Do you own shares in individual companies? Sometimes events called Corporate Actions pop up that affect your shareholding. These events could be as simple as a payment of a dividend, to something more complex, such as your company acquiring another company. So what do the different Corporate Actions mean, and are they good or bad? Read on to find out…

This article covers:

1. Mergers and Acquisitions

2. Raising Capital

3. Distributing Capital

4. Share splits

5. Other things you need to know

1. Mergers and Acquisitions

The ownership of a publicly traded company changes everyday without causing much of a fuss. Every trade on the sharemarket results in a seller reducing or ceasing their ownership in a company, and a buyer taking over that ownership.

But there are times when company structures and ownership changes significantly. Companies merge and acquire each other, which can fundamentally change a company. Each instance of a merger or acquisition is unique and should be looked at on a case-by-case basis, but here’s a look at some common merger and acquisition scenarios.

Your company is acquired by another company

This is where your company is the target of an acquisition, and an acquirer offers to buy out most or all of the shares of your company. They may offer cash, shares in the acquiring company, or a combination of both in return for your shares. Acquisitions have been a common scenario in New Zealand, with foreign firms gobbling up plenty of Kiwi companies lately. For example, aged care provider Metlifecare is one of our most recent acquisition targets, with an overseas firm looking to buy 100% of the company for $7 cash per share. If the deal goes ahead, Metlifecare will be absorbed by their new owners, and delisted from the NZ sharemarket.

Shareholders vote on whether an acquisition deal should go ahead, and the company’s board of directors will often recommend whether shareholders should vote for or against the deal.

And although the amount of money offered in an acquisition deal is usually higher than a company’s current market price, there may be reasons to be unhappy if the deal goes ahead:

- You think the company is worth more – For example, Metlifecare shareholders are being offered $7 cash per share. This is higher than the $6.30 or so Metlifecare was trading at prior to the announcement of the deal, but shareholders might not be happy if they feel the company is worth more than $7.

- You make a loss – For example, in 2018 cosmetics company Trilogy was acquired for $2.90 per share. However, the company once traded at over $4 per share, meaning some shareholders would have taken a substantial capital loss.

- You have to exit your investment earlier than anticipated – You might have been intending to invest in the company for the long-term, but the acquisition of your shares forces you to find a new investment to deploy your money.

Your company acquires another company

This is where your company buys or merges with another company. A recent example is outdoor apparel retailer Kathmandu acquiring Rip Curl. The acquiring company may raise more capital or take on more debt in order to pay for the acquisition. More on raising capital in section 2 of this article.

You may see the terms “accretive” or “dilutive” when a potential acquisition is being described. Accretive means the acquisition will increase your company’s Earnings Per Share (EPS), essentially making it more profitable. Dilutive means that the acquisition will decrease a company’s EPS, however the acquisition may still benefit the company in another way – perhaps by being of strategic importance.

A new company demerges or spins off from your company

This is where a company splits/sells off a particular business unit or assets. These demerged assets may be acquired by another company, or may even form a totally new company. For example, in 2017 Real Estate Investment Trust Stride split its large format retail properties into a brand new company, Investore. Stride shareholders received 1 Investore share for every 4 Stride shares held, with Stride shares reducing in value to reflect the downsizing of the company.

2. Raising Capital

Companies sometimes need more money to fund growth, acquire new assets, or pay down debt. One way to do this is by issuing new shares in the company and selling them to investors for cash. This is one incentive for companies to keep their share prices high, as it enables them to raise more capital by issuing fewer shares (particularly as any new shares are sold to investors at a slight discount to the current share price). There are three main methods of raising capital that you may come across:

Rights Issue

A Rights Issue gives existing shareholders the opportunity to buy a certain number of new shares, depending on how many shares they already own. For example, in mid-2019 Arvida offered a 1 for 5.7 Rights Issue – this means for every 5.7 shares you owned in the company, you received the right to buy 1 new share.

Rights Issues are voluntary for shareholders to participate in, and whether you think the new shares are worth taking up is up to you to decide. You could either take up all your rights, some of your rights, or do nothing once you receive notice of a Rights Offer.

Due to the voluntary nature, it is likely that not all shareholders will take up their rights to buy new shares. Therefore there will be a shortfall in the amount of capital a company is looking to raise. To address the shortfall, the company may use one or more of the following solutions:

- Tradable rights – The ability for shareholders to sell any rights they don’t want to another person

- Shortfall offer – The opportunity for shareholders to apply to buy the “shortfall shares” – the shares that other shareholders don’t take up.

- Underwriting – An institutional investor will buy any shortfall shares that weren’t taken up.

Share Purchase Plan

Share Purchase Plans (SPP) allow existing shareholders to apply to buy any number of new shares they desire. For example, in late 2019 Goodman Property Trust offered their retail shareholders the chance to apply for between $2.10 and $50,000 of new shares. SPPs are also voluntary for shareholders to participate in.

An SPP may result in oversubscriptions – the case where applications for new shares exceeds the maximum number of shares on offer. When an offer is oversubscribed, applications are scaled down so that applicants will receive fewer shares than they applied for.

Placements

Placements are where a company issues a large amount of new shares to a select group of institutional shareholders. Placements are conducted very quickly, and have a limited number of participants involved, so it’s a fast way for companies to raise capital. An example is Infratil, who raised $100 million through a placement, in addition to $300 million via a Rights Offer, in order to acquire Vodafone NZ.

3. Distributing Capital

When a company has excess capital, they may choose to distribute this capital back to shareholders – the opposite effect of raising capital. An example could be a company with a lot of cash on hand, but with few opportunities to deploy this cash. Distributing capital gives value to shareholders, and is often preferable to keeping excess cash sitting around in the company.

Share buybacks

This is where the company buys its own shares, and usually cancels them. This reduces the number of outstanding shares, and therefore makes each outstanding share worth more. For example, each share is theoretically worth more if you divide $100 million company up into 90 million shares, as opposed to dividing the same company up into 100 million shares. This may also have the impact of improving a company’s financial metrics such as EPS.

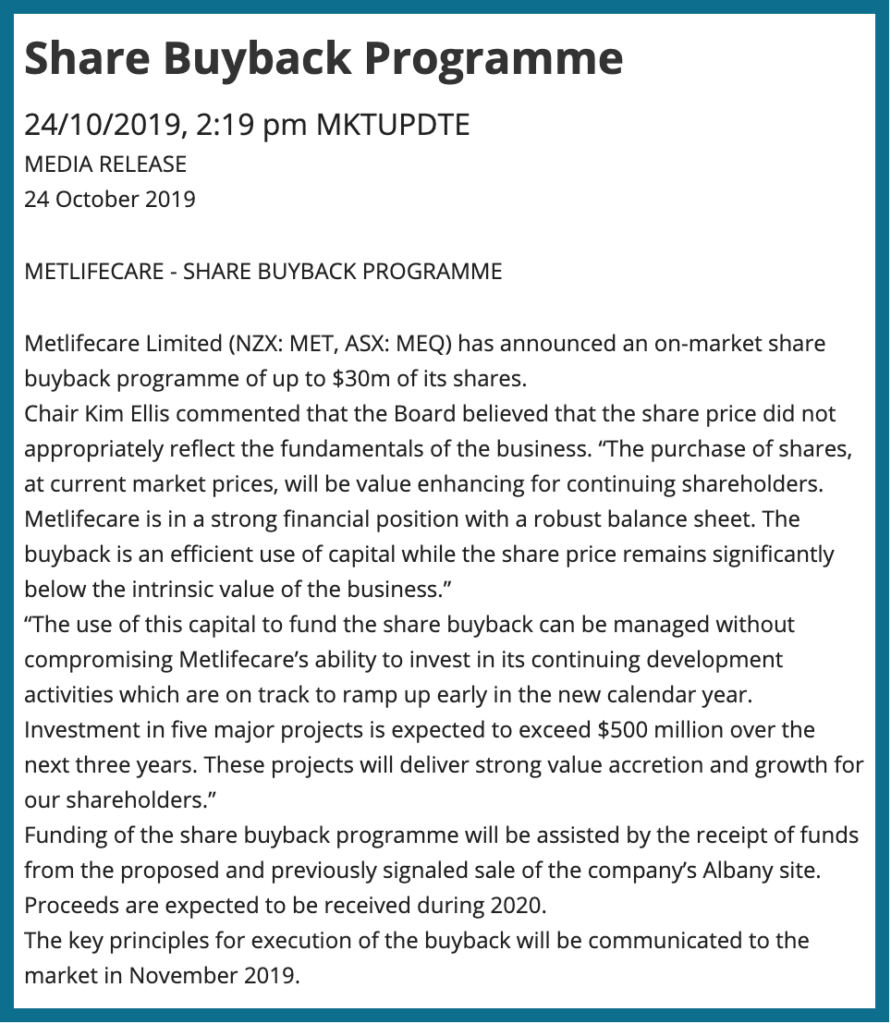

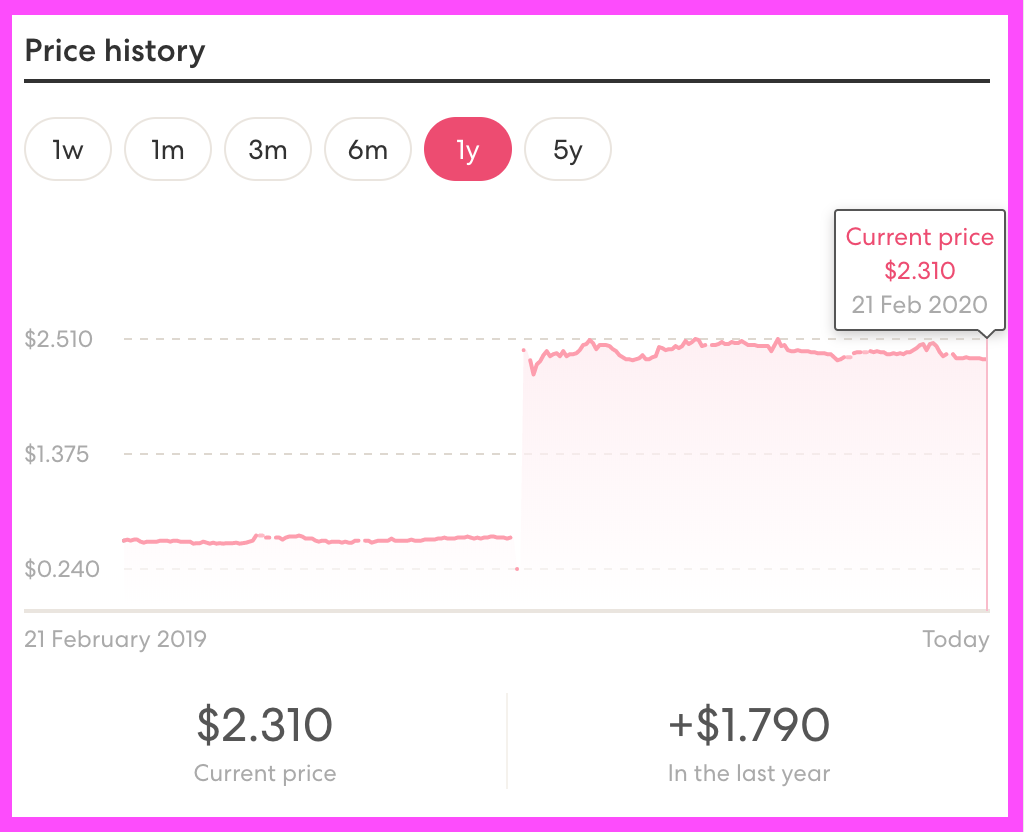

Share buybacks are often performed when a company feels its shares are undervalued. A lower share price makes it cheaper for companies to perform a buyback, and the buyback might be an encouraging signal to the market that the shares are worth more than they currently are. Metlifecare is an example of a company that recently initiated a share buyback programme after suffering from a lagging share price.

Sometimes companies buyback their own shares for other purposes (other than cancelling them), such as using them to pay shareholders as part of a dividend reinvestment plan, or to their staff as part of their remuneration package.

Dividends

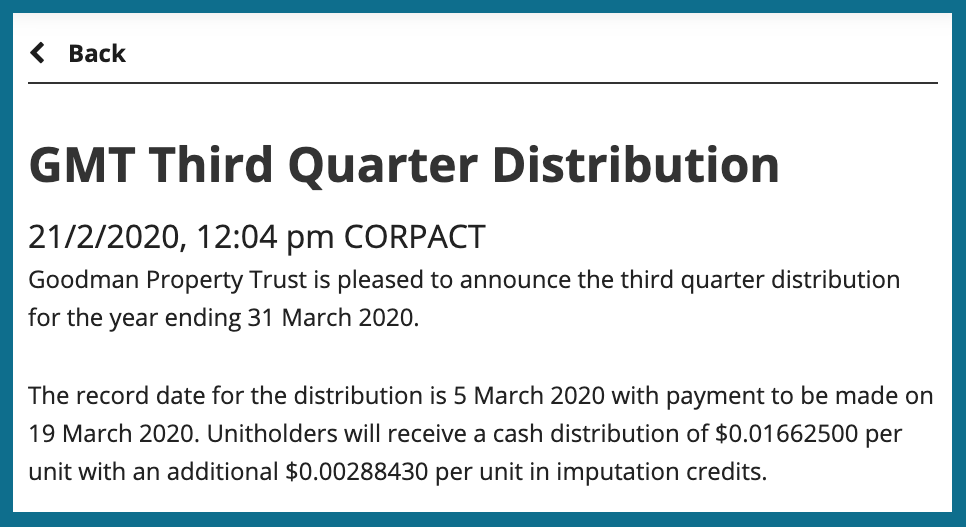

The payment of a dividend is a very common and ordinary Corporate Action you might already be familiar with. Dividends are the distribution of a company’s profits out to shareholder, as opposed to the company keeping the profits within the company to grow or pay down debt. Companies that pay dividends typically do so on a regular basis (usually every quarter or 6 months).

Further Reading:

– Dealing with dividends – 5 things to know about them

Special dividends

Special dividends are a type of dividend that are paid out to shareholders over and above a company’s ordinary dividends. Similar to share buybacks, special dividends are usually paid when a company has excess capital – as a way to directly distribute that excess capital back to shareholders.

Although special dividends have a more direct impact on shareholders compared to share buybacks (as they get a cash payment), there are also downsides. For example, dividends are taxable, while share buybacks don’t result in anything taxable for the shareholder.

4. Share splits

Share split

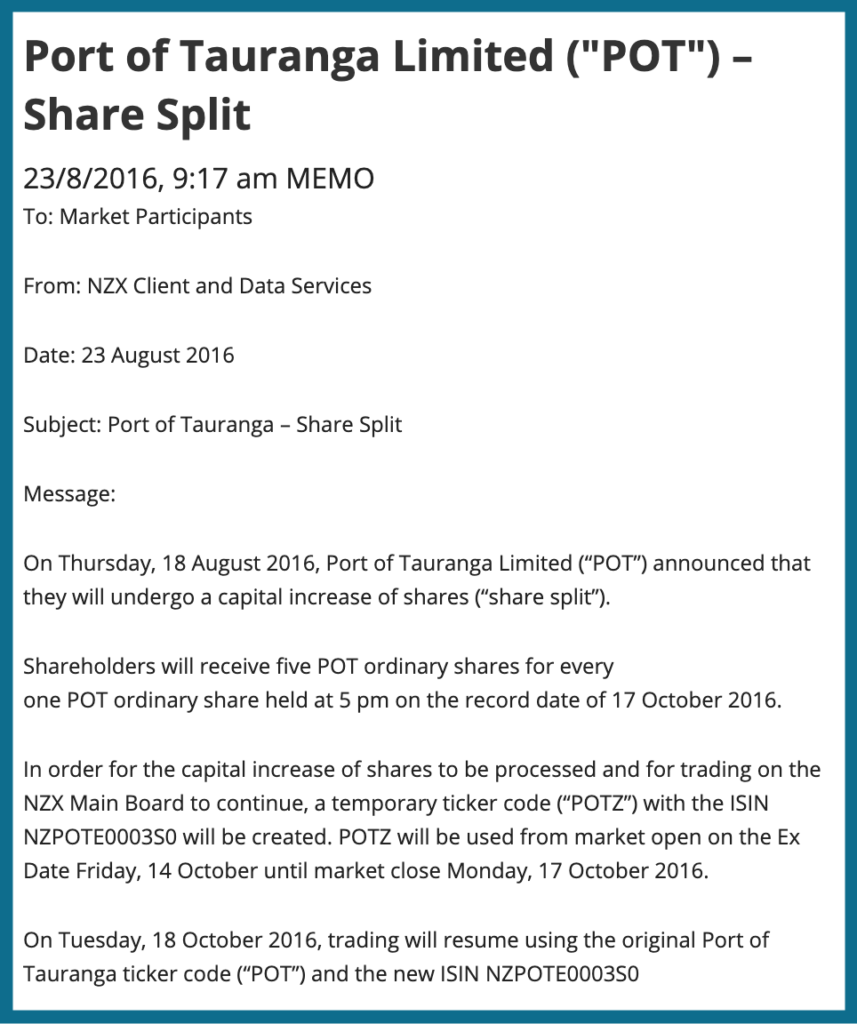

Share splits are when your shares are split into more shares with smaller value. For example, Port of Tauranga underwent a 5 for 1 share split in 2016, where shareholders received 5 shares for every share they already owned. At the same time Port of Tauranga’s share price was adjusted from around $20 per share to $4 per share.

Share splits don’t directly change the value of your investment in a company, nor does it affect the company’s overall value. Owning 100 shares at $20 before the split, is the same as owning 500 shares at $4 after the split – In either case, you’d have $2,000 worth of Port of Tauranga shares. It’s the same effect as splitting a $100 note into five $20 notes.

However, one purpose of a share split is to make a company’s shares more attractive from a psychological point of view. Investors might perceive that paying $2,000 for 500 shares is better than paying $2,000 for 100 shares. And perhaps not as critical here in NZ (as share prices tend to come in at lower than $10 a piece), share splits might help increase liquidity – it can be easier to transact shares when they are worth $1 each, compared to when they are $2,000 each (like with Amazon shares).

Yahoo Finance is a good source to tell if a company’s shares have been split in the past, as their Statistics page for each company shows details of their most recent split:

Share consolidation

Opposite of share splits, share consolidations (or reverse splits) are when your shares are combined to form fewer shares with bigger value. PGG Wrightson performed a 1 for 10 share consolidation as part of a capital restructure in 2019, where each shareholder got 1 share for every 10 shares they held. This is reflected in their Sharesies price chart where the shares suddenly spiked in value:

Again, share consolidations don’t affect the value of a company, but the impact may be psychological. Shares that are too small in value could give investors the perception that the company is a poor performing, risky, small-cap business that’s not worth investing in.

Side note:

A somewhat common question from beginner investors is: does the quantity of shares you own matter? As an example:

– Company A is $1 per share

– Company B is $100 per share

If I invest $100 in each company, I’d get:

– 100 shares in Company A

– 1 share in Company B

What’s better?

Let’s say both companies go up in value by 10%

– Company A shares are now worth $1.10 each

– Company B shares are now worth $110 each

How much are each of my holdings worth?

– Company A: $1.10 x 100 = $110

– Company B: $110 x 1 = $110

Conclusion – The quantity of shares you own doesn’t matter. Don’t let it influence your investing decisions.

5. Other things you need to know

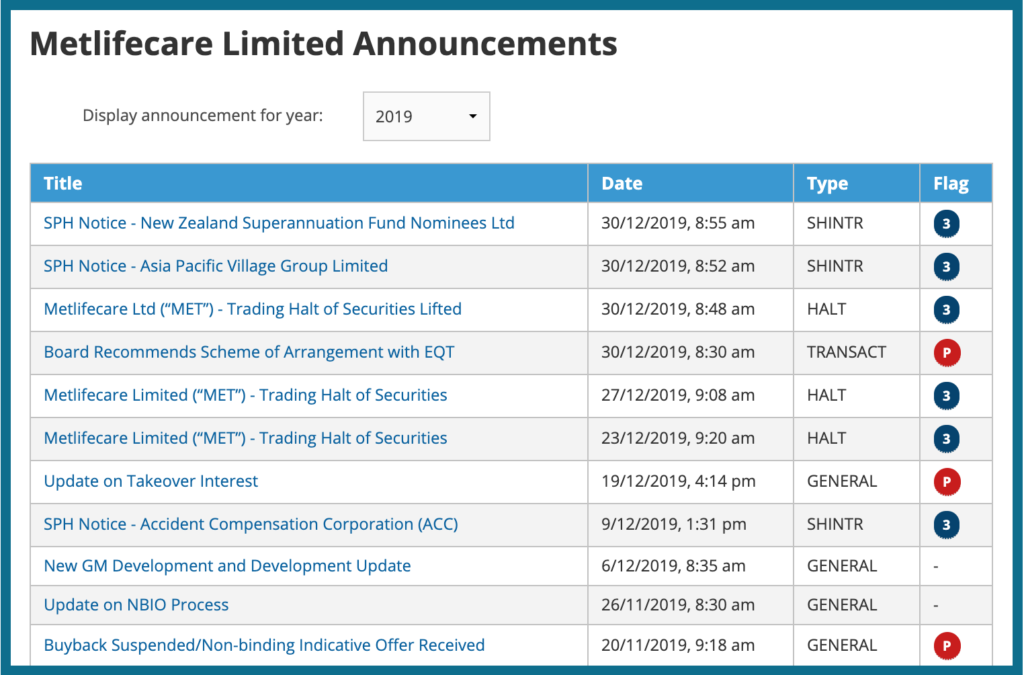

Announcements

Companies must inform the market of any Corporate Actions they make via the exchange. For example, announcements of any Corporate Actions for NZ listed companies can be found on the NZX website under each company’s Announcements page.

It’s a good place to start investigating if you’re curious why the value of your shares have suddenly spiked or dipped significantly. But if you don’t find an announcement corresponding to your share price movement, don’t be concerned – share prices can still move for reasons external to the company or for no reason at all.

Trading halts

Sometimes companies place a trading halt on their shares – meaning no one can buy or sell shares in that company until the trading halt is lifted. This usually happens when a company is pending the announcement of a major Corporate Action, or waiting for a Corporate Action to be progressed. A trading halt is put in place to protect investors from making trades until new information that could materially affect one’s trading decisions is released.

Conclusion

Though none of these corporate actions are particularly difficult to digest, Investing in shares might not be as passive as you think. It’s a good idea for investors to keep up with the news of their companies, and events that might affect their shareholdings. Businesses change all the time, and these events are part of what makes investing individual companies so interesting. So I hope this article will help you better understand these Corporate Actions if you happen to encounter them on your investment journey.

Follow Money King NZ

Join over 7,500 subscribers for more investing content:

Disclaimer

The content of this article is based on Money King NZ’s opinion and should not be considered financial advice. The information should never be used without first assessing your own personal and financial situation, and conducting your own research. You may wish to consult with an authorised financial adviser before making any investment decisions.