What a year it’s been! In December 2022’s What’s been happening in the markets article we cover Sharesies’ KiwiSaver announcement, Sharesies’ controversial pricing changes, new tax rules coming in for some US investments, as well as some highlights and lowlights for the year.

This article covers:

1. Market movements

2. Product updates

3. Highlights from 2022 and what to expect in 2023

4. What we’ve been up to

1. Market movements

Here’s how the markets performed to 23 December, in both their local currencies and in NZ dollar terms:

| MTD | MTD (NZD) | YTD | YTD (NZD) | |

| NZ shares (S&P/NZX 50) | -0.49% | -0.49% | -11.81% | -11.81% |

| Australian shares (S&P/ASX 200) | -2.42% | -3.14% | -4.53% | -3.92% |

| US shares (S&P 500) | -5.77% | -5.39% | -19.33% | -12.25% |

| Bitcoin | -1.91% | -1.51% | -63.53% | -60.33% |

This month’s performance follows inflation figures in the US coming in at 7.1%. That’s good news, given it’s down from 7.7% in the previous month and lower than the 7.3% figure that was widely expected. However, the market turned pessimistic over the US Federal Reserve raising interest rates by 0.50%. While this increase is a step down from previous 0.75% increases, investors are still concerned that rate increases will continue to be persistent and perhaps wreak havoc on the economy.

Locally we saw NZ GDP up 2% for the quarter ending 30 September. That’s also gotten a few people worried as it seems the economy has stayed resilient despite interest rates shooting up. While GDP isn’t as important as actual inflation figures, it still raises fears that the Reserve Bank will have to continue raising rates aggressively to cool down the economy and inflation.

Buy the dip?

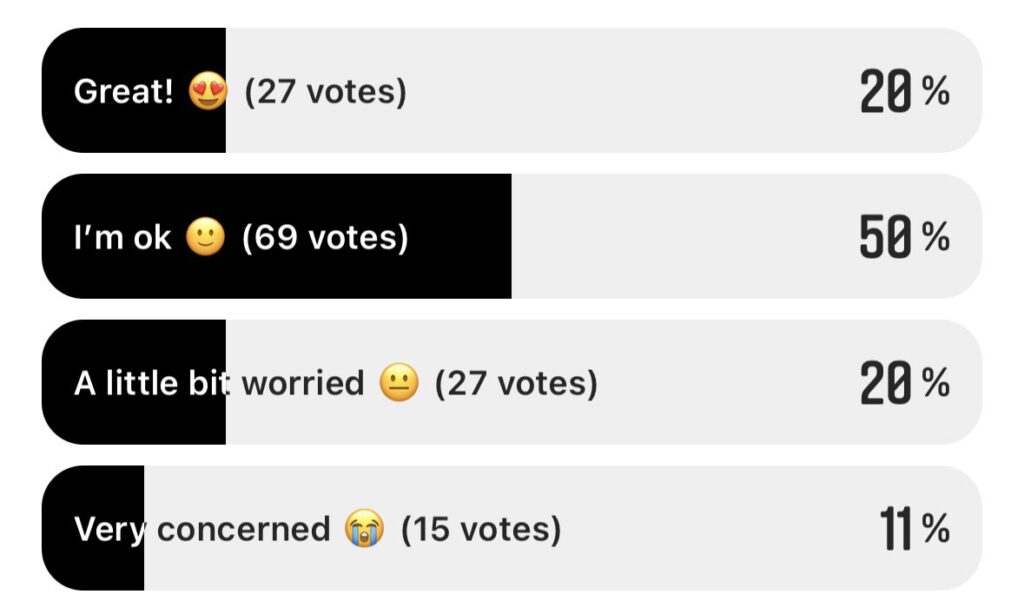

We checked in on our Instagram followers to see how they were doing during this time of high market uncertainty. And it was good to see most people doing ok:

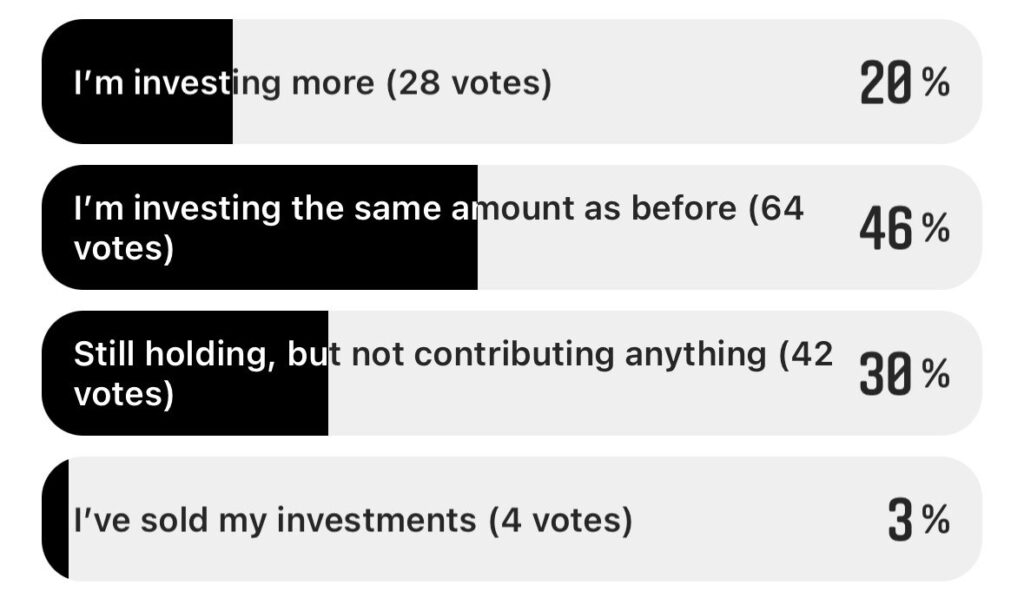

However, perhaps a little concerning is that so many people have stopped their investment contributions during this time:

While some people had good reason to stop contributing (like building up their emergency funds, or changes in their personal circumstances), it seems like some have gotten caught up in the fear around the current state of the market. Here’s a couple of interesting Instagram posts from Kernel and Lighthouse Financial which sums up the current situation nicely. We think a key point that can be taken away from these is that it’s not the actual investment that’s riskiest part of investing, but rather the behaviour of the investor 🤔.

2. Product updates

Sharesies KiwiSaver officially announced

There have been rumours around Sharesies launching their own KiwiSaver scheme for at least a year, and this month they officially announced that they’ll be launching their scheme in 2023. The scheme will allow members to select from a range of funds from various fund managers, similar to InvestNow’s KiwiSaver scheme. The funds that will initially be available are:

- Smartshares/SuperLife Growth Fund

- Smartshares/SuperLife Balanced Fund

- Smartshares/SuperLife Conservative Fund

- Pathfinder Ethical Growth Fund

- Pie Funds Growth 2 Fund

Some have been hoping that Sharesies’ KiwiSaver scheme would give investors the flexibility to pick individual companies for their KiwiSaver portfolio. However, it’s very unlikely the scheme will ever allow investment into individual companies, due to the regulatory hoops they’d have to jump through. So those worried about people potentially investing their entire retirement savings in meme stocks can breathe a sigh of relief.

We know that Sharesies is (or was?) a well-loved brand among many investors, so is this KiwiSaver announcement something to get excited about? We don’t think so as their current selection of funds is pretty poor (though it’s likely other fund managers will eventually jump onboard). For example, there’s no Aggressive or Cash fund, and the fund options have relatively high management fees. In addition, competing providers like InvestNow, Kernel, and Simplicity have already set the bar high when it comes to KiwiSaver, so it’ll be interesting to see what Sharesies can deliver to make their scheme unique.

Sharesies announces pricing changes

Not long after their KiwiSaver announcement and just days before Christmas, Sharesies announced they’re making big changes to their pricing structure, effective from 31 January 2023. In summary the changes are:

- Transaction fees – These are increasing from 0.5% to 1.9% with caps (e.g. the transaction fee for a single NZX order is capped at $25).

- Monthly plans – Investors will now have the option to subscribe to monthly plans ranging from $3 to $15, which will cover your transaction fees up to a certain amount.

- Foreign exchange fees – These are increasing from 0.4% to 0.5%.

- Transfer fees – Transferring NZX shares out from Sharesies to your CSN will now cost $15 (up from $5).

In general, the impacts on investors are:

- Some regular investors will be better off under the new fee structure. As long as you consistently invest $600 or more per month, the new fee structure can work out cheaper thanks to the monthly plans, which can reduce the effective transaction fee to as low as 0.1%.

- Small or infrequent investors will be worse off under the changes, as they don’t invest enough to benefit from the monthly plans. In this case you’ll have to pay the regular transaction fees which are almost quadrupling from 0.5% to 1.9%.

So some will win and some will lose following the changes. However, the response from Sharesies’ investor community has been largely negative:

- Sharesies’ purpose is “to financially empower the next generation by giving someone with $5 the same investment opportunities as someone with $5m”. The fee changes go against this purpose given they make investing in shares much less viable. For example, investors will need their assets to deliver a return of ~3.8% just to break even (to offset the 1.9% buy transaction fee and 1.9% sell fee).

- The new fee structure with caps and plans is confusing compared with their existing percentage based fee structure.

- A lot of people can’t help but feel Sharesies are being sneaky by announcing the changes so close to Christmas when everyone is winding down for the year.

Check out our very popular article below for a detailed analysis on the changes, or check out our Instagram for more memes.

Further Reading:

– Sharesies’ January 2023 fee changes – Are they good or bad?

New tax rules for some US investments

New US tax rules are coming into force on 1 January 2023, which will result in non-US taxpayers being hit with a 10% withholding tax on US partnership investments. Don’t freak out – this rule does not apply to all US investments like Apple, Microsoft, Tesla, and S&P 500 ETFs, but only to a small number of investments structured as a publicly traded partnership, which have different tax rules over in the US. Sharesies has provided a list of affected investments here, Hatch has provided a list here, Interactive Brokers has provided a list here.

If you do hold any of these investments, a 10% withholding tax will apply to your sale proceeds when you sell the asset, regardless of whether you made a profit or loss on the investment. For example, if you sold your units in the United States Oil Fund (USO) and received $1,000 USD for the sale, a $100 USD withholding tax would apply. Sharesies and Hatch will deduct this tax from you automatically, but it’s unclear how other platforms will handle this tax.

Property crowdfunding continues to struggle finding traction

We first covered Realties back in October, the fourth company giving Property Crowdfunding a crack by offering investors the opportunity to buy a share in an Auckland property for as little as $50. They’ve since failed to raise the $1.44 million they were seeking for the investment property, raising just ~$4,500. Ouch.

We’ve long criticised NZ property crowdfunding deals as relatively poor investment options due to the high fees, no opportunity to utilise leveraging, and the feeling that platforms were primarily trying to capitalise on people’s FOMO towards the property market. But with the heat now taken out of the property market, Realties had a near impossible task to make it work – If the concept of property crowdfunding didn’t work during the good times, how can they expect to make it work during a downturn?

3. Highlights from 2022 and what to expect in 2023

Financial markets

Most of us would probably rate 2022 as a tough year to be in the markets, with it being the first real market downturn experience for many investors:

- January set the scene for the year, with the NZX 50 falling over 6% and the S&P 500 falling over 8% during the month.

- The awful situation in Ukraine brought the markets down further in February.

- But high inflation was the main star of the show, leading to rapidly rising interest rates and the fear this will tip the world into a recession. The markets continued to fall over the course of the year, with both NZ and US markets finishing 2022 down around 12%.

- The weakening NZ dollar played its part, insulating Kiwis against the worst of the sharemarket weakness, but also making people question whether to keep investing in overseas shares.

- House prices are also dropping as interest rate increases are making home loans less affordable and scaring buyers out of the market.

- Crypto related assets and platforms went down the toilet as coins like Luna imploded, and platforms like FTX and Celsius went bust.

But it’s not all doom and gloom. On the bright side:

- The market downturn is a good thing for long-term investors, as it means we can buy into assets at cheaper prices. The downturn is really only a bad thing if you have to sell your investments right now.

- We’ve shaken out some of the bad actors (like dodgy crypto platforms), and investors that are here to make a quick buck. Sometimes the market needs to take a breather and clear out the trash before it can sustainably move forward.

- Not all assets have had a nasty year. Spark (+20.78), a2 Milk (+22.74%), and Auckland Airport (+3.11%) are some local companies that ended up positive for the year, while UK (-0.43%) and Australian (-6.35%) markets held up relatively well. It shows there’s value in diversifying across different industries and geographies.

- Eventually we’ll come out of the other side of this downturn as better and more experienced investors.

Unfortunately we don’t have a crystal ball to tell what’s going to happen in 2023. It’s widely predicted that we’ll see a mild recession as high rates start to bite, but if we were to speculate, the markets won’t necessarily crash because of this, as at least some of the nasty stuff has already been priced into the market.

Though it’s just so difficult to predict where things will head next – So instead of trying to predict market movements and picking investments based on where you think the markets will go in 2023, we prefer to focus on things we can control, like regularly contributing to investments that align with your financial goals and personal circumstances regardless of what happens in the markets.

Products and platforms

Defying the weak financial markets, 2022 was a big year for new investment platforms and products. Some of the highlights were:

- Kernel launched one of the most competitive KiwiSaver offerings in the world. They also expanded their range of funds, adding S&P 500, High Growth, Hedged Global Infrastructure, Hedged Global 100, Balanced, and Cash Plus funds.

- Foundation Series launched a couple of ultra low cost index funds. Their US 500 and Total World funds have respective management fees of 0.03% and 0.07%.

- Flint came to market, taking on InvestNow with a somewhat similar offering of funds.

- Sugar Wallet released a new, but more expensive way to invest in Simplicity’s funds.

- More companies took a crack at property crowdfunding but failed. Opoly unsuccessfully tried to make it work under new ownership, while Realties never really got off the ground.

- Sharesies had a busy year adding new features, such as a native mobile app, auto-invest for shares, and voting for NZX companies.

- kōura became the first KiwiSaver scheme to allow investors to add a dedicated allocation to Bitcoin to their portfolios.

However, there were a few things lowlights for the year:

- Hatch was sold to FNZ over a year ago, with the promise of adding more markets like the NZX and ASX to the platform. These new markets never came, but they’ve since partnered with Jarden Direct to deliver them.

- Australian investment platform Superhero had been preparing to launch in NZ as a potential Sharesies killer. This never eventuated, and now seems highly unlikely as they focus their efforts on merging with crypto exchange Swyftx (which is currently under a bit of financial pressure).

- Australian ETF issuer BetaShares also signalled its intention to expand into NZ, but a year later we’re still waiting for their funds to launch.

- The government proposed making tweaks to tax rules that would lead to GST applied on fund management expenses. This would’ve flowed onto investors as increased KiwiSaver fees, but public backlash saw the government make a quick u-turn on the changes.

- Sharesies announced changes to their pricing structure and copped a ton of backlash from their customers.

And here’s what we can expect to see in 2023:

- Sharesies will launch their KiwiSaver scheme. They’ll also be looking to add more new features like support for dividend reinvestment plans. But the big question is whether their customers will stick around if they go through with their proposed fee changes.

- Hatch will hopefully finally expand their offering to include other markets like NZ shares.

- Simplicity should resolve their tax leakage issues by moving away from Vanguard.

- InvestNow, Flint, and Kernel will probably sneak in some new funds and features.

- It’s likely that even more new platforms like Trove will launch.

- However, the environment for platforms remains difficult with the currently low appetite for investing. We won’t be surprised if one of the smaller players shuts down or gets gobbled up by a larger platform.

Money King NZ

Money King NZ had a relatively quiet year, with visitor numbers to the site down about 25% compared to the previous year. That’s unsurprising with so many people losing interest in investing and running for the exits as markets dumped. On the bright side we still managed to grow our audiences across social media, as well as our email subscriber list. We’re fortunate to have many regular readers and supporters.

We also published 55 new articles on our site this year. This included comprehensive guides on topics like hedged vs unhedged funds, FIF tax, and ways to help you build a house deposit, and reviews on platforms like Milford, kōura, and Simplicity. But our most popular articles for the year were our in-depth index fund comparisons:

Most popular articles of 2022:

1) What’s the best global shares index fund in 2022?

2) What’s the best S&P 500 index fund in 2022?

3) What’s the best NZ shares index fund in 2022?

4) The ultimate guide to index funds in New Zealand

5) 4 steps to create an incredibly simple long-term investment portfolio

In 2023 we look forward to writing about even more topics and reviewing more investment platforms. Let us know if there’s anything in particular you want us to cover in the comments.

4. What we’ve been up to

Money King NZ happenings

As we’re in the expensive holiday season, we’ve been trying our best to save money and control our spending. Quite a challenging thing to do when supermarket prices and other costs keep creeping up (though at least we have a better variety of fruits and vegetables over the summer months).

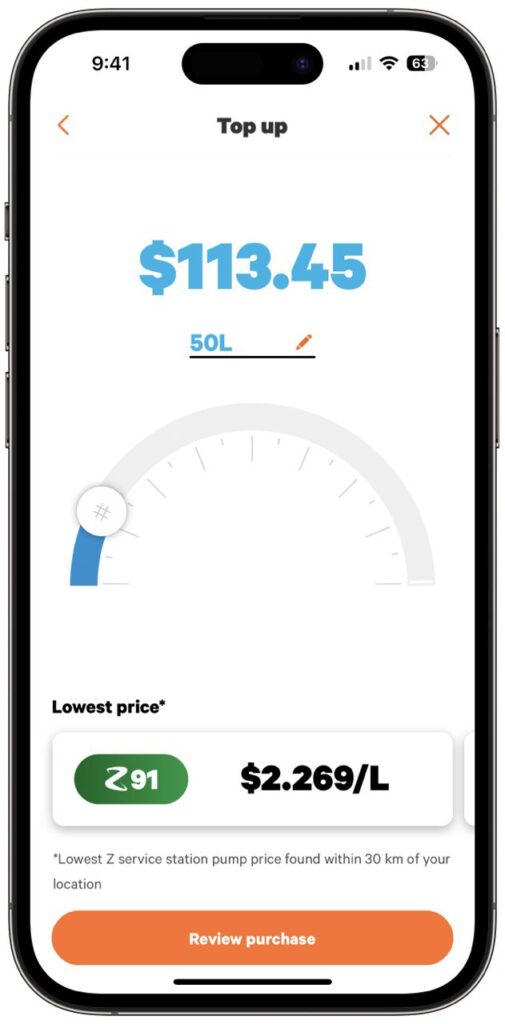

But one thing we’ve managed to save money on this month is petrol. We’ve started to use Z’s Sharetank feature, which we can use to buy petrol at the lowest priced Z station within 30km of our current location. For us that means we can buy unleaded 91at cheaper Wiri/Manukau prices of around $2.269, versus ~$2.60 in our central Auckland suburb. The only downside is that you can’t get the 6 cents Airpoints or Flybuys pumped discount, but it’s still worth it considering as it saves us from having to make the trip south to get cheaper fuel.

Otherwise our finances are in pretty good shape for now! We’re continuing to invest relatively aggressively, taking advantage of the dropping sharemarket. But at the same time we’re making sure we have plenty of cash put aside for short-term expenses and emergencies.

Apart from investing, this month we went to Fieldays to see whether controversial jeans company Woolies Jeans would make an appearance (they weren’t there, but we did see our friends from Kernel and Milford at the event). We also checked out the famous Christmas lights on Franklin Road, and the Festival of Lights at Pukekura Park.

In case you missed them

Thanks for dropping by and reading our December 2022 news article. In case you missed them, here’s the articles we published over the month:

- Ask Money King NZ (Summer 2022) – Best way to come up with a house deposit?

- Simplicity review – Could there be better fund options out there?

- Sharesies’ January 2023 fee changes – Are they good or bad?

Really appreciate everyone who reads and supports our site! Have a great new year and we’ll see you in 2023!

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.

Cool article! Have a enjoyable and relaxing break.

Thanks for reading Pete 🙂