Most KiwiSaver providers take a “three sizes fit all” approach in the funds they offer, with investors having to choose from either a “Conservative”, “Balanced”, or “Growth” fund to invest their retirement (or first home) money in. However, there are a small number of providers who offer increased flexibility by enabling their members to choose specific assets to invest their KiwiSaver money into.

In this article I’ll be reviewing three KiwiSaver providers – InvestNow, SuperLife, and Craigs Investment Partners – who all enable investors to “build their own” KiwiSaver portfolio out of a wide selection of investment options. What are the options, the fees, and who are these providers suitable for?

This article covers:

1. What’s on offer?

2. What are the fees?

3. Performance

4. Other considerations

Update (9 October 2021) – InvestNow KiwiSaver has added 3 new fund options.

1. What’s on offer?

Traditional KiwiSaver providers typically offer the three following types of pre-built funds:

- Conservative: invests in mostly bonds and cash to reduce volatility and preserve capital, making these funds best for shorter-term investment.

- Balanced: invests roughly evenly between bonds and shares, making these funds best for medium-term investment.

- Growth: invests in mostly shares to achieve higher growth (although with higher volatility), making these funds best for long-term investment.

Apart from choosing between these three types of funds, investors do not get a say in the mix of assets or asset classes these funds invest into.

“Build your own” KiwiSaver providers take a different approach by enabling investors to decide which assets make up their portfolio out of a selection of investment options. The benefits of this approach are more control over your KiwiSaver investment, and better alignment of your portfolio to your needs and preferences. For example, there may be a particular asset class or company you want more exposure to, a specific investment you want to avoid, or a desire to be more aggressive in your KiwiSaver (i.e. invest 100% of your portfolio into shares, given “Growth” funds usually only invest up to 80% in growth assets).

So what are the investment options of our three “build your own” providers?

InvestNow

InvestNow KiwiSaver enables investors to build a portfolio from 33 investment options. All options are funds from 12 different fund managers such as AMP, Milford, and Fisher Funds. The selection includes both actively and passively managed funds, and covers different asset classes.

The following table summarises the funds on offer:

| Asset class | Active funds | Passive funds | Total |

| Diversified | 10 | 3 | 13 |

| Cash | 1 | 0 | 1 |

| Fixed Interest (bonds) | 5 | 1 | 6 |

| Australasian Shares | 4 | 1 | 5 |

| International Shares | 4 | 1 | 5 |

| Listed Property/REITs | 2 | 1 | 3 |

| Total | 26 | 7 | 33 |

Examples of funds in each asset class:

- Diversified (a fund which invests in multiple asset classes) – Foundation Series Growth Fund (investing mostly in shares, with a small allocation to bonds), Milford Conservative Fund (investing mostly in bonds, with a small allocation to shares)

- Fixed Interest – Russell Investments Global Fixed Interest Fund

- Australasian Shares – Mint Australasian Equity Fund

- International Shares – AMP Capital All Country Global Shares Index Fund

- Listed Property – Salt Enhanced Property Fund

While there is good coverage of different asset classes and geographies, a very minor point is that InvestNow’s selection could be more coherent. Rather than all the funds complementing each other, they often compete with each other – for example InvestNow offers three different Australasian equity funds from three different competing fund managers (Mint, Castle Point, and Harbour). While it is good to have a choice between fund managers, there would be limited value for an investor to have three different Australasian equity funds in their portfolio.

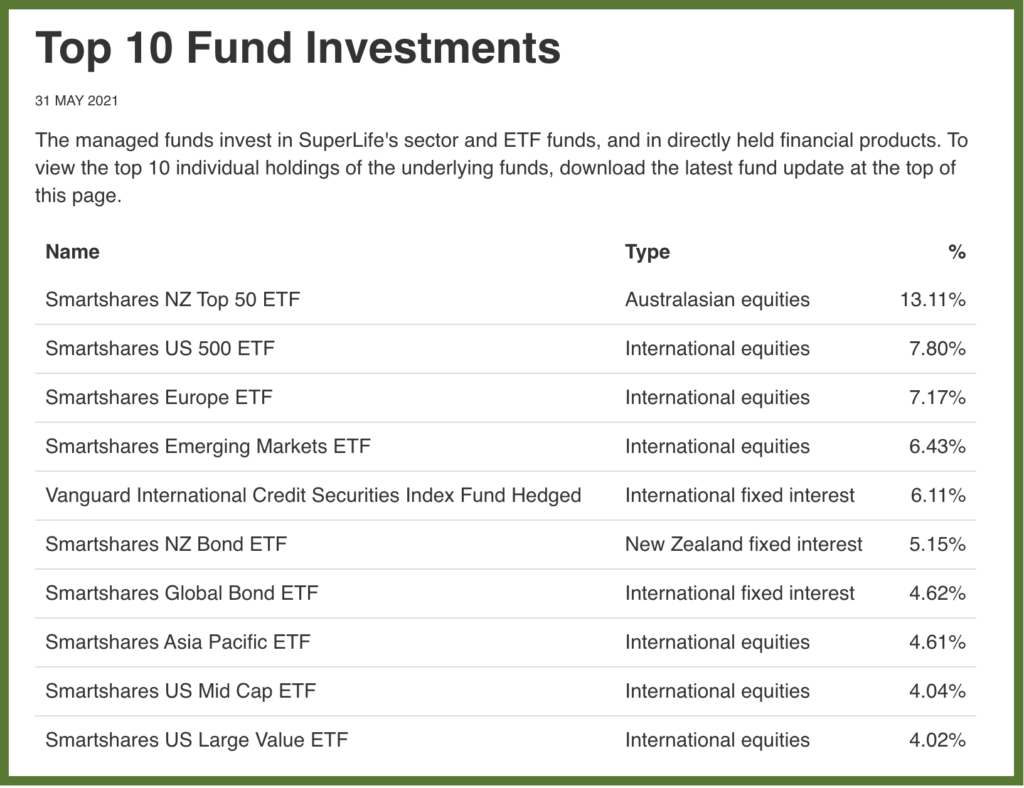

SuperLife

SuperLife‘s KiwiSaver scheme offers the “My Mix” strategy, which enables investors to build a portfolio from 42 investment options – 7 diversified funds, and 35 sector specific funds:

| Asset class | Number of options |

| Diversified | 7 |

| Cash | 2 |

| Fixed Interest (bonds) | 5 |

| Australasian shares | 13 |

| International shares | 12 |

| Listed Property/REITs | 3 |

Sector specific funds mostly mirror Smartshares’ ETF range. For example, the Total World Fund invests entirely into the Smartshares Total World ETF, and the NZ Top 10 Fund invests entirely into the Smartshares NZ Top 10 ETF. However, a few Smartshares ETFs are unavailable through SuperLife like the thematic Automation and Robotics and Healthcare Innovation ETFs, and their ESG ETFs.

Notable exceptions to the above rule are:

- Global Property Fund – includes a 50% allocation to a Vanguard international property index fund

- Overseas Non-government Bonds Fund – invests in the Vanguard International Credit Securities Index Fund

- UK Cash Fund – invests almost entirely in UK cash

And the following which compile multiple ETFs into one fund:

- Australian Shares Fund – Compilation of 7 Smartshares Australian shares ETFs

- Overseas Shares Fund (Hedged & Unhedged) – Compilation of 8-9 Smartshares international shares ETFs

The Diversified options (Income, Conservative, Balanced, Growth, High Growth, Ethica, and the externally managed Castle Point 5 Oceans Fund) are mostly made up by packaging multiple Smartshares ETFs + some Vanguard funds into one fund. For example, the SuperLife Growth Fund primarily invests in share ETFs with a smaller allocation to bond ETFs.

Overall SuperLife’s selection is well-rounded and most funds complement each other, with excellent coverage of different asset classes and geographies. However, investors should take care to avoid overlaps as many funds invest in very similar underlying assets. For example, the NZ Shares Fund and the NZ Top 50 Fund both strangely invest entirely in the Smartshares NZ Top 50 ETF – and to make things more confusing, these funds invest in the exact same underlying companies as the S&P/NZX 50 Fund (although with different weightings towards each company).

Further Reading:

– More funds = less diversification? Are you investing in too many funds?

SuperLife also has a somewhat traditional KiwiSaver offering, with a few pre-built funds to choose from:

- Age Steps – a scheme where your asset allocation changes automatically based on your age, investing aggressively for young investors, and becoming increasingly conservative after each decade of your life

- 6 Diversified options – Income, Conservative, Balanced, Growth, High Growth, and Ethica (an ethical fund)

- A Cash fund

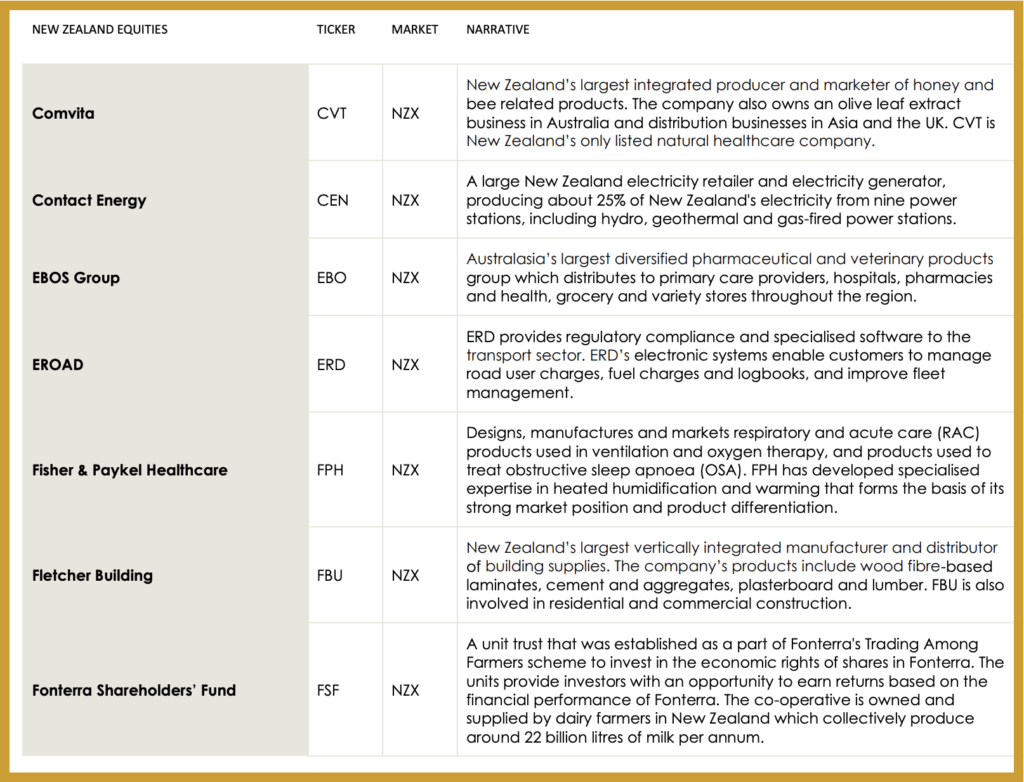

Craigs Investment Partners

The Craigs KiwiSaver scheme offers a massive 210 investment options to build a portfolio from. I have categorised these into four asset classes:

| Asset class | Number of options |

| Individual companies | 118 |

| Exchange Traded Funds (ETFs) | 33 |

| Investment trusts and managed funds | 43 |

| Real Estate Investment Trusts (REITs) | 16 |

Here’s a further breakdown of each asset class:

Individual Companies

| Subclass | Options | Example(s) |

| NZX listed companies | 43 | Fisher and Paykel Healthcare Mainfreight Spark |

| ASX listed companies | 37 | Commonwealth Bank Woothworths Xero |

| International listed companies | 38 | Amazon Disney Unilever |

ETFs

| Subclass | Options | Example(s) |

| NZX listed ETFs | 5 | Smartshares NZ Top 50 Fund |

| ASX listed ETFs | 1 | SPDR S&P/ASX 200 Fund |

| International listed ETFs | 27 | Vanguard Total World Stock ETF SPDR Gold Shares ETF iShares 20+ Year Treasury Bond ETF |

Investment trusts and managed funds

| Subclass | Options | Example(s) |

| NZ managed funds | 16 | QuayStreet Income Fund Milford Active Growth Fund |

| Australian funds | 2 | Australian Foundation Investment Co |

| International funds | 25 | Worldwide Healthcare Trust Bankers Investment Trust JP Morgan Indian Investment Trust |

Real Estate Investment Trusts

| Subclass | Options | Example(s) |

| NZX listed REITS | 8 | Investore Vital Healthcare Property |

| ASX listed REITs | 6 | Scentre Group |

| International REITs | 2 | TR Property Trust |

While you can’t FOMO into Gamestop or AMC shares with your KiwiSaver money, Craigs’ wide range of investment options is still unrivalled. The main limitations are the small selection of international companies (relative to the vast size of international markets), and few fixed interest investments for more conservative or shorter-term investors. However, there are a few interesting options like a gold ETF.

2. What are the fees?

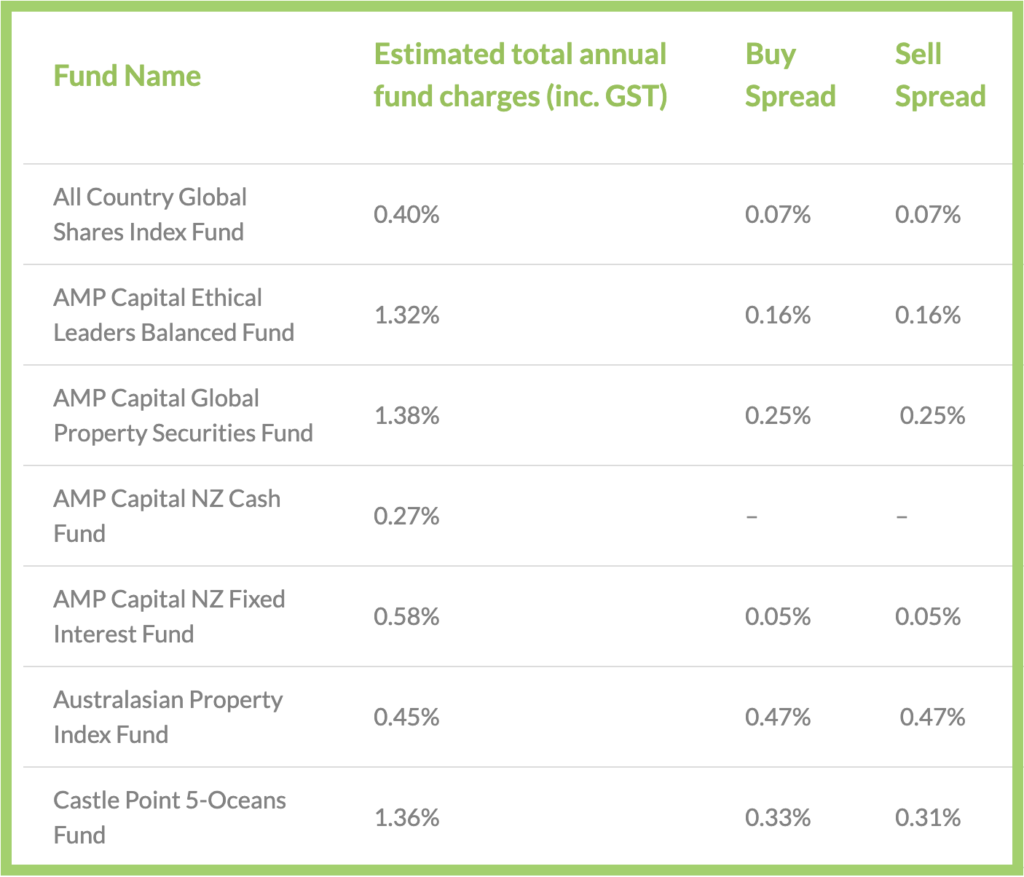

InvestNow

Fund management fees – This is a percentage fee based on the dollar amount you’ve invested in each fund. This ranges from 0.27% per annum (for the AMP Capital NZ Cash Fund) to 1.53% per annum (for the Russell Investments Hedged Global Shares Fund). For passively managed funds the management fee ranges from 0.33% (AMP NZ Shares Index Fund) to 0.45% (AMP Capital Australasian Property Index Fund).

This fee is not charged by InvestNow, but rather by the fund’s manager to cover the costs of managing that fund (although InvestNow may receive a commission from the fund manager). The fee is not an out of pocket expense, but rather it is reflected as a very small reduction in the unit price of the funds you’ve invested in.

Buy/sell spread – Many of InvestNow’s funds have a buy/sell spread. The spread applies each time you buy or sell units in a fund. For example, the spread for the AMP All Country Global Shares Index Fund is 0.07%. That means:

- When you buy units in the fund, you buy them at a 0.07% premium to the current unit price. If the unit price was $1, you would pay $1.0007 to buy each unit.

- When you sell units, you sell them at a 0.07% discount to the current unit price. If the unit price was $1, you would sell each unit at a price of $0.9993.

Spreads are charged to cover the transaction costs of buying into or selling out of a fund and typically range from 0.05% to 0.10%. However some spreads are quite high, coming in at 0.47% for the AMP Capital Australasian Property Index Fund, and 0.44% for the AMP Capital NZ Shares Index Fund.

Lastly, Milford’s funds charge a “swing pricing adjustment” which works similar to a spread by adjusting the unit price up or down depending on the flow of investor money into or out of the fund.

Example

Ivan has $45,000 invested in InvestNow KiwiSaver. He invests an additional $5,000 at the very start of the year. His asset allocation is:

– 80% AMP All Country Global Shares Index Fund

– 20% AMP NZ Shares Index Fund

Over the year Ivan’s fees are:

– $7.20 for the buy spreads on the $5,000 invested at the start of the year

– $192.97 in fund management fees

For a total of $200.17 or 0.40% in fees

The lack of administration fees makes InvestNow one of the cheapest KiwiSaver options depending on the mix of funds you invest in, making the below comparison worthwhile:

InvestNow vs Simplicity fees

InvestNow offers the Foundation Series Growth Fund and Foundation Series Balanced Funds (both with 0.37% fees) which are similar in asset allocation to Simplicity’s Growth and Balanced Funds (both with 0.31% management fees + a $20 annual membership fee). Assuming a portfolio invested 100% into either one of these Foundation Series funds, InvestNow works out cheaper than Simplicity (and any other KiwiSaver scheme in the country) for balances up to $33,333.

Further reading:

– Simplicity vs JUNO vs BNZ – Battle of the low cost KiwiSaver funds

– InvestNow Foundation Series vs Simplicity funds – Tax leakage an issue?

SuperLife

Administration fee – This is a fixed $30 per year.

Fund management fees – This ranges from 0.49% per annum (for the UK Cash fund) to 1.44% per annum (for the Castle Point 5 Oceans Fund), with most funds charging between 0.54% to 0.59%.

Example

Sally has $45,000 invested in SuperLife KiwiSaver. She invests an additional $5,000 at the very start of the year. Her asset allocation is:

– 20% S&P/NZX 50 Fund

– 60% Total World Fund

– 20% NZ Bonds Fund

Over the year Sally’s fees are:

– $30 in administration fees

– $287 in fund management fees

For a total of $317 or 0.634% in fees

SuperLife’s relatively simple fee structure puts them firmly on the cheaper side of KiwiSaver providers, but they are not as low as the likes of Simplicity or BNZ’s KiwiSaver scheme.

Craigs

Administration fees – $45 per year, comprising an up to $30 admin fee + approximately $15 of scheme expenses (covering regulatory and transaction charges)

Management fee – Charged by Craigs as a percentage of your balance invested in each asset class:

- Cash: No management fee for balances under $10,000, and 0.35% for balances over $10,000

- NZ Managed funds: No management fee for QuayStreet funds, and 0.35% for all other NZ managed funds

- Listed securities (individual shares, ETFs, REITs, most investment trusts): tiered fee depending on amount invested

| Amount invested in listed securities | Management fee |

| $0 – $250,000 | 1.25% |

| $250,001 – $750,000 | 1.00% |

| $750,001 – $2,500,000 | 0.75% |

| $2,500,001 and above | 0.25% |

Brokerage – Up to 1.25% of your transaction value when you buy or sell an investment option

Fund management fees – Individual assets (ETFs, managed funds, and investment trusts) may incur their own management fee. This fee is not charged by Craigs but rather by the fund manager of that ETF or fund. For example, the QuayStreet Growth Fund has an estimated management fee of 1.28% per annum.

Example

Caroline has $45,000 invested in Craigs KiwiSaver. She invests an additional $5,000 at the very start of the year. Her asset allocation is:

– 20% QuayStreet Growth Fund

– 25% EBOS Group

– 25% Apple

– 25% Contact Energy

– 5% cash

Over the year Caroline’s fees are:

– $45 in administration fees

– $46.88 in brokerage on the $5,000 invested at the start of the year

– $467.15 in management fees

– $128 in underlying fund management fees on the QuayStreet fund

For a total of $687.03 or 1.374% in fees

Craigs’ KiwiSaver fees are amongst the highest in the country. They’re clearly not competing with low cost providers, but rather they’re targeting customers who want a premium product.

One last item to note somewhat related to fees is tax. The structure of Craigs KiwiSaver means that investors are taxed at a flat rate of 28%. Investors who fall into lower tax brackets may find other KiwiSaver schemes more suitable as they allow you to elect a lower tax rate.

3. Performance

It is impossible to say which of the three providers will deliver the best performance, given the flexibility each of them has. Performance will vary from individual to individual depending on what funds or shares you’ve picked for your portfolio.

For example in the Craigs scheme:

- The best return you could have possibly made in the last 5 years is 56.2% per annum if you had invested into a portfolio comprised 100% of Xero shares (the best performing investment option Craigs offers)

- The worst return you could have possibly made in the last 5 years is -40.2% per annum if you had invested 100% into SKY TV (the worst performing investment option Craigs offers)

While these returns are all theoretical (your adviser probably wouldn’t let you invest 100% into a single company), it demonstrates the potentially large variance in returns.

The below tables show the theoretical best possible and worst possible returns for each provider over the last 1 and 5 years (assuming you had invested 100% in the best and worst performing investment options in each scheme):

Best possible returns over a 1 year and 5 year period (to 30 April 2021)

| Best possible returns over 1yr | Best possible returns (p.a.) over 5yrs | |

| InvestNow | 43.76% (Russell Hedged Global Shares Fund) | 19.23% (T. Rowe Price Global Equity Growth Fund) |

| SuperLife | 44.49% (Australian Financials Fund) | 16.55% (Australian Resources Fund) |

| Craigs | 156.6% (Serko) | 56.2% (Xero) |

Worst possible returns over a 1 year and 5 year period (to 30 April 2021)

| Worst possible returns over 1yr | Worst possible returns (p.a.) over 5yrs | |

| InvestNow | -2.13% (AMP NZ Fixed Interest Fund) | 1.69% (AMP NZ Cash Fund) |

| SuperLife | -4.19% (UK Cash Fund) | -1.67% (UK Cash Fund) |

| Craigs | -61% (a2 Milk) | -40.2% (SKY TV) |

Past performance does not guarantee future results – so before you drop everything and dump all your KiwiSaver money into Xero, know that Xero won’t necessarily deliver the same returns into the future.

A better approach is to decide on which strategy you wish to take to achieve investment returns. Broadly speaking there are two strategies you can follow:

- Passive – Aims to match the average performance of the market, with the view that it’s extremely hard to beat the market consistently over the long-term. Uses low-cost index funds with the aim to minimise fees. Simplicity is an example of a passive KiwiSaver manager.

- Active Aims to beat the average performance of the market, with careful research and selection of investments. JUNO and Milford are examples of active KiwiSaver managers.

InvestNow enables investors to follow both strategies by offering a suite of passively and actively managed funds. However, I think they are most suitable for passive investors given the low fees that are on offer.

Almost all of SuperLife‘s offering is passive.

Craigs, being the most flexible scheme supports an active approach, given the opportunity to pick individual companies and funds – putting you in the driver’s seat as an active manager of your own fund! A hybrid approach is also possible, by complementing an investment in funds/ETFs with a selection of individual companies.

4. Other considerations

Advice

InvestNow or SuperLife do not offer any investment advice. It is up to yourself to research and select a mix of funds that best suits your financial situation. This research is very important as the financial impact to you could be huge if you select the wrong funds.

Craigs offers the services of a professional investment adviser as part of their KiwiSaver scheme. They can provide guidance on what shares to select and which asset classes to build your portfolio with, and are backed by a research team who analyse companies and the financial markets.

Switching

All providers allow you to change the investment options that make up your portfolio at anytime. But be aware of fees when switching. For InvestNow you may incur a spread while selling out of a fund, and again while buying into your new fund. For Craigs you will incur brokerage while selling an investment, and when buying into your new investment.

Craigs also notes that your adviser may reject your request to switch investment options if you are using your KiwiSaver account to actively trade shares. This is fair given KiwiSaver funds are primarily intended for long-term growth rather than trading for short-term profits.

Rebalancing

Rebalancing is a common practice used by fund managers and investors to bring their portfolios back in line with a portfolio’s target asset allocation. For example, a fund has a target asset allocation of 80% towards shares and 20% towards bonds – if share prices rose faster than bonds, making the actual asset allocation become 85% shares and 15% bonds, the fund would need to be rebalanced by selling some shares and/or buying some bonds to bring the asset allocation back to the target.

Investnow and Craigs do not offer automatic rebalancing of their investors’ portfolios. You can manually rebalance your investment options, but note this will incur the respective switching fees.

SuperLife automatically rebalances their investors’ portfolios on a monthly basis, although you can choose to opt-out of rebalancing.

Conclusion

Our three “build your own” KiwiSaver schemes are very unique in that they give investors such a large amount of choice. Those who want more control and flexibility over the “three sizes fits all” approach that the likes of Simplicity or JUNO offer will certainly find the InvestNow, SuperLife, or Craigs offering compelling.

InvestNow offers a wide selection of passive and active funds, and provides a strong alternative to Simplicity’s funds. However, you need to be willing to take some time to choose the right funds, especially given many of the funds compete with each other rather than complement each other. Their product should improve as it matures and as new funds come onboard.

SuperLife‘s fees are reasonable but are on the high end for passively managed funds. Their selection of investment options are well-rounded, but for most investors they are probably not unique enough to justify the higher fees.

Lastly, it isn’t really fair to compare Craigs with InvestNow and SuperLife as they target a different audience with an expensive, but premium product offering. They offer a huge selection of investment options which lets you be your own fund manager, and are backed by professional investment advice.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.