Easy Crypto, Binance, Crypto.com, Swyftx, Kiwi-Coin, Exodus, Trust Wallet, Ledger, and Trezor. Whether you’ve been investing in cryptocurrencies for a while, or you’re new, you’ve probably heard of these popular crypto services. They are all good services, but having so many options can make it difficult and confusing for investors to decide which one to use. But if you dig deeper, they are actually all quite different things, offering unique services and working in different ways:

- Exodus, Trust Wallet, Ledger, and Trezor are what I’ll call “Cryptocurrency Wallets”

- Easy Crypto is what I’ll call a “Cryptocurrency Broker”

- Binance, Crypto.com, Swyftx, and Kiwi-Coin are what I’ll call “Cryptocurrency Exchanges”

In this article I’ll be giving an overview of what each of these services do and offer, as well as giving a brief mention of fees, technical differences, and who they’re suitable for. While there’s many more cryptocurrency services out there than the ones mentioned here, this article should provide a good starting point in getting your head around some of New Zealand’s most popular services.

Update (2 October 2021) – Added Swyftx to coverage

1. Cryptocurrency Wallets

Cryptocurrency wallets provide a place to receive, hold, and send cryptocurrency.

Technically speaking (unlike the name suggests) your cryptocurrency is not actually stored on a wallet. It is actually stored on an address on the blockchain (essentially a record of all of a cryptocurrency’s balances and transactions that lives on the internet).

What a wallet really does is generate an address for your cryptocurrency and more importantly, the keys to that address. These keys give you control over the coins held in that address (i.e. the power to move the coins from one address to another), thus giving you ultimate ownership of those coins.

Exodus & Trust Wallet

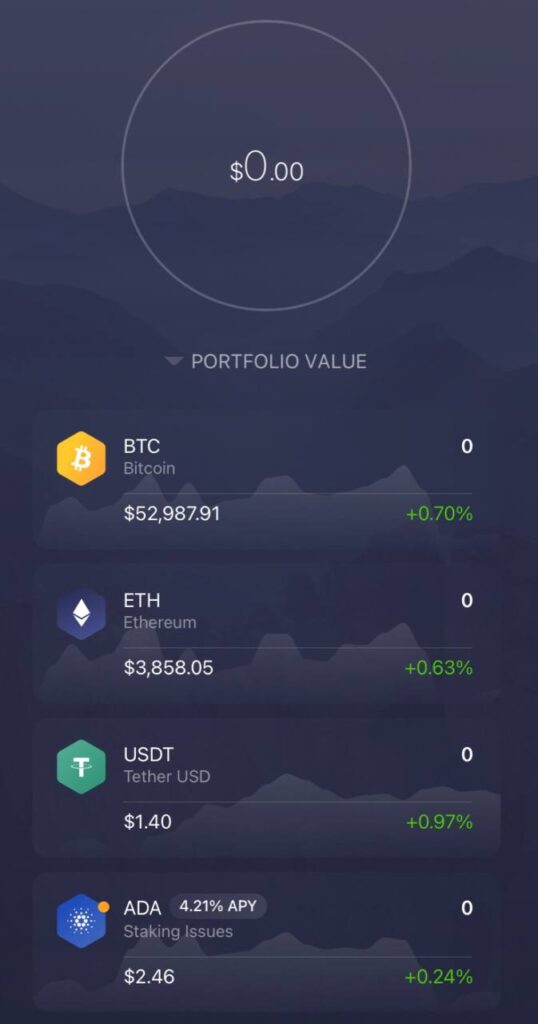

Exodus and Trust Wallet are two popular software wallets – apps that are installed on your smartphone or computer. They are multi-currency wallets, allowing you to manage multiple types of cryptocurrency (e.g. Bitcoin, Ethereum, Litecoin, Dogecoin, and many more) on one single app.

Ledger & Trezor

Ledger and Trezor are manufacturers of hardware wallets. These are small devices made for the sole purpose of being a cryptocurrency wallet. Being separate from your other internet connected devices, they offer a higher level of security compared with software wallets.

Other things to know about wallets

Other features

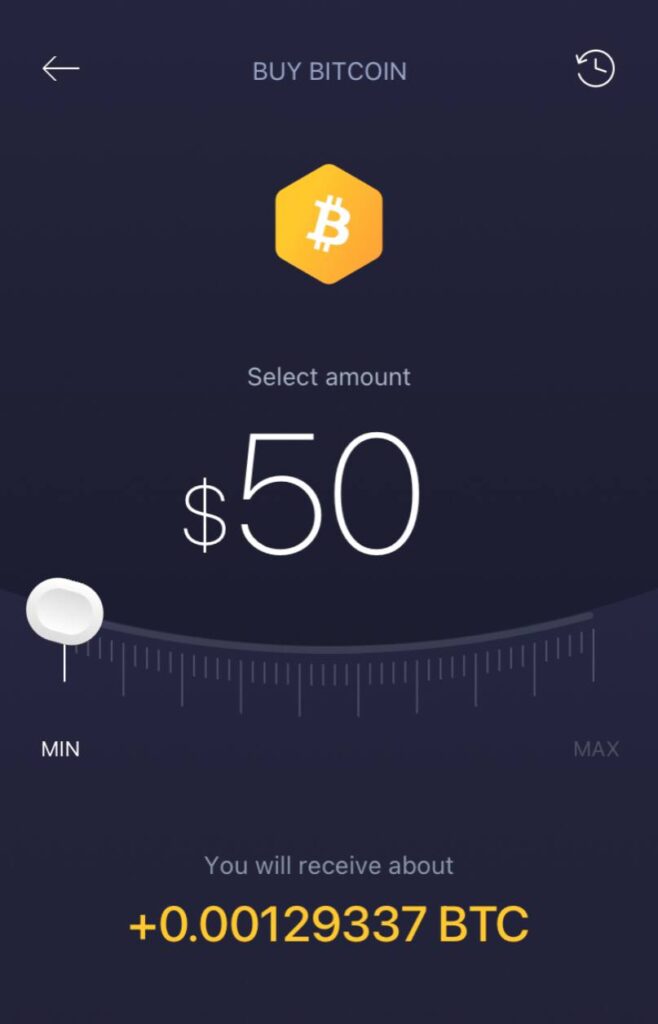

Most wallets offer additional services such as the ability to purchase cryptocurrency or swap from one cryptocurrency to another. However, these services tend to be expensive, so it’s better to use dedicated cryptocurrency brokers or exchanges to buy or swap your crypto.

Some wallets also allow you to stake your coins. This generally involves locking up your coins (to help secure the network for your cryptocurrency), and in return receiving interest on the coins you’ve staked. Different cryptocurrencies have different rules and rates for staking your coins, so it’s best to research the specific cryptocurrency you want to stake before doing so. Examples of cryptocurrencies that can be staked are Cardano, and Tezos, while the likes of Bitcoin, Litecoin, or Dogecoin cannot be staked.

Software vs hardware wallets

Software wallets store your keys on a piece of software. They are free of charge and convenient, enabling you to manage your crypto with just an app on your phone or computer – making them ideal for short-term storage or spending of your coins. The downside is that they are more susceptible to getting hacked and having your keys stolen because software wallets are installed on devices that are connected to the internet (such as your smartphone).

Hardware wallets store your keys on a physical device. Given these devices are not internet connected, they are less susceptible to malware or getting hacked. They are commonly referred to as cold storage and are ideal for long-term storage of your coins. However, the main downside is the cost involved in buying a hardware wallet, which will set you back around $150-$250.

Recovery phrase management is key!

When setting up a cryptocurrency wallet you will usually be provided with a 12 or 24 word recovery phrase. Recording your recovery phrase in a safe place and taking care of it is critical in ensuring the safety of your cryptocurrency, as it provides a way to recover your wallet in case it’s lost. For example, if you lose your smartphone with your software wallet on it you can simply set up the same wallet on a new smartphone by using your recovery phrase.

Safety tip:

Whether you’re using a software or hardware wallet, the targeting of recovery phrases is a common method that hackers use to steal your coins. A widespread way this is done is to trick you into handing over your recovery phrase e.g. by posing as a fake support representative, or making you type the phrase into a fake wallet app (like this man who lost $1 million to a fake Trezor app).

To avoid this, only type your recovery phrase into a wallet app downloaded from a reputable source. For hardware wallets, only enter your recovery phrase into your hardware device itself (e.g. if you’re using a Ledger wallet, only enter the recovery phrase into your Ledger device. The Ledger Live app will never ask you for your recovery phrase). And never give your recovery phrase to anyone alleging to be a wallet support representative.

Fees

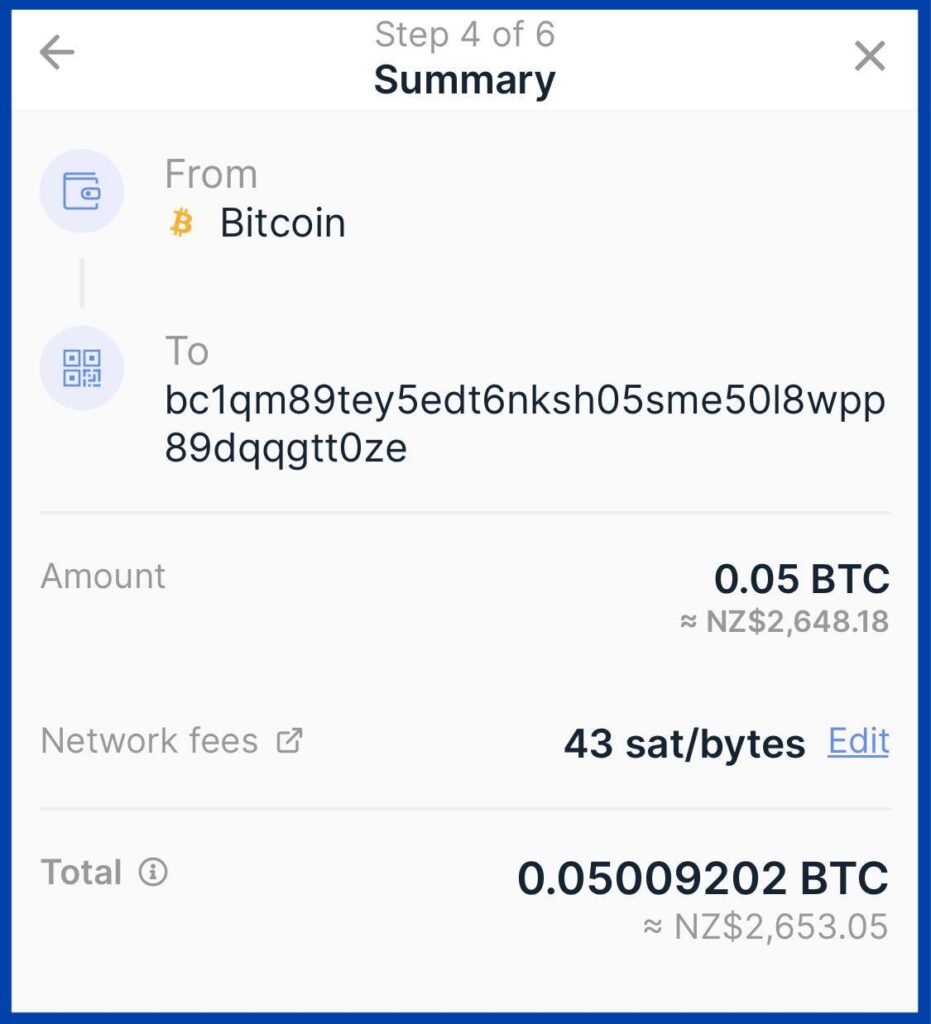

You will encounter fees when you send/withdraw your crypto from your wallet to another destination such as another wallet, an exchange, or a broker. This fee to send your crypto is known as a network fee.

Network fees are not charged by the wallet, but rather by the network of the cryptocurrency you are sending to cover the cost of transferring your crypto from one address to another. The fee depends on the congestion of the cryptocurrency network you’re using. For example, the Bitcoin network has a large number of transactions with relatively low capacity, making Bitcoin transaction fees relatively high. Ethereum faces a similar issue having a popular, congested network.

Most wallets will allow you to set custom fees to send Bitcoin (and sometimes Ethereum), however setting a fee too low may result in your transaction being very slow to process or even getting stuck – given transactions paying higher fees are processed sooner than transactions paying lower fees.

2. Cryptocurrency Brokers

Cryptocurrency brokers provide the ability to buy crypto with your fiat currency (i.e. New Zealand Dollars). They also allow you to sell your crypto for fiat currency. They provide an easy way to convert your money back and forth between fiat and crypto.

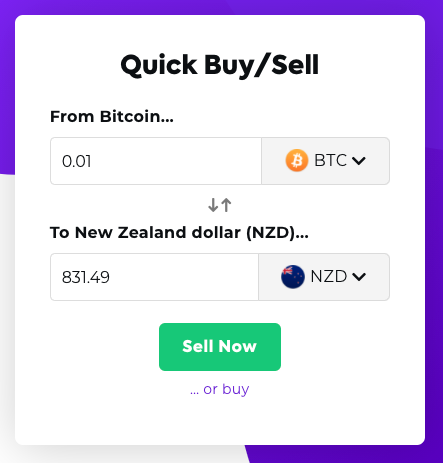

Easy Crypto

Easy Crypto allows you to buy a wide range of cryptocurrencies with New Zealand Dollars. Their minimum purchase amount is $100. Easy Crypto is non-custodial – they do not hold any coins you’ve purchased through them. Instead you must set up your own wallet and have the coins sent to your wallet after every purchase. Therefore, Easy Crypto is essentially a middleman arranging the end-to-end process of purchasing cryptocurrency for you, including foreign exchange, sourcing the crypto, and having the crypto sent to you.

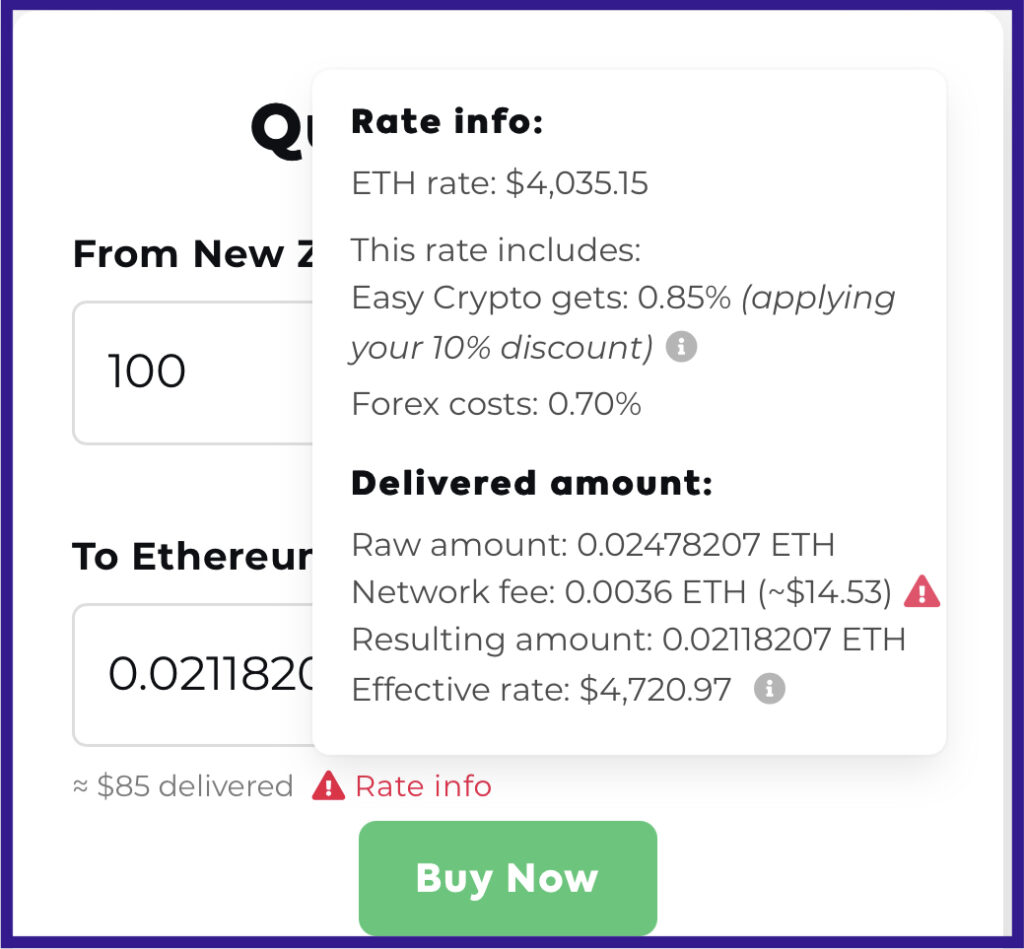

Because you need to have your coins sent to your wallet after every purchase, it’s important to be aware of the network fees you must pay to have the coins sent (the fee is not charged by Easy Crypto, but by the respective network of each coin):

- Buying Ethereum (or Ethereum based tokens such as USDT) can be problematic given Ethereum’s high network fees. Given the fee is a fixed amount (currently around $30), it is much more cost effective to buy larger amounts.

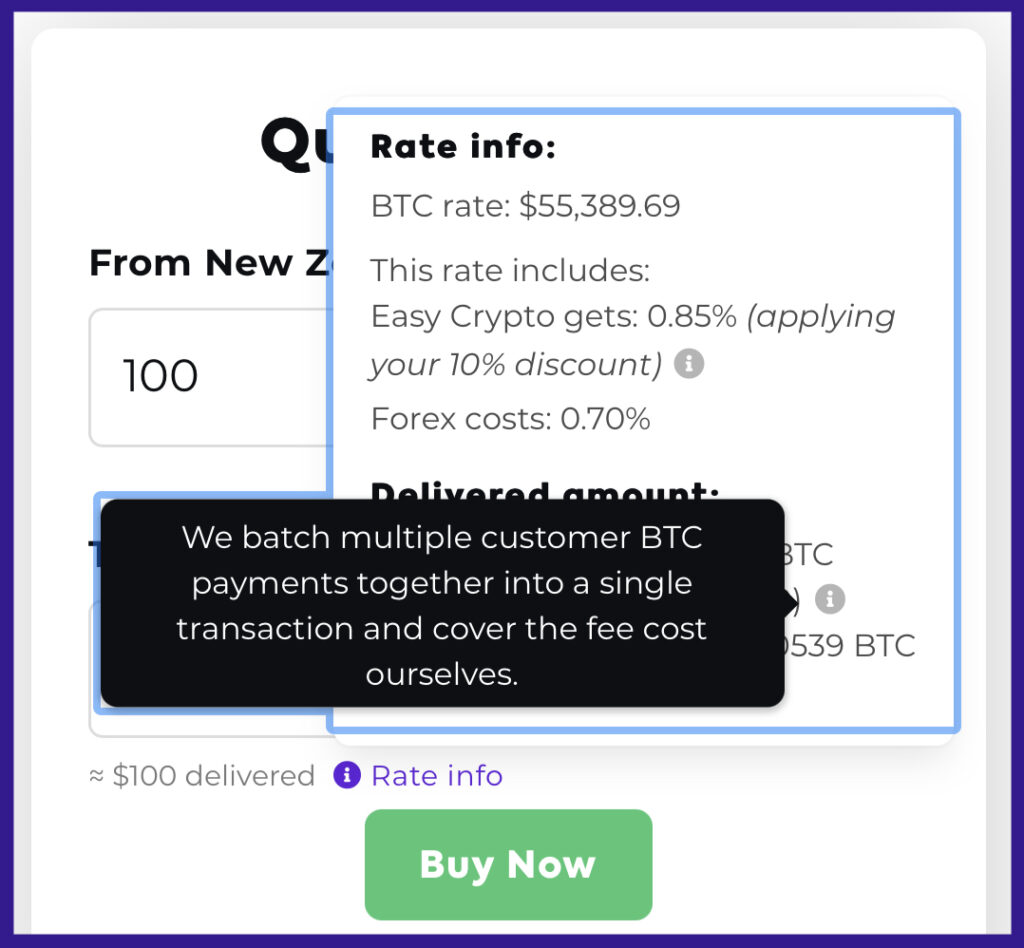

- While Bitcoin network fees are also expensive, Easy Crypto covers this fee for you. Therefore buying larger amounts of Bitcoin through Easy Crypto is no more cost effective than buying small amounts of Bitcoin.

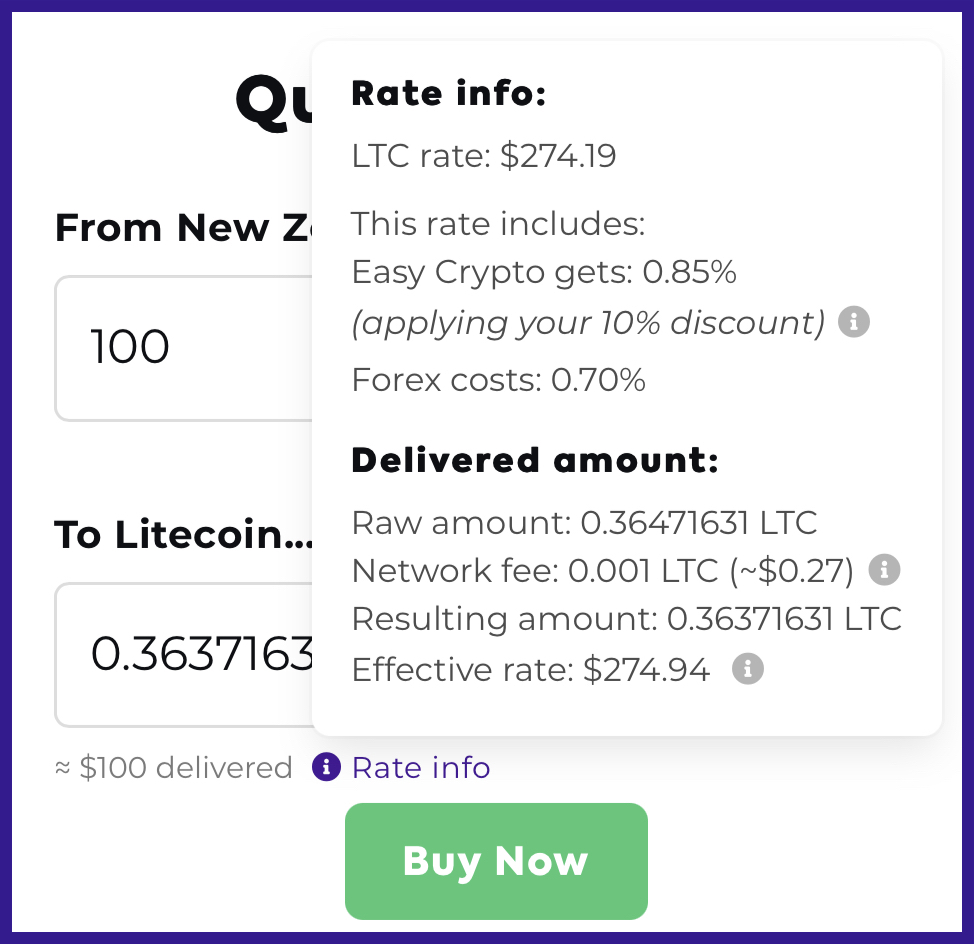

- Most other coins are relatively cheap in terms of network fees so you should have no problems with small purchases. A good example is Litecoin, currently with a network fee of just $0.27.

Easy Crypto also allows you to sell your cryptocurrency back to New Zealand Dollars. This works by creating a sell order for your coins, sending your coins to Easy Crypto, then receiving New Zealand Dollars in your NZ bank account.

Further Reading:

– How to buy Bitcoin in New Zealand (step-by-step guide)

– How to sell Bitcoin in New Zealand

– Easy Crypto review – The best on-ramp to the world of cryptocurrency?

3. Cryptocurrency Exchanges

The main function of cryptocurrency exchanges is to provide the ability trade from one cryptocurrency to another. Some local New Zealand exchanges also provide the ability to trade between cryptocurrencies and New Zealand Dollars.

Exchanges are more complex compared to brokers – they require you to place orders into the order book, manually withdraw funds into your own wallet, and they have more complicated fee structures. However, they are often cheap and convenient services to actively trade cryptocurrencies on.

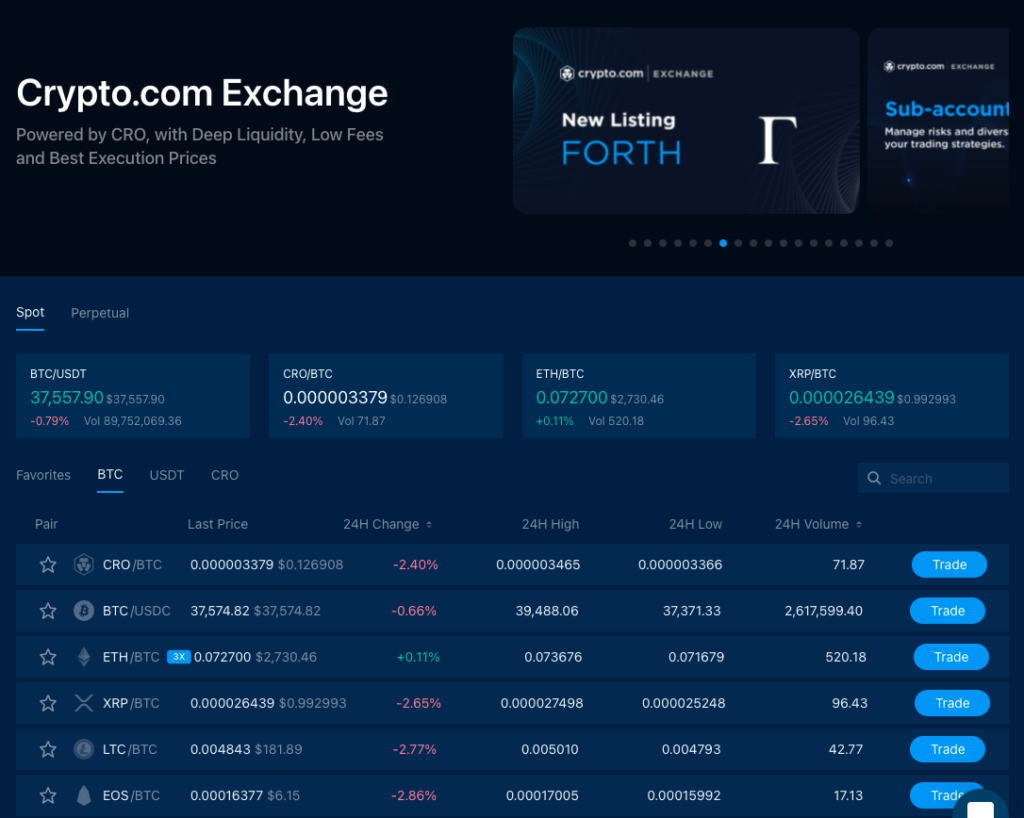

Binance and Crypto.com

Binance and Crypto.com are a couple of the world’s largest cryptocurrency exchanges, offering the ability to trade a very wide range of cryptocurrencies – you can trade from one crypto to another, or even to and from stablecoins (like USDT) entirely within these apps.

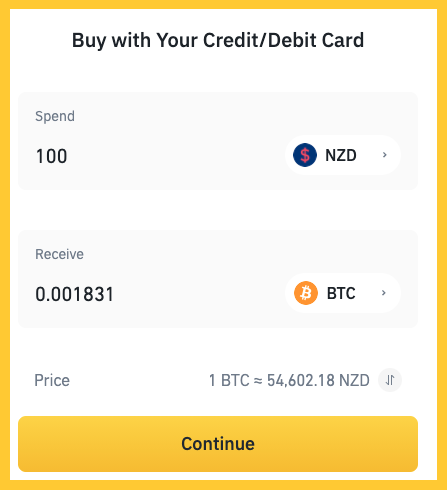

In addition, both Binance and Crypto.com allow you to buy a small range of cryptocurrencies with a New Zealand debit/credit card with low minimum purchase amounts – For Binance the minimum purchase is $25, and for Crypto.com the minimum is $1 USD (versus $100 on Easy Crypto).

One issue you will encounter is that neither service allows you to sell cryptocurrency back to them for New Zealand Dollars. Instead you will have to withdraw your coins to a service like Easy Crypto in order to convert them to New Zealand Dollars. As an alternative, Binance has recently launched a P2P service in New Zealand which lets you sell your coins to other individuals (although this is quite limited and doesn’t always offer the best rates).

Kiwi-Coin

Kiwi-Coin is a long-standing Bitcoin exchange. They’re a simple service that allows trading from New Zealand Dollars to Bitcoin and vice-versa.

Swyftx

Swyftx is an Aussie exchange that recently became available to New Zealand customers. They allow you to buy and sell crypto with NZD, as well as trade between different cryptocurrencies. However, their only funding option is by debit/credit card which has extremely high fees.

Other things to know about exchanges

Custody of coins

A major difference between the above exchanges and Easy Crypto is that exchanges are custodial. When you buy cryptocurrency from an exchange, the exchange holds your crypto (and the associated keys) on your behalf. This can be a good thing as you don’t have to be responsible for protecting your wallet recovery phrase (although you still have to take care of your password to the exchange). You also don’t have to incur network fees each time you make a purchase of cryptocurrency (although you still have the option of withdrawing from an exchange whenever you wish to).

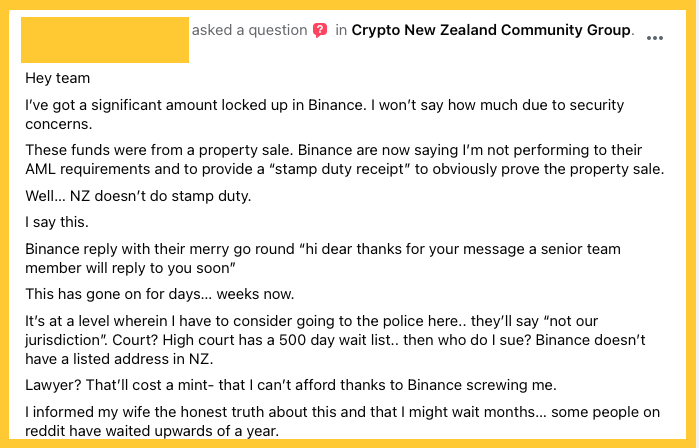

However, having exchanges control your keys comes with major risks. The exchange could get hacked (e.g. New Zealand based exchange Cryptopia got hacked in 2019, losing $24 million), or your account could be suspended or frozen for no particular reason (example in the below Facebook post). You may have heard the phrase “Not your keys, not your coins” representing the fact that exchanges have ultimate control of any coins you hold with them. I would personally feel uncomfortable leaving significant amounts of cryptocurrency on an exchange due to this risk.

Other features

Big exchanges like Binance and Crypto.com tend to offer a wide range of extra features. One being the ability to earn interest on your cryptocurrency holdings (similar to a bank savings account or term deposit).

Crypto.com also offers debit cards to New Zealand customers, which are designed to be a relatively easy way to spend your cryptocurrency in everyday life.

Easy Crypto vs Binance and Crypto.com fees

Buying crypto via a debit or credit card on Binance or Crypto.com has been a popular option for many New Zealanders, but there is often confusion over whether they are cheaper compared with Easy Crypto. The quoted rates on Binance and Crypto.com are often better than that of Easy Crypto’s, but this doesn’t give the full picture.

Firstly, both Binance and Crypto.com charge a credit/debit card fee on top of your purchase. For Binance the fee is about 2%, and for Crypto.com the fee is about 4%.

Secondly, the quoted rate doesn’t include the network fee to withdraw the coins into your own wallet. For example, the fee to withdraw Bitcoin from Binance is 0.00057 BTC (approx. $30). This compares unfavourably to Easy Crypto which has no Bitcoin withdrawal fees.

Of course this fee is avoidable if you choose to keep your coins within the exchange. This may work out favourably for expensive coins like Ethereum where Easy Crypto has a network fee of ~$30 (compared to $0 if you choose to purchase and store your coins on the exchange). However, another strategy people use to avoid fees is to buy a cheaper coin (like Binance Coin) on Easy Crypto and have it sent to Binance where you can exchange the BNB for Ethereum.

Conclusion

The number of cryptocurrency services that New Zealanders can use is continuing to grow. So which should you use?

- Wallets: Software wallets are free and convenient to use, so it’s worth having one to receive, store, and send your coins. But it’s best to avoid buying or swapping cryptocurrencies through these wallets as this can be expensive. Hardware wallets require an upfront purchase and shipping cost, but are best for long-term storage of larger amounts of crypto.

- Brokers: Brokers are an overall good solution for exchanging NZD for crypto, and crypto back to NZD. They are especially suitable for beginners (as they take care of the end-to-end process of buying coins for you), or long-term holders (as with Easy Crypto they have have regular purchase plans, and your coins get sent straight to your own wallet). However, brokers can be expensive for coins like Ethereum as you incur ETH network fees on every purchase.

- Exchanges: Exchanges are the best solution for active trading of cryptocurrencies, or for their wide range of features (like earning interest or crypto debit cards). However, on exchanges you sacrifice security by not having the keys to your coins – so be wary of using them to store large amounts of cryptocurrency.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.