Most investors buy overseas assets to diversify their portfolios internationally. While many people consider things like the tax implications of such investments, one thing that’s sometimes overlooked is the foreign currency aspect of investing overseas. That’s where the topic of hedged vs unhedged funds come in, which is often a source of confusion for investors trying to understand and pick between the two types of funds. So in this article we’ll breakdown the topic, addressing the difference between these types of funds, and the pros and cons of hedged funds vs unhedged funds.

This article covers:

1. How exchange rates can impact your overseas investments

2. What are the currency hedged investment options?

3. The arguments for and against currency hedging

1. How exchange rates can impact your overseas investments

Currency/exchange rates can have an impact on your overseas investments whether whether it be US, Australian, or UK assets. This includes bonds, shares, or alternative assets like gold or Bitcoin. Here’s some basic examples to illustrate how:

William invests in Woolworths

William buys 1 share in Woolworths which is an Australian listed company. This share is currently worth $33 AUD. If the current NZ dollar to Australian dollar exchange rate is 0.91, William’s share would be worth $36.26 in NZ dollar terms.

However, here’s what would happen if the NZD-AUD exchange rate changes (assuming the Woolworths share price stays at $33 AUD):

- If the exchange rate increased to 0.93, his share would now be worth $35.48 NZD

- If the exchange rate decreased to 0.89, his share would now be worth $37.08 NZD

So even if his investment stays at $33 AUD and doesn’t gain or lose any value in Australian dollar terms, exchange rate movements can still influence the value of William’s investment when translated back to NZ dollars. Sometimes this impact can be positive, and sometimes it can be negative.

Vincent invests in the Vanguard S&P 500 ETF

Vincent buys 1 unit in the Vanguard S&P 500 ETF which is a United States listed ETF. This unit is currently worth $366 USD. If the current NZ dollar to US dollar exchange rate is 0.61, Vincent’s investment would be worth $600 in NZ dollar terms.

Here’s what would happen if the NZD-USD exchange rate changes:

- If the exchange rate increased to 0.66, his unit would now be worth $555 NZD

- If the exchange rate decreased to 0.56, his unit would now be worth $654 NZD

Sophia invests in the Smartshares US 500 ETF

Sophia buys 1 unit in the Smartshares US 500 ETF which is a NZ domiciled ETF that invests into US shares. This fund is priced in NZ dollars, though this doesn’t mean the fund is hedged to the NZ dollar. The term “priced in NZ dollars” simply refers to the fact the unit price of the fund is automatically converted to and displayed in NZ dollar terms.

Let’s say the current unit price of the fund was $12 NZD, and the current NZ dollar to US dollar exchange rate is 0.61. Here’s what would happen if the NZD-USD exchange rate changes:

- If the exchange rate increased to 0.66, the unit price would now be around $11.09 NZD

- If the exchange rate decreased to 0.56, the unit price would now be around $13.07 NZD

In summary the impact of currency movements on unhedged overseas investments will generally be:

- If the exchange rate goes up/the NZD strengthens – The value of your overseas investment will go down.

- If the exchange rate goes down/the NZD weakens – The value of your overseas investment will go up.

What are currency hedged funds?

Currency hedged funds (not to be confused with “hedge” funds) attempt to eliminate the above currency impacts your investment. Therefore in general:

- Hedged funds – Their value is only affected by performance of their underlying assets.

- Unhedged funds – Their value is affected by both the performance of their underlying assets AND foreign exchange rates.

Here’s a simple example of how a hedged fund might perform:

Karen invests in the Kernel S&P 500 Fund

Karen buys 1 unit in the Kernel S&P 500 Fund, which is priced in NZ dollars and also 100% hedged to NZ dollar. Let’s say the current unit price of the fund was $4 NZD, and the current NZ dollar to US dollar exchange rate is 0.61. Here’s what would happen if the NZD-USD exchange rate changes:

- If the exchange rate increased to 0.66, her unit would still be worth around $4 NZD

- If the exchange rate decreased to 0.56, her unit would still be worth around $4 NZD

Unlike Sophia’s investment in USF, exchange rates have a minimal impact on Karen’s fund. This is because the fund manager (in this case Kernel) has purchased a forward currency contract to offset the currency movements. This fund would only change in value if its underlying investments (i.e. the companies of the S&P 500) went up or down in value.

How the performance of hedged and unhedged funds can differ

Now let’s look at a few more examples. Say you invested $100 NZD into US shares while the exchange rate was 0.61. This table shows how an unhedged fund will perform compared with a currency hedged fund in different scenarios:

| Scenario | Share price movement | Currency movement | Unhedged fund value | Hedged fund value |

| 1 | Up 10% | Up to 0.66 | $102 NZD | $110 NZD |

| 2 | Up 10% | Down to 0.56 | $120 NZD | $110 NZD |

| 3 | Down 10% | Up to 0.66 | $83 NZD | $90 NZD |

| 4 | Down 10% | Down to 0.56 | $98 NZD | $90 NZD |

| 5 | Flat | Up to 0.66 | $92 NZD | $100 NZD |

| 6 | Flat | Down to 0.56 | $109 NZD | $100 NZD |

| 7 | Up 10% | Flat | $110 NZD | $110 NZD |

| 8 | Down 10% | Flat | $90 NZD | $90 NZD |

- In scenario 1 share prices go up 10%, and the NZD-USD exchange rate goes up to 0.66. The unhedged fund would only be worth $102 as the exchange rate has worked against it, while the hedged fund would go up to $110, as it benefits from the full 10% gain in share prices.

- In scenario 2 share prices also go up 10%, but the NZD-USD exchange rate falls to 0.56. The unhedged fund would be worth $120, but the hedged fund would only be worth $110 as it isn’t affected by the beneficial exchange rate movement.

- In scenario 3 share prices go down, while the exchange rate goes up. That makes the unhedged fund perform much worse that the hedged fund.

- In scenario 4, exchange rates go up, acting as a shock absorber for the unhedged fund. It only drops to $98, while the hedged fund takes the full force of the decline in share prices, falling all the way to $90.

- In scenarios 5 & 6 share prices stay the same, but the currencies fluctuate. In both cases the hedged fund would remain at $100 NZD, but the unhedged fund either rises or falls in value.

- In scenarios 7 & 8 share prices go up or down, but currencies stay the same. In these cases both hedged and unhedged funds perform the same.

Simply put, sometimes hedging helps your investment returns and sometimes it hurts your investment returns.

2. What are the currency hedged investment options?

Here’s a list of some (definitely not all) of the funds which are hedged to the NZ dollar:

Fully hedged funds

These funds are fully (100%) currency hedged to the NZ dollar:

Global share funds

Global share funds invest in companies from all around the world including North America, Europe, and Asia:

- Smartshares Total World (NZ hedged) ETF (TWH)

- Russell Hedged Sustainable Global Shares Fund

- Kernel Hedged Global 100 Fund

- Simplicity Hedged Global Share Fund

- Vanguard International Shares Select Exclusions Index Fund (NZD Hedged)

These five funds are also available in unhedged form, so you can easily customise your level of hedging. For example, you could split your investment 50/50 between Kernel’s unhedged Global 100 Fund and their Hedged Global 100 Fund to be 50% hedged.

Further Reading:

– What’s the best global shares index fund in 2022?

Other share funds

Kernel also offers the following three funds which have a narrower focus than the above share funds:

- Kernel S&P 500 Fund – Invests in the 500 largest companies listed in the United States.

- Kernel Hedged Global Infrastructure Fund – Invests in infrastructure related companies from around the world.

- Kernel Global Green Property Fund – Invests in REITs from around the world.

Further Reading:

– What’s the best S&P 500 index fund in 2022?

Bond funds

These funds invest in international bonds:

- Smartshares Global Aggregate Bond ETF (AGG)

- SuperLife Overseas Non-government Bonds Fund

- Macquarie Ethical Leaders Hedged Global Fixed Interest Index Fund

Partially hedged funds

These funds are partially currency hedged to the NZ dollar. For example, a fund that’s 65% currency hedged would have 65% of the value of the fund hedged to the NZ dollar, and the remaining 35% unhedged:

- Macquarie All Country Global Shares Index Fund – 69% hedged to the NZ dollar.

- Macquarie Australasian Property Index Fund – The Australian investments in this fund are 100% hedged to the NZ dollar.

- Kernel’s diversified funds – This includes their High Growth and Balanced funds. The global shares in these funds are 50% hedged, while the infrastructure, REITs, and international bonds in these funds are 100% hedged.

- Foundation Series’ diversified funds – This includes their Growth and Balanced funds. The international shares in these funds are 50% hedged, while the international bonds in these funds are 100% hedged.

- Simplicity’s diversified funds – This includes their Growth, Balanced, and Conservative funds. The international shares in these funds are 65% hedged, while the international bonds in these funds are 100% hedged.

Tip

If you’re unsure whether a fund is hedged or unhedged, you can check the fund manager’s SIPO (Statement of Investment Policy and Objectives) to find out their hedging strategy.

3. The arguments for and against currency hedging

Reasons to invest in a currency hedged fund

Being hedged gives you a pure equities/bond exposure

Most people buy into international assets (shares/bonds) with the intention of diversifying their portfolio and making a profit off the capital gains, dividends, or interest. But many people forget they’re also exposing themselves to foreign currency and potential currency gains or losses. This is often a source of confusion for investors. For example, you might look on Yahoo Finance and see that the S&P 500 is up 0.8% for the day, yet an unhedged fund will have likely performed differently due to the currency movements.

With currency hedged funds, the value of your investment is only affected by the performance of the underlying assets it’s invested in. For example, if the S&P 500 goes up 0.8% for the day, a currency hedged S&P 500 fund will also be up around 0.8%. This saves you from having to worry about the potential currency gains and losses, and may make understanding your investment less confusing than with unhedged funds.

Exchange rates can have an adverse impact on your investment objectives

For some investments it’s undesirable to have them exposed to exchange rate volatility, and international bonds are a good example of this. Bonds are typically bought for short to medium-term investment or to shield your portfolio from volatility. Exchange rates can add a layer of volatility, therefore can potentially undermine the defensive properties of bonds. That’s why NZ domiciled international bond funds are almost always 100% hedged to the NZ dollar, and international domiciled bond funds (like the bond ETFs listed in the US) may not be suitable for Kiwi investors.

Funds that invest in Real Estate Investment Trusts (REITs) and infrastructure are other types of funds that are commonly currency hedged, given these funds focus on somewhat defensive companies.

You’ll eventually spend your investments in NZ dollars

Most people invest with the objective of increasing or preserving the amount of money you have to use in the future. Therefore at some point you will have to sell your investments in order to spend the money – And this spending will typically occur in NZ dollars. Take a New Zealander investing for retirement as an example, who will need to eventually sell their investments for NZ dollars to spend on housing, transport, food, healthcare, and so on.

Currency hedging keeps the returns from your investments in NZD terms, so your ability to spend your money on your investment objectives won’t be eaten away by adverse currency movements. However, keep in mind there’s a slight flaw to this argument. Even though much of your future spending may be denominated in NZ dollars, the likes of petrol prices, international travel, many other goods are still influenced by foreign currency. Therefore currency hedging cannot fully protect your NZ dollar purchasing power.

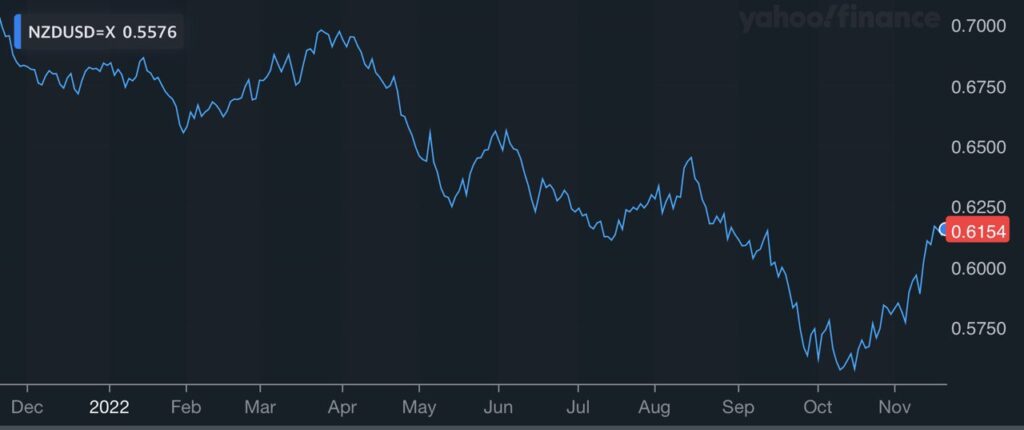

The NZ Dollar is currently weak

The NZ dollar has been trending downwards for the past year or so:

This has led to a number of investors worrying that:

- Now isn’t a good time to invest overseas – The weak NZD means my money doesn’t go as far in buying up international shares.

- As financial markets recover, the NZ dollar will also recover and hurt my returns.

Investing in a currency hedged fund can help ease these concerns, as they effectively remove currency from the equation.

However, we think this is a relatively poor reason to choose a hedged fund over an unhedged one. You’re effectively wagering that the NZD is going to strengthen against foreign currencies in the short-term. In reality, similar to how it’s hard to time the market when it comes to shares, currencies are extremely unpredictable and no one knows with 100% certainty where and how exchange rates will move next. We think a better strategy to smooth out the impact of exchange rates is to dollar cost average into your investments.

Reasons against investing in a currency hedged fund

The impact of exchange rates evens out over the long-term

In the short-term, exchange rate fluctuations can have a sharp impact on your investments. But over the long-term, the impact of currency tends to even out.

If we look 30 years back to November 1992, the NZD-USD exchange rate at that time was around 0.53. Since then there’s been plenty of big ups and downs in the exchange rate, down to around 0.4 at one point, and up to almost 0.9 at another point. Now at the time of writing the exchange rate is around 0.61 – higher, but not too far away from where it was 30 years ago. Over the long-term there tends to be a limit as to how low or how high exchange rates can go.

On the other hand, the increase in share prices has no bounds as companies innovate and grow. Take the S&P 500 for example, which was at 417 points in November 1992. Now it’s increased to around 3900 points – and that’s before you factor in all the dividend cheques over that time.

So the rise in share prices over the long-term have well outstripped any adverse currency movements. These currency fluctuations would’ve been further smoothed out if you had regularly drip fed money and averaged in to your investments. Therefore for shares, which typically have a long-term investment horizon, hedging is far less critical as it is for bonds.

Being unhedged provides currency diversification

Most people have their eggs largely in one basket when it comes to currency. For example, a big proportion of people living in NZ earn their incomes in NZ dollars, may own a house NZ, perhaps have a home bias towards NZ shares, and so on. For these people their wealth is highly dependent on the NZ economy and strength of the NZ dollar.

That could be bad news if the NZ dollar were to crash against other currencies (e.g. due to an economic or political crisis on our shores). Even though a fall in NZ dollar exchange rates doesn’t make you poorer in NZ dollar terms, you’ll actually become poorer from a global perspective. Weaker exchange rates means stuff we source from overseas like petrol, clothing, and electronics will become more expensive. International travel would also become pricier.

Unhedged funds give you exposure to foreign currency, which can provide the benefit of diversifying your wealth away from the NZ dollar, and help offset losses associated with the weakening of our local currency.

Hedging is more expensive

There is extra cost and effort involved in adding currency hedging to a fund. This is often reflected in the higher management fees for hedged funds compared with unhedged funds:

| Unhedged fund fee | Hedged fund fee | |

| Smartshares Total World | 0.40% | 0.46% |

| Russell Sustainable Global Shares | 0.34% | 0.36% |

| Vanguard International Shares | 0.20% | 0.26% |

The Exception is Kernel who charge the same management fee regardless of whether you invest in their hedged or unhedged funds.

Despite the higher fees, you won’t necessarily earn a higher return to compensate for that. Remember, hedging exists to minimise the impact of currency fluctuations, rather than to enhance performance. So if we were to assume that underlying assets of hedged and unhedged funds delivered the same returns over the long-term, a currency hedged fund would come out slightly worse off after fees, given the extra costs involved.

Exchange rate movements can reduce volatility

This may seem counterintuitive, but the exchange rate fluctuations that unhedged funds experience can actually reduce volatility. During uncertain times the NZ dollar often goes down against the US dollar. That’s because during downturns people seek the security of the US dollar which is seen as a safe haven currency, while the NZ dollar is seen as relatively risky.

This decline in the NZD-USD exchange rate can act as a shock absorber for your investments. For example, so far in 2022 the S&P 500 has fallen 16.25%. However, at the same time the NZD-USD exchange rate has fallen from 0.684 to 0.615. As a result the S&P 500 has only fallen 6.95% when you look at it from a NZ dollar perspective.

We won’t always see this correlation between share prices and currencies in every market downturn, so exchange rates aren’t guaranteed to act as a shock absorber in every circumstance. But this factor could be a consideration for share investors with a lower risk tolerance.

Conclusion

The aim of currency hedging is not to make a profit or increase returns, but rather it’s a tool to minimise the impact of exchange rate fluctuations on your overseas investments. Hedging is more appropriate for some assets than others. For example, it’s almost always used on international bond funds as they’re typically bought as short-term, defensive investments – in this case currency fluctuations could defeat the purpose of these investments.

But on shares the use of hedging is debatable. In the short-term it can hurt you as much as it can help you. And over the long-term the currency fluctuations should even out, plus the gains of your shares should well outstrip any adverse currency impacts. So should you go hedged vs unhedged in this case? Unfortunately we don’t have a crystal ball to tell which one will perform best, and there are compelling reasons both for and against hedging. This probably isn’t the answer you’re looking for, but there really isn’t a definitive best.

But what we do know is that currencies incredibly hard to predict. So rather than try and outsmart the market and try to predict which hedging strategy will perform best, pick a hedging strategy based on what you think best suits your investment goals and preferences – Whether it be fully hedged, fully unhedged, or a mix of both. And stick with it! There may be times when your chosen fund’s performance falls behind, tempting you to change your hedging strategy. But similar to timing the market, constantly switching from fund to fund trying to pick the most favourable currency exposure doesn’t work.

Still struggling to decide? Consider seeking advice from a professional adviser regarding which hedging strategy might suit you. Or consider just picking a fund that chooses the hedging strategy for you (like Kernel’s High Growth Fund which is 50% hedged, or Simplicity’s funds which are 65% hedged). The topic of hedging will likely make a small impact on your investments in the grand scheme of things, so it’s better to focus on the big stuff like making sure your investments are aligned with your goals, setting up regular contributions, and not panic selling during downturns, rather than letting it be an issue that causes analysis paralysis in your investment journey.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.