Are you a fund shopaholic? Thanks to services like InvestNow and Sharesies, it’s super easy and affordable for investors to invest in lots and lots of funds. And like with most purchases we make in everyday life, we buy more and more funds with good intentions – like trying to further diversify our portfolios.

While most people manage to keep their portfolios relatively simple, there are a good number of fund shopaholics out there who don’t realise that sometimes buying more funds can actually hurt or impact their portfolio in a way they didn’t intend. So let’s start with some general insights on investing in too many funds, followed with a more detailed analysis on what having too many funds could do to your portfolio.

This article covers:

1. What’s the deal with too many funds?

2. Example analysis on investing in too many funds

3. A better approach?

1. What’s the deal with too many funds?

Two fund shopaholics

I used to be a fund shopaholic. Early last year I was the holder of twelve different funds in my InvestNow portfolio:

- AMP All Country Global Shares Index

- AMP Australasian Property Index

- AMP Global Listed Infrastructure

- Smartshares NZ Top 50

- Smartshares Australia Top 20

- Smartshares Emerging Markets

- Smartshares Automation & Robotics

- Smartshares Healthcare Innovation

- Devon Dividend Yield

- Pathfinder Global Property

- Russell Global Fixed Interest

- Nikko AM NZ Corporate Bond

Fellow personal finance blogger Rohan from Passive Income NZ has also confessed to being a bit of a fund shopaholic. His 2019 End of Year wrap up post revealed that he had eleven funds in his InvestNow portfolio:

So as a fellow fund shopaholic, I asked Rohan for his help in putting this article together, and you’ll see his insights throughout this article.

It is true that I like fund shopping, and that I had 11 funds at the end of 2019 – which is just way too many.

Passive Income NZ

We buy with good intentions

Fund shopaholics have good intentions when it comes to adding more funds to their portfolios. Here are some objectives we might be trying to achieve when buying each fund:

To have skin in the game

I figured the best way I’d learn is to just have skin in the game, rather than become overwhelmed by information paralysis.

Passive Income NZ

Many people are eager to start investing as it’s a great way to be better with money and improve our financial position. To avoid overwhelming ourselves with information and research, it’s easier to just chuck some money in a bunch of different funds, so we can get started and learn by doing.

To diversify your portfolio

I also bought a property fund to increase my diversification – the AMP Capital Australasian Property Index Fund.

Passive Income NZ

Most investors are familiar with the concept of spreading your investment across many different assets to reduce risk. Therefore we add more funds to our portfolio with the intention to gain exposure to more companies, countries, or asset classes.

To pursue new investment strategies

I also started reading up about dividend investing – some people are convinced that is the way to go. Again, to get skin in the game I purchased the Smartshares NZ Dividend fund.

Passive Income NZ

My experience with running Money King NZ has led me to believe that Kiwis are hungry for knowledge about investing. A downside of this pursuit for knowledge is that we often get exposed to new investing strategies, or information that makes us question our existing portfolios (and this article is probably guilty of adding to that!) We get excited by these new strategies and end up buying more funds in pursuit of this strategy.

Why does it matter?

Platforms like InvestNow and Sharesies don’t penalise you for buying more funds, and allow you to hold as many funds as you like. So why does investing in too many funds matter?

An important note: There is no right or wrong with having too many funds. This article is just to make you a better informed investor, about the potential downsides of having too many funds.

More time and effort

I don’t think it’s necessary a negative to have too many funds in your portfolio – if all the funds have been chosen for a specific purpose. But if you have multiple funds that overlap, they don’t really add any diversification to your portfolio – rather, they only increase the time it takes to manage your portfolio.

Passive Income NZ

A portfolio with more funds takes more time and effort to track and manage. This could be through having to track more dividend payments, spending more effort in rebalancing your portfolio, or potentially adding complexity to your tax returns. And in the rare case you decide to switch investment platforms, it would take more work to move your investments over to your new platform.

Lack of focus

In hindsight my first mistake was selecting funds based on past performance, rather than selecting funds to fit my asset allocation.

Passive Income NZ

Every fund you buy should ideally fit in with an asset allocation that suits your investment objectives. Investments spread across too many funds may mean a lack of focus on that asset allocation, and makes it harder to determine precisely what asset classes, industries, and countries your portfolio is allocated to. It also adds complexity to deciding where to invest next – deciding how to split your investment contributions between 2-3 funds is easier than deciding between 10 funds.

Can have an undesirable effect on diversification

The idea that more funds could reduce diversification might come as a surprise to you. But many funds all invest in the same companies – for example, the Smartshares NZ Top 50, NZ Mid Cap, NZ Dividend, and NZ Property ETFs all invest in Kiwi Property Group! Although you are buying more funds, you may just be concentrating your money on certain companies. A more detailed analysis on how this could happen is provided in section 2 of this article.

Can have an undesirable effect on fees

Fund Management Fees are typically charged as a percentage of the amount of money you have invested, rather than by the number of funds you own. So while owning more funds is unlikely to have a significant impact on your fees, there are a couple of things to be aware of:

- If you add a fund to your portfolio which has higher fees than your existing funds, you would increase the weighted average management fee of your portfolio.

- External services may charge more when you have more funds. For example, portfolio tracking app Sharesight charges a subscription fee if you want to track over 10 holdings.

2. Example analysis on investing in too many funds

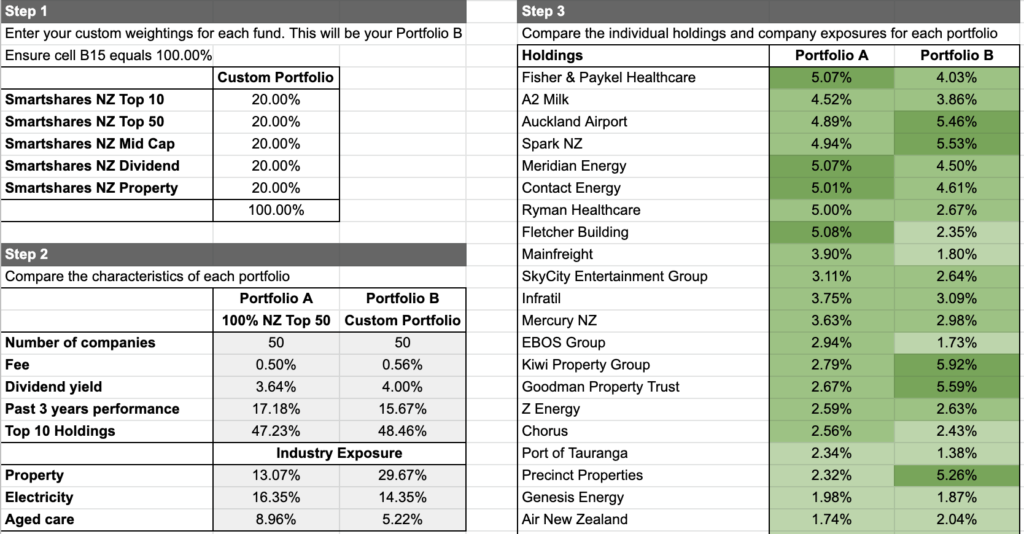

I often see many investors hold Smartshares’ NZ Top 10, NZ Top 50, NZ Mid Cap, NZ Dividend, and NZ Property funds all in the same portfolio (like in the below screenshot). Given these are all NZ Share Index Funds, is it wise to invest in all of them?

So let’s take a deeper look at how investing in all these funds could impact your portfolio, in areas such as diversification and fees. To do this analysis I’ll use four hypothetical portfolios made up entirely of domestic index funds you can get from Sharesies, and compare the characteristics of these portfolios:

A. Abby from Ashburton

Abby is only invested in one fund:

- Smartshares NZ Top 50 ETF (100%)

As shown in the table below, this portfolio gives her exposure to 50 companies, with a management fee of 0.50%. The table also shows that the top 10 largest companies in her portfolio make up 47.23% of her portfolio. And while not the most important factors, her dividend yield is 3.49% and past 3 year’s performance has been 18.17% per year.

| Companies invested in | 50 |

| Management fee | 0.50% |

| Top 10 concentration | 47.23% |

| Dividend yield | 3.49% |

| 3 year performance | 18.17% |

The below table shows how much of her portfolio is exposed to Real Estate Investment Trusts (REIT), Electricity (e.g. Genesis Energy, Trustpower), and Aged Care (e.g. Summerset, Arvida) sectors:

| REIT exposure | 13.07% |

| Electricity exposure | 16.35% |

| Aged Care exposure | 8.96% |

B. Bridget from Balclutha

Bridget has a portfolio made up of two funds:

- Smartshares NZ Top 50 (80%)

- Smartshares NZ Top 10 (20%)

Even by investing in two funds compared to Abby’s one, Bridget does not get exposure to any new companies, yet her weighted average management fee increases to 0.52%! In addition, she has further concentrated her portfolio towards the top 10 holdings, with 57.02% of her investment being in the 10 largest companies (as opposed to Abby’s 47.23%) – the opposite of diversification!

| Companies invested in | 50 |

| Management fee | 0.52% |

| Top 10 concentration | 57.02% |

| Dividend yield | 3.40% |

| 3 year performance | 17.85% |

However, Bridget’s exposure to REIT, Electricity, and Aged Care sectors does not differ significantly to Abby:

| REIT exposure | 10.46% |

| Electricity exposure | 16.92% |

| Aged Care exposure | 8.84% |

C. Claire from Cambridge

Like Abby, Claire also invests in the NZ Top 50, but decides to add a property fund in an attempt to diversify her portfolio. Claire’s portfolio looks like:

- Smartshares NZ Top 50 (80%)

- Smartshares NZ Property (20%)

This hasn’t made much of an impact on the core characteristics of the portfolio:

| Companies invested in | 50 |

| Management fee | 0.51% |

| Top 10 concentration | 44.71% |

| Dividend yield | 3.53% |

| 3 year performance | 17.98% |

However, the most interesting impact is that Claire’s exposure to REITs has blown out from 13% to 30%! This has resulted in a concentration towards investing in REITs, rather than providing actual diversification. Perhaps not the outcome Claire was looking for, unless she was intentionally looking to increase her exposure to the commercial property sector.

| REIT exposure | 30.28% |

| Electricity exposure | 13.08% |

| Aged Care exposure | 7.17% |

D. Daniel from Dargaville

Daniel has a portfolio, made up of all five of the NZ shares index funds available on Sharesies. Surely with five different funds, he is more diversified than Abby?

- Smartshares NZ Top 50 (20%)

- Smartshares NZ Top 10 (20%)

- Smartshares NZ Mid Cap (20%)

- Smartshares NZ Dividend (20%)

- Smartshares NZ Property (20%)

Even with all these funds, Daniel still only has exposure to 50 companies (the same as Abby with her single fund), and his weighted average management fee has blown out to 0.56%! Past performance has been a little lower than Abby’s portfolio too.

| Companies invested in | 50 |

| Management fee | 0.56% |

| Top 10 concentration | 48.46% |

| Dividend yield | 3.84% |

| 3 year performance | 16.54% |

In addition, Daniel has significantly concentrated his exposure towards REITs, while his investment in the promising aged care sector has reduced:

| REIT exposure | 29.67% |

| Electricity exposure | 14.35% |

| Aged Care exposure | 5.22% |

Summary of analysis

While they are completely hypothetical, these scenarios have demonstrated that adding more funds to your portfolio often doesn’t provide the effect you’re looking for. In our examples, none of our portfolios increased diversification or gave us exposure to any additional companies. Instead they just concentrated our investments on specific companies/industries, and increased our management fees:

| A | B | C | D | |

| Companies invested in | 50 | 50 | 50 | 50 |

| Management fee | 0.50% | 0.52% | 0.51% | 0.56% |

| Top 10 concentration | 47.23% | 57.02% | 44.71% | 48.46% |

| Dividend yield | 3.49% | 3.40% | 3.53% | 3.84% |

| 3 year performance | 18.17% | 17.85% | 17.98% | 16.54% |

| REIT exposure | 13.07% | 10.46% | 30.28% | 29.67% |

| Electricity exposure | 16.35% | 16.92% | 13.08% | 14.35% |

| Aged Care exposure | 8.96% | 8.84% | 7.17% | 5.22% |

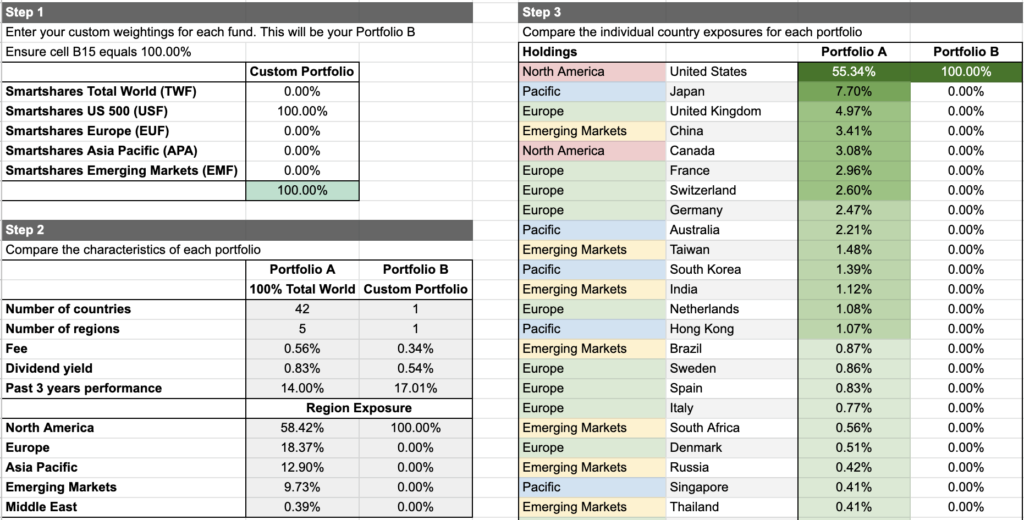

So which portfolio out of A, B, C, or D is best? In the end it comes down to personal preference – maybe you genuinely want to concentrate your portfolio towards a specific sector. But my opinion is that portfolio A (investing solely in the NZ Top 50) is best, as there are better ways to diversify your portfolio – such as investing in international funds like the Smartshares Total World ETF to diversify your portfolio globally.

Resources

Want to do your own analysis on a portfolio of NZ Share Index Funds? Check out this spreadsheet which allows you to compare the Smartshares NZ Top 50 ETF, with your own custom portfolio (you must have a Google account to use the spreadsheet).

Or check out this spreadsheet which allows you to do your own analysis on International Share Index Funds, comparing the geographical exposure of the Smartshares Total World ETF, with your own custom portfolio (you must have a Google account to use the spreadsheet).

The following article Beyond the top 10 – How to see everything your fund is invested in may also help with your research.

3. A better approach?

Designing a new portfolio

Over the time that I have been investing, and writing my blog I have learned that you should keep you investments simple but deliberate. Focus on low fees and allocation to match what type of investor you are.

Passive Income NZ

There is no perfect number of funds to have in your portfolio, as this is a personal choice based on personal preferences, investing strategy, and objectives. But in any case, you’d ideally want things to be low cost, diversified, simple, and deliberate, as Rohan suggests above. Here’s how I’d approach it (assuming I’m investing for the long-term):

First, I would start with a core of 1-2 funds that make up the bulk of your portfolio. For this core I would choose funds that gave very broad coverage of the market, therefore excellent diversification by just investing in a couple of funds. Examples are:

- Global shares – Vanguard International Shares SE Index , AMP All Country Global Shares Index, Smartshares Total World

- Domestic shares – Smartshares NZ Top 50, AMP NZ Shares Index

Next, if you’re still itching to add more funds to your portfolio, you could add “satellite” investments based on your personal preferences. Perhaps you want to get more exposure to a specific industry (like property or healthcare), a specific country (like US or Australia), or companies with specific characteristics (like high dividend paying companies). An 80%-20% split between your core and satellite funds would be a good starting point, which you can then adjust however you like.

Further Reading:

– 6 ways to build a long-term investment portfolio in New Zealand

– 4 steps to create an incredibly simple long-term investment portfolio

Sell your excess funds

Over time I will start to cull funds – I just need to get over my fear of selling.

Passive Income NZ

Letting go of your excess or redundant funds to tidy up your portfolio can be a difficult thing to do. I have personally struggled to sell off funds, due to FOMO – the fear of missing out on great returns from that fund, or being worried about selling at the wrong time.

However, you simply have to bite the bullet and overcome your fear of selling. Don’t worry about timing the sale of your old funds, or the purchase of new funds, otherwise you’ll never find a perfect time. And my experience is that you won’t miss your old funds once they’re gone – so just sell them and don’t look back.

Conclusion

While there is nothing wrong with being a fund shopaholic, I firmly believe in keeping things simple when it comes to investing. This way your portfolio is more focussed, you’ll have a better idea of where your money is allocated, and you’ll spend less time and effort on managing your investments. In addition, funds are designed to be diversified, even as a standalone investment product, given they invest in many different assets. Therefore you don’t need a lot to be a well diversified investor.

I have personally gone from 12 funds to just two, following the principles of simple, low-cost index fund investing. It may seem unexciting, but I definitely feel the portfolio is more focussed and requires a lot less thinking about. And as many people say, boring investing is good investing:

If investing is entertaining, if you’re having fun, you’re probably not making any money. Good investing is boring.

George Soros

So even though the ideal investment portfolio might be boring, doesn’t mean we can’t have fun talking about investing! So let’s finish up this article with a fun fact:

The average InvestNow and Sharesies investor holds between 4 and 5 funds, while one InvestNow customer is in over 120 funds!

InvestNow and Sharesies (via Twitter)

Thanks to Rohan for sharing his insights for this article. You can check out his blog Passive Income NZ here.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Thanks heaps once again Money King NZ.

I have the following Smartshare funds: MDZ, NPF, TNZ, AUS, NZG, USF, USG, USV and USM. I also have Pathfinder Global Water Fund, Macquaire Global Shares and Milford Trans-Tasman equity fund wanted to diversify from Smartshare funds. These are mainly through InvestNow and yes, you are right. Platforms like these have made it so easy to invest, I have become a Fundaholic 🙂 . Upon reading your article, I have realised am paying excess management fees by having 12 funds!

Planning to get rid of TNZ and NPF. Can you please let me know if MDZ and NZG have the same exposure? MDZ has preformed really well in the last 2-3 years.

In terms of US ETF’s, what do you recommend I get rid of? USF, USG, USV and USM. USV, USM and USF have all done really well.

Hi Srikar, in regards to your NZ funds, NZG is the broadest one as it covers all 50 companies in the NZX 50 index. MDZ pretty much just covers the 11th to 50th largest companies in that same index, so has exposure to the same companies (though it’s useful if you intentionally wanted more exposure to the smaller companies on the NZX).

For your US ETFs, USF is similar to NZG in that it’s the broadest fund covering the S&P 500 index. USG and USV will overlap with USF quite a bit given they essentially invest in a subset of companies within the S&P 500 (one focussing on growth companies, the other on value companies). USM is a bit different, containing smaller US companies so significantly less overlap with USF.