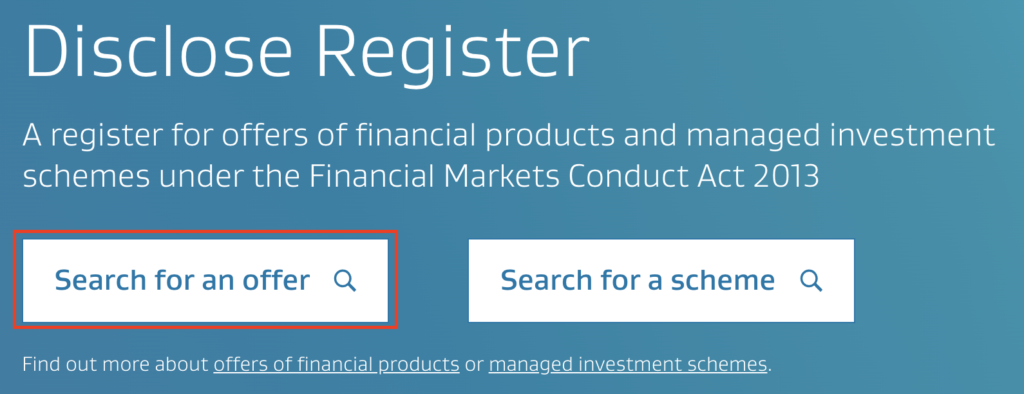

1. Go to the Disclose Register website.

2. Select Search for an Offer.

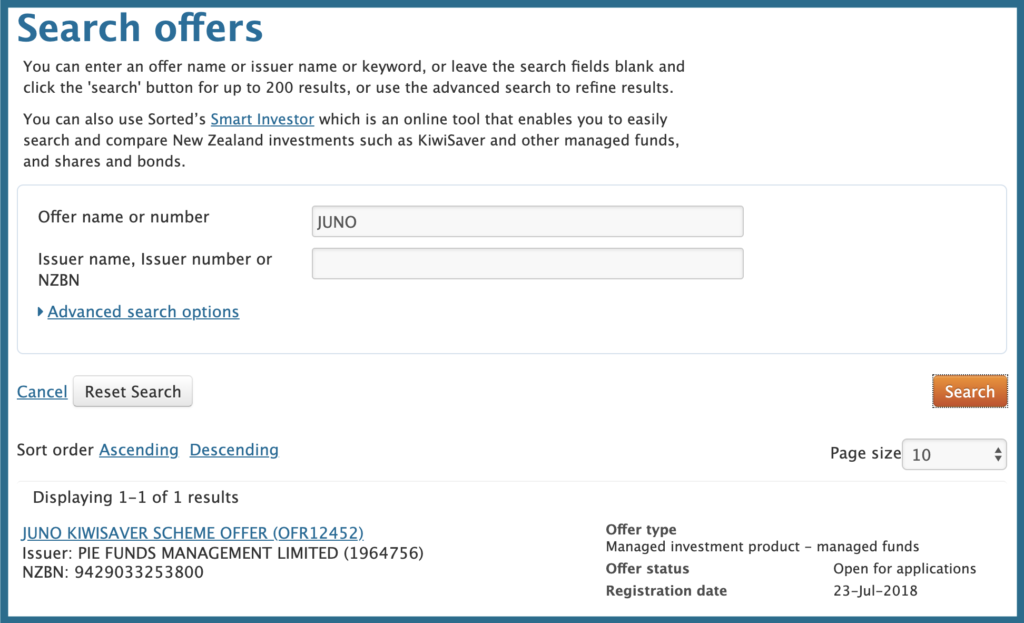

3. In the Offer name or number search box, search for the name of your fund manager. In this example, I’ll be searching for JUNO. Click Search.

4. Click the name of your fund manager/offer. In this case it’s JUNO KIWISAVER SCHEME OFFER.

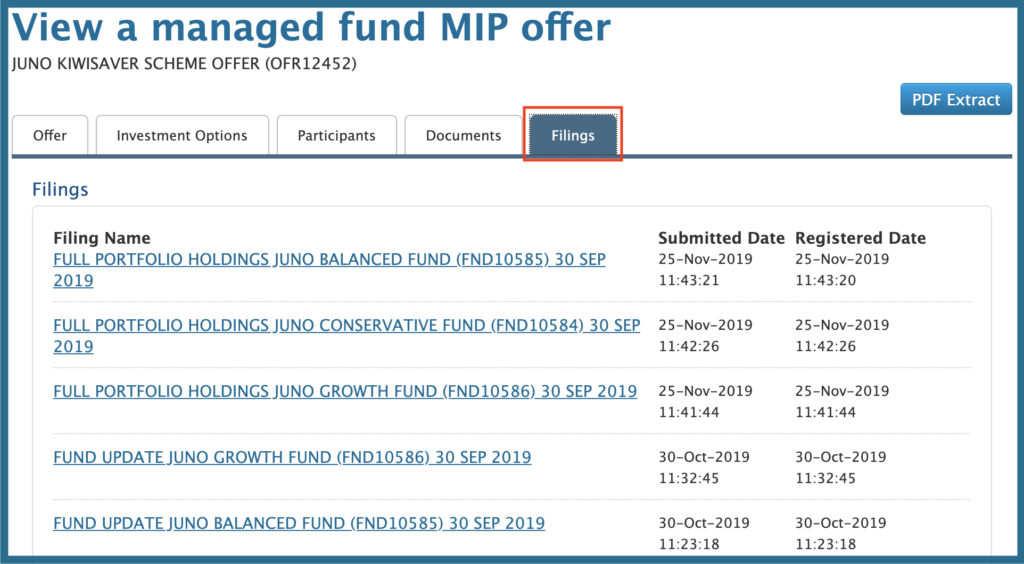

5. Go to the Filings tab. Then select the Full Portfolio Holdings filing for the fund you want to see. In this case I’ll select the Full Portfolio Holdings for the JUNO Growth Fund.

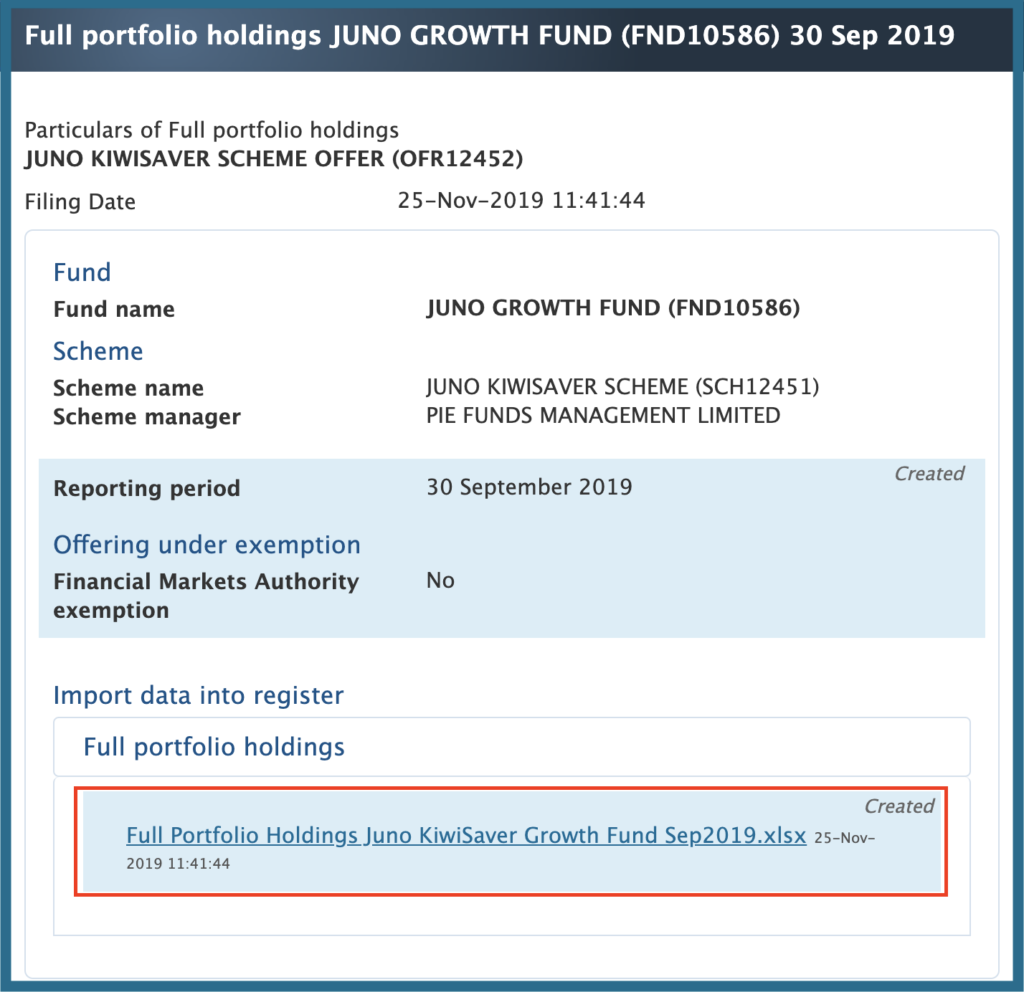

6. Go to the Import data into register section, where there will be the Full Portfolio Holdings spreadsheet.

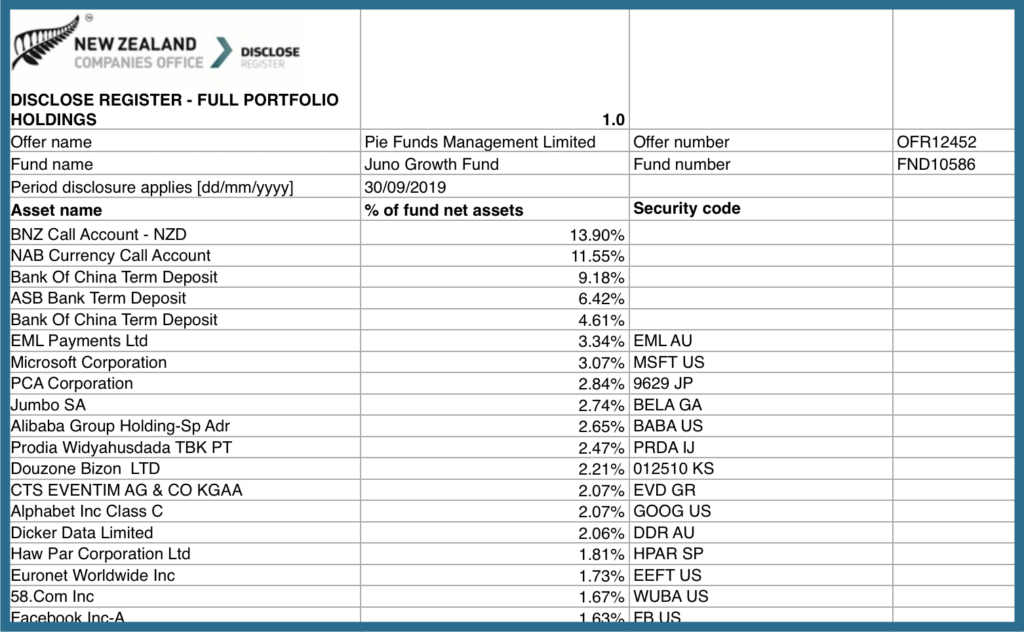

7. Open the spreadsheet to reveal the fund’s full holdings.

For those interested, here’s some more background on these Full Portfolio Holdings spreadsheets:

The Disclose Register is where Fund Managers have to regularly upload legally required fund data, such as Fund Update documents and Full Portfolio Holdings spreadsheets. In the case of the spreadsheets, these are required to be filed every 6 months as a snapshot of a fund’s full holdings as at 31 March and 30 September of each year.

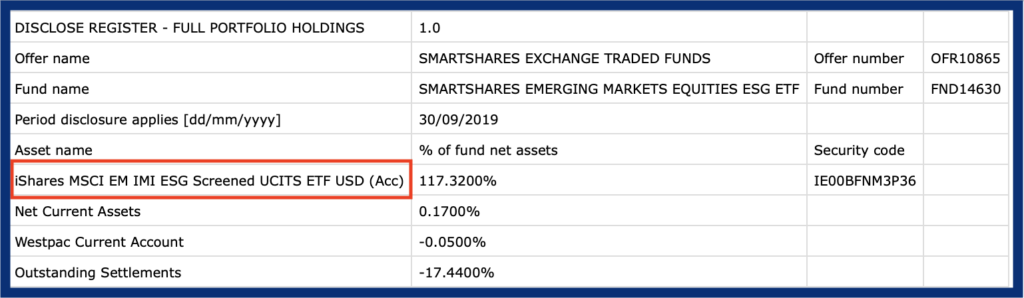

3. How to see indirect holdings

Sometimes you’ll hit a roadblock when trying to find all the companies a fund is invested in. For example, when looking at the full holdings for the Smartshares Emerging Markets ESG ETF, you’ll see the iShares Emerging Markets IMI ESG Screened UCITS ETF as its only holding. That doesn’t tell us much about the exact companies contained within the fund!

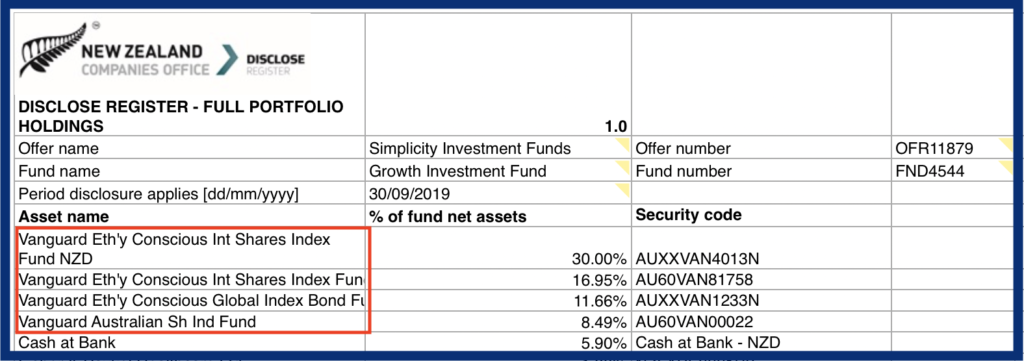

Similarly, Simplicity’s Growth Fund contains a few Vanguard ETFs:

Most Simplicity, Smartshares, and SuperLife funds have indirect holdings, mainly in Vanguard and iShares ETFs. Therefore you are going to have to dig even further to find out the exact assets these ETFs invest in! First I will show you the steps to do this for Vanguard, followed by the steps for iShares:

Vanguard

Most of Smartshares’ and SuperLife’s non-New Zealand and non-Australian Funds, and all of Simplicity’s diversified funds contain at least one Vanguard ETFs in their holdings. You can also use these steps for any Vanguard ETFs bought through Hatch. Use these steps to determine which assets are in a Vanguard ETF:

1. Determine whether the Vanguard ETF is US or Australian domiciled. As a general guide, Smartshares uses US Vanguard ETFs and Simplicity uses Australian Vanguard ETFs.

2. Based on step 1, go to Institutional site for either Vanguard United States or Vanguard Australia. Below I will show the steps for the US Vanguard site, but the steps for Australia aren’t too different.

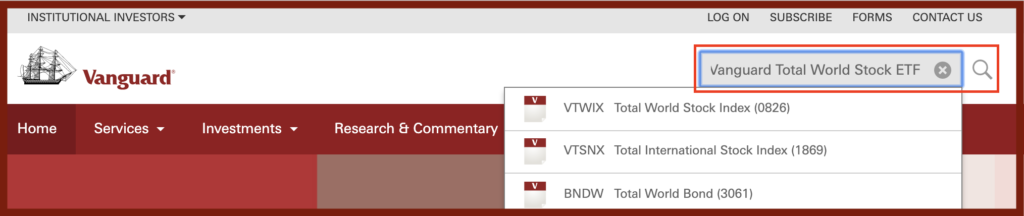

3. Search for your ETF. In this example, I am searching for the Vanguard Total World Stock ETF, used in the Smartshares Total World ETF. Select the first search result Total World Stock Index.

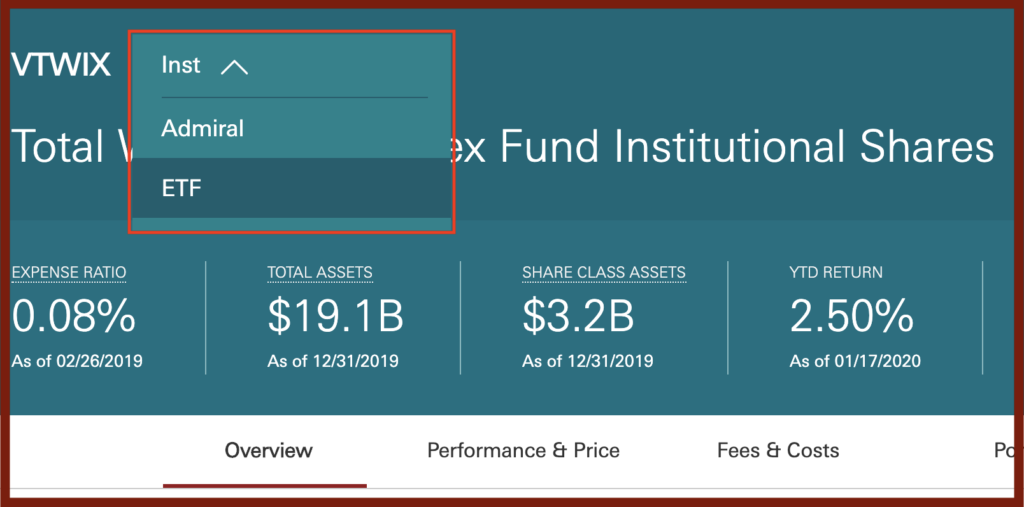

4. Make sure that the dropdown next to the fund’s ticker symbol (VTWIX) is set to ETF.

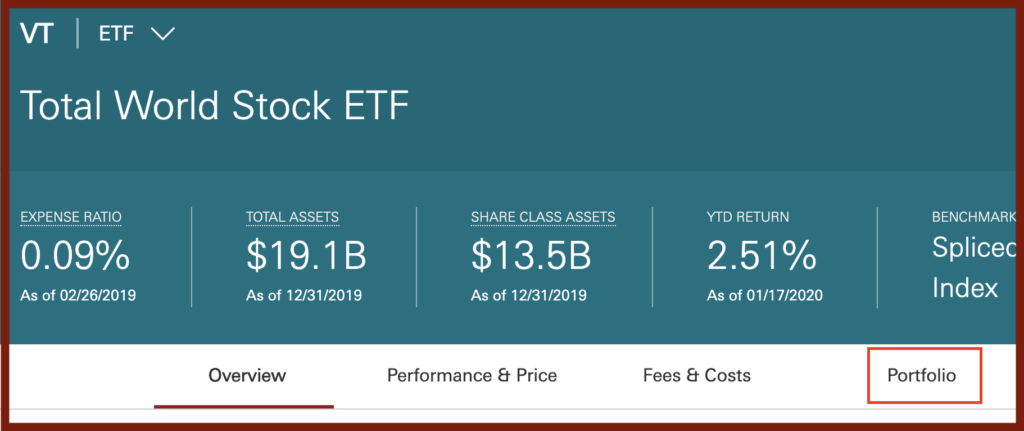

5. Once the dropdown has been set to ETF, you should arrive at the fund details page of the Total World Stock ETF (VT). Go to the Portfolio tab.

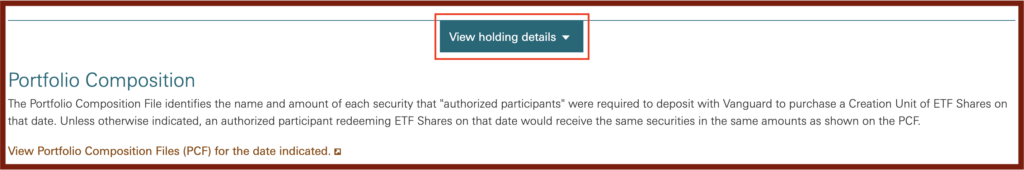

6. Near the bottom of the Portfolio section, you will find a View holding details button.

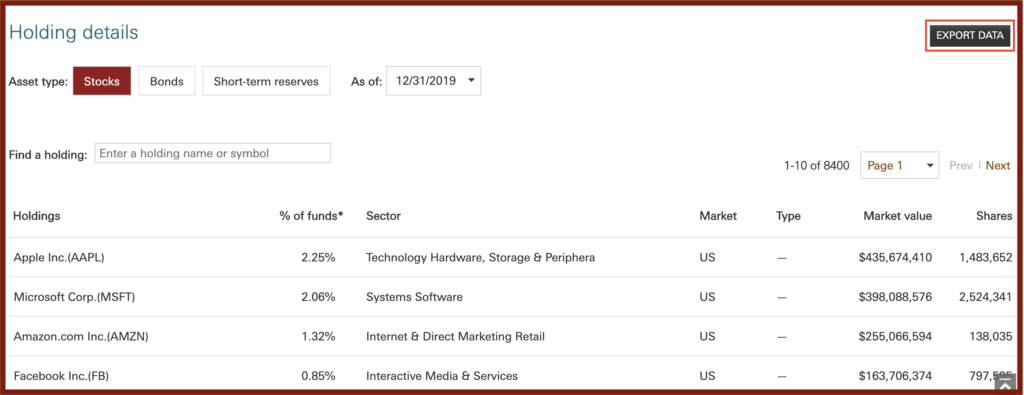

7. Clicking the button will reveal the full holdings of the ETF, which you can browse through or click the EXPORT DATA button to download all the holdings as a spreadsheet.

iShares

All of Smartshares’ “new ETFs” which were released in June 2019 contain European domiciled iShares ETFs. Use these steps to determine which assets are in an iShares ETF:

1. Go to iShares’ UK Website, and click the search icon on the top-right of the page. Those interested in US domiciled ETFs (e.g. those bought through Hatch) can use the iShares US website.

2. Search for the ETF. In this example, I am searching for the iShares MSCI EM IMI ESG Screened UCITS ETF, used in the Smartshares Emerging Markets ESG ETF. Select the relevant search result.

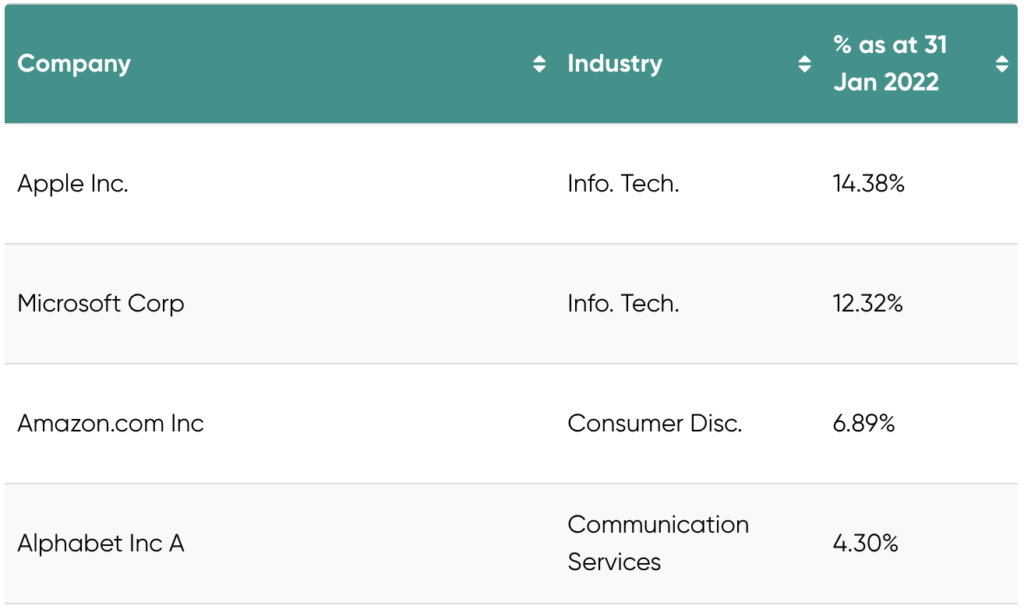

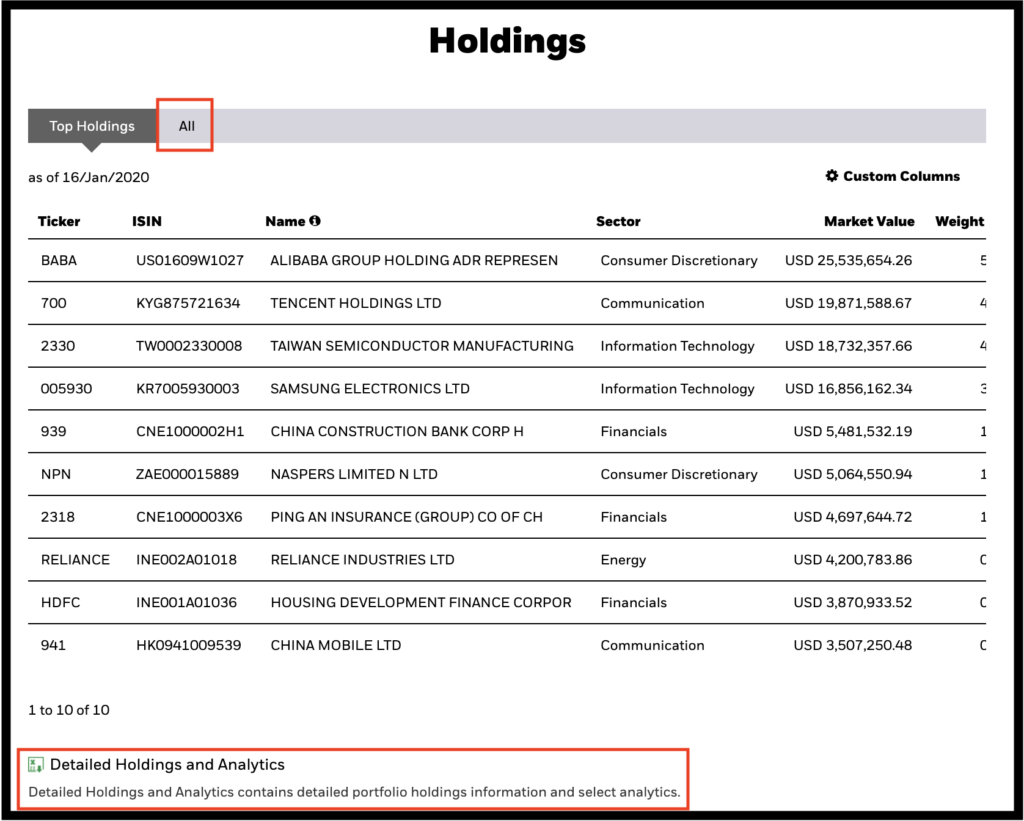

3. Scroll down to the Holdings section. Click the All tab to browse through all the holdings, or click the Detailed Holdings and Analytics link to download all the holdings as a spreadsheet.

Bonus – Going further with your research

Here’s a brief mention of a couple of other resources that can help you look into a fund’s holdings.

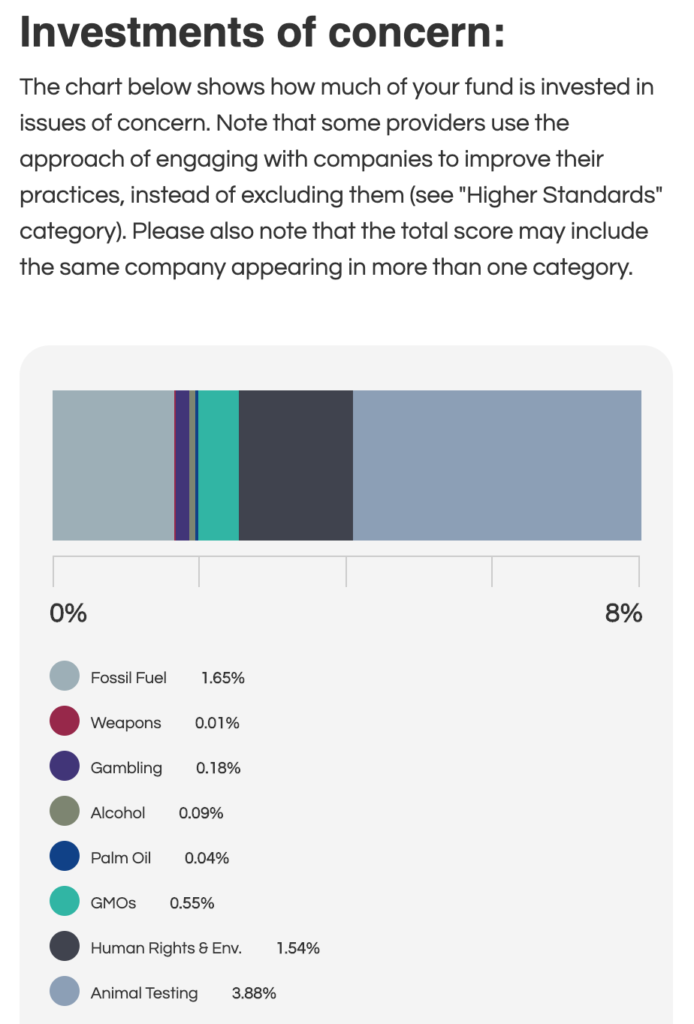

Mindful Money

Mindful Money is a handy website which allows you to analyse whether your KiwiSaver fund is invested in any undesirable industries such as fossil fuels or animal testing. The site even includes indirect holdings in its analysis! Good for seeing whether your KiwiSaver fund’s investments align with your values.

Further Reading:

– Clean and green? 5 things to know about Ethical investing

Index Providers

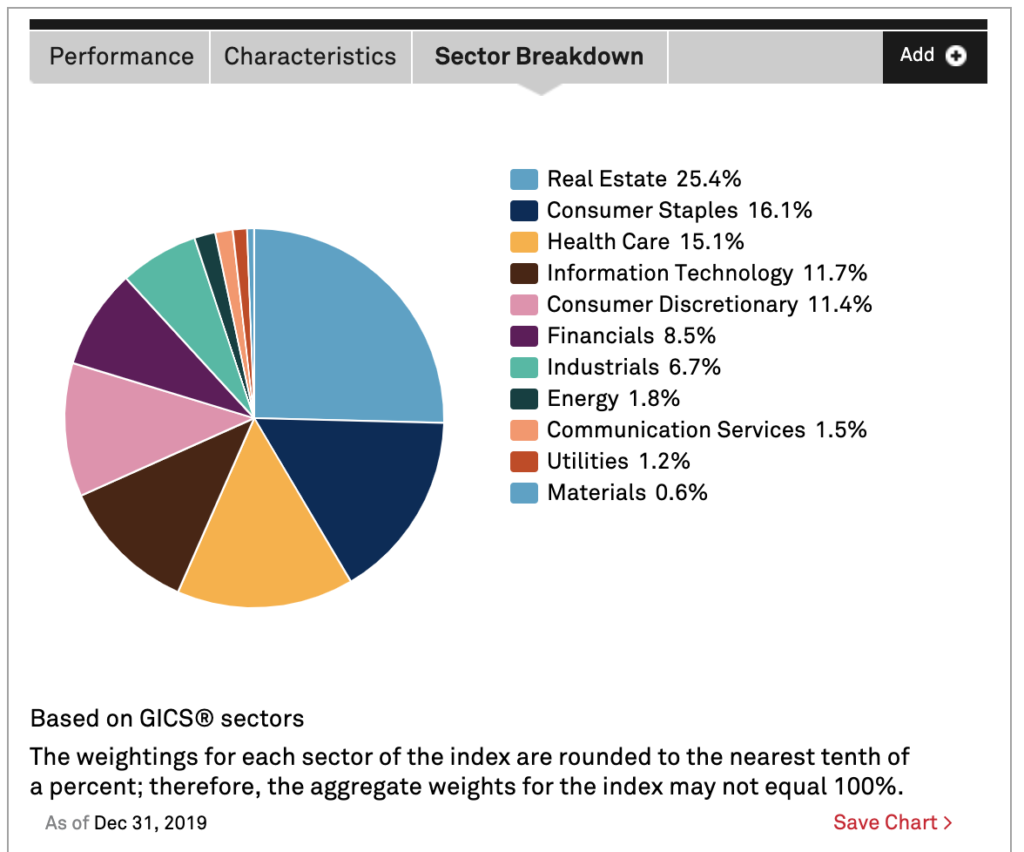

Most index funds track indices run by Index Providers such as S&P Dow Jones, MSCI, or FTSE. For example, Kernel’s Level 9 Fund invests in the S&P/NZX Emerging Opportunities Index provided by S&P Dow Jones. Once you find the name of the index your index fund is tracking (usually found on the index provider’s website or fund update document), you can then search the index provider’s website for a fact sheet containing data on a fund’s characteristics, performance, and sector breakdown.

Further Reading:

– Funds 101 – What’s the difference between an Index Fund, ETF, and more?

Final thoughts

I am disappointed that for most Fund Managers, it takes investors so many steps to find out exactly what their funds (and ultimately our dollars) are invested in. I asked Kernel‘s Dean Anderson, why fund managers are reluctant to publish this information in a more accessible manner, and he suggests:

Most managers in the market are active, and don’t want to publicly publish their holdings and reveal their investment strategies. Index funds have no material disadvantage in publishing their holdings, and therefore we encourage it.

Dean Anderson, Founder & CEO, Kernel

But given the data is already freely and publicly available, surely increasing transparency for investors is more important than trying to hide this information from competitors? So I hope fund managers can follow the likes of Kernel and Simplicity, and take steps to maximise the transparency of their fund’s investments to their current and prospective investors.

Anyway, I hope this article has given you the knowledge to go and find out all the exact assets your funds are invested in, making you a better informed investor.

Happy investing!

Follow Money King NZ

Join over 7,300 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.