May 2022 has been another rough month for the markets, leaving a lot of investors wondering whether now’s a good time to be investing or not. In this article we’ve got lots of juicy content, taking a look at market movements, addressing the above concerns around whether you should be investing right now, and as usual we have some updates on some new investment products. Lastly we’ll take a look at the antics Opoly’s founders have been up to – have they pulled off an investment scam?

This article covers:

1. Market movements

2. Should you stay out of the market?

3. Product updates

4. Have Opoly’s founders pulled off an investment scam?

1. Market movements

Let’s see how certain markets have been doing as at 27 May 2022, by looking at the performance of selected Smartshares ETFs:

| 1 month return (NZD) | Year-to-date return (NZD) | |

| NZ shares (NZG) | -5.66% | -15.43% |

| Australian shares (AUS) | -1.62% | -0.69% |

| US shares (USF) | -4.16% | -11.54% |

| European shares (EUF) | 1.55% | -10.78% |

| Asia Pacific shares (APA) | 0.28% | -8.33% |

| Emerging Markets shares (EMF) | 0.93% | -10.82% |

| Global shares (TWF) | -3.02% | -11.81% |

| NZ Government bonds (NGB) | 0.63% | -3.72% |

| NZ cash (NZC) | 0.17% | 0.51% |

This month has been a continuation from previous months, where the primary driver of the market weakness has been inflation and rising interest rates:

- A number of factors like supply chain issues, labour market tightness, lockdowns, wars, and economic stimulus (from the COVID-19 response) has led to incredibly high inflation.

- High inflation leads to the raising of interest rates, in an effort to control that inflation. For example, the Reserve Bank has raised the OCR from 1% to 2% just within the last couple of months, and they expect it to peak at 3.90% in June 2023.

- Higher interest rates makes it more expensive to borrow money, dampens housing and company valuations, and makes shares less attractive relative to bonds and bank deposits. They increase fears that the economy will slow down and enter into recession. A simple example of how this works is to think about mortgages – with rates increasing, homeowners have to pay more interest so have less money to spend elsewhere in the economy.

- The above factors has led to the sharemarkets getting hammered. Which leads to people getting scared and panic selling their investments as they try to get out of what they see as a sinking ship. Panic selling contributes to the markets getting even more hammered, which can result in even more fear and panic selling.

But there’s a few interesting points we can take from the performance of the markets this year:

- There’s value in diversification – Global markets as a whole have taken a beating this year, but some markets have held up better than others (Australia for example). Being well diversified across countries and industries can help reduce the volatility of your portfolio.

- Asset allocation is key – Bonds and cash don’t tend to get a lot of love, but they’ve shown their value in recent months. Their relative stability has protected those who have a lower risk tolerance, or those who are investing short-term.

- Exchange rate volatility can work in your favour – The S&P 500 has gone down 15.21% year-to-date, but USF (the NZ domiciled S&P 500 fund) has only gone down 11.54%. That’s because the NZ Dollar has fallen against the US Dollar, dampening the drop in US shares. Volatility goes both ways.

2. Should you stay out of the market?

The current situation isn’t pretty, and we’ve seen heaps of investors concerned that the volatility, market downturn, and recession fears are reasons to pause contributions to their investments or stay out of the market altogether until things stabilise. Here’s what we think about the various concerns we’ve heard:

Concern 1

The markets are too volatile right now!

Our opinion – Volatility is poor excuse to stay out of the sharemarket. It’s pointless trying to avoid it, as it’s a normal part of investing and you’ll inevitably encounter it again at some point. Plus volatility shouldn’t bother you if you’re a long-term investor – short-term ups and downs in the market are just noise, particularly when you won’t be selling your investments for several more years.

But if you feel like you can’t tolerate these ups and downs, an allocation to lower risk assets like bonds and bank deposits might be more suitable for you. Just keep in mind you’ll pay for the lower volatility with lower potential returns.

Concern 2

It isn’t a good time to invest when the markets are down!

Our opinion – Market downturns are a great time to invest! You make money from investing by buying low and selling high, so don’t be that person who does the exact opposite by only investing during the good times, and bailing out as soon as there’s a hint of trouble.

As you contribute to your investments during a downturn, you’ll buy into them at lower prices than before (like they’re on sale). Every dollar you put in will go further. Many are even taking the opportunity to contribute more money during the market downturn, like the following commenter posted on Instagram:

Spent less on groceries this week so I can invest as much as possible. A different way of chasing the specials!

We certainly admire their dedication to seize the opportunity and invest as much as they can!

Concern 3

The markets might go down further!

Our opinion – It’s entirely possible the market could still go down further, but how can you know for sure? No one knows what’ll happen next, but we’re sure the downturn won’t last forever. And when the markets do bottom out they’ll bounce back quicker than you expect. For example, of the last 6 times the S&P 500 has fallen 15% or more:

- The average 1-month return after reaching the bottom was 17.3%.

- The average 1-year return after reaching the bottom was 46.3%.

It’s incredibly hard to pick the bottom, especially with how quickly the market can turn. So we’re not waiting until the sale is over before going shopping in the sharemarkets. And remember, gradually drip feeding your money into your investments is always a great strategy as it means you’re not exposing all your money to the sharemarket at once, in case they do go down further.

Concern 4

There’s a recession on the horizon!

Our opinion – An upcoming recession doesn’t necessarily mean the markets will plummet further in response. Markets are forward looking and much of the economic uncertainty ahead is likely already factored in to current share prices. The markets tend to hit the bottom well before the economy actually does. For example:

- The NZX 50 declined 30%+ over February and March 2020 before the economy was hit by the harsh Level 4 lockdown, and started to recover during the lockdown (not after it).

- During the Global Financial Crisis, the markets bottomed out and started to recover in March 2009, a few months before the recession actually ended.

So if you waited for the economy to strengthen before investing, it’s likely you’d have already missed the boat in terms of recovering share prices.

Concern 5

This time is different! The markets are doomed!

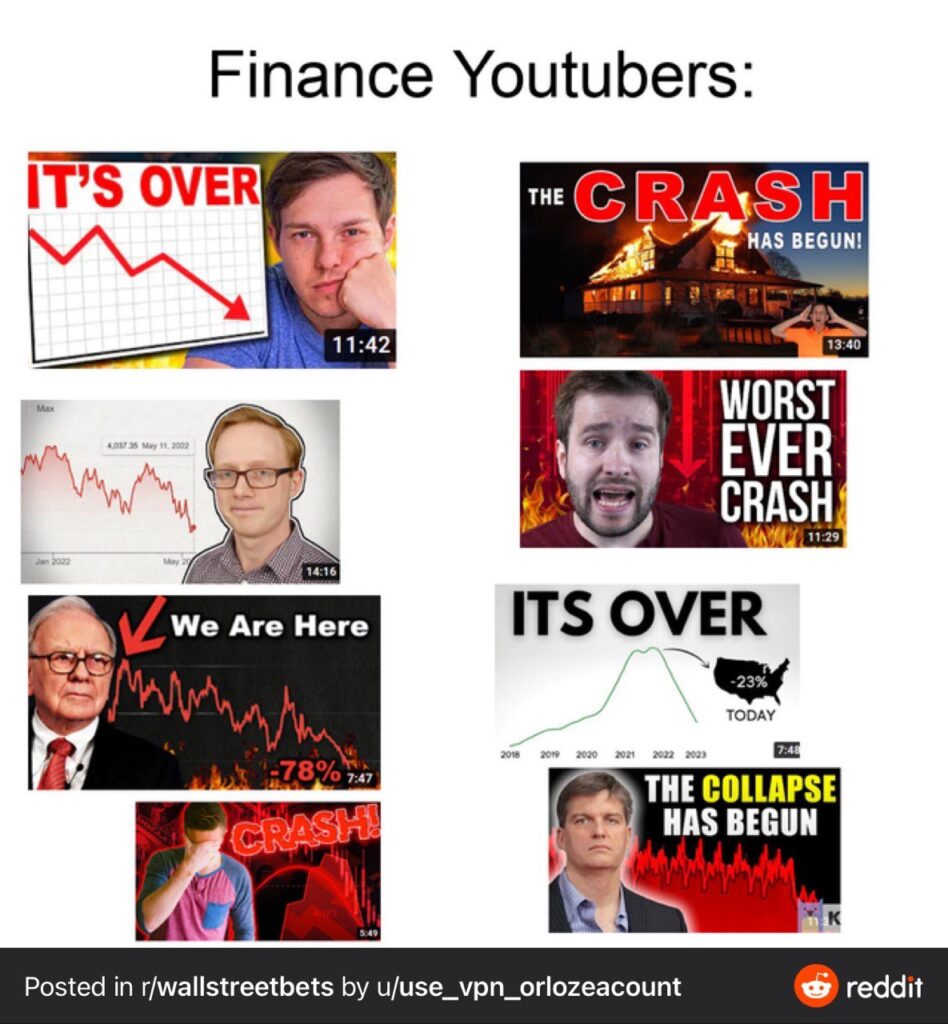

Our opinion – We know from history that markets have always recovered from downturns. The world and its listed companies have always adapted and found solutions to the challenges it’s faced. However, there are plenty of predictions that this time will be different and that we’re in for the “worst ever crash”, the “great reset”, “the collapse”, or the end of the current financial system.

The problem with this is that doomsday predictions and conspiracy theories are nothing new. They crop up every year:

- 2000 Tech Bubble: “Tech is dead!”

- 2008 Global Financial Crisis: “The world economy is dead!”

- 2016 Brexit vote: “Europe’s economy is stuffed!”

- 2016 Election of Donald Trump: “The world is f*cked!”

- 2020 COVID-19: “The world is gonna shut down for years!”

Yet the market has bounced back every single time. Following these doomsday predictions and staying out of the markets has done no good to investors, and has only served to line the pockets of content creators with extra clicks on their videos and articles. So while no one can say with 100% certainty that the markets will recover this time round, it’s very likely 2022 will be no different to the rest.

Reasons to stay out of the market

Lastly, remember there are a couple of reasons where you probably shouldn’t invest in the sharemarket. Perhaps you need your money in the short-term, or maybe the market volatility is causing sleepless nights. In these cases you might not have a long enough time horizon or the right level of risk tolerance to be investing in shares. Instead more conservative asset classes like bank deposits and bonds may be more suitable for you.

Otherwise we strongly believe that those who stay calm, don’t panic sell, and keep investing will eventually reap the rewards.

Further Reading:

– Evergrande, COVID-19, rising interest rates – Sell all shares now?

3. Product updates

Kōura KiwiSaver adds crypto

This month small KiwiSaver provider kōura added three new funds:

- Carbon Neutral Cryptocurrency Fund – Invests into Bitcoin, while offsetting their estimated carbon emissions associated with the investment by buying carbon credits or planting trees.

- Clean Energy Fund – Invests in “companies engaged in manufacturing, development, distribution and installation of emerging clean-energy technologies including, but not limited to, solar photovoltaics, wind power, advanced batteries, fuel cells, and electric vehicles.”

- New Zealand Property Fund – Invests into NZX listed Real Estate Investment Trusts (REITs) and retirement village companies (e.g. Ryman, Summerset, Oceania).

kōura allows you to allocate up to 10% of your KiwiSaver portfolio into each of these funds, and they’re the first provider to offer a dedicated crypto option for your KiwiSaver investments. These speciality funds come with a management fee of 1.10%, versus 0.63% for their core funds.

These funds are definitely not for everyone, especially with crypto being a speculative and highly volatile investment. Plus the NZ Property Fund is just an expensive way to invest into NZ REITs and retirement companies, both of which can already be found in kōura’s NZ Equities fund. Check out our full kōura review below:

Further Reading:

– Kōura review – Crypto meets KiwiSaver

Flint expands their fund offering

Relatively new Fund Platform Flint added a bunch of new funds this month including funds from Milford and SuperLife. This brought their total offering up to almost 100 funds from 12 different fund managers. Flint are quickly turning into a viable competitor to InvestNow, particularly with SuperLife’s funds which greatly increases the passive investment options on their platform.

The addition of SuperLife’s funds also provides an interesting alternative to InvestNow’s Smartshares offering. SuperLife’s funds don’t have the same cash drag issue as Smartshares funds on InvestNow as they allow the purchase of partial units. They also allow you to be taxed at your PIR, rather than a flat 28% rate on Smartshares. However, some SuperLife’s funds have higher management fees than their Smartshares equivalents.

The Flint platform isn’t as mature as InvestNow (missing features like auto-invest and distribution reinvestment), but they have some of those features on the way. Check out our full Flint review below:

Further Reading:

– Flint Wealth review – A superior InvestNow clone?

Debut aims to offer DeFi lending

Debut is a new investment platform we came across this month and they’re looking to launch soon. They’ll offer 3 investment options:

- “Stack”, targeting a 5% p.a. return

- “Build”, targeting a 7% p.a. return, requiring a $3,000 minimum investment

- “Boost”, targeting a 10% p.a. return, requiring a $5,000 minimum investment

They aim to achieve these returns by lending your money out through crypto-backed DeFi platforms, using stablecoins so that you’re less exposed to the volatility of the crypto market. However, it’s not yet clear which DeFi platforms and products they’ll use to generate those returns, and how they’ll manage foreign exchange risk (given most stablecoins are linked to the US Dollar, rather than NZ Dollars). We’ll reserve our opinion until we learn more about the Debut platform and its underlying investments.

4. Have Opoly’s founders pulled off an investment scam?

Those of you following Money King NZ may already be familiar with Opoly, a failed property crowdfunding platform founded by Felix Watkins and Isaac Williams. Recently, the focus of Watkins and Williams has been on Woolies Jeans, their new startup company which aims to make the world’s most comfortable jeans. Late last year Woolies raised over $300,000 from everyday investors in an equity crowdfunding campaign.

On 21 May a Stuff article surfaced alleging the two mates had used the crowdfunded money for personal expenses including “cars, holidays, and booze”. Further to that it seems they’ve fallen out with the 3rd co-founder of Woolies Jeans, Jovian Cummins, after Cummins became concerned over Watkins’ and Williams’ “party culture” and use of shareholder funds.

No sooner had investors ploughed $337,000 into his merino-lined jeans startup, than Felix Watkins was spending the money on a $49,000 1966 Ford Mustang.

Martin Van Beynen, Stuff.co.nz

We weren’t fans of Woolies Jeans in the first place, due to them unrealistically valuing the company at $5 million. And now the “borrowing” of company money to fund a luxury lifestyle, and the falling out between the founders won’t give much confidence to shareholders. Some have even called the founders a bunch of scammers.

They’ve yet to manufacture or sell a single pair of jeans, yet they’ve valued the company at $5 million. This valuation is based purely on having a “sound business idea”, “prototype”, “management team”, and “strategic relationships”.

Money King NZ

It’s still too early to say how the company pans out and whether the “borrowed” money will actually be paid back, but we’ll continue to keep an eye on their progress. They claim they’re launching their jeans at Fieldays 2022, so we’ll have to make a trip down to see for ourselves. In the meantime we certainly won’t be investing in any ventures involving Watkins and Williams. We think this emphasises the importance of doing due diligence on a company’s management before investing.

Conclusion

Thanks for dropping by on our site and reading our May 2022 news article. Despite a rough month in the markets, we’re feeling good. We haven’t been tracking our investments too closely, nor have we changed our investing plans in response to the market movements. We’re simply continuing to contribute to our investments when we can, and doing so at lower prices certainly feels better than buying in higher. We’re confident that when we retire in 20-30 year’s time, we’ll look back to today and think about what a great decision we made by investing so diligently into the sharemarket during an ugly time. We’ll get through these tough times perfectly fine, and we’re sure you will too.

Lastly, be sure to check out our May 2022 articles if you haven’t already:

In case you missed them – May 2022’s articles:

– Sugar Wallet review – Clipping the ticket?

– Kōura review – Crypto meets KiwiSaver

– Can’t afford a house? 5 ways to help you get on the ladder

– Flint Wealth review – A superior InvestNow clone?

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.